In an interview with Unchained Crypto in October, Solana co-founder Anatoly said that by observing multiple key indicators such as the number of active addresses, TVL, DeFi section, Meme craze and developer ecology, he realized that Base is gaining momentum and becoming the strongest L2 in the Ethereum ecosystem.

In late November, Dan, the founder of Little Fox, released the Meme coin $CONSENT on Base and Solana on the same day, further causing the crypto market to compare Solana and Base.

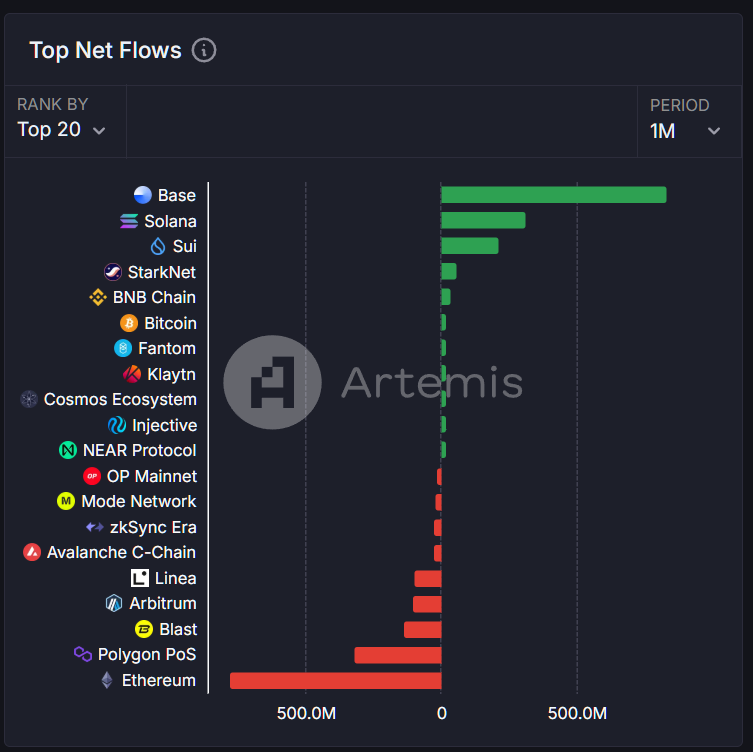

According to Artemis data, last month, Base's net capital inflow was US$835 million, ranking first among all public chains, while Solana's was US$313 million, less than half of Base.

Capital has the most sensitive sense of smell. Where there are more opportunities, more capital will gather. As the popularity of Solana MEME decreases, the next choice of capital will undoubtedly be the Base chain.

Unlike many other L2 projects, Base has currently made it clear that it does not plan to issue native tokens. This move is in stark contrast to previous projects that have attracted funds by issuing tokens. Base's growth is entirely dependent on the value of its platform and its ecological construction. Base's own value will be more mapped to the leading ecological projects on its chain.

Leading derivatives project SynFutures

As the leading derivatives protocol in the DeFi track, SynFutures is about to airdrop and TGE. Doing the right thing at the right time, the popularity of the Base ecosystem will bring more attention and adoption to SynFutures, and SynFutures will also contribute to the rapid growth of Base and form a positive flywheel. Its token F will also carry more value and potential brought by the Base ecosystem.

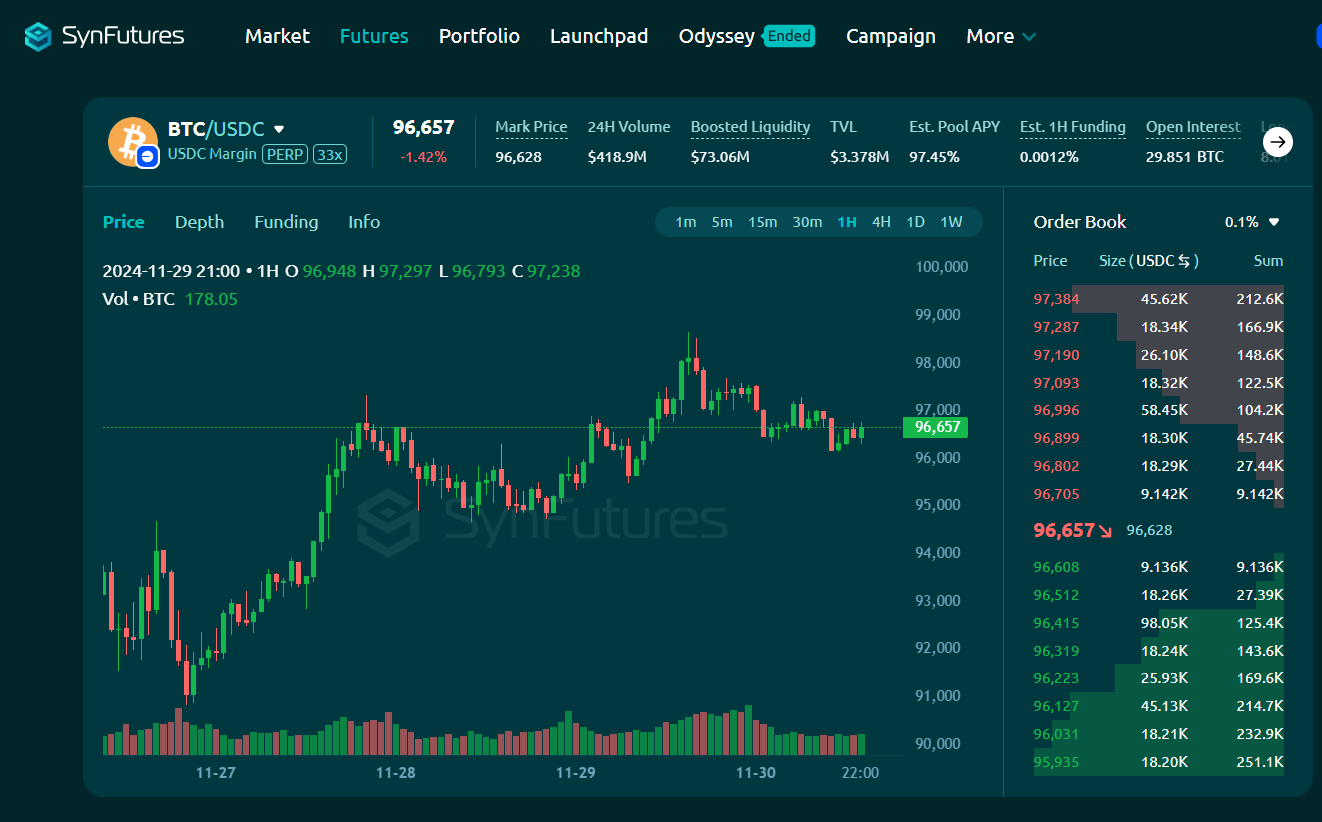

SynFutures has processed more than $200 billion in trading volume since its launch in 2021. Its products have been iterated to V3, and V3 Oyster AMM is the first unified AMM and permissionless on-chain order book of its kind.

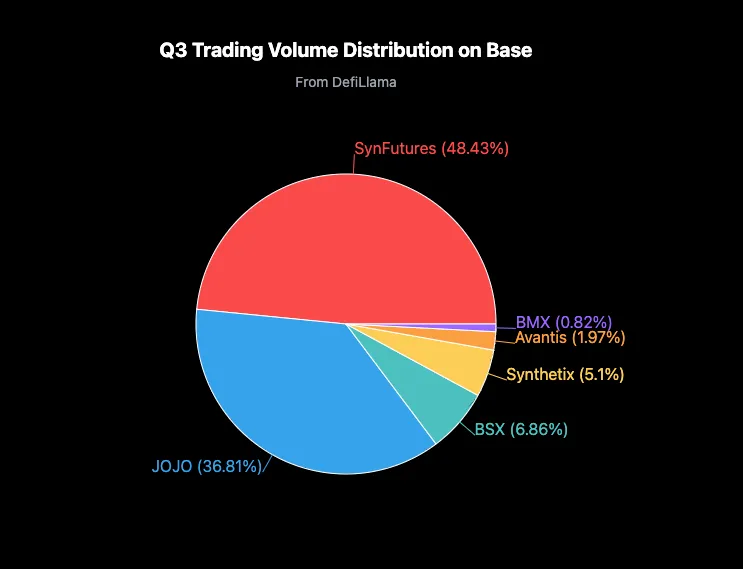

After integrating the Base chain in July, thanks to its mature products, large community, and strong cooperative resources, it quickly became the leading derivatives protocol with the largest transaction volume on the Base chain. It took only 10 days after the launch of Base to exceed $100 million in transaction volume, and the transaction volume in Q3 accounted for nearly 50% of the Base network.

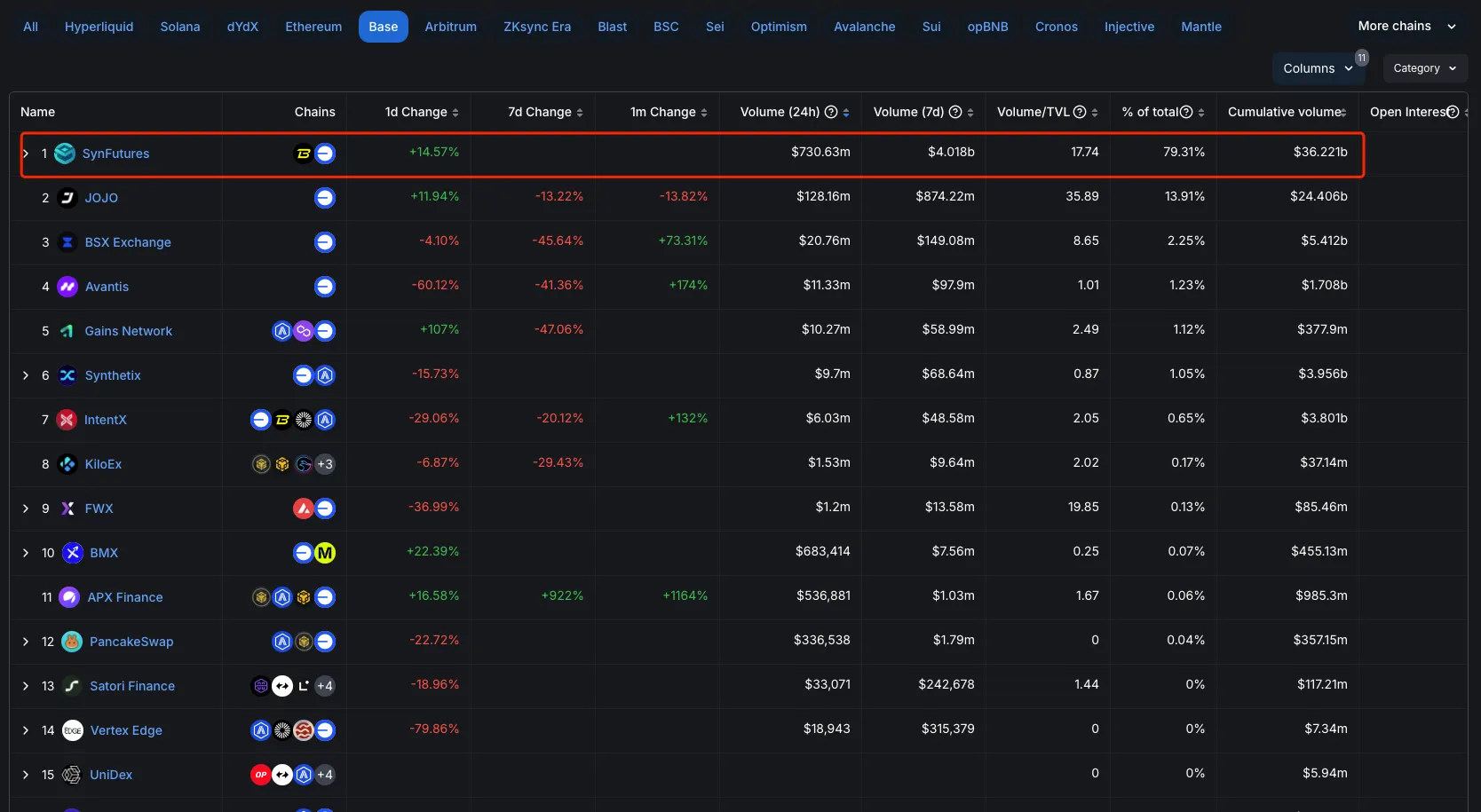

The cumulative trading volume exceeds 35 billion US dollars, with an average daily trading volume of more than 200 million. The single-day trading volume on November 12 exceeded 910 million US dollars, currently accounting for more than 70% of the Base chain's daily derivatives trading volume, which is 6 times that of the second-ranked project.

With only contract transactions, SynFutures has earned more than 3.3 million USD in fees in the past 30 days, ranking third in the protocol (the third is the Sequencer of the Base network). Strong profitability is also the basis for SynFutures to operate healthily in the long term and continue to innovate and iterate.

Mechanism and innovation of SynFutures V3

SynFutures V3's Oyster AMM model allows liquidity to be added in a specified price range and combines leverage to improve capital efficiency. Unlike Uniswap V3's spot market liquidity model, Oyster AMM uses a margin management and liquidation framework tailored for derivatives trading to ensure the security of LPs and protocols.

A very important point of the Oyster AMM model is that it introduces bilateral liquidity at the same time, allowing liquidity to be added using only one token without the need to provide bilateral assets 1:1. Liquidity providers can list any trading pairs, such as pairing meme coins with each other or any asset pairing. This mechanism brings more flexibility and selectivity to the ecosystem.

oAMM itself is an open source smart contract deployed on the chain, which has the feature of no permission. No complicated pre-listing communication and review is required, and anyone can add any trading pair at any time. Whether it is the project owner or the holder, they can create their own token trading pair on SynFutures and add liquidity in 30 seconds. This brings more optionality to the ecosystem and improves the response speed.

By supporting users to provide liquidity at specified price points, SynFutures implements on-chain price limits, simulates order book trading behavior, and greatly improves capital efficiency. This model is more in line with the habits of market makers on centralized trading platforms, and can attract more active market makers to participate, thereby improving trading depth and efficiency and providing a trading experience close to CEX.

Unlike off-chain order books such as dYdX, oAMM is deployed on-chain, all data is open, transparent and verifiable, and it is completely decentralized, with no need to worry about shady operations or false transactions.

Compared with GMX's Vault model and dYdX's application chain model, SynFutures makes up for the shortcomings of both while maintaining high efficiency and high performance, and is naturally integrated into the asset ecology of the underlying public chain. With the iteration of technology, this advantage will be further expanded.

Perp Launchpad injects new vitality into on-chain asset issuance

In the past year, asset issuance has become the most attractive track. From runes and inscriptions to the popularity of Pump.fun, all have proved the strong appeal of "innovative gameplay + wealth effect". Base Chain has outstanding performance in token issuance platform and has great development potential.

Under the mature framework of SynFutures V3, the launch of the industry's first perpetual contract Perp Launchpad has opened up a new situation for on-chain asset issuance and trading, injected more vitality into the DeFi market, and helped Base maintain its lead in the fierce public chain competition!

For example, if a MEME project uses its token to create a contract market on SynFutures, it can not only provide more trading methods and options, but also drive arbitrage funds into the market through the spot and contract price difference, increase token visibility and the number of holders, and amplify the wealth effect. More importantly, the dominance of the contract market is in the hands of the community. Project owners and supporters can benefit from providing liquidity, get rid of dependence on centralized exchanges, and form a healthier ecological cycle.

In the past few years, the initiative of the spot market has returned to the on-chain liquidity pool, and the dominance of the future contract market will also return to the community and the chain, and reward the community and holders through SynFutures. These can only be achieved under the V3 model framework of SynFutures, which allows the setting of value ranges, supports unilateral liquidity, does not require 30 seconds to add liquidity, and runs limit order books on all chains . It is a unique advantage and moat that is difficult for any other competing products to imitate.

Spot aggregator is being planned and may become the Juptier of Base chain

SynFutures and Jupiter have many similarities. Both were founded in 2021. Both have been tested by the market and have emerged from the most brutal bear market . They are leading DeFi protocols with profitability. What is very commendable is that both of them have issued tokens after long-term stable operation and continuous iteration, and use the issuance of tokens as a driving force for the project to enter the next stage. Issuing tokens is a node in their long-term strategy, or a new beginning, rather than some projects setting the issuance of tokens as a goal.

The difference is that Jupiter initially chose to be a spot aggregator on the chain, while SynFutures chose the derivatives track. However, the two paths are the same. After issuing tokens, Jupiter began to enter the derivatives track and achieved remarkable results; SynFutures will also launch a spot aggregator after TGE. What the Base chain lacks is precisely an influential spot aggregation trading product.

The synergy between on-chain transaction volume and asset issuance enables SynFutures to not only provide trading liquidity for Base, but also participate in the asset issuance process, occupying the largest value capture entrance on the chain. Once the spot function is launched, SynFutures will further consolidate its market position with its dual advantages in the two major areas of spot and derivatives trading.

Track comparison: What is a reasonable valuation for SynFutures?

SynFutures has announced its token economics. The total amount of token F is 10 billion. So based on its positioning in the ecosystem as "Jupiter of Base chain", what is the most reasonable valuation?

The FDV of Raydium, the largest spot DEX on Solana, is 3 billion US dollars, and the FDV of the largest spot DEX on the Base chain is currently 2 billion US dollars, with a ratio of 3:2.

Jupiter CoinGecko on Solana shows that the FDV is 11.2 billion, but because the official announcement was made to destroy 30% of the team's shares, the actual FDV is 7.84 billion US dollars. According to the 3:2 ratio of spot DEX, SynFutures' FDV is approximately 5.22 billion US dollars.

However, the spot part of SynFutures has not yet been launched. We can use a multi-dimensional approach to come up with a reasonable valuation:

It may be more reasonable to refer to the FDV when the Jupiter token was first launched, which is US$5 billion. Then the reasonable valuation of SynFutures is US$3.333 billion.

The FDV of Drift Protocol, another well-known derivatives trading platform on Solana, is US$1.36 billion. If we simply use the ratio of 3:2, the result is US$900 million.

However, SynFurures' V3 and Perp Launchpad clearly have greater advantages and growth potential. Averaging the conclusions drawn from Jupiter and Drift, SynFutures' current reasonable valuation is around US$2.1 billion.

As a project driven by Coinbase, Base has gained strong support in the market. The possibility of Base chain tokens being listed on Coinbase is much greater than other chains. If it can be listed on Coinbase like Aero, F's valuation will be further improved.

In addition, with the continued rise of the Base chain and the launch of SynFutures spot aggregation trading, FDV will also rise, and it is possible that it will even surpass Jupiter. After all, Web3 is where miracles are created.

Industry prospects and future thinking

From a macro perspective, the development of the Base network has injected new vitality into the on-chain derivatives market, and SynFutures is the most promising project in this field. Its innovative Perp Launchpad model not only promotes the marketization of on-chain assets, but also provides users with more diversified trading options. This model may become the mainstream trend of on-chain transactions in the future, further consolidating SynFutures' leading position in the market.

The launch of spot aggregation trading will help SynFutures gradually occupy the two most promising tracks in the Base ecosystem - derivatives trading and spot trading. This dual layout will bring more users and trading volume to SynFutures, thereby promoting the long-term sustainable development of the platform.

For investors, the launch of SynFutures tokens is not only a reflection of its own ecological value, but also may indirectly carry the growth dividends of the Base network. This token opportunity in the "coinless network" ecosystem may be the most scarce potential explosion point in the market.