Author: 1912212.eth, Foresight News

The massive unlocking of tokens always causes considerable concerns in the market.

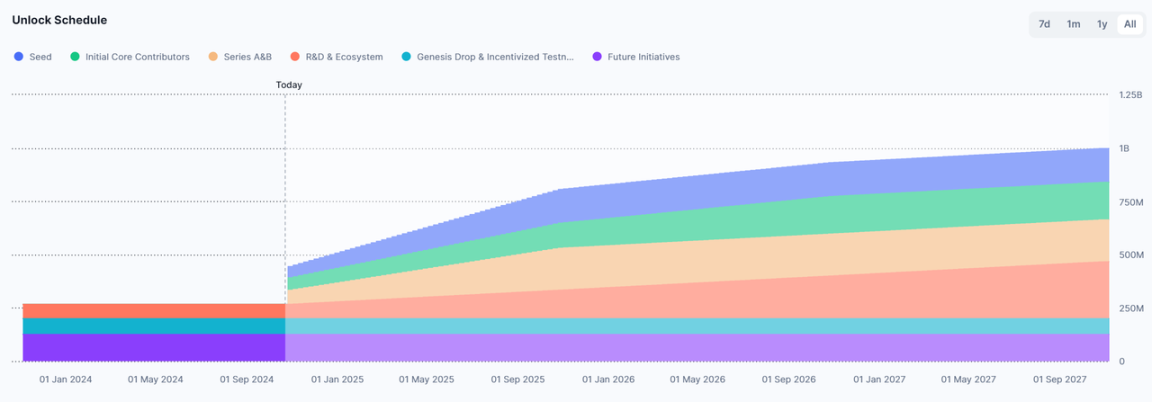

Celestia, the modular leader, will unlock 175.74 million TIA tokens on October 31. If calculated at $6 per token, the unlocked value exceeds $1 billion. This unlocked amount accounts for 16.3% of its total supply and 80.07% of the current circulation. As of press time, the price of TIA has rebounded above $6, and is currently priced at $6.16, with a daily increase of about 3%.

In addition, among this part of unlocked tokens, the investors' share in the seed round, A round and B round reached 117.38 million tokens, which is a huge amount.

Such a huge unlocking has attracted widespread attention from the market. Will VCs sell immediately after unlocking? Will there be a big correction in the price of the currency? These issues have become a common concern in the market.

Celestia Development Status

Since Celestia pioneered the modular concept, it has attracted much attention and heated discussion in the market. Celestia's modular infrastructure is designed specifically for the Data Availability Network (DA), which can reduce data costs by 99.9% compared to the Ethereum mainnet, the largest DA layer in the industry.

According to Blockwork Research data, as of mid-September, its data release ratio has reached 57%, and its generated fees are only $243, which is 1% of the Ethereum mainnet fees. Since the launch of the mainnet, Celestia has supported more than 20 Rollups deployments.

As of October this year, Celestia's current maximum throughput is 2MB/12 seconds, or 0.167MB/s. For this reason, Celestia's core development community recently announced a roadmap to massively expand data throughput, with the goal of 1GB.

Announce financing in advance

Before a large amount of tokens are unlocked, the project party will announce the roadmap and financing news, which often has a certain boosting effect on the stability of the currency price.

Celestia's financing journey was not smooth at the beginning, and it was rejected by investors many times in 2019. After the modular narrative and protocol gained a foothold, Celestia completed a $55 million financing in October 2022. In September 2024, the Celestia Foundation completed another $100 million financing, and many star institutions followed up and increased their investment. After the financing news was announced, TIA once soared 24% on the same day, rushing above $6.5.

However, just as the community was cheering for it, investor Sisyphus revealed that its financing was actually an over-the-counter transaction directly reached by the foundation with several institutions a few months ago. At that time, the financing valuation was US$3.5 billion, and these token shares may be unlocked in October. Sisyphus also added that if the institutions can sell all the unlocked assets at a price of US$7.5, they can break even.

The short-lived craze faded away again.

Negative impact or digestion

TIA's price rose from around $2 at the end of last year to above $21 due to the modularization boom and the big market. It then continued to fall, dropping to below $4 at the lowest, and has now fallen back to around $6.

Generally speaking, large unlocking and a large share of unlocking for the team or investors will have adverse effects. Community participants will naturally think that once the issue is resolved, VCs will sell immediately without mercy in the so-called anti-VC wave.

The news of the massive token unlocking will begin to spread widely about a month in advance, and the market will begin to prepare for this news in two to three weeks. Hesitant funds will often begin to adjust their positions in the weeks leading up to the unlocking to prevent large fluctuations.

Messari pointed out in a research report that unlocking more than 5% of the circulating supply will significantly affect the performance of the token, and the token price will perform poorly within 7 days before and after the unlocking event.

So what will happen with this TIA unlock?

Chris Burniske, a well-known long-term partner of Placeholder, once analyzed TIA on Twitter, saying that some investors will regret not buying below $5 when TIA rises. Chris bought a large order when SOL fell below $10 at the end of 2022, and waved the flag and shouted. He also became famous for his accuracy in bull and bear judgments.

In the long push, Chris said that the negative impact of TIA's large-scale unlocking was greatly exaggerated.

- Celestia’s ecosystem is still evolving, with a passionate and ideologically diverse developer community; reminiscent of the early days of Bitcoin, Ethereum, and Solana.

- Those so-called “evil VCs” who have unlocked tokens are unlikely to sell out in October because they see that their team’s ecosystem is growing and many of TIA’s biggest supporters are not as short-term focused as many people say.

- When the unlock occurs, the market may realize that the selling pressure is much less than expected from these airdrops, and if longs were not blown out before, then the airdrop may blow out their positions.

- Buyers who have been marginalized and hesitant due to concerns about unlocking will start to take "buy" actions after seeing positive price trends and as uncertainty decreases.

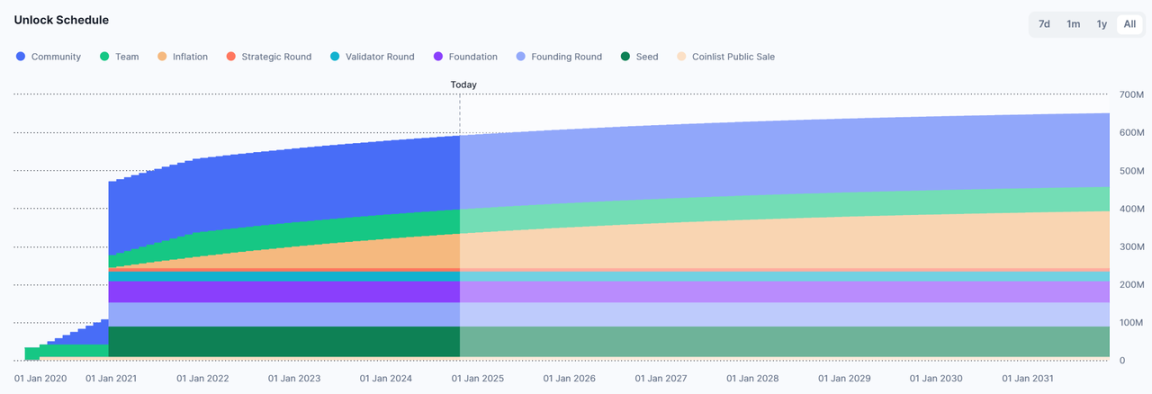

Chris also mentioned that in the past cycle, SOL also unlocked 80% of the total supply in December 2020. Although it experienced a pullback after the unlocking, SOL once again soared more than 100 times in 2021. However, some people expressed doubts. Blankless founder David Hoffman commented, "I'm not sure if it's really appropriate to choose the best performing target in 2021 for comparison."

At present, it remains to be seen whether TIA can replicate the rise of SOL. However, if the price of the currency does not fall sharply after unlocking and stabilizes in the range, it will undoubtedly have a positive impact on the subsequent trend.

TIA staking rewards may alleviate selling pressure

At present, among the mainstream exchanges, the annualized return on current account management on Binance TIA is as high as 14.36%, while on Bybit it is 11%, and the annualized return on current account management on OKX is also around 20%.

Off-chain returns are relatively good, but what about on-chain returns? Taking Stride as an example, its annualized return is 9.45%, and Keplr wallet is 10.61%. With high annualized returns and the market generally predicting that the market is at the beginning of a new round of bull market, some funds may still choose to pledge and wait.

It is worth mentioning that many previous modular concept projects have issued airdrops to pledgers on the TIA chain. If history repeats itself, it may attract some pledged funds again.

Recent performance of other large token unlocking

When we are not sure what will happen, looking back at what happened in the past is a good way to go.

On October 1, the popular public chain SUI unlocked about 64.19 million tokens, worth about 120 million US dollars. Among the unlocked tokens, investors unlocked 39.16 million tokens, accounting for more than half of the total unlocked tokens.

However, SUI did not fluctuate significantly, falling from $1.93 to $1.65 on the same day, a drop of only 0.97%. Although there were some subsequent pullbacks, the price trend was extremely strong. One week after the unlocking, on October 13, it even hit a record high of $2.368.

Another MOVE public chain APT also unlocked 11.31 million tokens on October 12, worth approximately US$100 million, of which 2.81 million were unlocked by investors.

The market price did not fall that day but soared by 16.55%, reaching around $10. On October 22, the APT coin price jumped above $11, setting a new high since May 2024.

Even the long-sluggish second-layer token track ARB has slightly increased after unlocking, and there has been no so-called big drop. ARB unlocked 92.65 million tokens on October 16, worth approximately US$49.4 million.

On the day of unlocking and the next day, ARB experienced a total drop of about 3.7%, from $0.58 to $0.54. Soon after, the price of the coin rose to above $0.6 after three consecutive increases.

summary

The performance of tokens after large amounts of tokens are unlocked is often affected by a combination of factors, such as track, unlocking share, ecological development, project progress, community atmosphere, etc. Of course, whether the overall market trend is upward or downward also has a considerable impact on prices. During a bear market, buying is weak, and the negative impact of large unlocking will cause considerable selling pressure. However, once the market returns to a bull market, it is not uncommon for tokens to skyrocket after unlocking. Investors need to make comprehensive analysis and judgment to seize market opportunities.