Hash of this article (SHA1):35e14cfaaff32c39e94d75a88968168b13bdd3ccd0868b17bb33330fdc31c28d

Number: Lianyuan Security Knowledge No.123

Recently, Fuel Network, a second-layer Ethereum network, launched its own shorting plan and is preparing to launch its own native token, Fuel. So will Fuel become a network of the same caliber as Base, or will it be like ZK, which was met with widespread complaints as soon as it was launched?

Fuel's past and present

Fuel is one of the hottest modular public chain projects this year. It is an ETH Layer2 public chain co-founded by Nick Dodson and Brandon Kite.

Fuel's major well-known investors include CoinFund, Blockchain Capital, and Stratos. The background of Fuel's team is very interesting. Its co-founder John Adler is also the co-founder of Celestia, and CEO Dodson is also an early participant in the Ethereum ecosystem. Before joining Fuel Labs Arjun Kalsy has also been involved in ecosystem growth-related work at Polygon and Mantle, and has built an ecosystem that includes more than 50,000 DApps.

What is the difference between Fuel and ordinary public chains?

The development of the crypto ecosystem is accompanied by an explosive growth in the number of users and interactions. In the existing monolithic Layer 1 architecture, the constraints of handling a large number of concurrent transactions are relatively prominent. Therefore, in the long history of the development of the EVM ecosystem, there are many issues related to capacity expansion and efficiency improvement. The discussion is endless.

When Vitalik proposed Rollups as the technology development route, the Fuel team became the first team to deploy Optimistic Rollup on the mainnet, but due to their unique approach of building the execution layer based on UTXO, they had few users.

But when modular narrative emerged, the team began to build their V2 version and positioned it as a modular execution layer. They innovated their own Fuel VM by combining the UTXO model and the Sway language that inherited Rust syntax and integrated the characteristics of Solidity language, and then built Fuel has developed a Rollup OS that maximizes throughput and minimizes latency. These constructions have made Fuel one of the emerging expansion teams in the Ethereum field.

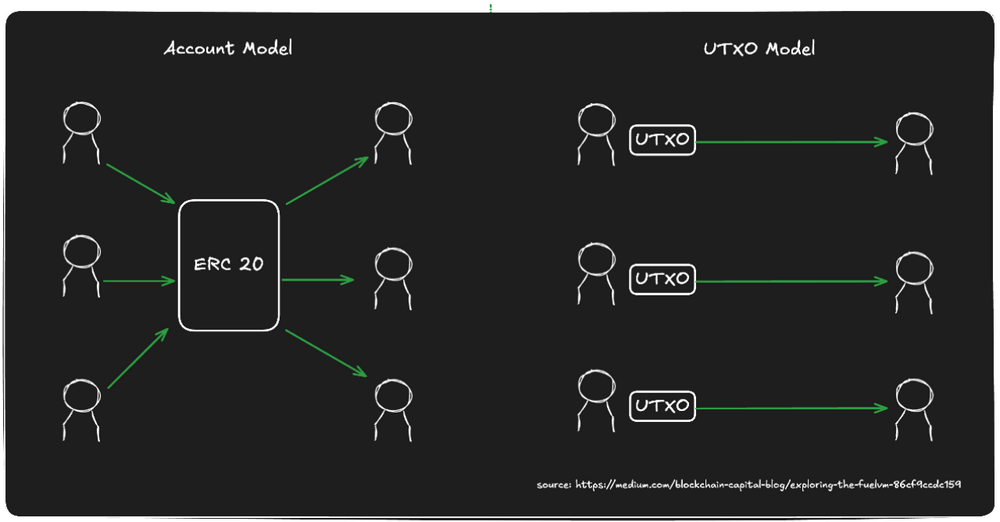

Seeing this, do you feel a little strange? ETH is obviously a ledger accounting model, so how can it be connected with BTC's UTXO? And the "parallelism" that is impossible to achieve in the ETH layer is also achieved here? Can this kind of publicity solve any problems or is it just a gimmick?

UTXO Model and Parallelization

Fuel's parallel transaction execution model is the core innovation of its efficiency and scalability, focusing on solving the performance bottlenecks of traditional blockchains, such as throughput and latency issues. Traditional blockchains usually adopt a sequential execution model, where each transaction relies on This design limits the system's processing capabilities in high-concurrency scenarios.

Fuel breaks this sequential dependency by introducing a parallel model, decomposing tasks into multiple relatively independent subtasks and executing these subtasks simultaneously using the multi-core processing capabilities of modern hardware. This parallel processing method greatly improves system throughput while reducing transaction latency.

Fuel's parallelization also relies on a precise conflict detection mechanism to ensure that only non-conflicting transactions are allowed to be processed concurrently, thereby avoiding problems caused by state competition. After all parallel tasks are completed, the system will integrate the results and verify the consistency of the global state. Ensure the security and integrity of the blockchain.

Fuel's parallelization capabilities rely heavily on its underlying UTXO (unspent transaction output) model. The UTXO model models the input and output of a transaction as independent state units, each of which can be processed separately and are not dependent on each other. This independence not only simplifies transaction verification, but also provides natural support for parallelization.

In the design of Fuel, the UTXO model is used to handle all transactions from simple token transfers to complex smart contract calls. The unspent coins (UTXO) held by each address can be consumed or transferred directly through the FuelVM without relying on Global account status. This approach greatly reduces the system's global status update costs and significantly improves transaction processing efficiency.

FuelVM is the core virtual machine of Fuel. Its combination with the UTXO model further improves the performance of Fuel. FuelVM can quickly verify the legitimacy of UTXO and perform corresponding operations, thus avoiding the lengthy status check process in the traditional account model. In addition, since UTXO FuelVM is able to process multiple transactions simultaneously due to its independence, thus achieving a high degree of parallelism. Whether it is a simple token transfer or a complex smart contract call, this design ensures that Fuel's transaction execution is efficient and flexible.

Fuel's parallel transaction execution and UTXO model complement each other and jointly build an efficient transaction processing system. Each transaction depends only on its own input UTXO, so it can be executed independently, greatly improving transaction isolation. Fuel can accurately select transactions that can be processed in parallel to further optimize performance. Even in the face of complex smart contract calls, Fuel can decompose the state update of the contract into multiple independent transactions for parallel execution through the UTXO model. , thereby significantly improving processing efficiency without sacrificing flexibility.

Through the synergy of the parallel transaction execution model and the UTXO model, Fuel has demonstrated outstanding performance advantages in throughput, latency, and scalability. It can not only handle more transactions and meet the needs of high-concurrency scenarios, but also significantly Shortened transaction confirmation time.

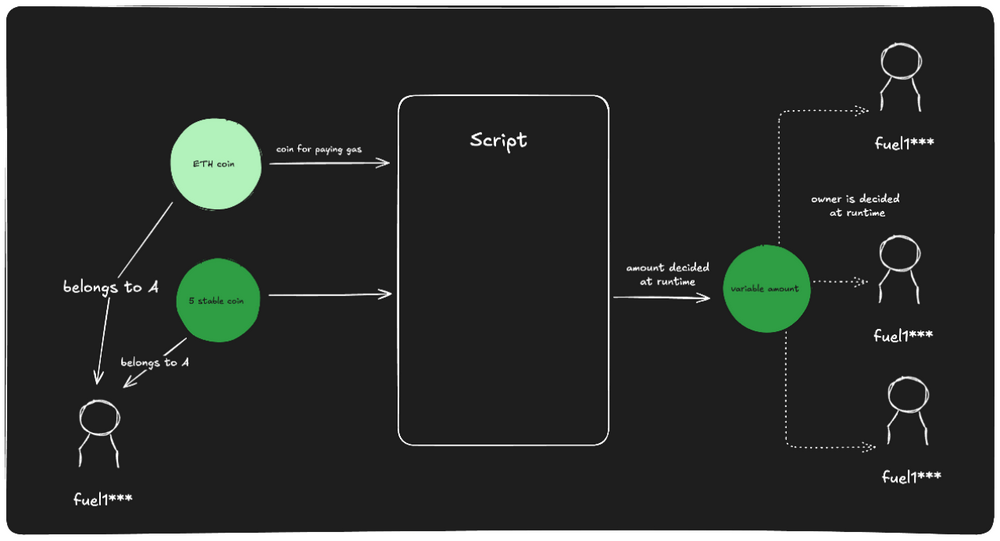

Design of UTXO transactions

Fuel uses the UTXO model to process transactions. This model was first adopted by the Bitcoin protocol and is known for its support for parallel transaction execution. In Fuel, an address can own local assets and consume these assets through transactions. There are five types: Script, Create, Mint, Upgrade, and Upload. This classification method clarifies the different functions that users can perform in the Fuel ecosystem.

The core components of a Fuel transaction include Inputs, Scripts, Outputs, and Witnesses. Inputs contain state elements that users access in a transaction, such as Coins, Contracts, ) and Messages. Fuel supports smart contracts as input, which have persistent storage capabilities and can perform complex operations, breaking through the limitations of the Bitcoin protocol. Witnesses provide digital signatures and verification information for transactions to ensure the legality of token consumption. sex.

Fuel's UTXO model is unique in that it supports Turing-complete smart contracts, which allows contracts to not only have local assets, but also be called through transactions as input. The state and balance of the contract can be updated after the transaction is executed, and these The output of the contract can be used in subsequent transactions. In addition, Fuel implements multi-call functionality through scripts, allowing users to interact with multiple contracts in a single transaction.

Fuel's Outputs define the new UTXO generated after the transaction, which can be used as input for the next batch of transactions. Output types include Coin, Contract, Change, Variable, and ContractCreated. (Contract creation). An interesting optimization made by Fuel is that any output with a zero amount will be removed from the UTXO set to keep the system efficient.

A new language: Sway

Sway is a programming language designed by Fuel specifically for the development of smart contracts on this chain. It combines the advantages of modern programming languages while being optimized for the unique needs of the blockchain environment. Sway is inspired by Rust , which means it It inherits some advantages of Rust, such as strong type system and security, but at the same time removes some complexities in Rust that are not suitable for blockchain development.

Compared to Solidity, the most widely used language in blockchain smart contract development, Sway provides more modern language features and tool support. Solidity has long been limited by the historical design of the Ethereum Virtual Machine (EVM). The language features and tools seem a bit outdated. For example, Solidity's type system is relatively weak and lacks features commonly used by programmers, such as generics and algebraic data types. Sway, on the other hand, helps developers by introducing a more powerful type system and static analysis. Catch potential errors at compile time and avoid problems at runtime.

Relationship to Rust

Although Sway's design was inspired by Rust, it is not completely identical to Rust. Rust is a powerful general-purpose language suitable for system programming. It is sold as memory-safe and high-performance, especially for applications that require complex memory management. However, smart contract development on blockchain is different from traditional programs. Since the execution and deployment costs of blockchain are very high, overly complex memory management and compile-time checking (such as Rust's borrow checker) may increase the cost. Therefore, Sway abandons some of the complex features of Rust and focuses on providing lightweight, resource-efficient tools to meet the special needs of blockchain development.

Why Sway

The main reason for choosing Sway over Solidity or Rust is that its design is more in line with the actual needs of smart contracts. Sway can effectively reduce common programming errors through stronger type inference and static analysis functions, especially in smart contracts. In addition, Sway also provides many modern tools necessary for smart contract development, such as automated testing frameworks, integrated development tool chains (including code completion, document generation, etc.), which are extremely The land has improved development efficiency.

In general, Sway tries to find a balance between Rust and Solidity: it inherits Rust's system programming ideas, maintains efficiency and security, while avoiding Rust's overly complex memory management; it is more modern and more Powerful, but not limited by the design flaws of the EVM like Solidity.

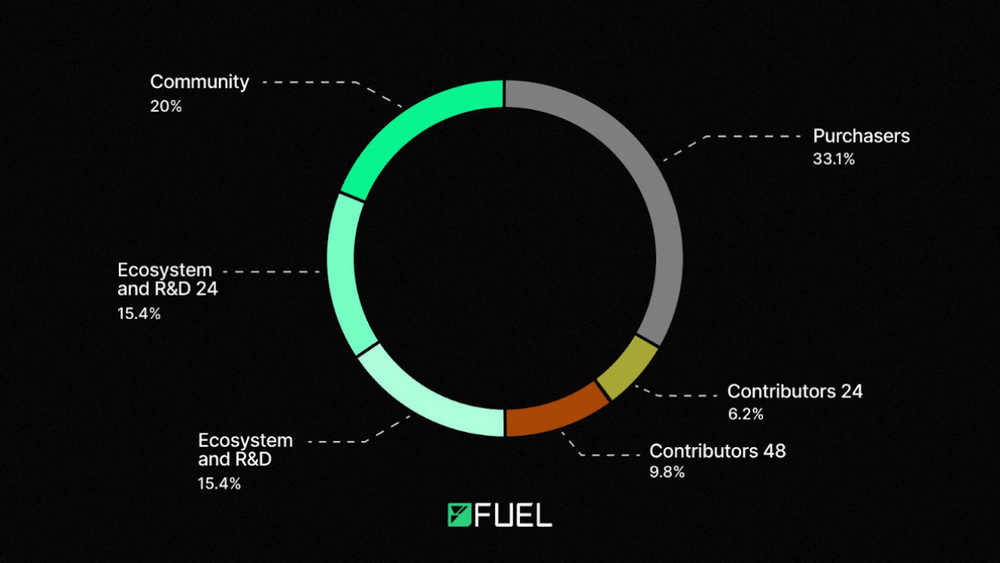

Fuel Airdrop Allocation

20% is allocated to the community — including a total of 5% for community outreach efforts across platforms, and the remaining 15% for incentives, programs, events, and activations.

16% is allocated to contributors who have developed the Fuel technology stack and contributed to the growth and success of the Fuel ecosystem to date.

30.8% is used for ecosystem and R&D to promote ecosystem development and research and development of future fuel technologies.

33.1% is allocated to purchasers who purchased between 2020 and 2022.

at last

Fuel's technical design is based on the core concept of modular public chain. Through the innovative UTXO model, parallel execution mechanism and exclusive FuelVM, it breaks through the bottleneck of scalability and efficiency of traditional blockchain. At the same time, it is based on Rust optimization. The Sway programming language enables developers to build smart contracts in a more modern and efficient way. These technical differences have made Fuel gradually stand out in the ETH ecosystem and provided new solutions to the performance problems of the current blockchain. path.

From a market perspective, Fuel’s financing history and team background show strong financial and resource support. In particular, its founding team has deep technical accumulation and has played an important role in the development of blockchain. This qualification is This has laid a solid foundation for the long-term development of the project. In addition, the narrative of modular public chains has gradually been accepted by the market, and Fuel, as a leader in this field, undoubtedly has a first-mover advantage.

However, while we are optimistic about Fuel’s technical potential and market positioning, we also need to be wary of the challenges it faces. On the one hand, the popularization of modular public chains requires the collaboration of the entire ecosystem, and how Fuel can attract developers and users will be a key issue. On the other hand, although parallelization and the UTXO model perform well in theory, it will take time to verify whether they can be widely used on the main network.

Looking ahead, the success of Fuel is not only about itself, but also likely to inject new vitality into the development of the entire blockchain industry. As readers, we should draw inspiration from Fuel's practice and continue to pay attention to the development trend of modular narrative. Whether it can gain a foothold in the fiercely competitive public chain market, its technological attempts and innovative models are worth remembering.