1. Background of Asset Tokenization

1. RWA from the perspective of Crypto

2. RWA from the perspective of TradFi

2. How does RWA subvert traditional finance?

1. Market accessibility helps diversify investment strategies

2. Improve liquidity and price discovery

3. Improve market efficiency and reduce costs

4. Traceability and programmability

III. RWA Project Classification and Representative Project Operation Mechanism

1. Institutional-grade permissioned blockchain project: Polymesh Private

2. Stablecoin tokenization project: RWA is easily overlooked

3. Real estate tokenization: Propy is making a useful attempt at the future of real estate

4. Tokenized securities market: promising growth but still faces some limitations

5. Carbon credit tokenization: Toucan occupies 85% of the industry share

7. Precious Metals: PAXG solves common challenges of traditional gold investment

4. Is RWA’s narrative too optimistic?

1. Regulatory and compliance issues

2. Blockchain underlying technology

3. Hype and reality are hard to distinguish

Preface

Since its birth, the total market value of cryptocurrencies has exceeded one trillion US dollars, of which Bitcoin and Ethereum have occupied more than 50% of the market share, but the market value of mainstream assets and commodities, whether it is gold futures or stock markets, far exceeds the total market value of cryptocurrencies.

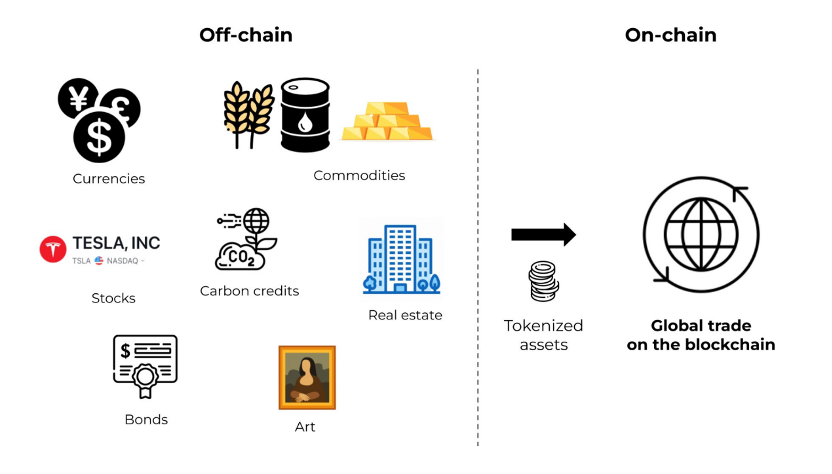

In this context, the concept of "RWA" has become popular in the crypto field since 2023. RWA (Real World Asset) means "real world assets", which is to tokenize real-world assets and introduce them into the blockchain field, such as commercial real estate, bonds, cars, and almost any assets that can be tokenized to store value. This makes it possible to store and transfer assets without a central intermediary, and to map the value to the blockchain for transaction circulation. Although "RWA" has great imagination for expanding the ceiling of the total market value of cryptocurrencies, its definition, advantages and development trends need to be explored urgently.

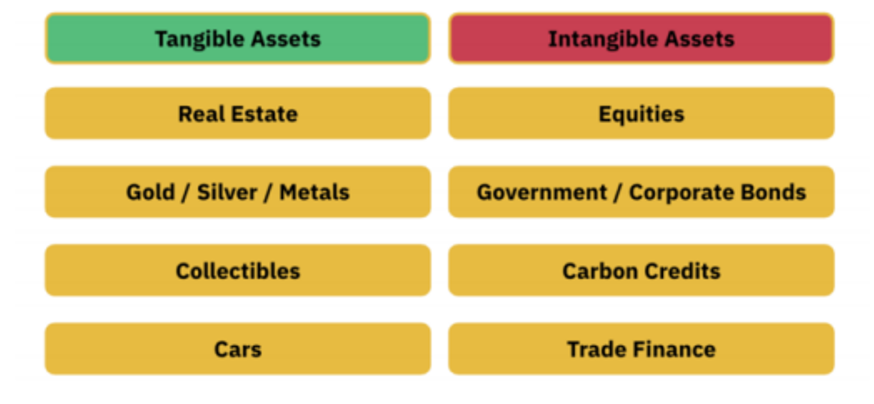

Figure 1. Real-world assets that can be tokenized

Source: Binance ResearchOn the one hand, there is a view that RWA is nothing more than market hype and cannot withstand in-depth discussion;

On the other hand, some people are full of confidence in RWA and are optimistic about its future.

This article hopes to conduct a more in-depth discussion and analysis of the current status and future of RWA by sharing the cognitive perspective on RWA.

The core ideas are as follows:

Ÿ The future development direction of RWA should be a two-way run between the real world and the virtual world: specifically, it will be a new financial system using DLT technology deployed on a permissioned chain under the framework of multiple different jurisdictions and regulatory systems.

Ÿ Take a cool head on RWA: The RWA industry needs to calm down from the current hype and look at the RWA of assets rationally. Not all assets are suitable for RWA, and some assets that are unpopular in the real world will not be welcomed by the market after being converted into RWA.

Ÿ Many countries around the world are actively promoting blockchain-related legal and regulatory frameworks. At the same time, blockchain infrastructure, such as cross-chain protocols, oracles, and various middleware, are rapidly improving.

Ÿ The principles, challenges and obstacles faced by RWA projects with different underlying assets are very similar, but they have their own solutions and focuses in terms of specific operating mechanisms. For example, although they are both security tokens, bond tokens that are often held to maturity usually do not require the same high liquidity as stock tokens.

1. Background of Asset Tokenization

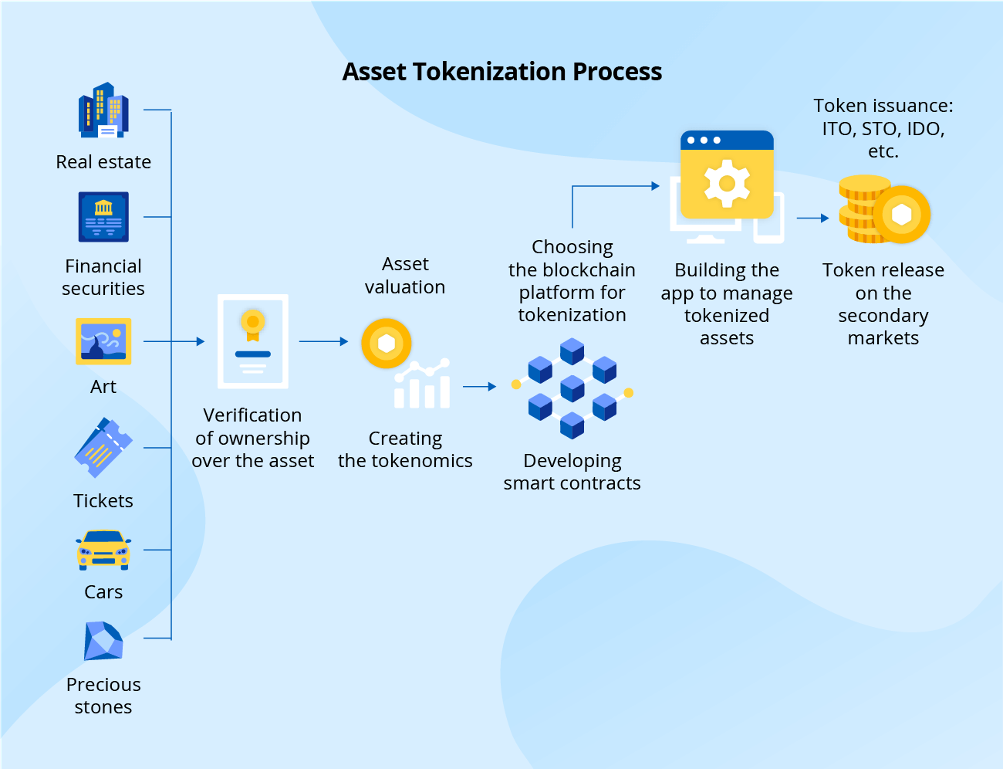

Asset tokenization is the process of recording the ownership of a specific asset into a digital token that can be held, bought, sold, and traded on a blockchain. The resulting token represents a share of ownership in the underlying asset. In theory, any asset can be digitized, whether it is a tangible asset like real estate, or an intangible asset like company stock. Converting these assets into digital tokens makes them easier to divide, thereby enabling fractional ownership and enabling more people to participate in investing, which in turn can make the market for these assets more liquid. Asset digitization can also enable traditional assets to be traded directly on a peer-to-peer platform without the need for intermediaries, and bring greater security and transparency to the market. The basic principles of asset tokenization are as follows:

Ÿ Real-world asset acquisition

Ÿ Tokenization of these assets on the chain

Ÿ Distribution of RWA to on-chain users

Figure 2. Tokenization process

Source: https://www.scnsoft.com/blockchain/asset-tokenizationRWA is not a new concept. The current asset tokenization market size is estimated to be around $600 billion by 2023. Driven by advancements in blockchain technology and increased demand for liquidity across asset classes, the market is expected to grow at a compound annual growth rate (CAGR) of 40.5% from 2024 to 2032. RWA tokens are the fastest growing asset class among decentralized finance (DeFi) tokens.

Figure 3. Global RWA Market

Source: https://www.scnsoft.com/blockchain/asset-tokenizationAlthough the RWA market is in its early stages of development, it is growing at a considerable rate, and more and more RWAs are being adopted in Web3 protocols. As of November 25, 2024, data from the DefiLlama platform showed that the TVL (total locked value) of RWA token assets has reached US$6.512 billion. TVL can measure how much cryptocurrency is locked in the DeFi protocol. The rise in TVL to a certain extent shows the recognition and smoothness of token assets in the Web3 world.

Figure 4. RWA token asset TVL has reached $ 6.512 billion

Source: DefiLlama PlatformAt present, there are two groups with completely different views on the tokenization of RWA. This article refers to them as RWA from the Crypto perspective and RWA from the TradFi perspective. The focus of this article is on RWA from the TradFi perspective.

1. RWA from the perspective of Crypto

The traditional DeFi space has been struggling to generate yields, but DeFi’s underlying yield generation mechanism only works when prices rise. In the context of the crypto winter, the sluggish on-chain activity has directly led to a decline in on-chain yields. The decline in TVL in DeFi protocols from $180 billion to $50 billion since the market peak best reflects the unsustainable yield model. As yields plummet, the pursuit of “real yields” intensifies, prompting DeFi protocols to integrate RWA tokens as a more stable source of income. This is why on-chain US bonds are the hottest track recently.

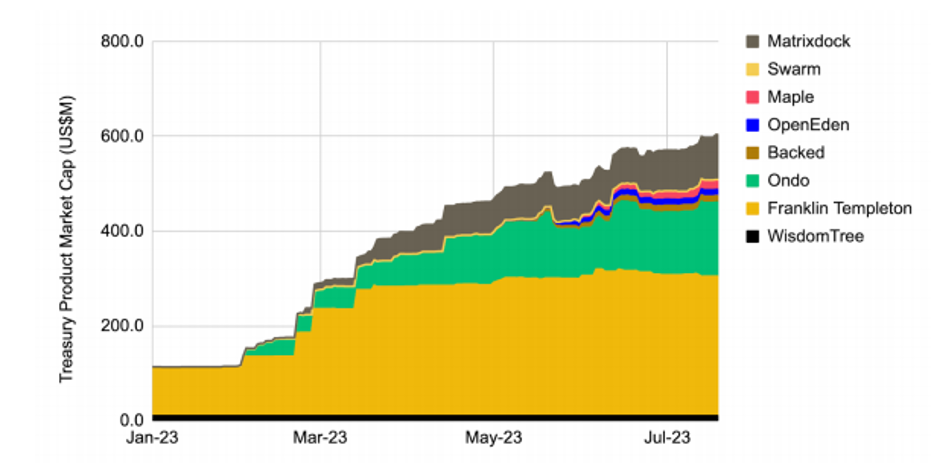

Therefore, RWA from the perspective of Crypto can be summarized as the unilateral demand of the Crypto world for the yield of real-world financial assets. The main background is that under the background of the Fed's continuous interest rate hikes and balance sheet reduction, the yield of U.S. Treasury bonds has steadily increased slightly. At the same time, the interest rate hike has extracted liquidity from the crypto market, causing the yield of the DeFi market to continue to decline. The most popular of these is MakerDAO's announcement that it plans to invest its $1 billion reserves in tokenized U.S. Treasury products.

Figure 5 : The tokenized U.S. Treasury market is worth $ 603 million

Source: Binance ResearchThe significance of MakerDAO's purchase of US Treasury bonds is that DAI can use the power of external credit to diversify the assets behind it, and the long-term additional income brought by US Treasury bonds can help DAI stabilize its exchange rate, increase the flexibility of issuance, and the inclusion of US Treasury bonds in the balance sheet can reduce DAI's dependence on USDC. At the same time, by investing in tokenized US Treasury bonds, MakerDAO can obtain a stable source of income. In fact, MakerDAO has recently increased the demand for DAI by sharing part of its US Treasury bond income and raising the interest rate of DAI to 8%. Maker's governance token MKR has also risen by 5%.

2. RWA from the perspective of TradFi

If we look at RWA from the perspective of Crypto tokens, it mainly expresses the unilateral demand of the crypto world for the asset yield of the traditional financial world, and is just looking for a new asset sales channel. From the perspective of traditional finance (TradFi), RWA is a two-way rush between traditional finance and decentralized finance (DeFi). RWA not only introduces value to the cryptocurrency market, but also empowers the advantages of cryptocurrency to real assets.

For the traditional financial world, DeFi financial services based on automatic execution of smart contracts are a revolutionary financial technology tool. RWA in the TradFi field is more concerned about how to combine DeFi technology to realize the tokenization of assets to empower the traditional financial system. Specifically:

Improve transaction efficiency: RWA can transfer multiple links in traditional IPO (such as service providers, securities firms, custody, etc.) to the blockchain and complete the transaction in one go, avoiding the cumbersome processes between different locations and entities, and is not restricted by exchange time, supporting direct transactions between crypto wallets.

Reduce financing costs: Through the STO (Securities Token Offering) channel, RWA can provide financing for some less popular industries, reduce investment banking fees (from 5-6% to 3%), attract projects that have difficulty obtaining loans due to bank lack of interest (such as the difficulty of financing for small and medium-sized enterprises), and help them find interested investors.

Simplify investment threshold: RWA allows users to invest in global stocks, real estate and other assets with just one account, solving the problem of needing multiple accounts when purchasing financial products across platforms, and reducing the threshold and complexity of investment.

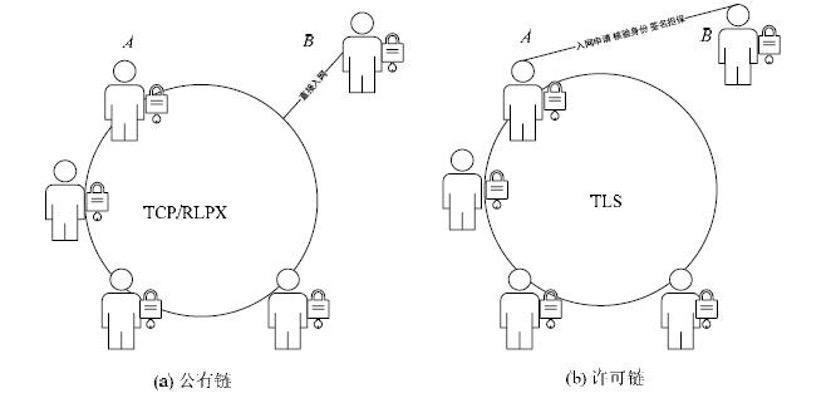

This article believes that it is necessary to distinguish the logic of RWA. Because the underlying logic and implementation path behind RWA from different perspectives are very different. First of all, in terms of the type of blockchain, the two have different implementation paths. The RWA of traditional finance is based on the path of permission chain, while the RWA of the crypto world is based on the path of public chain.

Since public chains have the characteristics of no entry requirements, decentralization, anonymity, etc., the RWA of crypto finance will not only face greater compliance obstacles for the project party, but also the technical loopholes of the public chain or the defects of the smart contract may lead to the loss of users' assets or transaction failures. Therefore, the public chain may not be suitable for the tokenization and trading of a large number of real-world assets on it; while the permission chain allows only authorized participants to access the network, which can ensure that only compliant financial institutions, regulatory agencies and other relevant parties can participate in transactions and data access, which provides the basic prerequisite for legal compliance in different countries and regions. In addition, unlike the public chain, the assets issued by the institutions on the permission chain can be native on-chain assets instead of being mapped with existing assets off-chain. The potential for change brought about by the RWA of such native on-chain financial assets will be huge.

Figure 6 : The entry barriers for public and private chains are different

Source: https://www.jos.org.cn/html/2019/6/5743.htmIn summary, the future development direction of RWA should be a two-way run between the real world and the virtual world: specifically, it will be a new financial system using DLT technology deployed on permissioned chains/private chains under the permissioned chain structure of multiple different jurisdictions and regulatory systems.

2. How does RWA subvert traditional finance?

In the traditional financial system, assets such as stocks, bonds and real estate usually exist in the form of paper certificates, which are then converted into digital records held by centralized financial institutions. These records cover aspects such as ownership, liabilities, conditions and contracts, and they are usually scattered in different systems or ledgers that operate independently. These institutions maintain and verify financial data so that people can trust the accuracy and completeness of this data. However, because each intermediary holds different pieces of the puzzle, the financial system requires a lot of post-coordination to reconcile and settle transactions to ensure the consistency of all relevant financial data. As you can imagine, this traditional system faces many challenges:

Ÿ Higher transaction costs due to the presence of multiple intermediaries, including brokers and custodians.

Ÿ Slower settlement times, especially for cross-border transactions, which often take several days to complete.

Ÿ Investment opportunities are limited, and only high net worth individuals and institutional investors can participate in certain asset classes.

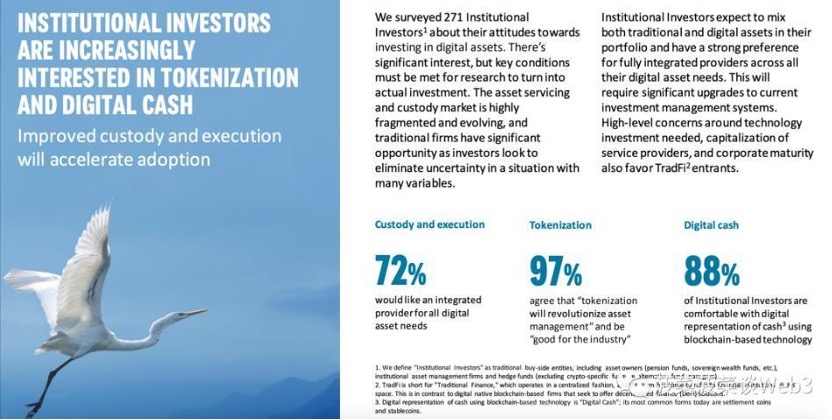

As a distributed ledger technology, blockchain has shown great potential in solving the efficiency problems prevalent in the traditional financial system. It directly solves the information fragmentation problem caused by multiple independent ledgers by providing a unified, shared ledger, greatly improving the transparency, consistency and real-time update capabilities of information. The application of smart contracts further enhances this advantage, allowing transaction conditions and contracts to be encoded and automatically executed when specific conditions are met, significantly improving transaction efficiency and reducing settlement time and costs, especially in the case of complex multi-party or cross-border transactions. Therefore, for the traditional financial system, the significance of RWA is to extend the benefits of distributed ledger technology to a wide range of asset classes for exchange and settlement by creating digital representations of real-world assets (such as stocks, financial derivatives, currencies, equities, etc.) on the blockchain. A study conducted by Bank of New York Mellon in 2022 showed that tokenized products are popular among institutional investors. After surveying 271 institutional investors, Bank of New York Mellon found that more than 90% of respondents said they were interested in investing funds in tokenized products, and 97% of respondents agreed that "tokenization will revolutionize asset management" and "benefit the industry." Benefits of tokenization include removing friction in value transfer (84%) and increasing access for mass affluent and retail investors (86%).

Figure 7 : Public and private chains have different entry barriers

Source: https://www.bny.com/corporate/global/en.htmlIn order to further explore the transformative power of RWA on the traditional financial system, the following is a more detailed analytical framework:

1. Market accessibility helps diversify investment strategies

Tokenization democratizes investment opportunities by fragmenting high-value assets, such as real estate and art, into tradable tokens, enabling fractional ownership and enabling small investors to participate in markets that were previously inaccessible due to high costs.

Imagine that traditionally illiquid assets, such as a house, can be sold in pieces through tokenization, and real estate investors from other countries can also participate. These assets can be actively traded in the market, and investors can convert their assets into cash more quickly. The tokenization process is like turning these assets into commodities that can be bought and sold at any time, greatly improving the efficiency of transactions.

In addition, unlike the specific trading hours of traditional financial markets, tokenized RWA can be traded around the clock on the blockchain platform, providing more opportunities for cross-time zone transactions, thereby improving liquidity.

“Tokenization allows fractional ownership of assets, which opens up opportunities for small investors, with blockchain as the enabler. It’s a win-win situation where more people can access high-value investments and institutions can tap into new revenue streams,” said a participant at the 2023 Hubbis Token Digital Asset Forum in Singapore.

2. Improve liquidity and price discovery

Tokenization enables once illiquid assets to be traded seamlessly at almost zero cost by reducing the friction associated with asset sales, transfers, and record keeping. In traditional financial markets, the transfer of assets often involves multiple intermediaries, resulting in a complex and time-consuming transaction process. In the past, investors had great difficulty trading positions in rare gemstones or private equity, and often required a lot of time and effort to find buyers or sellers. Tokenization uses the decentralized nature of blockchain to simplify this process, allowing buyers and sellers to trade directly and reduce transaction costs. With blockchain technology, investors no longer have to wait months or years to find the right buyer, but can quickly transfer assets to other investors when needed, thereby providing secondary market liquidity in a safe and compliant manner.

At the same time, buyers and sellers can more easily conduct transactions and price them based on new relevant information. This transparency and real-time nature allows market participants to better assess the value of assets and make more informed investment decisions.

Figure 8. Tokenization enables illiquid assets to be traded seamlessly at almost zero cost

Source: https://blog.defichain.com/unlocking-real-world-value-what-are-real-world-assets-and-why-do-they-matter-in-defi/3. Improve market efficiency and reduce costs

Clearing and settlement are ubiquitous in all aspects of human daily life, financial activities, and trade activities. For users, the money is transferred just by making a payment, but in fact, there are many clearing and settlement processes involved behind this simple payment action.

Figure 9. Clearing and Settlement Process

Source: https://www.woshipm.com/pd/654045.htmlAs can be seen from the figure, in the traditional financial system, clearing and settlement is a "calculation" accounting and confirmation process. The parties reach a consensus through continuous checking and verification, and transfer assets on this basis. This process requires the collaboration of multiple financial departments and a large amount of manpower costs, and may face the risk of operational errors and credit risks. For example, the collapse of Herstatt Bank on June 28, 1974 exposed the credit risk of cross-border payments and its potential huge destructive power.

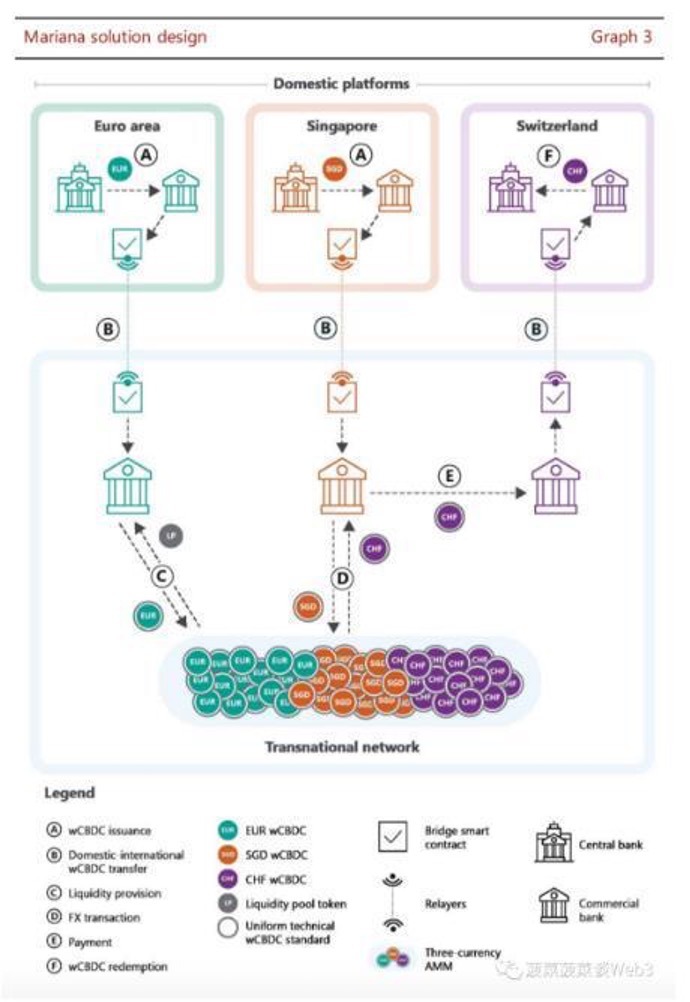

Blockchain eliminates many middlemen by using distributed ledgers and automated smart contracts, enabling 24/7 payments, instant collection, and easy cash withdrawals, and successfully meets the convenience needs of cross-border e-commerce payment and settlement services. Since assets can be transferred autonomously between parties through smart contracts and stored in an unalterable ledger, it creates a globally integrated cross-border payment trust platform at a lower cost, reducing the financial risks brought about by cross-border payment fraud.

The Mariana Project, a collaboration between the Bank for International Settlements Innovation Hub (BISIH), the Bank of France, the Monetary Authority of Singapore (MAS) and the Swiss National Bank, the central bank of Switzerland, released a test report on September 28, 2023, which successfully verified the technical feasibility of using automated market makers (AMMs) for international cross-border transactions and settlements of tokenized central bank digital currencies (CBDCs).

Figure 10. Mariana Project verified the technical feasibility of international cross-border transactions and settlements

Source: https://www.bis.org/publ/othp75.html4. Traceability and programmability

The 2008 financial crisis is a classic example of a global financial disaster caused by financial derivatives. During this crisis, financial institutions packaged subprime loans into securities (such as mortgage-backed securities MBS and collateralized debt obligations CDOs) and sold them to investors, forming complex financial products that made it impossible to track the physical assets behind them. These layered and packaged derivatives were sold to various securities firms and investors, causing the leverage ratio of the entire financial system to soar rapidly, and eventually became the fuse that triggered the financial tsunami.

Imagine if RWA (real world asset) technology was applied in 2008, investors would be able to trace the underlying assets of these financial instruments, so that they can trade on the basis of fully understanding the risks of the assets. This transparency will completely change the way assets are managed and traded. Through blockchain technology, every transaction is recorded in an immutable ledger, providing a clear and auditable record of ownership and transfer. This not only greatly reduces the risk of fraud and mismanagement, but also enables regulators to more easily track activities and ensure trust between financial institutions and customers.

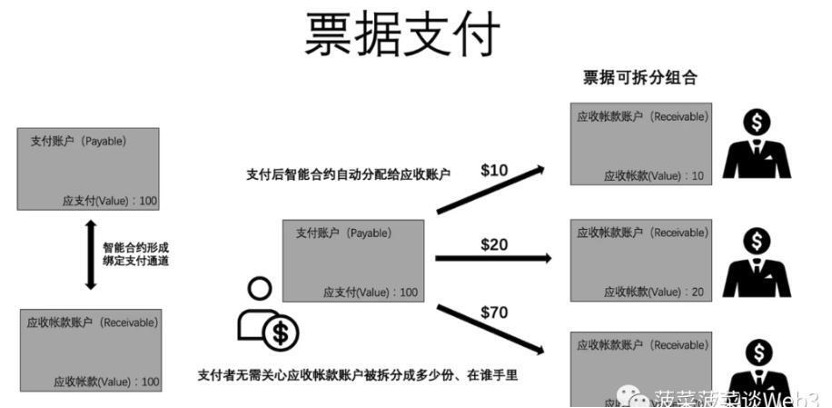

Another example of the benefits that programmability and traceability bring to the traditional financial system is the "digital invoice tokenization" project of Australian startup Unizon. Small and medium-sized enterprises are often in a dilemma when faced with the problem of falsification of bills: if they cannot accept delayed payment of accounts, it will be difficult to obtain orders from large companies; and accepting orders from large companies may lead to tight liquidity and increase the risk of cash flow interruption. Unizon's project creates two accounts through ERC-3525: a payment account (Payable) and an accounts receivable account (Receivable). A payment channel similar to quantum entanglement is formed between the two accounts. As long as the buyer remits money to the payment account, the funds will be automatically distributed to the accounts receivable account through the smart contract.

Figure 11. Unizon ’s “Digital Invoice Tokenization” Project

Source: https://mirror.xyz/bocaibocai.eth/q3s_DhjFj6DETb5xX1NRirr7St1e2xha6uG9x3V2D-A

By converting invoices into digital tokens, Unizon can achieve the rapid transfer and transaction of invoices. This tokenization makes invoices not just paper documents, but digital assets that can be managed on the blockchain. And all invoice transaction records will be recorded on the blockchain to ensure the transparency and immutability of information.

III. RWA Project Classification and Representative Project Operation Mechanism

RWA projects mainly involve RWA infrastructure projects and RWAs belonging to a certain class of specific assets.

Infrastructure projects mainly include:

Layer Token 1 blockchain: such as Polymesh, an institutional-grade permissioned blockchain built specifically for RWA tokens; MANTRA Token Chain built on the Cosmos Token SDK that allows users to issue and trade RWA tokens; Ondo Token Bridge that enables the transfer of native cross-chain tokens RWA tokens.

Tokenized platforms: such as Centrifuge, a decentralized financial platform that aims to provide financing solutions for small and medium-sized enterprises.

Identity: Such as SprucelD and Quadrata that solve the decentralized identity problem.

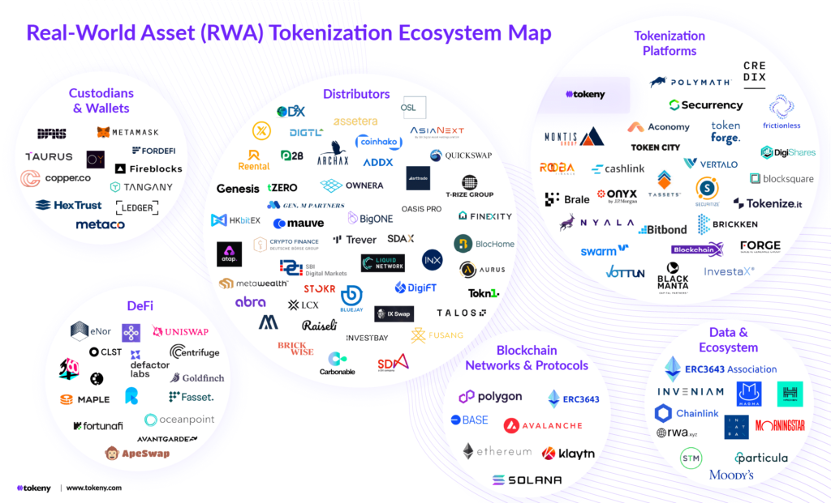

Figure 12. RWA Tokenization Ecosystem Map

Source: https://tokeny.com/real-world-asset-rwa-tokenization-ecosystem-map/In theory, all assets can be put on the chain and tokenized. Through tokenization, these assets can be divided into small shares, lowering the investment threshold, improving liquidity, and providing higher transparency and security through blockchain technology, thereby attracting more investors to participate.

Figure 13. Multiple RWA protocols have emerged across various asset classes

Source: Nansen, Root Data, crypto.com Research1. Institutional-grade permissioned blockchain project: Polymesh Private

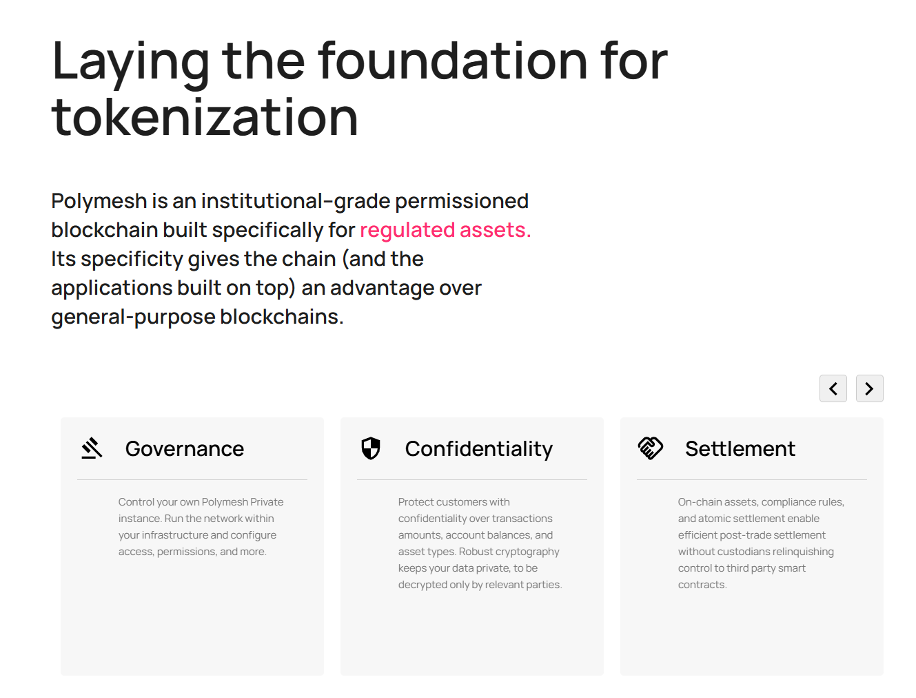

Ethereum has established a foundation layer for security tokens - smart contracts, which make tokens programmable and automated. So why do we need to build a dedicated blockchain in the future? As mentioned earlier, the public chain has the characteristics of no entry requirements, decentralization, anonymity, etc., which obviously cannot meet the compliance and regulatory requirements of RWA. We also need more foundation layers to ensure regulatory compliance and institutional confidence.

The Polymesh Token Association announced at the 2024 Digital Asset Summit the launch of Polymesh Private: a new and complementary version of the public permissioned blockchain token Polymesh Token, bringing enhanced confidentiality and control to its infrastructure built specifically for regulated assets. Polymesh Private is specifically targeted at the institutional finance sector, including banks and large financial institutions. It solves common issues around visibility on public networks and compliance with regulatory frameworks, making it ideal for organizations that need a secure and controlled tokenization environment. It shares core infrastructure with the public permissioned blockchain Polymesh, but is built on three core elements that set it apart from public blockchains:

Ÿ Operational Control: The operating entity has complete autonomy over the blockchain environment, including who can participate, whether network tokens are included, network fees, block size, and transaction speed. This flexibility ensures that the blockchain can be customized to the specific needs of the business and work seamlessly with its operational goals without encountering issues with scalability, throughput, or compliance.

Ÿ Privacy: Unlike public blockchains where transaction details are visible to everyone, Polymesh Private uses advanced encryption technology to ensure that transaction amounts, account balances, and asset types are kept confidential, and only relevant parties can decrypt sensitive information.

Ÿ Public compatibility: Polymesh Private runs on the same architecture as Polymesh, and users can enjoy the development, new features and versions of the public network as needed. Compatibility provides enterprises with the flexibility to transition to public infrastructure when they are ready, ensuring that financial institutions can take full advantage of the advantages of private and public blockchain technologies as their needs evolve. This is a huge advantage for an industry with a fast pace of innovation and rapidly changing technology.

Figure 14. Polymesh Private is an institutional-grade permissioned blockchain project

Source: https://polymesh.network/privateAccording to 4 independent third-party audit reports, the Polymesh public network has been running for more than two years without any security incidents. The Polymesh mainnet has also been upgraded to version 7.0, introducing new features, updates, and performance improvements. Polymesh Private users can benefit from the continued development of the public Polymesh infrastructure, which is carried out by the Polymesh Association and the wider community.

However, it should be noted that although Polymesh Private is designed to be compatible with the public Polymesh network, there may be technical barriers to achieving full interoperability in actual operation, and ensuring seamless migration and communication between private and public networks is an ongoing challenge. In addition, although Polymesh Token Private is designed to provide services for enterprise-level users, its performance and scalability have not been fully tested in large-scale deployments. As the number of users increases, how the network performs and whether it can handle a large number of transactions, these issues still need further verification.

2. Stablecoin tokenization project: RWA, which is easily overlooked

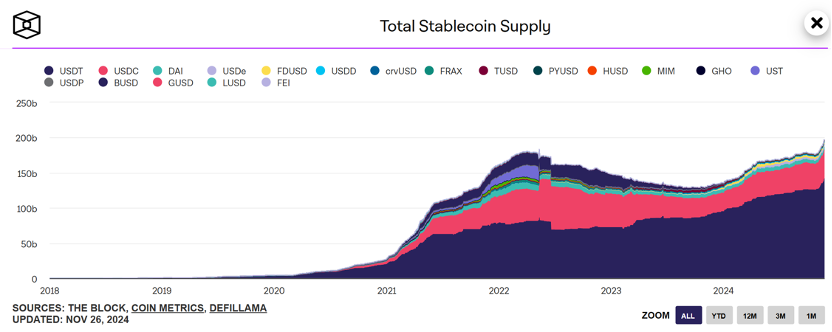

Centralized stablecoins are perhaps the earliest, largest, and often overlooked type of RWA, as defined by real-world assets. The market cap of stablecoins has grown significantly since 2020, from $5 billion to $180 billion, although they only account for about 5.58% of the total cryptocurrency market cap of $3.35 trillion. As of November 26, 2024, the total market cap of stablecoins is estimated to be $187.38 billion, of which Tether tokens (USDT), as the largest stablecoin, have a market cap of $135.05 billion, accounting for 72.07% of the total stablecoin supply. Issuers of stablecoins such as Tether and Circle issue stablecoins backed by fiat currency or cash equivalents. While providing a price-stable trading medium for the crypto world, stablecoin issuers also earn income through bonds they hold, and stablecoins have become the foundation of the crypto market.

Figure 15. Polymesh Private is an institutional-grade permissioned blockchain project

Source: https://www.theblock.co/data/stablecoins/usd-pegged/total-stablecoin-supply , the supply shown in this chart includes the unissued USDT currently held in the Tether token vault

In the DeFi field, more than 75% of DeFi transactions are conducted using stablecoins. In June 2024, due to the implementation of MiCA regulations, some major exchanges cancelled transactions of some well-known stablecoins for European users, but USDC was not affected, indicating that USDC has been recognized in terms of regulatory compliance. The stablecoin market is expected to continue to grow, but attention should also be paid to regulatory changes and market risks.

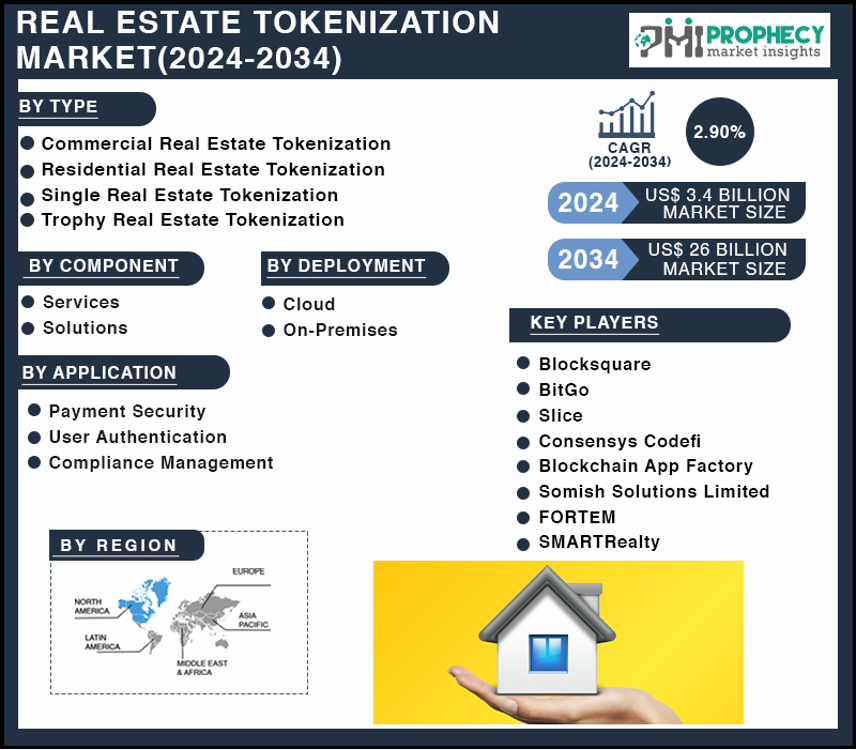

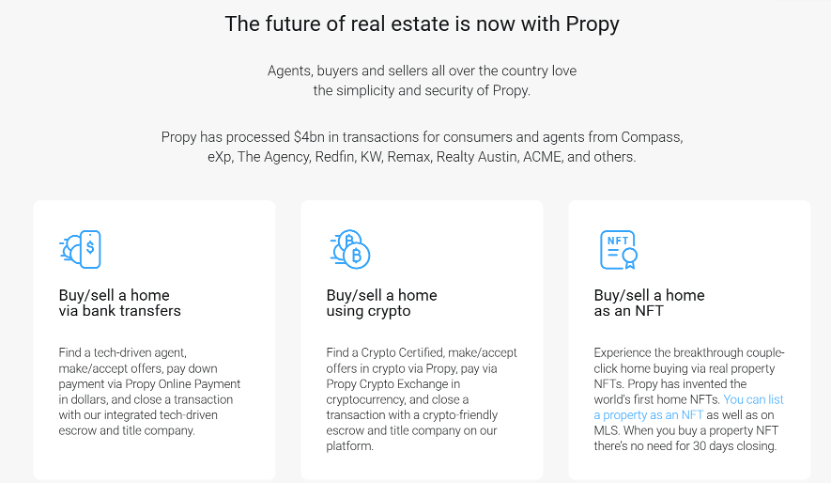

3. Real estate tokenization: Propy has made a useful attempt on the future of real estate

One of the most obvious opportunities in the RWA space is real estate. Real estate ownership, sales, and mortgages have long been based on rules and regulations set by judges or courts, while intermediaries have made asset transactions cumbersome and introduced additional costs, making real estate one of the most fragmented and inefficient markets.

By putting real estate assets on the blockchain, many tasks involved in transactions can be completed autonomously and without restrictions. For example, properties that originally needed to be sold by unit can be sold in fragments, ordinary investors can hold partial ownership for investment, and real estate investors from other countries can also participate. By introducing oracles, real estate valuation data can be obtained directly from the market. In addition, ownership and transfer records can be recorded seamlessly and economically, eliminating the possibility of fraud and human error.

Figure 16 : Development prospects of real estate tokenization market

Real estate tokenization projects include the global real estate transaction platform Propy, the real estate tokenization platform ReaIT, the real estate transaction and leasing platform Atlant, the real estate investment platform BlockVenture, which allows companies to issue STOs representing real estate token financing, RWA tokenization and stablecoin lending platform Tangible, etc.

Take Propy as an example. The project was founded by Natalia Karayaneva in 2016. It uses blockchain, smart contracts and cryptocurrency to simplify and innovate the way real estate is bought, sold, managed and traded. According to the official website, Propy has processed $4 billion in transactions for consumers and agents of companies such as Compass, eXp, The Agency, Redfin, KW, Remax, Realty Austin, ACME, etc. The key features of Propy include:

Ÿ Simplify the home buying experience and eliminate fraudulent transactions through blockchain technology.

Ÿ Provide a decentralized land registry system to record property ownership and title transfers.

Ÿ Enable online processing of real estate purchases, increasing transaction security and transparency.

Ÿ Automate transactions through smart contracts and cryptocurrency payment systems.

Propy has three core products: Propy real estate transaction platform, Propy title and escrow services, and PropyKeys.

Propy real estate transaction platform uses smart contracts, RWA and blockchain technology to provide end-to-end real estate transaction services for agents and customers.

Propy is a blockchain-based title and escrow service that ensures transaction security while supporting traditional title transfer processes.

PropyKeys is based on the Ethereum Layer 2 token network Base, which realizes the tokenization of real estate. In March this year, PropyKeys was officially opened to the public. Users can use the PropyKeys app to mint and store on-chain addresses corresponding to physical properties and property certificates, thereby earning PRO tokens.

Figure 17. Propy official website promotion

Data source: https://propy.com/browse/Through three core products, Propy combines blockchain technology to significantly improve the security and efficiency of real estate transactions. In addition, Propy also plans to unlock new buying, selling and investment opportunities through cooperation with REITs, making real estate transactions more popular and accessible. Propy is also committed to pushing the boundaries of real estate technology through its Web3 portal and Propy Labs to provide better user experience and community participation.

Despite the potential advantages of the real estate tokenization concept, there are still many challenges and problems in its practical application. One of the main issues is geographical limitations: there are differences in legal provisions in different countries and regions, which involve multiple legal systems and frameworks and may lead to compliance issues. In addition, the lack of unified regulatory standards affects the legitimacy and feasibility of real estate tokenization projects. Therefore, whether an internationally applicable real estate tokenization law can be formulated and its enforcement can be ensured will directly affect the future development potential of real estate tokenization.

4. Tokenized securities market: optimistic growth prospects, but still faces some limitations

Tokenized securities refer to the digitization of traditional securities such as stocks or bonds on a blockchain platform. The tokenized securities market size reached USD 202 billion in 2023 and is expected to reach USD 301 billion by 2030, growing at a CAGR of 5.96% during the forecast period.

Compared to traditional securities that often face restricted trading hours, a key advantage of tokenized securities markets is liquidity, with tokenized assets being traded 24/7 on a variety of platforms.

By product/type, the tokenized securities market can be divided into equity market and public bond market.

Stock trading on the chain initially existed in the form of synthetic assets, with Synthetix and Mirror Protocol being typical representatives. However, such projects are not backed by real stocks and have compliance issues. Currently, some compliant projects are joining the ranks.

Take Backed Finance as an example. Backed Finance is a company that focuses on tokenizing traditional financial assets. It has issued a variety of tokenized products, including tokenized stocks and fixed income, with a total issuance volume of more than 52.04 million US dollars. The tokens issued by Backed are called bTokens. These tokens are 1:1 anchored to physical assets (such as ETFs, treasury bonds, securities, etc.), allowing investors to hold these assets in a tokenized form. According to Backed's official information, the platform has currently issued 8 fixed income products, such as the iShares Short-Term Treasury Bond ETF; and 9 securities products including Tesla, NVIDIA, Coinbase, MicroStrategy and S&P 500 Index ETF.

Ÿ bIB01: Tracking TokensiShares Tokens$ TokensTreasury TokensBond Tokens0-1yr TokensUCITS TokensETF TokensPrice.

Ÿ bC3M: Tracking TokensAmundi TokensGOVIES Tokens0-6 TokensMonths TokensEuro TokensInvestment TokensGrade TokensUCITS TokensETF Tokens’ prices.

Ÿ bCOIN: Tracks the price of the Coinbase Token Global Token stock.

bNVDA: Tracks the price of the NVIDIA Token stock token.

Figure 18. Propy official website promotion

Data source: https://backed.fi/#In terms of technology, Backed Finance has solved the three core problems of tokenized assets through three functional integrations with Chainlink: data on-chain, liquidity, and synchronization.

Ÿ Data on-chain: Tokenized assets often rely on a large amount of off-chain data, such as market pricing, reference data, and identity information. In order to ensure that the status of assets is updated in a timely manner and facilitate transactions, Chainlink Data bFeeds can transmit these necessary data to the blockchain to ensure the accuracy and real-time nature of the data. At the same time, relying on the reserve proof established by Chainlink PoR, Backed can effectively prevent over-issuance attacks (Over-Issuance Token Attacks) and better manage market risks, liquidity, issuance period, and liabilities.

Ÿ Liquidity: With the diversified development of blockchain, the fragmentation of liquidity between public chains has become increasingly serious, leading to the so-called "liquidity island" dilemma. Tokenized assets must be able to flow frictionlessly between multiple blockchains to meet the needs of traditional financial institutions. By integrating Chainlink's token CCIP, Backed can enable institutional clients to seamlessly transfer tokens between different blockchains and access cross-chain liquidity pools.

Figure 19. Backed Finance and Chainlink integration solves the liquidity problem of tokens between different blockchains

Data source: Binance

Ÿ Synchronicity: Once tokenized assets are deployed on multiple blockchains, ensuring the synchronization of data on different chains becomes a top priority. The synergy between Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Proof of Reserve (PoR), and Data Feeds ensures the consistency and connectivity of these critical data in multi-chain deployments, while ensuring that tokenized assets are fully collateralized and have the highest security in a multi-chain environment.

In summary, the cooperation between Backed Finance and Chainlink not only solves the problems of liquidity islands and data synchronization in the RWA tokenization process, but also provides strong technical support for promoting multi-chain transmission and large-scale adoption of global blockchain assets. The success of this integration may become a classic case in the field of RWA tokenization in the future, leading more innovative applications to maturity.

Tokenized Bond, also known as Digital Bond, is a debt instrument. Unlike traditional bonds, the issuance and trading of digital bonds do not rely on traditional financial intermediaries, but are achieved through distributed ledger technology (DLT), especially blockchain technology.

The Hong Kong Monetary Authority (HKMA) pointed out in the report "Tokenization of the Hong Kong Bond Market" that as of March 2023, the total issuance of tokenized bonds worldwide has reached approximately US$3.9 billion. In the practice of digital assets and digital bonds, the Hong Kong Special Administrative Region Government of my country is at the forefront. In 2023, the Hong Kong Special Administrative Region Government successfully issued a digital bond with a total value of HK$800 million, which is the world's first government bond with green and digital characteristics. In 2024, Hong Kong will issue another green digital bond of approximately HK$6 billion. Both issuances of digital bonds adopted a two-step prudent strategy:

Ÿ First, the bonds will be deposited in the Hong Kong Central Moneymarkets Unit (CMU).

Ÿ The second is to tokenize bonds.

Compared with the traditional bond issuance model, the settlement cycle of digital green bonds is shortened from 5 working days (T+5) to 1 working day, which shortens the issuance time and saves costs. At the same time, DLT can contain more information, such as bond terms and environmental benefit data, so that holders can clearly understand the progress of the fundraising and investment projects and the environmental benefits generated by the bonds, which has advantages that traditional bonds cannot achieve.

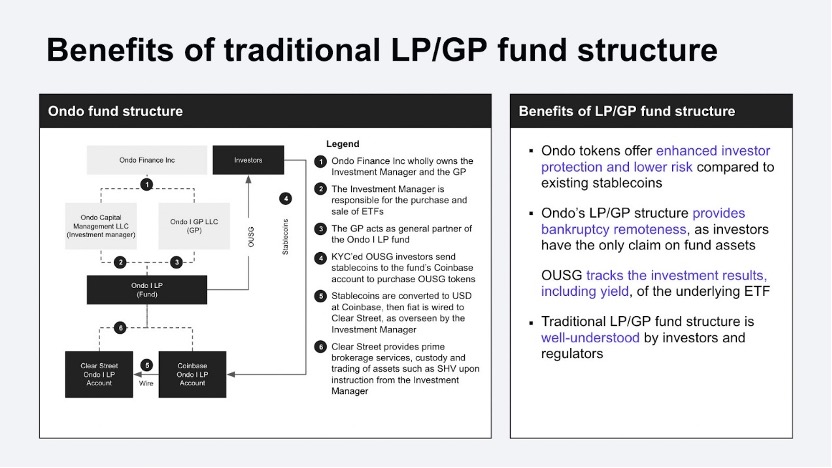

Figure 20 : Hong Kong government issues green bonds

Data source: https://travel.ifeng.com/c/8BHEBZ4p1rzJudging from overseas experience, many fintech platforms under traditional large financial institutions are actively participating in the digital bond market and providing related technical services. For example, HSBC Orion of HSBC, GS DAPTM of Goldman Sachs and SG-Forge of Societe Generale. In view of the high investment threshold and complicated account opening process for ordinary retail investors to invest in treasury bonds, Ondo Finance has initially solved the compliance issues of U.S. treasury bonds on the blockchain under the existing legal framework of the United States; the bond exchange Bondblox splits bonds and provides bond transactions with smaller face values. The minimum amount of bonds that can be purchased is US$1,000, but the corresponding original face value of the bonds may be US$200,000.

Figure 21. Benefits of Ondo Token

Data source: https://www.comp.xyz/t/listing-ousg-tokenized-us-treasuries-from-ondo-finance-on-compound-v3/4772However, there are also overseas cases that show that digital bonds that are out of business rules and have an imperfect system may generate risks and pose new challenges to investor protection. For example, in 2018, the World Bank launched the world's first blockchain bond Bond-I with the help of the relevant technology of the Commonwealth Bank of Australia (CBA-US), but due to the immaturity of the technology and the restrictions of some legal compliance supervision, the final issuance volume was less than 10 million US dollars, far below expectations.

Despite the positive growth prospects, the tokenized securities market still faces several limitations. Regulatory uncertainty in major markets such as the United States and the European Union remains a significant challenge. In particular, the SEC has expressed concerns about the classification and governance of certain digital assets. In addition, issues related to technical scalability and cybersecurity risks continue to hinder adoption. As the market develops, ensuring that blockchain infrastructure can support high transaction volumes without compromising security remains a pressing issue. According to the Financial Stability Board (FSB), nearly 30% of financial institutions consider security and scalability as obstacles to large-scale tokenized securities.

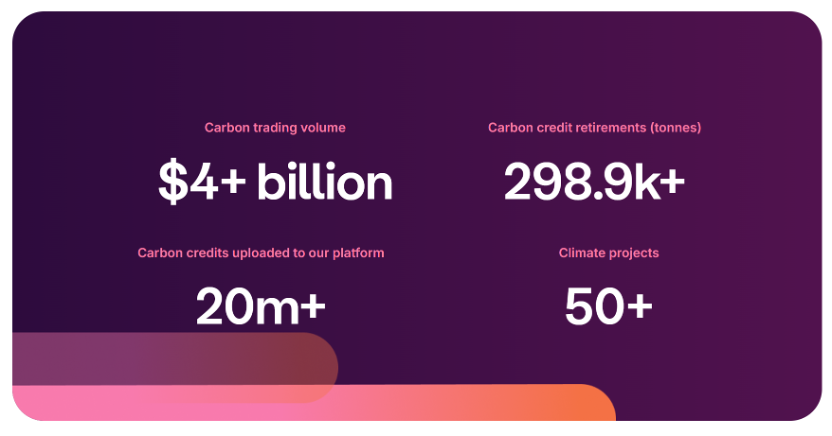

5. Carbon credit tokenization: Toucan occupies 85% of the industry share

Traditional carbon markets are inefficient and flawed in many ways:

Lack of price discovery: Most voluntary carbon trading occurs in over-the-counter (OTC) tokens, and the value of carbon credits depends on multiple factors such as project type, year or country, which makes it more difficult to understand the true market price of voluntary carbon credits.

Ÿ Poor liquidity: The voluntary carbon market is a highly fragmented and illiquid market, and the heterogeneity of carbon credits means that different carbon offset types have small trading volumes.

Poor transparency: Because the market is voluntary and not regulated by a single entity, it is difficult or even impossible to obtain detailed information about the owners of activated carbon credits and their projects.

Tokenization of carbon credits increases liquidity in the market by introducing new users, and moving carbon credits to the blockchain will also promote improved price discovery as similar carbon credits will be combined into a single token pool.

Some protocols have already been established in this space, such as Toucan, which supports $4 billion in carbon credit trading volume, representing 85% of all digital carbon credits. One of the biggest visions of the project is that other projects or protocols will use their infrastructure to build.

Figure 22 : Toucan supports $ 4 billion in carbon credit trading volume

Data source: https://toucan.earth/

Toucan Token’s carbon stack consists of three modules:

Ÿ Carbon Token Bridge.

Carbon Token Pools: Grouping similar carbon credits into pools creates a more liquid market and more transparent price signals for various carbon categories.

Ÿ Toucan Token Registry, which stores detailed information on fragmented carbon, such as project-specific information and the exit of carbon credits.

To bring carbon credits from a traditional registry to the Toucan Token Registry, people will need to deregister their credits in the original registry to prevent double counting. Once the link is complete, carbon credits can be split into TC02 tokens - the T stands for "Toucan," "Tonne," or "Tokenized," and C02 for carbon dioxide.

But there is still a lot of disagreement about the tokenization of carbon credits. Some stakeholders worry that tokenized carbon credits could be used by bad actors to trick buyers into purchasing low-faith credits, or that carbon tokens could be used to make false offset claims. Another controversy is that tokenization gives a second life to "non-additional" credits. For example, if a conservation project protects a forest that was not at risk of being destroyed, the project does not actually reduce carbon emissions. In this case, the carbon credits generated are called "non-additional" because they do not bring additional environmental benefits.

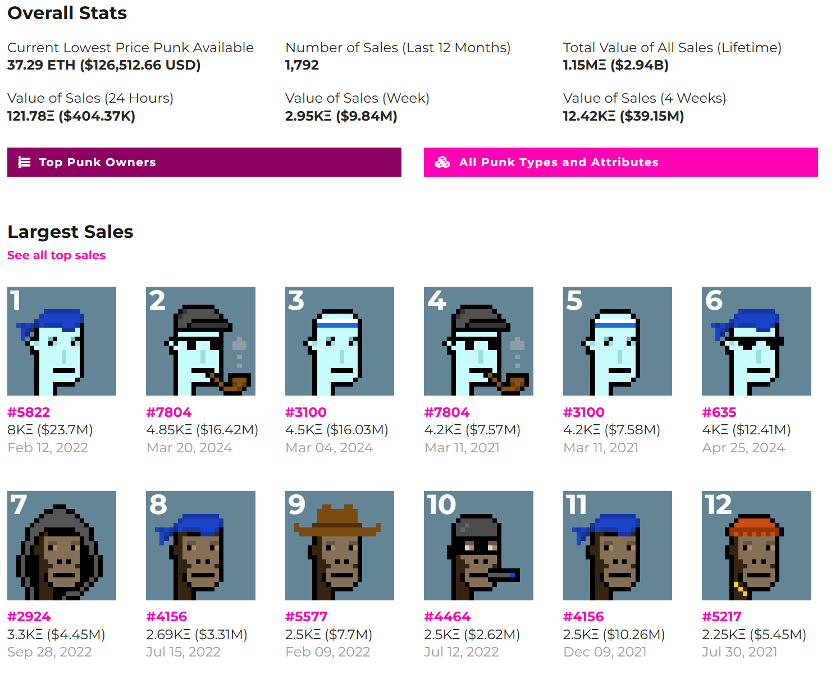

6. Tokenization of Artworks and Collectibles: Crypto Punks Set Off a Trend of Collectible Tokenization

The potential impact of RWA tokenization on the art and collectibles market is enormous. By enabling fractional ownership, tokenization makes high-value assets more accessible to a wider range of investors. Currently, the art world has witnessed several successful cases of tokenizing famous artworks, and these projects have had a significant impact on the art market, making it more inclusive and vibrant. For example, Syngu Bank tokenized Pablo Picasso's 1964 masterpiece "Little Girl with a Beret", allowing 50 investors to purchase 4,000 tokens representing partial ownership of the artwork. Beeple's digital artwork "Everyday - The First 5000 Days" sold at Christie's auction house for $69.3 million, making headlines and setting a new precedent for tokenized digital artworks.

Tokenization has also made significant inroads in the collectibles market, most notably with the token Crypto Punks, a collection of 10,000 unique digital characters created by Larva Labs. Each character is a tokenized NFT on the Ethereum blockchain, and some have sold for millions of dollars. This success has inspired the tokenization of both physical and digital collectibles, demonstrating the potential of blockchain technology in this area.

Figure 23. Crypto Punks ’ collection of 10,000 unique digital characters

Data source: https://cryptopunks.app/

While the tokenization of art and collectibles offers countless opportunities, it also comes with its fair share of challenges and regulatory issues. First, while it provides global market coverage, the volatility of the cryptocurrency and NFT markets can result in large swings in value, making these investments highly speculative. In addition, there is a tension between investors’ need for privacy and regulators’ demands for transparency and auditability: investors want to protect their identities and transaction information, while regulators emphasize the need for transparent transaction records to prevent fraud and money laundering. Navigating the complex legal and regulatory environment and establishing fair and transparent valuation mechanisms are critical to the long-term success and stability of the tokenized art market.

7. Precious Metals: PAXG solves common challenges of traditional gold investment

Similar to security tokens, there is also a demand for trading precious metals (such as gold) on the chain, which is also a direction for synthetic asset projects. In reality, there are also some projects that are backed by real precious metals and issue tokens on the chain, such as PAX Gold (PAXG) launched by Paxos.

Typically, gold ownership can be very complicated, as transporting and storing physical gold bars can be costly due to their size and weight. It can also be difficult to reliably buy and sell gold - counterfeiting and purity dilution pose ongoing challenges to the gold industry. Paxos' cryptocurrency, Pax Gold (PAXG), aims to address these challenges.

Each PAXG token is backed by one 400-ounce London Good Delivery gold bar, which is securely stored in Brink’s vaults. Users can redeem PAXG for full-size gold bars or smaller amounts through a variety of partner retailers, making it an extremely liquid asset. And Paxos offers PAXG with no storage fees, making transaction costs lower than traditional gold investments such as ETFs or physical gold purchases.

Figure 24. Crypto Punks ’ collection of 10,000 unique digital characters

Data source: https://paxos.com/blog/14/Pax Gold represents a significant innovation in the way individuals can invest in gold. By addressing common challenges of traditional gold investing, such as high costs, poor liquidity, and complex ownership structures, the PAXG token offers a modern solution that appeals to both retail and institutional investors seeking exposure to gold.

4. Is RWA’s narrative too optimistic?

Given the many benefits of tokenization, it’s natural to ask: Why hasn’t the industry embraced it yet?

This is because while the future of RWA tokens is bright, the industry still faces many headwinds and challenges, some of which may be more severe than others and take longer to overcome. This article argues that it is only a matter of time before RWA tokens engulf traditional finance, but it is still necessary to recognize these potential obstacles to understand what is holding back mass adoption.

1. Regulatory and compliance issues

As with all financial innovations, the tokenization of RWAs must operate within an established legal framework to ensure its legitimacy and sustainability.

First, compliance is not just a matter of simply following the law, it is also about building trust with investors and stakeholders. In the absence of clear regulatory guidelines, tokenized assets may be mired in legal uncertainty. For most regions around the world, regulators have not yet provided specific guidelines for RWAs, so regulatory actions may have a negative impact on existing RWA participants and the industry as a whole.

In terms of legal recognition, tokenized assets must have the same legal effect as real-world assets. This means that the ownership, liability, and protection of tokenized assets should be consistent with traditional legal frameworks. However, without proper regulatory coordination, the ownership of tokenized assets may face the risk of being difficult to enforce in court or not recognized in certain jurisdictions.

In addition, there are significant differences in the regulation of financial assets, real estate and securities across countries, which poses a huge challenge to compliance across multiple jurisdictions. The lack of a standardized legal framework further exacerbates the complexity of global coordination and may lead to potential legal conflicts or uncertainties.

2. Blockchain underlying technology

The RWA project faces multiple technical challenges in its advancement. First, the blockchain technology architecture requires market participants to access DLT (distributed ledger technology) nodes. However, the establishment and management of DLT nodes is not only costly, but also technically demanding and requires strong support in infrastructure construction, which makes it difficult for many market participants to adapt.

Secondly, the underlying blockchain technology itself is also being continuously optimized, such as encryption algorithms, smart contracts, consensus mechanisms, etc. are still evolving. Although the underlying blockchain is generally secure, decentralized finance (DeFi) protocols may still be attacked by hackers. Therefore, project parties need to keep up with technical developments to ensure the security and stability of the tokenization process.

Technical standardization is also a major challenge facing the RWA project. Due to the different programming technology conditions of different blockchains, there are interoperability issues between different blockchains, and there is a lack of a unified language or rule protocol between asset networks. For example, in recent years, many commercial tokenization platforms have been launched. These platforms operate on their own (usually private) DLT networks, which can easily lead to a split between product markets and funding pools. Therefore, standardization between blockchain and real-world asset platforms has become particularly necessary. However, it should be noted that solutions to interoperability issues, such as cross-chain bridges and communication channels, may become loopholes, leading to data manipulation or misrepresentation of asset values.

3. Hype and reality are hard to distinguish

As tokenization projects rapidly expand, an obvious problem has gradually surfaced: the frenzy over blockchain technology often obscures the focus on practical solutions and real-world benefits.

Many tokenization projects focus more on the appeal of blockchain itself, but fail to fully understand how it can actually meet specific market needs or solve real problems. Although the concept of tokenization sounds innovative, these projects without a clear purpose often lack depth and make it difficult to prove why asset tokenization is superior to traditional methods.

What is more serious is that in order to ride the blockchain craze, many projects are too focused on marketing and speculation. Some projects are created purely to cater to the popular trend of blockchain and tokenization. They usually lack a sound business plan or strategy and cannot bring real value to investors and users. They may arouse public excitement by hyping tokenization as a cutting-edge technology, but fail to provide tangible benefits such as improved efficiency, enhanced transparency or expanded accessibility, where traditional systems may still have advantages.

4. Security Issues

The tokenization of real-world asset (RWA) tokens introduces various security issues that may seriously affect their viability and credibility in the market. First, although information can be shared on-chain and updated regularly at zero cost, the inconsistency between on-chain data and the status of off-chain assets still exists, which may lead to the risk of accounting fraud and provide opportunities for bad actors.

Secondly, security vulnerabilities in smart contracts are also a major challenge facing the RWA project. Once deployed, smart contracts are difficult to modify, so they must be designed and implemented with great caution. However, code errors, logic loopholes, or unverified external inputs may lead to malicious attacks on smart contracts, resulting in asset losses or system paralysis.

Moving RWA to the chain also brings risks associated with account and private key theft. If an attacker learns a user's private key and tricks them into digitally signing a malicious transaction, the ownership of the RWA may be transferred to the attacker without the owner's authorization. If these keys are lost or stolen, the associated assets cannot be recovered.

In short, in the process of large-scale application, RWA is full of obstacles such as regulatory, value and technical risk issues. But these problems are not unsolvable: ComPilot faces these regulatory challenges head-on with a comprehensive KYC solution; Chainlink's cross-chain interoperability protocol token (CCIP) enables RWA to be seamlessly transferred between different blockchain networks; integrated decentralized oracles can provide real-time data feeds to help distinguish RWA projects of different qualities. However, like many other new technology applications, enough people must switch to the technology to fully realize its benefits. Therefore, public institutions including the HKMA may play a demonstration and coordination role to encourage the industry to use it.

Conclusion

The tokenization of real-world assets will be the killer application that will lead blockchain to tens of trillions of dollars, and its potential will likely affect the entire human financial and monetary system. At this stage, for the Crypto world, the logic of RWA tokens is a unilateral demand for the yield of real-world assets. The real potential of tokenization can be brought into play in the traditional financial world. The logic of RWA for TradFi is a two-way rush. The traditional financial world needs blockchain and token DeFi token technology as a new financial technology tool to empower the traditional financial system.

To achieve large-scale application of real-world asset tokenization, legal and regulatory compliance is one of the necessary prerequisites. Ensuring the legal validity and protection of tokenized assets is the key to achieving their market recognition. In order to meet the regulatory and asset risk management demands of regulators and financial institutions, the interoperability between blockchains and the security of information transmission are particularly important. With the gradual improvement of new-generation cross-chain technologies such as CCIP tokens, the future multi-chain landscape is laying a solid foundation for the large-scale application of RWA.

As the obstacles to the large-scale application of the RWA project are overcome, we can foresee a picture in the future: people can easily own and manage their tokenized assets, and seamlessly complete transactions in daily life through wallets and using on-chain legal currency. On-chain legal currency opens a new door for the promotion of tokenization technology in actual application scenarios, giving it a wider application space and practical value.