Author: Luke, Mars Finance

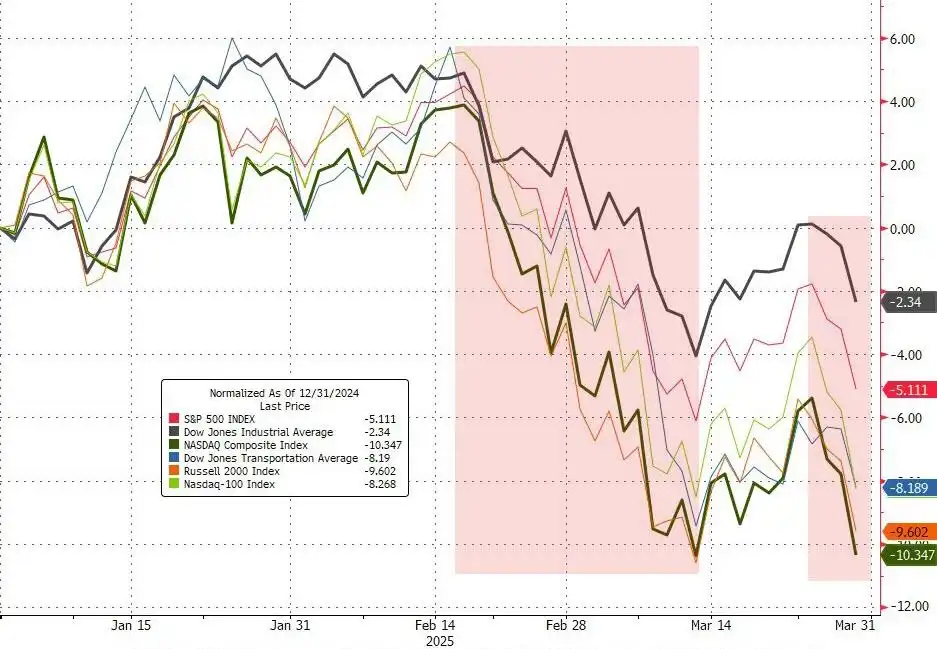

At the end of March 2025, the global financial market experienced a violent turmoil. The US stock market suffered a "Black Friday" on March 28, with the S&P 500 index falling 1.97%, the Nasdaq index plummeting 2.7%, and the Dow Jones Industrial Average falling 715 points, a drop of 1.69%. This decline quickly spread to the cryptocurrency market, with Bitcoin (BTC) falling from $84,000 in the afternoon of March 29 to $81,565 in the morning of March 31, Ethereum (ETH) falling to a recent low of $1,767, and Solana (SOL) hitting a low of $122.68 at 18:00 on March 30.

According to Coinglass data, in the past 48 hours, about 70,000 cryptocurrency investors have lost about $200 million. This cross-market chain reaction has not only triggered widespread panic, but also exposed the fragility of the current economic environment. This article will combine the views of multiple authoritative institutions to deeply analyze the reasons for the plunge and explore the key events that investors should pay attention to this week and their potential impact.

The whole story of the crash: the ripple effect from Black Friday to the crypto weekend

Key nodes and data

The plunge in U.S. stocks began on "Black Friday" on March 28. According to Investopedia, the S&P 500 fell 112.37 points to 5,580.94, the Nasdaq fell 481.04 points to 17,322.99, and the Dow Jones Industrial Average fell 715.80 points to 41,583.90. Technology stocks led the decline, with the market value of the seven major technology giants (including Apple, Microsoft, Amazon, etc.) evaporating by about US$505 billion, and the Philadelphia Semiconductor Index fell by 2.95%. This is the largest single-day drop since the U.S. stock market crash on March 10, marking a sharp adjustment at the end of the first quarter of 2025.

The cryptocurrency market followed closely and came under pressure. Bitcoin fell from $84,000 on the afternoon of March 29 to $81,644 in 8 hours, a drop of more than 3%. It then rebounded to $83,536 at 18:00 on March 30, but failed to maintain its upward trend and fell to $81,565 at 6:00 on March 31. Ethereum fell to $1,767 and Solana fell to $122.68. According to The Block data, the total market value of cryptocurrencies fell from a peak of $3.9 trillion to $2.9 trillion, a drop of 25%, and trading volume fell from $126 billion after the November 5 election to $35 billion, a shrinkage of about 70%.

Market sentiment and capital flows

The simultaneous decline of the U.S. stock market and the crypto market reflects the rising risk aversion of investors to risky assets. Galaxy Research pointed out that Bitcoin and technology stocks are clearly linked. During this decline, crypto-related stocks such as MicroStrategy (MSTR) plummeted 10% on Friday, and Coinbase Global (COIN) fell more than 6%, indicating that panic is spreading rapidly. InvestingHaven analyst Taki Tsaklanos believes that Bitcoin's short-term support level is $77,000, and if it fails, it may trigger larger-scale liquidations.

Causes of the plunge: Multiple factors interweave to impact the market

Macroeconomic pressures, higher-than-expected inflation and declining consumer confidence

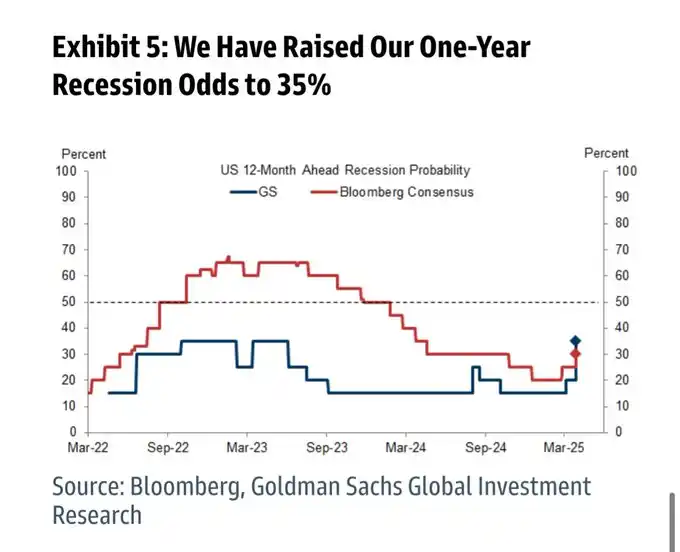

The core PCE price index for February released by the U.S. Department of Commerce on March 28 showed a monthly increase of 0.4% and an annual increase of 2.8%, both higher than the market expectations of 0.3% and 2.6%. In a research report on March 31, Goldman Sachs pointed out that this data shows that inflationary pressure is stubborn, which may push up the core PCE to 3.5%, and lower the GDP growth forecast for 2025 from 1.5% to 1.0%, and the probability of recession from 20% to 35%. The University of Michigan Consumer Confidence Index fell to 57, the lowest since 2022, and consumers' inflation expectations for the next year rose to 5%, and the five-year expectation reached 4.1%, both of which were decades high.

The statements of the Fed's voting members have exacerbated market concerns. Boston Fed President Collins said, "It is appropriate to maintain high interest rates for a longer period of time," while Richmond Fed President warned that tariffs may bring "a more lasting inflation shock." Goldman Sachs analysts believe that inflation exceeding expectations has weakened expectations of interest rate cuts, and capital flows to safe-haven assets have become an important driver of the market decline.

Policy uncertainty, fears sparked by Trump’s tariffs

The Trump administration's "reciprocal tariff" policy, which is scheduled to be announced on April 2, is the core catalyst for the plunge. Goldman Sachs expects that tariffs will be levied on all trading partners at an average of 15%, 5 percentage points higher than previously expected, which may push up import costs and trigger global retaliatory actions. Evercore ISI senior strategist Matthew Aks warned that "if other countries take retaliatory actions, it may trigger the risk of tariff escalation and further weaken market confidence." Michael Arone, chief investment strategist at State Street Global Advisors, pointed out that "uncertainty continues to plague the market, and next week may be the peak of volatility."

Investopedia cited experts’ opinions that tariff policies not only push up inflation expectations, but may also weaken corporate profitability and consumption capacity, especially affecting the technology and automotive industries. Jay Woods, chief global strategist at Freedom Capital Markets, said, “Investors tend to avoid risks when major events are approaching, leading to an increase in weekend selling.” X platform user @White7688 also mentioned that “BTC is more like a technology stock than a safe-haven asset due to the influence of external funds from ETFs.”

Capital Flow and Market Interaction

The "Black Friday" of the US stock market triggered a chain reaction of risky assets. Data from Nasdaq showed that the correlation between the Nasdaq index and Bitcoin reached 0.67 at the beginning of 2025, and its 2.7% decline was quickly transmitted to the crypto market. Mike McGlone, a commodity strategist at Bloomberg, analyzed that "if the S&P 500 continues to be weak, Ethereum may fall to $1,000 and Bitcoin may fall to $72,000." Gold prices hit a new high, and the yield on the 10-year U.S. Treasury bond fell from 4.369% on Thursday to 4.254% on Friday, indicating that funds are accelerating to safe-haven assets. Crypto-related stocks such as MicroStrategy fell 11% at one point, and MARA Holdings fell 11%.

The Block pointed out that the end-of-quarter fund rebalancing and next week's "super risk week" (the announcement of tariffs on April 2 and the non-farm data on April 5) prompted investors to adjust their positions in advance to avoid risks, and funds were withdrawn from risky assets and turned to gold and US bonds. Galaxy Research analyst Alex Thorn believes that "shrinking trading volume may indicate greater volatility in the future, and reduced liquidity will amplify price impacts."

Intrinsic risks in the market: leverage and shrinking trading volume

InvestingHaven predicts that if Bitcoin falls below $77,000, it could trigger about $300 million in long liquidations, further exacerbating the decline. The Block analyzed that the trading volume fell from a peak of $126 billion to $35 billion, indicating that market participants may be waiting for regulatory clarity and lack buying support in the short term.

Events that investors should watch this week

As the market enters early April, investors need to pay close attention to the following key events, which may further affect the trend of the US stock and crypto markets:

· Tuesday, April 2: Trump’s “reciprocal tariff” policy announcement Overview: The Trump administration plans to announce an average tariff of 15% on all trading partners. Goldman Sachs expects this move to push up import costs and could trigger retaliatory tariffs around the world. If the tariffs are as severe as expected, U.S. stocks could fall 3%-5%, and Bitcoin could fall below the $80,000 support level; if the policy is less severe than expected (such as excluding the semiconductor and automotive industries), the market could see a short-term rebound, with Bitcoin expected to rebound to $85,000. “The market reaction will depend on the timing of the tariffs and the targeted industries,” said Matthew Aks of Evercore ISI.

· April 3 (Wednesday): ECB March Monetary Policy Meeting Minutes Released Event Overview: The ECB will release the minutes of its March meeting, which may reveal the latest assessment of the eurozone economy and inflation, and whether to accelerate the pace of interest rate cuts. If the minutes show a dovish tendency (such as further interest rate cuts), it may boost global risk assets, and the crypto market may follow the rebound of US stocks; if a cautious stance is maintained, it may intensify risk aversion and suppress the prices of Bitcoin and Ethereum. Michael Arone of State Street believes that "the policy direction of the ECB will affect global liquidity expectations."

· Thursday, April 4: Fed Chairman Powell's speech event overview: Powell will speak on the U.S. economy and monetary policy, and may respond to inflation data and tariffs. If Powell sends a signal of a rate cut (such as in response to an economic slowdown), the U.S. stock and crypto markets may rise by 2%-3%, and Bitcoin may break through $83,000; if he emphasizes maintaining high interest rates, it may intensify selling pressure. Bloomberg analyst Mike McGlone warned that "Powell's tone will directly affect the short-term trend of risky assets."

· April 5 (Friday): U.S. non-farm payrolls release event overview: March non-farm payrolls data will reveal the health of the U.S. labor market. The market expects new jobs to be less than 200,000 and the unemployment rate may rise to 4.2%. If the data is weak (less than 150,000 new jobs), it will strengthen the expectation of interest rate cuts, which will benefit the U.S. stock market and the crypto market. Bitcoin may rebound to $86,000; if the data is stronger than expected, it may push up U.S. bond yields and suppress risky assets. Goldman Sachs predicts that "non-farm data will be the climax of market volatility this week."

· Friday, April 5: Microsoft's 50th anniversary and Copilot update Event overview: Microsoft will celebrate its 50th anniversary and may announce a major update to its AI assistant Copilot. If the update exceeds expectations, it may boost confidence in technology stocks, and the Nasdaq index may rise by 1%-2%, indirectly driving crypto market sentiment; if the update is mediocre, the impact will be limited. Taki Tsaklanos of InvestingHaven believes that "the performance of technology stocks will provide a vane for the crypto market."

Institutional Views and Market Outlook

Goldman Sachs: Risk of recession rising

In a research report on March 31, Goldman Sachs significantly raised its tariff forecast for 2025, predicting that the average tariff rate will rise by 15 percentage points, core PCE inflation will rise to 3.5%, GDP growth will slow to 1.0%, and the unemployment rate will climb to 4.5% by the end of the year. The bank raised the probability of a recession within 12 months to 35%, and expected the Federal Reserve to cut interest rates three times in the second half of the year to cope with growth pressure. Goldman Sachs analysts pointed out that "consumer and business sentiment is weak, the economy has entered a fragile stage, and the impact of policy risks is greater than in recent years."

Galaxy Research: Crypto Market Still Has Potential

Galaxy Research predicts that Bitcoin could reach $185,000 in 2025 and Ethereum could exceed $5,500, but only if the regulatory environment improves and institutional adoption deepens. Analyst Alex Thorn believes that "short-term fluctuations are inevitable, but in the long run, Bitcoin will surpass the S&P 500 and gold." The agency also predicts that the asset management scale of US Bitcoin ETFs will exceed $250 billion by the end of 2025.

InvestingHaven: Technical support and risks coexist

Taki Tsaklanos, an analyst at InvestingHaven, said that Bitcoin's long-term bullish pattern has not changed, and $77,000 is a key support level. If it holds, it may rebound in May. But if it falls below, it may test $70,000. The analyst warned that "the market needs to respect the 50% Fibonacci retracement level, otherwise the bullish expectations will be invalidated."

Bloomberg and Evercore ISI: Short-term volatility increases

Bloomberg strategist Mike McGlone believes that "Bitcoin's high correlation with the Nasdaq 100 makes it more like a high-beta asset, and it may follow the U.S. stock market further down in the short term." Matthew Aks of Evercore ISI pointed out that "the tariff announcement on April 2 is an important milestone, but uncertainty will not be eliminated all at once, and the market needs to be wary of the chain reaction of retaliatory tariffs."

Summary and future trends

The Black Friday and weekend cryptocurrency crash are the result of macroeconomic pressures, policy uncertainty, capital flows and inherent market risks. In the short term, the tariff announcement on April 2 will be a key turning point. If the measures are severe and trigger global trade frictions, Bitcoin may fall below $80,000 and US stocks may fall further. However, the rate cuts expected by Goldman Sachs and institutional adoption mentioned by Galaxy Research may inject momentum into the market.