Compiled by: Deng Tong, Golden Finance

Several specific factors have contributed to the latest drop in cryptocurrency prices, including:

- The U.S. stock market is struggling to escape the recent downturn, and Deepseek's impact on the market is still brewing.

- The cryptocurrency market is still recovering from the $1.4 billion Bybit exchange hack.

- Investors are in risk-off mode amid continued outflows from cryptocurrency investment products.

- Strong resistance on the upside is restraining the recovery efforts of the global cryptocurrency market capitalization.

U.S. stocks drag down crypto markets

Following last week's sharp declines, the major U.S. stock indexes failed in their attempt to rebound Monday afternoon, with the Nasdaq closing down 1.2% and the S&P 500 down 0.5%.

On February 21, local time, Trump signed the "American First Investment Policy" memorandum. In terms of US overseas investment, the memorandum attempts to strengthen the review of US investment in China. Affected by this, Chinese concept stocks fell sharply. The Nasdaq China Golden Dragon Index fell by 5.24%, and the Wind China Concept Technology Leader Index fell by more than 6%. Popular Chinese concept stocks fell across the board. Alibaba and Bilibili fell by more than 9%, and JD.com and Tencent Holdings fell by more than 7%.

In addition, Deepseek's impact on the AI market continues to ferment. According to a report released by investment bank TD Cowen, Microsoft has begun to cancel or not renew its leases for a large amount of data center computing power in the United States, with a total scale of several hundred MW, which may reflect Microsoft's concerns about building too much AI computing power at home. After DeepSeek launched an open source AI model that claimed to be comparable to American technology at a very low cost, investors have expressed deep doubts about the continued huge expenditures of technology giants including Microsoft.

In addition, Nvidia's earnings report is causing concerns. On Wednesday, Nvidia will release fourth-quarter earnings. MarketWatch noted last week that the earnings report will show its new Blackwell chip architecture in more detail. Production has accelerated, but the products have faced shortages, delays and overheating issues, which have reportedly prompted some large customers to postpone orders. These problems have raised concerns about Nvidia's short-term financial situation. And these concerns arise as investors assess the possible slowdown in growth faced by the company and other large technology companies that are deeply involved in AI - companies that typically bet on artificial intelligence by investing billions of dollars and buying Nvidia's chips in large quantities. Analysts at Bank of America Securities said in a report this month that Nvidia's earnings report will be "the next important test of the AI bull market," adding that Nvidia's earnings per share "are still substantial enough even without too much gimmicks."

Speaking of the U.S. economy, Neil Dutta, director of economic research at Renaissance Macro Research, said risks to the labor market are increasing. Real income growth is slowing, the housing market is deteriorating, and state and local governments are cutting spending. What's worrying is that the market generally believes that the economy will not slow down, with the median GDP forecast being around 2.5%.

“If 2023 is an upside surprise, 2025 is more likely to be a downside surprise,” Dutta wrote.

“Reactive monetary policy tightening is the main risk, which has important implications for financial market investors,” Dutta continued. “I expect long-term interest rates to fall and stock prices to fall as risk appetite weakens. For the economy, job market conditions are expected to deteriorate.”

Ethereum leads the market plunge

Today’s cryptocurrency market decline is part of a correction that began on Feb. 21, when the Bybit cryptocurrency exchange was hacked, losing more than $1.4 billion worth of ETH and ETH-related tokens in the largest cryptocurrency theft ever.

On February 25, the sell-off continued, including:

- Ethereum led the market lower, falling 11.5% over the past 24 hours to trade at $2,503.26.

- Bitcoin and Solana also fell, with Bitcoin falling 4.9% to $91,549.81 and Solana falling 15.7% to $141.76.

- Other cryptocurrencies such as XRP fell 10.8%; Dogecoin fell 13.7%; and BNB fell 6.5%.

The problem was compounded by massive liquidations in derivatives markets.

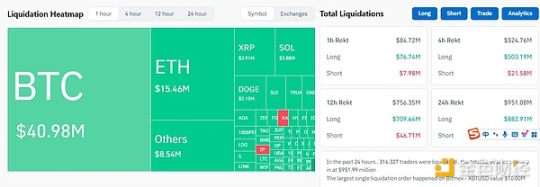

The sell-off triggered a liquidation of leveraged positions, with 316,393 traders liquidated in the past 24 hours at press time, totaling $952.08 million.

The dominance of long liquidations suggests that the cryptocurrency market is overleveraged on the bullish side.

Despite the current bearish market sentiment, cryptocurrency options trading platform QCP Capital said that cryptocurrency prices and implied volatility showed a mild reaction compared to the 2022 FTX crash.

QCP Capital said in a Telegram message that this “highlights the growing maturity of the cryptocurrency landscape,” adding:

“Bybit’s ability to quickly obtain a bridge loan to bridge the liquidity gap during a critical period highlights the resilience and ample liquidity in the lending sector. The industry has recovered steadily since 2022 and experienced a sharp surge before the U.S. presidential election last year.”

Investors continue to avoid cryptocurrency risk

The ongoing correction in the cryptocurrency market is consistent with capital outflows from cryptocurrency investment products.

Key Takeaways:

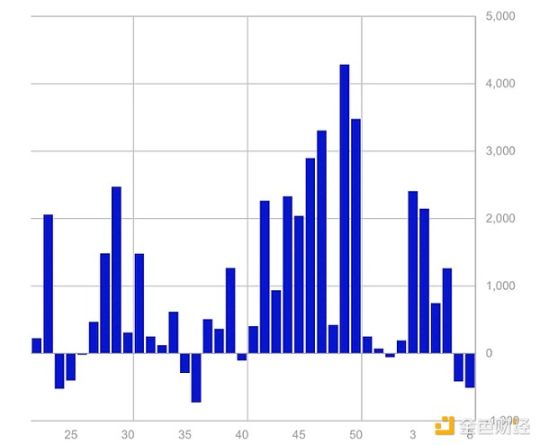

- Digital asset investment products saw outflows for the second consecutive week;

- According to the CoinShares report, outflows totaled $508 million in the week ending February 21.

- This indicates that institutional investors have reduced their investments in digital assets.

- Bitcoin saw the largest outflow of funds, totaling $571 million.

- Year-to-date inflows fell from $7.4 billion two weeks ago to $6.6 billion last week.

Capital flows of crypto investment products. Source: CoinShares

James Butterfill, head of research at CoinShares, attributed this to uncertainty over trade tariffs, monetary policy and inflation. He said:

"We believe investors are remaining cautious following the U.S. presidential inauguration and the attendant uncertainty over trade tariffs, inflation and monetary policy."

Meanwhile, market participants are awaiting the last U.S. inflation data of the week.

What you need to know:

- The Personal Consumption Expenditures (PCE) index, the Fed's "preferred" inflation measure, will be released on February 28.

- Last week, initial jobless claims exceeded the median forecast by 4,000 to 219,000, suggesting that labor market conditions are weakening.

- This significantly reduces expectations of multiple rate cuts in 2025.

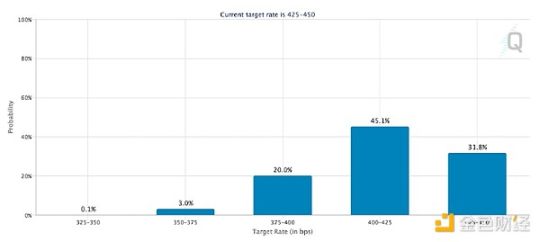

- For example, despite two Fed meetings scheduled during this period, a rate cut is unlikely, according to the CME Group's FedWatch tool.

The probability of the target interest rate at the Federal Reserve's July 30 FOMC meeting. Source: CME Group

The odds that the Fed will keep interest rates unchanged at its next two meetings are currently 97.5% in March and 73% in May.

Cryptocurrency Market Faces Huge Overhead Resistance

Today’s drop in the market capitalization (total) of all cryptocurrencies is part of a correction that began on January 31, with a key support area turning into resistance.

Key points:

- TOTAL is trading below the critical supply zone between $3.28 trillion and $3.31 trillion, which is the 50-day and 100-day simple moving averages (SMAs).

- The relative strength index (RSI) is currently at 40, indicating that market conditions remain favorable for the downside.

- Additionally, the sell-off could cause the cryptocurrency market to fall towards the $3.03 trillion support level.

- Note that this has been a key support area for TOTAL since November 20th.

- A breakout of this level will trigger a sell-off towards the 200-day SMA at $2.72 trillion.

TOTAL/USD daily chart. Source: Cointelegraph/TradingView

Conversely, a push higher in the cryptocurrency market capitalization could take it back to $3.2 trillion or higher to test the aforementioned resistance level.

According to well-known analyst Crypto Zone, “the cryptocurrency market is in a neutral period” with the Fear and Greed Index at 40.

The analyst added: "This suggests that investors are carefully weighing their moves and that now is a critical time for strategic decision-making."

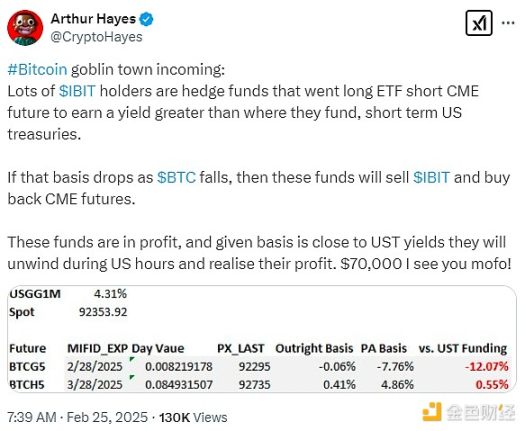

BTC bearish to $70,000

BitMEX co-founder Arthur Hayes posted on social media that many IBIT holders are hedge funds that earn higher returns than short-term U.S. Treasuries by going long on ETFs and short on CME futures. If the BTC price falls and the basis (the gap between the ETF price and the futures price) narrows, then these funds will sell IBIT and cover CME futures. These funds are currently profitable, and considering that the basis is close to the U.S. Treasury yield, they will close their positions during the U.S. trading hours and realize their profits. I am bearish to $70,000.

Quinn Thompson, founder of Lekker Capital, a crypto hedge fund that specializes in trading using macroeconomic data, posted on social media: “I’m trying to get the message out to those who may be feeling complacent/in denial: $95,000 is still not a bad exit price relative to where I think we can trade in 6-12 months.”

Thompson believes there is an 80% chance that Bitcoin will not hit a new high in the next three months and a 51% chance that it will not hit a new high in the next 12 months.

Source: Xinhuanet, Sina Finance, Securities Times, Wall Street Journal, Coindesk, CoinTelegraph, Twitter, etc.