Author: Frank, PANews

AI Agent has become a hot topic in current on-chain transactions. From ai16z to Virtual, and then to Swarms, in just one month, the AI Agent track has once again derived a new sub-ecology in the MEME field. In the face of the ever-evolving AI Agent tokens, which ones can break through the siege and which ones are just a concept wave? There may be multiple angles to consider, but the flow of funds on the chain and the changes in the main force may still be the most important consideration indicators.

PANews takes the recently popular Swarms token as the main analysis object, and conducts comparative analysis on the addresses of the major holders of the six AI Agent tokens with higher market value, trying to "carve the boat to find the sword" again and spy on some codes. The data range of this analysis includes: the initial purchase and initial sale of the top 1,000 holding addresses of Swarms tokens (data time as of 24:00 on January 6, 2025), the address overlap of six AI-related tokens with a market value of more than 100 million US dollars, such as Fartcoin, GRIFFAIN, ZEREBRO, ai16z, arc, and Swarms (data time as of 14:00 on January 7, 2025), and the transaction records of the internal market.

Some people quietly make plans at the lowest price, while others follow suit and enter the market

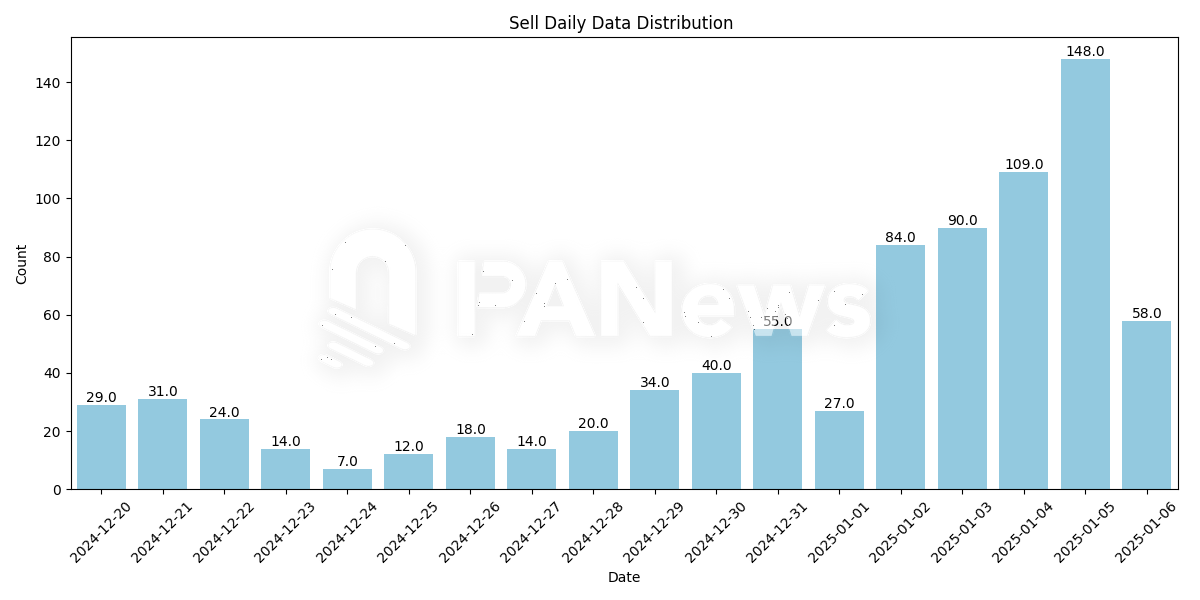

First, judging from the timeline of large investors entering the market, most of them started to enter the market after January 2, 12 days after the token was created. In terms of time, many large investors of Swarms also started to buy after the Swarms ecosystem became popular, and failed to complete the early layout.

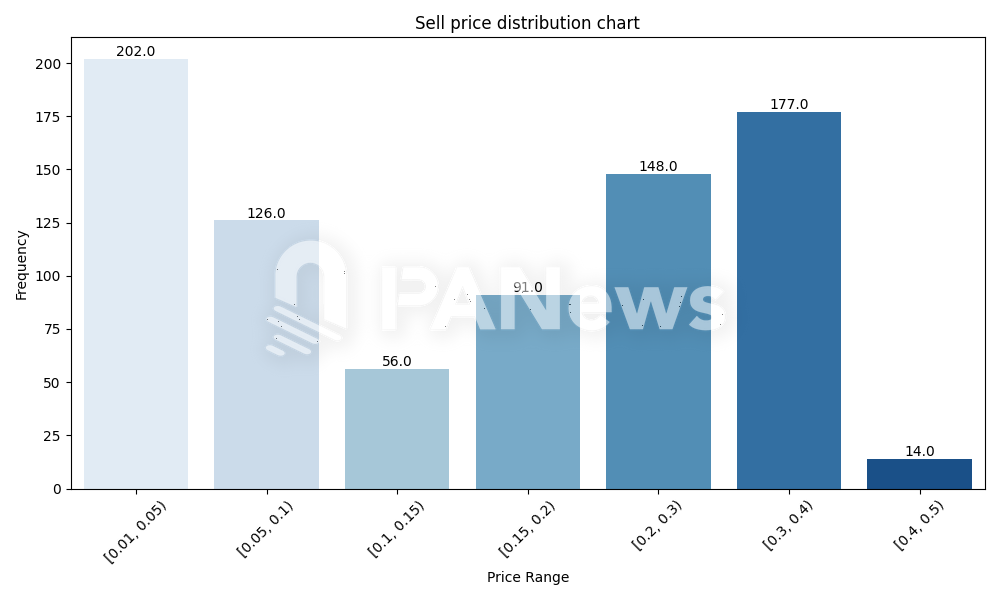

However, according to the price curve of Swarms, if you buy before December 27, the price can basically be maintained below $0.02, which is nearly 30 times higher than the current highest price of $0.6. By analyzing the initial purchase price of these addresses, 202 addresses bought in the price range of $0.01 to $0.05, followed by the largest number of addresses buying between $0.3 and $0.4.

The distribution of these two data also means that the early investors of Swarms bought at the bottom price in batches during the period when the price plummeted, and this purchase was also relatively scattered and not concentrated in a unified time period. The advantage of this is that you can get chips at a lower price. Another group of big investors began to enter the market in large quantities after the discussion of Swarms became hot, but the holding prices of these big investors did not have much competitive advantage.

This distribution of chips may explain why the Swarms market seems to fluctuate greatly in the short term. If the big investors who were hiding in the market early sell at the high point, the cost for the new big investors will be high. Once a large-scale sell-off occurs, it is easy to touch the sensitive nerves of both parties and cause a short-term sharp drop.

However, judging from the distribution of chips, the main chips of Swarms are relatively dispersed. In the analysis of the top 1,000 holding addresses, not too many tokens come from the same address, and the initial token sources of most addresses are mainly on-chain exchanges. Therefore, there are few cases where early big holders obtain a large number of chips and then disperse them to multiple addresses.

In addition, by comparing the internal trading addresses, it was found that the addresses purchased in the internal market basically did not appear in the current top 1,000 holding addresses. Therefore, the early chips of the token have basically completed the rotation.

From the overall data, the average first purchase price of Swarms tokens was $0.17 and the average first sale price was $0.23. The average initial purchase amount per address reached $37,600, and the average first sale amount was about $28,200. In comparison with the buying and selling of a single address, the average first sale price of these addresses was about 2.43 times the purchase price.

The largest investor made a profit of $25 million without selling.

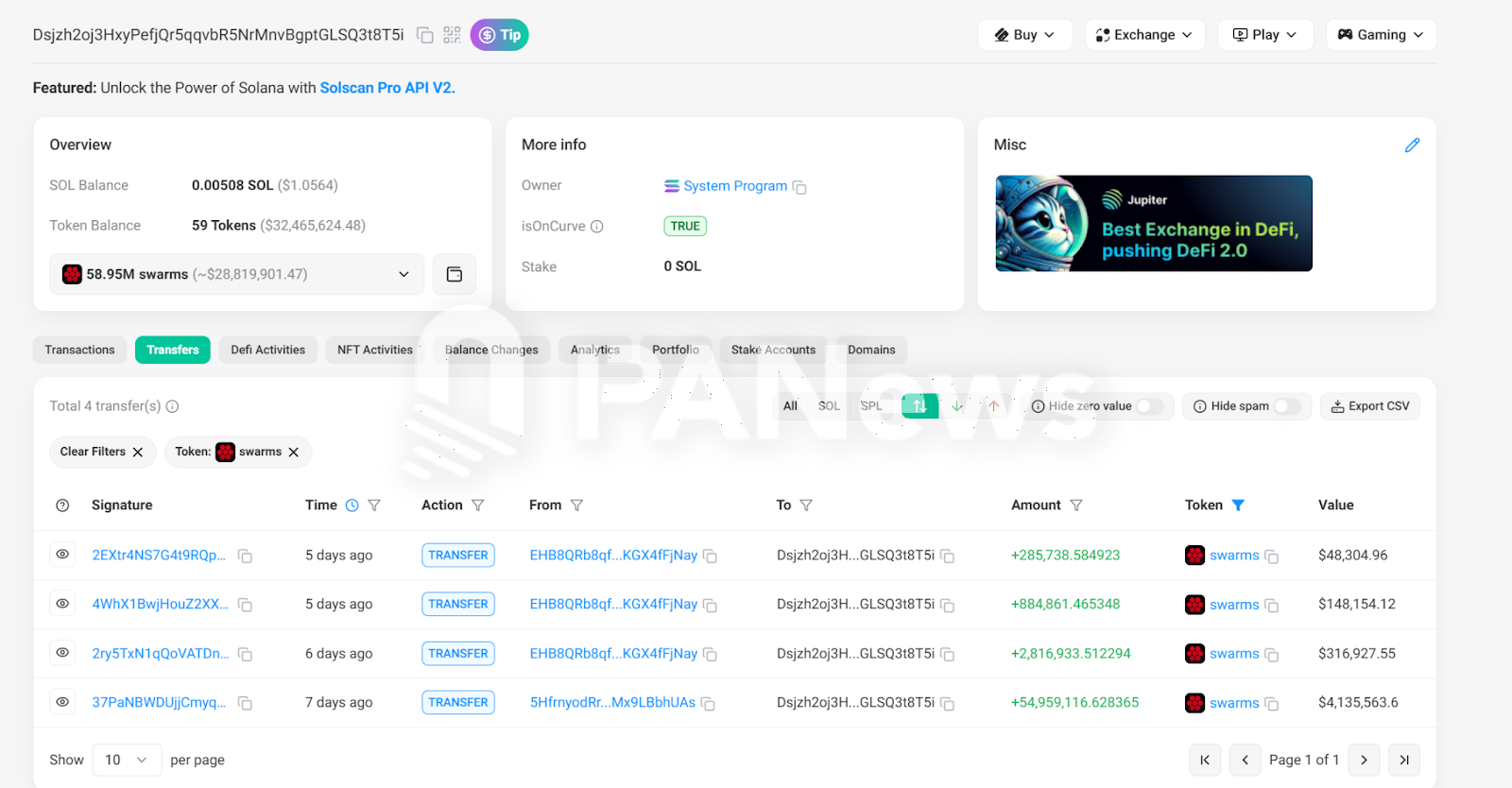

Compared with other MEME tokens, the above average initial purchase amount is significantly higher. The main reason here is that it is affected by some large addresses. Among them, the address with the highest initial transfer amount is Dsjzh2oj3HxyPefjQr5qqvbR5NrMnvBgptGLSQ3t8T5i. About 4.13 million US dollars were transferred to this address from another address on December 31, and about 500,000 US dollars were transferred in subsequently. The current holding value is 27.33 million US dollars.

The address to which it was transferred, 5HfrnyodRraAw63aRVPueD5Er4D1sRKMZBMx9LBbhUAs, started buying in large quantities as early as 8:22 on December 20, and has been buying continuously since then, spending a total of US$1.89 million to purchase 54.95 million Swarms at an average price of about US$0.034. The current profit is about US$25.44 million.

According to tracking, the earliest associated purchase of this address started as early as 7:13 (Swarms opened at about 06:45 on December 20). It is worth mentioning that the associated fund address of this address also started buying ai16z tokens as early as October 27, with a profit multiple of about 36 times.

In addition, another address 5NQTp9jHbzS4N9yKMWxwm8pPZW3RFSFPze3Edwss7iLe transferred Swarms tokens worth about $3.63 million on January 4. According to the on-chain traces, this address also purchased tokens in a dispersed manner through several addresses around January 2, and finally gathered the tokens into one address. The current holding value of this address is about $5.26 million.

There is also an address H1zFMUjYLzJwcfgXEtwiJ2ykvxmBr7JW6afW29PkcEAe that uses a similar method and holds approximately US$2.27 million. The only difference is that the tokens of this address initially came from the Bitget exchange, followed by multiple purchases on the chain.

The total initial transfer amount of these three addresses was about 10.53 million US dollars. From the purchase process, it can be seen that the initial purchase was made by multiple addresses in a dispersed manner. After Swarms became popular, all tokens were collected into a few addresses, becoming smart money in the eyes of on-chain hunters.

27% of addresses purchased multiple AI Agents. Who is driving AI Agents behind the scenes?

In addition to analyzing the token addresses of Swarms, PANews also conducted comparative analysis on the top 1,000 holding addresses of six addresses, including Fartcoin, GRIFFAIN, ZEREBRO, ai16z, arc, and swarms. In the analysis, it can be seen that among the 6,000 addresses involved in the analysis, 1,647 addresses appeared repeatedly, which means that about 27% of the addresses purchased multiple AI Agent-related tokens, among which ZEREBRO seems to be the favorite token of AI big players, with 405 addresses purchasing this token. The next ones are arc (368 addresses) and ai16z (334 addresses).

Among these addresses, the address with the highest holdings is DJnHztNmw1H56uYm98PNu5eVZ5yhi9482rZ9zA22TUUz, which currently holds AI-themed tokens worth about $49.86 million, of which ai16z alone holds about $42.7 million. Moreover, this is not all the holdings of this address. As early as a month ago, this address had made tens of millions of dollars in profits by purchasing tokens such as ZEREBRO and GRIFFAIN.

In addition, 3xzTSh7KSFsnhzVvuGWXMmA3xaA89gCCM1MSS1Ga6ka6 also holds about $42.84 million in AI-related tokens, and the on-chain holdings of this address are worth more than $73 million. According to social media information, this address should be the wallet address of the early AI Agent address Truth Terminal.

In addition, there are many similar addresses. According to the statistical data, the AI-related tokens held by these 1,647 large addresses are worth more than US$1.58 billion. Among them, there are about 29 addresses with AI holdings exceeding US$10 million, and the holdings of these 29 addresses are approximately US$690 million.

Rather than saying that AI Agent may be the hottest trend in 2025, it is better to say that AI Agent is essentially a better story topic in the eyes of big money investors.

Analyzing transaction behavior is more important than tracking smart money addresses

With the continuous deepening of on-chain data analysis, tracking smart money seems to have become a popular science, but from the perspective of large traders, when they are laying out their chips in the early stage, they do not want too many retail investors to follow them and grab the chips at the bottom price. Therefore, constantly changing new wallets and diversifying purchases have become the basic operations of large traders.

In this way, blindly chasing smart money will gradually become ineffective, and it may be the target of malicious harvesting. However, after analyzing the operations of large holders many times, even if new addresses and decentralized purchases are used, there are still management difficulties and fund collection problems. Therefore, in most cases, large holders still need to collect funds from various wallets into one or several wallet addresses for easy management, and they can also stimulate more copycat users to enter the market through small purchases during peak periods. Second, in order to quickly collect and buy in the early stage, these early layouters have to concentrate on buying a large amount in a certain period of time. Although the amount is relatively scattered, this regular purchase may still become a sign. After all, their investment amounts are often between hundreds of thousands of dollars and millions of dollars. If they do not have a certain determination to trade, they generally will not buy crazily.

In general, for general retail investors, if they insist on chasing smart money through on-chain tracking, perhaps paying attention to on-chain behavior is much more effective than chasing smart money addresses. Of course, there is also an important premise, which is to think like big investors about what kind of subject matter will be a good story. Otherwise, in the face of endless new tokens, blindly chasing is tantamount to finding a needle in a haystack.