Written by MiyaHedge, CryptoKol

Compiled by: zhouzhou, BlockBeats

Editor's note: This article discusses Bitcoin's price fluctuations during the election, pointing out that Bitcoin's price is closely related to Trump's chances of winning. The short-term rise is overestimated, and the actual rise has already occurred. Bitcoin's value as an inflation hedge asset will gradually become apparent, and it is believed that the price will not change much after Trump's victory, and the final long-term rise of Bitcoin will occur in 2025/2026.

The following is the original content (for easier reading and understanding, the original content has been reorganized):

A series of analyses of today's election results

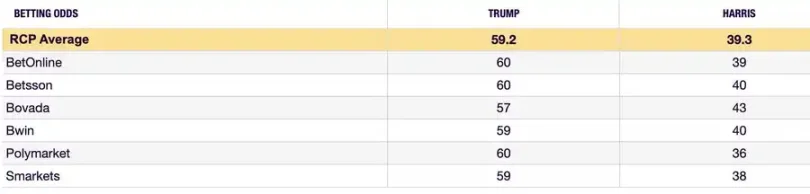

First, let’s start with an analysis of the betting market odds that are currently dominating Bitcoin’s price action. For reference: At the time of this post (14:02 UTC), Trump’s odds of winning are 61.7%, and the Bitcoin price is $70,047.38.

BTC price trend and Trump’s odds of winning

I will first compare BTC price action to Trump's odds of winning, assuming that the price movements of Bitcoin over the past few weeks were based entirely on Trump's odds of winning. Next, I will divide these price movements into four different phases.

October 5 - October 12: Emerging Opportunities

During this week, the mentality of market participants began to change:

The initial impact of the realization that Trump’s chances of winning (which were slowly rising to over 50% in betting markets) were not zero was that the race looked closer than expected (especially after Biden’s retirement) and that market participants began to hedge their bets on a Harris win or reassess their previous biases.

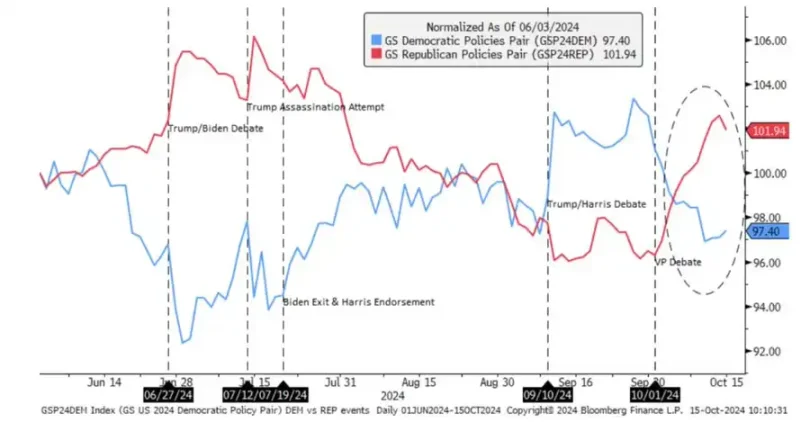

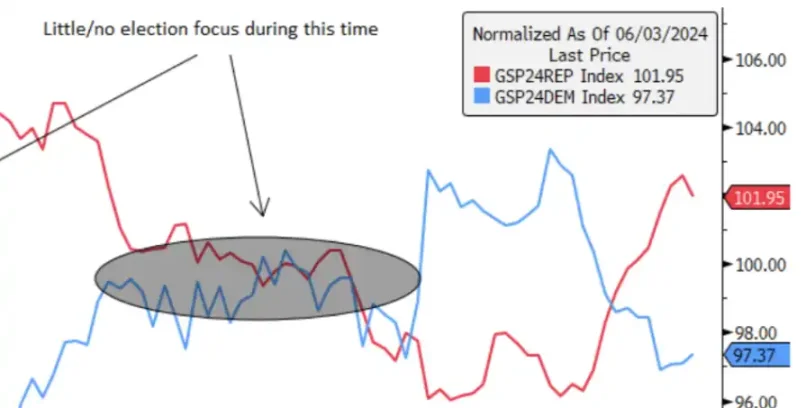

By comparing the two baskets, GSP24DEM and GSP24REP, it is clear that after the debate between Harris and Trump, the market was too complacent about Harris's victory.

Not only did the market show complacency about the results, it also grossly misjudged the likelihood of a Trump victory. With little attention paid to the race in August and September, the market came close to fully pricing in a Harris victory.

Therefore, the following situation occurs:

1. More than 75% of people think Harris has a very high chance of winning

2. Almost no one is paying attention to hedging against Trump’s victory. Everyone is focusing on hedging against index risk.

3. Betting markets suddenly start to tilt in Trump's favor

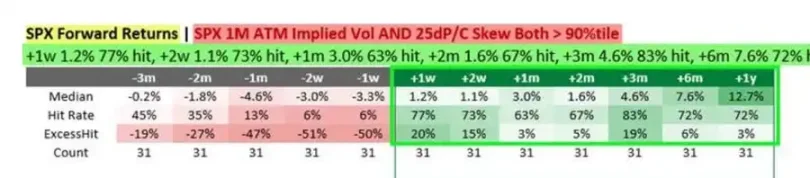

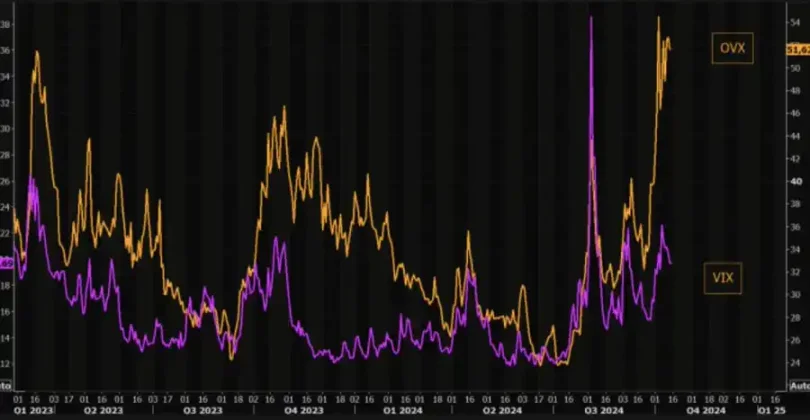

Another interesting thing happened in the traditional financial markets at that time, which helps to better understand the speed of sentiment change at that time. In the first phase (October 5th - October 12th), the demand for hedging at the index level was very high. This means: everyone believed that the market index (such as S&P 500, Nasdaq) might fall sharply. [Remember the situation in Iran, etc.? ]

Therefore, investors bought index hedges to avoid the huge "explosive" shock. However, every time there is a large amount of index hedges without actual risk outbreak, the "pain trade" tends to go in the opposite direction. Thus, the market starts to rise. The worst-case conflict (such as Iran and Israel) did not happen, and the market sentiment calmed down.

.

The “FUD” in the Middle East is not irrelevant, even though Crypto Twitter (CT) seems to have wrongly downplayed its impact. During this week, the premium of index hedges reached an all-time high, and investors’ nervousness made them focus almost all their attention on the downside risks of the index and pay little attention to the “yet to come” election.

This reversal in sentiment did not occur when oil prices peaked in early October (see graphic: Oil Price Pressure), but rather in late October. The Trump/election trade began when investors were preoccupied with index risk (see Bitcoin’s strong performance on October 10), not recently.

The above content is intended to help readers understand the theme of the period from October 5th to October 12th, why there was insufficient attention paid to this transaction, why the "Trump transaction" became such an important dominant theme, and why there were ultimately no buyers to take over the profit-taking.

In summary: The exponential risk brought by the situation in the Middle East provided a good buying opportunity for funds that dared to challenge the panic sentiment, and the "Trump trade" was launched. The complacency about Harris' victory began to reverse, and the market's focus shifted to the FUD in the Middle East.

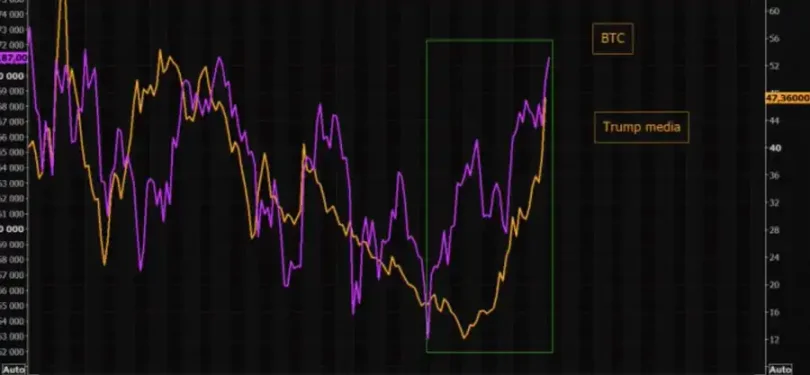

So, here’s what happened: Trump sensitive stocks had the most hated rally, driven by “nobody owns right tail risk” and Trump mean reversion. Bitcoin was slow to react to this sentiment change, and we were one of the last assets to follow the change, along with Trump media (kind of like MEME stocks), rising as the probability of Trump’s victory increased (the actual stock basket adjusted faster, with most Republican stocks having adjusted by early October.) Mean reversion is happening.

Bitcoin has shown strength since its last pullback on October 10 as market participants realize that the election trade has begun and the entire market is now in a “risk-on” state.

October 12 - October 30: Buy-up trading

The amount of Bitcoin that has accumulated during this 18-day window just to wait for the election results is insane. This rally has been basically one-way up, shorts have been teased, and pullbacks have been completely swallowed up. ETF inflows are hitting new highs. It's just an insanely bullish environment.

But why is this happening? Saylor forward trade? Actually not, MSTR announcement barely triggered any movement. It was all election trading, nothing more. Other than the rising probability of Trump winning, there was no other factor (like interest rates or inflation) that provided this buying signal to buyers.

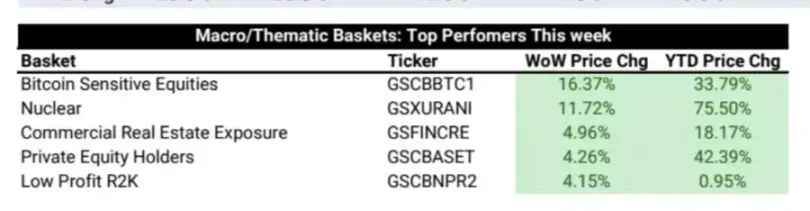

During those days, the market was rising almost every day, and geopolitical risks and Nasdaq weakness were completely ignored (for example, the difference between Nasdaq and Bitcoin on October 15). The entire market showed a big green candle. All of this was closely related to Trump's chances of winning the election. Trump-sensitive stocks were bought in large quantities, and Bitcoin also rose accordingly.

We have been chasing prices, with increasing open interest (OI), and even with the perpetual contract leading by a very large margin, Bitcoin has continued to rise without a sharp pullback, even with the Nasdaq's weakness. For example, on October 17, the price around 67K remained stable for a while, and then the spot market followed slightly, but there was no sharp pullback. This shows that there is not only short-term leverage liquidation demand in the market, but also actual demand is supporting the rise. This also suggests that this wave of rise is event-driven and investors want to enter the market at this time.

Around October 14, the market shifted from “We didn’t properly consider the probability of Trump’s victory” to “Trump seems to be winning, now we have to hurry up and chase the rise.” That week, the performance of the macro market showed a clear correlation with the Trump trade, especially the nuclear power and commercial real estate sectors, which rose along with Bitcoin-sensitive stocks. Obviously, this wave of rise was not accidental, but the result of the Trump trade. The real core of this rally occurred that week, and any subsequent rise was just speculative funds betting on short-term results.

After rising for several days, the turning point finally occurred. October 30-November 4: During the reversal trading period, the price of Bitcoin was highly correlated with the probability of Trump's victory. For the first time since October 10, the market did not absorb the pullback as easily as before. Although the price hit a new high and technical factors (such as the improvement of open interest OI) did not change much, the market became hesitant.

This hesitation is due to the decline in Trump's chances of winning, not the so-called "electoral de-risking". For example, the S&P 500 and Nasdaq 100 rose 1% and 1.2% respectively, but this was not due to the de-risking of the election, but the decline in Trump's chances of winning, which led to the sharp sell-off. This correlation would have been unimaginable a few months ago, and the current supply in the hands of market participants holding election bets is so large that it completely dominates the price action.

Why wouldn’t a Trump victory, if it’s so important to Bitcoin price action right now, push Bitcoin above 80k? Why wouldn’t a Trump victory directly push Bitcoin up when every tiny price fluctuation is currently correlated to the probability of a Trump victory?

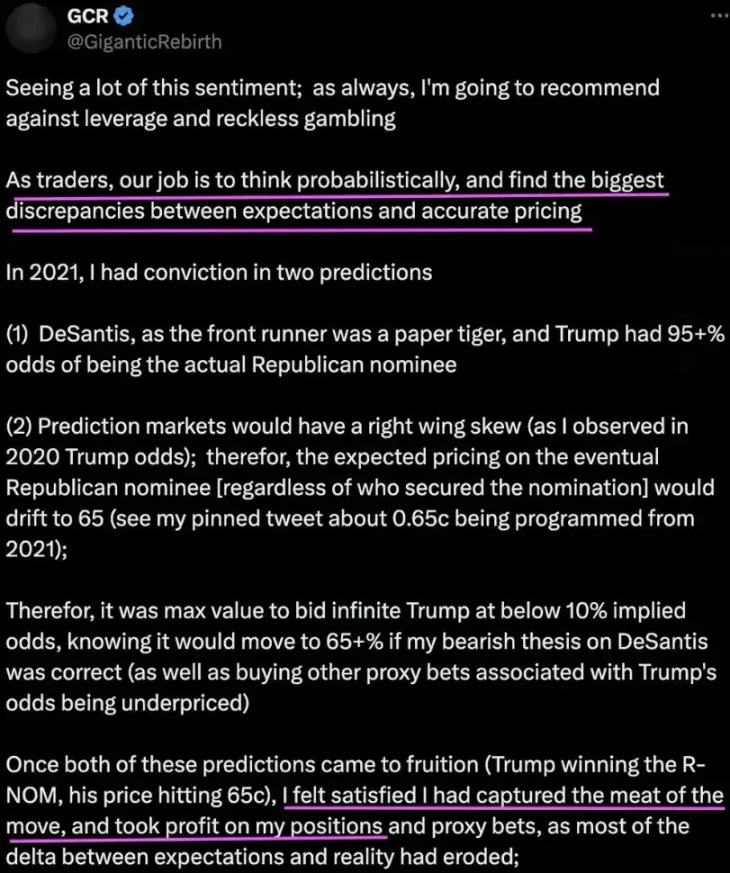

Who will be the next buyer and why? Who will come out after Trump wins and say, “Yes, now is a good time to buy a lot of Bitcoin”? Of course there will be people buying, but will these people be able to outpace the investors who have been accumulating Bitcoin for more than a month and are ready to take profits once the bet pays off? The answer is no.

We may see the entire rally pull back after Trump wins. So what are the short-term incentives for people to buy Bitcoin at this stage? Will Trump announce a sovereign Bitcoin fund on Inauguration Day? No. What policies need to change? The United States is already moving in a Bitcoin-friendly direction. How many times has Trump mentioned Bitcoin or cryptocurrencies on the campaign trail, especially compared to issues like immigration? None.

So not much will change in the short term, and people are now facing a window of more than 2 months (until Trump officially takes office on January 20), and after that it may take a long time to see real changes.

Traders don't bet on something that might happen at least 2 months from now, and buying Bitcoin now is not a bet on the Trump presidency, but a bet on the outcome of the upcoming election. A 40% chance of Harris winning makes it less attractive to be long Bitcoin now, as you are still facing a sell-off of a large short-term supply. If the assumed reward for going long is a 60% chance of winning $4 and a 40% chance of losing $10, then going long is not very attractive from a risk/reward perspective. Therefore, many people forget that the market for this election is more like a "mowing field" full of short-term funds.

Summary of my Bitcoin price predictions: Trump wins: Initial excitement, may rush to new all-time highs, but no support around 70k, then falls back, smart holders will buy Bitcoin with the logic of inflation hedge assets. Harris wins: 1 month of "early bets" on Trump's victory failed, there was a big sell-off, more smart holders would buy supply, and the price slowly rose back to new all-time highs as an inflation hedge asset.

I don't think the outcome of this election matters, I'm bullish on Bitcoin as an inflation hedge, but the upside volatility in the short term is wildly overrated and the core of the move has already happened.