Recently, the surge in Meme coins has surprised many investors. In particular, ACT and PNUT, two Meme coins that were listed on Binance, have skyrocketed hundreds of times, making many investors rich overnight. The performance of Meme coins always seems to achieve crazy gains amid the extreme market sentiment and speculative craze. So, how can we seize the next explosive opportunity in these volatile Meme coin markets and achieve a hundred-fold or even a thousand-fold return? This article will take you through an in-depth analysis of how to use factors such as Binance's listing dynamics, market sentiment, and social platform popularity to dig out the next explosive Meme coin.

Market drivers behind meme coins: liquidity, social media popularity, and monetary policy

The surge in Meme coins is not entirely due to random market fluctuations. They often ferment rapidly under specific market environments and social sentiments, thereby attracting capital inflows. We can understand the growth mechanism of Meme coins from the following aspects.

1. Macroeconomic impact of monetary policy

The easing of global monetary policies, especially the massive monetary stimulus by central banks after the epidemic, has led to an increase in liquidity in the market. In this situation, investors with higher risk appetite began to look for more high-risk assets with greater potential. Meme coins have become a key area of capital inflow due to their low price, low entry threshold and potential high returns.

In the latest article of Binance, the official explained in detail the reasons for the surge in Meme coins. In short, the inflow of funds in the market is the key factor driving the rise of Meme coins.

The increase in money supply not only promotes the growth of traditional assets, but also makes risky assets, especially Meme coins, another option for capital to seek high returns. A large amount of funds poured into the Meme coin market, which not only pushed up their short-term price surges, but also further intensified the speculative atmosphere in the market.

2. Participation of retail investors and the role of social media

The rise of Memecoin is not only driven by market funds, but also inseparable from the extensive participation of retail investors and social media. A core feature of Memecoin is its "sociality". This asset usually generates extensive discussions on social platforms, especially on platforms such as Twitter and Reddit. The discussion heat of the project and the user's emotions can directly affect the short-term price fluctuations of the currency.

KOL, the main promoter of ACT

For example, the surge in $ACT and $PNUT after listing on Binance was largely driven by the craze of KOL discussions on social media. Since these projects themselves do not have fundamental advantages in the traditional sense, their prices are more determined by market sentiment and short-term capital push. Therefore, the price fluctuations of Meme coins are highly dependent on market sentiment, and investors need to keep up with market dynamics and pay close attention to trend changes on social platforms.

3. High risk and high return of low market value assets

Unlike traditional mature assets, Meme coins generally have low market capitalizations, which makes their prices extremely volatile in the short term. Assets with low market capitalizations are more likely to be favored by capital, and once a large amount of funds flow in, they can drive their prices up in the short term. This surge is usually accompanied by a rapid outflow of funds, which also leads to the high instability of Meme coins. Therefore, although the growth of Meme coins is amazing, they also face extremely high risks.

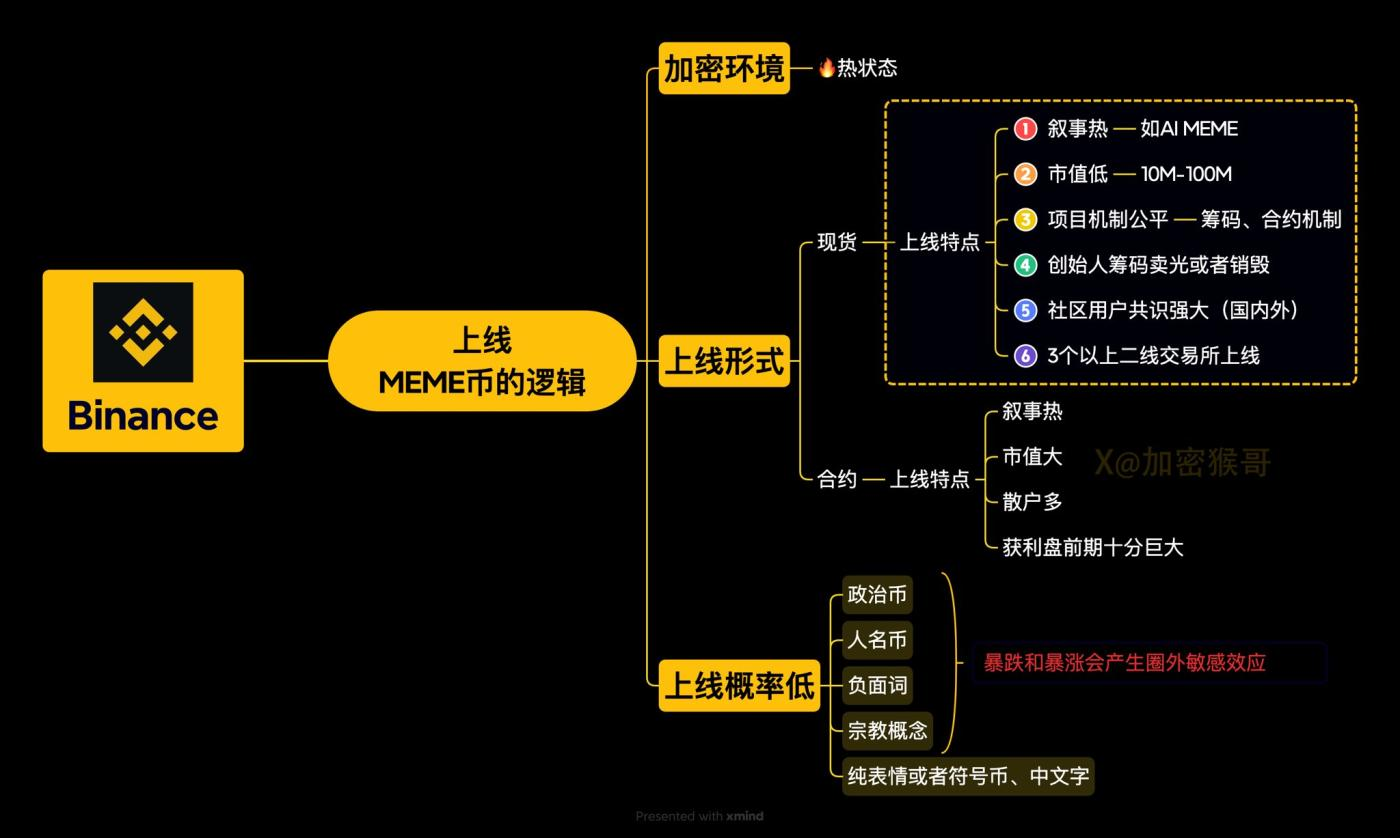

The impact of Binance listing: the logic from announcement to surge

As one of the world's largest cryptocurrency exchanges, Binance's influence on the launch of Meme Coin cannot be underestimated. Binance's launch is not only an endorsement of the project, but also a market verification of the project's potential. Every time Binance announces that it will launch a project, it often triggers a crazy reaction in the market, and investors' attention and purchasing enthusiasm quickly heat up. Specifically, the impact of Binance can be analyzed from the following aspects:

1. Market reaction to the listing announcement

According to Binance's announcement, the prices of ACT and PNUT, two meme coins, soared 42 times and 20 times respectively after the announcement of their listing. This surge not only reflects the market's recognition of the liquidity and fund security of the Binance platform, but also means that Binance's exposure has a profound impact on Meme coins. Binance's liquidity, trading pairs and global user base enable the listed coins to quickly attract a large amount of capital inflows, thereby driving their prices up rapidly.

2. Impact on liquidity and trading volume

The listing of Binance not only improved the market liquidity of Memecoin, but also promoted the growth of its trading volume. Take $HIPPO as an example. After the listing on Binance, the coin soared 4 times within 5 minutes, significantly exceeding investors' expectations. The listing of Binance platform provides a strong channel for capital inflow for these projects, and the platform's huge user base ensures the continued attention and investment enthusiasm of the projects.

How to select potential meme coins: screening criteria and tools

1. Screening popular projects: starting from decentralized exchanges (DEX)

To explore potential Meme coins, we should first focus on those that are currently active on decentralized exchanges (DEX).

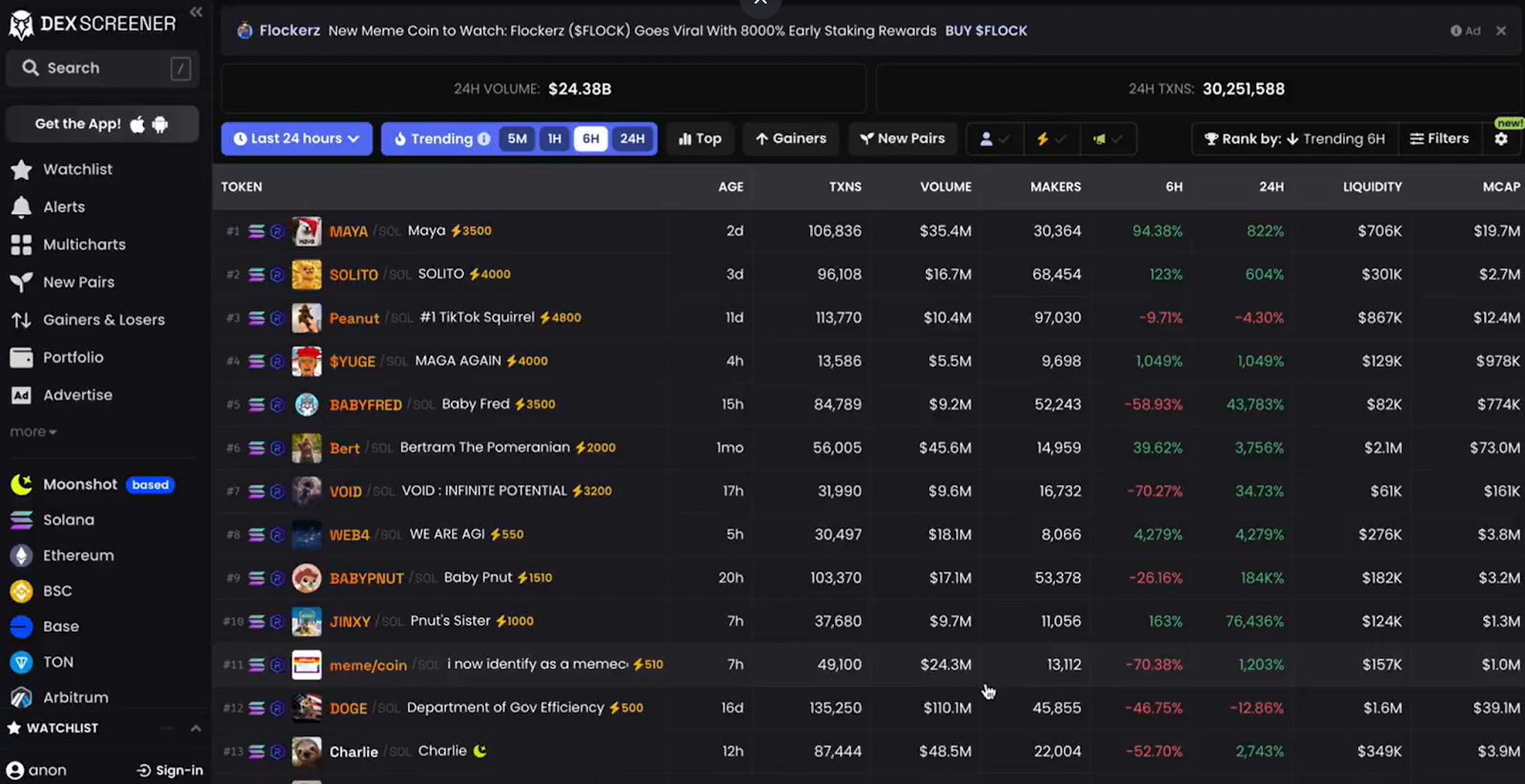

Through tools such as @dexscreener, investors can view the currencies with the largest gains and the highest trading volumes in the current 24 hours. Through the preliminary screening of these currencies, potential investment opportunities can be discovered. The specific screening criteria include:

- Market capitalization greater than $15 million

- 24-hour trading volume greater than $5 million

- Liquidity greater than $300,000

- Time to market greater than 3 days

Tokens with a market capitalization of less than $5 million are not very safe for the long-term prospects of MEME coin and are very risky.

2. Analyze project potential using ToxiSolanaBot

For each potential project, investors can use tools such as @ToxiSolanaBot for further screening.

This tool can help analyze the project's contract address, market sentiment, and historical performance, providing investors with more comprehensive data support. When using this tool, investors need to pay attention to:

- Select the contract address for analysis;

- Choose the right purchase amount and check the project’s liquidity and market activity.

Through these analytical tools, investors can better assess whether a project has the potential to explode.

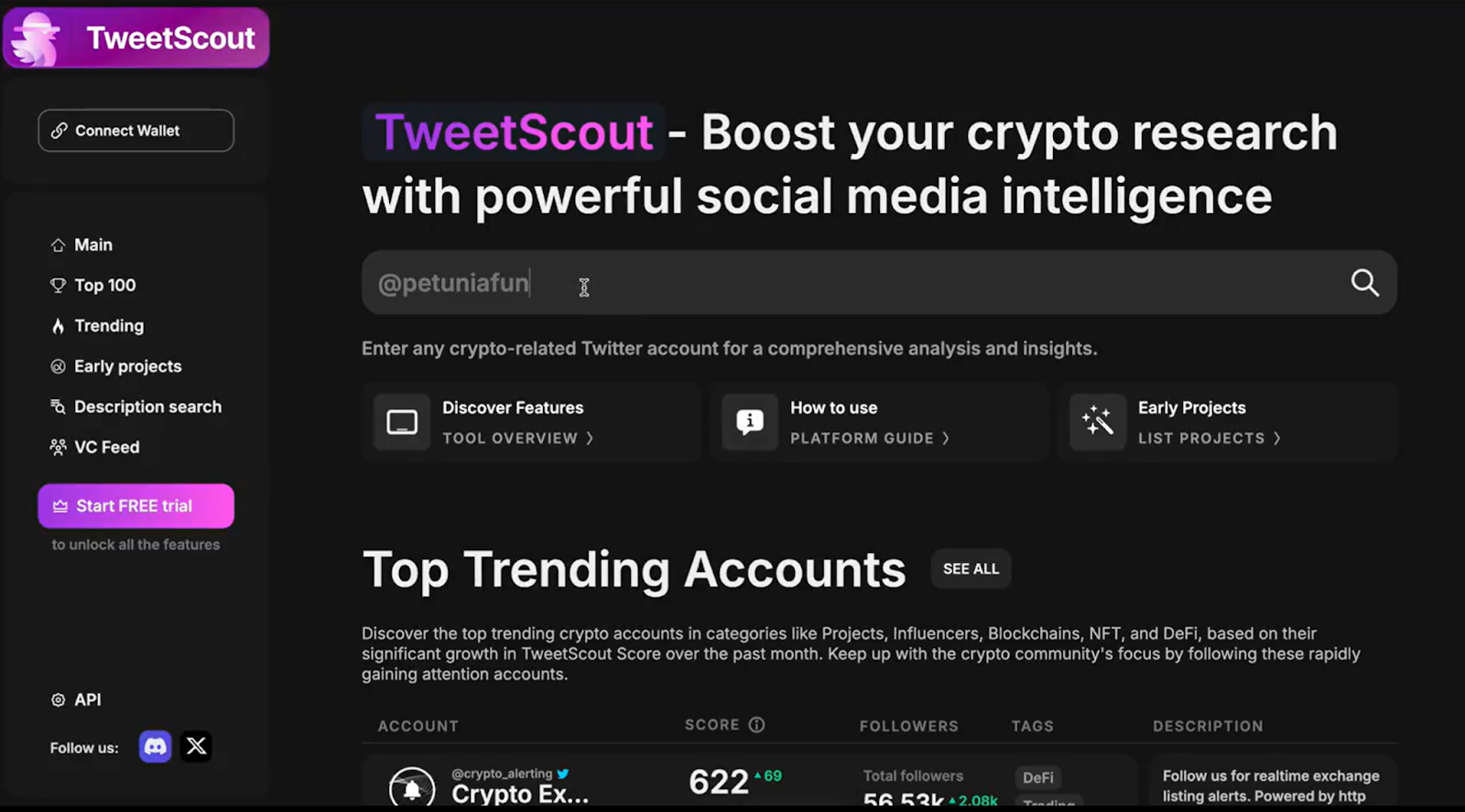

3. Analysis of popularity on social platforms

Investors can also further verify the potential of a project through social platforms. On Twitter, the popularity of a project's discussion often directly reflects the market's attention to it. By viewing the project's official account and related discussions, investors can get real-time feedback about the project. At the same time, using platforms such as @TweetScout_io, you can analyze the project's fan base and market influence to help judge its potential.

Avoid risks and ensure stable investment

Although the surge in Meme coins is tempting, its high risk cannot be ignored. Before investing, investors should diversify their investments and avoid concentrating all funds on one project. In addition to technical analysis and social platform analysis, investors also need to pay close attention to market dynamics, especially policy changes, platform announcements and other external factors that may affect the price of Meme coins.

1. Diversify investments to avoid single risk

Investors are advised to diversify their assets and avoid concentrating all funds on a single asset, especially projects with low market capitalization and insufficient liquidity. They can choose a diversified investment portfolio, including some mature projects and some potential stocks. By allocating funds reasonably, they can obtain higher returns while ensuring safety.

2. Track market trends and seize key opportunities

The Meme coin market is very volatile, and investors need to keep track of market dynamics, especially announcements from major exchanges, policy changes, and other information. Listing announcements from exchanges such as Binance and the social media performance of projects may have a significant impact on prices. Maintaining market sensitivity and adjusting investment strategies in a timely manner are the keys to success.

Summary: Grasp the trend and seize the opportunity

As a high-risk, high-return investment tool, the potential for a surge in Memecoin undoubtedly brings huge opportunities to investors. However, to seize the next 100-fold return project, investors must make full use of market liquidity, the popularity of social platforms, and the listing dynamics of exchanges such as Binance. Through scientific screening methods, technical analysis, and social media heat analysis, investors can increase the probability of discovering potential projects, thereby gaining an invincible position in this market full of variables.

But like all high-risk investments, the speculative nature of Meme Coin also comes with huge risks. While pursuing high returns, investors should also ensure reasonable risk control and asset allocation to avoid major losses due to excessive market fluctuations.