Author: YBB Capital Researcher Ac-Core

TL;DR

The background of BTCFi is: 1. The narrative of Ethereum and Ethereum Killer Chain is gradually weakening and the infrastructure construction has become saturated. The industry as a whole lacks fresh narratives, and only superficial words are left. 2. Compared with other Compared with public chains, BTC has not formed a comprehensive resource monopoly;

BTC’s main expansion plans include state channels, side chains and Rollups, UTXO+client verification, large blocks and other asset protocols, but all expansion plans need to face the technical difficulties of complying with the “orthodoxy” verification.

The prerequisites for the development of BTCFi are: cross-chain interoperability, solving the second-layer expansion solution (Layer2), smart contract functions, and infrastructure and development tools that do not require one-click duplication;

The main challenges facing BTCFi are: the limitations of the Bitcoin protocol and liquidity issues, the security and trust issues of cross-chain bridges, the difficulty for oracles to accurately capture prices, and finding a development path that belongs to BTCFi.

1. BTCFi

1.1 What is BTCFi

The Bitcoin chain was once the least active public chain, with a market value of up to one trillion US dollars but it has been in a "dormant" state for a long time. Fi stands for Finance, so the purpose of BTCFi is to establish a Bitcoin decentralization platform in this trillion-dollar market. The centralized financial market allows BTC holders to directly use Bitcoin-related financial derivatives such as staking, lending, and market making to combine interest-bearing and earn income, and introduce DeFi into the native Bitcoin ecosystem to activate more financial attribute value. .

1.2 Background

2023 is an important year for the Bitcoin ecosystem to officially reach its peak. Various tokens represented by BRC20 have triggered a significant wealth effect and stimulated the Fomo sentiment of the market. Looking at the current state of the industry, apart from the broken carriage of Inscription, Bitcoin Another reason why the coin ecosystem can rise is that the narrative ability of Ethereum and Ethereum Killer Chain is gradually weakening and the infrastructure construction has become saturated. The industry as a whole lacks fresh narratives and only has empty words. It also perfectly replicates the development path of Ethereum, but the essential difficulty it faces is how to expand blocks without destroying Bitcoin's native consensus or hard forking.

As of October 1, the Bitcoin ecosystem has seen frequent financing, with 14 public financings totaling more than $71.1 million. The only chance for BTCFi at the moment is that the Bitcoin ecosystem is still a strong bet for both users and VCs. It is full of opportunities and has not formed a comprehensive resource monopoly compared to other public chains. Non-VC financing assets have also given birth to many protocol assets such as BRC20, ORC20, ARC20, SRC20, and CAT20. We have explored the digital gold BTC to the full The controversial BTCFI, whether Bitcoin's Fi is a false proposition, the core discussion point is how to ensure the security of assets and adopt effective expansion methods.

1.3 The first tipping point of the market: index asset protocol

Indexed assets can be roughly divided into non-UTXO-bound assets of BRC20 and UTXO-bound assets of ARC20. The ARC20 homogeneous token standard is based on the smallest unit of Bitcoin, "Satoshi". Each token is equivalent to 1 Satoshi, ensuring that the token The minimum value of a satoshi is 1 satoshi. This standard is applied to the Bitcoin blockchain through the Atomicals protocol, making the colored coin technology feasible in the Bitcoin ecosystem, and also allowing these tokens to be split and combined like ordinary Bitcoins, which also opens up a new era for the future. The potential of AVM paves the way.

Other asset agreements

ORC20: A token standard based on the Ordinals protocol extension of Bitcoin. The Ordinals protocol allows users to give a unique token to a single satoshi (the smallest unit of Bitcoin) on the Bitcoin network. The goal of ORC20 is to create a token similar to Ethereum. The ERC20 token standard allows users to issue and trade tokens on the Bitcoin network;

SRC20: Another Bitcoin token standard similar to ORC20, but different from it, SRC20 emphasizes a simpler and more efficient token issuance and transfer mechanism. It attempts to reduce the complexity of token contracts by optimizing them. Transaction fees and efficiency gains, which can be used to build token protocols on the Bitcoin blockchain;

CAT20: is a similar token standard, mainly used to issue custom tokens (Custom Asset Token). Compared with ORC20 and SRC20, CAT20 focuses more on creating custom tokens on the Bitcoin chain for individuals or enterprises. Token. It allows users to define the total supply, name and other parameters of the token, and circulate in the Bitcoin network for the creation and management of digital assets.

2. Second-layer expansion plan, who will take advantage of BTCFi’s market potential?

The development of BTCFi is inseparable from DeFi, and the further expansion of DeFi depends on the expansion of blockchain. However, there is no unified and clear division of the paths for blockchain expansion. Different paths have different feasibility, degree of decentralization and security. The trade-off between these two aspects is still controversial, and they all face a common technical difficulty: the need to comply with the verification of Bitcoin's "legitimacy".

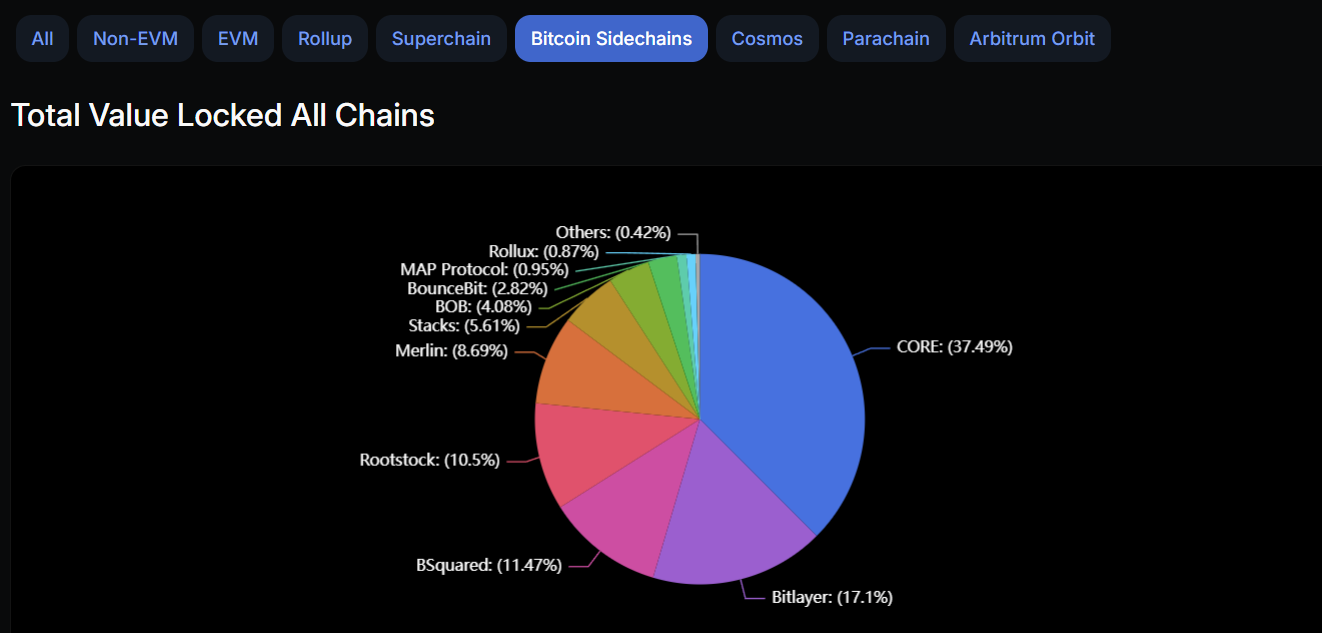

Image source: DeFiLlama: Bitcoin Sidechains / Total Value Locked All Chains

By observing the above-mentioned DeFiLlama data on November 5, 2024, we can also find that among the current sidechain-related projects, the four projects of CORE, Bitlayer, BSquared, and Rootsock have the highest TVL share, totaling up to 76.56%. Comparing BTCFi with ETHFi, which has the same nesting income, the following similar characteristics appear:

BTCFi's currency-based Buff income comes from: analogy to Babylon + LRT rewards + BTC extension chain rewards + ETH chain LRT package income (such as Pendle and Swell);

ETHFi’s currency-based Buff income comes from: POS interest + re-staking rewards + LRT rewards + ETH extension chain rewards.

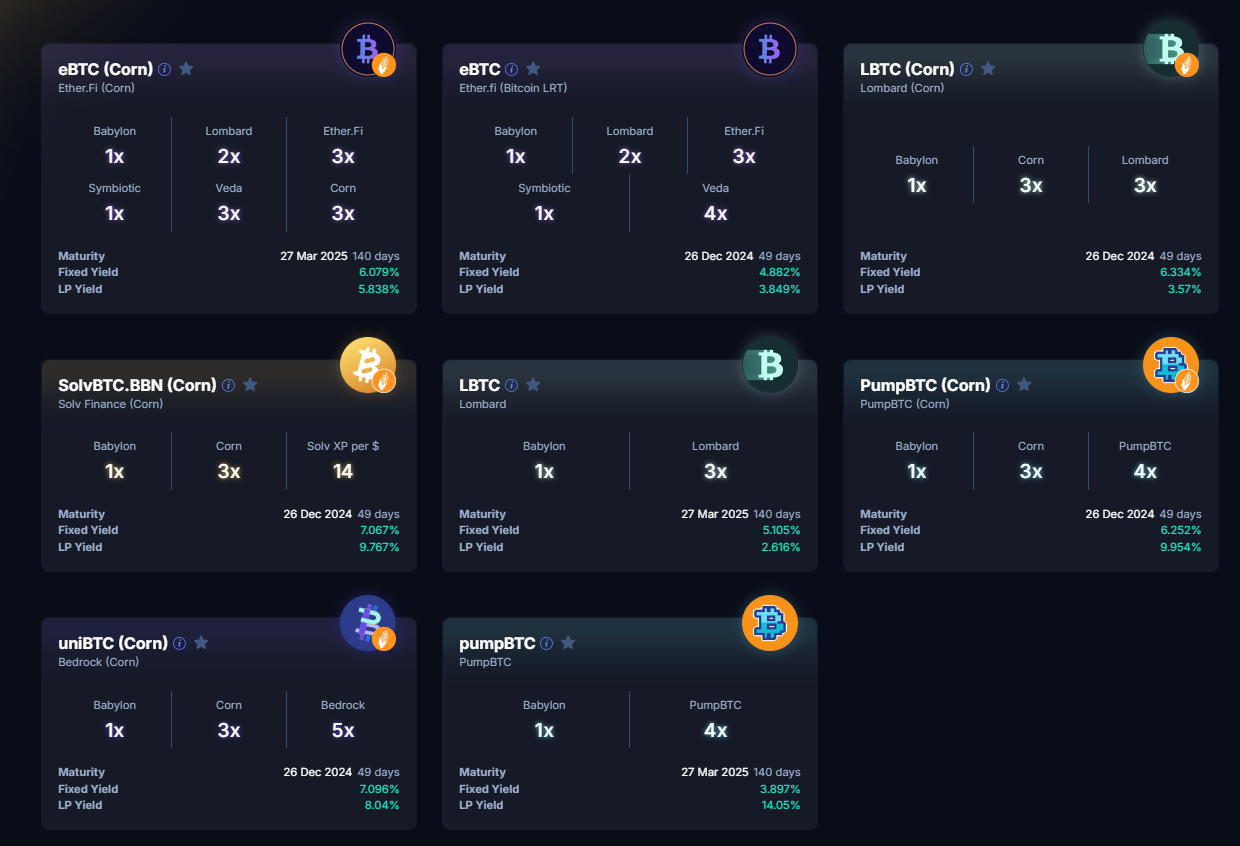

Image source: Pendle / BTC Bonanza

2.1 State Channel

The state channel is an extension solution that allows users to conduct multiple transactions outside the main network and submit them to the main network only when the channel is opened or closed. In Bitcoin, there are currently lightning networks and Ark. Users store multiple transactions in a multi-signature address. After BTC is deposited, daily transactions are carried out through the state channel, and finally the transaction results are verified through the main network consensus to ensure security.

2.2 Sidechains and Rollups

From the perspective of developing the Bitcoin ecosystem from the market side, achieving fast transactions, Turing completeness and interoperability, sidechains and Rollups are more suitable for the development of Bitcoin's ecosystem. Bitcoin's sidechains and Rollups have strong independence. Rollups are designed to By moving complex operations to Layer2, the main network is only responsible for verifying the proofs submitted regularly by Layer2, thereby improving throughput. This mechanism ensures that the Layer2 ledger security is consistent with the main network. It is impossible to directly verify whether the cross-chain behavior on the side chain is legal. The cross-chain bridge will lock the main network assets and map the assets on the side chain. Both often increase the decentralization of the chain by adding other verification methods to ensure asset security. At the same time, in terms of releasing liquidity, the current side chain and Rollups solutions still have good market performance.

2.3 UTXO+Client Verification

In terms of originality and security, the UTXO solution is more prominent and more in line with the definition of "orthodoxy". UTXO + client verification is an off-chain solution based on the characteristics of Bitcoin, aiming to improve transaction efficiency and privacy. Because Bitcoin natively uses the UTXO (unspent transaction output) model instead of the account model, the core idea of client verification is to transfer transaction verification from the consensus layer of the blockchain to the client-side verification layer. The transaction is verified off-chain by the client related to the transaction. Specifically, users need to verify the validity of the transfer statement on their own client to ensure that the transaction is safe and efficient. This off-chain verification reduces the burden on the blockchain. , and user privacy is guaranteed by each client storing only data related to itself.

The RGB protocol is a concrete implementation of this concept, which was first proposed by Peter Todd in 2016 as the concept of "one-time seal" and "client verification". RGB uses Bitcoin's UTXO as a "seal" to change the status of off-chain assets. Binding to Bitcoin's UTXO ensures secure off-chain state changes without double spending. In this way, RGB retains the strong security of the Bitcoin network.

Although this solution brings significant efficiency and privacy advantages, it still has some flaws. The user's client only stores transaction data related to itself, resulting in data silos and hindering the development of applications such as DeFi. End-to-end verification achieves efficient and privacy-friendly off-chain transaction verification by inheriting the security of Bitcoin, but there is still much room for improvement in terms of data transparency, ease of operation, and completeness of development tools.

2.4 Large blocks that change the original consensus

Changing the original consensus also means changing today’s Bitcoin. In realizing the BTCFi vision, there are hard issues such as consensus and ecological development, which are only explained here.

BCH (Bitcoin Cash) is a hard fork of Bitcoin at Block 478558 (August 1, 2017) due to Bitcoin scalability issues. The block size of Bitcoin Cash is 8M, while the block size of Bitcoin is On the same day, it was decided to increase from 1MB to 2MB within six months. The Bitcoin Cash plan was first proposed by the Chinese Bitcoin mining machine company Bitmain, and the related hard fork tokens include BSV.

3. Fi in BTCFi needs to release liquidity better

Image source: pixabay.com

As mentioned at the beginning, Bitcoin’s trillion-dollar market value cannot be kept dormant for a long time like Ethereum. The only storage methods are safe hardware wallets or trusted centralized exchanges. How can BTCFi gradually convert such a huge The market value of the blockchain is circulated through on-chain financialization.

3.1 Prerequisites for development

Cross-chain interoperability

Unlike other smart contract platforms such as Ethereum, the Bitcoin blockchain does not have native smart contract functionality in its architecture. BTCFi’s first priority is to develop a trusted cross-chain bridge so that Bitcoin can be used on other smart contract platforms. Participate in DeFi applications in blockchain. These bridges enable Bitcoin to be “mapped” to other chains, achieving more functions while retaining its value;

Layer 2 Scaling Solution

Compared with Ethereum’s second layer, Bitcoin’s second layer is more difficult to balance between the three problems, and both will more or less give up on decentralization. But for the market, more centralized development is often more likely to produce The new wealth-creating effect, how the project team should give the market more wealth effects to make up for the lack of decentralization may be the first consideration;

Smart Contract Functionality

In order to support DeFi applications, Bitcoin needs some form of smart contract functionality. There is no native smart contract in the current Bitcoin network, and developers are exploring the use of second-layer solutions (such as RSK, AVM, Bitvm) or sidechains. This will enable Bitcoin to directly support DeFi functions such as lending, liquidity provision, and derivatives;

Powerful developer tools and infrastructure

Developers need comprehensive tools and infrastructure to create and deploy BTCFi applications, but the Bitcoin ecosystem does not seem to require repetitive one-click chain-issuing construction.

3.2 Main Challenges

Limitations of the Bitcoin Protocol

Bitcoin is designed to be a secure and reliable store of value and does not have the flexibility of Ethereum or other blockchains designed specifically for DeFi. Due to the lack of built-in smart contract functionality, there are many challenges to overcome when developing BTCFi applications. The limitations of the protocol itself, which may involve complex technical innovations;

Liquidity issues

Even if Bitcoin is introduced to Ethereum and other blockchains that support smart contracts through cross-chain bridges, the liquidity of Bitcoin in DeFi is still much lower than that of tokens such as Ethereum. The current lack of liquidity may limit BTCFi the popularity of;

Security and trust issues of cross-chain bridges

Cross-chain bridge technology is the key to the development of BTCFi, but such bridges themselves have security risks. In recent years, cross-chain bridge attacks have occurred frequently, resulting in a large amount of capital losses. How to ensure the security of cross-chain bridges and prevent centralization or technical failures? The risks brought about by this are still an important challenge facing BTCFi;

Oracles are difficult to accurately capture prices

Due to the architectural limitations of the Bitcoin blockchain, oracle services cannot be deployed on the Bitcoin blockchain as easily as projects such as Chainlink on Ethereum. This limitation makes the deployment of oracle systems in the BTCFi ecosystem more complicated and may require reliance on The second layer or side chain solution. In terms of cross-chain bridge dependence and price synchronization, in the future BTCFi may mainly rely on cross-chain bridges to map Bitcoin to other chains to achieve cross-chain price synchronization. The accuracy of the machine faces greater technical and security challenges than Ethereum;

Can it find its own development path instead of blindly imitating Ethereum?

The core goal of Bitcoin's initial design was to prioritize security over functionality. Even more so in the design of BTCFi, market acceptance and security will always take precedence over functionality. Bitcoin's global adoption is mainly focused on value storage. And payment, so BTCFi may focus on financial products related to payment and value storage. The concept of PayFi is not only applicable to Solana but also to Bitcoin.

Reference articles: