Key Points

Establishing Asian Benchmarks : HKEX Virtual Asset Index Series introduces standardized Bitcoin and Ethereum pricing to address regional price differences and increase investment transparency in the Asia-Pacific market.

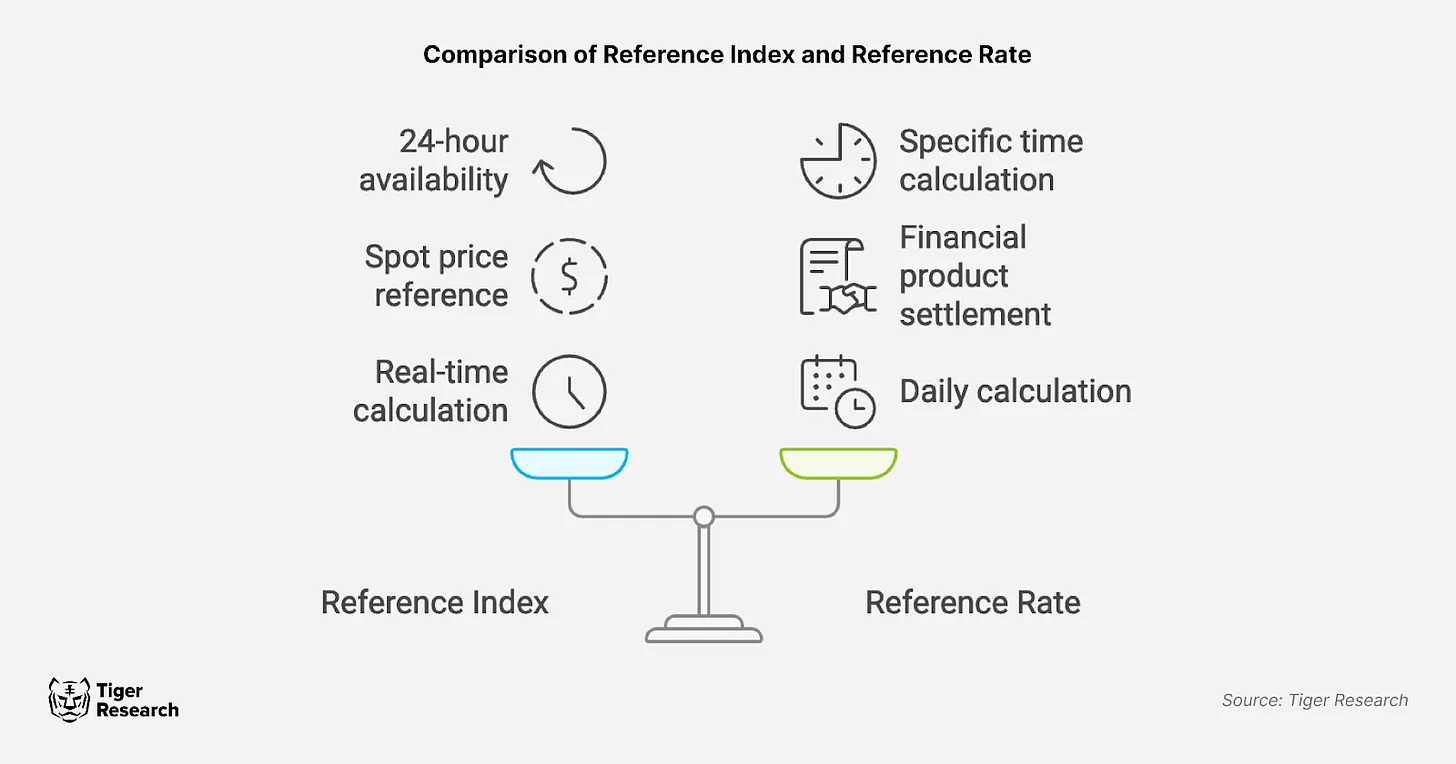

Dual tools, flexible and stable : The HKEX Index Series includes real-time reference indices for instant trading decisions and daily reference rates for continuous settlement of financial contracts, meeting various trading and investment needs.

A step towards institutional integration : By complying with EU standards and providing reliable data, HKEX’s index aims to attract institutional investors, support the growth of structured crypto products and promote the integration of cryptocurrencies into mainstream finance.

1. Introduction

Hong Kong took a decisive step towards establishing itself as a leader in the cryptocurrency market with the official launch of the Hong Kong Exchanges and Clearing (HKEX) Virtual Asset Index Series on October 28, establishing a reliable benchmark for Bitcoin and Ethereum prices in the region.

So far, cryptocurrency indices have been developed primarily by private companies. The lack of institutional-grade benchmarks has led to price discrepancies between trading platforms, creating uncertainty and risk for investors and hindering seamless integration between the cryptocurrency market and traditional finance.

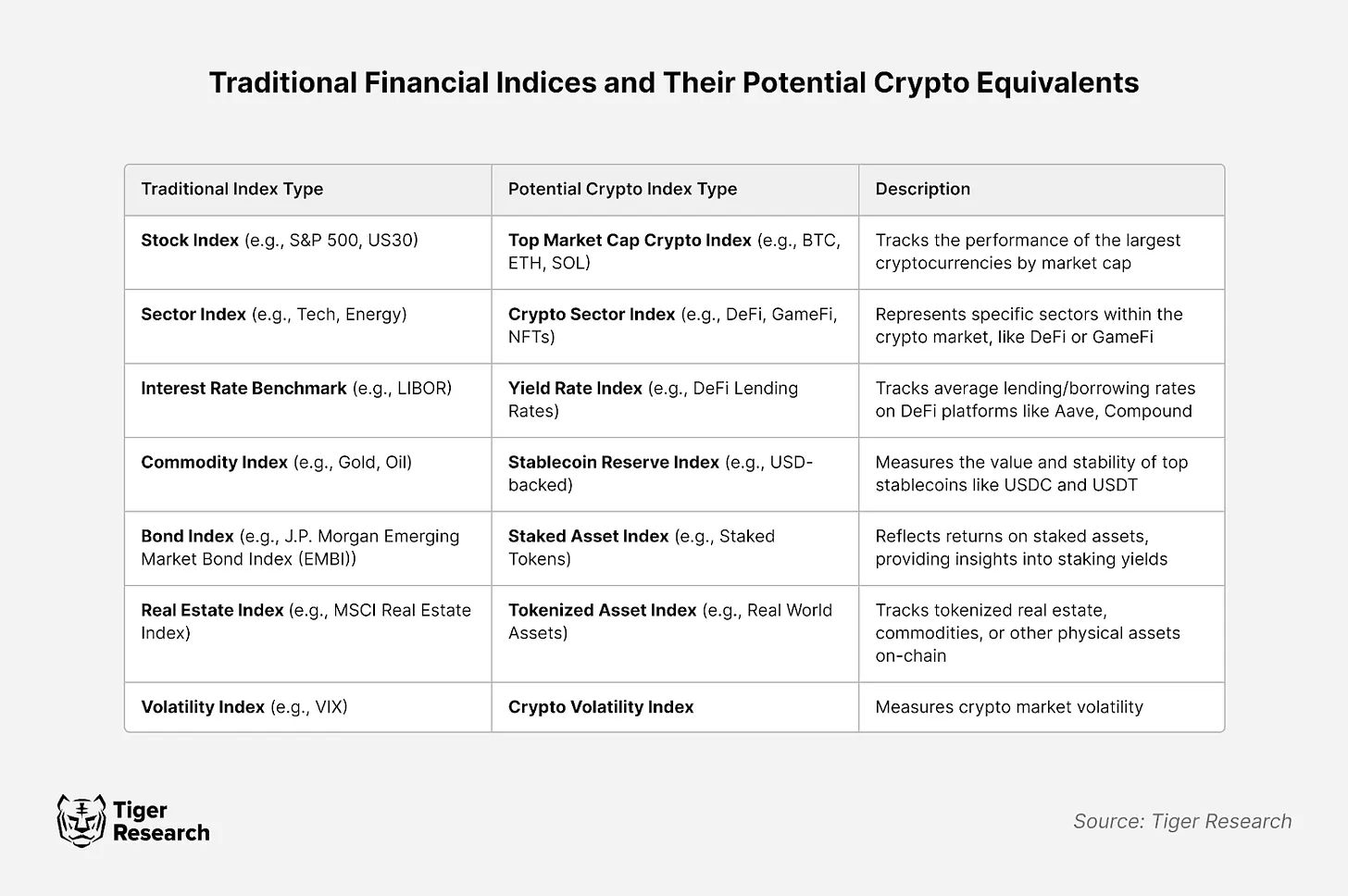

In traditional finance, indices are essential for price discovery, risk management, and performance evaluation. The HKEX Virtual Asset Index Series aims to bring these advantages to the cryptocurrency space by providing real-time, volume-weighted reference prices. This effort aims to enhance trust, transparency, and consistency between traditional and cryptocurrency markets.

This report explores the HKEX Index Series’ methodology, its potential to build market trust, and its impact on trading and investment strategies in Asia’s dynamic cryptocurrency landscape.

2. HKEX Virtual Asset Index Series

Launched on November 15, 2024, the HKEX Virtual Asset Index Series introduces two key tools: a reference index and reference rates for Bitcoin and Ethereum, providing standardized pricing consistent with the Asian time zone.

2.1. Reference Index

The cryptocurrency market has been plagued by price discrepancies between exchanges. To address this, the Hong Kong Stock Exchange has developed a volume-weighted average index with Bitcoin and Ethereum as initial assets.

The methodology reduces distortions caused by low-volume or irregular trades by assigning weights based on volume. By prioritizing trades with larger volumes, the index more accurately represents the collective consensus of market participants.

Volume-weighted methods are particularly effective in mitigating market manipulation. In markets where liquidity varies widely between exchanges, simple averages are easily skewed by low-volume trades. By assigning a greater weight to trades on highly liquid exchanges, volume-weighted averages can significantly reduce the risk of manipulation.

While this approach is particularly important for altcoins, which have more volatile prices, HKEX strategically chose to focus on Bitcoin and Ethereum first. The smaller price variances of these assets provide a stable foundation for building credibility and ensuring smooth adoption of the index.

This approach is expected to be expanded to the altcoin market in the future. By first validating the approach with Bitcoin and Ethereum, HKEX is creating a scalable framework that can be expanded to more volatile assets, thereby improving reliability and market inclusion.

2.2 Reference Rate

A reference rate is a daily price index designed to facilitate the standardized settlement of financial products such as derivatives and futures.

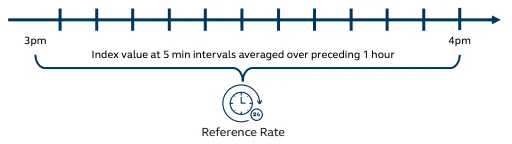

The Reference Rate is calculated once daily at 4:00pm Hong Kong time - based on a one-hour data window between 3:00pm and 4:00pm. During this window, the HKEX Reference Index value is recorded every five minutes and averaged, ensuring a fair and representative market price that minimizes differences between exchanges.

The reference rate complies with the EU Benchmark Regulation (BMR), ensuring robust governance, transparency and data accuracy. It enhances trust and reliability in the cryptocurrency market by addressing challenges such as price manipulation and benchmark inconsistency. The benchmark supports the development of advanced financial instruments such as futures and ETFs, and promotes institutional adoption of digital assets.

As cryptocurrencies become increasingly integrated with traditional finance, the HKEX Reference Rate will play a key role in decision-making and market stability. This move further consolidates Hong Kong's global leading position in the digital asset ecosystem.

3. The strategic impact of the index series on the cryptocurrency market

3.1 The impact of the HKEX Index on the cryptocurrency ecosystem

The HKEX Virtual Asset Index Series brings greater transparency, standardization and reliability to the cryptocurrency market. By providing real-time volume-weighted pricing for Bitcoin and Ethereum, the index addresses the long-standing price discrepancies between exchanges. These indices are an important tool for instilling confidence in investors, especially institutions that are reluctant to get involved in cryptocurrencies due to concerns about fragmented and unreliable pricing data.

Transparent indices like the HKEX Index can stabilize market volatility by providing a consistent reference point. This aids risk assessment and supports more informed investment decisions, creating a more structured environment for market participants. As regulatory transparency improves in Hong Kong and the region, the HKEX Index could become a key enabler for the development of structured financial products that rely on stable, reference pricing.

3.2 Crypto Index Promotes Financial Product Innovation

With their role in providing pricing consistency, indices such as the HKEX Virtual Asset Index Series pave the way for a wide range of financial products. ETFs, equity-linked securities (ELS) and deposit-linked securities (DLS) tailored for regional investors are just some of the instruments that can be developed based on this index. In addition, the inclusion of derivatives such as futures and options expands opportunities for hedging, speculative trading and risk management.

These innovations mark an important step in the convergence of cryptocurrency markets with the traditional financial system. As the indices develop, they may also support DeFi protocols, enabling tokenized loans, yield instruments, and other complex products that rely on accurate, real-time price references.

3.3 Lessons from Traditional Finance

Traditional financial markets have long relied on benchmarks such as the S&P 500 and the Dow Jones to provide consistency and credibility for pricing, performance tracking, and portfolio management. Commodity markets similarly use indices to stabilize the prices of commodities such as crude oil and gold. Cryptocurrency indices can adopt this proven model to provide institutional investors with a trusted framework for asset allocation, performance measurement, and portfolio rebalancing.

In addition to traditional applications, benchmark indices can also support algorithmic trading and other advanced strategies that rely on accurate real-time data. By combining traditional financial principles with the innovation of blockchain technology, indices such as the HKEX Virtual Asset Index Series have the potential to redefine the integration of digital assets into the broader financial ecosystem.

4. Conclusion and Future Outlook

The HKEX Virtual Asset Index Series is a landmark move in Hong Kong's efforts to position itself as a digital financial hub. By introducing standardized benchmarks for Bitcoin and Ethereum, HKEX has laid the foundation for a more transparent, stable and investor-friendly cryptocurrency market in Asia. The series meets the need for unified pricing of cryptocurrencies while also laying the foundation for potential expansion into structured products and risk management tools similar to traditional finance.

The HKEX Index Series could encourage other Asian markets to adopt similar standards, potentially creating a more unified, regulated framework for cryptocurrencies across the region. Such standardization could attract more institutional investors and drive market liquidity and stability. For stakeholders and investors, the Index Series provides an opportunity to participate in a more transparent and structured crypto environment that is consistent with traditional financial principles and advances the maturity of the crypto ecosystem.

In summary, the HKEX Index Series represents an important step in integrating cryptocurrencies into the financial system. It has the potential to reshape the cryptocurrency investment landscape by providing valuable insights and tools to both retail and institutional participants. The adoption of a reliable benchmark could mark a pivotal moment for the cryptocurrency market, establishing a new standard for transparency, security, and growth in Asia’s growing cryptocurrency economy.