By Helen Partz, CoinTelegraph

Compiled by: Wuzhu, Golden Finance

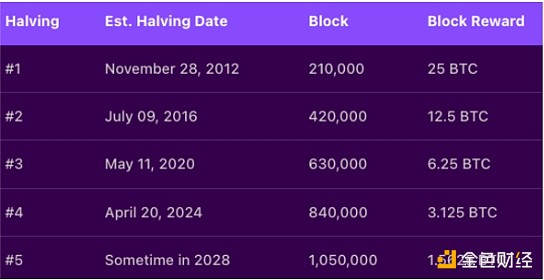

Bitcoin, the largest cryptocurrency by market cap, experienced its first halving event 12 years ago, reducing the block reward from 50 BTC to 25 BTC.

Since then, the Bitcoin block reward — the incentive for crypto miners to verify Bitcoin transactions and secure the network — has shrunk to 3.125 BTC after three halvings, significantly limiting the supply of newly mined BTC entering the market.

Bitcoin is trading close to its all-time high of around $99,600 set on Nov. 22, in part due to Bitcoin’s fourth halving event in April.

Bitcoin halving date and block reward. Source: BitDegree

As the community celebrates the anniversary of the first Bitcoin halving, this article revisits some of BTC’s key historical milestones and changes in the mining ecosystem.

1.2 million Bitcoins left to be mined

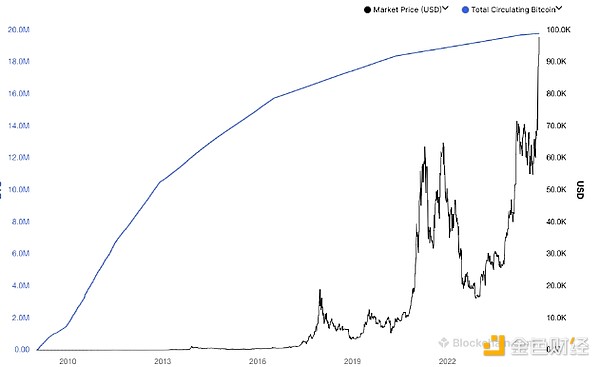

As of November 27, there are 19.8 million BTC in circulation, with 1.2 million to be mined until the limited supply of 21 million is reached.

Bitcoin’s supply is capped at 21 million, which is one of the fundamental principles of the Bitcoin network and is designed to provide scarcity of the asset.

The total amount of Bitcoin in circulation. Source: Blockchain.com

Although the amount of 1.2 million BTC is small relative to the number of Bitcoins that have been mined, due to the reduction in rewards and the increase in mining difficulty, the mining process of the remaining BTC will require miners to spend more time and energy.

According to MinerStat, the Bitcoin mining difficulty rate is currently at 102.3 trillion, having passed the 100 trillion mark for the first time on November 5. The next Bitcoin difficulty adjustment is expected to take place on December 2.

Bitcoin hits new price record as miners are far from capitulating

Despite the challenges posed by higher Bitcoin mining difficulty and lower block rewards, Bitcoin miners are far from succumbing as the cryptocurrency market continues to rise.

As of this writing, Bitcoin is trading at $95,364, up 154% over the past year, according to Coingecko. The cryptocurrency has also seen a significant increase in price since Bitcoin’s most recent halving event on April 20, 2024, increasing in value by approximately 45%.

According to a report from European cryptocurrency investment firm CoinShares, Bitcoin miners have been taking steps to reduce costs and adopt artificial intelligence, even as Bitcoin's rally in 2024 has led to increasing block rewards denominated in US dollars.

“The bitcoin mining industry has faced significant challenges this year, with both revenue and hash price declining,” CoinShares said in an October mining report.

In July, when BTC was trading around $56,500, Bitcoin mining company TeraWulf considered consolidation due to low profit margins.

Some major cryptocurrency mining companies such as Marathon Digital sold a large amount of mined BTC after the fourth halving this year, citing the need to improve efficiency and remain competitive. Marathon has also turned to actively buying Bitcoin and announced a $250 million convertible senior notes offering in August.

El Salvador, on the other hand, has stepped up efforts to find alternative Bitcoin mining methods that harness geothermal volcanic energy.