Source: Forbes

Compiled and edited by: BitpushNews

Bitcoin halving, new all-time highs, and the start of alt season — a classic bull run recipe? Or not?

First, the BTC halving reduces its issuance rate, which triggers a supply shortage. BTC then climbs all the way to a new all-time high, followed by altcoin speculation, and investors are more inclined to pursue higher returns, and the altcoin season breaks out in full swing. Shortly after the most recent halving, Bitcoin broke through the $100,000 mark - a historic milestone. However, the altcoin market has not seen a surge.

Where is the usual rally? Has the classic plot been disrupted? The surge in institutional capital and the liquidity crunch brought on by high interest rates, coupled with Trump’s positive and bold views on cryptocurrencies, have confirmed one thing: this cycle will be different from any we have seen before.

How is this cycle different?

Each cycle has four phases: accumulation, rally, distribution, and decline. While the mechanics behind these phases are well known, timing the market is one of the most recognized skills. You try to predict when we enter a specific phase in order to develop a trading strategy. However, while cycles follow predictable patterns, we must not forget the broader market context—cryptocurrency has been through a lot in the past year.

Institutional Capital

The increasing presence of institutional investors in the Bitcoin market has reshaped the dynamics of the Bitcoin market. Bitcoin has become the seventh largest asset in the world, supported by the emergence and growth of cryptocurrency ETFs, and has become a new choice for institutional investors. Increased participation from institutional investors usually leads to greater price stability. However, this may not be good news for altcoins. After all, volatility and sharp corrections will redirect capital flows into altcoins. Reduced volatility means that there will be less returns that may flow back into the altcoin market.

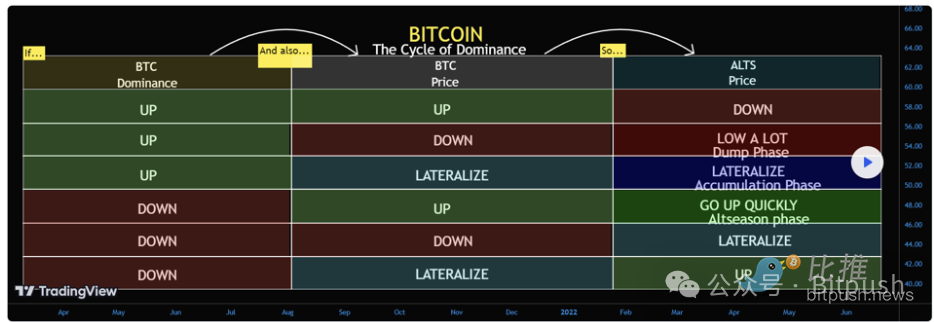

This year is special. The launch of Bitcoin spot ETFs has brought a large inflow of traditional financial capital to the cryptocurrency market. The inflow of institutional funds into these ETFs has triggered a Bitcoin supply shock, strengthening its dominance. The demand for Bitcoin triggered by ETFs has directly affected Bitcoin's dominance, which is currently around 56%, an important indicator that is often overlooked by novice traders. It measures BTC's market share relative to altcoins and can provide insight into whether we are in a Bitcoin season (BTC outperforms) or an altcoin season (altcoins outperform). What does strong BTC dominance coupled with a stable Bitcoin price mean? Altcoins sell off. And in this cycle, Bitcoin spot ETFs have extended Bitcoin's dominance. This new variable, which did not exist in previous bull markets, will make the 2025 altcoin season undoubtedly unique.

Macro: Liquidity and Regulation

If you ask any finance executive what the most important financial metric is, they will tell you it’s liquidity.

In 2023 and 2024, U.S. interest rates rose to one of the highest levels in a long time. Although it has fallen from 5.25% a year ago to 4.19% now, it is still a relatively attractive yield for a risk-free asset. On the other hand, rate cuts tend to fuel crypto bull markets for a simple reason - they create a favorable environment for riskier assets to thrive. After all, a risk-free government bond yielding 0.11%, as it did in 2021, is just as attractive as losing capital to inflation. Low interest rates equal cheaper borrowing and higher liquidity, which in turn motivates investors where to park their money to receive higher returns. Where? Yep, you guessed it. Cryptocurrencies.

Trump’s victory has undoubtedly shaken up the crypto world. The Bitcoin Act has sparked a heated debate in crypto and non-crypto circles. If passed, the Senate legislation would require the Treasury Department and the Federal Reserve to purchase 200,000 Bitcoins per year over five years to accumulate 1 million Bitcoins. In other words, about 5% of the global supply. Needless to say, pro-crypto regulations are a very meaningful step for the widespread adoption of crypto assets, and Trump’s stance has proven to inspire positive sentiment, with BTC hitting a new all-time high shortly after the future president confirmed the creation of the BTC Federal Reserve program.

With BTC maintaining dominance, high interest rates, and the US supporting crypto regulations, should we expect a full-blown altcoin supercycle in 2025? That’s the billion dollar question.

When does the cottage season come?

If history has taught us anything, it’s that altcoin surges often follow major moves in Bitcoin. However, estimating how big these price swings will be — or how soon after Bitcoin hits a new all-time high will altcoin surge — is impossible.

David Siemer, CEO of Wave Digital Assets, said: “I don’t think we’ll see a dramatic altcoin season like 2021 in the near future, which would mean BTC dominance falling below 40%. But as BTC continues to rise, we will see altcoins rise significantly in value.”

Siemer then added: “For altcoins to breakout against BTC like they did in 2021, altcoin usage (adoption) and value (revenue capture) would need to increase by several orders of magnitude,” stressing that this could take at least 3 years. But once it starts, the altcoin season itself is easy to identify as there are some pretty bullish signals:

Altcoin prices are growing rapidly and outperforming Bitcoin, especially large-cap altcoins. This means that not only are altcoins rising overall, but they are rising more than Bitcoin.

Altcoin dominance is surging, just like the altcoin season in May 2021. These tokens dominate the market, with the total market cap of the top 100 altcoins reaching 1.3 times that of Bitcoin.

FOMO-driven sentiment, high trading volumes, and risk-on investors are fueling buying pressure and price momentum.

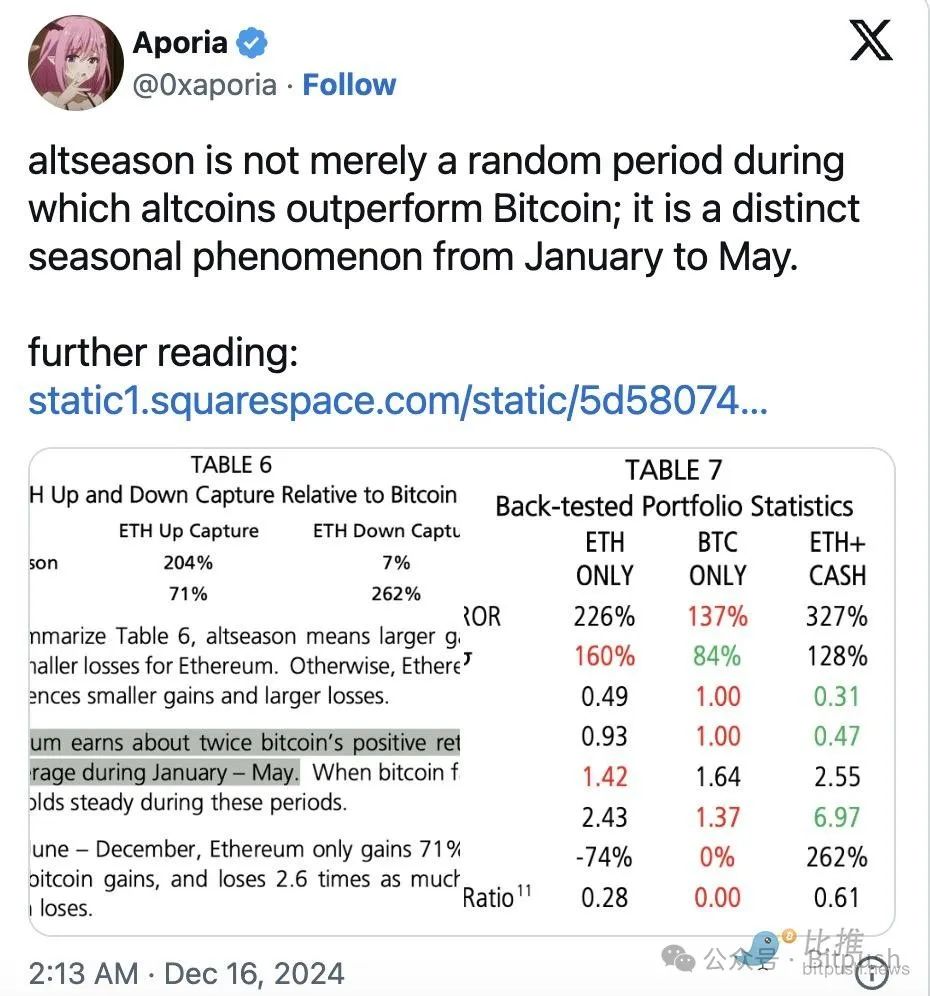

Cane Island Digital Research shared its findings on the seasonality of altcoin rallies in its “Proof of Altcoin Seasons,” showing that ETH is a representative of altcoins experiencing bull runs. In addition, it mentioned the recurring pattern of altcoin seasons from January to May.

Narrative Dominance

While the upcoming altcoin season may look very different than the ones we are used to, certain niches have already taken hold in the crypto space. After the VIRTUAL token’s 24,908.4% surge (or 249x), it’s safe to say that we have entered a new level of narrative dominance.

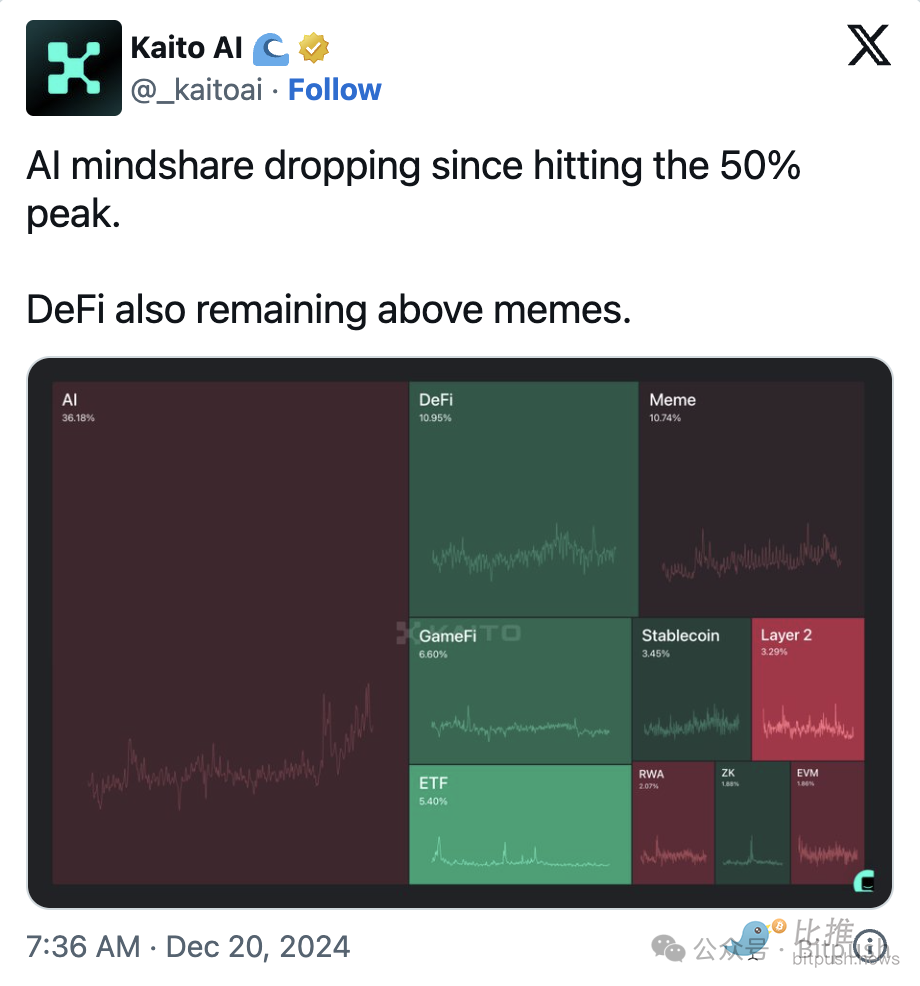

While memecoins may outpace real-world assets or areas like AI, AI agents are in a league of their own and are often seen as the driving force of the next supercycle. AI is still at its peak, and with the advancement of AI agents, the on-chain AI economy has already captured a large portion of the market share, which will peak at 50% in 2024 according to Kaito AI. This trend is likely to continue in 2025, driven by unprecedented demand for AI services.

Institutional adoption sparked by major companies such as BlackRock has also impacted areas such as real-world assets, legitimizing tokenization as a fundamental component of the crypto world. While much of the attention has been focused on AI and AI agents, traditional finance is exploring tokenization as a viable business option, with major banks such as JPMorgan Chase and Goldman Sachs attempting to disrupt financial markets.

How to prepare for the altcoin season?

As we head into 2025, there are a few things to keep in mind before the altcoin season arrives.

Bitcoin dominance is a classic indicator, use it to identify trading opportunities. Websites such as BlockchainCenter.net can help assess whether the market is currently in altcoin season or Bitcoin season.

Crypto markets are largely driven by sentiment, so pay attention to regulatory moves, macroeconomic trends, or crypto-native narratives (DeFi, AI agents, meme coins).

Not all altcoins will follow the dynamics of Bitcoin's price. Historically, projects with strong fundamentals or that align with an emerging narrative (such as AI projects) have performed better. However, it is important to prioritize quality over quantity and focus on projects with strong fundamentals, active teams, and ideally product-market fit that inspires a large community.

Pullbacks are healthy. They indicate that the market is consolidating and allow investors to enter positions before the next rally. Altcoin seasons usually occur in the late stages of a bull market. Be patient.

Conclusion

The cryptocurrency market is maturing. Each cycle is a stepping stone and should be viewed as a learning lesson. While meme coins are still reaping the fruits, new narratives are becoming more influential. But what’s most interesting is — the currently popular narratives, such as AI agents, are more than just a passing fad. On top of that, we will now face greater influence from macro factors and institutional adoption than any previous bull run. Does this mean we should expect different altcoin dynamics this time? To some extent, yes. We also shouldn’t blindly follow the patterns of the past few years. The question is not if an altcoin season will happen, but when it will happen and how it will be different from the past few years.

Get ready for the challenge!