By Ryan S. Gladwin

Compiled by: Vernacular Blockchain

The number of tokens launched by the popular launch platform and cultural hub Pump.fun on Wednesday was 64.6% lower than its peak in January. Meanwhile, the weekly graduation rate of tokens has also fallen to its lowest level since July 2024, according to Dune data. Graduation refers to tokens reaching a certain market value threshold, which was previously $69,000 but was raised to $100,000 at the end of last year.

The silence has led some traders to believe that the Memecoin casino has closed and will never reopen. Loopify (pseudonym), the founder of crypto education platform Pluid and a trader, believes that the Memecoin cycle is over. He pointed to some data showing that the Memecoin craze has surpassed the peak of the previous NFT bull market.

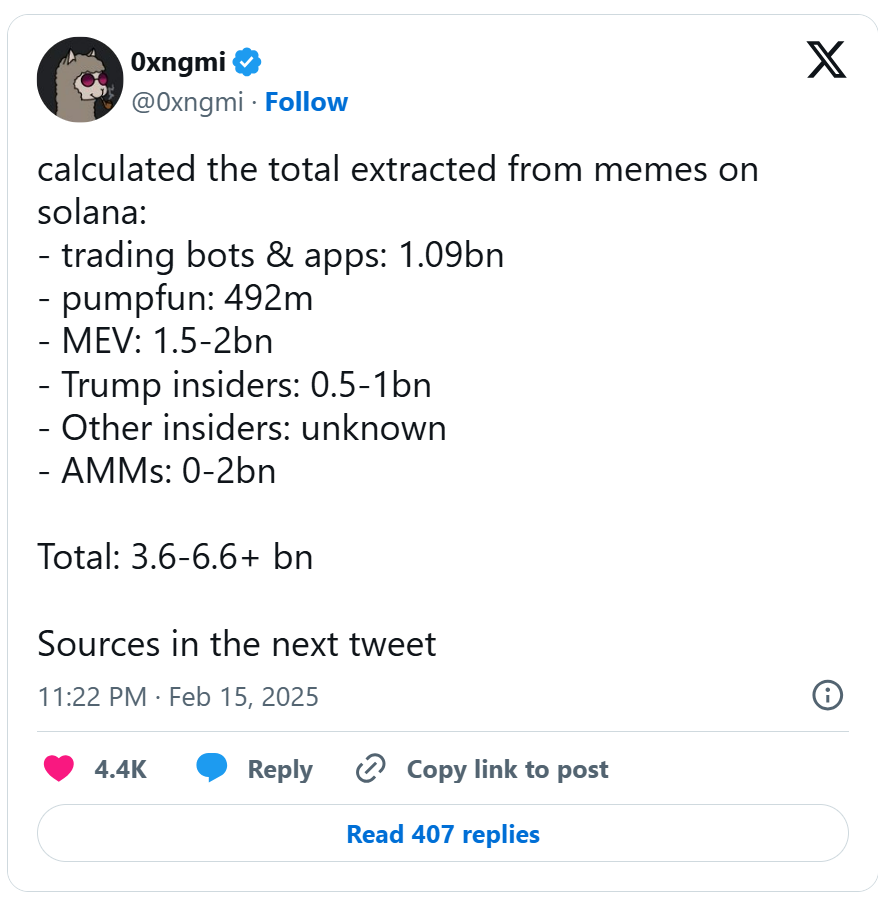

According to Dune, the most popular NFT market, OpenSea, has generated $943 million in revenue since its launch in 2017, while Pump.fun, by comparison, has generated more than $574 million since its launch in January 2024. Not to mention the revenue generated by trading bots, market makers, and other protocols that are critical to the meme coin economy.

Others saw these statistics and decided it was time to abandon Pump.fun as the center of the Memecoin ecosystem.

“The era of Pump.fun is over,” Solana Bateman, a pseudonymous trader and WIFToken deployer, told Decrypt. “They never gave anything back, but they took so much.” He added: “The difference between us and them is: We care about Solana, it’s our home. They only care about filling their pockets.”

This accusation is often directed at the launch platform, with opponents arguing that it does not do enough to develop the market and simply sells all the SOL generated by the platform - although the founder denies this claim. Bateman said the platform could improve by improving token economics, creating better liquidity pools, or providing a more sustainable model, such as increasing token unlocking at a certain market value.

“I agree that the Pump.fun model is far from perfect, and I know the team is always working hard to find ways to improve it,” Pump.fun co-founder Alon Cohen said in an interview with Decrypt.

“The design space for managing user incentives after token creation is very broad, so it will take time to perfect this. However, from day one, Pump.fun adhered to some principles that I think still hold true today.”

Cohen said these principles include keeping barriers to entry low when creating tokens, while pursuing “simplicity and elegance” because complexity will drive away retail investors. He also added that he believes Pump.fun’s standardized contracts are a “huge positive” for the ecosystem because they reduce the risk of developers creating malicious contracts that can be abused.

How did we get here?

Memecoin’s collapse can largely be traced back to the launch of Donald Trump’s official memecoin, just days before his inauguration in January. The market was filled with enthusiasm, with speculators heralding a new era for memecoins and cryptocurrencies.

The next day, Melania Trump also launched her own token, causing TRUMPToken to plummet - and MELANIA soon followed. Sentiment changed quickly, and traders began to realize where the "scam" was. According to data from DEX Screener, TRUMPToken has fallen 85% from its all-time high, while MELANIA has fallen by 94%.

These launched tokens sucked liquidity from Memecoin traders and created a large number of losers. Rennick Palley, founder of hedge fund Stratos, said in an interview with Decrypt. In the following months, more large Memecoin tokens rose and fell sharply within 24 hours - causing heavy losses for traders.

Most notably, LIBRA, which soared to a market cap of $1.17 billion after being promoted by Argentine President Javier Milley via social media, plummeted 96% to $40 million in just six hours. In the aftermath, widespread insider trading allegations broke out, involving multiple major protocols and influencers, while investigators also found ties between the issuer of the memecoin and the team behind the Melania Trump memecoin.

As the narrative that Memecoin is a rigged game continues to grow, fears that the industry is completely corrupt have reached an all-time high. Bateman believes this is the "final nail in the coffin" for Memecoin.

"At first, [Memecoin] looked like a casino game," Nick Vaiman, co-founder and CEO of analytics firm Bubblemaps, told Decrypt. "But in reality, it's much worse than that: the game is rigged from the start," he explained. "Your chances of winning are almost zero because the real winners are already determined: those insiders who know the inside story in advance, those smart snipers who get in early, and the teams behind them."

For some, this is enough to make them abandon Memecoin and start looking for more stable investments that have real value behind them. VanEck portfolio manager Pranav Kanade told Decrypt that he expects funds to flow out of Memecoin and into "some of the niche altcoins" because they can provide more psychological comfort. But not everyone is convinced.

“Many people don’t like traditional VC-backed altcoins with big visions,” Loopify told Decrypt, “so they are more likely to stick with a single culture token or simply exit the market until new opportunities arise.”

Crypto trader Murad Mahmudov has spoken about his Memecoin investment thesis, which centers on finding “sects” and buying their tokens. However, according to data from Coingecko, none of the tokens on his list have risen in the past seven days.

In addition, macroeconomic pressures are also driving the overall market downward. According to TradingView data, Bitcoin (BTC) has fallen 17% since the launch of LIBRA, the S&P 500 has fallen 2.7% in the past month, and the Trump administration’s tariff policy has exacerbated market instability.

“Global liquidity has declined recently, and Memecoin is particularly sensitive to this change,” Palley said, predicting that “it looks like liquidity has bottomed out and Memecoin may recover in the coming months.”

Some traders in the market also agree with this view. The pseudonymous Memecoin trader 0xWinged believes that the market is overreacting and predicts that Solana will soon rebound to $170 and market liquidity will flow back to the Memecoin field.

“At the end of the day, human nature is to gamble, and as liquidity in the market increases, I believe the amount of money involved in gambling will increase as well,” Palley said, adding, “Memecoin will continue to exist.”