Market Overview

Overall market overview

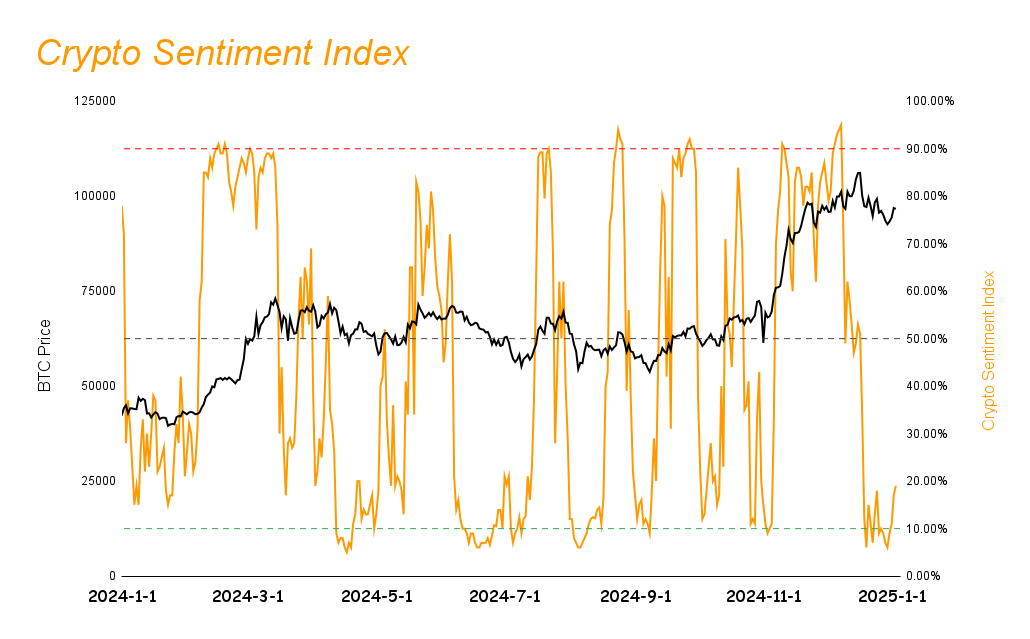

The market sentiment index rose from 10% last week to 19%. Although it is still in the panic zone, it has shown signs of recovery. Although it is still during the New Year's Day holiday and market liquidity has not fully recovered, funds have begun to gradually flow back into the cryptocurrency market. Altcoins performed better than the benchmark index overall this week, but are expected to keep pace with the benchmark index in the short term.

DeFi Ecosystem Development

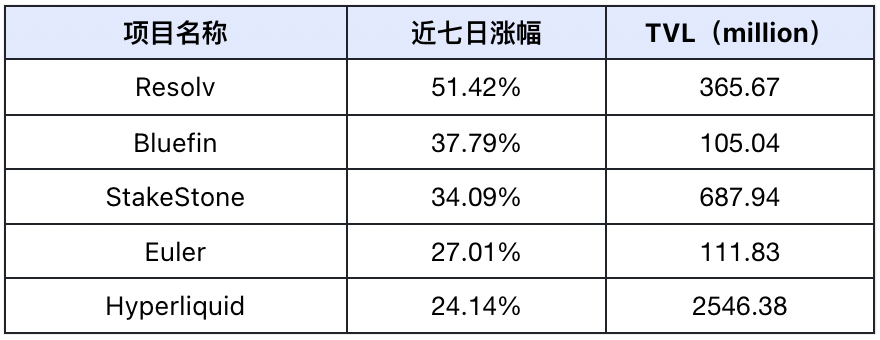

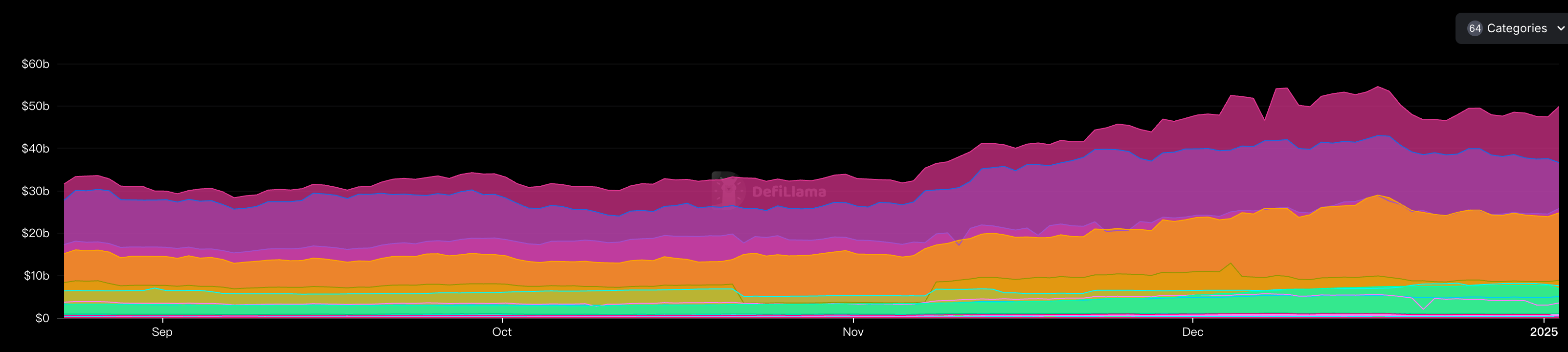

The TVL of DeFi projects increased from $52.7 billion last week to $53.2 billion, an increase of 0.95%, ending two consecutive weeks of negative growth. The machine gun pool project and Prep DEX project performed outstandingly, mainly benefiting from the increase in yields brought by the increase in market base interest rates and the increase in contract trading demand caused by the decrease in liquidity during the holidays.

AI Agent Development

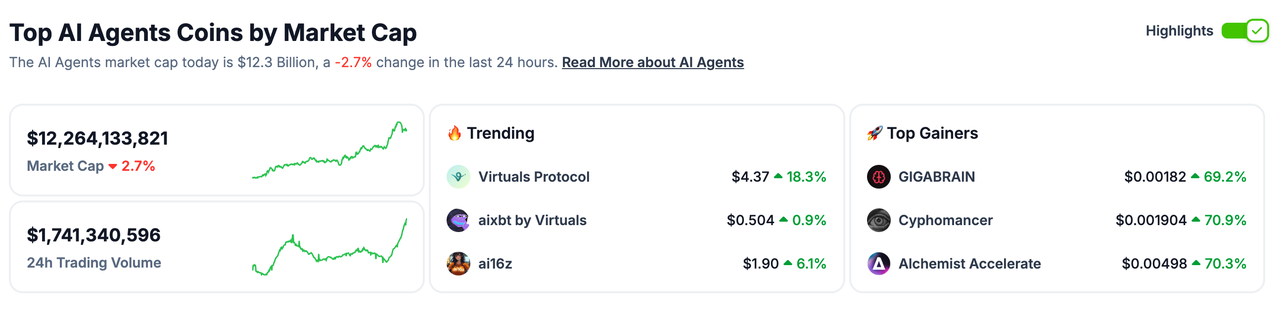

The AI Agent track continues to maintain its position as a hot market, with a market size of $12.2 billion, a weekly increase of nearly 12%. Market attention has gradually shifted from AI Meme to AI infrastructure construction projects, among which AI Agent's self-issued tokens have become the most concerned area, and related infrastructure projects such as Phala Network have performed outstandingly.

Memecoin Trends

This week, the Meme coin market was mainly focused on AI-related projects. Benefiting from the wealth-creating effect brought about by AI Agent’s self-issued coins, AI Meme projects have achieved significant growth. This trend reflects that market funds are chasing AI-related concepts, but it also shows that speculative characteristics are increasing.

Public chain performance analysis

Public chain projects performed well in this week's market rebound, mainly due to the increase in APY of on-chain DeFi projects and the development needs of AI projects. Among them, public chains that support AI development, such as Solana, zkSync Era, etc., performed outstandingly, showing that public chains are developing in the direction of AI infrastructure.

Future Market Outlook

Next week, the market will see the release of US employment data, which may affect the Fed's decision to cut interest rates and is expected to bring market fluctuations. As the holidays come to an end, institutional investors will return and market liquidity is expected to recover. Investors are advised to maintain a defensive allocation and increase the allocation ratio of top assets such as BTC and ETH. They can moderately participate in high-yield machine gun pools and Prep DEX projects, but they need to strictly control their positions and do a good job of risk management.

Market Sentiment Index Analysis

The market sentiment index rose from 10% last week to 19%, which is in the panic range.

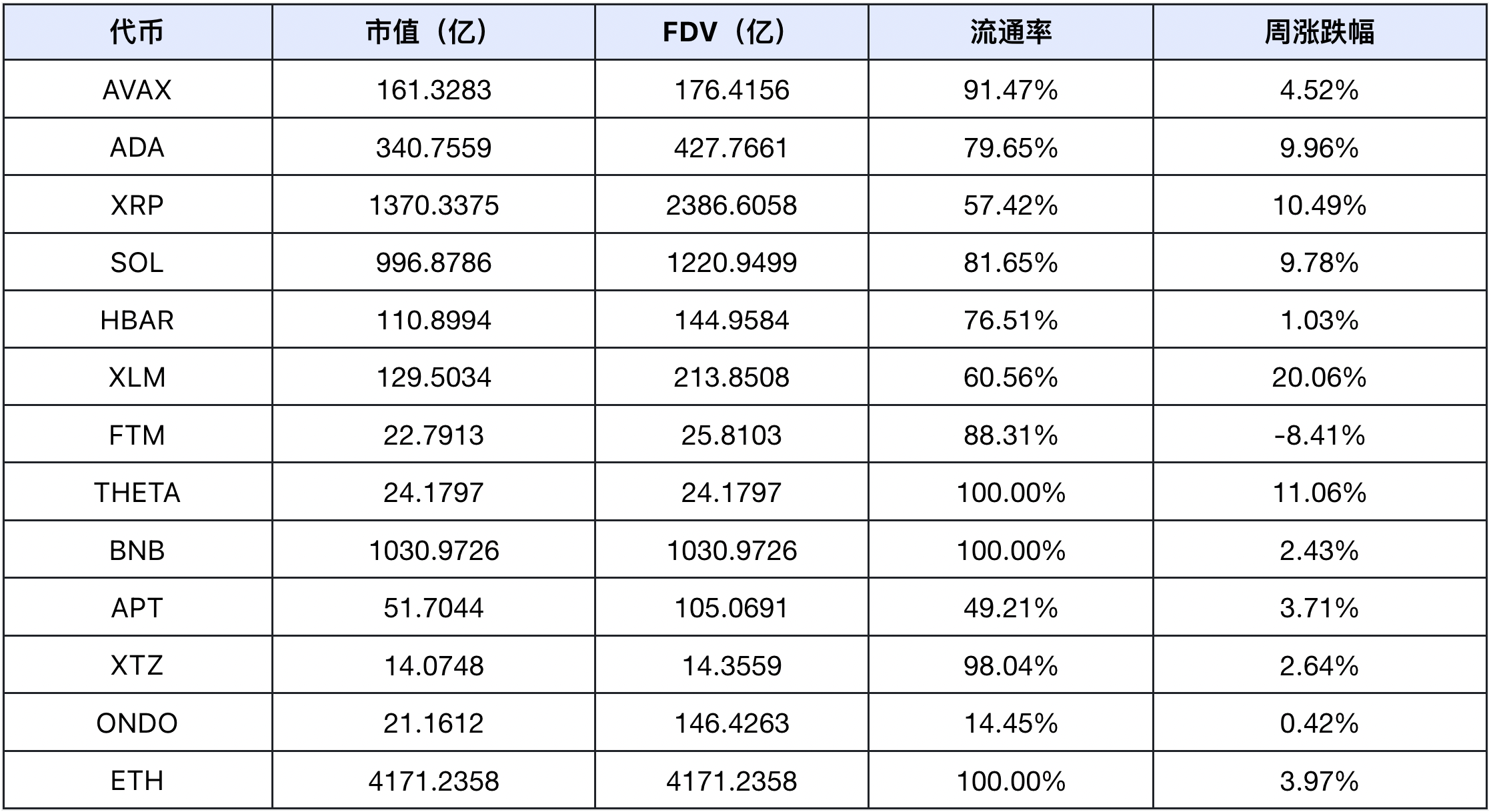

Altcoins outperformed the benchmark index this week, and most tokens rose more than the market. Although it is still the New Year's Day holiday and liquidity has not yet fully recovered, funds have begun to return to the Crypto market, and the market is slowly recovering. However, given the current market structure, it is expected that Altcoins will keep pace with the benchmark index in the short term, and the probability of independent market is low.

Overview of overall market trends

The cryptocurrency market is on an uptrend this week, with sentiment indicators still in panic territory.

Defi-related crypto projects performed outstandingly, showing the market's continued focus on improving basic returns.

The AI Agent track project has received high public opinion this week, indicating that investors are beginning to actively look for the next market outbreak point.

Hot Tracks

AI Agent

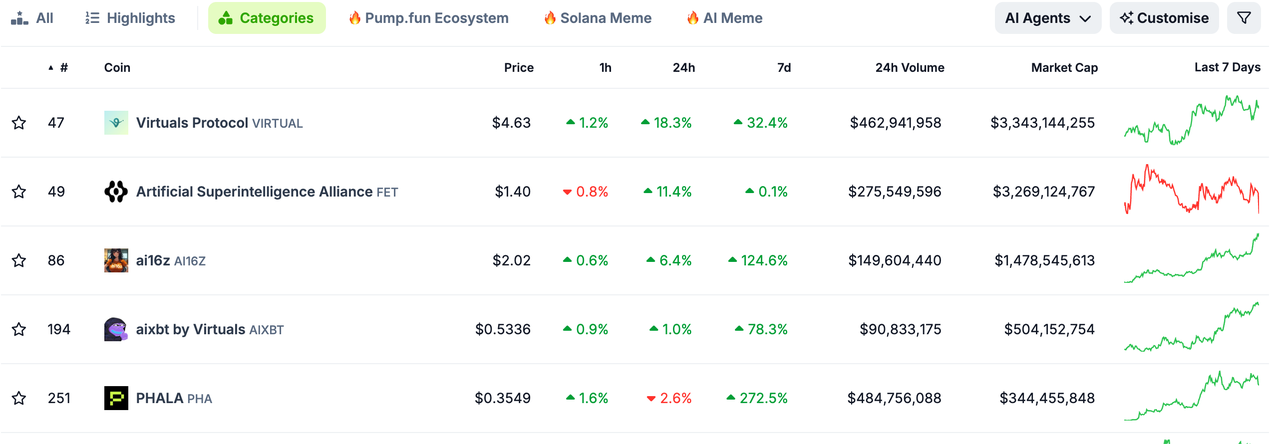

The overall market is on an upward trend this week, and most tracks are in an upward state. Among them, the prices of most tokens in the AI Agent track are also on the rise this week. In addition, because AI Agent independently issues tokens, it has become a hot topic in the market and is the most discussed in the market. In addition, all tokens related to the AI Agent track have risen this week.

This week, the AI Agent track continues to be the focus of market attention because of the self-issued tokens of AI Agent. Some of the Meme coins issued through Virtuals and ai16z this week have seen a sharp increase, creating a certain wealth effect, thereby attracting investors in the market to invest their attention and funds in the self-issued tokens of AI Agent. From the increase, we can see that the most popular this week are the ai16z asset issuance platform and the infrastructure construction project of AI Agent's self-issued tokens - Phala Network. Therefore, we can see that the market has begun to shift its attention from AI Meme to AI infra. So we will focus on the projects in the AI infra track next.

The top five AI Agent projects by market value:

DeFi track

TVL Growth Ranking

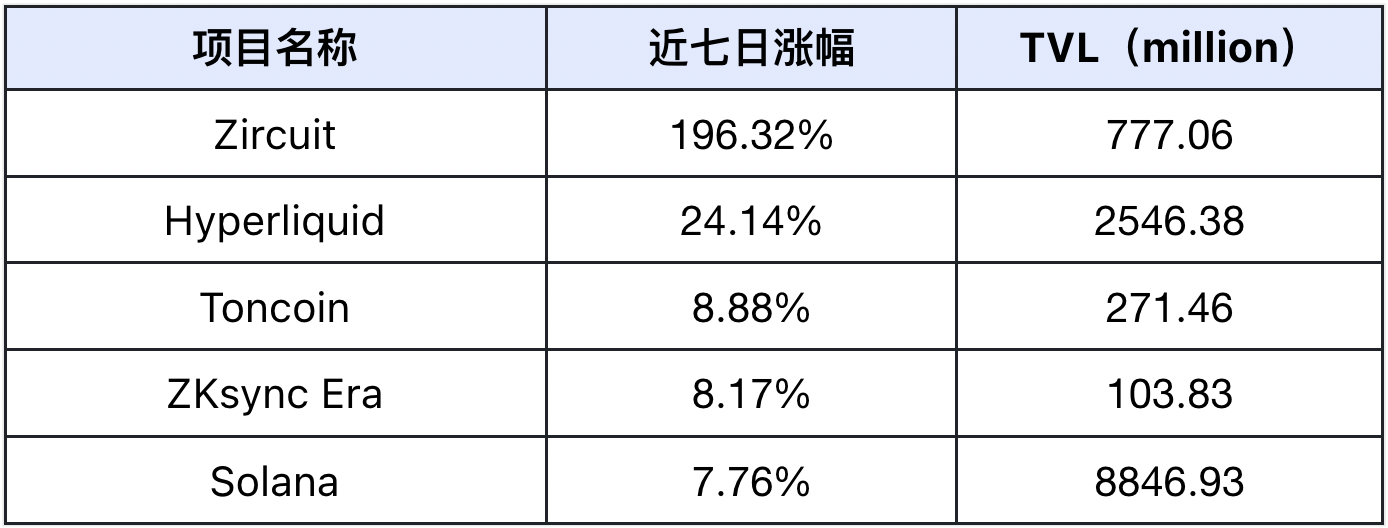

Top 5 TVL growth rates of market projects in the past week (excluding public projects with smaller TVL, the standard is more than 30 million US dollars), data source: Defilama

Resolv (no token issued): (Recommendation index: ⭐️ ⭐️ ⭐️ )

Project Introduction: Resolv is a Delta neutral stablecoin project that revolves around the tokenization of market neutral portfolios. The architecture is based on an economically viable and fiat-independent source of income. This allows competitive returns to be distributed to the protocol's liquidity providers.

Latest development: This week, Resolv successfully launched new liquidity pools such as USR/RLP and USR-GYD, completed the cross-chain expansion of the Base network, and reached strategic cooperation with well-known projects such as Gyroscope, Aerodrome and Pendle. The TVL of the Pendle pool reached 85 million US dollars and the transaction volume exceeded 66 million US dollars. At the same time, Resolv implemented a full range of user incentives through the Points Program. The RLP product performed well, with an APR of 38% on the day, attracting a large number of on-chain users to Resolv. In terms of community building, 9 community contributors were supported through the Grants Program, further strengthening the sustainable development of the ecosystem.

Bluefin(BLUE):(Recommendation index: ⭐️ ⭐️ ⭐️ )

Project Introduction: Bluefin is a decentralized exchange on the Sui chain, providing contracts and spot, focusing on providing high-performance derivatives trading services. In addition, Bluefin has built a complete set of meme infrastructure, aiming to become the meme trading center of the Sui ecosystem.

Latest development: This week, Bluefin successfully completed the integration of Sui Bridge, supporting the cross-chain function of suiUSDT. At the same time, through cooperation with Transak, the payment system was significantly upgraded, adding Apple Pay, Google Pay and credit card payment support, greatly optimizing the user recharge experience. At the same time, it reached a listing cooperation with Bitget Exchange, and the BLUE token will be listed on its spot trading area soon, and launched the suiUSDT liquidity mining project, providing a competitive rate of return of more than 40% APR.

StakeStone (unissued token): (Recommendation index: ⭐️ ⭐️ ⭐️ )

Project Introduction: StakeStone is a full-chain liquidity infrastructure that focuses on providing liquidity staking (LST) services for Ethereum and other blockchain networks. The project aims to solve the staking income and liquidity problems in the Layer 2 network in a decentralized manner, while supporting cross-chain compatibility and multi-scenario applications.

Latest developments: This week, StakeStone successfully launched the Berachain Vault that supports multi-chain access, and realized cross-chain functionality through the Intent Adapter of the Router Protocol. It also reached in-depth cooperation with Uniswap and established a large-scale liquidity pool. At the same time, it launched the innovative yield-bearing asset beraSTONE. Through cooperation with multiple strategic partners such as KodiakFi, Dolomite.io, Pendle Finance, and the implementation of the Bera-Wave Points incentive plan, StakeStone is building a comprehensive DeFi ecosystem, and its user base has rapidly expanded to 80,000.

Euler (EUL): (Recommendation index: ⭐️ ⭐️ )

Project Introduction: Euler is a protocol built on lending protocols such as Aave and Compound. It allows users to create their own lending markets for any ERC-20 tokens and provides a Reactive interest rate model to reduce governance intervention.

Latest Development: Euler has shown strong growth momentum this week. The number of weekly active users has reached a level comparable to Compound. It has successfully established a partnership with mETH Protocol to support $mETH asset lending. At the same time, it has cooperated with the Smart M team to achieve the highest ROE performance on the revolving lending page, and integrated Midas RWA's mTBILL/USDC automated strategy to provide users with a yield of up to 25% APY, thereby attracting more on-chain users to participate.

Hyperliquid(HYPE):(Recommendation index: ⭐️ ⭐️ ⭐️ ⭐️ ⭐️ )

Project Introduction: Hyperliquid is a high-performance decentralized financial platform that focuses on providing perpetual contract trading and spot trading services. It is based on its own high-performance Layer 1 blockchain and uses the HyperBFT consensus algorithm, capable of processing up to 200,000 orders per second.

Latest development: Hyperliquid officially launched the staking function on the mainnet this week, and in response to community demand, it added leverage trading support for two AI-related tokens, AI16Z and AIXBT, with a maximum leverage of 5 times. Due to the recent increase in the price and popularity of AI Agent tokens in the crypto market, Hyperliquid has attracted a large number of users to participate in transactions.

To sum up, we can see that the projects with faster TVL growth this week are mainly concentrated in machine gun pool projects and Prep DEX projects.

Overall performance on the track

The market value of stablecoins has grown steadily: USDT has dropped from $144.7 billion last week to $142.7 billion, a drop of 1.38%, while USDC has increased from $42.9 billion last week to $44 billion, an increase of 2.56%. It can be seen that although the overall market value of the stablecoin market has declined, USDC, which is mainly in the US market, has still increased, indicating that the main buyers of the market are still maintaining a continuous inflow of funds.

Liquidity is gradually increasing: The risk-free arbitrage rate in the traditional market is constantly decreasing as interest rates continue to fall, while the arbitrage rate of on-chain Defi projects is constantly increasing due to the increase in the value of cryptocurrency assets. Returning to Defi will be a very good choice.

Funding situation: The TVL of Defi projects has increased from $52.7 billion last week to $53.2 billion now, an increase of 0.95%. Although the increase is small, it has ended two consecutive weeks of negative growth. From this, we can see that although it is still a major holiday in the United States, funds on the chain have begun to flow in and Defi activities on the chain have begun to recover. It is expected that next week, after various institutions and investors return to the market after the holiday, the TVL of the Defi market will continue to rise. Therefore, next week, we should focus on the rate and amount of funds returning to the Defi market.

Deep analysis

The driving force behind the rise of the machine gun pool project: The core driving factors of this round of rise can be summarized into the following transmission paths: Since the market is in an upward trend this week, the APY of various Defi protocols have increased to varying degrees, which has led to a significant increase in the APY of the machine gun pool project.

Specifically:

Market environment: The market is on an upward trend this week, which has led to an increase in the market base interest rate.

Interest rate: The base lending rate has risen, reflecting the market's pricing expectations for funds.

On the income side: The rate of return of machine gun pool projects is higher than that of other projects, thereby attracting more users to participate in this transmission mechanism, strengthening the value support of machine gun pool projects and forming a benign growth momentum.

Driving force behind the rise of the Prep DEX project: As the recent market, mainly in the United States, is in the Christmas and New Year holidays, the liquidity in the market has dropped significantly, causing the market token prices to rise or fall significantly. In this process, investors participate in the market in order to maximize their own interests, and thus often choose to participate in contract transactions. Because contract transactions in CEX often result in artificial liquidation of the exchange, after the performance and transaction depth of the on-chain Prep DEX are improved, investors are often willing to choose Prep DEX to participate in contract transactions, thus driving the development of the entire Prep DEX track project.

Other track performance

Public Chain

The top 5 public chains with the highest TVL in the past week (excluding public chains with smaller TVL), data source: Defilama

Zircuit: This week, Zircuit started cooperation with the Gud Tech AI team and is developing AI smart vaults and multi-chain transaction infrastructure, which is expected to be launched in January 2025. It has also successfully established a partnership with KelpDAO and launched multiple reward programs (including 3x Kelp Miles, 2x Zircuit points, etc.), and cooperated with Reown to provide developers with Appkit login solutions. It is worth noting that the ecological project Gud Tech AI has achieved $9 million in ZRC tokens pledged, and the platform plans to launch a brand update in January 2025 to continue to deepen its technical advantages in the fields of AI protection trading systems and automated finance.

Hyperliquid: Hyperliquid officially launched the staking function on the mainnet this week, and in response to community demand, it added leverage trading support for two AI-related tokens, AI16Z and AIXBT, with a maximum leverage of 5 times. Due to the recent increase in the price and popularity of AI Agent tokens in the crypto market, Hyperliquid has attracted a large number of users to participate in transactions.

Toncoin: Toncoin is developing the TON Teleport BTC permissionless bridge solution this week, which is expected to significantly reduce the cost of BTC transmission, and has reached a strategic cooperation with Jupiter Exchange to develop a liquidity aggregator. At the same time, USDT has completed more than 120 ecological integrations on TON, and the circulation volume has exceeded 1 billion US dollars. At the same time, Toncoin is holding a DeFi innovation competition (the winner will be announced on February 15, 2025) and plans to launch a BTCfi hackathon (with a prize pool of over 1 million US dollars).

ZKsync Era: This week, zkSync Era mainly focused on the promotion of the strategic positioning in 2025. The project team released the important declaration "2025 is the year of ZK", which received a good community response of 1,467 likes and 158 reposts. The project reiterated the core concept of "Web3 without compromise", emphasized the development commitment in the three dimensions of performance (Performant), security (Secure) and usability (Usable), and showed strong confidence in the development of ZK technology.

Solana: Solana partnered with Send.ai this week to launch the AI Agent Kit development toolkit, and at the same time welcomed the official launch of RedotPay on the Solana chain, supporting USDC and USDT for use in 1.2 million merchants worldwide, and connecting to Apple Pay and Google Pay. This week, several key projects on the Gamefi track, such as Nyan Heroes and Star Atlas, announced plans to increase their efforts to develop on the Solana chain in 2025.

Overview of the Rising Stars

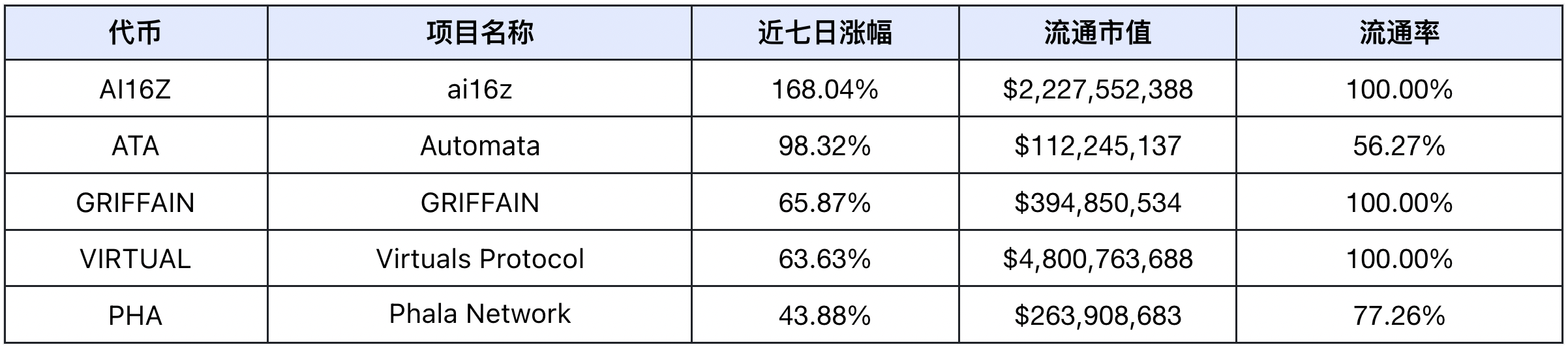

The top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins), data source: Coinmarketcap

AI16Z: ai16z released an important v0.1.7 update this week, which includes more than 50 improvements and fixes, added support for multiple chains such as Cronos ZKEVM, Avalanche, AlienX, Fuel, and improved AI functions such as text-to-3D and speech synthesis. At the same time, ai16z started the early development of Eliza V2, and its token performed well, becoming the first Solana AI token to reach a market value of US$2 billion, with more than 62,000 holders. In terms of ecological construction, the project held an offline AI Agent Builders meeting in South Korea on January 3, and plans to strengthen open source feedback through the RGPF program.

ATA: Automata Network has made important technical breakthroughs this week, successfully bringing TEE (Trusted Execution Environment) technology to the chain, and cooperating with EigenLayer to develop the Multi-Prover AVS system. At the same time, Automata has joined the Optimism ecosystem as a member of the Optimism Collective, providing TEE-compatible GPU support for Worldcoin's AMPC, and plans to hold the last community meeting of the year on January 6. In particular, Automata's conquest of TEE technology just caught up with the current AI Agent market. If other AI Agent self-issued coin projects adopt Automata on a large scale, its price will rise further.

GRIFFAIN: Griffain's most important move this week was the launch of the SAIMP (Solana AI Message Protocol) open standard protocol, a protocol system that allows AI agents to send messages on public blockchains. All messages are stored on the chain and support anyone to build a SAIMP client. Griffain also proposed the "@ Store" concept (analogous to Apple's App Store) and plans to officially release it in 2025, integrating a dedicated financial agent ( @uselulo ) to provide financial services.

VIRTUAL: As AI Agent projects have been hot recently, Virtuals Protocol has seen significant growth in all aspects of data this week: GAME framework has been used by more than 200 projects within one month of its launch, with a total market value of more than $500 million, 150,000 requests per day and a 200% week-on-week increase. Since its launch on Base on October 16, 2024, Virtuals has 220,000 token holders, supported AI agents with a total market value of $2 billion, and protocol revenue of $60 million (approximately $300 million annualized). At the same time, the "Virtuals Agent Spotlight" program was launched to showcase outstanding projects, and the progress of ecological projects continues to be displayed through Discord educational sessions and social media.

PHA: This week, Phala Network released the 2025 TEE x AI Technology Report, which highlighted the technical layout in the field of decentralized AGI (dAGI), and announced important network architecture adjustments: PHA deposits and withdrawals on the Khala network will be terminated on January 8, 2024, and a 1:1 ratio of PHA tokens will be migrated from Khala to Ethereum (ERC20). In addition, this week, PHA tokens were launched on Binance Futures and Bitget, providing up to 75 times leveraged trading, and Phala Network announced that it will continue to promote ecological cooperation with multiple leading projects such as 0G Labs, SentientAGI, and NEAR Protocol.

It can be seen from the list of gainers that all the projects on this week’s list are related to the AI Agent track.

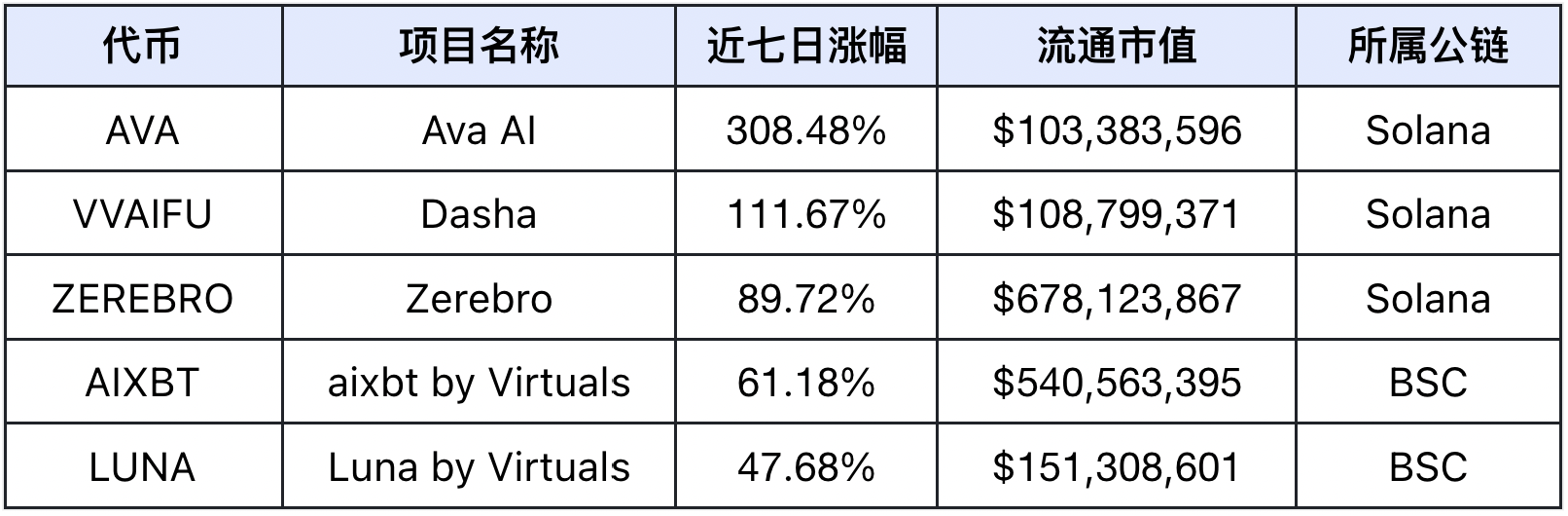

Meme Token Gainers

The increase in the Meme track this week was mainly concentrated on AI Meme projects related to AI. Since the recent AI Agent self-coin issuance projects and the AI Agent track as a whole have been very popular in the market, a wealth-creating effect has emerged, and the market's attention and funds have entered the AI Agent track. As a result, the Meme project, which is an AI Agent self-coin issuance project, has also attracted market attention, resulting in a relatively large increase.

Social Media Hotspots

Based on the top five daily growth in LunarCrush and the top five AI scores in Scopechat, we get the statistics for this week (12.28-1.3):

The most frequently appearing theme is L1s, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included) :

According to data analysis, the L1s project received the most attention on social media this week. As the New Year's Day holiday is here, the US-dominated market is still on holiday this week, so all market makers and institutions are on holiday, causing a sharp decline in liquidity in the market. However, due to the large decline in the entire Crypto market in the previous two weeks, the price of the entire Crypto market rebounded this week, and the performance of various public chains in this rebound was relatively good. With the recovery of the overall market sentiment, on-chain users have turned their attention and funds to on-chain Defi projects. As the overall Crypto market price increases, the APY given to investors by Defi projects in the public chain is also increasing rapidly, which has led to an increase in the TVL and trading volume of various Defi projects. At the same time as the Defi project, there are AI track projects, and all public chains support the development of AI projects, so all public chains have performed well in this week's rebound.

Overall overview of market themes

Based on weekly return statistics, the AI track performed best, while the SocialFi track performed the worst.

AI track: VIRTUAL, RENDER, FET, and TAO account for a large proportion of the AI track, with a total share of 73.36%. This week, their declines were 63.63%, 5.39%, 10.04%, and 7.89%, respectively, resulting in the best index performance of the entire AI track. In addition, as the AI Agent self-issuing coin track has continued to remain hot recently, the market has concentrated funds and attention on the AI track, causing a general rise in various tokens on the AI track.

SocialFi track: The absolute main force of the SocialFi track is still TON, accounting for 90.68% of the market value of the SocialFi track. This week, TON did not rebound with the broader market, but fell by 2.86%, making the SocialFi track the worst performer.

Crypto Events Next Week

Thursday (January 9) The number of people applying for unemployment benefits in the United States at the beginning of the week; the Federal Reserve released the minutes of the December monetary policy meeting

Friday (January 10) U.S. unemployment rate in December; U.S. non-farm payrolls in December seasonally adjusted

Outlook for next week

Macroeconomic factors analysis

The US unemployment rate and seasonally adjusted non-farm payrolls for December will be released next week. These two data are of great concern to the Federal Reserve recently and will largely affect whether to suspend interest rate cuts in January. It is expected that the market will fluctuate before and after the release of the data.

After the various institutions return to normal work after the holidays, the market with the United States as the main purchasing force will become active again, liquidity will be restored, which will help boost market prices to a certain extent.

Sector rotation trend

Although the current market environment of the DeFi track is poor, investors generally expect that the market will rise in the first quarter of next year, so most investors are still reluctant to sell their tokens. At the same time, in order to increase the income of holding coins, they have participated in the machine gun pool project to increase their income. At the same time, the recent market fluctuations are relatively large, so many investors have participated in contract transactions in order to increase their income, which has led to good development of various Prep DEX projects in the near future.

The AI Agent track of the AI sector has received continuous attention from the market. The market size has reached 12.2 billion US dollars, an increase of nearly 12% from last week. The growth is very rapid. This week, the market is still focusing on the AI Agent self-issued currency, so the projects related to the AI Agent self-issued currency track have all seen an increase.

Investment strategy recommendations: Maintain defensive allocations, increase allocations of top assets BTC and ETH, enhance the risk aversion properties of assets, and while hedging risks, participate in some high-yield machine gun pool Defi projects and Prep DEX projects. Investors are advised to remain cautious, strictly control positions, and do a good job of risk management.