Source: Delphi

Compiled by: Luke, Mars Finance

Introduction

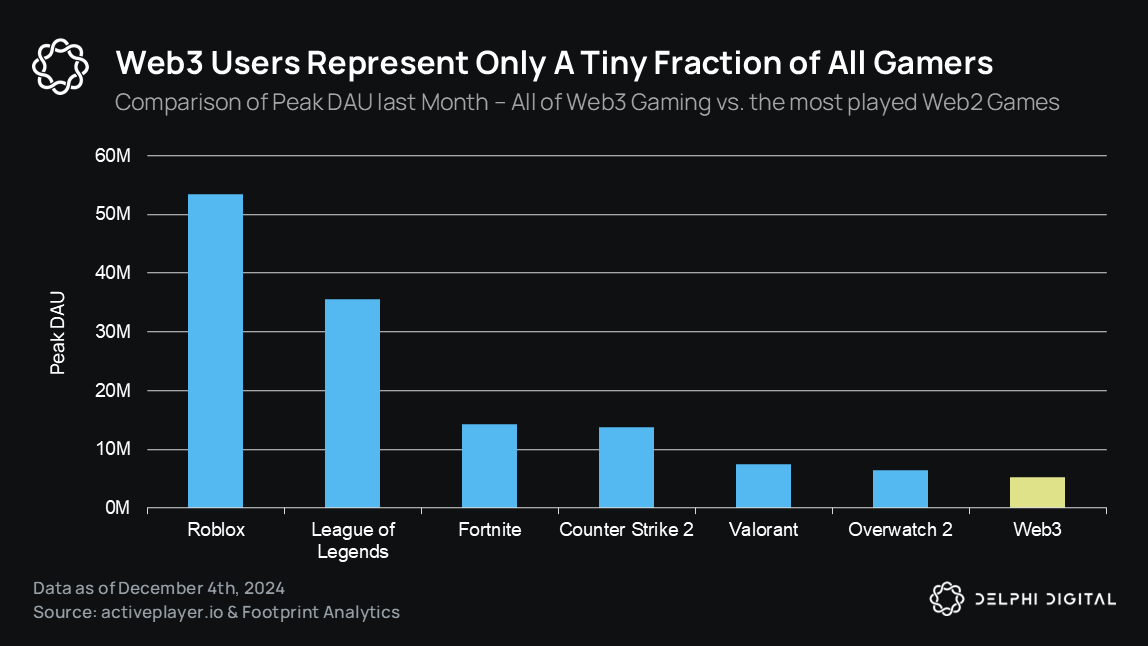

A string of successful launches towards the end of 2023 means the outlook for Web3 gaming looks promising. That said, in last year’s Future Outlook report we expressed concerns about the sheer volume of new game and token launches, and how the challenging Web2 distribution landscape has them all competing for the same limited pool of Web3 users. This competition for player liquidity, combined with the monopoly of attention by memecoins and more recently AI, has led to a relatively poor performance for Web3 gaming this year.

However, 2024 is also objectively the year with the highest quality gaming content. Early access releases of highly anticipated games like Off The Grid and MapleStory Universe (MapleStoryU), along with some promising updates to ecosystems like Telegram and plenty of exciting AI innovations, make us more bullish than ever about the future of the industry.

This report will briefly summarize gaming developments across all key sectors so far this year, and highlight how we think the situation will develop in 2025. It will also outline three core themes for the year ahead: the current state of liquid gaming tokens, how the prospect of wider adoption will impact the fight for player liquidity, and what role gaming will play in the future of crypto x AI.

This is a critical time for the gaming industry, and the next 12 months will be critical in predicting the next five years. Whether it is a bull or bear market, we believe that as the market continues to develop and mature, there will be tremendous opportunities for those who are best informed in positioning themselves.

Year in Review

Web3 Game Funding

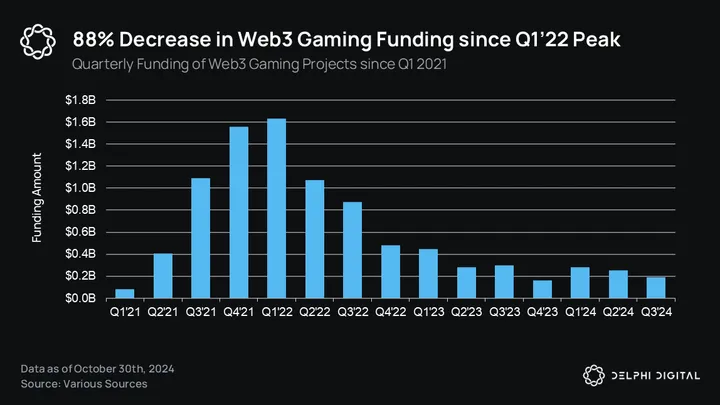

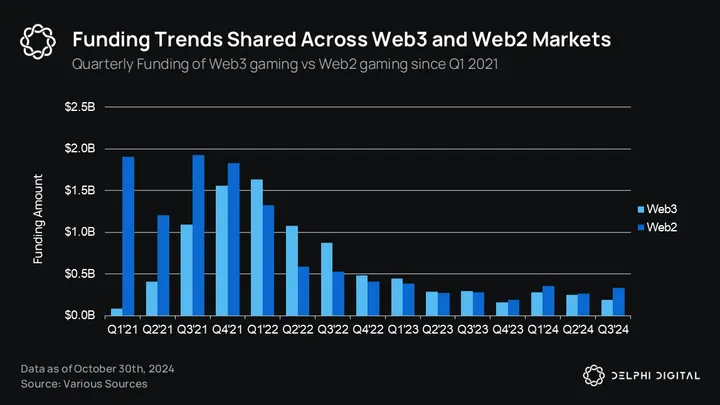

Funding for Web3 Games has shown relative resilience in 2024, raising a total of $715.5 million by the end of the third quarter. Web3 Game deal count has remained stable, with 135 deals recorded so far in 2024, in line with the full year of 2021, but down from the peak of 265 deals in 2022.

While the funding metric is significantly lower than the $4.07 billion total raised in 2022 (cumulative funding in 2024 represents only approximately 43.8% of funding in the first quarter of 2022), it still reflects relatively healthy flows of capital in a challenging macroeconomic environment that features the highest interest rates in more than 20 years.

While overall funding has declined, the focus has shifted to fewer, higher-quality projects. In 2024, only eight gaming projects raised more than $20 million, compared to 18 in 2023, suggesting that investors are becoming more selective.

In the absence of a unifying narrative like Play to Earn (P2E) or the Metaverse, many investors who lacked the expertise needed to evaluate exchanges or fund mandates that did not prioritize gaming have retreated after suffering too many losses.

In addition, there is a clear shift in funding toward early-stage deals and a decline in later-stage rounds. This trend suggests that despite the large amounts of capital invested during the 2021-2022 funding boom, many projects during that period are struggling to obtain follow-on funding. This could indicate product-market mismatch or difficulty maintaining growth in tough market conditions.

The current environment highlights that BTC price increases and bullish sentiment will not flow into the gaming market immediately. However, it also marks a maturing industry that is no longer subject to market volatility and where capital can find teams with stronger fundamentals and more sustainable long-term visions.

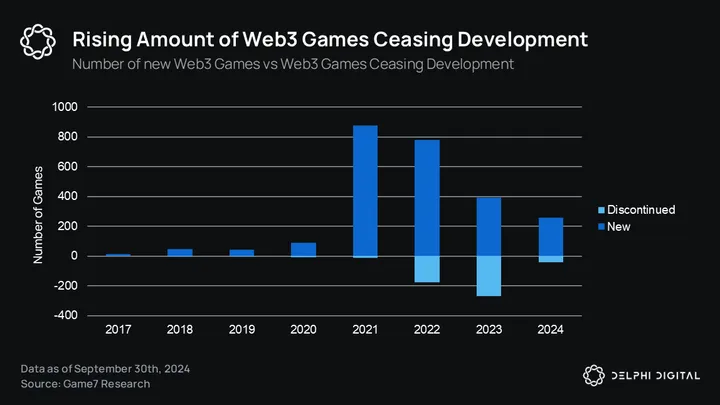

The bear market of 2022 and 2023 served as a much-needed cleansing, with many subpar projects ceasing development. Of the 2,489 funded Web3 game projects tracked by Game7 DAO, 514 have ceased development, with more than half (271) ceasing development in 2023 alone.

Further regulatory clarity from the Trump administration and increasing compliance with MiCA in the EU market will provide some much-needed confidence to both institutional and retail investors. In stark contrast to the relatively dire funding environment for Web2 games, the increased liquidity and novel value accumulation mechanisms that Web3 token rounds offer investors will remain an attractive value proposition.

Looking ahead to 2025, the trajectory of Web3 game funding will depend heavily on the state of the market sector. In a more optimistic scenario, successful token launches on leading exchanges by companies like Off The Grid and MapleStoryU will attract new liquidity and reaffirm the importance of having great products first. This not only attracts more developer and VC interest in future industry growth, but also catalyzes additional interest in more niche sub-sectors, such as high-stakes on-chain games and the intersection of AI and gaming.

If the most anticipated launches in late 2024/early 2025 don’t go as smoothly as many hoped, the bear scenario will lead to aggressive consolidation, lack of liquidity (except for AI games), and a tough 2-3 years for gaming teams. The silver lining here is that the teams that survive will demonstrate their anti-fragility and strong fundamentals. This will create several interesting bear buying opportunities for those who can identify the strongest teams with the best products and sustainable token models.

Market Trends

The total gaming market cap has been showing significant growth since reaching $7.49 billion in mid-October 2023. As of now, the market cap has reached $34.8 billion, an increase of more than 360% from the 2023 low and a significant 115% increase from the pre-election peak of $16.16 billion. However, the market is still 10% below the March 2024 peak of $38 billion and approximately 43.5% below the previous cycle's peak of $49.96 billion.

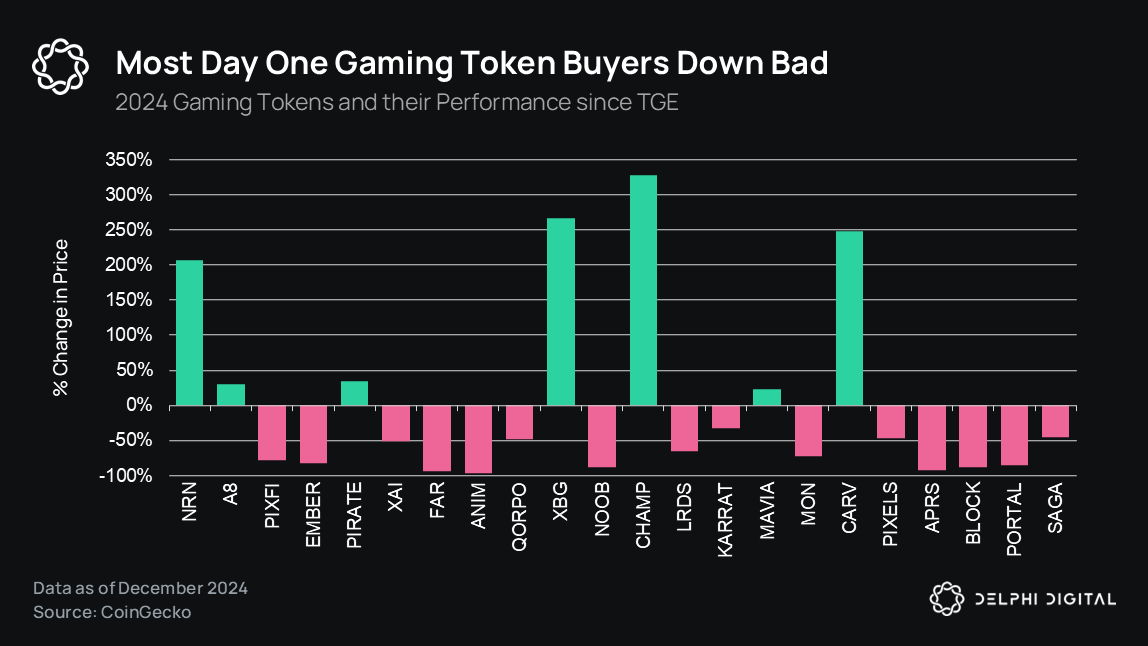

According to Game7, 66 new game tokens were issued in 2024, bringing the total to 349, an increase of 23.3%. Issuance has accelerated significantly compared to 2023, when there were only 34 new tokens, a 94.1% year-over-year increase in the number of new tokens. The data shows that as the gaming market value rebounded strongly from its low point in October 2023, many projects that built products during the bear market launched TGEs to take advantage of this new momentum.

The industry’s subsequent underperformance compared to the meme and AI sectors illustrates the importance of attention markets and continued “price up” marketing. As we’ll outline later in the report, the current state of gaming tokens has caused teams to reevaluate their go-to-market strategies. Nonetheless, 2025 will undoubtedly be a crowded Web3 gaming market. Whether a string of successful launches and new narratives can turn things around remains to be seen.

Game NFT Market

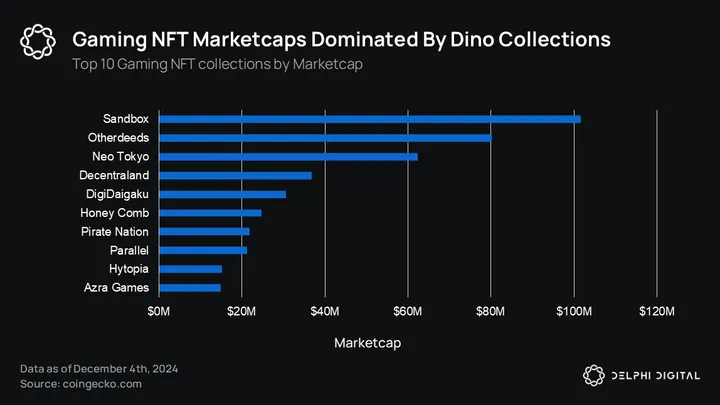

As mentioned earlier, Web3 gaming NFTs have shown slight signs of recovery over the past 12 months, with a notable increase in trading volume since November 2024. Collectibles such as Pirate Nation Genesis Pirates and Hytopia Worlds have seen volume increase by over 100% month-over-month, while My Pet Hooligan and Infinigods have seen 50% growth since October 2024. Surprisingly, older gaming NFT collectibles such as The Sandbox, Decentraland, and Otherdeed/Otherdeed Expanded (three metaverse projects that lost most of their hype in 2022) are still leading the pack, with Neo Tokyo being the most valuable gaming NFT collectible by market cap.

Collectibles that promise to airdrop tokens continue to perform well, thanks to the uncapped potential they offer. This dynamic reflects Web3 investors’ strong preference for assets with speculative upside potential, even in mature markets. The main takeaway from the recent NFT market rally is that projects that combine token utility with compelling game mechanics are likely to garner the most lasting interest.

Infrastructure

The underlying public chain

The role of the underlying public chain in Web3 games has gone beyond simply providing the underlying infrastructure, and people increasingly expect blockchains to provide additional support and funding (similar to the services provided by publishers in Web2) to remain competitive and attract top teams.

Major networks like Avalanche, Arbitrum, and Ronin act as hubs for game developers, with roles that extend far beyond the technical side. For example, Arbitrum allocated 225 million ARB tokens ($234 million) through its DAO to support gaming initiatives, while Xai, Sophon, and SUI allocated large grants to secure exclusive games for their ecosystems.

However, it’s not entirely fair to compare these grants to traditional Web2 game publishers, who often invest millions or even hundreds of millions of dollars to bring a game to market in exchange for ownership, royalties, or a portion of early revenue. In contrast, blockchain focuses on milestone-based funding, technical support, and network effects to support teams and achieve broader ecosystem goals.

These goals include increasing on-chain activity, earning fees indirectly, and solidifying its position in the increasingly crowded field of gaming networks. As competition between chains grows, offering such “additional services” has become key to staying relevant and attracting the best teams.

The explosion of new ecosystems

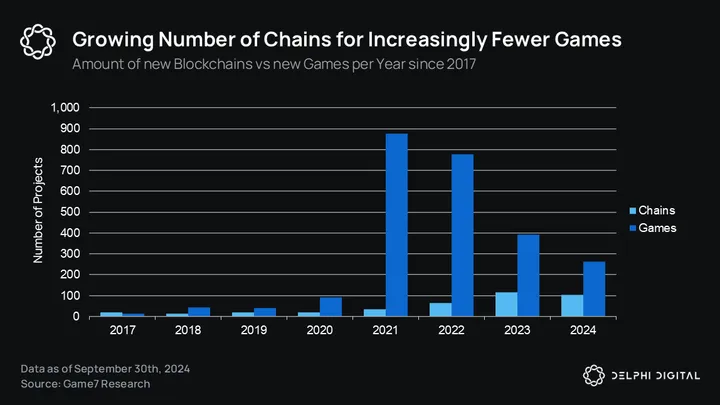

The surge in the number of new ecosystems focused on gaming (especially Layer 2 and Layer 3) has led to a growing imbalance between the number of networks and the number of games. More than 104 new L2/L3 networks will be announced in 2024, while the number of new games will be only 263, a ratio that shows the "premium" of ecosystems relative to individual applications.

Ecosystems often look more attractive because they promise multiple shots at goal by introducing a variety of different applications, including games. While the number of new games decreased from 875 to 778 between 2021 and 2022, the number of new networks almost doubled, from 33 to 64. Since then, the number of games has continued to decrease (391 in 2023 - 263 in 2024), while the number of new networks has increased or remained stable (116 in 2023 - 104 in 2024).

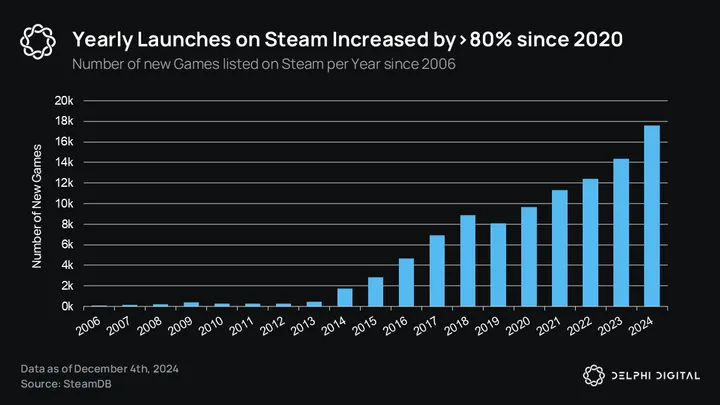

The success of the Steam platform is a great example that highlights the importance of killer apps in driving ecosystem adoption. Steam started as a way to digitally deliver updates to millions of players of Valve's flagship games Half-Life 2, Team Fortress 2, and Counter-Strike. Over time, Valve opened the platform to all developers and continued to add features like the Steam Store, Steam Workshop, and Steam Community for players to view profiles, gradually evolving into the go-to platform for digital game distribution.

As L2 and L3 foundational technologies continue to improve and commoditize, fees are expected to approach zero while throughput increases. This gradual shift makes it increasingly difficult for high-performance networks to differentiate based on technology alone, highlighting the importance of exclusive killer content in capturing market share.

However, this raises serious concerns about the impact of exclusivity on the games themselves, especially since distribution remains the biggest challenge in Web3. For example, the Epic Games Store’s reliance on exclusives often leads to poor sales, as was the case recently with Alan Wake 2, highlighting the potential risks of limiting a game’s reach for the sake of ecosystem loyalty.

Game users

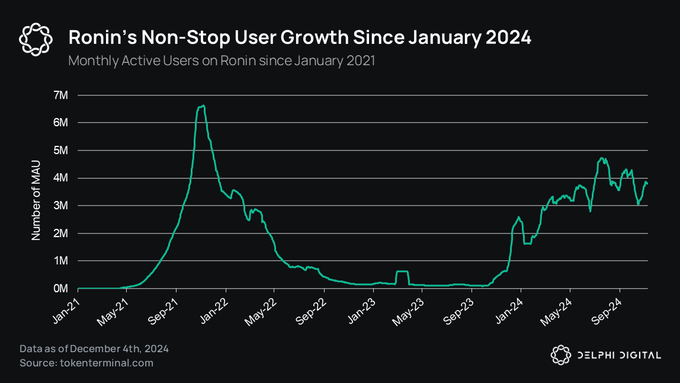

Web3 gaming has seen a slight but steady increase in users, with the total number of wallets tracked rising to 6 million. While bot activity may inflate these numbers, the growth trend highlights the growing influence of Web3 gaming, driven by ecosystems such as TON and Ronin.

Playoffthegrid (OTG) is the biggest game launch of 2024 and has been an outstanding success, making @avax a strong contender in the gaming space.

Currently, MapleStory is in public beta and is scheduled to be released in 2025. AVAX is preparing a second premium game and has received $100 million in funding.

Following a brief peak of 82 million transactions in July 2023, daily transaction volume for Web3 games has stabilized at an average of 10 to 12 million transactions. Since its launch, Playoffthegrid has contributed approximately 2.5 million transactions per day on its Avalanche subnet, with a total of 199 million transactions recorded.

Web3 Gaming & AI

AI will be a dominant topic in 2025, and we believe gaming will play an increasingly important role in the future development of the industry. In addition to being the perfect testing ground for AI primitives, gamified experiences will help increase engagement and bring in some much-needed token takers. The teams that best understand both sides of the AI x gaming equation will be most likely to be first movers in the space, securing market share by providing highly engaging experiences for their connected communities.

Retail and Institutional Interests

The mismatch between supply and user growth was highlighted by a surge in token listings in early 2024. As issuance outpaced cryptocurrency adoption, a small group of buyers was overwhelmed by a plethora of investment options, exposing the challenge of balancing supply and demand.

The battle for player liquidity in Web3 games intensified in 2024, validating our predictions from last year’s YA report. Network oversaturation has led to fierce competition for Web3 users, which have only grown slightly since the end of 2023. Coupled with the struggles of Web2 UAs, the limited Web3 audience has forced games and networks to compete fiercely for user attention and engagement.