By Arthur Hayes

Compiled by: zhouzhou, BlockBeats

Editor's note: This article mainly expresses that the Chinese government is stimulating the economy through quantitative easing and promoting credit growth, but its effects will take time to show. At present, domestic investors mostly choose to buy undervalued stocks and real estate, and have not yet flocked to Bitcoin. But as policies are gradually implemented, the market may turn to Bitcoin to protect assets. If demand increases sharply, the price of Bitcoin may rise sharply.

The following is the original content (for easier reading and understanding, the original content has been reorganized):

Wharton School has always praised capitalism and the so-called "American exceptionalism". Students from all over the world come with aspirations and are indoctrinated by professors into the free-market capitalism and the "rules-based" American peace concept, an order escorted by Tomahawk cruise missiles.

However, if you entered the workforce in September 2008 as I did, you quickly discovered that most of what you were taught was bullshit. The reality is that the system is not truly meritocratic, but rather that the companies that are best at relying on government resources ultimately have the greatest financial success. Capitalism is a poor man’s game.

My first lesson in “real capitalism” — what I now call “corporate socialism” — came from watching which top investment banks prospered and which tanked after the 2008 global financial crisis (GFC). American banks were bailed out by the government through direct equity injections following the collapse of Lehman Brothers.

Although European banks also secretly received financial support from the Federal Reserve, they did not receive government equity injections or forced mergers (backed by central bank loan guarantees) until 2011. So when my class of analysts at Deutsche Bank received our first full bonuses for 2009 in February 2010, we were left far behind by our colleagues at Bank of America who had pressed “F9.”

This is the KBW Bank Index, which covers the major commercial banks listed in the U.S. From its low point in March 2009 following the global financial crisis, the index has risen more than 500%.

This is the Euro Stoxx Banking Index, which includes the major European banks. It is up just 100% from its post-crisis lows in 2011. Corporate socialism is far more profitable and widespread in the US than in Europe, no matter what the political commentators say. Remember kids, privatize the gains and socialize the losses, that’s a recipe for big bonuses.

Given that China has always emphasized the differences and advantages of its economic system, one might think that China would adopt different policies to solve its economic problems. This is not the case. The reality is more complicated. To understand the huge changes currently taking place in China, we must first review the recent financial crises in three other major economies: the United States, Japan, and the European Union. These economies all suffered serious financial crises due to the bursting of the real estate market bubble:

Japan: 1989

United States: 2008

European Union: 2011

China has also joined the list of economies whose real estate bubbles have burst, a process that began in 2020 when the central government adopted the “three red lines” policy to restrict credit to real estate developers.

ChatGPT explains the "three red lines" policy

China’s “three red lines” policy is a regulatory framework introduced in August 2020 to limit excessive borrowing by real estate developers and reduce financial risks in the real estate sector. The policy sets strict thresholds for three key financial indicators: a debt-to-asset ratio excluding prepayments of less than 70%, a net debt ratio (the ratio of net debt to equity) of less than 100%, and a cash-to-short-term debt ratio of more than 1. Developers are classified based on how many thresholds they hit, and their borrowing growth rates are limited accordingly—companies that meet all the criteria can increase their debt by up to 15% per year, while companies that violate three criteria are not allowed to increase debt. By implementing these “three red lines,” the Chinese government seeks to promote financial stability and encourage developers to deleverage and strengthen their financial position.

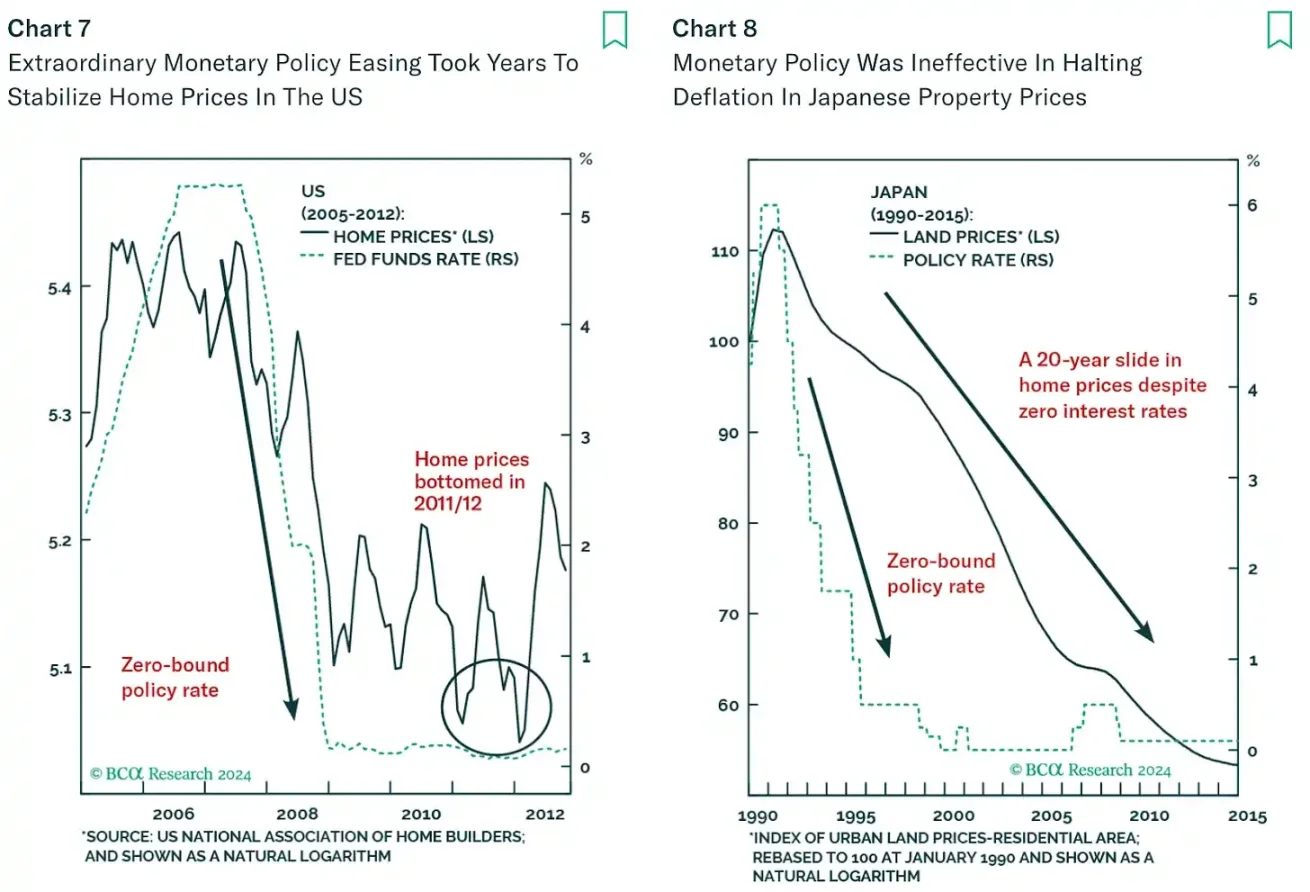

The Chinese economy then fell into a liquidity trap or balance sheet recession, like other victims. Private companies and households tightened their spending and reduced economic activity during this period to repair their balance sheets. When the credit demand of households and companies declined, the traditional Keynesian economic approach - that is, moderate fiscal deficits and central bank interest rate cuts - failed. Strong monetary and fiscal measures must be used to curb the terrible deflation. The time to switch to "panic mode" depends on national culture, but no matter what economic system is adopted, all countries will eventually respond to the crisis through "monetary chemotherapy."

While this chemotherapy may cure deflation, it will ultimately hurt the lower and middle classes, who suffer from rising asset prices without significant improvement in the real economy. And this ineffective monetization therapy is extremely profitable for a few financial giants, who are headquartered in New York, London/Paris/Frankfurt, Tokyo, and now possibly Beijing/Shanghai.

There are two parts to the monetization approach:

1. Public funds recapitalize the banking system, and banks’ balance sheets are always filled with bad mortgages. Private markets will no longer provide equity funding, which is why banks’ share prices plummet, appear insolvent, and eventually go bankrupt. The government must inject new funds and change accounting rules ex post to legitimize the financial condition that banks claim to be in. For example, Japan allows its banks to hold real estate assets at acquisition cost rather than current market value to maintain accounting solvency. With the government capital injection, banks can re-expand their loan books, increasing the amount of broad money. As bank credit increases, nominal GDP also rises.

2. Central bank money printing, or quantitative easing (QE). By buying government debt, central banks use money printing to inject money. With reliable buyers of debt, governments can implement large-scale stimulus programs. QE also pulls reluctant savers back into risky financial markets. With central banks buying large amounts of safe interest-bearing debt, savers are forced to speculate in financial markets with "safe" government bonds. They know that the inflationary shock brought by monetization therapy is imminent, so they are eager to return to the real estate and stock markets. For those who do not have enough assets, they can only be forced to accept this situation.

Bankrupt banks are saved because the prices of the financial assets (properties and stocks) that support their loan books rise. I call this "reflation," as opposed to deflation. Governments are boosting stimulus programs by increasing revenues from rising nominal GDP, which is driven by bank-led broad money creation and unlimited debt purchased by the central bank. For investors in financial markets, the rise in asset prices is no longer dependent on the actual economic development. That is, even if the economy does not really improve, the prices of assets such as property and stocks will continue to rise due to the injection of funds from the government and the central bank.

The stock market is no longer a forward-looking reflection of the economy, it has become the economy itself. The only thing that matters is monetary policy and how fast money is created. Of course, government policy also affects the types of businesses that get capital, which is key for stock pickers, but Bitcoin and cryptocurrency prices are primarily affected by the total money supply. As long as fiat money keeps being created, Bitcoin will continue to rise, and it doesn't matter who the ultimate beneficiaries are.

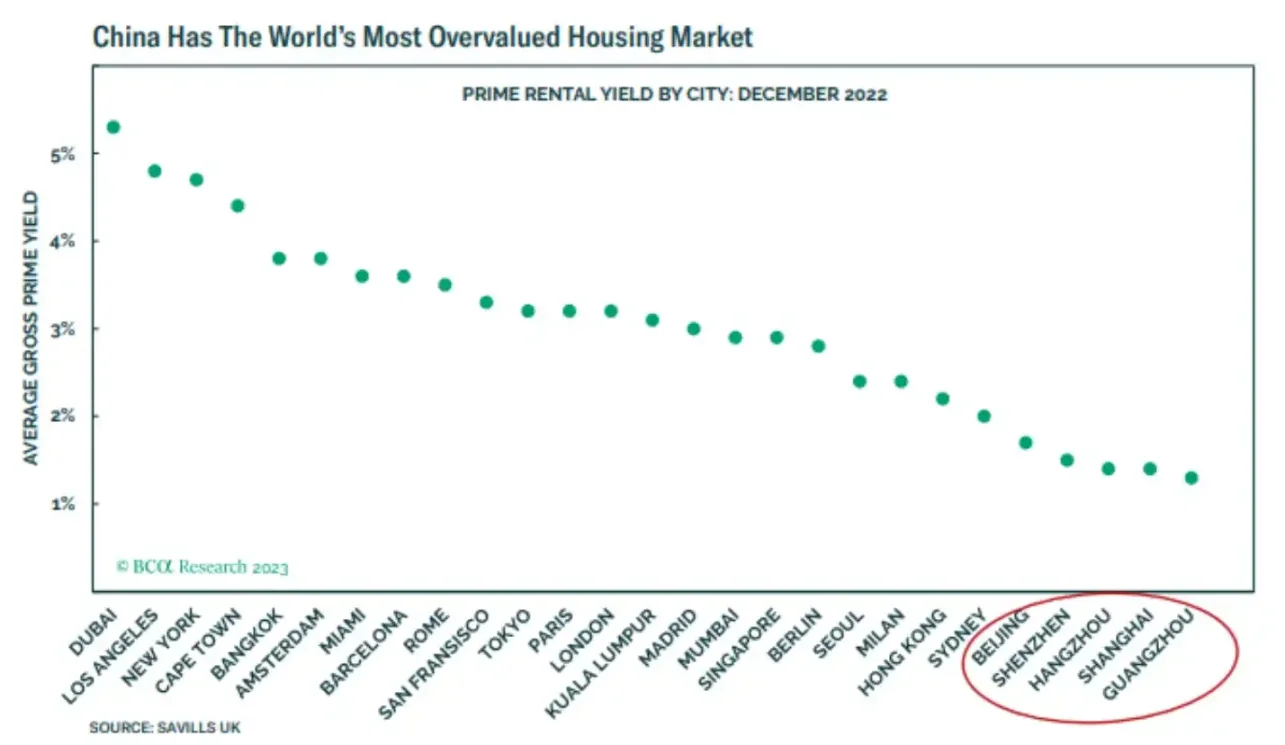

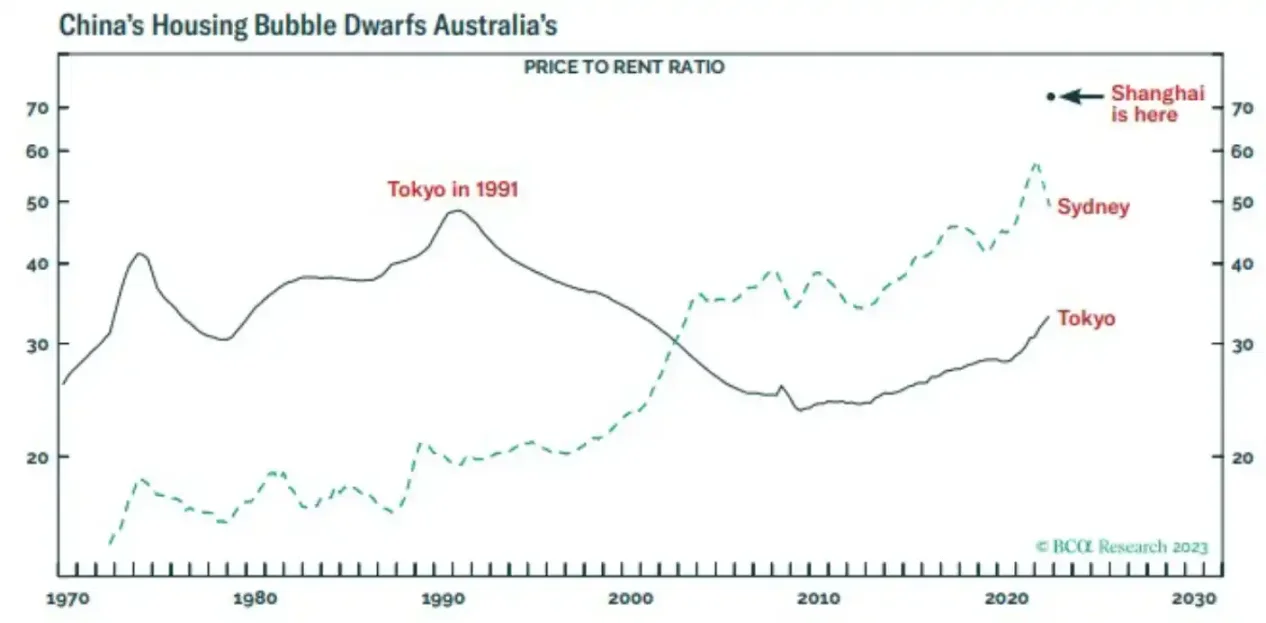

Financial analysts generally believe that the stimulus measures announced by China are not enough to resize the economy. But the latest measures reveal some signs that under Beijing's leadership, China is ready to inject "monetization therapy" to deal with deflation. This means that Bitcoin will soar in the long run as China revitalizes its banking system and real estate industry. Considering that China's real estate bubble is the largest in human history, the RMB credit generated will match the total amount of US dollars printed by the United States during the 2020-2021 epidemic.

In order to prove the above point, the following contents will be analyzed step by step:

- Why do modern governments all inflate real estate bubbles?

- Analyze the scale of China's housing bubble and why Beijing is determined to end it.

- Find signs that Beijing is ready to revive China's economy.

- How the Chinese Yuan Enters the Bitcoin Market.

Social Order

Modern governments are based on broad public support. How can states keep their people on board in an age that doesn’t rely on the empowerment of organized religion? The simplest way to avoid revolution is to tie the economic net worth of citizens to the success of the ruling regime. The most important financial asset is your primary residence. The human body survives within a very narrow temperature range. When you’re homeless, you can get too cold or too hot, which can lead to death.

Putting aside the cost of housing, assuming you have saved enough money to buy a home for your family, your biggest concern is who protects your property rights? Without a government that can legally fight domestic opponents, you need private armed forces to defend these rights. In the absence of government protection, how do you prevent armed neighbors from claiming your land as theirs? When the state is strong and the law is respected, there is no need to worry about vagrants stealing property; when the state is weak, you must be prepared to use violence against infringers. Therefore, people who own property naturally trust the government to protect their property rights and are willing to follow the government's orders. Ultimately, this means that you will not easily rebel, otherwise it will lead to economic self-destruction.

Governments convert as many citizens as possible into homeowners, tying their economic and material well-being to the state. Because building structures requires expensive energy, governments often encourage private ownership of property through various debt-based financing schemes. Even in the so-called communist country of China, property rights were one of the first reforms, beginning with Deng Xiaoping's reforms in the late 1980s and early 1990s.

I took a housing policy course taught by former U.S. President Bill Clinton’s Under Secretary of Housing in the first half of 2008, when the subprime mortgage crisis was spreading, and we learned about the various programs implemented by the government to increase homeownership. My main takeaway was that housing bubbles always require government support and financing. In the U.S. context, the government has strongly promoted the increase in homeownership since the Clinton era (1992-2000), expanding the role of federal government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac through the Federal Housing Enterprise Financial Security and Soundness Act of 1992.

The GSEs are publicly traded private companies with an implicit backing from the federal government. They are financed by the federal government and take on the majority of home mortgages. As a result, Fannie Mae and Freddie Mac are among the most profitable financial services companies. Banks benefit, too, originating loans at a risk-free profit, ultimately shifting risk to the public sector’s balance sheet. Of course, because of these distorted incentives, the “Masters of the Universe” will go too far — but they would never take these risks without the government backing them up.

A real estate bubble with Chinese characteristics

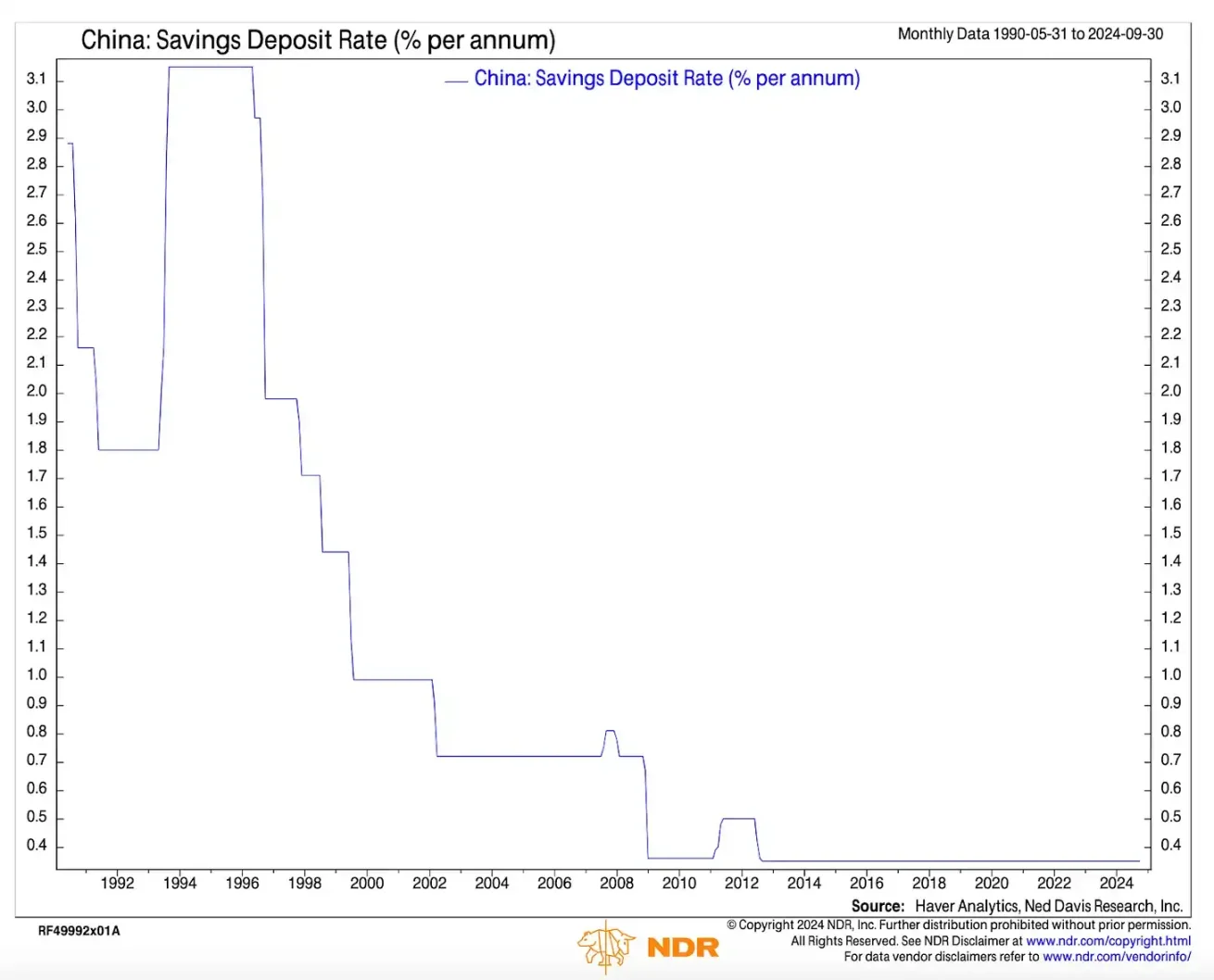

Let's first understand China's economic model. To accelerate industrialization, China has used the state-owned banking system to financially repress depositors, allowing state-owned enterprises (SOEs) industrial companies to obtain capital at low cost. If the largest users of bank credit are industrial enterprises, then a fair interest rate for depositors should be the industrial value-added ratio. The industrial value-added ratio refers to the proportion of the industrial sector's contribution to the country's GDP, calculated by dividing the value added created by all industrial activities by the total GDP.

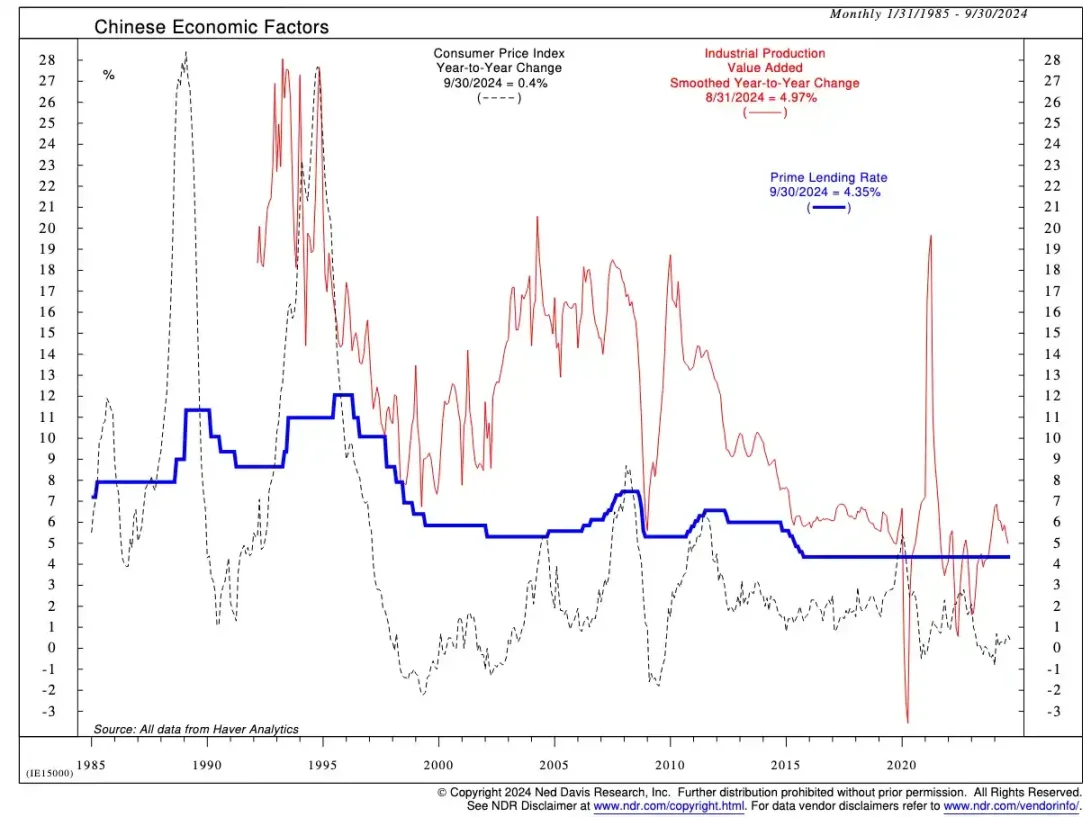

As you can see, the base lending rate is always lower than industrial value added because state-owned banks offer very low deposit rates to ordinary savers - see the chart below.

Savers know that the returns they get are not worthwhile, but because the RMB is a restricted currency, they cannot invest their funds overseas. In order to obtain higher returns on capital, they can choose to invest in the local stock market or real estate market.

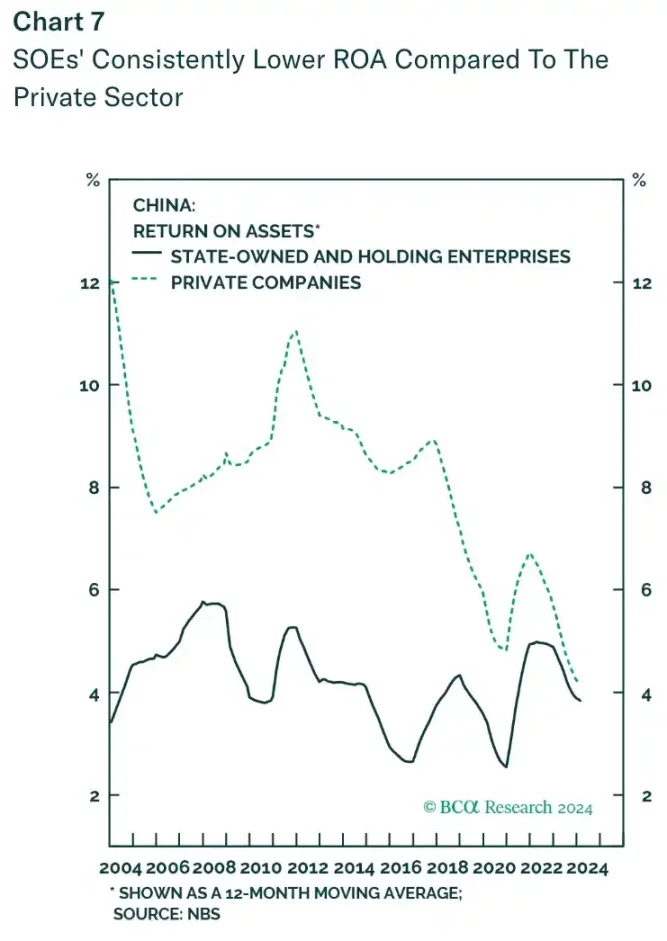

However, there is a problem with the stock market: the best performing companies tend to be state-owned enterprises. SOEs have access to the cheapest bank credit and exclusive operating licenses that allow them to operate in high-profit industries such as telecommunications, oil and gas, and mining. You might think this means that SOE stocks are performing very well, but in fact, SOEs have mediocre returns on equity (ROE). This is because all SOEs are led by party members at the top, the interests of the party and shareholders are not always aligned, and the needs of the party always take precedence.

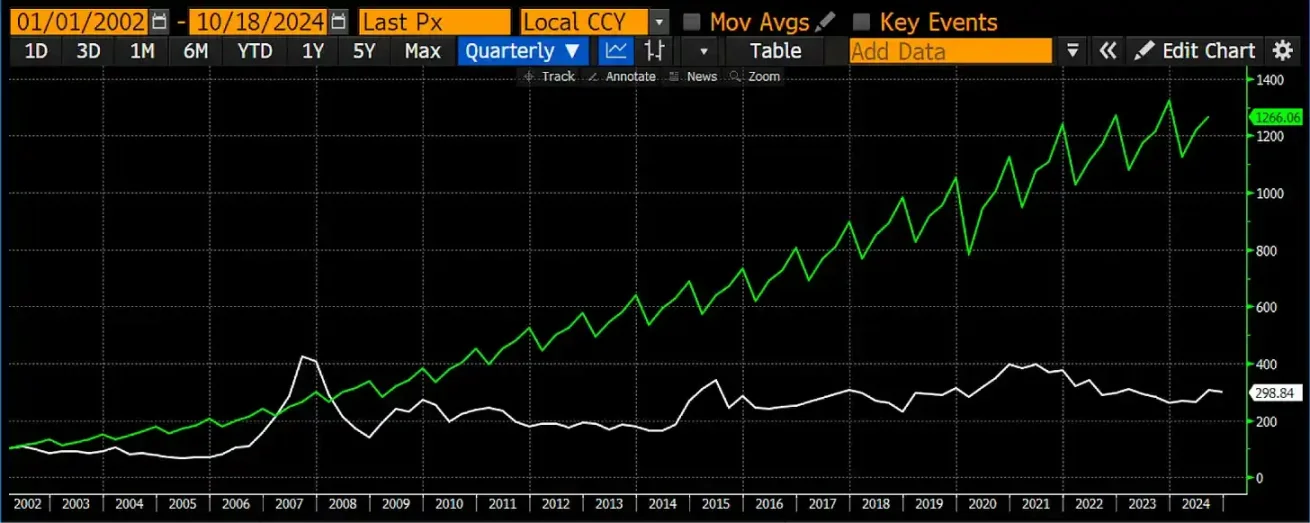

This chart shows the difference between the return on equity (ROE) of the CSI300 index and the return on equity of the S&P 500 index. As can be seen, Chinese stocks have significantly underperformed US stocks.

Private firms that face real competition have much higher returns than state-owned enterprises (SOEs), yet SOEs are more strongly represented in major stock market indices.

With a base value of 100, China's GDP (green) grew by 1,200%, while the CSI300 index (white) grew by only 200%.

Since the early 2000s, the stock market has lagged far behind the crazy growth of the Chinese economy (as shown in the chart above). The average Chinese is not stupid, so stocks are not their first choice for growing their savings, and they prefer to invest in the real estate market.

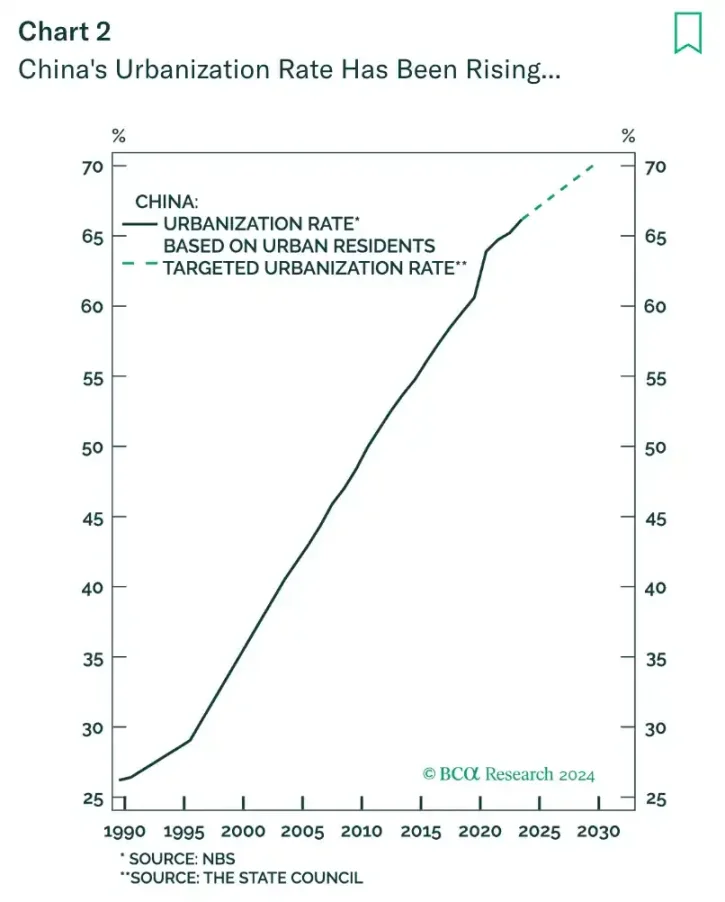

Chairman Mao started the process of urbanization in China, and then Deng Xiaoping and his more market-oriented policies pushed urbanization into high gear. The party believed that the only way to restore China (literally "the Middle Kingdom") to global dominance was to rely on global manufacturing prowess. This meant moving farmers from the countryside to the cities to manufacture goods for export. Therefore, every five-year plan had an urbanization target.

Moving hundreds of millions of people from rural areas to cities in just a few decades necessarily requires frantic residential and industrial real estate construction. The first step to making money in real estate is to sell land to developers. Local governments own the land and sell it to developers by granting land use rights.

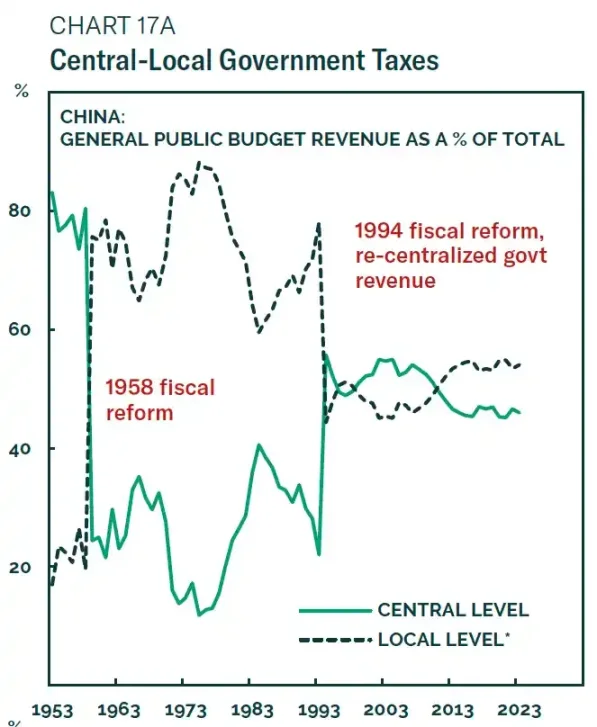

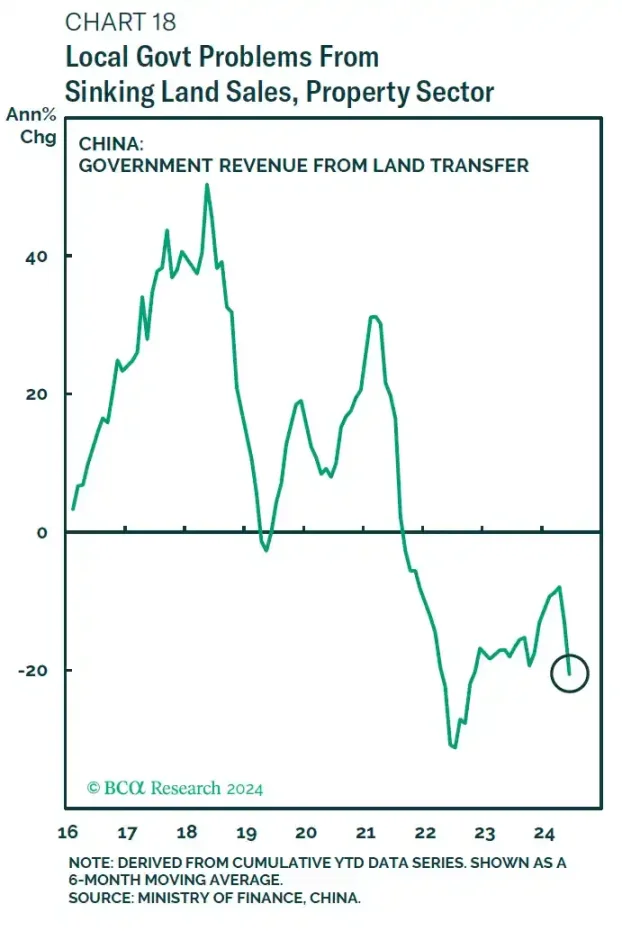

Because the central government keeps most of its income tax revenue for itself, local governments’ main source of funding is land sales. As urbanization accelerates and the economy grows, land becomes increasingly valuable, and sales revenues balloon. Beijing also sets limits on the amount of debt local governments can take out each year, which is typically backed by their land reserves. As a result, a government’s finances are directly tied to rising property prices.

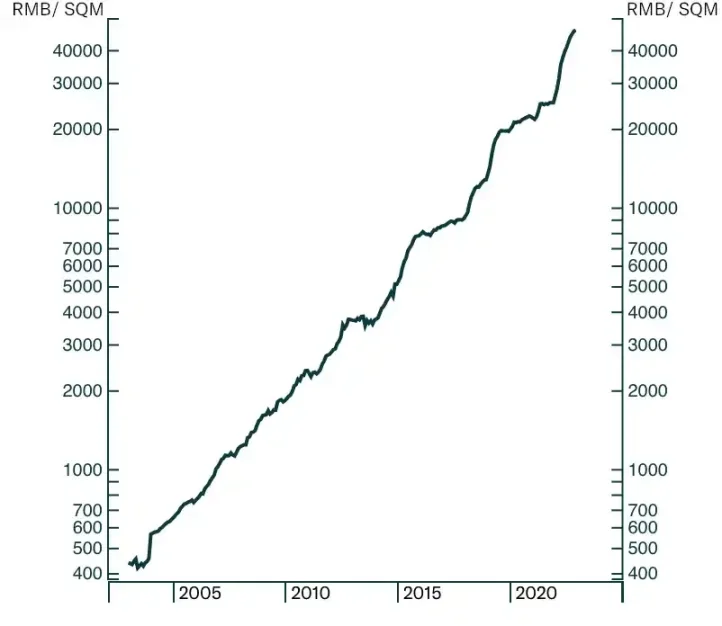

Land prices have increased 80 times in 19 years, with a compound annual growth rate (CAGR) of 26%.

Ordinary people gradually accumulated wealth by saving and then buying one or more apartments. From the early 1990s to 2020, real estate prices have been rising. Banks generally do not provide any form of consumer credit, but are willing to lend against real estate, and the net worth of the average household is almost entirely tied to the rise in real estate prices.

As real estate prices climbed, all stakeholders made money. After the initial demand of a rapidly urbanizing population was met, the market continued to build apartment units because this was encouraged and the only area where banks felt safe to extend credit. Thus, a massive real estate bubble was created.

Maintaining a harmonious society is the party's stated goal, and when the vast majority of people cannot afford housing, the social fabric is torn apart. The sharp drop in birth rates is a symptom of the real estate bubble. Young people are dating, but because of high housing prices, the only housing they can afford is condoms.

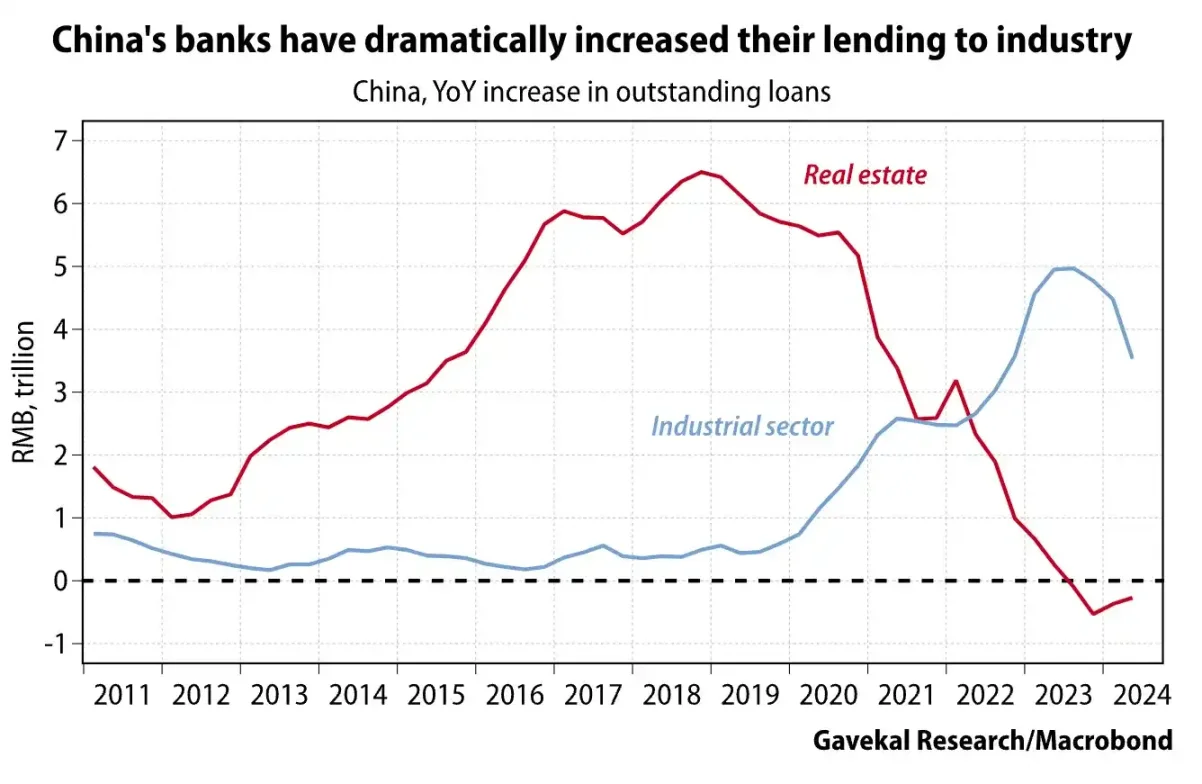

In addition, too much bank credit flowed into real estate rather than into the development of new technologies. Beijing shifted funds from unproductive, speculative real estate development to high-tech manufacturing.

Beijing began talking tough about reining in the property market in the mid-2010s, but actually popping the bubble comes with its own set of risks. Every major state-owned bank and industrial company has huge exposure to the property market. The asset base for many bank loans is residential loans to households or developers. One of the biggest customer groups for companies that make goods like air conditioners, steel, and cement is property developers.

Moreover, Beijing keeps most of the tax revenue for itself to ensure that the central government's balance sheet looks strong, which means that local governments cannot achieve the party's growth targets without continued land price increases. Popping the real estate bubble would hit ordinary households, banks, industrial companies and local governments hard. If Beijing cannot control the downward trend of the market, social harmony could collapse.

By 2020, Beijing announced that “houses are for living, not for speculation.” The “three red lines” policy was subsequently introduced. Soon, the most over-leveraged real estate developers stopped new construction and completions and began to default on offshore bonds. Evergrande is an example of a high-profile Chinese real estate developer that collapsed after credit was restricted.

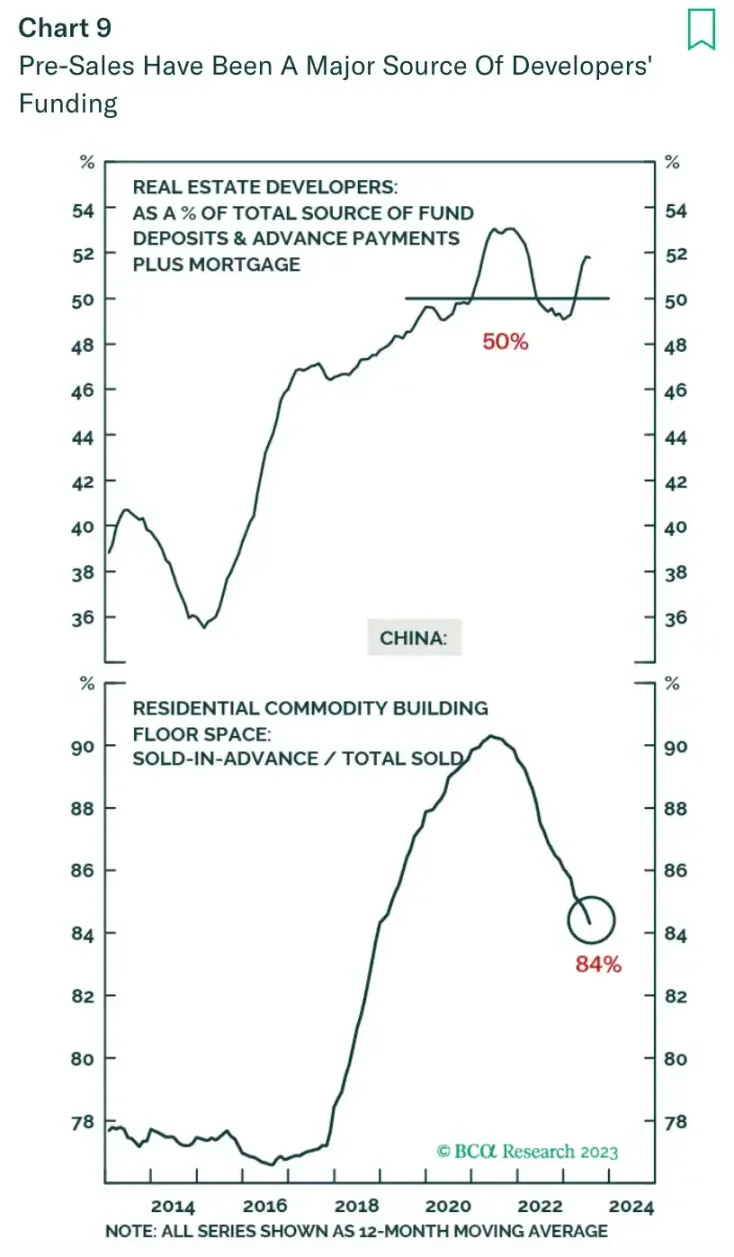

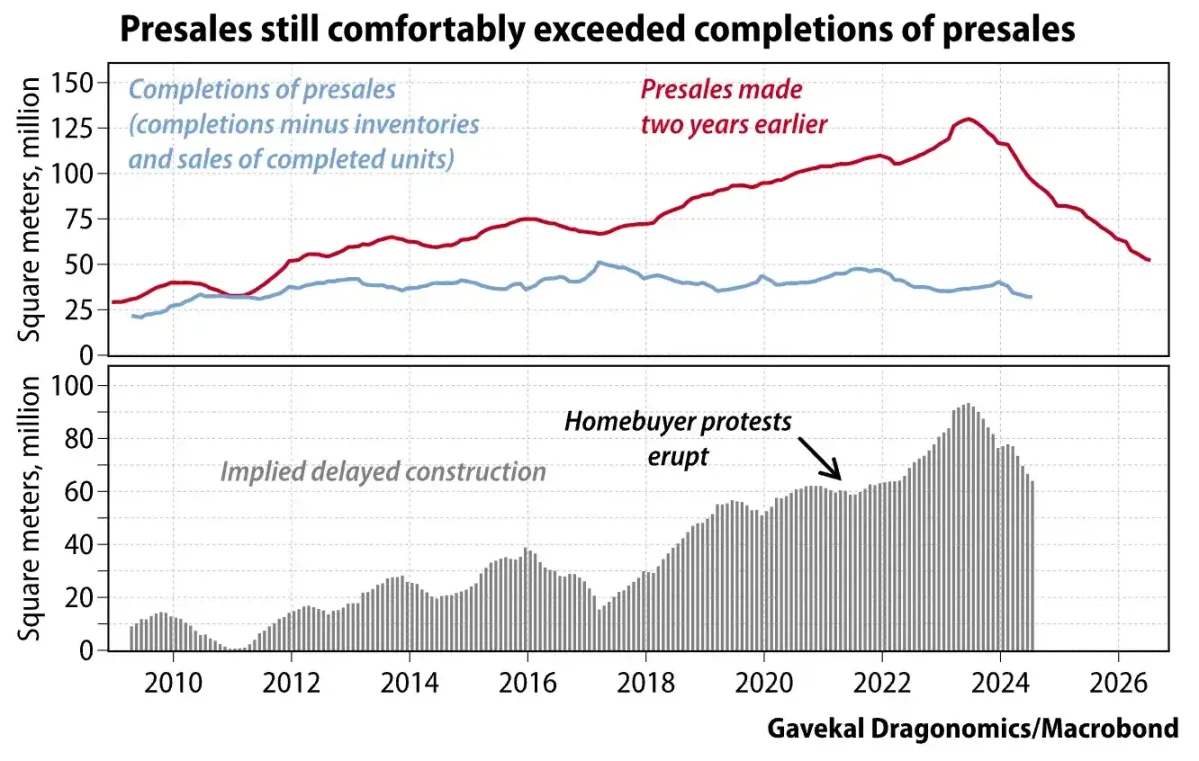

Before I continue with the timeline of my story, I want to quickly mention a lesser-known feature of the Chinese real estate market and its impact on the success of policy measures to end the crisis. In China, most apartments are purchased before they are even built. Buyers are required to pay a cash deposit up front and then provide the remainder of the payment several years before the property is completed.

In essence, the real estate developers acted like a Ponzi scheme operator, with the full payment for the units that had not yet been delivered being used to pay for the completion of the old units. The developers also used this pre-sale cash as collateral to obtain bank credit, as they still needed more funds to complete old projects and purchase new land from local governments.

When banks were instructed to reduce lending to highly indebted developers, it raised questions among homebuyers about whether unfinished units would be delivered. If ordinary Chinese households did not trust property developers to finish construction, they would not buy pre-sale properties. Without pre-sale funds, property developers could not finish old projects. The end result was that developers had to stop construction, confidence in the entire property market collapsed, and everyone lost.

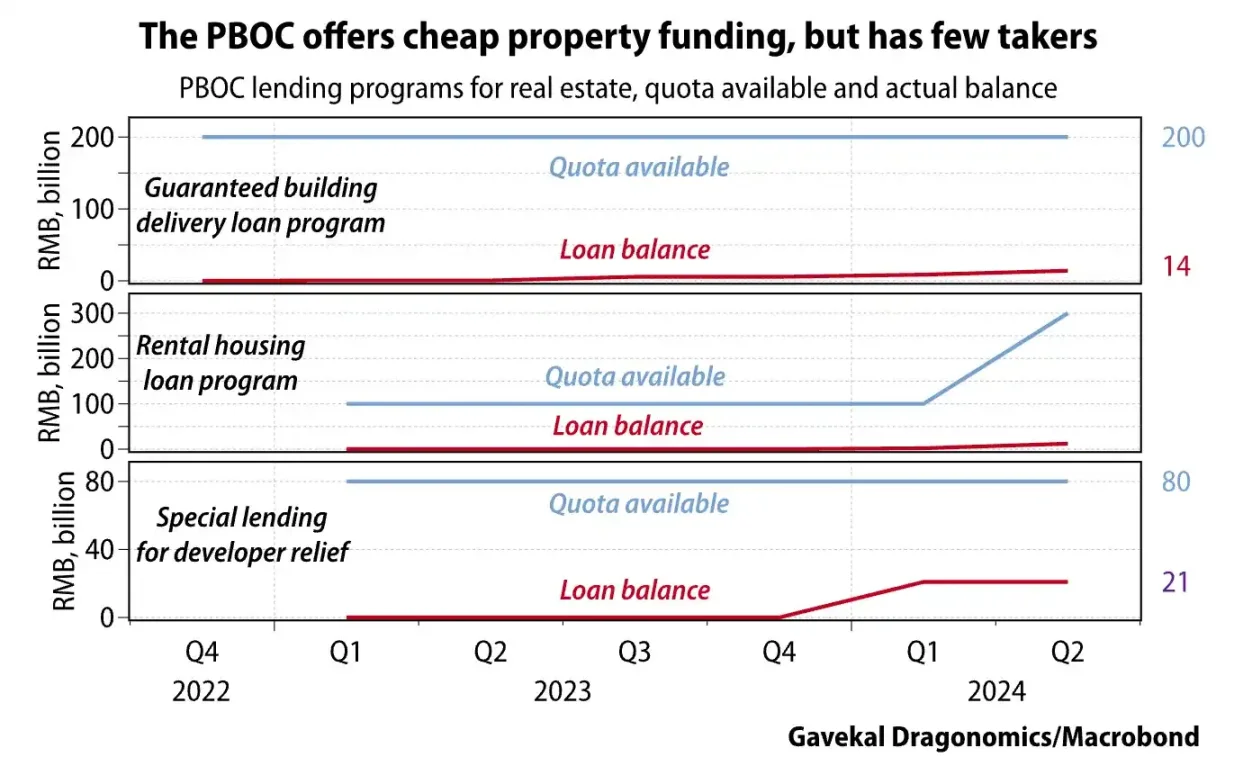

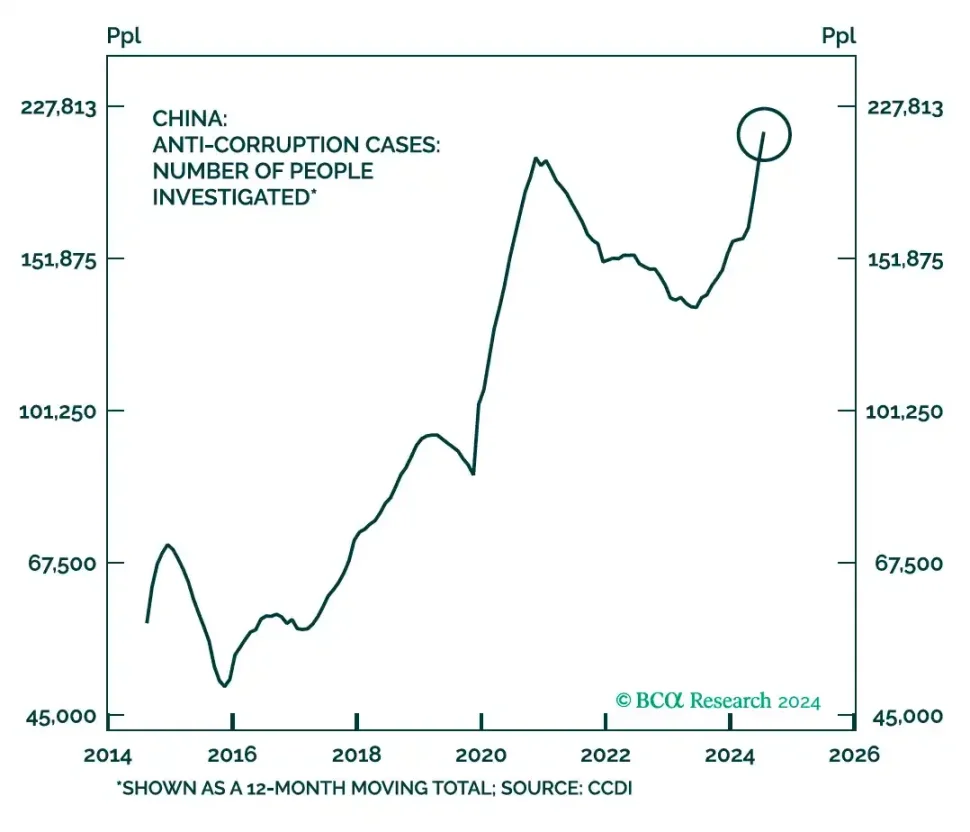

The Chinese government’s response in the early stages of the crisis was to instruct banks and local governments to lend to real estate developers in order to complete the delivery of units. However, there is a huge agency problem here. Although the central government is extremely powerful on paper, they rely on members of the party to take professional risks to implement their directives.

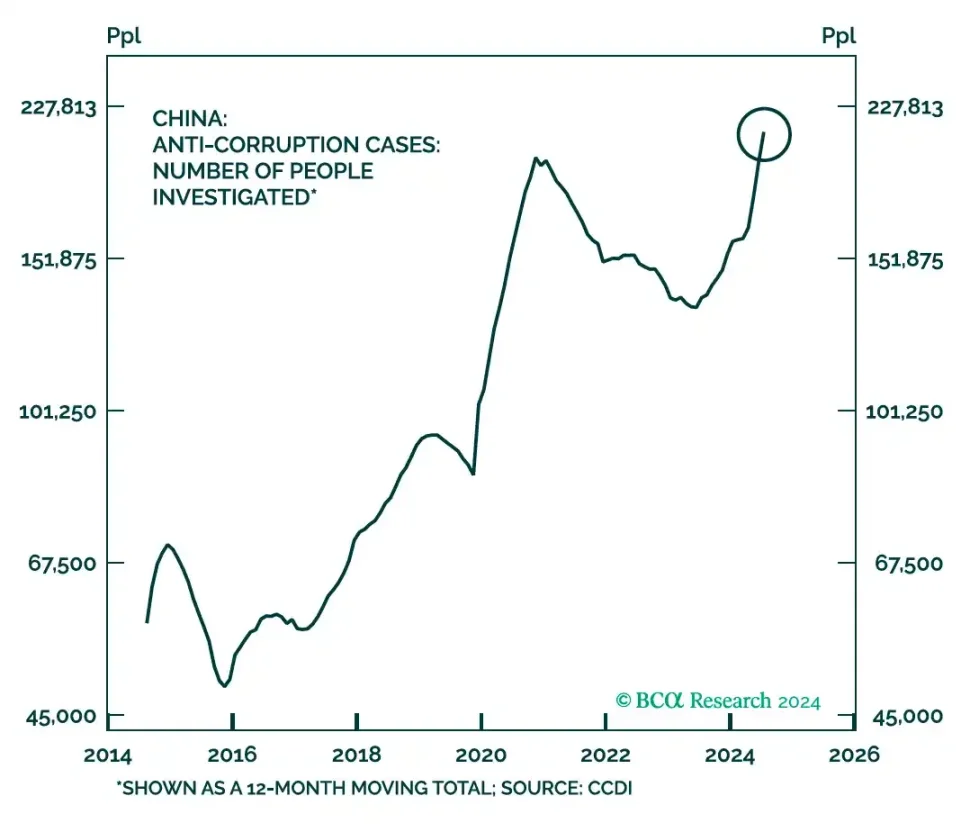

Imagine you are the head of a local government. If you can generate economic growth, you will be promoted, but if you lose money, you will be investigated by the central anti-corruption committee. Party discipline for corruption can lead to imprisonment or death, and investigations are often sudden and many years after the fact. Therefore, there is no benefit in taking risks, and even if the central government tells you to borrow, you may choose to sit on it.

Beijing continues to issue higher quotas, allowing more real estate developers to obtain credit, but these credits are not being allocated effectively. Another option is for the government - both central and local - to directly participate in construction and complete millions of unfinished units to restore market confidence. However, they have not taken such action so far, and I think this may be because such a huge project is too complicated for a top-down centralized government, especially with millions of square feet of buildings that need to be completed.

Moreover, if the government enters the construction sector, angry citizens may blame the government rather than the failed real estate developers if the units it builds fail to meet the quality initially promised. This brings us to the current moment. It may take decades to use traditional monetary policy to put a floor under prices and restore confidence.

Beijing will not be willing to wait that long, as the Chinese economy is slowing rapidly. It is time to summon the financial “wizards” and start “chemotherapy”.

Reflation

Let's look at some depressing charts to see how the bursting of the real estate bubble is affecting the Chinese economy. Listening to economists' pessimistic views on the Chinese economy might give you the impression that Beijing has been holding back, but that is far from the case.

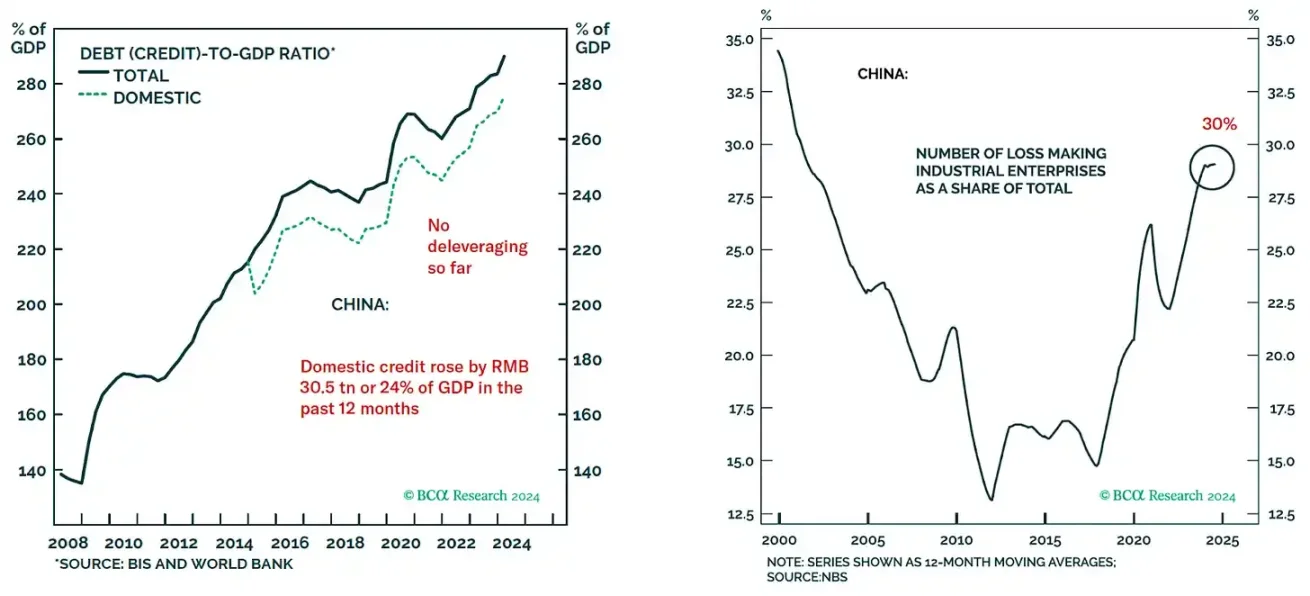

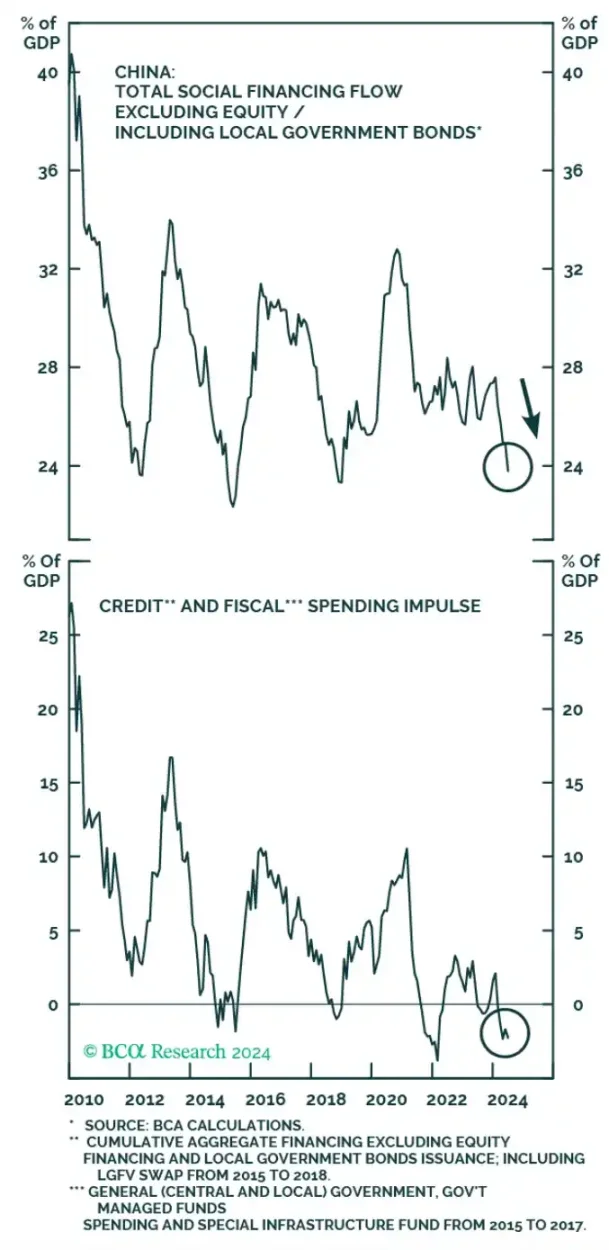

The Chinese government has implemented massive fiscal and monetary stimulus, however, due to the huge excesses in the economy, these funds are only used to keep the basics running. The left chart shows the rising debt-to-GDP ratio, which has allowed "zombie" state-owned enterprises to stay afloat (right chart) and avoid large-scale layoffs.

However, when you have just punctured the largest housing bubble in human history, you need strong "chemotherapy" to curb deflation. All measures are relative. Compared with the size of the economic "black hole" created by the housing market collapse, the current stimulus measures are not enough to produce positive credit or fiscal spending effects.

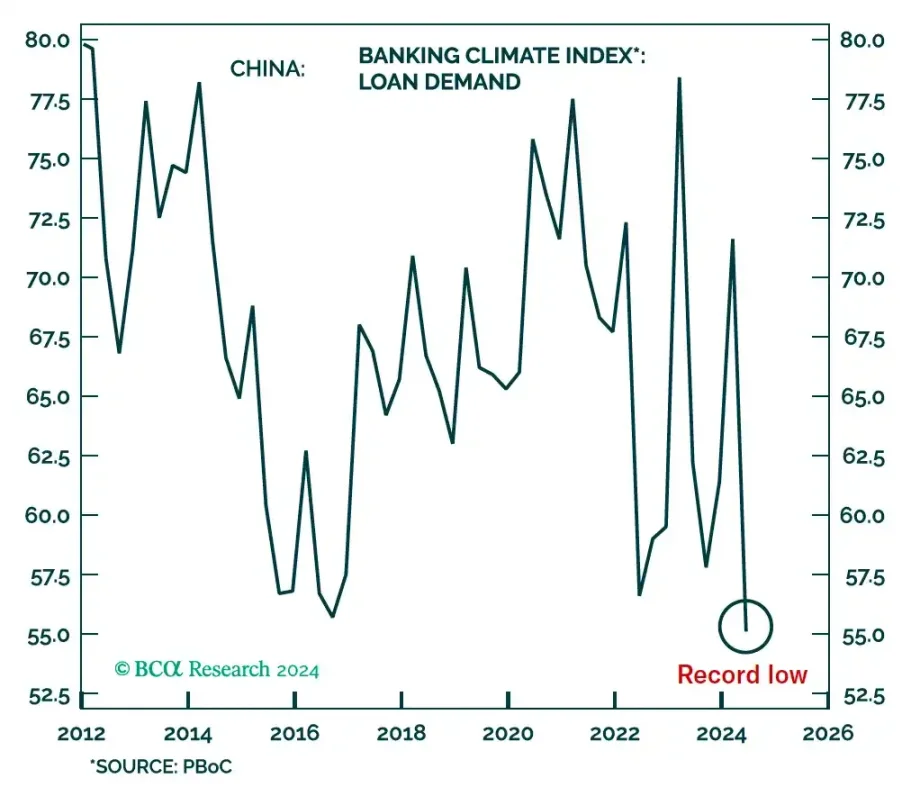

Despite massive stimulus, demand for loans remains historically low. That’s because real interest rates remain too high.

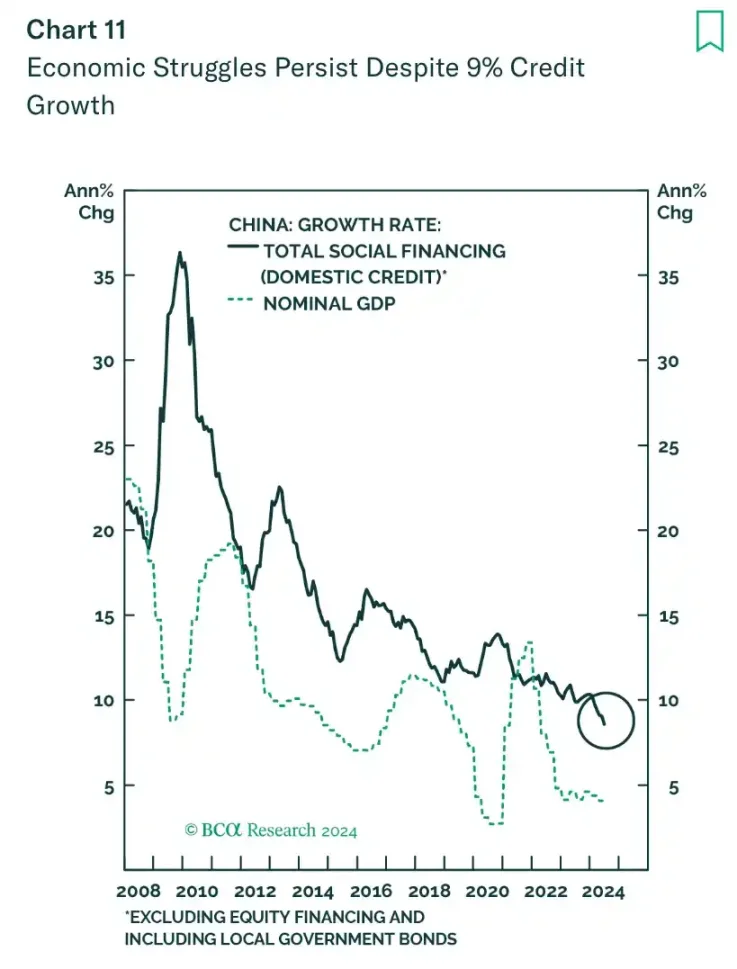

China's broad money growth has fallen to its lowest level on record, leading to a sharp slowdown in nominal GDP growth.

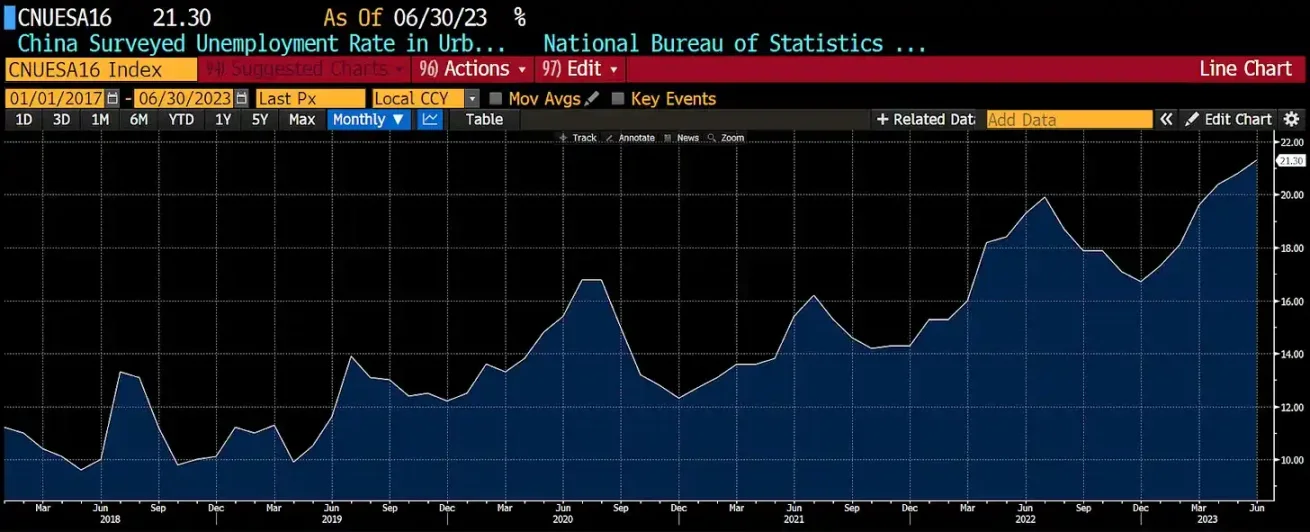

The real problem facing Beijing is the large number of unemployed young people as economic activity shrinks due to the deflationary liquidation of excess capacity. China stopped publishing data on urban youth unemployment in June last year because of its high rate.

A large number of young, educated, unemployed and homeless men, lacking the attraction of the opposite sex, are prone to discontent and could become a potential factor in a popular uprising. The CIA may be watching this situation closely, hoping to provoke a "color revolution" in China. These newly graduated young people may be dissatisfied with the existing system because they have not been given the opportunities for prosperity that were promised to them.

If China were the United States or the European Union, it might divert these young people through foreign wars. However, China has not traditionally been keen on large-scale foreign military adventures. Therefore, China needs to restore economic activities through quantitative easing (QE) and increase the broad money supply to allow ordinary college graduates to get employment opportunities.

Beijing is well aware of this. Starting this summer, it instructed the People's Bank of China (PBOC) to update its tools to conduct open market operations in the government bond market. The PBOC is gradually including the secondary market trading of Chinese government bonds in its tool library. In recent years, the market has paid more and more attention to this, and we have been enriching and improving the methods of base money injection. In the past period of time, the method of foreign exchange deposits was to passively inject base money. Since 2014, the amount of foreign exchange deposits has declined, and we have actively injected base money through tools such as open market operations and medium-term lending facilities.

It is worth noting that including the purchase and sale of Chinese government bonds in the monetary policy toolkit does not mean implementing quantitative easing, but rather serves as a channel for base money injection and a tool for liquidity management. The purchase and sale of Chinese government bonds will work together with other tools to create a suitable liquidity environment.

China's current monetary policy stance and the evolution of its future monetary policy framework

Today, quantitative easing (QE) has become a sensitive term because people know it can trigger inflation. However, since August this year, the People's Bank of China has increased its holdings of local government bonds from RMB 1.5 trillion to RMB 4.6 trillion, the first time since 2007 that it has injected money by purchasing government debt.

For fiscal policy to be stimulative enough to escape deflation, a massive issuance of local and central government bonds is necessary. Although Chinese bond yields are at historically low levels, they are still too tight in substance. The price of money needs to be close to zero, and the supply must increase significantly, which can only be achieved through quantitative easing by the People's Bank of China.

The Fed, the ECB, and the Bank of Japan all started with small-scale government bond purchases in their early stages of quantitative easing, but eventually got out of the deflation trap by printing a lot of money. China and the People's Bank will follow the same path. Although the initial intervention will be small, the People's Bank will eventually print tens of trillions of RMB to resize the Chinese economy - this is Beijing's intention!

China is about to start quantitative easing, but this is only half the solution. Banks also need to resume lending to drive higher nominal GDP growth.

Going back to the incentive structure of top managers of state-owned enterprise (SOE) banks, they are reluctant to issue a large number of new loans because some loans may default and they may be investigated for corruption in a few years, and they need to know that Beijing has their back.

The People's Bank of China (PBOC) has recently issued a series of monetary policy measures to encourage bank credit growth, with the Chinese government announcing that it will borrow and directly inject capital into the banking system. While the state-owned banks are essentially passing funds from the "left hand" to the "right hand", this is more of a gesture. Through this move, Beijing is showing bank executives that increasing loan growth will not bring personal risks.

Another sign that Beijing is ready to ease up on its crackdown on corruption is the re-emergence of the "three distinctions" policy. In a recent party document, the Politburo told party members that it would forgive poor decisions made by lower-level officials in order to improve the economy. By reducing the personal responsibility of the top leaders for risks, officials can start lending and provide the credit needed to revive the economy.

Financial indicators for China’s banking sector, especially data on non-performing loans (NPL), appear somewhat distorted. According to the Bank for International Settlements (BIS), on average, the banking system’s NPL ratio after the real estate crisis reached about 22%. Chinese banks, on the other hand, report an NPL of only 2%. Are Chinese banks really that special?

I think not. That’s why in China banks are generally only willing to lend to projects that are directly supported by the government. To use a crypto metaphor, imagine a bank whose lending is primarily to companies like FTX, Three Arrows Capital, BlockFi, Genesis, and Voyager. Would you believe it if this bank reported the lowest nonperforming loan ratio? Therefore, to revive the banking sector, Beijing needs to repair the banks’ balance sheets through equity injections.

Another policy that suggests Beijing is ready to ease credit is the cap on total compensation for bankers, with recent government regulations limiting, I think, total compensation for any financial services worker to $420,000, whether they work for a state-owned or private bank. When the U.S. bailed out its banking sector, no such cap was set; JPMorgan Chase CEO Jamie Dimon still earned $17.6 million after the bank was rescued in 2009.

Beijing knows that credit expansion is extremely profitable for the banking system, especially when the government essentially backs all lending. At the same time, they also know that wealth will not trickle down, which could spark anger among ordinary people. The last thing Beijing wants is an "eat the rich" movement similar to "Occupy Wall Street" to happen on Nanjing Road in Shanghai, which is also in line with Beijing's common prosperity policy.

Beijing is signaling to the market that it is injecting monetary "chemotherapy" and you just have to listen. One side effect many analysts mention is the depreciation of the yuan against the dollar.

RMB

Russell Napier has written an excellent article arguing that China is ready for the monetary “chemotherapy” I described in the previous section, and that Beijing would tolerate a depreciation of the renminbi due to a sharp increase in the money supply. I am not sure that Beijing would allow a large depreciation of the renminbi, which could trigger capital outflows. However, I do not think that the renminbi will depreciate significantly against the dollar, so this prediction will not be tested.

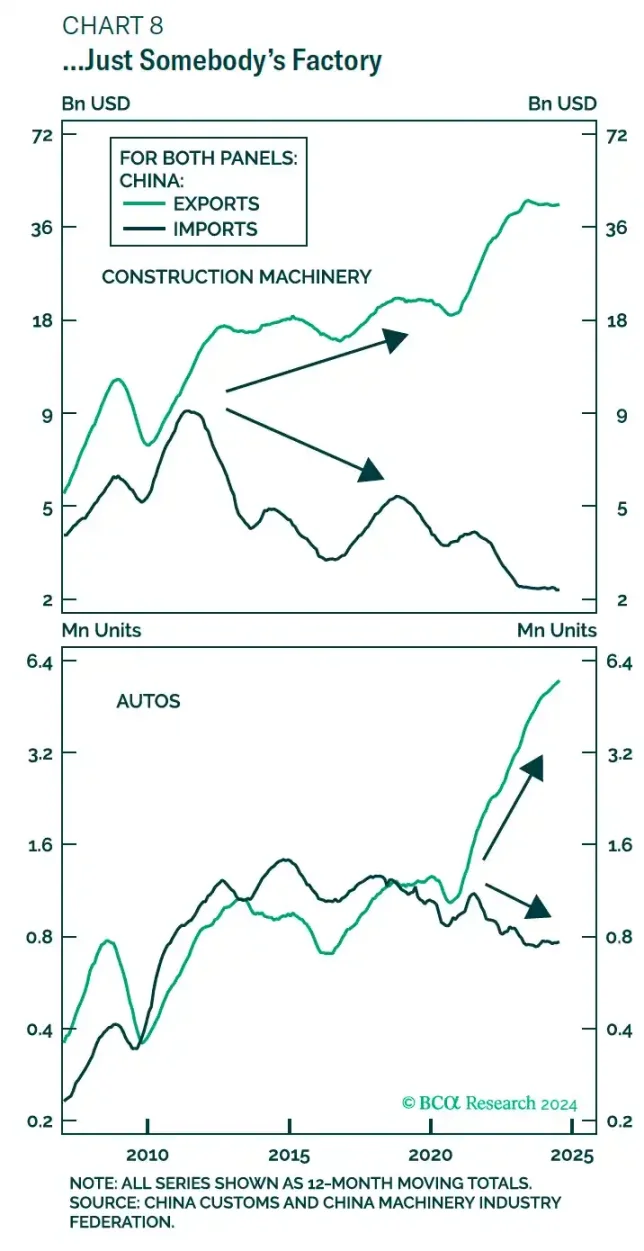

As we all know, China is the world's production workshop, so China's trade surplus continues to hit record highs. However, a deeper analysis of the data shows that the reason for the increase in China's trade surplus (exports minus imports) is not the increase in exports, but the decline in its economy's import dependence, and China can pay for more imports in RMB.

To illustrate my assumptions, let’s assume that China’s exports total $100 per month and imports total $50, which translates to a trade surplus of $50. Now, its export economy is less import-dependent—for example, China used to need to import parts from abroad to make cars, but now most parts are made domestically. This allows the trade surplus to grow, even if the volume of goods exported has not increased.

The chart above shows how China is exporting more construction machinery and cars while importing fewer goods.

The main commodity China lacks is energy, yet it is currently able to purchase goods from countries such as Saudi Arabia and Russia using yuan rather than dollars.

China was not able to dominate trade terms until the West froze Russia’s dollar and euro reserves and imposed sanctions after the outbreak of the Ukrainian war in February 2022. But now Russia has no choice but to pay in RMB at China’s request and supply energy to China at a discount.

As China increases its domestic supply of yuan to boost growth, inflation will rise. However, because China produces a higher proportion of its goods domestically and pays for a greater share of its energy in yuan, rising inflation will not weaken the yuan against the dollar as much as it did in the past.

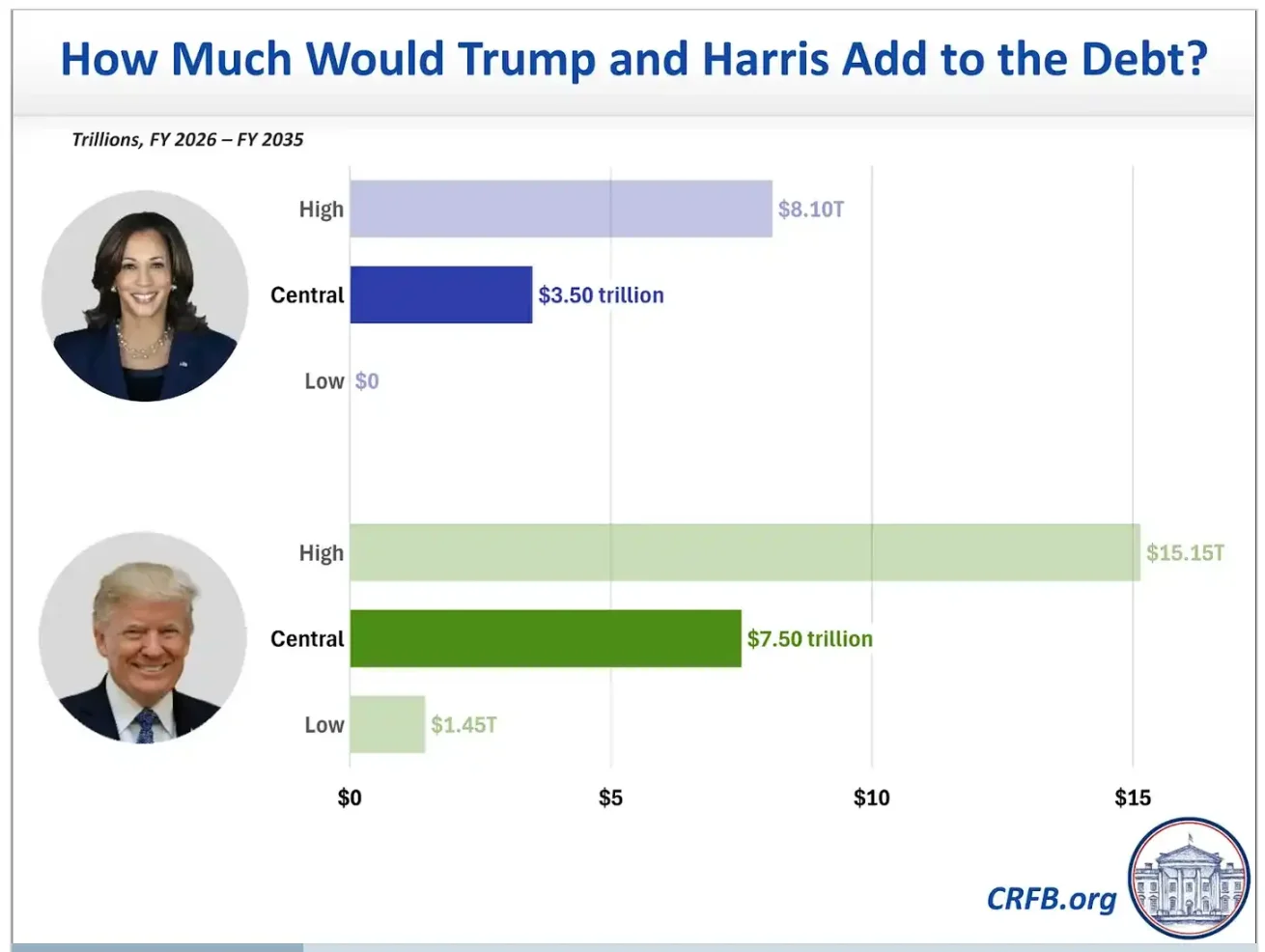

The last reason why the RMB will not depreciate significantly is that, in sync with China's reflation measures, the United States will pursue a "weak dollar" industrial policy regardless of the election results. Although Trump and Harris try to emphasize their differences, in essence, they will both stimulate the economy by printing money and injecting funds into key US industrial sectors.

Whether Trump or Harris wins, the United States will inject trillions of dollars of fiat currency supply into the market in the next few years, which will undoubtedly lead to a structural depreciation of the US dollar.

For China, the negative monetary effects of implementing a reflationary policy may not be directly apparent. All signs indicate that Beijing is ready to print a large amount of RMB. However, against the backdrop of credit creation growth, ordinary people may not see a significant strengthening of the real economy. For these people, perhaps Bitcoin will become an "antidote."

Let's Go Bitcoin

The Chinese people are known for their adaptability and innovative spirit, and they will not let the RMB in their hands depreciate in asset price inflation. Bitcoin is not unfamiliar to residents of middle- and upper-income coastal cities, and although exchanges are prohibited from offering public Bitcoin/RMB trading pairs, the Bitcoin and cryptocurrency market is still thriving in China.

Currently, China's cryptocurrency market has once again returned to the model of peer-to-peer (P2P) transactions. In the early days of the heyday of the three major Chinese exchanges (OKCoin, Huobi and BTC China), users often had to transfer RMB to exchange accounts through complicated methods. Today, China is rumored to have an active P2P market again, and major Asian spot exchanges such as Binance, OKX and Bybit have a large presence in mainland China. Exchanges have P2P information boards to help local traders assist each other in cryptocurrency transactions. In short, highly motivated Chinese can relatively easily exchange RMB for cryptocurrency.

Beijing's reason for closing the Bitcoin/RMB trading pair may be to avoid Bitcoin becoming a "siren" of currency devaluation, thereby prompting investors to choose Bitcoin instead of stocks or real estate to store value. Although the Chinese government cannot completely ban Bitcoin, and the holding of cryptocurrencies is not completely prohibited in China, Beijing prefers to keep Bitcoin low-key. Therefore, I cannot directly track the flow of RMB into the Bitcoin ecosystem through statistics, and the only clue may be feedback from market movements.

Bitcoin ETFs listed in Hong Kong are also unlikely to receive significant inflows. The funds flowing into the Hong Kong market through the Shanghai-Hong Kong Stock Connect will not be used to purchase domestic stocks or real estate, which is why mainland China is prohibited from purchasing Hong Kong Bitcoin ETFs. Therefore, even if the companies issuing these ETFs place expensive advertisements in Hong Kong subway stations, they will not be able to easily expose mainland investors to Bitcoin.

While I don’t have tools to directly track RMB inflows into Bitcoin, or look at the Bitcoin/RMB price conduit, I do believe that stocks and real estate generally underperform against a backdrop of central bank balance sheet expansion.

The chart above shows the performance of Bitcoin (white), gold (yellow), the S&P 500 (green), and the Case-Shiller U.S. House Price Index (magenta) relative to the Federal Reserve's balance sheet, with the initial value of these assets set to 100. Bitcoin's performance relative to other risk assets is so strong that the return curves of other assets are indistinguishable on the right side of the chart.

As I said before, this is my favorite chart. No other major risk asset class is as effective at protecting against currency debasement as Bitcoin. Investors instinctively realize this, so when thinking about how to protect the purchasing power of your savings, Bitcoin will be staring you in the face like fate, and it will be impossible to ignore it like Kwisatz Haderach.

For those who think the market will quickly figure out the future and quickly push Bitcoin higher, I must disappoint you. The People's Bank of China's quantitative easing (QE) policy and the re-acceleration of credit growth will take time. Chemotherapy also takes time to consume the "patient". In the initial stage, Chinese savers are buying oversold domestic stocks and deeply discounted apartments as I expected. This policy may not be obvious now, but give it time, and its effects will eventually become non-negligible.

Economists' current pessimism about the scale and intensity of stimulus provides investors with an excellent buying opportunity. When wealthy investors living on the coast decide to buy Bitcoin at any price, the upward price fluctuations will be reminiscent of August 2015, when the People's Bank of China suddenly devalued the RMB, and the price of Bitcoin rose from US$135 to US$600 in less than three months, a nearly 5-fold increase.