Author | BowTied Bull

Compilation|Baidu Blockchain

With the arrival of 2025, as the year turns from old to new, we will, as is customary, sum up the past and look forward to the future.

An interesting thing to look back at the past of the crypto industry is that every four years there is a “copycat season” where everything in the industry is going up, and you’ll probably hear about your alcoholic uncle making a killing by buying some animal emojis, and he probably did it while drunk.

By 2025, the real alt season has not yet arrived. Although no one can predict how crazy this alt season will be, I would like to remind everyone that the trend of Altcoins is generally out of control quickly and may end suddenly. Once it collapses, the decline may not only be -99.99%, but may even be a complete collapse.

But before that, everyone is immersed in the atmosphere of prosperity and entertainment. So, let's take a look back at the past copycat seasons to see how they developed and whether we can learn some valuable lessons from them?

01. 2012-2013 Copycat Season: Early Enthusiasts, Market Value Peaked at $15 Billion

We know that the current market followers are likely to reappear. This happened in 2013, and the trend has become very interesting.

In the “altcoin season” of 2013, Bitcoin was still in its infancy, with a total market value of only about $1 billion and a whale transaction of only about $100,000. At that time, CEX Mt. Gox was still operating, and most of the investors were those who frequently appeared in the “Magic Wind and Gathering” trading card activities (this is also the background of the Mt. Gox incident).

At that time, people proposed the idea of improving the speed of Bitcoin transactions, believing that transactions could be accelerated by reducing block time, which was seen as a far-reaching innovation at the time.

Litecoin: Still exists today, and the whole idea (proposed by Charlie Lee) was to reduce the block time from Bitcoin’s 10 minutes to 2.5 minutes.

The price of Litecoin rose from about 10 cents to $48, an increase of about 47,900%, and saw another sharp rise in 2017, and then Charlie Lee sold all his holdings at the top, claiming that "the Bitcoin network is fine without him" (everyone knows what it means for a founder to sell 100% of his holdings).

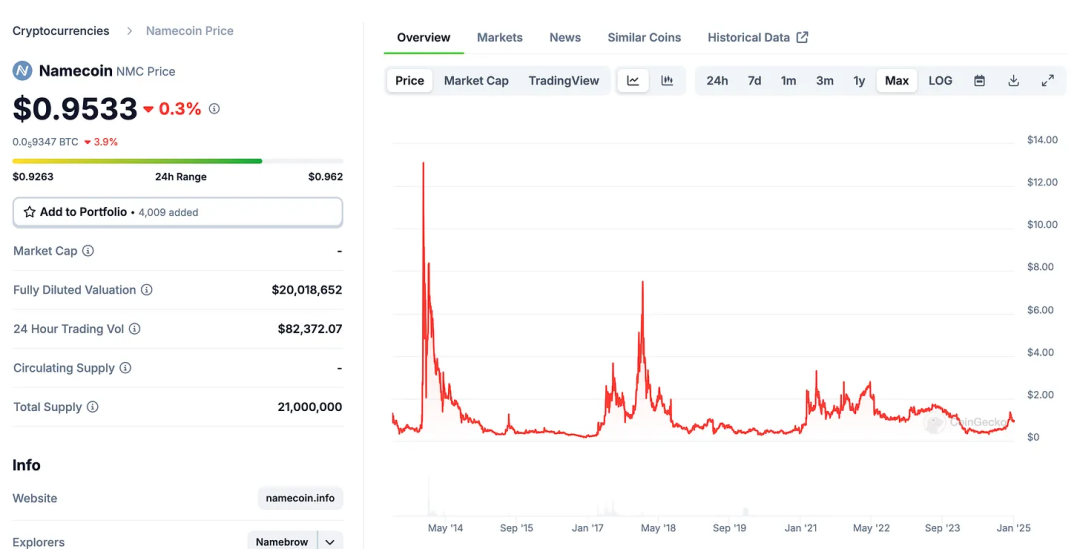

Namecoin: This is a Bitcoin fork that aims to create decentralized web domains (similar to the concept of ENS through the ".eth" extension). Its price once soared to about $13, but soon fell to the bottom. From the lowest point to the highest point, its price increased by about 30 times. In fact, it still exists today and is currently trading at nearly $1.

Peercoin (PPC): This is one of the earliest Proof-of-Stake tokens (the same mechanism used to secure ETH today), and it experienced two major surges. The first was in 2013, and the other was in 2017 when the ETH 1CO craze broke out. Its price once soared to about $7, a 60-70x increase. Naturally, it did not gain mainstream adoption and eventually fell to $0.42. (But the next conclusion I want to draw is that except for pure Ponzi schemes like Bitconnect or LUNA, nothing else on the market will really go to zero at present.)

Frenzy: Bitcoin eventually hit $1,200, and these cryptocurrencies all rose due to increased interest in crypto. Any project that posted on BitcoinTalk could quickly rise based on speculation alone. The closest thing to this today is probably a memecoin promoted by a celebrity or named after a celebrity.

Mt. Gox Crash: The party was over when Mt. Gox crashed. The crash was due to a major hack and caused a massive drop in the price of Bitcoin, probably 85-90% (depending on how you look at the bottom), while Altcoins dropped over 99%.

02. 2017 Copycat Season: ICO craze and the rise of Ethereum, with a market value of up to $800 billion

Then during the bear market, many interesting events happened. Ethereum was born as a smart contract platform with the purpose of creating programmable money. This was a real innovation because it not only allowed people to transfer tokens, but also create smart contracts, which completely changed the rules of the game.

Like many things in the cryptocurrency space, Ethereum comes with some common risks. Ethereum’s DAO (decentralized autonomous organization) was hacked, resulting in losses of more than $100 million, which ultimately led to the blockchain forking into two chains, ETH and ETC. To this day, some people still believe that the decision to fork was wrong, but we are not going to discuss this today, just a brief review of this period of history.

Around 2016, people realized that new tokens could be issued on the Ethereum blockchain, which gave rise to the initial coin offering (ICO). In 1CO, the project party sells tokens directly to investors. In 2017, the ICO craze officially broke out, and many scam projects you can think of emerged at this time.

Ethereum (ETH): Since ETH is required to issue these tokens, it has driven the rapid rise in ETH prices, soaring from about $8 to $1,400 in January 2018, which was an almost unimaginable return at the time. Currently, ETH is trading at around $3,650.

Ripple (XRP): Still considered a “bank coin”, the theory is that it will replace SWIFT (the international money clearing system) overnight as the de facto financial standard. Despite being centralized (most people don’t mind), it has attracted millions. The price of XRP has skyrocketed from about 1 cent to $3.80 and is currently trading at $2.41.

Oddly, Ripple’s investor base is still mostly retail investors. You can see a similar phenomenon in the recent rally — Ripple dominated TikTok, attracted a lot of discussion, and even asked “what if it could reach the same market cap as Bitcoin?” This discussion about the “four trillion dollar market cap” is a bit bizarre.

Litecoin: As mentioned before, Litecoin has risen again, with the price soaring to $360. Even though Charlie Lee sold all his Litecoins, it still rose to $384 again in 2021!

EOS: EOS raised $4 billion through ICO and called itself the “Ethereum Killer.” Its price once soared to $22, but has since failed to reach a new high.

NEO: Another self-proclaimed “Ethereum killer” project, it was called “China’s Ethereum” when NEO’s price rose from $0.20 to $200, achieving a 1,000x return.

Bitcoin Cash: Roger Ver was once a well-known figure in the Bitcoin circle. He participated in the debate on large blocks and supported Bitcoin Cash. At block 478,559 in August 2017, users who held 1 Bitcoin would receive 1 Bitcoin Cash. Due to Roger Ver's support, the price of Bitcoin Cash soared to about $3,800, but then gradually faded out of people's sight.

Other Ethereum Killers: During this period, some other tokens were also promoted as "Ethereum Killers" (such as ADA, Tron, etc.). If a token had a "white paper", it seemed to drive its price to a 10x or 100x surge. Other tokens, such as Filecoin and Tezos, were also launched during this period.

Yield Scams: If you think BlockFi, LUNA, Celsius, and Voyager were the first yield scams, you are wrong! In fact, the first large-scale yield Ponzi scheme was Bitconnect, and many people lost millions of dollars.

Regulators step in: Just like the 2021 cycle, regulators step in and Ponzi schemes break out, destroying the industry once again. The SEC starts going after projects like EOS, and the market experiences a solid 85% correction, taking Bitcoin down to around $3,500 by March 2020.

During that period, most tokens were just scams, so the Altcoin market experienced a crash of almost -99.999999%. At that time, if your token appeared in a Super Bowl ad, its price could increase fivefold in an instant. For example, VIBE is a typical example.

VIBE’s price soared from $0.04 to over $2, but ultimately its total market value fell to just $262.

03. 2021 Alternative Season: DeFi, NFT and Memecoin, with a market value of up to $3 trillion

In 2021, for well-known reasons, everyone is working from home, staring at computers and mobile phones doing nothing. The US government has printed $10 trillion in currency, and this is just the US government's spending.

DeFi projects boosted liquidity mining, NFTs made JPEG images mainstream (selling for millions of dollars), and Memecoin valuations reached ridiculous levels. Bitcoin broke $69,000, ETH reached $4,800, and the total cryptocurrency market cap exceeded $3 trillion in November 2021.

Dogecoin: It started out as a joke, but as Elon Musk took an interest in the coin, its price began to rise parabolically, becoming a trending topic on the forum platform Reddit. Today, it is almost Elon's meme coin, representing the government efficiency department. The price soared from about 0.5 cents to 74 cents, an increase of about 15,000%.

Solana: Promoted as the next “Ethereum killer”, it attracted a lot of attention with its fast transaction speeds and low fees. This was mainly promoted by SBF (now in jail). The price soared from $1 to about $260, an increase of 26,000%.

Shiba Inu: The meme coin that mimics Dogecoin has created a large number of millionaires. If you look at the market cap from almost zero, it has increased by 500,000%.

DeFi Token: AAVE, UNI, SUSHI, YFI and other DeFi Tokens have increased by 10 to 50 times, and the TVL of decentralized finance (DeFi) has exceeded hundreds of billions of US dollars. Today, the TVL of many DeFi projects is even higher than it was then!

NFTs:

CryptoPunks: Sold for millions of dollars, with the cheapest CryptoPunk costing over 100 ETH.

Bored Ape Yacht Club (BAYC): Became a cultural phenomenon, with rock-bottom prices reaching incredible levels.

Airdrop madness: For some old users of some projects, just owning a .eth domain worth $100 can get a $40,000 Airdrop. You can even get 2% in a day or a week by crossing a bridge (completing certain operations). NFT projects like BAYC have also Airdropped a large number of other highly valued NFTs, and the total Airdrop amount is as high as billions of dollars.

What’s even crazier is…almost all tokens are going up, with tokens like SAFEMOON being promoted by people like Dave Portnoy. Celebrities like Snoop Dogg and Paris Hilton are also endorsing various projects. Tom Brady and Stephen Curry are promoting cryptocurrency exchanges. Even the now-defunct FTX paid for the naming rights to the Miami Heat. FTX (now defunct) even bought the naming rights to the NBA’s Miami Heat.

Ponzi Schemes: A large number of Ponzi schemes have emerged. Although some people have accused us of being involved in these scams, in fact we are not involved. Fortunately, many people have successfully avoided large losses. It is never a wise move to invest in these products and entrust your assets to others.

Death spiral: As liquidity began to dry up (the funding that had previously been provided to these projects no longer appeared), we saw the collapse of the aforementioned Ponzi schemes. In addition, FTX collapsed due to the theft of user funds, and then the US Securities and Exchange Commission (SEC) stepped in to regulate again. Various large-scale scams and leeks have finally led to a period of strict regulation of the entry and exit channels of the crypto industry.

04. Key Lessons

1) Take Profits in Time: The market is changing rapidly and you are likely to get greedy. If you find yourself saying “I wish I could buy 2x more of X token”, then you should probably sell half of your position and be content to take the profit. It doesn’t matter if you sell Bitcoin, Ethereum or stablecoins, the key is not to be greedy.

2) Hype cycles are repetitive: Each round of alt-season has a narrative theme: Bitcoin forks, ICOs, DeFi, NFTs, or Memecoins. If you find a theme, it’s best to stick with it, because the knowledge you accumulate in that area tends to disappear quickly at the end of the cycle. Instead of jumping around, it’s better to focus on a certain area and pick the final victory.

3) Risk management is critical: The benefits are great, but everyone is different. You are different from me, and I am different from my neighbor. Make a plan that works for you and stick to it, don’t keep adjusting your goals because someone with $100,000 said, “$10 million is not enough for retirement.”

4) Survivors will thrive: Altcoins come and go, but Bitcoin and Ethereum dominate in every cycle. If a project has been around for this long, the risk of it going to zero is relatively low. If Solana can find real-world applications that surpass Pump.fun by 2025, it may also be close to this level.

Have we learned anything from Ponzi schemes? Actually, no. From what we have seen, people still don’t understand the concept of “Not Your Keys, Not Your Coins”. You can buy crypto stocks or other crypto leveraged asset investments at a brokerage firm, but understand that if you hold these stocks or crypto ETFs, you don’t actually own any cryptocurrencies. You can never know what these companies or projects will do with the assets you invest.

During the bull market, we are often criticized for not participating in the hype of the latest memecoin. Although the speculation seems to be hot at the moment, if you look closely, you will find that those who stick to their strategies and keep calm have gradually accumulated.

In contrast, speculators who only want to get rich quickly through "10 times the return" may attract the attention of the market in the short term, but their funds and strategies are far from comparable to those anonymous big investors who continue to invest steadily every month and accumulate wealth. These big investors usually have a more solid financial foundation and clearer long-term plans. In the end, the market performance and data will prove what kind of strategy is the key to success.

Finally, I wish you all good luck in 2025.