Written by Tyler

From a certain perspective, Bitcoin, with a volume of $1.75 trillion (the latest Coingecko data as of November 12, 2024), is the largest "sleeping capital pool" in the crypto world.

Unfortunately, most of the time it neither brings benefits to holders nor injects vitality into the on-chain financial ecosystem. Although there have been many attempts to release the liquidity of Bitcoin assets since the start of DeFi Summer in 2020, most of them are just reinventing the wheel, and the overall BTC capital inflow attracted is very limited, and it has never really been able to leverage the BTCFi market.

So what is the main battlefield of BTCFi? Or what problem does Bitcoin staking need to solve first? This is an answer worth at least $100 billion, and it is also a must-answer question for the Bitcoin ecosystem, especially Bitcoin staking projects.

As the current top player in the Bitcoin Staling field, Solv has provided a forward-looking solution to the problem. The core of the answer lies in the concept of "standardization" of SAL (Staking Abstraction Layer).

Bitcoin trapped in "liquidity fragmentation"

We can first take a look at the development history of the Ethereum Staking ecosystem.

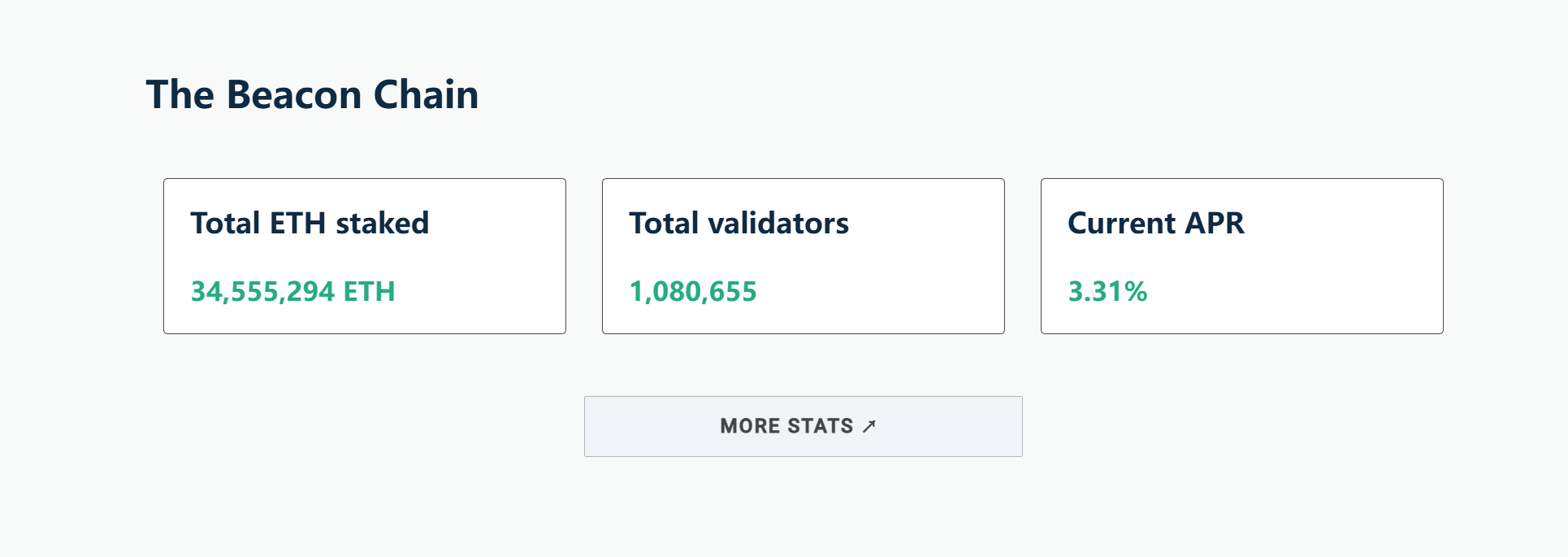

As of November 12, 2024, the total amount of Ethereum staked exceeds 34.55 million ETH. At the same time, CryptoQuant statistics show that the proportion of staked ETH to the total supply of ETH has also increased significantly from 15% in April 2023 to about 29%, nearly doubling, and the total scale has exceeded US$100 billion.

ETH staked amount/Source: Ethereum

However, the Bitcoin ecosystem, which began to gain momentum during the same period along with the Ordinal wave, had a much lower staking penetration rate than Ethereum. Even though BTC’s market capitalization and price increase were far better than ETH, it could not catch up with the expansion speed of Ethereum’s staking ecosystem.

You should know that even if 10% of BTC liquidity is released, it will give birth to a market of up to 175 billion US dollars. If the pledge rate can reach a similar level as ETH, it will release about 500 billion US dollars of liquidity, pushing BTCFi to become a super on-chain ecosystem that crushes the pan-EVM network.

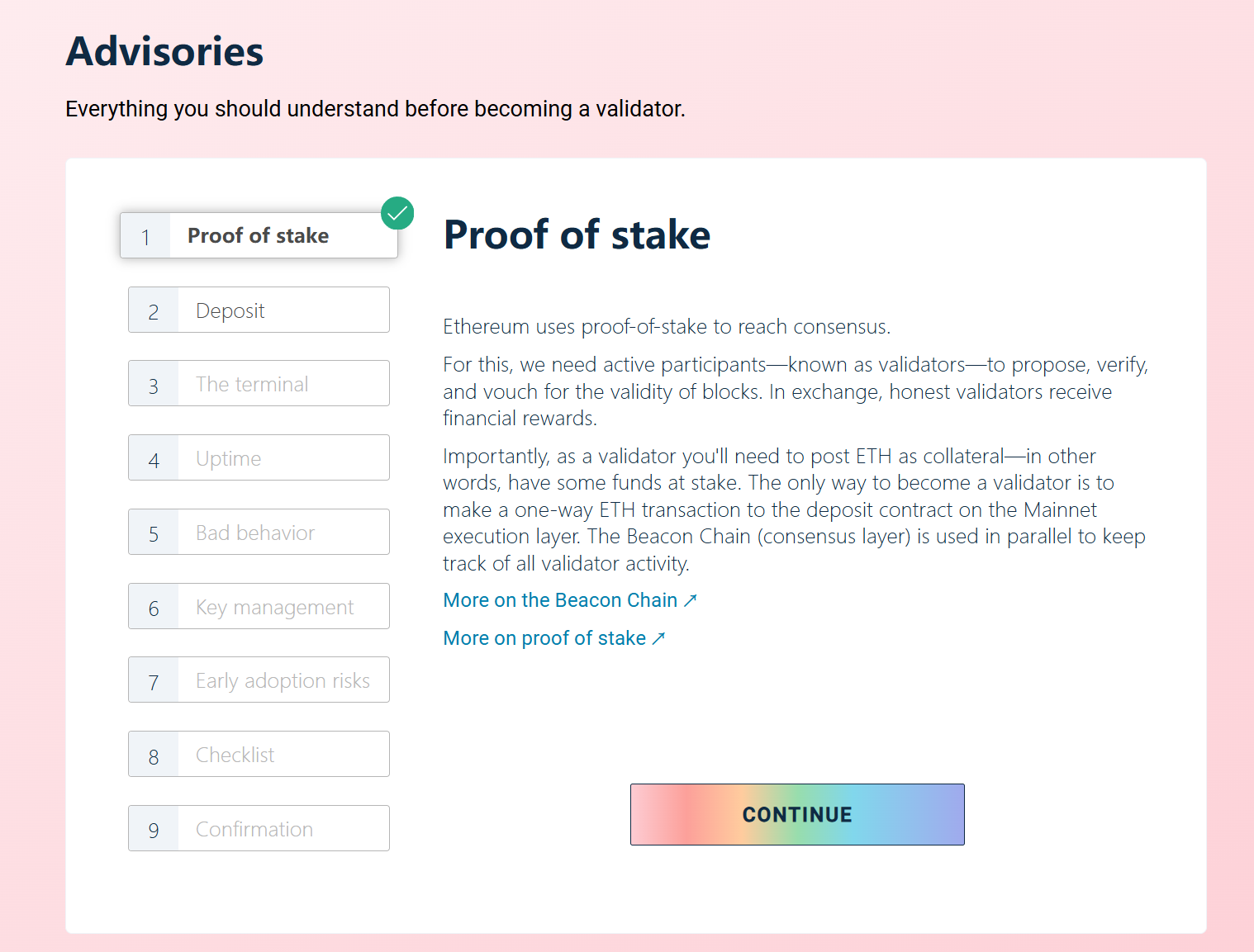

To some extent, the excellent performance of the Ethereum Staking ecosystem, in addition to the advantage of programmability, is also due to the Ethereum Foundation taking the lead at the protocol level to establish a clear and complete set of standards for ETH staking, including a clear 32 ETH staking threshold, Slash penalty mechanism, and comprehensive consideration of hardware and network costs. From the capital requirements of ordinary users to the economic security of node operation, all have been carefully designed.

Validators need to stake at least 32 ETH, Slash penalty mechanism, hardware and network thresholds, etc., which comprehensively considers the capital threshold, hardware and network costs, and economic security required for ordinary users to run nodes.

It is this unified, standardized framework design that not only improves the decentralization and security of the network, but also lowers the threshold for development and participation, prompting the rapid rise of projects such as Lido Finance, Rocket Pool, and Frax Finance, and driving the Ethereum Staking ecosystem to achieve leapfrog growth in scale and diversification in a short period of time.

ETH official staking process / Source: Ethereum

In contrast, the Bitcoin ecosystem has “no founder” and “no centralized driving organization”, which has formed its unique “chain sentiment” of extreme decentralization. This is both a unique advantage of the Bitcoin ecosystem and, to some extent, a “development curse”:

This completely decentralized structure means that the formulation of key technical standards such as the staking mechanism does not have the Ethereum Foundation taking the lead, but requires broad consensus from developers and node operators around the world to implement, and this consensus-building process is often long and complicated.

Therefore, a complete set of clear standardized frameworks in the Ethereum ecosystem has laid a solid foundation for the rapid growth of its staking and liquidity ecosystem. If BTCFi is to achieve similar progress, it will inevitably need to introduce similar standardized mechanisms in the staking field to solve many problems of liquidity and asset management.

Especially at a time when Bitcoin asset liquidity is accelerating fragmentation, the need for "unification" has become particularly urgent:

- On the one hand, when BTC is bridged to EVM-compatible networks such as Ethereum in the form of various types of packaged Bitcoin such as WBTC and cbBTC, it provides users with the opportunity to use their Bitcoin assets to participate in DeFi to obtain returns, but it also leads to the further dispersion of BTC liquidity on different chains, forming "liquidity islands" that are difficult to circulate and use freely, greatly limiting the development potential of BTCFi (including WBTC, which has recently attracted community attention due to custody risks, and decentralization and standardization are imperative);

- On the other hand, with the launch of Bitcoin ETF and the further strengthening of global asset consensus, Bitcoin is accelerating its expansion into CeFi and CeDeFi. More and more BTC are beginning to flow into institutional custody services, forming huge pools of deposited funds.

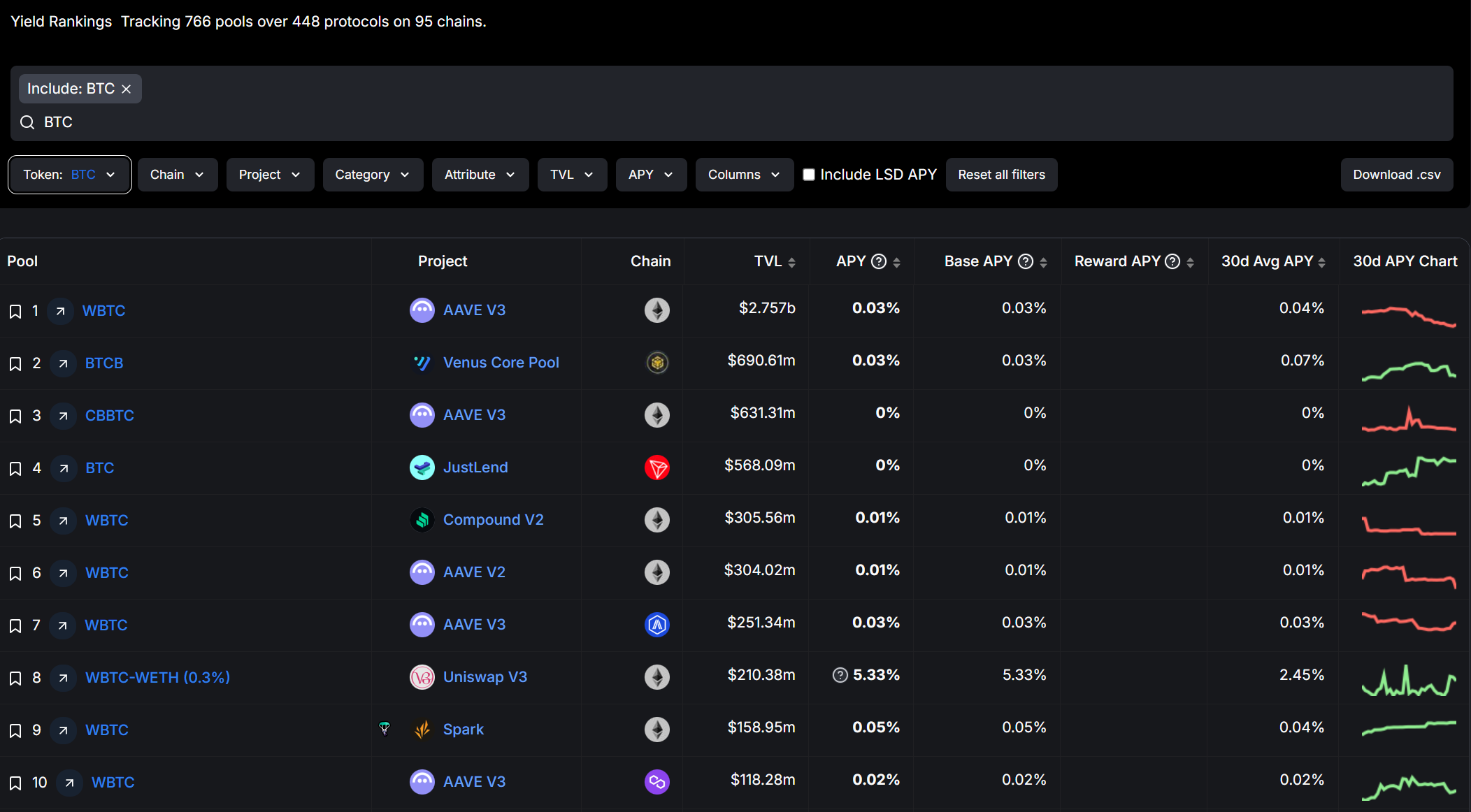

BTC liquidity statistics/Source: DeFiLlama

According to data from DeFiLlama , the current income-generating Bitcoin has been dispersed across 95 chains, 448 protocols, and 766 liquidity pools. However, due to the lack of unified pledge standards and cross-chain liquidity mechanisms, cross-chain, cross-platform, and cross-institutional BTC assets not only have high friction costs, but the dispersed liquidity cannot be efficiently integrated and utilized.

In this context, if BTCFi and the Bitcoin staking ecosystem are to continue to expand, it is urgent to establish a common, standardized industry security standard and framework to efficiently integrate Bitcoin liquidity resources scattered across multiple chains and platforms.

So objectively speaking, BTCFi and the Bitcoin ecosystem currently call for a leading role that can lead these standardization processes so that consensus can be formed on the integration of cross-chain Bitcoin liquidity and a unified technical framework and specifications can be established, thereby bringing wider applicability, liquidity and scalability to the Bitcoin staking market, further promoting the financialization of pledged assets, and pushing the BTCFi ecosystem towards maturity.

Solv: Bitcoin staking "the elephant in the room"

As the largest Bitcoin staking platform on the market, Solv has quickly seized the opportunity in the Bitcoin staking field in the past six months. Since April this year, it has attracted more than 25,000 Bitcoins (including BTCB, FBTC, WBTC, etc.) and accumulated more than US$2 billion in asset management scale.

More than 70% of SolvBTC has been invested in various staking scenarios, making Solv the protocol with the highest TVL and the most efficient capital utilization in the current Bitcoin field.

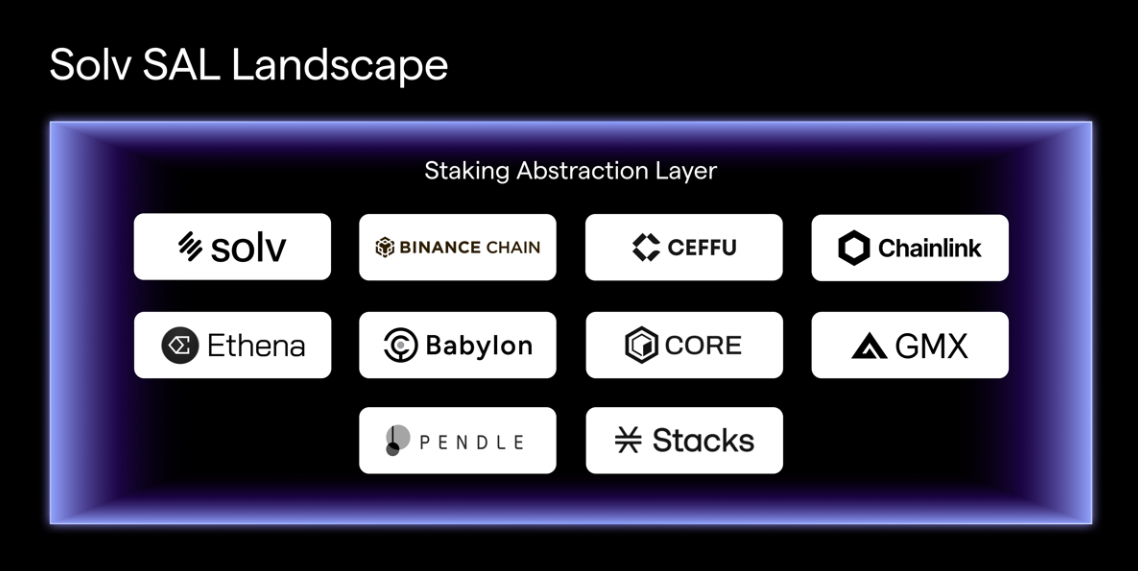

With the strongest liquidity and market penetration, Solv took the lead in proposing a new narrative of the Staking Abstraction Layer (SAL), aiming to aggregate the decentralized BTC liquidity of the entire chain and provide a scalable and transparent unified solution.

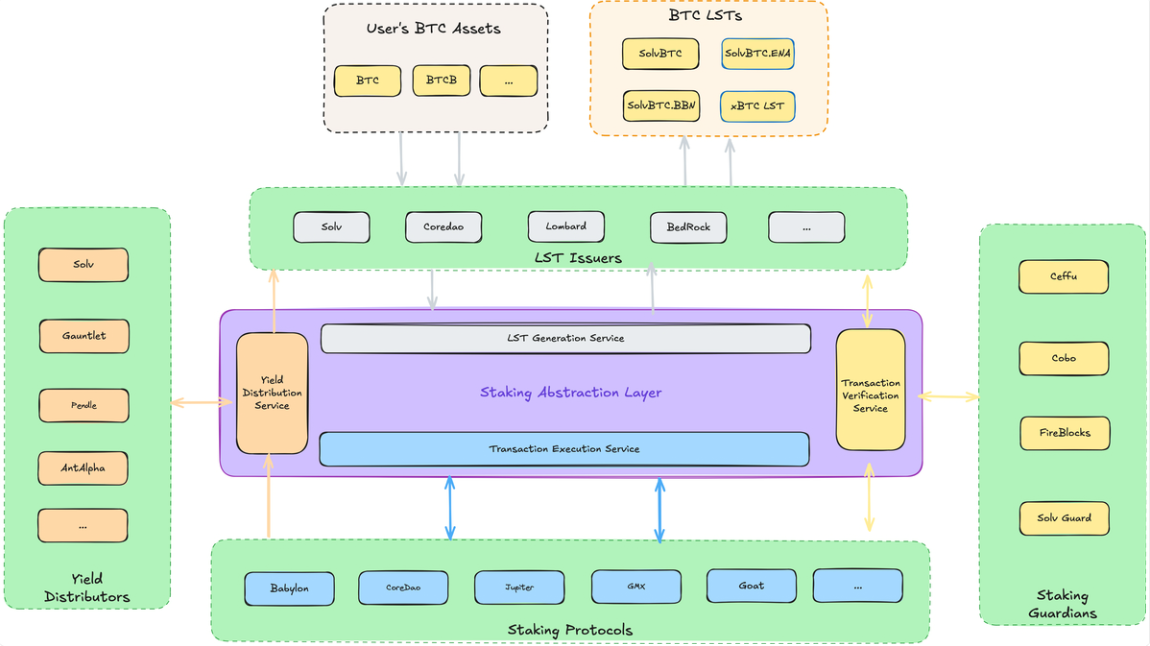

To achieve this goal, Solv first systematically sorted out the Bitcoin staking ecosystem and divided the core participants into four key roles, from bottom to top:

Staking protocols: protocols that allow users to deposit Bitcoin assets and generate income through staking activities, such as Babylon, CoreDao, Botanix, etc.

Staking validator: An entity responsible for verifying the integrity of the staking and trading process, ensuring that the LST issuer truly executes the staking and prevents errors or fraud, such as Ceffu, Cobo, Fireblocks, and Solv Guard;

Revenue distributor: An entity that manages the distribution of staking rewards and is responsible for distributing rewards efficiently and fairly. For example, Pendle, Gauntlet, Antalpha, and most LST issuers also play the role of revenue distributor;

LST issuer: A protocol that converts users’ Bitcoin pledged assets into liquidity tokens (LST), allowing pledgers to obtain returns while maintaining control over the liquidity of their assets, such as Solv, BedRock, etc.

These four roles complement each other and constitute the core structure of the Bitcoin staking ecosystem - the staking protocol, as the underlying foundation of the entire system, manages and supports all other roles; the staking validator operates on top of the protocol to maintain on-chain security; the profit distributor distributes profits according to the protocol rules to ensure the operation of the system's incentive mechanism; the LST issuer provides liquidity to the pledged assets through tokenization.

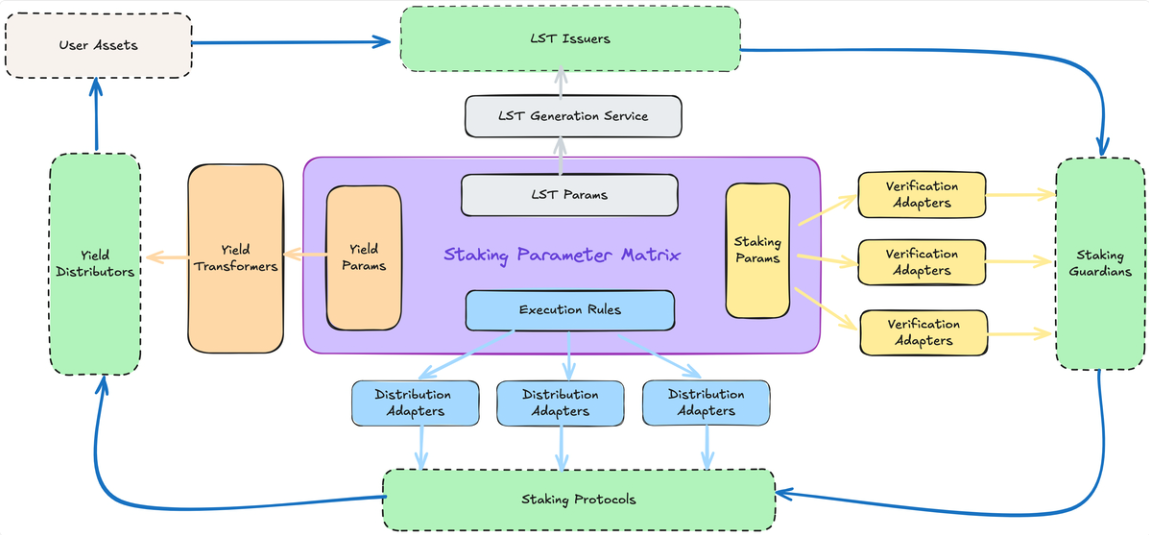

Therefore, SAL is designed closely around these roles and has launched key modules covering the entire process, including LST generation services, pledge verification services, transaction generation services, and revenue distribution services , which are efficiently integrated using smart contract technology and Bitcoin mainnet technology:

Specifically, SAL includes the following five core modules:

Staking Parameter Matrix (SPM): abstracts the core parameters required for the staking process, including Bitcoin script configuration, staking transaction parameters, LST contract parameters, and profit distribution rules. These parameters are not only shared among SAL modules, but also support cross-role collaboration in the staking process;

Staking verification service: Based on the Bitcoin mainnet algorithm, it ensures the correctness and integrity of each staking transaction, and verifies whether the issuance of LST matches the underlying BTC quantity to avoid malicious behavior;

LST generation service: responsible for the issuance and redemption of BTC LST, and supports the interaction between the Bitcoin mainnet and the EVM chain;

Transaction generation service: automatically generates pledge transactions, estimates the best transaction fee, and broadcasts transactions to the Bitcoin mainnet;

Revenue distribution service: transparently calculate staking revenue and distribute the revenue to users in proportion through oracle mechanism or revenue exchange service;

Through these modules, SAL not only effectively integrates the technical differences of different protocols in the Bitcoin ecosystem, but also provides a clear operational framework for different roles and builds a new system of efficient collaboration:

For pledge users: SAL provides a convenient and secure pledge process, reducing asset risks caused by operational errors and opaque protocols;

For staking protocols: SAL’s standardized interface allows the protocol to quickly access the Bitcoin staking market, shortening the development cycle and achieving an ecological cold start;

For LST issuers: SAL provides comprehensive revenue calculation and verification tools to enhance user trust while simplifying the issuance process, allowing them to focus on product innovation;

For custodians: SAL opens up a new business model for participating in the Bitcoin staking ecosystem, bringing additional income opportunities to custodians.

This greatly simplifies the entry threshold for participation in the Bitcoin staking ecosystem and provides multiple parties with a unified solution that can effectively meet needs and be jointly built and shared .

To date, multiple protocols and service providers have joined the SAL protocol ecosystem, including BNB Chain, Babylon, ChainLink, Ethena, CoreDAO, etc., which not only proves the wide applicability of SAL, but also brings more abundant application scenarios for Bitcoin staking, accelerating the sustainable development of the business model in this field.

Activate the diversified income ecosystem of Bitcoin staking

DefiLlama data shows that in the Ethereum LSD track, Lido Finance ranks first with a market share of 68.53% (9.81 million ETH). Although its centralization concerns have long been questioned, it is undeniable that Lido has promoted the deep integration of pledged assets and DeFi income ecology through the innovative design of LST, greatly improving the utilization efficiency of pledged assets.

Bitcoin staking also requires a basic framework that can promote the efficient use of assets, and SAL (Staking Abstraction Layer) was launched for this purpose: it not only lowers the participation threshold for all parties and provides a consistent user experience for the Bitcoin staking ecosystem, but also significantly improves capital utilization efficiency through a unified liquidity management mechanism, allowing Bitcoin assets to flow freely between different chains, laying the foundation for various financial innovations in the DeFi ecosystem.

Therefore, a more exciting possibility is that SAL can essentially derive a set of diversified income solutions based on the entire BTC chain , enabling Bitcoin holders to obtain diversified and dynamic income streams without affecting liquidity, opening up new development space for BTCFi (Bitcoin financialization).

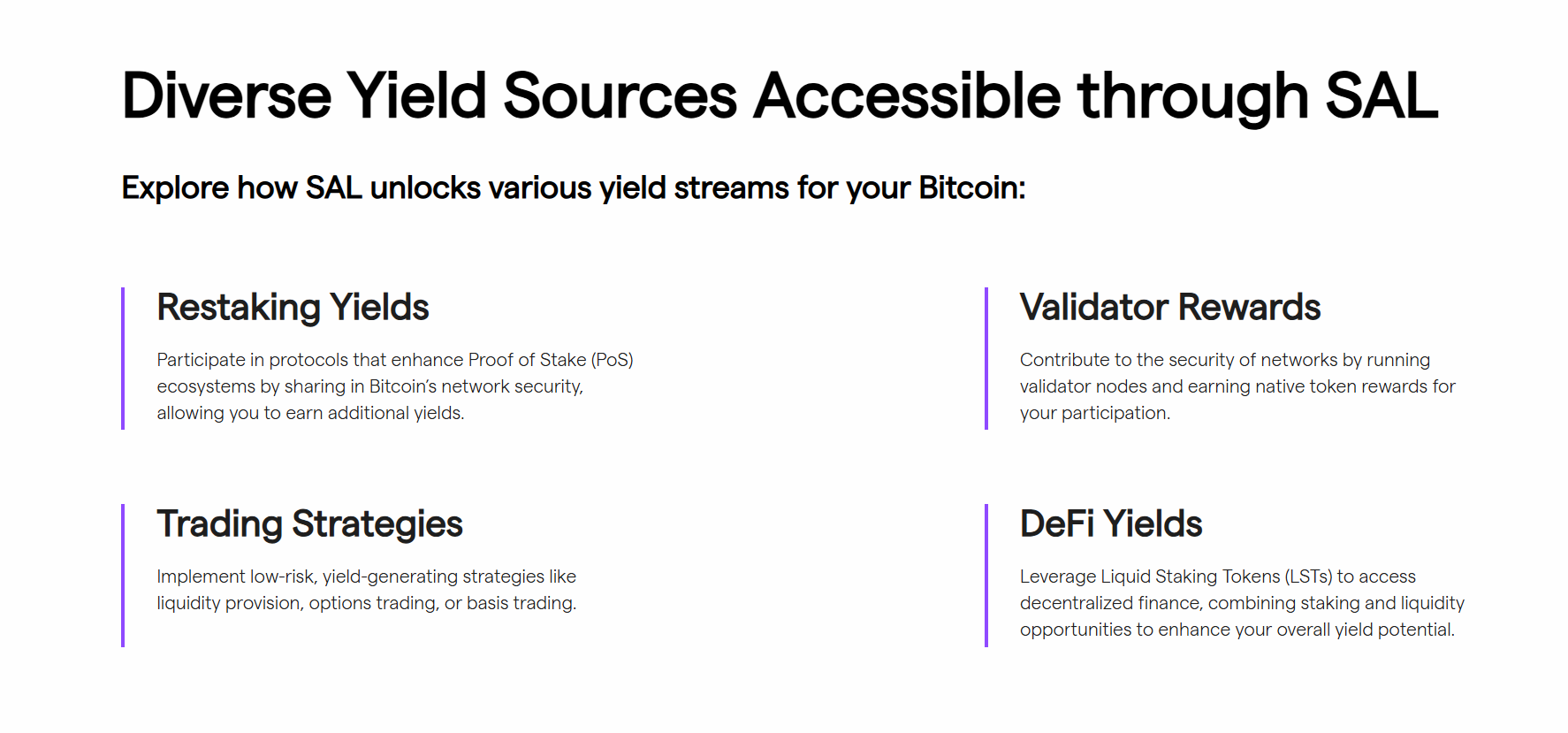

The main one is the cross-chain function based on SAL, which supports users to unlock various opportunities to generate income, transforming Bitcoin from a passive value storage to an interest-bearing & productive asset, and can participate in DeFi and other on-chain use cases to create new value:

Users can stake Bitcoin on platforms that benefit from the economic security of Bitcoin (such as Babylon) and use Restaking to obtain local token rewards;

Users can participate in the security maintenance of Bitcoin L2 networks based on the BTC they hold, and receive validator rewards by running validator nodes or delegating Bitcoin;

SAL enables Bitcoin holders to obtain relatively stable returns in DeFi through trading income strategies such as "Delta Neutral";

Users can also use Liquid Staking Tokens (LST) to further operate in DeFi, combining staking and liquidity opportunities to maximize overall profit potential;

1. Use Restaking to realize Bitcoin staking income

First, based on SAL, Bitcoin holders can stake Bitcoin on platforms that benefit from the economic security of Bitcoin to receive native token rewards, such as Babylon, EigenLayer, and Symbiotic.

In addition, these platforms rely on the economic security of Bitcoin to provide users with opportunities for income based on Restaking, converting the security attributes of Bitcoin into financial returns, allowing users to benefit from the economic security of Bitcoin and realize further appreciation of BTC assets.

2. Obtain rewards by verifying nodes

Secondly, users can also participate in the security maintenance of the Layer2 network and obtain validator rewards by running validator nodes or delegating Bitcoin.

By staking BTC, users can obtain rewards while ensuring network security, which currently include:

CoreDAO and Stacks: Allow users to stake BTC to maintain L2 security and receive the platform’s native token as a reward;

Botanix: Users can run validator nodes in the Botanix network, contribute computing resources and Bitcoin support, and receive validator rewards.

This verification node reward not only helps users obtain continuous BTC income, but also provides security for the BTCFi ecosystem, allowing BTC holders to directly participate in ecosystem construction and enjoy rewards.

3. Trading profit strategies such as "Delta Neutral"

SAL also provides Bitcoin holders with trading income strategies such as "Delta Neutral", enabling them to obtain relatively stable income in DeFi.

Taking the "Delta Neutral Strategy" as an example, Bitcoin holders can obtain stable returns by hedging against market fluctuations on cooperative platforms such as GMX, Pendle, and Ethena. Assuming the BTC price is $80,000, users can deposit 1 BTC and sell 1 futures BTC at the same time to form a "Delta Neutral" investment portfolio:

If BTC is initially worth $80,000, then the total value of the portfolio is 8+0=$80,000, so the total position value is still $80,000;

If BTC drops to $40,000, the total value of the portfolio is still $4+4=$80,000, so the total position value is still $80,000 (the same is true if it rises);

At the same time, since a perpetual futures contract of 1 BTC was opened short, funding rate income from long payments can be obtained (looking back at history, the funding rate of Bitcoin has been positive for most of the time, which also means that the overall return of short positions will be positive, and this situation is even more so in the context of strong bullish sentiment in the bull market ).

These trading strategies help Bitcoin holders obtain stable returns without directly bearing market risks, making BTC a versatile financial tool and further improving the utilization efficiency of Bitcoin in the DeFi ecosystem.

4. DeFi benefits in various use cases

Finally, based on SAL links to smart contract public chains such as Ethereum, it provides use cases such as DEX, lending, LSD, etc., so that it can be coupled with multi-chain ecosystems such as Ethereum to obtain farming income from diversified scenarios such as DeFi.

This creates a quadruple income for Bitcoin Holders who were originally receiving zero interest income. In addition, SAL has introduced Bitcoin into a wider range of application scenarios, revitalizing Bitcoin, the best crypto-native asset that has been dormant. At the same time, it has brought diversified income sources to BTC holders and improved capital efficiency. In a sense, it kills two birds with one stone.

Conclusion

For any industry or track, standardizing weights and measures is a key move to liberate productivity.

Judging from the current development status of the Bitcoin staking ecosystem, it is appropriate for Solv to take the lead. Based on the influence of the leader in the field and a wide circle of friends, SAL can bring significant collaborative effects by providing a clear standardized framework and co-construction and sharing solutions:

From ordinary staking users to staking protocols, validators, LST issuers and even custodians, SAL's universal standardized framework has brought tangible benefits to all participants, greatly improved the collaborative efficiency of the ecosystem, and enabled Bitcoin assets to play a more diverse role in the DeFi ecosystem. It is expected to trigger a series of chain reactions in the Bitcoin market and pave the way for the large-scale application of BTC staking business.

With 1.75 trillion dormant assets, profit opportunities and capital efficiency are the core issues throughout the Bitcoin ecosystem, especially BTCFi2. Solv SAL’s solution can be likened to the “infrastructure project” of the Bitcoin ecosystem to some extent:

It is expected that on the basis of giving the Bitcoin staking ecosystem a unified framework, Bitcoin assets, the highest quality native crypto asset with a volume of over one trillion US dollars, will be revitalized. This is full of imagination and is also quite challenging.