Preface

The cryptocurrency market has flourished in recent years, and platform coins, as an important part of it, have also attracted widespread attention. Platform coins are not only the "exclusive currency" of the exchange, but also shoulder multiple functions within the exchange ecosystem, such as transaction fee discounts, voting governance, liquidity incentives, etc. Therefore, the issuance and development of platform coins are of great significance in the cryptocurrency industry. Against this background, multiple exchanges have successively empowered their own platform coins, launched fierce competition, and formed a "platform coin battle". The core logic is that the platform increases user transactions and platform revenue through various means, thereby raising the price of platform coins, and then uses platform coins to enable the platform through methods such as Luanchpool mining, thereby attracting more users and ultimately forming a positive development spiral.

Exchange Tokens are usually tokens issued by cryptocurrency exchanges and are the exchange's own crypto assets. Initially, exchange tokens were mostly used to provide transaction fee discounts and promote the construction and operation of the exchange ecosystem. With the development of the crypto market, the functions of exchange tokens have gradually expanded to include multiple functions such as asset management, lending, voting governance, and staking rewards, becoming a key tool for competition among major exchanges.

Comparison of the development history of major exchange platform coins

Binance - BNB

Released: 2017

Original intention and positioning: BNB (Binance Coin) was originally released as a fee discount token for the Binance exchange. Users holding BNB can enjoy discounts on transaction fees on the platform, and this feature quickly attracted a large number of users to participate.

Development history: In 2017, Binance successfully issued 200 million BNB through ICO (initial coin offering) and used it as a fee discount tool within the platform.

Gradually expand functions: With the expansion of the Binance ecosystem, the functions of BNB are gradually increasing, including but not limited to participating in IEO (Initial Exchange Offering), staking rewards, lending services, Luanchpool, etc.

Burning mechanism: Binance adopts a mechanism of regular burning of BNB, destroying a certain amount of BNB every quarter, with the aim of reducing the total supply of BNB, thereby increasing the scarcity and value of the token.

Current situation: BNB has become an indispensable part of the Binance ecosystem. Binance continues to strengthen the use of BNB, which is not limited to transaction fees, but also expanded to on-chain governance, DeFi products, payments and other fields.

Bitget - BGB

Release date: 2021

Original intention and positioning: The issuance of BGB aims to enhance the user activity and platform competitiveness of Bitget Exchange. In 2021, Bitget further strengthened the connection between users and the platform through the issuance of the platform coin BGB. Similar to the platform coins launched by other mainstream exchanges, BGB is mainly used for transaction fee discounts, voting governance, liquidity incentives and other aspects within the platform ecosystem.

Development History: The first issuance of BGB platform coins was conducted in a public sale. Initially, the total supply of BGB was set at 1 billion, part of which was raised through ICO (initial token offering), and the other part was used for the incentive and reward mechanism within the exchange. The issuance of BGB not only brought liquidity support to the Bitget exchange, but also provided a source of capital for the expansion of the platform.

Application scenario expansion: Users holding BGB can enjoy discounts on transaction fees on the Bitget platform. Through BGB, users can get lower fees in spot trading and derivatives trading. BGB can also be used as a platform reward. Users can obtain BGB through participating in transactions, activity rewards, promotions, etc. With the rise of decentralized finance (DeFi), the Bitget exchange has also begun to explore the application of BGB in the DeFi field. BGB has gradually been integrated into the DeFi protocol and has become a key asset in decentralized financial products. By staking BGB, users can participate in the platform's DeFi lending, liquidity mining and other activities to obtain more benefits.

Repurchase and destruction: In order to ensure the long-term value and scarcity of BGB, Bitget Exchange has implemented a repurchase and destruction mechanism for BGB. Every quarter, Bitget will use part of the platform's profits to repurchase BGB and destroy it, thereby reducing the supply of BGB in the market and increasing its market value. This mechanism is similar to the repurchase and destruction strategy of other major exchange platform coins, which effectively enhances the long-term value of BGB.

Current situation: As the native token of Bitget Exchange, BGB has developed into an important part of the BITGET ecosystem. In the future, as the platform continues to grow, BGB is expected to occupy a place in the global cryptocurrency market and become one of the competitive exchange platform coins.

OKEx - OKB

Released: 2017

Original intention and positioning: OKB (OKEx Token) is the platform currency issued by the OKEx exchange. It was originally used for discounts on transaction fees. With the expansion of OKEx's functions, OKB has gradually been integrated into more application scenarios.

Development history: In 2017, OKEx issued OKB through ICO and provided basic functions such as fee discounts to platform users.

Extended functions: OKEx has gradually increased the application scenarios of OKB, including OKB staking, lending services, voting, participating in the platform's IEO, etc.

Destruction mechanism: Similar to BNB, OKB also adopts a regular repurchase and destruction mechanism, the purpose of which is to reduce the market circulation and increase the value of tokens.

Current situation: OKB has a wide range of application scenarios within the OKEx platform, including DeFi, lending, staking, etc. OKEx is committed to building OKB into a comprehensive ecological token to enhance user stickiness and platform competitiveness.

FTX (defunct) - FTT

Release time: 2019

Original intention and positioning: FTT (FTX Token) is the native token issued by the FTX exchange, used for transaction fee discounts, staking rewards, etc.

Development history: In 2019, FTT was issued for the first time and won the favor of many users. The platform also provided various benefits to users holding FTT.

Expansion before collapse: FTX originally planned to further integrate FTT into more DeFi scenarios, but after the platform collapsed, the value of FTT fell sharply and almost disappeared.

Current situation: The collapse of FTT has brought a huge impact on the entire crypto market and exposed the risks of platform coins.

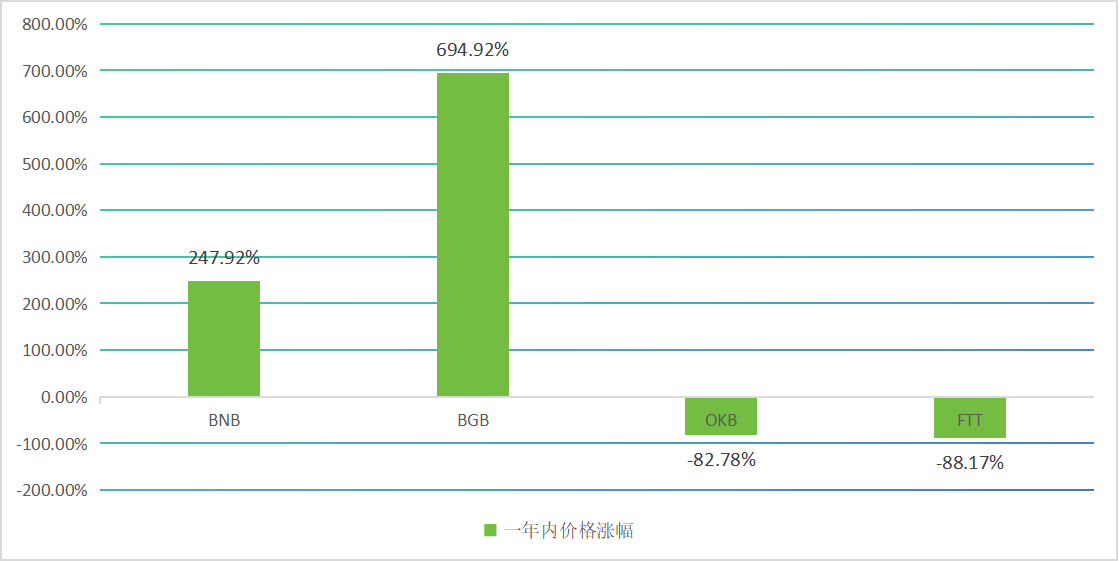

Data from Coingecko, compiled by Hippo Research

The above is the increase in platform coins in 2023-2024. It is not difficult to find that BGB has the largest increase. Looking back at each round of market conditions in the past, there will be an exchange platform coin that stands out. In the last round, $BNB performed the best, and this round, BGB is the best performer.

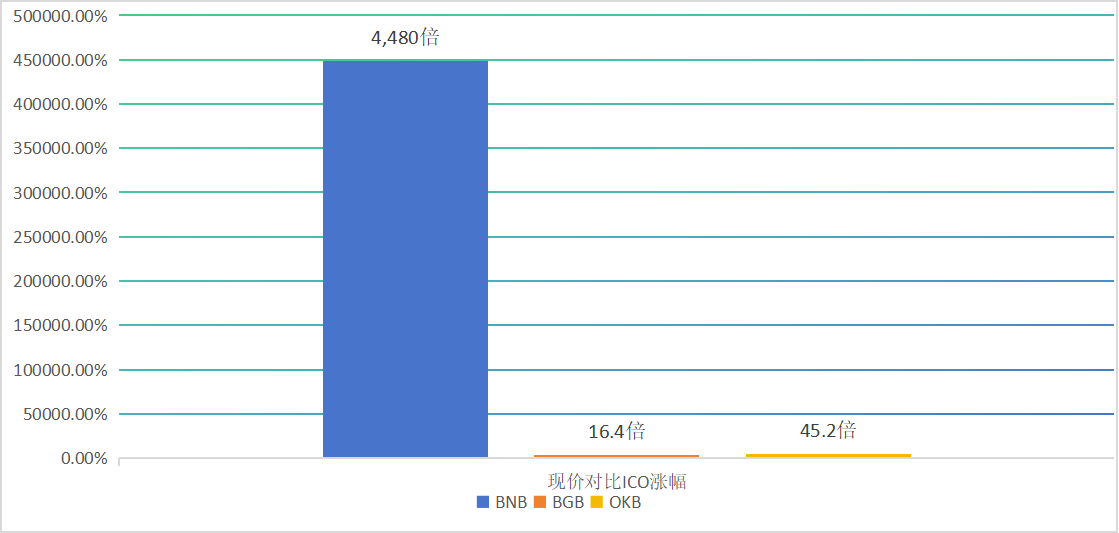

If we list the ICO prices of the above-mentioned platforms and compare them with the current prices, we can find that choosing a high-quality platform coin and accompanying the long-term growth of the platform will bring huge benefits.

In 2017, the ICO price of BNB was US$0.15. As of now, the price of BNB has reached US$672, a 4,480-fold increase in seven years!

In 2021, the CO price of BGBI was US$0.25. As of now, the price of BGB has reached US$4.1, a 16.4-fold increase in three years!

The ICO price of OKB in 2021 was 1 US dollar. As of now, the price of OKB has reached 45 US dollars, a 45-fold increase in three years!

FTT’s bankruptcy due to financial crisis is not included in the statistics.

As the cryptocurrency market changes, centralized exchanges (CEX) have begun to constantly seek innovative breakthroughs in the competition. From providing traditional trading pairs to expanding user groups and enriching trading products, CEX platforms are constantly iterating to cope with changes in market demand. Especially in attracting new users and increasing platform activity, many exchanges have successfully attracted a large number of users and liquidity by introducing new popular MEME coins and holding a series of "new user" activities.

What we must discuss is the development of this wave of MEME market. I believe that the popularity of MEME market is also a product of CEX crisis. Some CEXs have been suffering from market Fud due to poor performance of new products recently and the continuous decline of VC coins, which has brought investors' confidence to a gradual destruction. The wealth-creating effect and relatively fair mechanism shown by MEME market have attracted many investors.

Iteration of Centralized Exchanges (CEX)

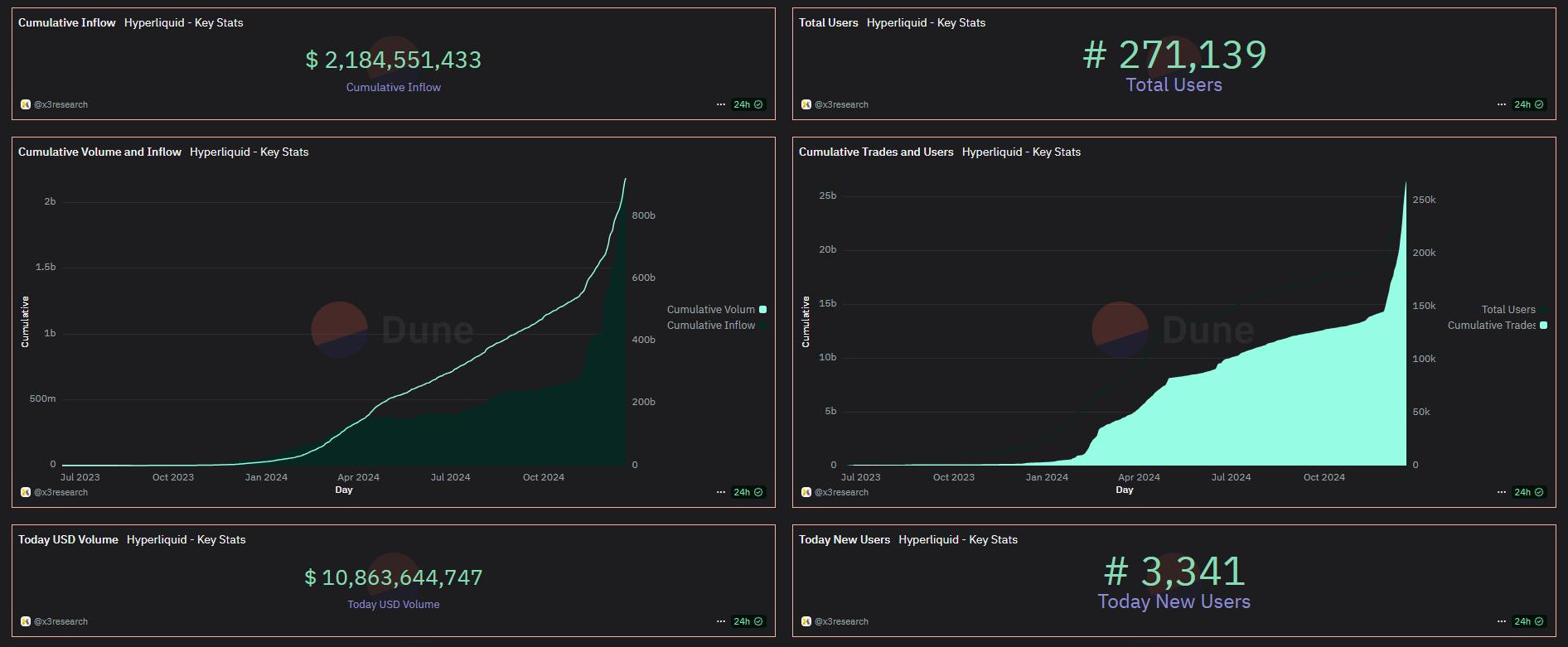

The popularity of the MEME market is just one of the products of the CEX crisis. Decentralized on-chain exchanges, which have been very popular in the market recently, have also been popular. Among them, HyperLiquid is the most eye-catching. As of press time, its circulating market value has reached 7.6 billion US dollars. According to Coinmarketcap statistics, HyperLiquid's total market value of 28 billion US dollars ranks 23rd.

From the Dune data dashboard, we can see that the recent transaction volume, inflow and number of users of HyperLiquid have continued to increase, which is the embrace of decentralized on-chain exchanges by some market users. In fact, decentralized on-chain exchanges are not a new narrative. Many teams have entered the relevant track before, especially the Arb ecosystem due to the high efficiency of its L2 and the security of the Ethereum settlement layer, so many projects in the on-chain exchange or derivatives related track were born. However, after nearly two years of development, we can see that decentralized on-chain exchanges have not run very successful projects. The main reason is that decentralized exchanges and centralized exchanges CEX on the chain have their own advantages and disadvantages.

Advantages and disadvantages comparison | Decentralized on-chain exchange | Centralized Exchange CEX |

advantage | Control: Users have full control over their assets and do not need to entrust their assets to a third party, reducing the risk of theft or being locked. Privacy: KYC (Know Your Customer) process is usually not required, providing higher privacy protection. Security: Since there is no single point of failure, DEX is less vulnerable to hacker attacks than centralized exchanges. Openness: Anyone can create and participate in the market without the need for approval from a centralized platform. Global access: Due to their decentralized nature, DEXs are usually not restricted by geographical location. | Liquidity: Usually has higher liquidity, providing better transaction prices and lower slippage. User experience: The interface design is usually more intuitive and suitable for beginners. Support: Provide customer support services to help solve user problems. Speed: Transaction execution and deposits and withdrawals are fast because they are centrally operated. Market Depth: More trading pairs and market options. |

shortcoming | Liquidity: DEXs may have lower liquidity than centralized exchanges, resulting in higher slippage and poorer trade execution prices. User Experience: The interface may not be that user-friendly and the learning curve may be steeper for newcomers. Speed: Transaction confirmation may be slow because it needs to be completed through the blockchain network. Technical Support: There is no traditional customer support team, and users may need to solve problems on their own. | Security risks: Assets are held in custody on exchanges, which may lead to asset losses due to hacker attacks or internal errors. Privacy: KYC/AML (anti-money laundering) processes are usually required, and user privacy is low. Control: Users have less control over their assets and rely on the security and stability of the exchange. Regulatory risk: Centralized exchanges may face more regulatory pressure, which may lead to sudden policy changes affecting user transactions. Transaction Fees: Some centralized exchanges may have high transaction fees, especially for high-frequency traders. |

From the above chart, we can clearly see the advantages and disadvantages of centralized exchanges and decentralized on-chain exchanges. Based on such a market pain point, is there a product that can combine the advantages of both to provide users with safe and efficient trading services? Through investigation and research on many exchanges, there is indeed such a product on the market - WOO Exchange (WOO Network).

WOO Overview

WOO Exchange (WOO Network) was founded in 2020 and was originally incubated by Kronos Research, a large cryptocurrency quantitative trading company. It is a cryptocurrency trading platform for institutional and retail investors that combines the technological advantages of centralization and decentralization. It includes spot trading, futures trading, derivatives, leveraged trading, liquidity pools, staking, etc. Most users' funds are stored in cold wallets to ensure security.

WOO is the native token of WOO Network and is currently available on leading CEXs such as Binance and EURAY. WOO is mainly used to pay transaction fees, participate in governance, etc. Users can obtain additional income on the platform by staking WOO tokens and enjoy certain governance rights.

WOO Highlights

Cross-platform services: WOO Network is not limited to centralized exchanges (CEX), but also includes a decentralized trading platform WOOFi, combining centralized and decentralized technologies.

Stability: WOO Network has experienced several years of market development and technological accumulation, and has maintained stable operation. The product itself is almost at the leading level in the industry, solving any problems including security, transaction speed, transaction depth, etc.

Low to zero transaction fees: WOO X is known for its low to zero transaction fee model, which is achieved by adopting an open and transparent payment for order flow model (PFOF), reducing transaction costs.

Deep Liquidity: By partnering with top market makers and liquidity providers such as Kronos Research, WOO X provides deep market liquidity and depth, ensuring that users can execute trades at the best price.

Security and Transparency: As the first exchange to adopt a transparent order flow payment model, WOO X ensures the transparency and security of transactions.

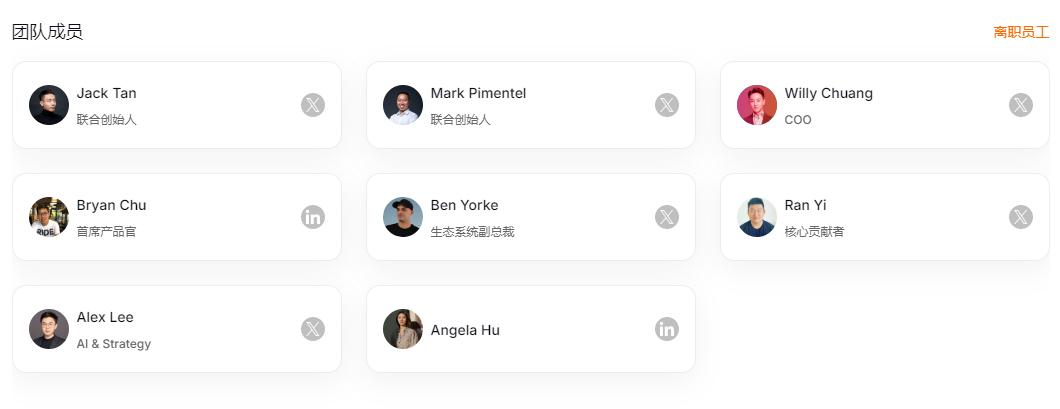

Team members

WOO Network has a team of professionals with rich experience in traditional finance and cryptocurrency, helping them to provide innovative trading solutions when designing and operating WOO X.

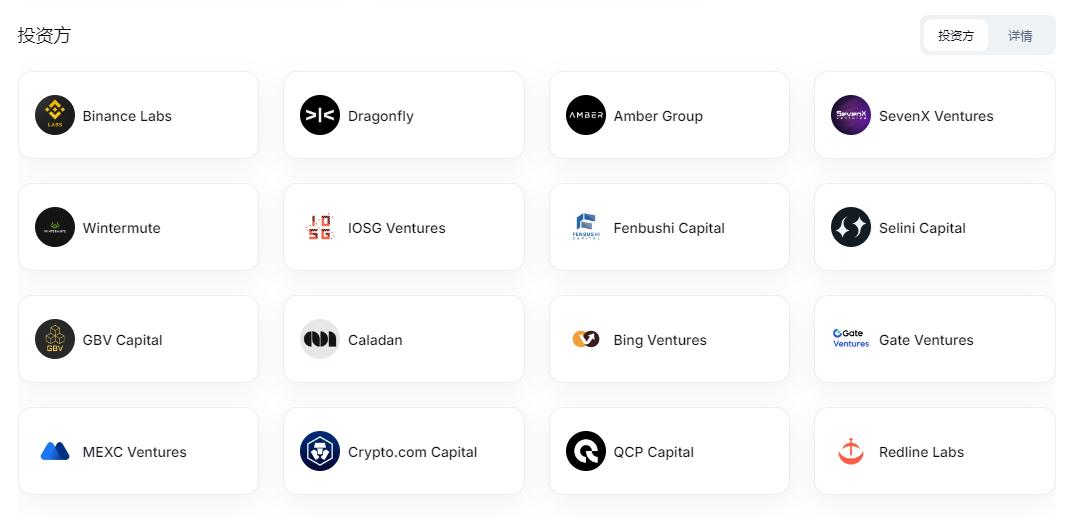

Investment Background

WOO has an investment background of over US$51 million from Binance Labs, Dragonfly, Amber Group, Wintermute and many other companies.

Token Information

Name: WOO

Total: 2.223 billion

Circulation: 1.862 billion

Circulation rate: 83.7%

Total market value: $487 million

Market value: $407 million

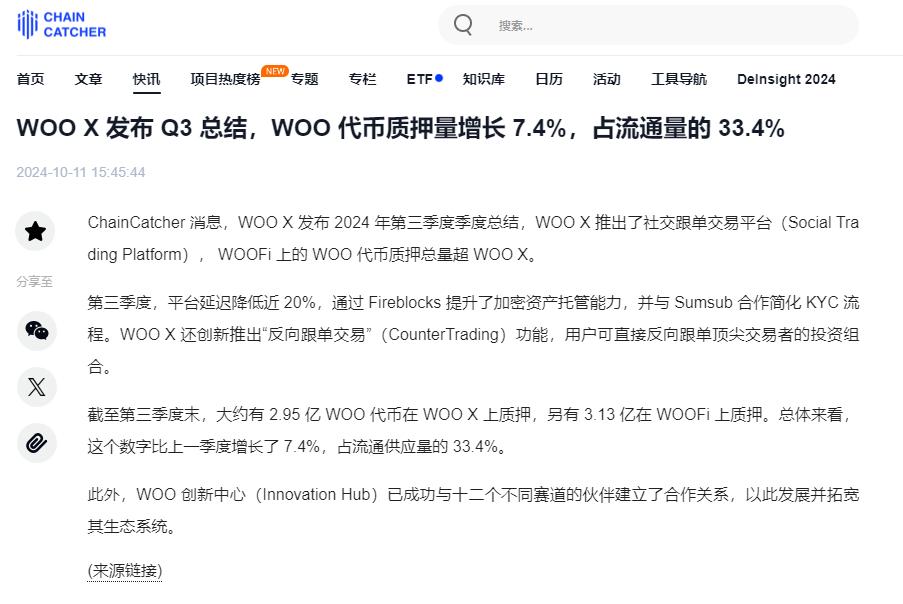

Pledge rate: 33.4%

From the article, we can see that WOO's pledge rate is as high as 33.4%, and its current total market value is only 487 million US dollars. Compared with HyperLiquid's FDV with a market value of 28 billion US dollars, WOO is a severely underestimated potential project. It is a leader in many aspects such as product strength and risk resistance. At the same time, the WOO team has been innovating and embracing new market concepts. The cooperation under the WOO Innovation Center aims to use blockchain technology to support the BIO protocol and solve challenges related to scientific research funding and liquidity through decentralized science (DeSci).

Summarize

In summary, in the unstable crypto market, looking for investment targets with high certainty and accompanying the long-term growth of the project is a very high-yield option. However, the update and iteration speed of many narratives or sectors is very fast, and the period in which narratives can continue to be hyped is very short. Only exchanges are one of the sectors with the longest life cycle, especially those that still survive and maintain rapid development and technological updates after market screening. WOO Network's platform coin WOO is one of the few projects that meet the above conditions and has a very large imagination space for token prices. It is a typical potential value target.

All the above content is personal opinion and does not constitute any investment advice or opinion!