Summary in one sentence: short squeeze, seasonal factors, sentiment bottoming out, pension rebalancing, continued retail buying, and cash waiting to be released may drive the rebound

Data from Goldman Sachs trading desk as of March 20:

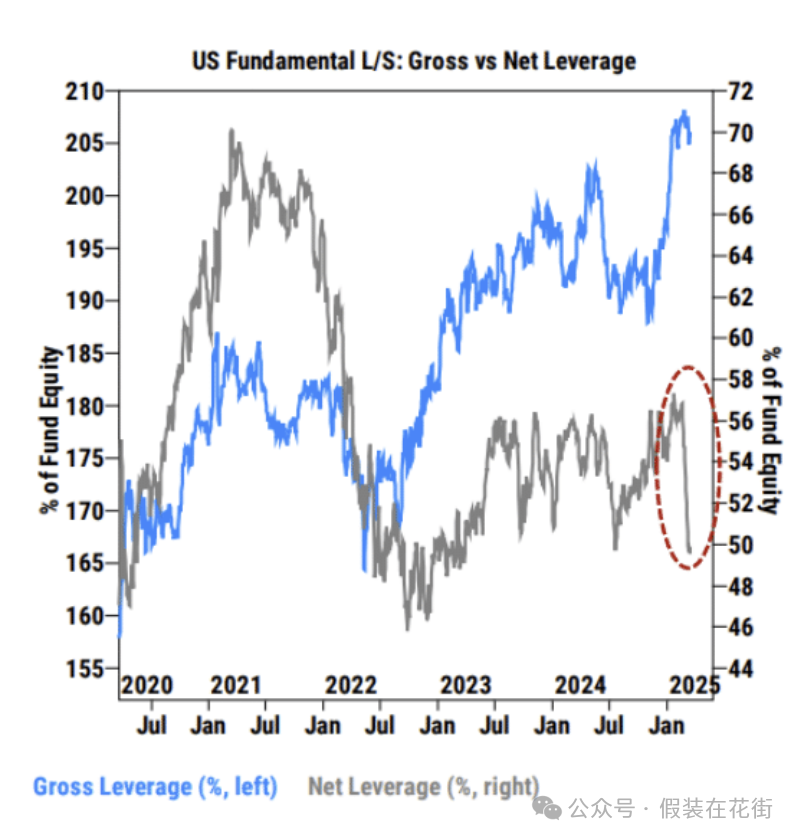

The net leverage ratio of US fundamental hedge funds (grey line in the above chart) fell sharply to a two-year low of 75.8%;

However, the total leverage ratio (blue line in the above figure) is still as high as 289.4%, the highest level in five years, which is obviously due to the increase in short positions;

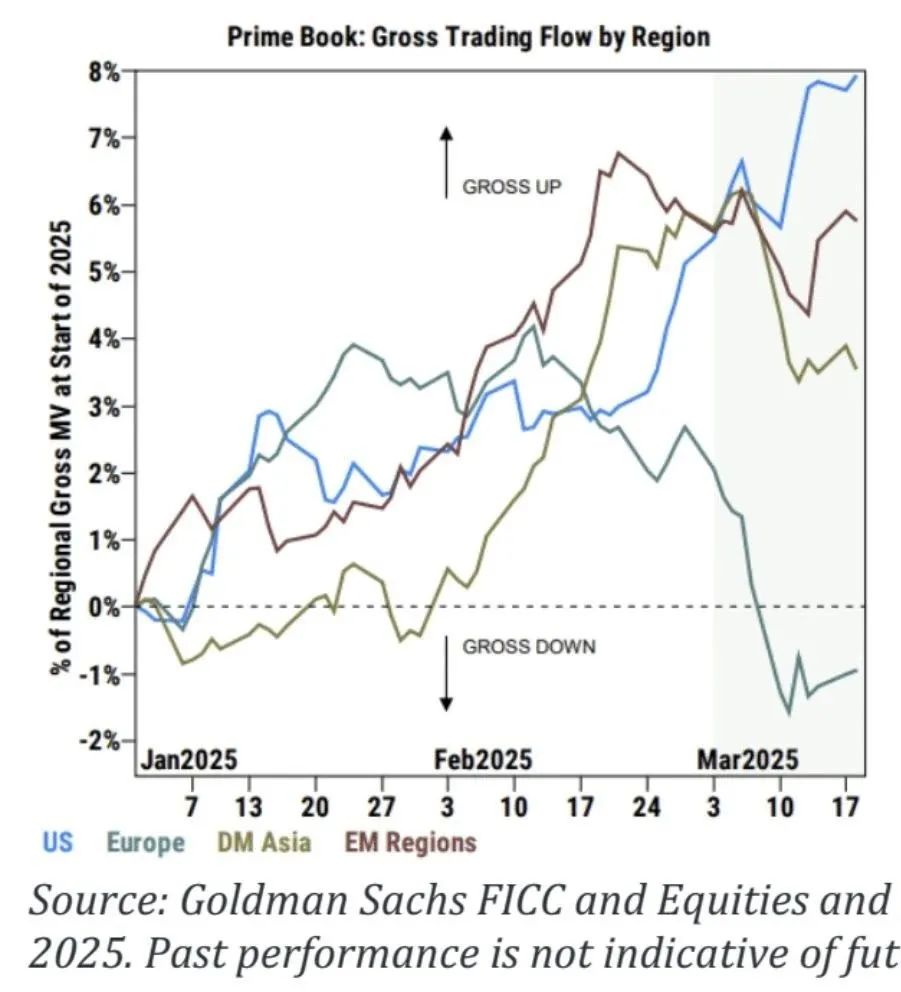

The above chart shows that the total leverage ratio of funds increased sharply by 2.5% in the United States in March, and deleveraged in other parts of the world;

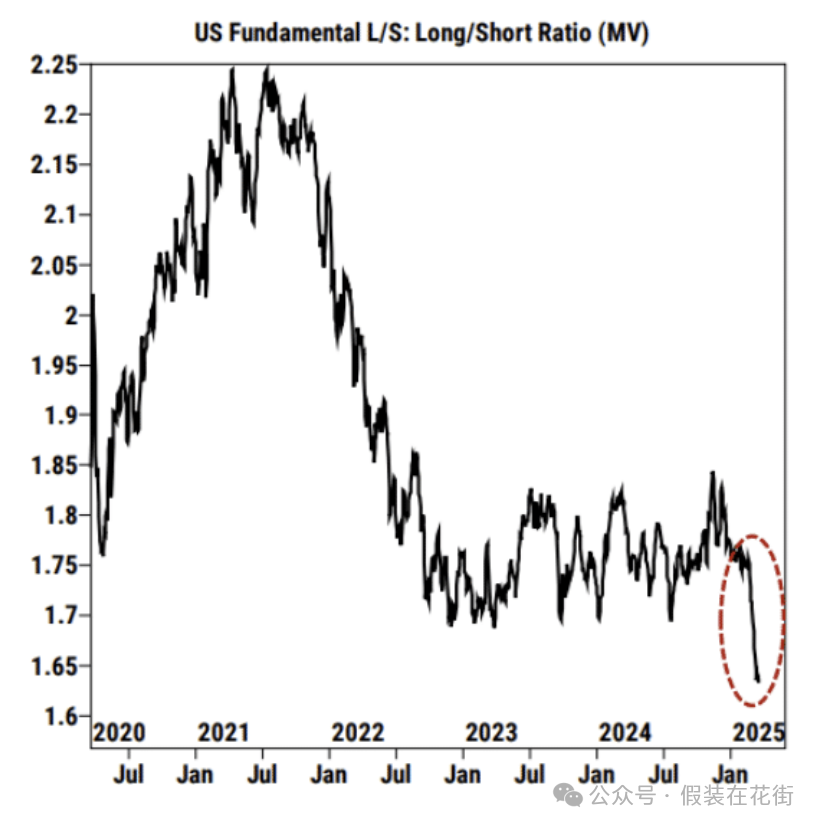

The long/short (market value) ratio fell to its lowest level in more than five years at 1.64;

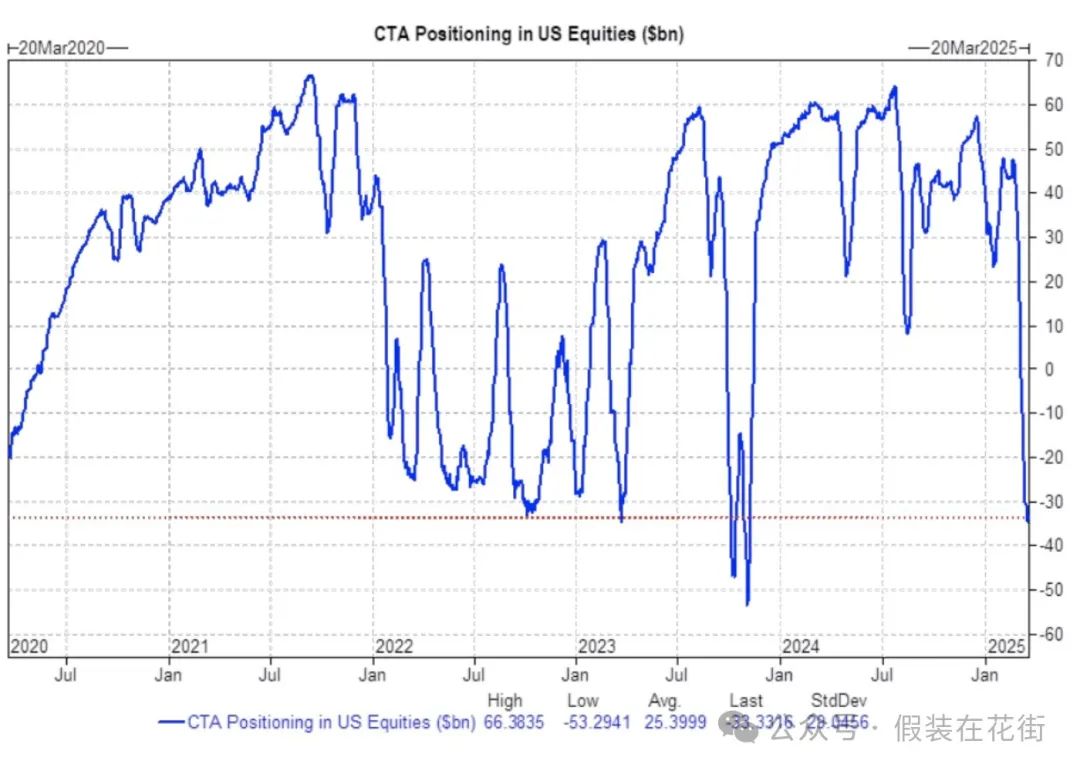

CTA funds are net shorting U.S. stocks for the first time in a year and a half;

CTA funds are net shorting U.S. stocks for the first time in a year and a half;

The above shows that high leverage has been reduced somewhat, but there is still room for deleveraging before tariffs are implemented, and we are very close to a reversal.

The increase in the total leverage ratio is due to the increase in leveraged short positions, which may be a good thing. The data shows that hedge funds are unwilling to cut long positions too much, but instead rely on leveraged short hedging with external financing. When the market fluctuates abnormally, the financing party may issue a margin call, causing short positions to be forced to close their positions or sell other assets to cover margin. In other words, the probability of a short squeeze has greatly increased. If funds choose the latter, that is, selling other assets, it may amplify abnormal market fluctuations.

But please note that this does not mean that there will be a necessary rise, but it means that if there is a rise, there will be a short squeeze to boost it.

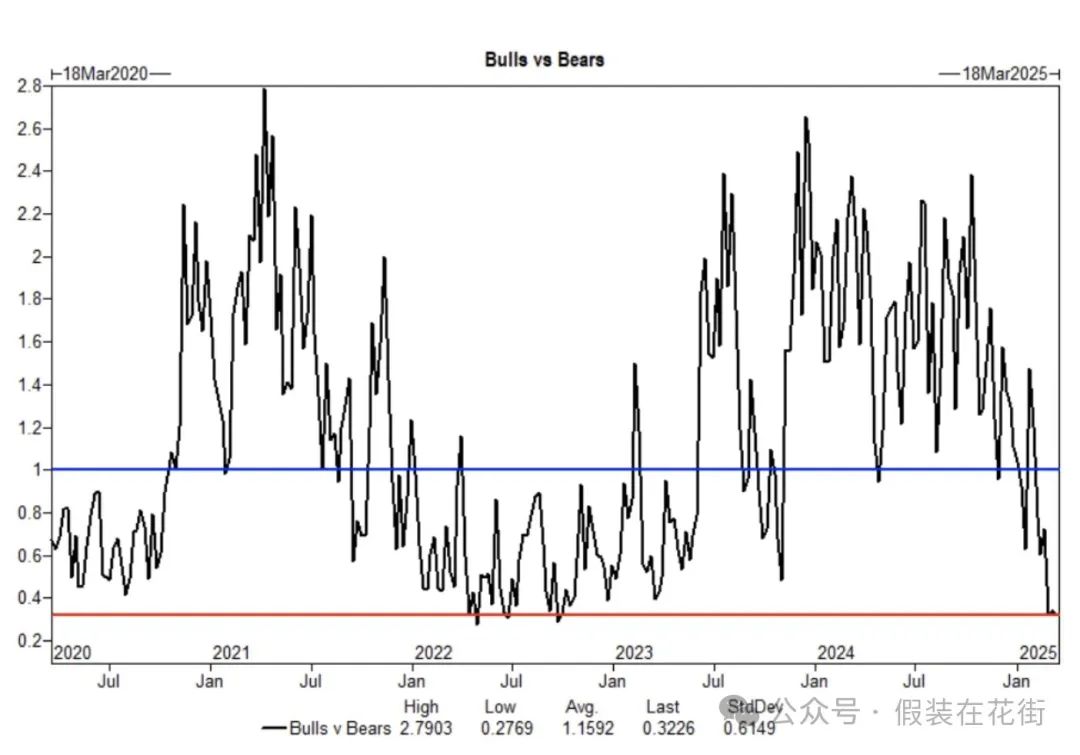

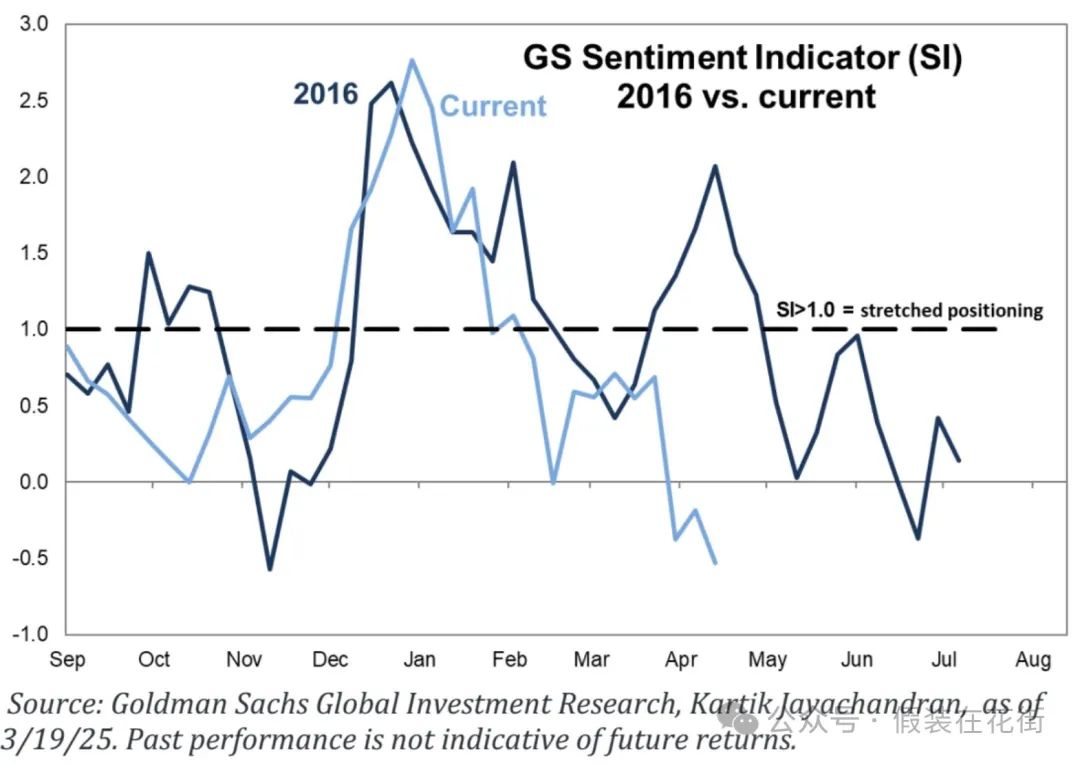

Market sentiment has hit rock bottom, and the market has returned to a "good news is good news" environment, and sentiment may pick up:

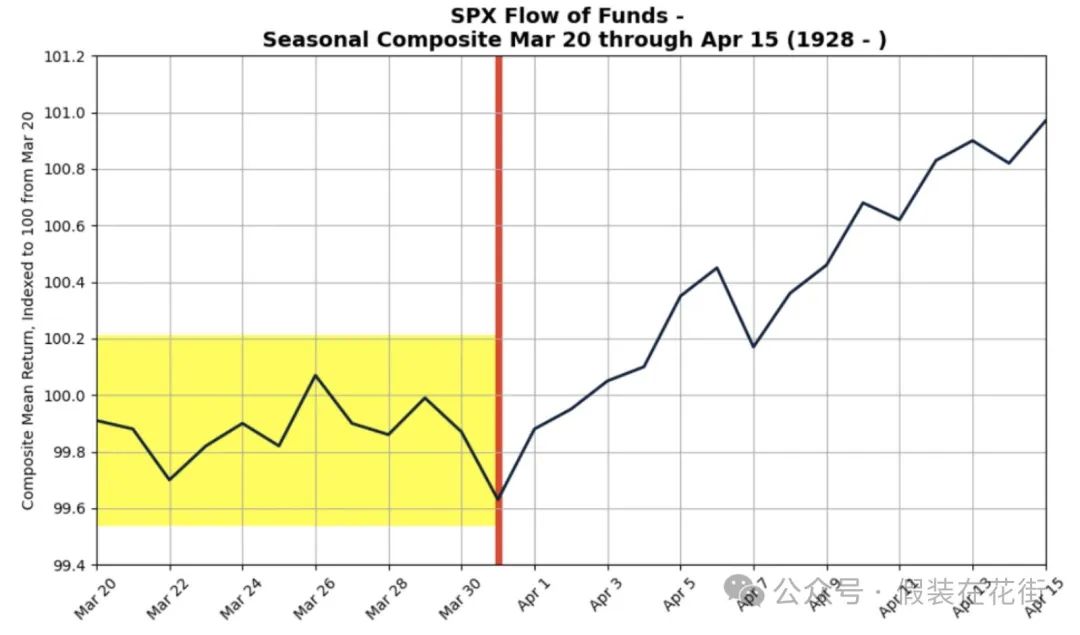

Seasonal bearishness is coming to an end:

The second half of March is typically volatile, based on data going back to 1928, and this year is no exception.

But the S&P 500 rose an average of 0.92% between March 20 and April 15, and rose an average of 1.1% between the end of March and April 15.

This suggests that there may be potential for a seasonal rebound in April, but the magnitude is limited. After April 2, the market may stabilize unless there are major unexpected events.

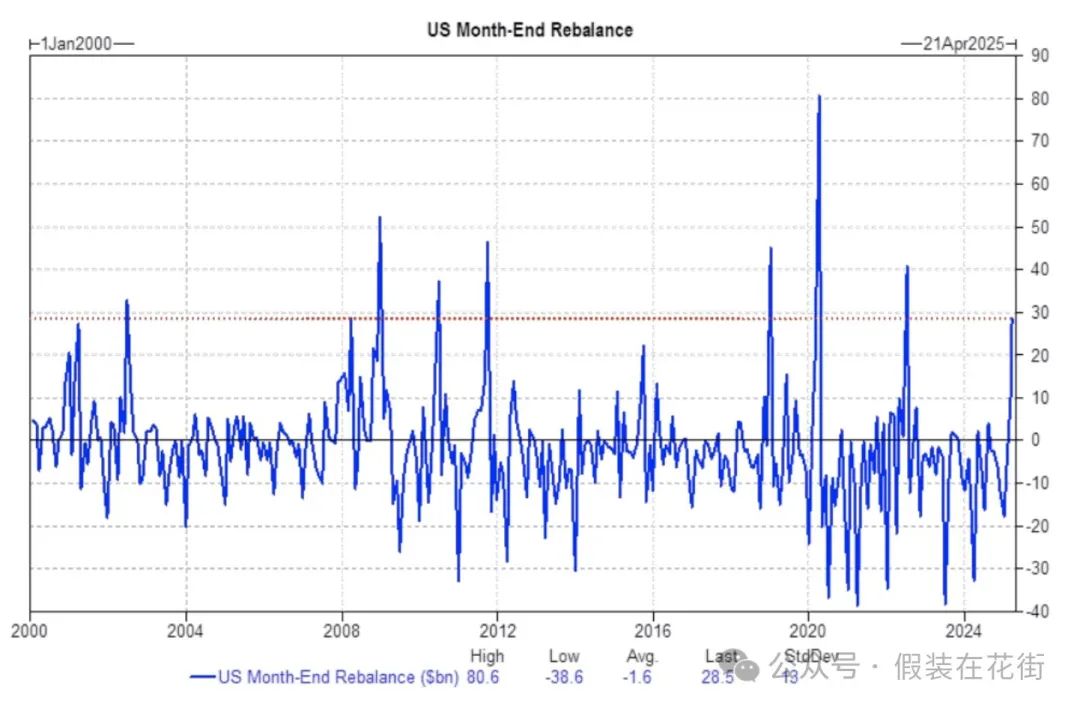

U.S. pension funds are expected to buy $29 billion of U.S. stocks at the end of the quarter, which ranks in the 89th percentile of absolute value estimates over the past three years and in the 91st percentile since January 2000. This move may provide some support to the market:

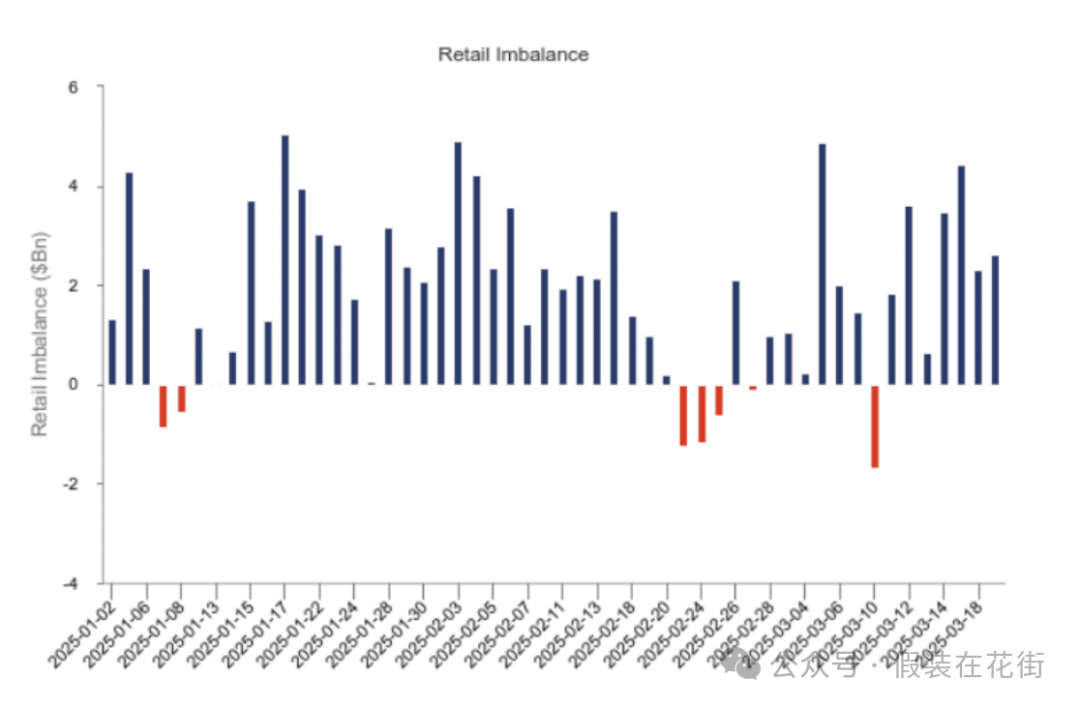

Despite market fluctuations, the participation rate of retail investors remains stable. Since 2025, retail investors have only seen net selling on seven trading days, with cumulative net purchases reaching US$1.56 trillion.

In addition, the assets of money market funds (MMFs) continued to grow in the United States, reaching $8.4 trillion. These funds represent the cash reserves of retail investors and other investors. Once market sentiment improves or investment opportunities emerge, these funds may quickly convert into buying power for the stock market.

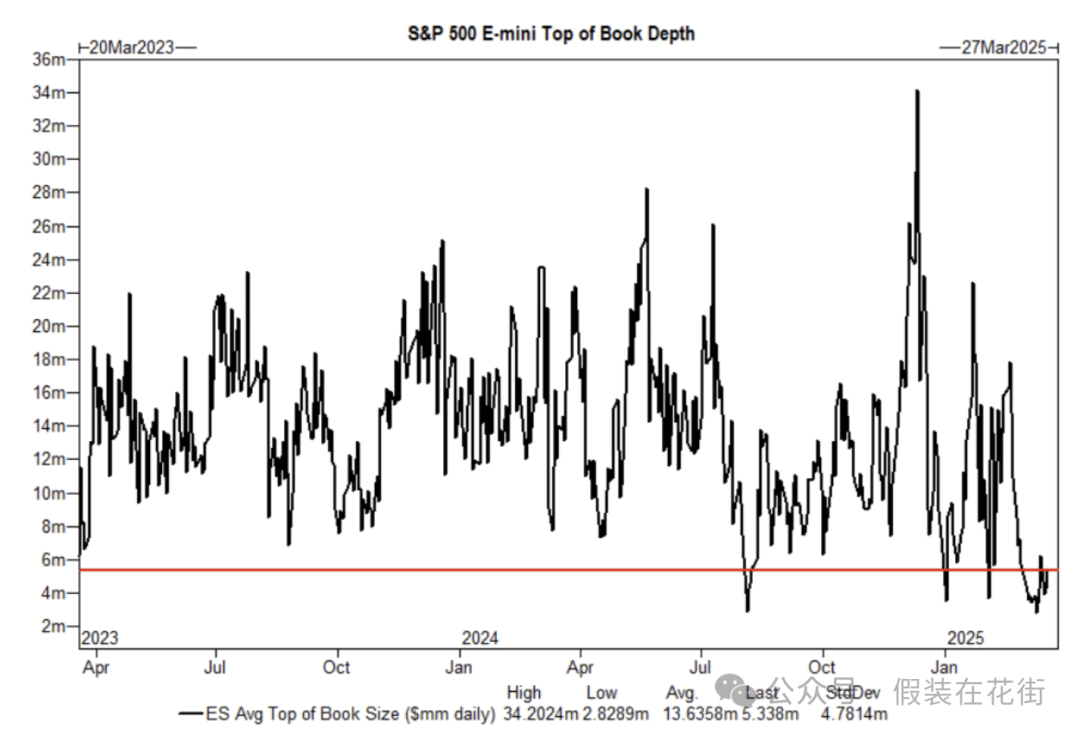

Market liquidity is still thin, which is why intraday fluctuations are often large. Be aware of the risks: