Author: Kevin, the Researcher from BlockBooster

On November 26, Paul Kohlhaas, founder of BIO Protocol, responded to CZ’s tweet on the social platform, saying, “Decentralized Science (DeSci) has successfully introduced the liquidity of Meme coins to universities and laboratories around the world to support real scientific research.” This phenomenon has caused deep thought: Why can scientific research, especially medical research, which has always been characterized by rigor and long-term investment, be successfully combined with the rapidly changing crypto market?

Scientific research, especially medical research, objectively requires a lot of time, usually in years or decades, which is in stark contrast to the "one-day quick pass" that the current market is chasing. Why did decentralized science spark market discussion in November? Is it because Meme sentiment reached an all-time high, leading to a market correction? Or is decentralized science just a new Meme disguised as scientific research for the benefit of mankind? This article will start from the business model and development direction of Bio Protocol and Pump.Science to explore what DeSci's real needs are; under what circumstances can it meet market demand and achieve long-term development.

Bio Protocol Business Model Breakdown

First of all, what triggered DeSci's narrative was Bio Protocol. On November 8, Binance completed strategic financing for BIO, but the round and amount were not announced. Stimulated by this, the BIO Genesis community fundraising campaign initiated by BIO raised US$33 million.

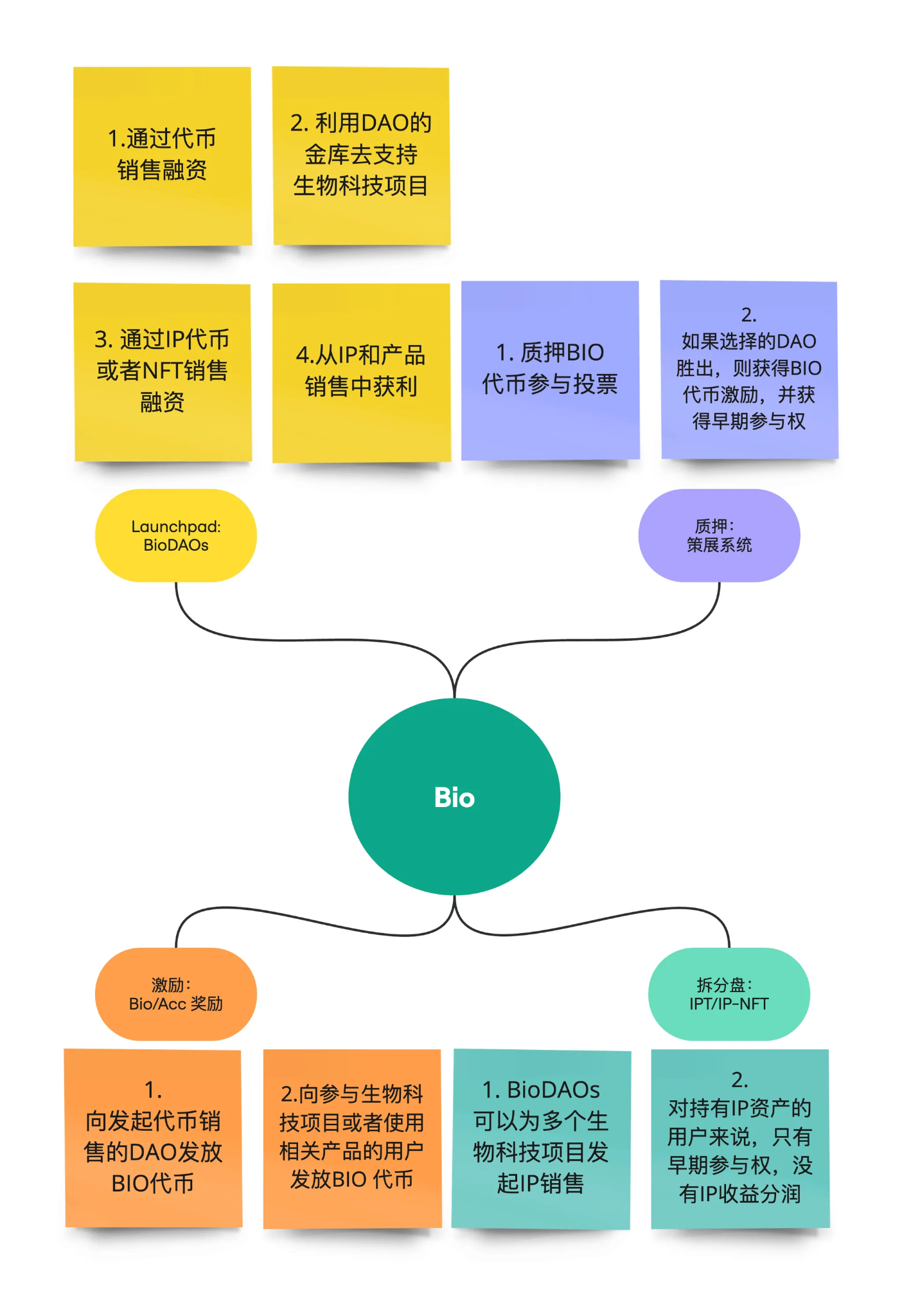

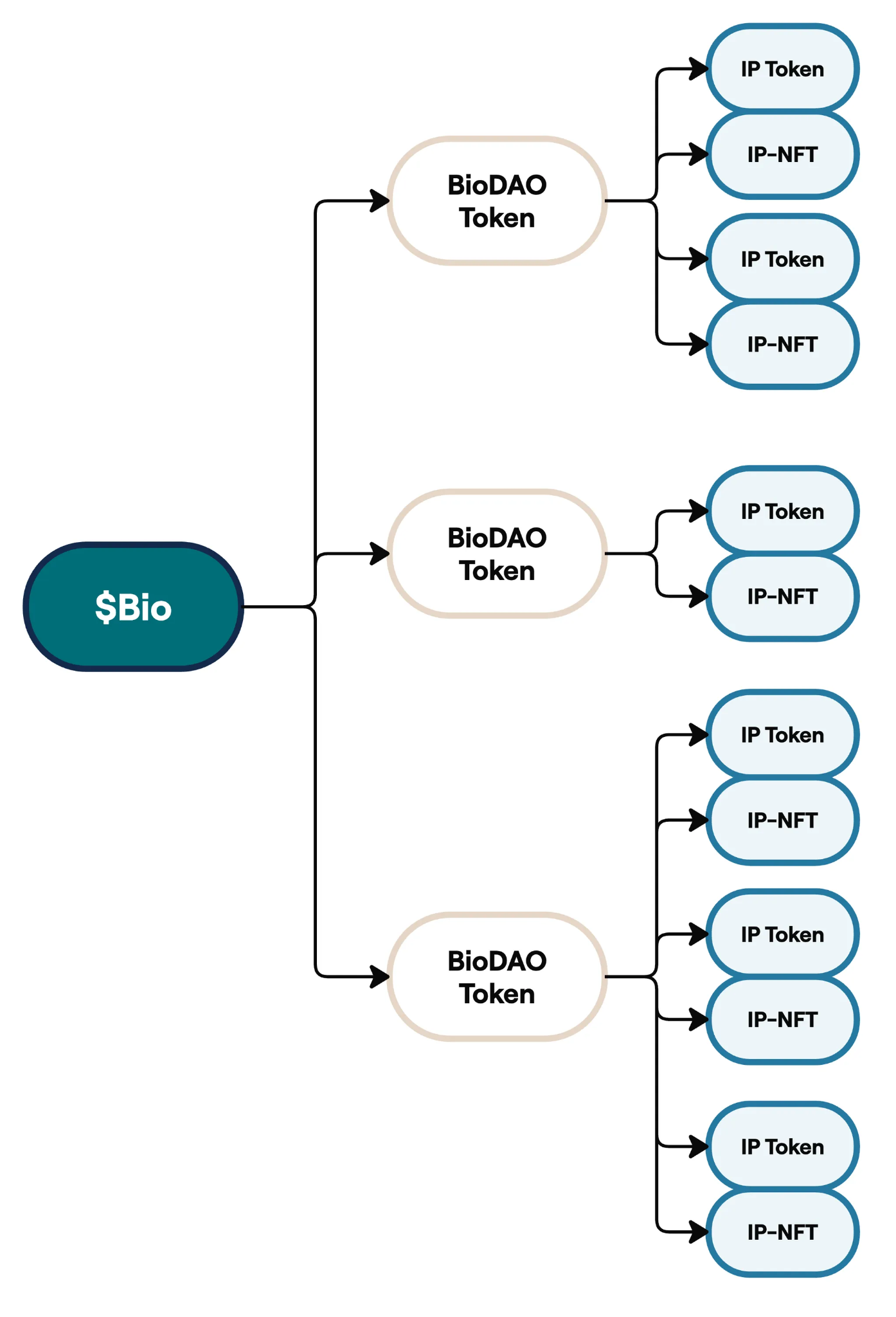

BIO currently has 7 active DAOs, with research contents such as longevity and health, hair loss treatment, brain health, etc. It should be noted that BioDAO does not refer to a research team in a certain direction, such as the longevity and health track, but should be regarded as a specific implementation of BIO Protocol. Why do I say this? Please see the BIO Protocol business model map above. In simple terms, BIO is a nested Launchpad, plus non-revenue staking, plus incentives, plus an embedded Launchpad to achieve unlimited splits. BIO consists of these four parts.

Specifically, in the first part, Launchpad BioDAOs, BioDAO raises funds through token sales and uses its funds to support related biotechnology projects. Each BioDAO can also be regarded as a Launchpad, which I will talk about in the fourth part.

The second part is the staking mechanism of BIO, which locks user tokens in the name of curation. From the governance and proposal pages, we can see that the normal staking rate of BIO is 15%, and the staking rate will exceed 20% when voting for a new BioDAO. There will be no income from user staking, but when the BioDAO selected by the user wins, the user who voted for the BioDAO will be rewarded with BIO tokens. If the BioDAO voted for is not selected, there will be no reward. Curation is a very good tool for BIO to lock user tokens. When a new BioDAO is generated, its value output to the BIO ecosystem will be much higher than the reward issued by BIO.

The third part is the main use case of BIO tokens, which is incentives. The incentives are divided into two parts. The first part is for participating BioDAOs. When they launch the initial token sale, BIO will issue incentives. For users, if they use BioDAO's products or make certain contributions to biodao, they will be issued incentives. I think the amount of tokens for this part is currently very small. Compared with the traditional scientific research industry, the cost is greatly reduced, because participating in drug trials in traditional industries is very costly, and BIO issues BIO token incentives.

The fourth part is the split plate. BioDAO can be seen as a sub-Launchpad. BioDAO selects specific teams or scientific research topics, raises funds to issue IP tokens or IP NFTs. The holders of these assets are promised some early participation rights, but no additional returns of any form are promised.

From the perspective of business model, BIO still operates in a familiar way in the industry, but its feature is that Launchpad is nested in Launchpad. As specific scientific research projects issue coins or release NFT assets, potential liquidity shortages will first impact BioDAO tokens, and BIO tokens are equivalent to being given a layer of insurance. When multiple BioDAO tokens have problems, the value of BIO tokens will be questioned, but the benefits of specific scientific research projects releasing assets will also be fully fed back to BIO, because it will attract more users to buy BIO tokens to participate in the ecosystem. Another feature is that users can pledge tokens on the grounds of participating in scientific research without having to pay for returns, so the potential returns are provided by BioDAO tokens or specific scientific research projects, and BIO can lock user tokens for a long time at a very low cost. Bio is an index token across all these DAO tokens.

How Pump.Science blurs the boundaries between DeSci and Memecoin

Molecule is a protocol that puts IP on the chain and issues IP-NFT and IPT for Bio Protocol; Pump.Science is Molecule's Launchpad, which represents the intellectual property rights of a certain compound in the form of tokens.

Pump.Science believes that compared to buying a biotech company's stock, it is equivalent to holding all the drugs of the company. But on Pump.Science, you can choose to invest in a single drug. The tokens issued on Pump.Science comply with legal rules, but from the perspective of tokenized intellectual property rights, they must be synthetic compounds, not naturally occurring substances such as nicotine. However, if nicotine is combined with other substances, such as caffeine, this combination can be patented. What Pump.Science does is to tokenize these patents or data and then test whether they are effective.

Pump.Science has launched two tokens, $RIF and $URO. $RIF has a market value of $100 million. The compounds behind these tokens can be used to develop supplements and benefit from sales or patent licensing in the future. In order to attract more investors, Molecule will develop a set of data to prove the effectiveness of these compounds, such as significantly extending lifespan in animal tests.

But does Pump.Science really want to do scientific research? Now it seems that this possibility is getting smaller and smaller. As Christmas approaches, Pump.Science will hold the 'Rif Christmas' event, launching two tokens every day for ten days. That is, in December, Pump.Science will intensively launch 20 artificial synthetic compound tokens. Although the platform claims that it will gradually show their development path, it hopes to eventually advance to the human testing stage and even develop into a product market to sell different supplements. But it is foreseeable that the vast majority of the 20 tokens will not support the corresponding supplements on the day they are listed, and their market value will be zero.

From the perspective of chasing market hot spots, Pump.Science is also actively promoting AI-related product development. It plans to create an AI robot that trades based on compound experimental data and performs operations based on the progress of events at different stages.

Back to the topic of this article, does DeSci need to return to value or chase Meme? From the business models and development directions of Bio Protocol and Pump.Science, it is not difficult to see that neither of them has completely chosen to invest in scientific research and give up the opportunity to provide Memecoin to the market. This may also be one of the future paths of the DeSci protocol. But one thing should be clearly recognized that scientific research needs to return to fundamentals and objective laws, and biological science research requires long-term and large amounts of funds. Therefore, short-term speculation in Memecoin will not last long, and a single Memecoin is not the development model of the DeSci protocol; buying DeSci tokens requires enduring the narrative of no one paying attention. DeSci needs to hype valuations in the form of VC coins, increase the expected value of the leader, and continue to release signals through spiritual totem-like characters, because DeSci's market awareness is far lower than AI, so more authoritative signals are needed to increase market confidence and consensus; from the perspective of specific GTM methods, DeSci's subdivisions include: financing, research, data, peer review, publishing, infrastructure and services, art, scientific open ecology, and community. Choose the direction that suits your understanding or has a relatively low threshold for implementation. In addition, DeSci's model is a natural split-plate. Different research topics are sub-coins, which require a big cart to pull a small cart. Using web3 financing to obtain a crowdfunding-like method to fund a real scientific research topic and make it a representative of DeSci's practicality is what several protocols in the industry are currently doing. However, due to the uncertainty and high failure rate of scientific research, it should be difficult to achieve.

The market needs a large number of DeSci-influenced cases to build consensus. This process will take more time than the AI narrative. ChatGPT was released at the end of 2022, and the currency circle began to speculate in 2023, while DeSci will take longer; but from another perspective, this has also paved some stumbling blocks for DeSci, because the rapid development of AI has made people subconsciously prepared to accept the possibility that some seemingly unattainable things will become a reality, and VitaDAO's longevity science is no longer a castle in the air. In general, I think the consensus of DeSci has just begun and needs long-term construction. We should be mentally prepared for this narrative to explode in the next bull market.