Original title: Coin Center's Analysis of the Crypto Policy Landscape Following the Elections

By Peter Van Valkenburgh

Compiled by: Mensh, ChainCatcher

Cryptocurrency has received a lot of attention in the recent election, and many are wondering how friendly the new administration and Congress will be. In short, we expect some areas to improve, while others will remain challenging. We expect Good policy may be easier to implement in securities and banking regulation, while there may be clearer rules governing centralized secondary markets and centralized stablecoin issuers.

In the areas of anti-money laundering, tax reporting, and sanctions, the outlook is less certain. Coin Center will continue to focus on protecting the rights of developers of self-driving and privacy software, as well as the rights of ordinary Americans who want to use these tools. Our thoughts on these issues, as well as our initial analysis of future opportunities and challenges.

How to think about encryption during a change of government

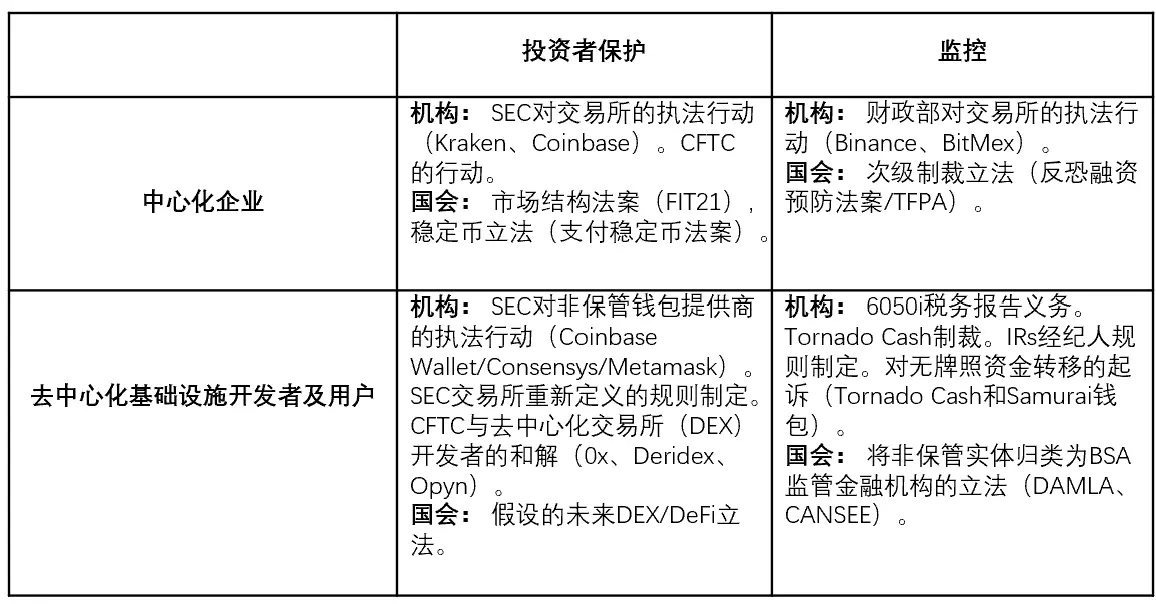

Policy issues for cryptocurrencies can be roughly divided into two categories: monitoring issues (tax reporting, BSA, AML, sanctions) and investor protection issues (SEC, CFTC, banks). Good policy does not guarantee similar positive results in another category. The rationale behind each policy area is different (protecting investors vs. identifying and blocking illicit financial flows), and legislators have political incentives to focus on one area. And alliance building opportunities are different too.

Similarly, the cryptocurrency ecosystem can be divided into two categories: centralized enterprises (custodial wallet providers, centralized exchanges, trusted issuers) and decentralized infrastructure developers and users (protocol developers, non-custodial wallet and application developers, and disintermediated users of these protocols and applications).

Coin Center hopes for good policy in all areas, but our core mission is to defend the rights of developers and users of decentralized and peer-to-peer tools. Overregulation in the areas of investor protection or surveillance could threaten the rights of developers and users. However, recent threats from the surveillance world are more profound.

Here’s a graphic of past and potential future policy actions to help you understand the framework:

You may notice that the box in the bottom right corner appears overcrowded. This may be partly our bias. Coin Center’s mission is focused on the rights of decentralized infrastructure developers to publish code (a First Amendment issue) and preventing improper surveillance. The fourth quadrant is where these two topics intersect. Although we may be biased, this issue area does seem to have been more aggressive than other areas over the past four years. There are many explanations for this, including arguments of political halo and news cycle, politicians mistakenly or opportunistically linking global and foreign policy tragedies to cryptocurrencies (e.g. Hamas funding, Russian oligarchs trying to circumvent sanctions), and political alliances. The left and the right, while rarely in agreement, sometimes find common ground on perceived issues of national security and surveillance.

What is the biggest threat?

The past few years have posed a serious threat to the freedom of individual cryptocurrency users and developers. In its exchange redefinition rules and enforcement actions against wallet providers such as Metamask and Coinbase Wallet, we have seen the SEC overly aggressively pursue Its transaction redefines rules to directly supervise individual developers and users. Monitoring issues also begin to emerge:

6050I

Tornado Cash Sanctions ( Translator’s Note: On August 8, 2022, the U.S. Treasury Department’s OFAC (Office of Foreign Assets Control) added Tornado Cash to its sanctions list, accusing the open application of facilitating billions of dollars in money laundering )

Broker Disclosure Rules ( Translator’s Note: In August 2023, the Treasury Department released a proposed regulation that aims to define if a cryptocurrency-related person is considered a “broker” under the tax law and they need to collect their crypto Tool users’ personal information and report this information to the IRS (Internal Revenue Service ) for tax purposes

and the unlicensed money transmitter prosecution of non-custodial developers ( Translator’s Note: On April 24, 2024, the Samourai Wallet indictment was unsealed. On the same day, in the Tornado Cash case, the Department of Justice opposed the dismissal and Motions to Exclude Evidence. Prosecutors have expanded the definition of money transmission, potentially affecting the legal status of cryptocurrency wallet providers. ). Meanwhile, in Congress, we oppose those in CANSEE (Crypto Asset National Security Enhancement Act) and DAMLA (Digital Asset National Security Enhancement Act). The Federal Reserve has also introduced legislation that imposes unreasonable monitoring obligations on non-custodial developers, such as in the Asset Market Structure and Regulatory Accountability Act.

This is a long battle

Three major threats come to mind: (1) 6050I, (2) Tornado Cash sanctions, and (3) unlicensed money transmission prosecutions. First, we already have ongoing litigation in the context of 6050I; we have advocated that the IRS The mandatory, warrantless reporting of personal information received in excess of $10,000 in cryptocurrency is unconstitutional. Second, with respect to the Tornado Cash sanctions, we argue that sanctions law does not give the Treasury Department the power to prohibit U.S. persons from using tools like smart contracts. Third, we watched with horror as the Southern District of New York filed unlicensed money transmission cases against developers of non-custodial software tools (Tornado Cash and Samurai Wallet). We will continue to do everything we can to help the defendants in these cases. While the Department of Justice may change under the Trump Administration, it maintains its political independence and is unlikely to abandon these prosecutions because of a change in administration.

Can we still be optimistic?

In short, the new administration will be favorable to U.S.-based centralized businesses, especially when it comes to investor protection, as intermediation services and efficient capital formation are critical to boosting the appeal of cryptocurrencies among a less technologically sophisticated audience. However, what about the key area of focus for Coin Center, namely, impacting developers and users of truly decentralized tools and services?

At the institutional level, there is reason to believe that ongoing controversial rulemaking could be frozen or even abandoned due to President Trump’s overall support for cryptocurrencies and his likely appointments to the SEC and Treasury. This would be a positive As a result, the SEC’s redefinition of transactions and the IRS’s broker-dealer rule for non-custodial developers hang like a sword over our heads.

It is less certain whether the new administration will be interested in scaling back the excessive sanctions and anti-money laundering policies that are at the heart of the fourth quadrant. However, we remain hopeful that even under a friendlier SEC, tough monitoring and control policies will remain in place. It continues to keep innovators out of the United States, stifling development and depriving ordinary Americans of the benefits of these technologies (but does little to prevent criminals and terrorists from using them).

We are also optimistic that Congress may play a larger role in opposing surveillance issues. Members have sent letters criticizing the implementation of 6050I, the sanctioning of Tornado Cash, and the prosecution of unlicensed money transmitters. The bill would provide a legislative solution to the prosecution of unlicensed money transmitters, and we are prepared to find a bipartisan path forward to advance its passage.

We look forward to working with the new administration on this topic, and if we can present our arguments persuasively, they will give us a fair hearing. Throughout history, America’s constitutional rights, especially our respect for free speech, have been and vigilance against warrantless search and seizure should ensure that this is the best place to build and use cryptocurrencies and open blockchain networks. “Pro-crypto” means more than just choosing friendlier agency heads or implementing pro-business policies. The regulations also represent a profoundly American spirit: standing up for privacy and expression in the most difficult moments, especially when national security interests run high and the shadows of crime and terrorism temporarily obscure our freedom, privacy, and openness.