This article was edited by the Ringing Finger Research team

Please indicate the source and link when reprinting

1. DeFi Industry Observation

1. Binance Labs invests in Lombard, the issuer of Bitcoin liquid staking token LBTC

Binance Labs announced an investment in Lombard, a company focused on developing and issuing LBTC. LBTC is a secure Bitcoin Liquid Staking Token (LST) that allows individuals and large institutional holders to earn yield and leverage their Bitcoin assets in DeFi. By partnering with Babylon, Lombard is committed to connecting the economic value and security of Bitcoin with the diverse opportunities of DeFi.

Since its launch in August, Lombard has captured 40% of the Bitcoin liquid staking market, with a total locked value (TVL) of more than $500 million or 8,500 BTC and more than 12,500 users. To achieve the goal of connecting Bitcoin to DeFi, more than 60% of LBTC has been used for yield strategies on Pendle, institutional lending on Maple Finance, and lending on platforms such as Morpho and ZeroLend. Lombard also pioneered the introduction of the first Bitcoin liquid heavy-staking token through a partnership with ether.fi.

Official announcement: https://www.binance.com/en/blog/ecosystem/binance-labs-invests-in-lombard-to-connect-bitcoin-to-defi-4826217132625427247

2. Kraken launches wrapped Bitcoin KBTC

Kraken launches kBTC, a cross-chain ERC-20 token fully backed by Bitcoin 1:1, designed to extend the value of Bitcoin to DeFi ecosystems such as Ethereum and OP Mainnet. kBTC not only brings Bitcoin liquidity, but also provides strict security, allowing users to verify on-chain reserves at any time. The launch of this token marks a new application scenario for Bitcoin in the multi-chain ecosystem and creates new opportunities for developers and investors.

The first-day partners included several well-known DeFi platforms such as deBridge, Gauntlet and Yearn, highlighting the ecological integration potential of kBTC. The launch of kBTC enables Bitcoin to be more flexibly integrated into decentralized finance and become an important choice for diversified asset allocation on the chain.

Official announcement: https://blog.kraken.com/news/kbtc

3. ZKsync's new proposal plans to distribute 300 million ZK tokens to DeFi users within 9 months

ZKsync launched its first governance proposal "ZKsync Ignite" on the @TheZKNation forum, planning to distribute 300 million ZK tokens to DeFi users over a nine-month period, with the goal of making ZKsync Era the liquidity center of Elastic Chain. The plan, written by @merkl_xyz, aims to energize the DeFi ecosystem of ZKsync Era by enhancing the liquidity of assets such as ETH, USDC, WBTC, and attracting liquidity providers and developers to participate. In addition, the proposal also requests 25 million ZK tokens to cover management fees. If passed, ZKsync Era will further consolidate its position in the DeFi field and become a liquidity hub for the multi-chain ecosystem.

Official announcement: https://x.com/zksync/status/1846904535651852340

4. Aptos plans to integrate stablecoins such as Tether and USDY

Aptos has risen rapidly in two years, and by integrating Tether and USDY stablecoins, it is driving it to become a new foundation for global payment solutions. The integration of these stablecoins enables Aptos to achieve faster, lower-cost and more secure cross-border circulation of funds, providing support for application scenarios such as DeFi and cross-border payments.

While the Aptos network has 27.7 million active addresses and 17 billion total transactions, it also set a record of 326 million transactions per day in the third quarter of 2024, demonstrating its excellent transaction processing capabilities and stable low-fee advantages. Its technology stack, including the latest Move 2 language, Raptr consensus protocol and Block-STM v2 parallel execution engine, makes Aptos an ideal platform for DeFi, gaming, and payments, and lays the technical foundation for future global financial applications.

Official announcement: https://aptosfoundation.org/currents/2-years-of-aptos

5. Modular DeFi L2 Network Mode has opened the second season airdrop

The modular DeFi L2 network Mode officially announced that the Season 2 airdrop is now open for collection, and the Season 3 staking activity is also launched simultaneously. The official expressed gratitude to users who participated in Season 2 and reminded users that they can only claim airdrops on the official dashboard of MODE to prevent being deceived.

Season 3 will be a critical moment for Mode. As the first protocol on Superchain to adopt the ve- model, Mode will focus on dynamic governance of staking (non-locked positions), protocol voting, and long-term growth, laying the foundation for the continued evolution of DeFi and innovative governance models. The official calls this new governance mechanism "Governance Game".

Official announcement: https://x.com/modenetwork/status/1847344754616676414

6. Arbitrum Ecosystem Derivatives Trading Agreement Variational Completes $10.3 Million Seed Round Financing

Crypto derivatives trading protocol Variational announced that it has successfully completed a $10.3 million seed round on the Arbitrum network. The round was co-led by Bain Capital Crypto and Peak XV Partners (formerly Sequoia India and Southeast Asia), with other participants including Coinbase Ventures, Dragonfly Capital, North Island Ventures and Hack VC.

Variational was founded in 2021 and initially operated as a proprietary market maker for two years before transforming into a DeFi protocol after becoming profitable. The first application of the protocol is the Omni platform for the retail market, which provides perpetual contract trading and allows users to leverage new tokens, asset portfolios, and products such as yield/volatility. In addition, Omni's liquidity providers (OLPs) can pool liquidity from centralized and decentralized exchanges and support community users to participate in deposits to earn returns.

Variational is currently being tested on Arbitrum Sepolia and plans to launch an invitation-only mainnet by the end of the year and a public mainnet in the first quarter of 2025. With the launch of the mainnet, the protocol's tokens will also be issued next year. Variational said that although it was first launched on Arbitrum, it does not rule out the possibility of expanding to other Layer 1 and Layer 2 blockchains in the future.

Source: https://www.theblock.co/post/322653/arbitrum-crypto-protocol-variational-funding

7. The European Commission approved the New York Stock Exchange and the Chicago Board Options Exchange (Cboe) to conduct spot Bitcoin ETF options trading

The European Commission recently approved the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (Cboe) to list options trading on spot Bitcoin ETFs. This decision has injected an important force of financial innovation into the European and global markets, marking the further legalization and mainstreaming of Bitcoin in regulated markets.

With this approval, investors can not only directly hold the value of Bitcoin through spot Bitcoin ETFs, but also use options for more flexible investment strategies, such as hedging risks or conducting leveraged transactions. This move not only expands the scope of Bitcoin's application as a financial asset, but also helps enhance market liquidity and stability.

Source: https://x.com/martypartymusic/status/1847403478898835581

8. Pump.fun launches advanced trading terminal and announces token issuance

Pump.fun, a Solana-based memecoin trading platform, announced the launch of a new advanced trading terminal "Pump Advanced" for advanced users, and announced on X Spaces that it will issue tokens in the future. This news has attracted widespread attention.

The Pump Advanced terminal provides a variety of powerful features for high-frequency traders, including price charts, TOP holder statistics, advanced filters, real-time updated discussion threads, etc., designed to meet the needs of professional users. The platform allows users to log in through a non-custodial wallet and offers a preferential period of 0% handling fees for the first 30 days. The Pump.fun team stated that the first batch of users will receive special feedback in the token issuance, and revealed that all proceeds have been reinvested in the development of the platform, with the goal of creating a platform that is comparable to or even beyond Binance.

According to data from The Block, Pump.fun's recent daily revenue has reached or exceeded one million US dollars many times, and it exceeded $100 million in cumulative fees at the end of August. Recently, it has once again triggered a surge in users due to the hot trading of memecoin Moo Deng.

Official announcement: https://x.com/pumpdotfun/status/1847730806334378287

9. ApeCoin launches L2 Apechain mainnet on Arbitrum Orbit and launches cross-chain bridge

ApeCoin announced the launch of its Layer 2 mainnet ApeChain on Arbitrum Orbit and officially launched the cross-chain bridge to provide more efficient capital circulation and profit opportunities for the Ape ecosystem. Now, users can transfer tokens to ApeChain through ApeChain's official bridge website and earn native returns on APE, ETH and stablecoins. Stablecoins will automatically convert to DAI after being bridged to ApeChain and deposited into sDAI accounts, accumulating returns based on MakerDAO's savings rate.

The ApeChain official website has been updated to not only provide cross-chain bridging functions, but also showcase various partners and launched applications, further expanding the global exposure of the Ape ecosystem.

Magic Eden also announced that it will support ApeChain and become its first ApeChain-based Launchpad and Marketplace, providing issuance and trading services for projects in the ApeChain ecosystem.

Official announcement:

https://x.com/apecoin/status/1847731593437155673

https://x.com/apecoin/status/1847773568429330791

https://x.com/apecoin/status/1848022073051889910

https://x.com/MagicEden/status/1847758312672284846

10.Sushi releases Super Swap roadmap and will launch multiple new liquidity protocols

Sushi announced its latest Super Swap roadmap to further promote the upgrade of decentralized finance (DeFi) liquidity and trading experience. Sushi has the most extensive exchange and aggregation capabilities in DeFi. Through its multi-chain router Route Processor, users can seamlessly trade on more than 35 blockchains and enjoy the best exchange paths and rates. The release of the Super Swap roadmap will enable Sushi users to "exchange any asset anytime, anywhere" and launch a number of new products and protocols.

New features include Blade Impermanent Loss (IL) Automated Market Maker (AMM) designed for professional traders, which aims to reduce the risk of liquidity providers while stabilizing the returns of blue-chip assets. In addition, Sushi also plans to launch a DeFi perpetual contract native protocol called Kubo, and innovative features such as ALM smart pools to help liquidity providers achieve stable returns in a multi-chain environment.

Sushi’s expansion plans also include the launch of multiple new native DEXs, each targeting a different blockchain ecosystem:

- Saru: Designed for the ApeChain ecosystem, expanding liquidity for NFTFi and GameFi.

- Susa: Based on Layer N blockchain, it provides CeFi-like low-latency and efficient liquidity trading experience.

- Wara: Designed specifically for Solana, it connects EVM and Solana's cross-chain liquidity through Route Processor technology.

To celebrate the Super Swap roadmap, Sushi will hold a series of community interaction activities including "SWAP ANYTHING" brand events, AMA, new FAQ area, YouTube tutorial series, Gaxle NFT issuance, and provide rewards to loyal supporters.

Official announcement: https://www.sushi.com/blog/swap-anything

11. Cryptocurrency trading platform Kraken plans to launch its native blockchain network Ink in 2025

Kraken announced that it will launch its first native blockchain network "Ink" in Q1 2025. This is a Layer 2 blockchain based on the Optimism Superchain and running on the Ethereum ecosystem. The launch of Ink aims to create a seamless and efficient DeFi entry for users and provide a bridge between centralized and decentralized finance.

Ink relies on Optimism's open source OP Stack and enjoys the security and consistent standard collaboration of Ethereum, which will make it part of Superchain and share security, governance and scalability with other blockchains.

Ink's core features:

Simplified DeFi entry barrier: Ink makes it easier for users to enter the on-chain DeFi ecosystem from the centralized world through an aggregated and frictionless approach.

Seamless interoperability: As a member of Superchain, Ink inherits the security of Ethereum and enhances the scalability of DeFi applications.

Support for developers: Ink provides rich documentation, expert guidance and financial support to help developers realize their ideas and further promote the development of DeFi.

Ink will be a major achievement of Kraken's years of accumulation in the crypto field, committed to bringing DeFi to a wider range of users and allowing developers to explore a new financial revolution in this DeFi-centric environment.

12. Ethereum The Verge Roadmap: Reduce node operation costs and promote blockchain universal verification

One of the great advantages of blockchain is that anyone can run a node and verify its correctness, which makes it difficult for a minority to manipulate the chain, whether it is running on PoW or PoS consensus. Even if most nodes agree to change the rules, as long as some nodes choose not to accept it, the old rules will continue to be used and still gain the support of users running full verification nodes.

However, this guarantee relies on enough users being able to run full validation nodes. Currently, ordinary laptops can run nodes, but the cost is high. Ethereum's "The Verge" roadmap is committed to reducing the cost of running nodes, allowing smartphones, watches and even browsers to perform node validation.

The core of The Verge is to implement stateless verification technology, which means that nodes do not need to store the complete chain state, but verify through a witness mechanism. This technology includes innovations such as Verkle trees and STARKs. As these technologies mature, the storage requirements of Ethereum nodes will be significantly reduced, which will further improve the decentralization of the network and enhance user participation.

Source: https://vitalik.eth.limo/general/2024/10/23/futures4.html

2. DeFi Data Dashboard

1. TVL data

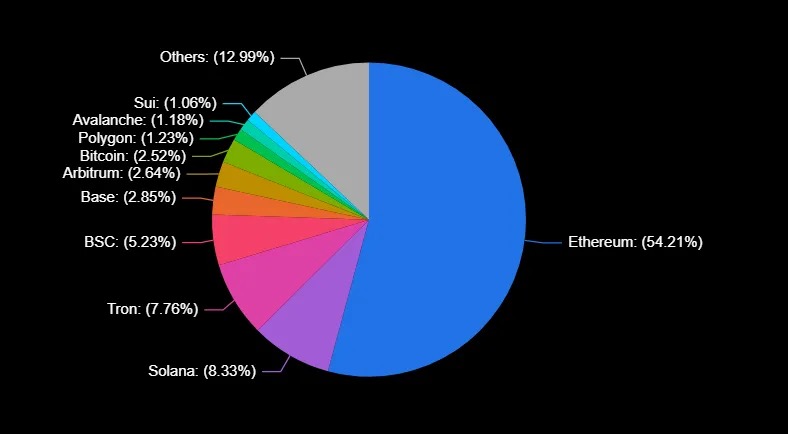

Solana's TVL (total locked value) returned to second place this week. It is also worth noting that Sui's TVL this week remained within the top 10, closely followed by Aptos, a blockchain that also uses the Move language.

2. Stablecoin data

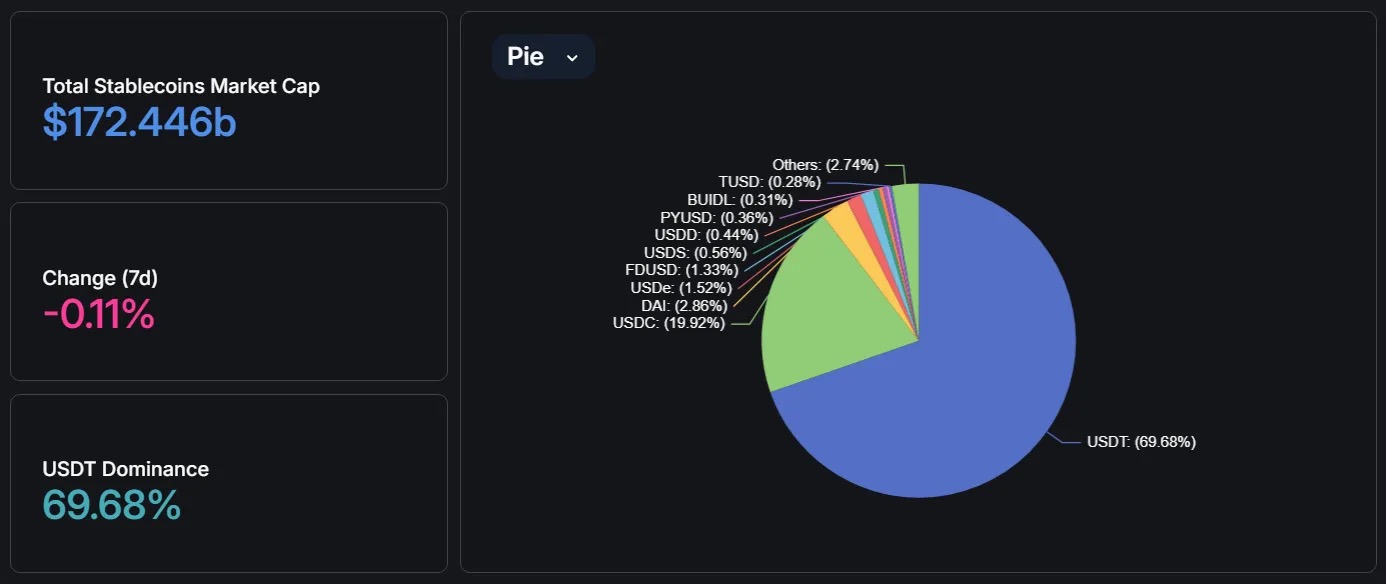

The total market value of stablecoins is now reported at 172.444 billion US dollars, down 0.11% in 7 days. Among them, USDT accounts for 69.68%, and USDe launched by Ethena Labs accounts for a slight increase to 1.52%, becoming the fourth largest stablecoin.

https://defillama.com/stablecoins

3. DEX Data

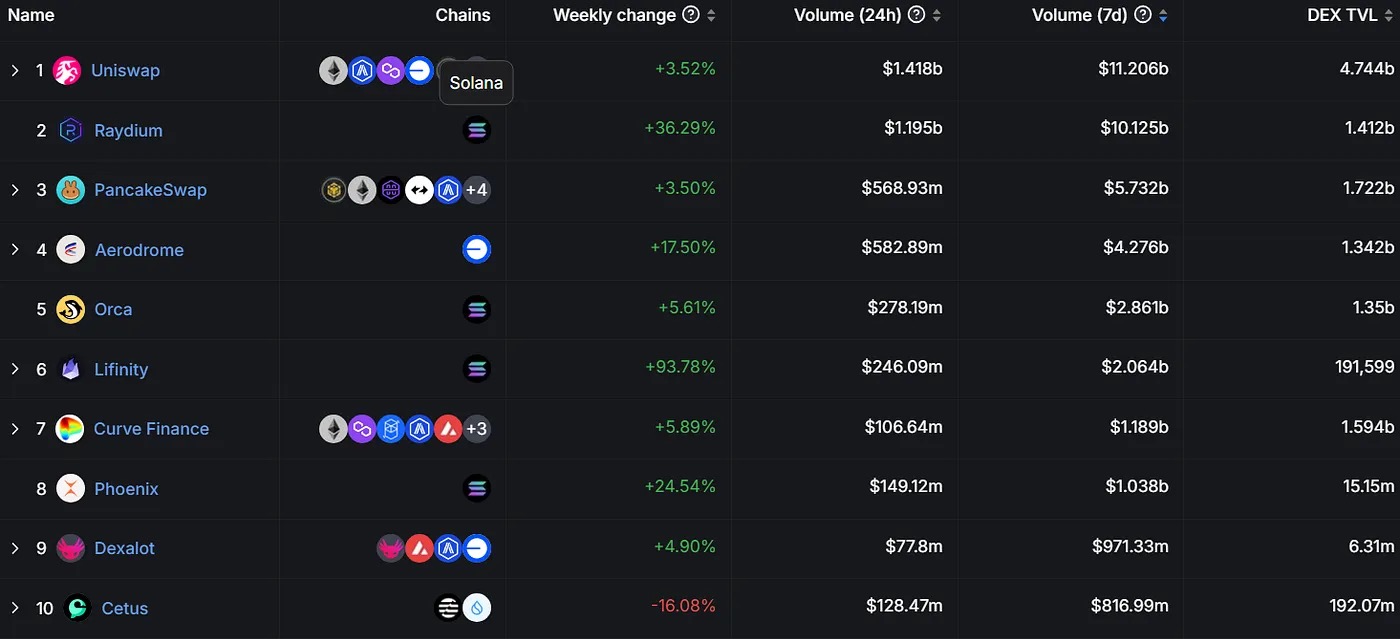

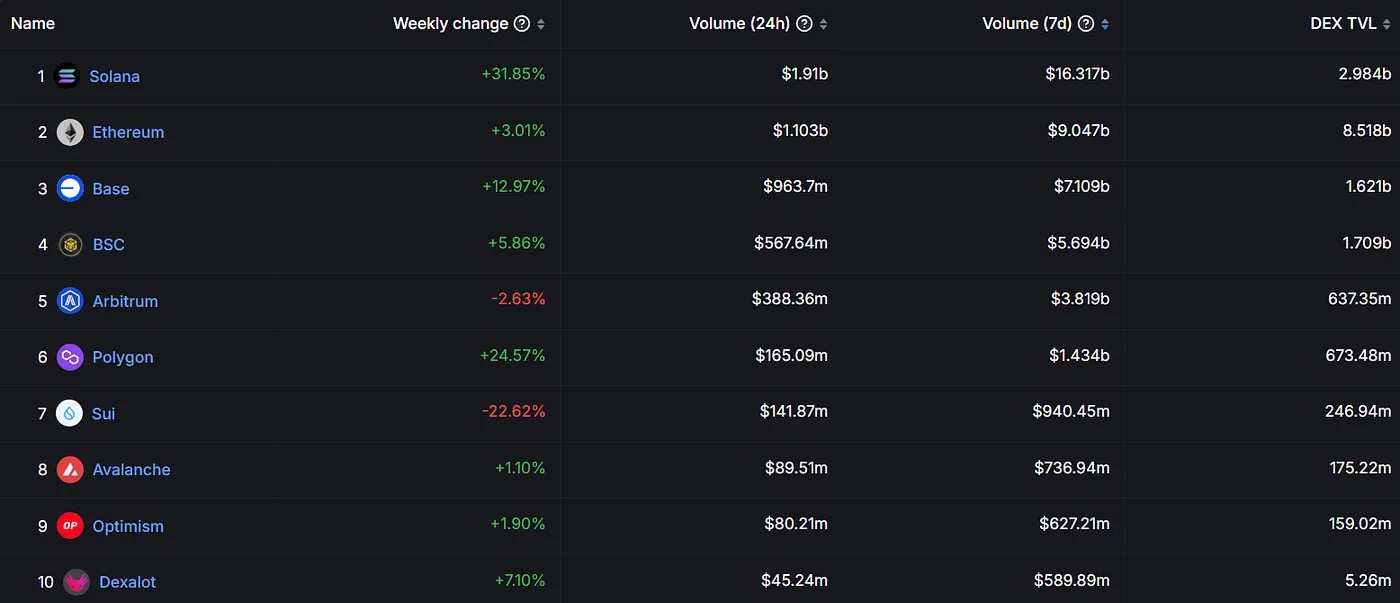

According to the latest data, Uniswap still maintains its leading position in the decentralized exchange (DEX) market. Raydium grew 36.29% this week, and its weekly trading volume surpassed PancakeSwap, ranking second. This week, the DEXs on the Solana chain performed very well. Solana's on-chain DEX trading volume in the past 7 days reached US$16.317 billion, ranking first in the entire chain.

https://defillama.com/dexs/chains

3. Snap DeFi Radar

At the time when both BTC and ETH return to their previous highs, we can expect the return of DeFi, but not in the form of DeFi Summer. As the bubbles of restaking burst one by one, high TVL can no longer represent the indicator of DeFi, but can only serve as a reference coordinate.

Of course, there are opportunities for new public chain DeFi projects, but these cannot last long. The real indicator is the number of times the DeFi is interacted with. Even if it is not a node that maximizes transaction fees or has ultra-high TVL, under the two mainstream narratives of Crosschain liquidity and Crosschain Intend (divided into three types: cross-multi-chain, cross-EVM chain, and cross-OP Stack), the protocol that can be called the most times in this environment will become the winner of this round.

Every DeFi wave will have new unicorn players, and will focus on replacing CEX. However, in this round of market with extremely high frequency of bull-bear conversions, DeFi that can cooperate with CEX or even combine CEX liquidity will be more popular. The Japanese and Korean communities are becoming new indicators in the market because they are beginning to move towards DeFi. Those with the highest practicality or those who win Japanese and Korean users will gain the highest profits in the market in 2025.

-END-

【Disclaimer】: The market is risky, so be cautious when investing. This article is for learning purposes only and does not constitute any investment advice.

https://defillama.com/chains

https://defillama.com/chains