Author: Carol,PANews

Ethereum's transition to a PoS mechanism has long been considered to help achieve currency deflation and meet the needs of larger-scale applications, which is conducive to the upward trend of ETH prices. However, on the second anniversary of the transition, Ethereum has faced many doubts. On the surface, these doubts mainly arise because ETH has performed poorly in the most recent market cycle, especially compared with BTC and SOL in the same period, the price increase is not as expected.

But at a deeper level, these doubts reflect two major challenges facing Ethereum in its development: one is the competition and cooperation between Layer 1 and Layer 2. The core here is how to position the role of Layer 2 and its relationship with Ethereum; the other is the contradiction between staking and liquidity. The core here is how to position the attributes of ETH.

In order to further demonstrate the current status of Ethereum and the challenges behind the doubts, PAData, a data column under PANews, comprehensively analyzed the changes in Ethereum's handling fees, Blob fees and Layer2 demand changes, and the changes in Ethereum's pledge and lock-up amounts. It was found that: First, Ethereum has reduced the handling fee price, but Layer2 has diverted the demand for on-chain activities and interacted with Ethereum at a lower price, resulting in challenges in ETH's value feedback and accumulation. Second, if ETH is positioned as a settlement currency, that is, it is expected that Ethereum will have a long-term sustainable high demand to achieve the long-term stable appreciation of ETH, but in the face of fierce competition, the market's willingness to pay for this long-term expectation may be shaken.

The main findings of this paper include:

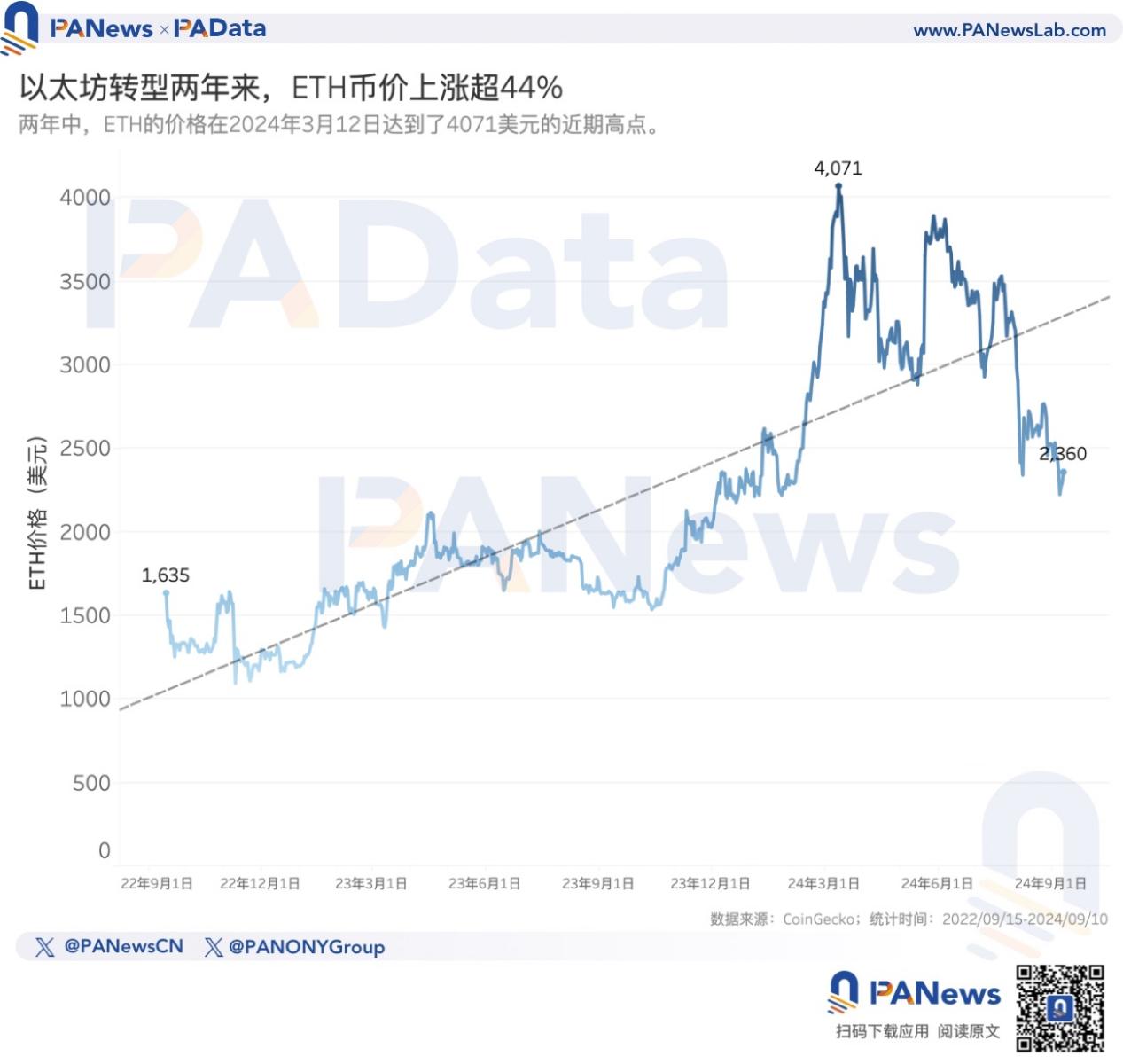

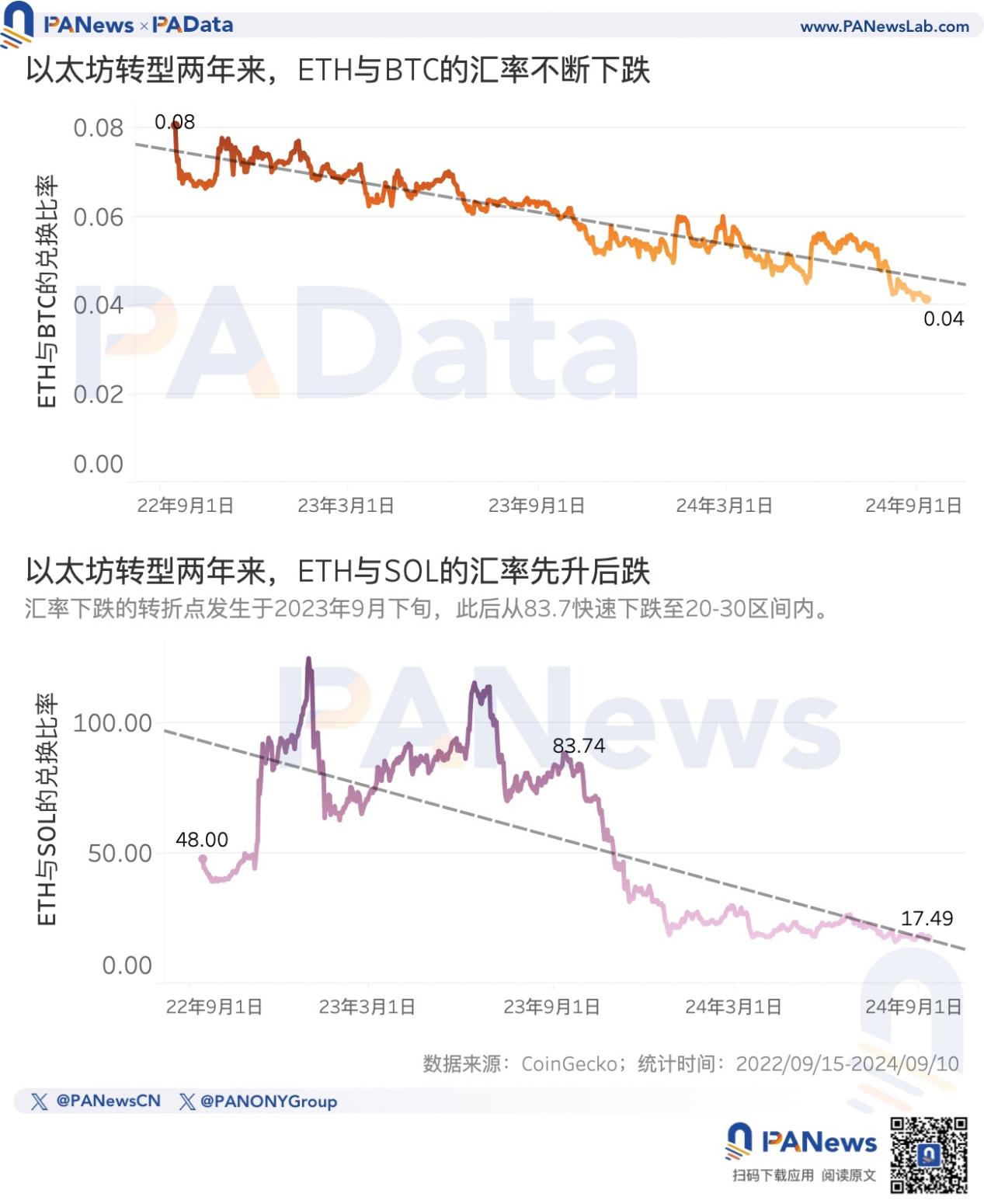

- In the past two years, the increase of ETH against USD is about 44.28%, but the decrease of ETH against BTC is about 48.70%, and the decrease of ETH against SOL is about 63.55%.

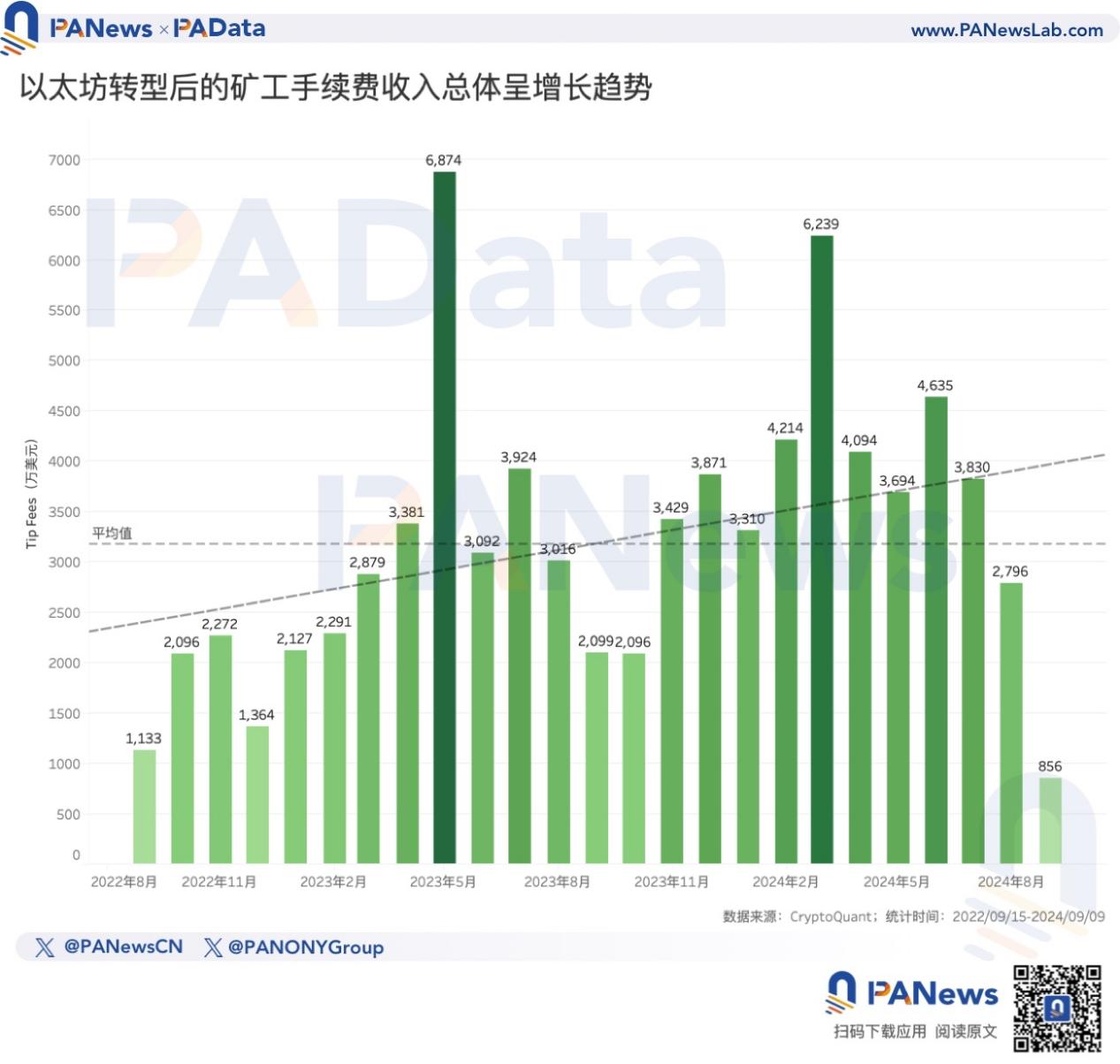

- In the past two years, Ethereum's monthly transaction fee income (taking only Tip fees into account) has generally shown a clear growth trend, with an average monthly fee income of approximately $32.8156 million. However, starting in August this year, the monthly fee income began to decline.

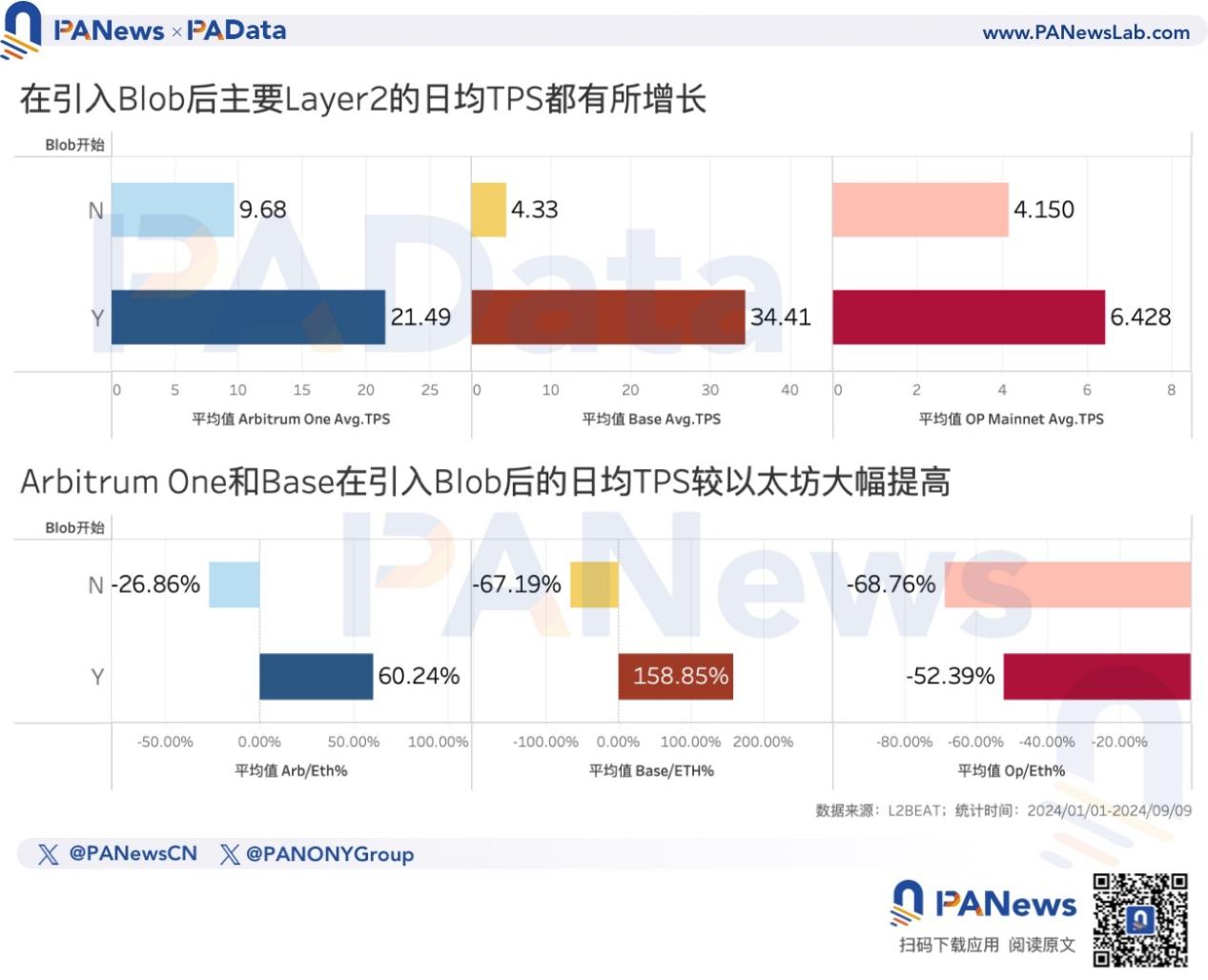

- After the introduction of Blob, the average daily TPS of Arbitrum One, Base and OP Mainnet increased by 122.00%, 694.69% and 54.94% respectively. Arbitrum One and Base are 60.24% and 158.85% higher than Ethereum’s daily average TPS.

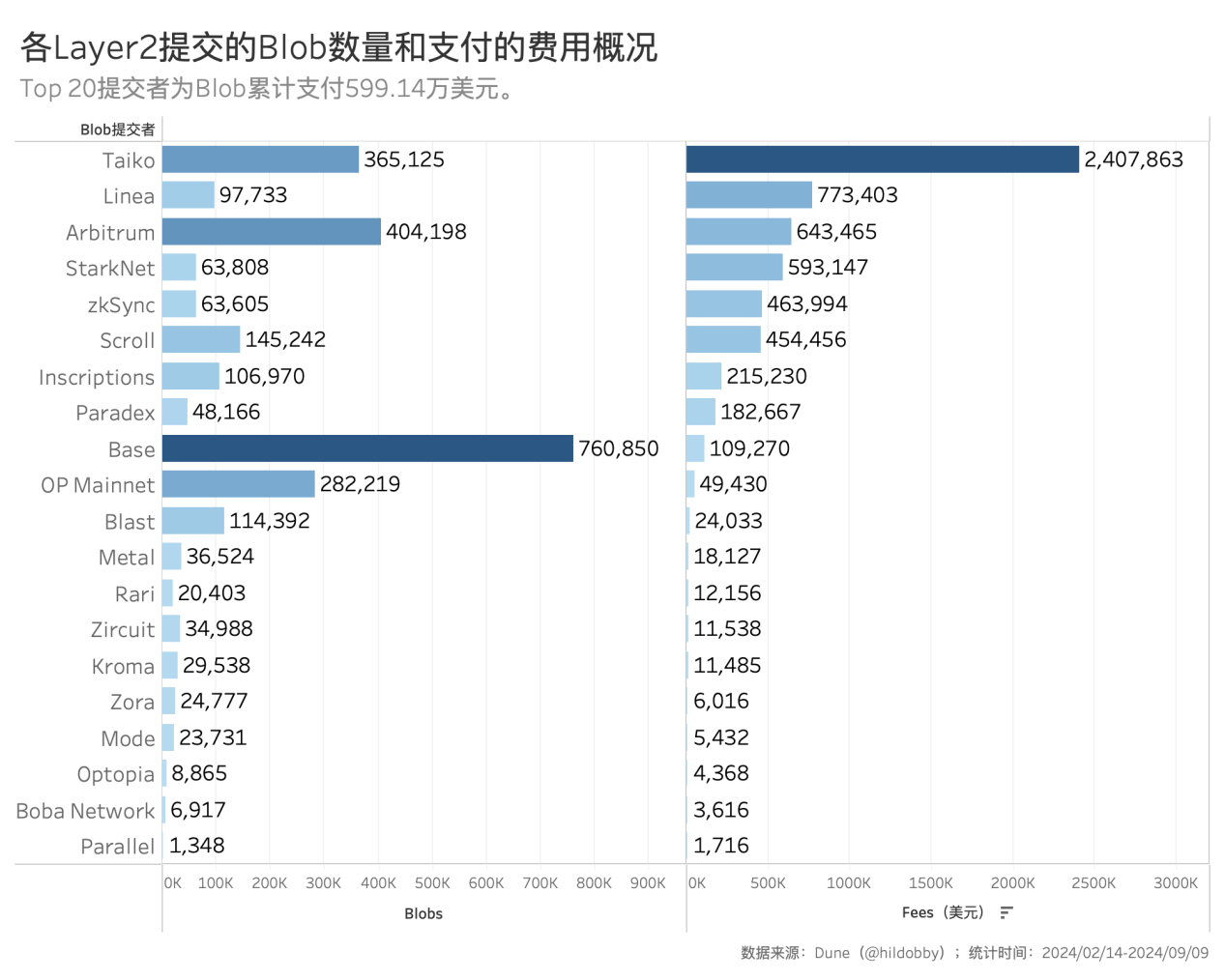

- The top 20 submitters in terms of Blob payment fees submitted a total of 263.93 blobs and paid a total of $5.9914 million, with an average fee of about $2.27 per blob. Among them, Base, which had the fastest TPS growth, only paid a total of $109,300.

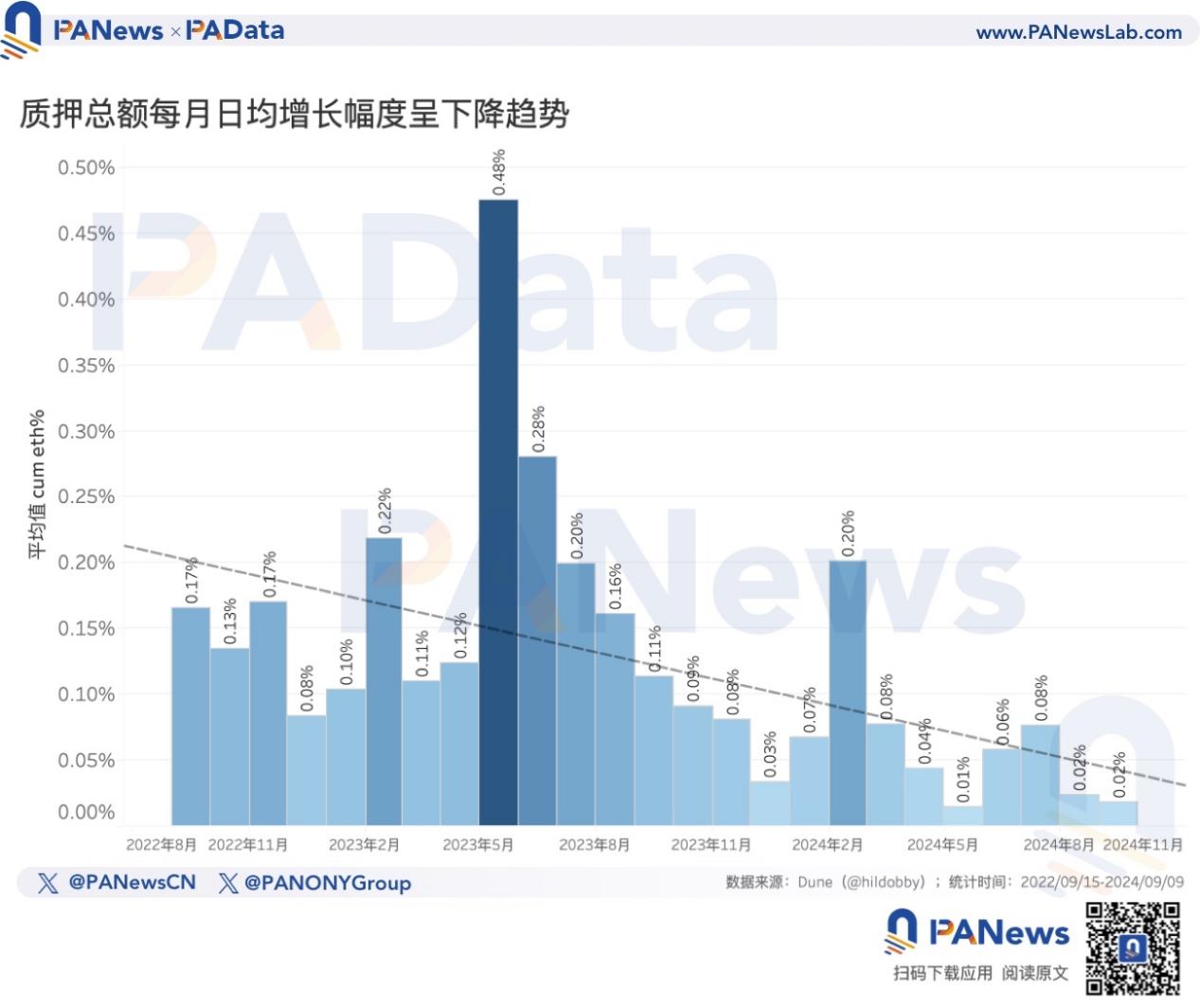

- The total amount of Ethereum pledged has increased by about 150.18% in two years, but the marginal growth of the total amount of pledged is slow. The average daily growth rate in the first nine months of this year was 0.06%, which was more than 0.1 percentage point lower than the average daily growth rate of 0.17% in the whole of last year.

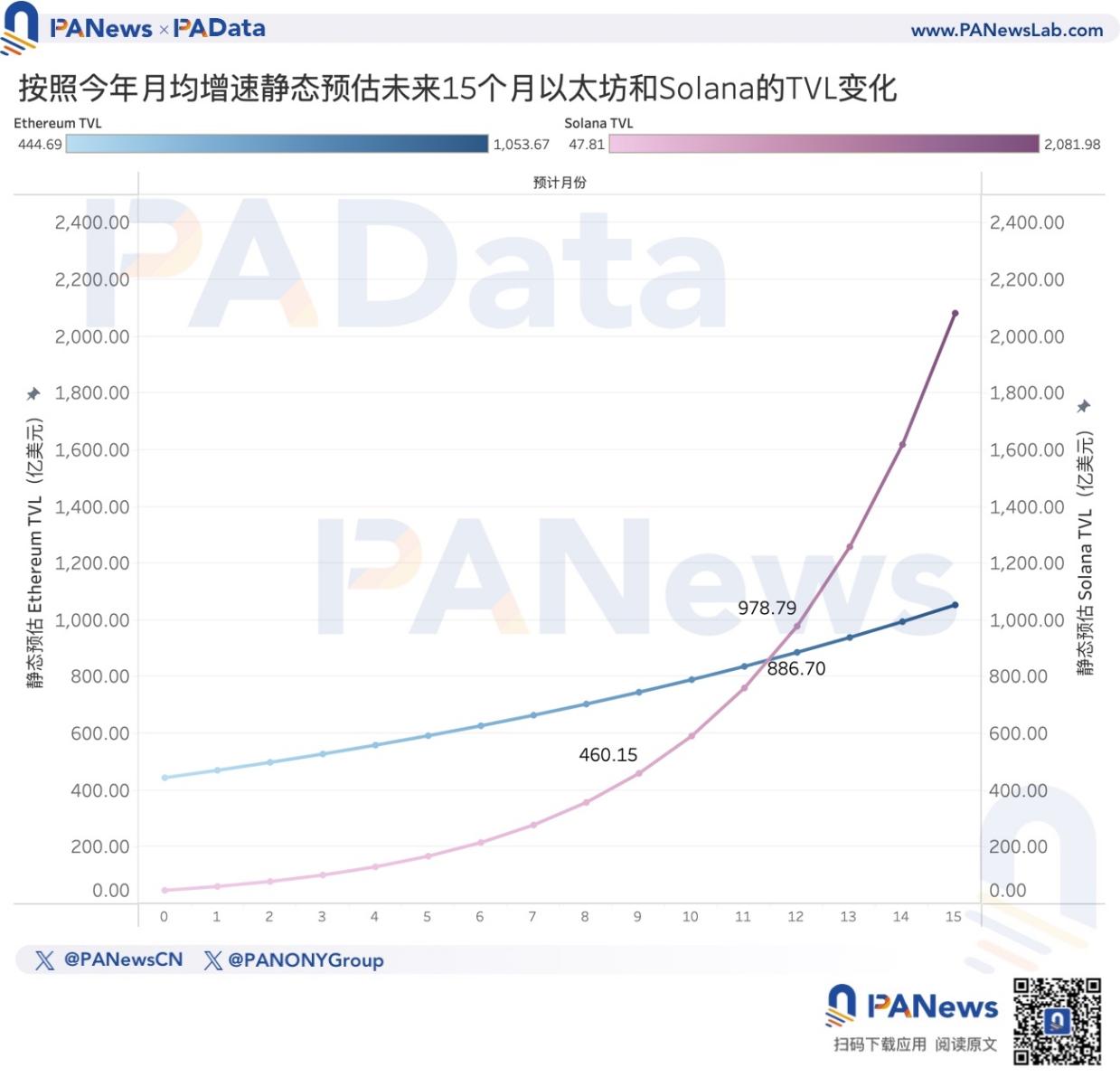

- The locked amount of DeFi on Ethereum has increased by 50.12% this year, but Solana has increased by 242.20% this year. According to the average monthly growth rate this year, Solana's locked amount is expected to exceed Ethereum in another 12 months.

01. The exchange rates of ETH, BTC and SOL all fell , and the fee income of Ethereum turned from increasing to decreasing.

The direct reason for Ethereum's doubts is its poor performance, but in fact, in terms of its own trend, ETH has maintained a clear upward trend after the transformation. According to Coingecko data, in the past two years, ETH has increased by about 44.28%, and once broke through $4,000 again, reaching a high of $4,071. The current price of more than $2,300 is still at a high level in the past two years.

However, when ETH is compared with BTC and SOL in the same period, ETH's performance is not satisfactory. Judging from the trend of these two ratios, in the two years since Ethereum's official transformation, BTC's performance has always been better than ETH, and SOL's performance has experienced a process of first worse and then better than ETH.

According to statistics, in the past two years, compared with BTC, the BTC that can be exchanged for 1ETH has fallen from 0.0807 to 0.0414, a decrease of about 48.70%, and overall, the ETH/BTC exchange rate has a clear downward trend.

Compared with SOL, before September 2023, 1ETH can basically be exchanged for more than 50 SOL, and the overall trend is increasing, with the highest exchange rate being 125.1895 SOL. However, after September 2023, the exchange rate dropped rapidly, and dragged down the overall exchange rate in the past two years. Currently, 1ETH can only be exchanged for 17.4939 SOL, with an overall decrease of about 63.55%.

Some people question that the direct reason for ETH's poor performance is the reduction in transaction fee income, which, although one of the main purposes of a series of upgrades after the transformation, has hindered the accumulation of ETH's value. However, according to the data trend of CryptoQuant statistics, in the past two years, Ethereum's monthly transaction fee income (considering only Tip fees) has generally shown a clear growth trend.

As of September this year, Ethereum's average monthly fee income in the past 25 months was $31.8445 million. If September this year is not taken into account, the average monthly fee income of Ethereum in the past 24 months will increase to $32.8156 million. Moreover, from November 2023 to July 2024, the monthly fee income is higher than $33 million, which is significantly higher than most of the previous period, and once exceeded $60 million.

However, in August this year, Ethereum's monthly fee income dropped to $27.96 million. If estimated based on the average fee income in the first 10 days of September, the monthly fee income in September may further drop to $25.6847 million. This indirectly confirms the market's concerns about the future value accumulation of ETH.

02. The TPS of the three major Layer2s increased significantly after the introduction of Blob, and the top 20 Blob submitters only paid a total of US$5.99 million

The continued reduction of Ethereum transaction fees should actually be expected, but why are recent doubts centered around this? The possible reason is that the balance between on-chain activity demand and transaction fee prices has not been established.

The ideal expectation is that Ethereum has reduced the price of transaction fees through Layer2 and other upgrades, which will directly boost or help boost the demand for on-chain activities in the long term, so the two can reach a balance and ETH can still accumulate value from it. But the problem now is that the total demand for on-chain activities is insufficient, and Layer2 undertakes more direct on-chain activities and interacts with Ethereum at a lower price. In this case, the continued reduction of transaction fees has led to challenges in the feedback and accumulation of ETH's value. In simpler terms, the transaction fee optimization solution designed by Ethereum during high-demand periods faces untimely difficulties during low-demand periods.

According to Dune (@hildobby)’s data, after the introduction of Blob transactions, the TPS of the three Layer2s with the highest lock-up volume have increased significantly, and the TPS of two of them have exceeded that of Ethereum. Ethereum’s series of optimizations in terms of handling fees have objectively promoted the development of Layer2, especially the development of Base.

From the beginning of this year to March 14, the average daily TPS of Arbitrum One, Base and OP Mainnet were 9.68, 4.33 and 4.15 respectively. From March 14 to date, the average daily TPS of the three have increased to 21.49, 34.41 and 6.43 respectively, with an increase of 122.00%, 694.69% and 54.94% respectively.

Moreover, from the beginning of this year to March 14, the average daily TPS of Arbitrum One, Base and OP Mainnet were lower than that of Ethereum during the same period, by an average of 26.86%, 67.19% and 68.76% respectively. However, after the introduction of Blob, the average daily TPS of Arbitrum One and Base were 60.24% and 158.85% higher than that of Ethereum. Although the average daily TPS of OP Mainnet is still lower than that of Ethereum, the gap between the two is also narrowing.

The growth in demand for Layer2 has benefited from the introduction of the Blob transaction type, but the fees paid by Layer2 for Blob are very low. In other words, the improvement in Ethereum transaction fees cannot currently be fed back into the value accumulation of ETH.

According to Dune (@hildobby), as of now, the top 20 submitters in terms of Blob payment fees have paid a total of $5.9914 million, accounting for more than 99% of the total fees. Among them, Base, which has the fastest TPS growth, has only paid a total of $109,300, Arbitrum has paid a total of $643,500, and OP Mainnet has paid a total of $49,400. Even Taiko, which has the highest payment amount, has only paid $2.4079 million.

These submitters have submitted a total of 263.93 blobs, which is equivalent to an average fee of about $2.27 per blob. However, this is based on the current fee data under the condition of insufficient total demand on the chain. If the demand for Ethereum chain activities increases in the future and network congestion occurs, the price of blobs will also rise, and Layer2 will naturally have to pay more fees to Ethereum. Whether blobs can make up for the part of the fee income transferred by Ethereum at that time remains to be further observed.

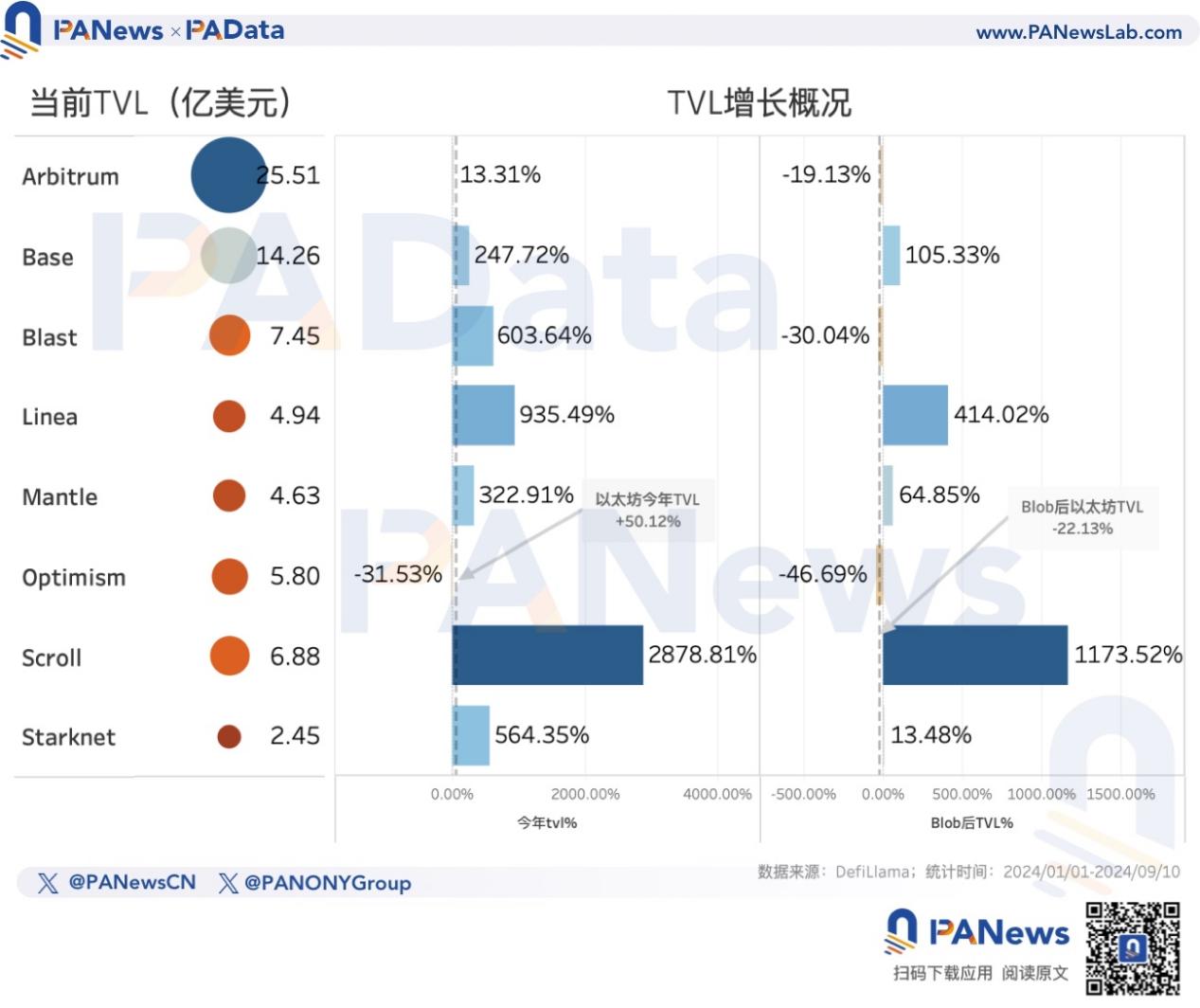

The growth in demand for Layer2 is partially reflected in the change in locked-up volume. According to DefiLlama statistics, after the introduction of Blob, Ethereum's locked-up volume fell by 22.13%, and only Blast and Optimism fell more than it. Base, which has the fastest TPS growth, has seen its locked-up volume increase by 105.33%, and Linea, which is second in paying Blob fees, has seen its locked-up volume increase by 414.02%. In addition, although Arbitrum's locked-up volume also fell by 19.13%, the decline was smaller than Ethereum.

03. Ethereum staking growth rate slowed down, TVL increased but the growth rate was lower than Solana

Another challenge for Ethereum after the transformation is how to achieve a steady state between the amount of pledge and the amount of locked positions to ensure that the Ethereum chain activity is safely maintained at a certain level. The mutual changes in the price of ETH and the pledge rate will be the key to achieving this balance. In essence, this will determine whether ETH has sufficient liquidity and sufficient demand, which is an important requirement for ETH to become a settlement currency. Another requirement is that ETH can maintain its value over time, which means that sharp fluctuations in ETH or sharp short-term increases should not be expected.

If we accept the positioning of settlement currency, then we expect Ethereum to have a long-term sustainable high demand to achieve the long-term stable appreciation of ETH. The question is whether the market is willing to pay for this long-term expectation. When this long-term expectation is insufficient, it is natural to question.

From the demand side reflected in the data, the total amount of Ethereum pledged is currently 34.3842 million ETH, an increase of about 150.18% compared with two years ago, a significant increase. However, in terms of the growth rate of the pledged amount, the average daily growth rate each month shows a downward trend, that is, the marginal growth of the total amount of pledged is slow. The average daily growth rate in September has dropped to 0.02%, and the average daily growth rate in the first nine months of this year is 0.06%, which is more than 0.1 percentage point lower than the average daily growth rate of 0.17% for the whole of last year.

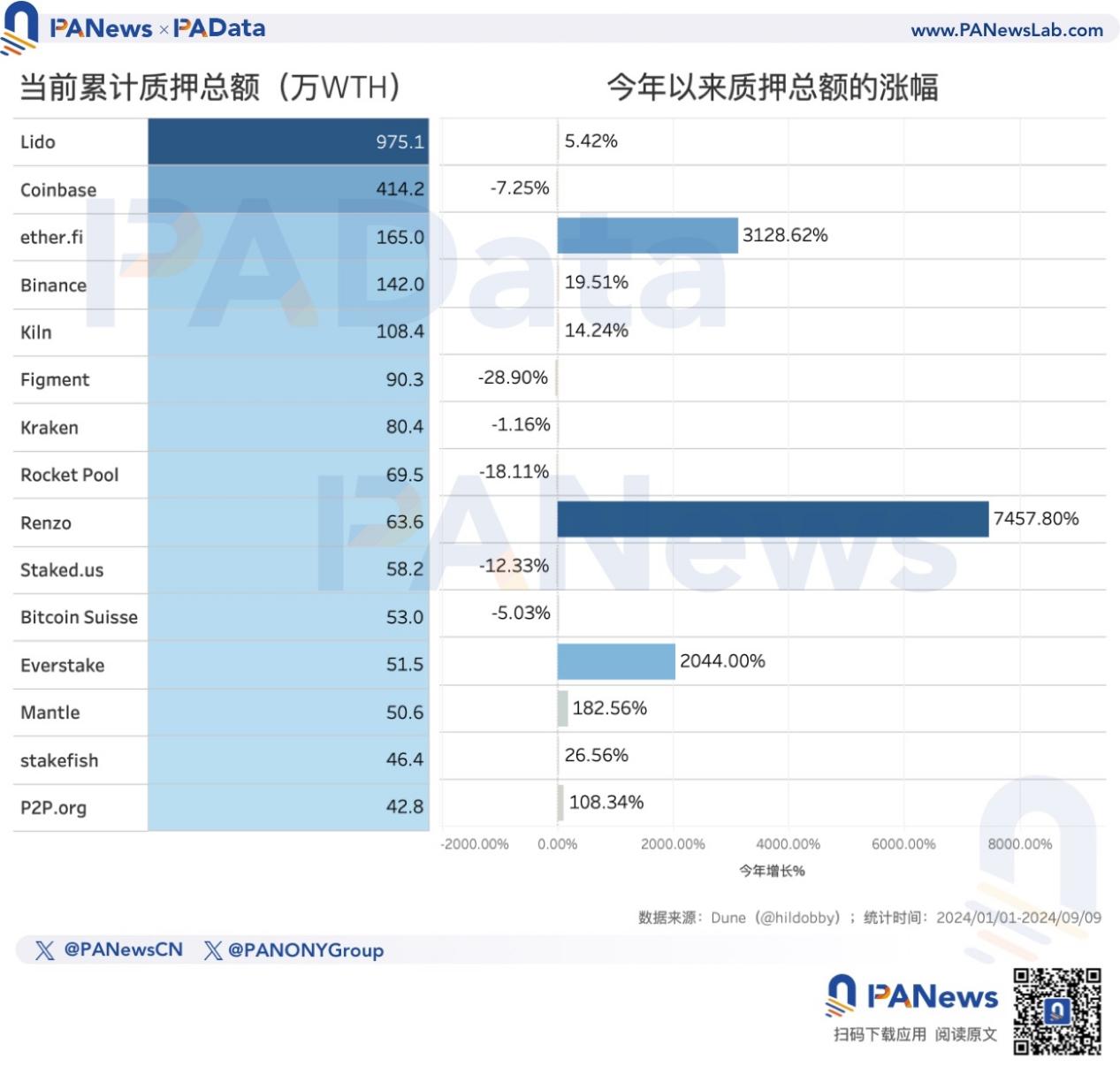

The three entities with the highest cumulative staking amounts are Lido, Coinbase and ether.fi, of which Lido alone has a staking amount of more than 9.75 million ETH. Since the beginning of this year, Renzo, ether.fi and Everstake have achieved rapid growth in staking amounts, with growth rates exceeding 7457%, 3128% and 2044% respectively.

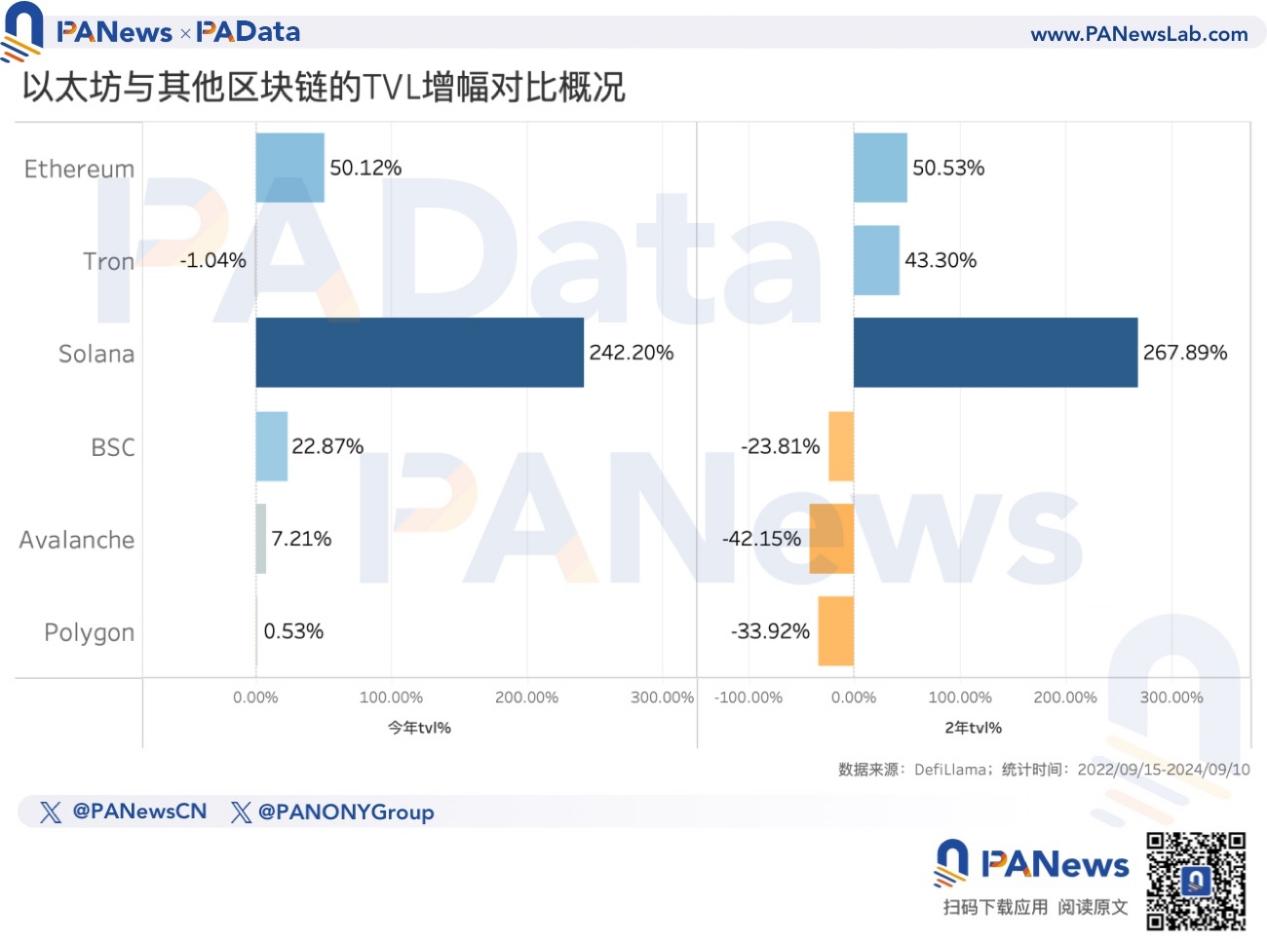

While the total amount of pledged assets remained high and grew slowly, the amount of DeFi locked on Ethereum reached a short-term high of $67.901 billion in June this year, and is currently $44.468 billion, up 50.12% so far this year and 50.53% in the past two years. In other words, the demand for Ethereum at the application level has recovered this year.

However, compared with Solana, Ethereum's demand growth seems to be insufficient. Solana's current locked-in amount is about 4.781 billion US dollars, and its overall scale is about 1/10 of Ethereum. However, Solana's locked-in amount has increased by 242.20% this year and 267.89% in the past two years, which is a very rapid development.

Doing a simple static analysis, if Solana continues to maintain this year's average monthly growth rate (this year's growth rate/254 days*30 days), it is expected that in another 9 months, its locked-in volume will reach more than 46 billion US dollars. If Ethereum also maintains this year's average monthly growth rate, it is expected that in another 12 months, Solana's locked-in volume will exceed Ethereum. Competition may be one of the reasons why the market has begun to question whether Ethereum's long-term expectations can be realized.