Written by: 0xWeilan

The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

Since the launch of the BTC Spot ETF, the correlation between BTC prices and US stocks has become stronger and stronger. This is vividly reflected in the market since November.

On November 5, Trump was elected as the 47th President of the United States, and the U.S. stock market and BTC simultaneously started the "Trump market". The confidence of all parties in Trump's economic policies was very strong, which pushed the market to continue to rise until December 18. On that day, the Federal Reserve made hawkish remarks, suggesting that monetary policy may change. The market expected the number of interest rate cuts in 2025 to be significantly reduced from 4 to 2. Since then, both the U.S. stock market and BTC have started to make significant downward revisions.

The same is true for capital flow, which was in a state of strong inflow before December 18, but quickly turned into an outflow after the 18th.

Although it hit new highs, BTC maintained an upward trend before the 18th, gradually approaching $110,000. The Fed's policy shift caused trading sentiment to cool, and the cooling of sentiment made BTC "feeling too high to be cold", forcing it to start a downward revision.

EMC Labs believes that the world is still in a cycle of interest rate cuts, and the current cooling is only a temporary setback. As liquidity gradually recovers, BTC will hit the $100,000 mark again after adjusting at a high level.

Macro Finance: Expected US rate cuts in 2025 reduced from 4 to 2

On December 18, the Federal Reserve made hawkish remarks after announcing a December interest rate cut, claiming that "the risks to achieving employment and inflation goals are roughly balanced, and the committee will be prepared to adjust the monetary policy stance as appropriate if risks emerge that could hinder achievement of the goals."

The so-called "goal" is to "achieve full employment" and "maintain price stability." Adjusting the balance between the two through the federal interest rate is considered the basic work of the Federal Reserve.

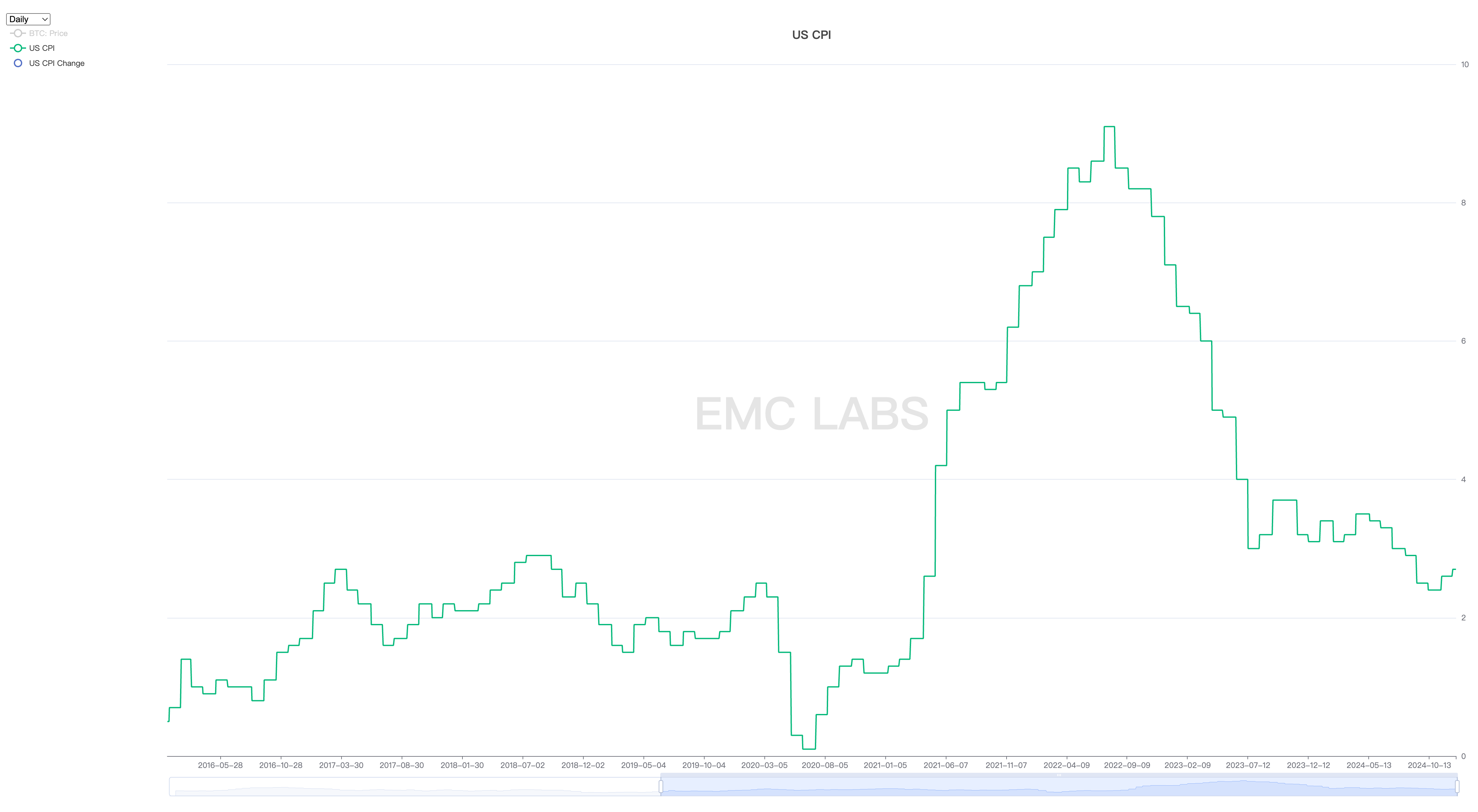

According to the November data released by the United States in December, 227,000 new jobs were created in November, indicating that the job market remained stable; the unemployment rate remained at 4.2%, the same as in previous months, indicating that the job market was relatively stable. The CPI data showed that the inflation rate rose by 2.6% year-on-year, slightly higher than 2.4% in October, indicating that inflationary pressure has picked up and has rebounded twice.

US CPI

Since September 2024, the Federal Reserve has cut interest rates three times by a total of 100 basis points. The current federal interest rate has dropped to 4.33%. Although it is still at a high level, the data does not show that it has suppressed economic activities. Both new jobs and unemployment rates indicate that the US economy is in a healthy state. The two-month rebound in inflation has led the Federal Reserve to decide to postpone the interest rate cut to observe whether the inflation data can fall back.

This pause is seen as the end of the first phase of interest rate cuts, and the second restart requires more guidance from economic data, that is, weakening economic activity or a downward CPI.

In 2024, despite twists and turns and chaos, the three major U.S. stock indexes have achieved substantial growth for two consecutive years. Looking ahead to 2025, the systemic risk is still not large, and the variable lies in the conflict between Trump's economic policy and monetary policy.

Due to market linkage reasons, if BTC wants to get out of the adjustment and completely conquer the $100,000 mark, it may need U.S. stock trading parties to clarify the direction and the stock index to return to an upward trend.

Crypto assets: $100,000 mark and market undersaturation

In December, BTC opened at $96,464.95 and closed at $93,354.22, down 3.23% for the whole month, with an amplitude of 17.74%. The trading volume decreased compared with November but still remained at a high level, indicating that there were large divergences and severe selling pressure after breaking through the $100,000 mark.

Looking back at 2024, BTC rose 120.76% throughout the year, but fell in 4 of the 12 trading months. From April to October, BTC was in a long-term oscillating consolidation state after hitting a record high of $70,000. During this period, the impact of the restart of interest rate hikes, the German government's selling, and the yen interest rate hike led to the collapse of arbitrage transactions, ups and downs, and dangers abounded.

This has been a difficult year.

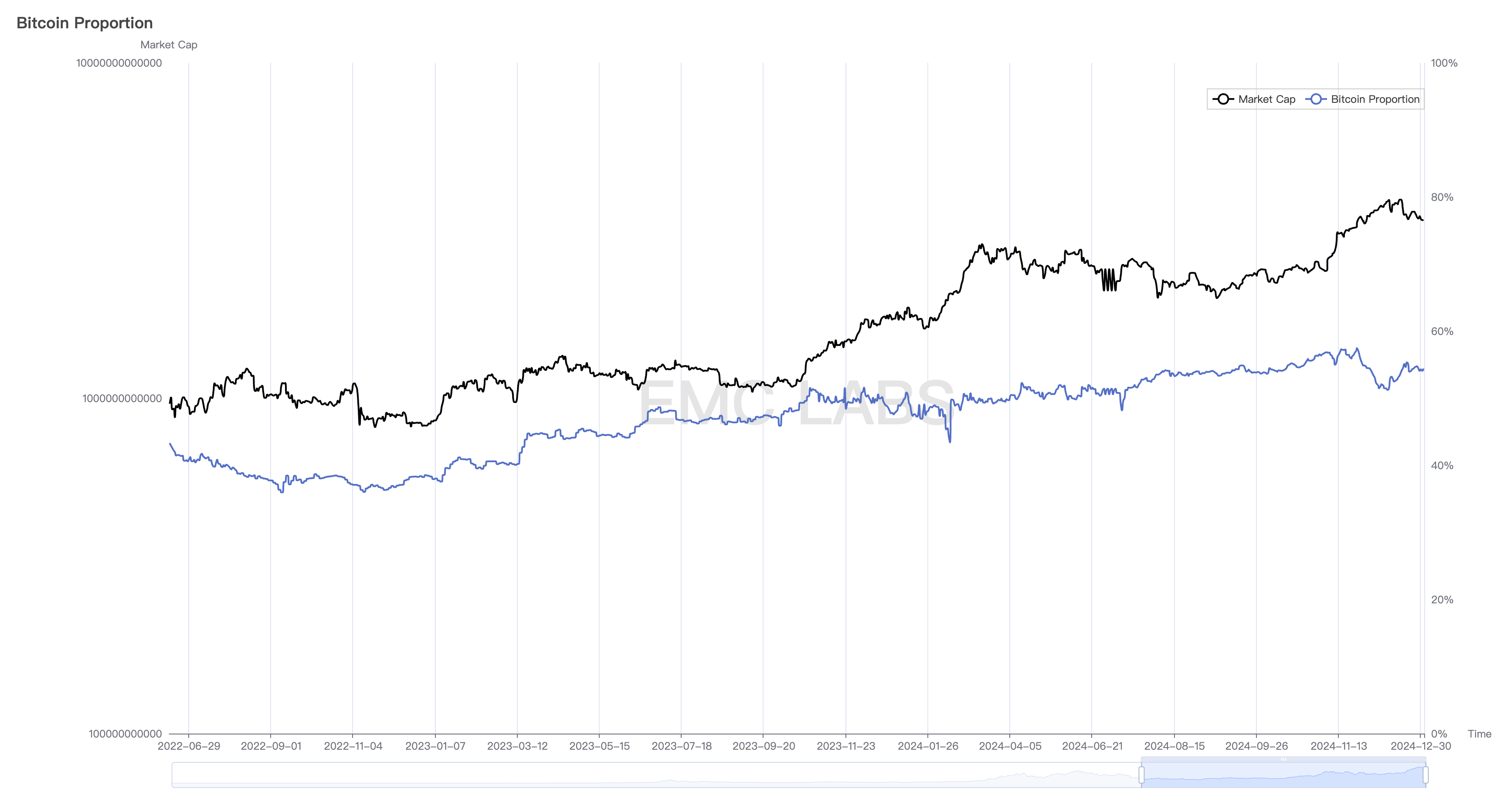

The two major smart contract platforms, ETH and SOL, rose by 46.27% and 86.11% respectively, both lagging behind BTC, which has strong support from US stock funds. Except for a small number of currencies that are still in the process of price discovery or are highly manipulable, only about 20% of the top 100 currencies by market value have an annual increase that exceeds BTC, which is very different from the previous bull market.

BTC Market Share

BTC's market share has been above 50% for a long time, reaching a peak of 57.53% (November 21), and then began to decline, falling to a low of 51.22% (December 8), and then rebounded again, but the trend failed to continue. This shows that Altcoin has not received sufficient long-term funding, and more often than not, after BTC's sharp rise, it has experienced sharp rises and falls under the control of short-term speculative funds or traders, making it much more difficult for investors to operate.

In addition, although various concepts and projects such as LRT, RWA, AI, Layer2, and DePhin have appeared one after another, the long bull market of DeFi and high-performance public chains that lasted for a year or even 20 months in the last bull market has not emerged. This is particularly noteworthy.

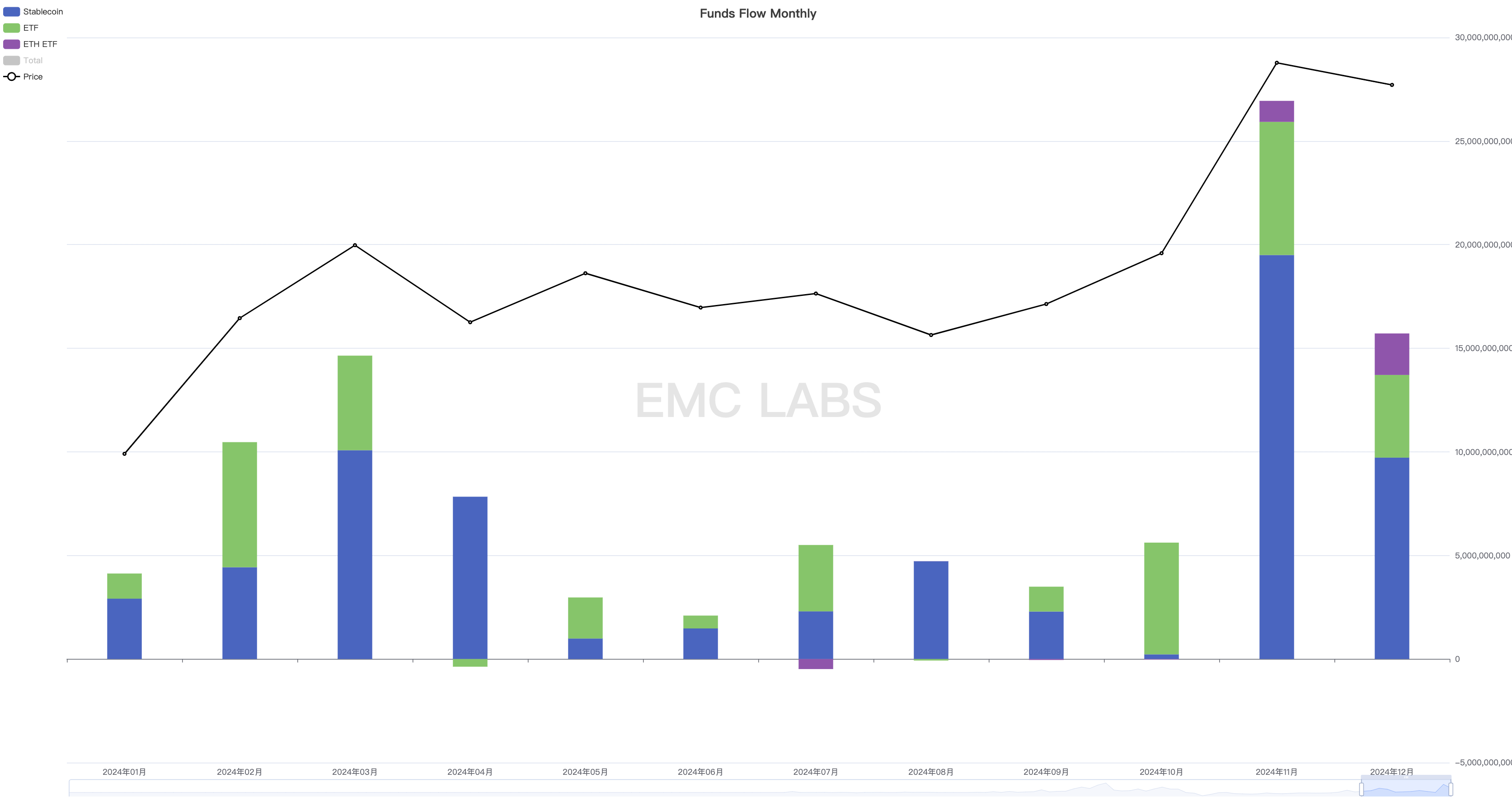

Funds: Rapidly turned to outflow after December 18

According to the data of statistical funds (stable coins, BTC ETF, ETH ETF), the crypto market recorded positive inflows throughout the year of 2024, and recorded positive inflows every month. This data shows that BTC and the crypto market are in the rising stage of this cycle, and the liquidity released by the interest rate cut cycle drives the market to rise in a pulsed manner.

Especially after the Federal Reserve began to cut interest rates in September, the second wave of liquidity began to gradually recover, and in November, with the victory of crypto-friendly candidate Trump, the market began to flow in excitedly, setting a monthly record of 26.9 billion US dollars. Throughout December, the market inflow amount reached 15.7 billion US dollars, ranking second in this round of bull market and fourth in history.

Stablecoin, BTC ETF and ETH ETF capital inflow and outflow statistics (monthly)

In addition, Microstrategy also invested approximately US$12.8 billion in BTC from November to December, which directly drove the company's market value to surge and enter the Nasdaq 100 Index.

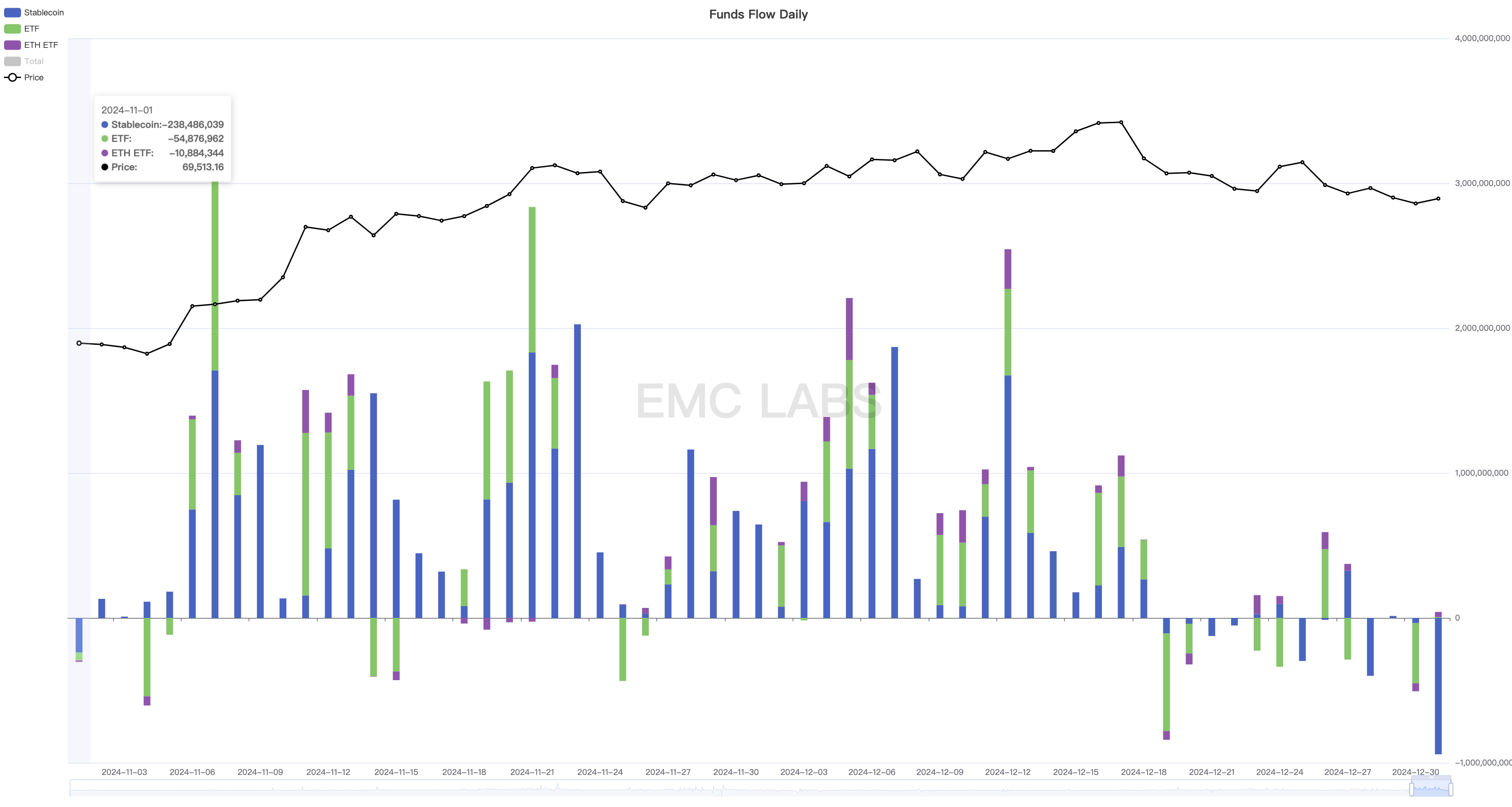

However, after the Fed lowered its rate cut expectations on December 18, the two major ETFs and stablecoin channels quickly turned to outflows the next day. Although there have been some fluctuations since then, the overall outflow is still increasing. The BTC price also fluctuated downward, from a high of 108388.88 to a low of 91271.19, with a maximum retracement of 15.84%.

Stablecoin, BTC ETF and ETH ETF capital inflow and outflow statistics (daily)

Stablecoin, BTC ETF and ETH ETF capital inflow and outflow statistics (daily)

The three major US stock indexes also fell during this period, with the Nasdaq, Dow Jones and S&P 500 falling by 5.13%, 6.49% and 4.39% respectively. The adjustment range of BTC is about 3 times that of the Nasdaq.

The momentum of the market that started on November 4 came from the speculative enthusiasm of the "Trump deal", which was quickly cooled by the Fed's lowered interest rate cut expectations on December 18. During this period, BTC adjusted along with the US stock index, and the retracement range was at a relatively low level in the bull market retracement record as of the date, and the volatility ratio with the Nasdaq was also in a reasonable range.

At present, there is still sufficient funds in the market, and there is no major crisis in the market. The subsequent focus will be on whether the US stock market can resume its upward trend after Trump takes office, and whether funds in the crypto market will return to inflows.

However, if the US stock market continues to adjust for a long time and the selling pressure accumulates, BTC may hit a new low. If so, the decline of Altcoin may be even greater.

Secondary Selling: Liquidity and Historical Laws

According to eMergeEngine, the BTC and crypto asset markets are currently in a bull market. The main market activities at this stage are long-term selling of chips, while short-term holdings continue to increase, and the continuous increase in liquidity drives asset prices to continue to rise.

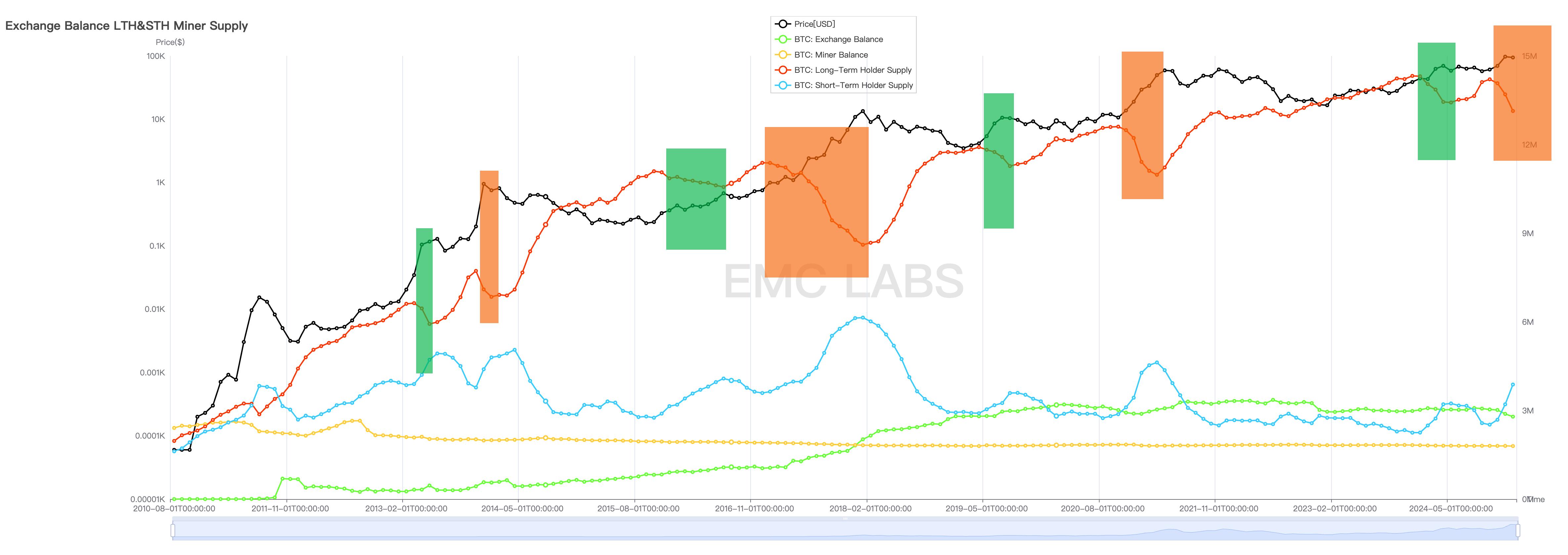

The long-term group sold off the first round of this cycle from January to May this year, and returned to accumulation in June, with positions reaching 14207303.14 in October. Since October, the group has resumed selling as prices rise. This round of selling is the second round of this cycle. Historically, this round of selling will continue until the transition period, which is the peak of the bull market.

Monthly position statistics of long and short positions, CEX and miners

Monthly position statistics of long and short positions, CEX and miners

As of December 31, the size of long-term positions was 13,133,062.92. Compared with the October high, the "scale of selling" (according to the on-chain UTXO revaluation statistics, which is greater than the actual selling volume) has exceeded 1.07 million.

The massive sell-off absorbs the huge influx of funds. Once the subsequent capital inflow becomes unsustainable, prices can only be revised down for the market to establish a new balance.

The behavior of long-term investors depends on the will of this group and the inflow of funds. Whether the selling will continue or be suspended requires continuous observation.

If funds resume flowing in and selling pressure decreases, prices may resume upward; if funds fail to resume flowing in or flow in in a tiny amount, and long hands continue to sell, prices will break through the new consolidation range of $90,000 to $100,000 and be revised downward; if funds fail to resume flowing in or flow in in a tiny amount, and long hands temporarily suspend selling, the market will most likely fluctuate in the new consolidation range, waiting for larger-scale fund inflows.

Conclusion

The cycle is running as usual. The game of time, space, and long and short all indicate that the adjustment in this stage is caused by the sudden cooling of the bullish sentiment caused by the sharp rise in prices and the downward adjustment of the Fed's interest rate cut expectations.

The timing and scale of the adjustment will first depend on when mainstream U.S. stock funds resume long positions and the selling plans of the long-term group.

As for the broader crypto market, the most noteworthy issue at the moment is that the second stage of the upward period has begun, but will the long-lasting AltcoinSeason, which is led by the core track, be absent from this bull market!