Author: Jessy, Golden Finance

As the U.S. regulation of virtual currencies becomes increasingly clear, DeFi has also become one of the main themes of this bull market.

At present, the DeFi under US regulation that people are talking about refers more to RWA, US dollar stablecoins, and PayFi, etc., which are real assets on the chain. These practices are generally built on Ethereum and its second layer, or some high-performance new public chains. The only relationship between all of this and Bitcoin seems to be that the encapsulated Bitcoin participates in financial activities on the chain.

In order to change the embarrassing situation that only packaged Bitcoin can participate in on-chain finance, BTCFi came into being. The so-called BTCFi refers to a financial service platform and protocol built around Bitcoin and its ecosystem, combined with decentralized financial technology, to expand the financial functions of Bitcoin.

Specifically, this enables Bitcoin itself to participate in financial activities on the chain, and the originally poor Bitcoin smart contract functions have been enhanced. The Bitcoin ecosystem also has more complex DeFi protocols similar to other public chains, such as centralized exchanges, over-collateralized stablecoins, and re-staking. In addition to BTC itself, some BTC ecosystem-related assets, such as inscriptions, runes, RGB++, etc., have also participated in DeFi-related activities.

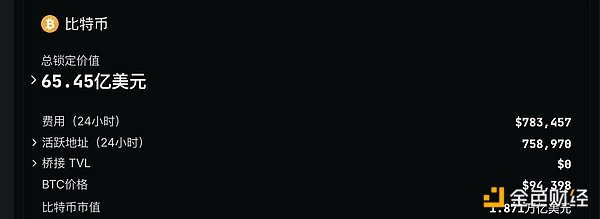

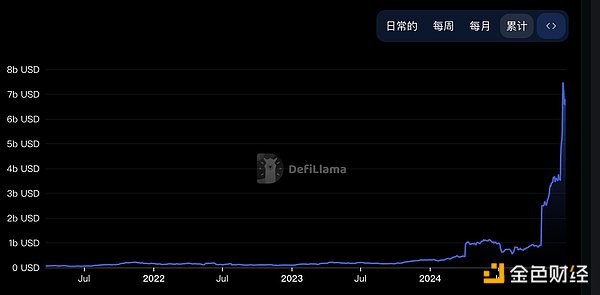

According to DeFiLlama data, the total TVL of BTC is currently $6.545 billion, while the total TVL of Solana is $8.297 billion and the total TVL of Ethereum is $68.31 billion. It can be seen that BTCFi is still a blue ocean with high development potential.

Currently, there are star projects like Babylon on BTCFi, which mainly introduces the Bitcoin staking protocol, allowing users to stake Bitcoin on another PoS blockchain and earn income without using third-party custody, bridging solutions or packaging services. In addition, what other projects are worth paying attention to?

BTCFi overall development

According to DeFiLlama data, the total TVL of representative projects in the BTCFi track, such as Babylon, has exceeded 5 billion US dollars. Among them, lending and re-pledge protocols are the two core components of the BTCFi ecosystem, occupying the largest market share.

BTCFi protocol TVL ranking (data as of December 24, 2024)

According to DefiLlama's forecast, the BTCFi market size will grow to about $1.2 trillion by 2030. This year is a year of rapid development of the BTC ecosystem. At the beginning of 2024, the overall TVL of BTC was $300 million, and by the end of 2024, it had reached $6.5 billion, an increase of more than 20 times.

In the BTCFi track, lending protocols are one of the most important applications. Traditionally, Bitcoin, as a digital asset, has not participated in the lending market. However, the BTCFi protocol enables Bitcoin to be used as collateral for decentralized lending. Typical projects include Liquidium, Shell Finance, etc.

Then there is the stablecoin protocol. The stablecoin protocol in BTCFi uses Bitcoin and its derivative assets (such as Ordinals and Rune) as collateral to issue stablecoins pegged to the price of Bitcoin. In the practice of stablecoins, there are Shell Finance's Bitcoin-pegged stablecoins, Babylon's Bitcoin-collateralized stablecoins, and so on.

The re-pledge mechanism is also an innovation in the current BTCFi ecosystem. This year, these projects have also made considerable achievements in terms of locked-up volume. There are currently many re-pledge protocols in the BTCFi ecosystem. Users can re-pledge already pledged Bitcoin or other crypto assets to receive additional rewards. For example, BounceBit and Lombard Protocol in the Babylon ecosystem are protocols that support re-pledge.

Introduction to the top BTCFi project

Babylon

When it comes to BTCFi, Babylon must be a project that cannot be ignored. It is the first project in the industry to introduce Bitcoin’s own standard Staking. It is essentially a pledge, security and liquidity protocol.

The main innovation is the introduction of Bitcoin's own standard Staking. Through the technical upgrades achieved through the Bitcoin Improvement Proposal, such as Schnorr signatures, Taproot upgrades, and Tapscript updates, the efficiency and privacy of Staking transactions are improved, allowing Bitcoin holders to lock BTC assets in the form of instruction code contracts in the Bitcoin mainnet in a self-custodial manner without the need for third-party custody, and output "secure consensus services" on many BTC layer2s, thereby obtaining rich benefits from other extensions.

Currently, the TVL exceeds 5 billion US dollars, and it has a rich ecology. According to public information, its ecological projects cover 7 categories including Layer2, DeFi, liquidity pledge, wallets and custodians, Cosmos, finality providers and Rollup infrastructure, with a total of 91 projects, including many well-known projects, such as BisonLabs, BSquared Network in the Layer2 field; Kina Finance, LayerBank in the DeFi field; Bedrock, Chakra, Lombard in the liquidity pledge field, etc. These projects have formed a huge ecosystem around Babylon, promoting the diversified development of the Bitcoin ecosystem.

Shell Finance

It is the first decentralized lending and stablecoin protocol built on the Bitcoin layer. It aims to provide decentralized lending and stablecoin protocols for the Bitcoin ecosystem, allowing Bitcoin and related asset holders to manage assets more flexibly and obtain liquidity.

One of its core functions is lending services. Users can use Bitcoin, Ordinals NFT, BRC-20, Runes and other Bitcoin ecosystem assets as collateral to lend a synthetic asset called BTCX. This process does not require trust in a third party and is achieved through a unique peer-to-protocol lending mechanism. Shell Finance acts as the counterparty of the borrower as a party to the agreement. Unlike traditional lending agreements, Shell Finance charges borrowers a one-time loan fee instead of continuously charging interest through floating interest rates, achieving interest-free instant lending and providing unique income opportunities for inscription holders.

The second core function is the issuance of stablecoins. Shell Finance is the first decentralized stablecoin protocol on the BTC mainnet. Users can obtain stablecoins by pledging the above-mentioned Bitcoin ecosystem assets. The launch of this stablecoin has improved the liquidity of BTC's first-tier assets and laid the foundation for the development of BTCFi. In the future, it will also be expanded to UTXO model networks such as Bitcoin Fractal, further expanding the use scenarios.

Technically, it adopts the Discreet Log Contract (DLC) technology and PSBT technology. The former was proposed by Tad Gredryja, co-creator of the Bitcoin Lightning Network, which can make the contract execution process more private, secure and fully automated, such as automatic liquidation to repay the loan when the value of the pledged assets falls below the critical point.

On December 4, 2024, the Shell Finance mainnet was launched.

Liquidium

An ordinal lending platform based on the Bitcoin blockchain that allows users to lend and borrow native Bitcoin using native ordinals as collateral, eliminating the need for intermediaries or custodians.

The product supports a variety of collateral, not only Bitcoin Ordinals as collateral, but also plans to support BRC-20 tokens, etc., providing users with more choices and further expanding the application scenarios of Bitcoin assets.

Technically, it is based on the Bitcoin network, and all lending operations are carried out directly on the first layer of Bitcoin. The project token LIQUIDIUM was launched on July 22, 2024, and is the first governance token of the Rune Token Standard on Bitcoin. The token aims to decentralize the Liquidium protocol and promote community participation in its governance.

BitSmiley

The project has three major components. The first is the over-collateralized stablecoin protocol bitUSD, which is benchmarked against DAI. Users can over-collateralize native BTC to the bitSmiley Treasury to mint the stablecoin bitUSD.

The second is the native trustless lending protocol bitLending, which uses peer-to-peer atomic exchange technology to achieve transaction matching and also introduces an insurance system to optimize the deficiencies of the traditional lending and liquidation process;

The third is the innovative derivatives protocol Credit Default Swaps (CDS), which is essentially a risk transfer tool. On the BitSmiley platform, one party (usually the party worried about the risk of debt default) regularly pays a certain fee to the other party (the party willing to bear the risk in order to obtain certain benefits), similar to an insurance premium. If the agreed underlying debt (such as the debt generated by the relevant Bitcoin ecological asset lending, etc.) defaults, the party bearing the risk must pay the party paying the fee in accordance with the agreement, so as to manage and hedge the risk of debt default. In terms of operation, it integrates NFT cutting CDS and uses aggregate bidding methods to improve market efficiency and fairness.

Currently, its token SMILE has been listed on multiple exchanges, such as Bybit, Gate.io, Bitget, Matcha, etc.

Chakra

The technical innovations of the Bitcoin re-pledge protocol are as follows: First, self-custody pledge. Through time-locked scripts, Bitcoin holders can pledge without transferring assets out of their wallets, avoiding third-party risks and following the principle of "not your keys, not your coins" to ensure asset security. Second, the use of zero-knowledge proof technology, specifically using Stark to implement the proof system. Bitcoin pledge events are verified off-chain through zero-knowledge proofs to access on-chain information without connecting to the Bitcoin network and without trusted settings, which enhances security compared to Snark.

By integrating decentralized Bitcoin liquidity, Chakra provides a more secure and smooth settlement experience. Users can easily stake Bitcoin with one click, use Chakra's advanced settlement network, and participate in more liquidity income opportunities including Babylon's LST/LRT projects.

Solv Protocol

The core highlight of the Bitcoin staking protocol is to cooperate with leading protocols in various ecosystems to provide diverse profit scenarios.

SolvBTC launched by the project is the first BTC product that allows self-generated income. Through staking, it creates a safe basic income for the idle Bitcoin in the user's wallet. SolvBTC captures staking income and restaking income from BTC Layer2, and DeFi income from ETH Layer2, and seamlessly integrates various protocols at the application layer to provide Bitcoin holders with rich income opportunities. Its income is generated through three strategies: staking, restaking and trading strategy income.

We can understand it as a unified Bitcoin liquidity matrix, aiming to unify the dispersed trillion-dollar liquidity of Bitcoin through SolvBTC. It is equivalent to a Bitcoin asset yield aggregator. Whether it is BTCB, FBTC, MBTC..., different BTC assets on different chains can be minted into SolvBTC, simplifying the user's asset management experience.

This is equivalent to integrating the liquidity opportunities of different Bitcoin assets. One SolvBTC goes all over the chain to form a unified asset pool, bringing more diversified income opportunities to holders.

Bedrock

Bedrock is a multi-asset liquidity rehypothesis protocol.

As for BTCFi, it uses uniBTC supported by babylon for re-staking. In the Babylon War, Bedrock performed outstandingly and successfully grabbed 297.8 BTC staking quota, accounting for nearly 30% of Babylon's initial staking amount.

Using this product, users can stake wBTC on Babylon on the ETH chain. After staking their WBTC, they will receive a 1:1 certificate - uniBTC, and the user's uniBTC can be exchanged for wBTC at any time. Babylon provides core technical support in this process. Users who stake wBTC and hold uniBTC can obtain Bedrock and Babylon points. Through uniBTC and Babylon's cooperation, Bedrock provides liquidity staking services to support Babylon's PoS chain. By minting uniBTC, the stability and security of the Babylon chain are ensured, and the Bedrock product is further expanded to the BTC chain.

Bouncebit

Committed to creating a yield infrastructure for Bitcoin, providing institutional-grade yield products, re-staking application scenarios, and CeDeFi services. Its specific businesses include:

Bouncebit Protocol: Users deposit BTC and other assets and can receive the corresponding Liquid Custody Token. The assets are managed on the Binance platform through a secure escrow account and mirror mechanism based on multi-party computing, generating income for users.

Bouncebit Chain: A Layer1 blockchain that uses a proof-of-stake consensus mechanism and is fully compatible with the Ethereum Virtual Machine. Users can delegate tokens to verification nodes for staking, and the staking certificates obtained can be used in DApps on the chain.

Share Security Client: Its logic is consistent with Eigenlayer, allowing the security of Bouncebit Chain to be rented, providing support for applications such as Bridge, Oracle, and Sidechain.

Bouncebit was launched in early 2024, raising a total of $7.98 million. In May 2024, its native token BB was launched on Binance.

Lorenzo protocol

A modular Bitcoin L2 infrastructure based on Babylon, designed to provide a Bitcoin liquidity financial layer.

Through Babylon's Bitcoin staking and timestamp protocols, we lay the foundation for a scalable and high-performance Bitcoin application layer, enhance Bitcoin's scalability, and enable functions such as the execution of smart contracts.

The project has an innovative token system, including liquid principal tokens (LPT, such as stBTC) and yield accumulation tokens (YAT). stBTC is 1:1 anchored to the pledged BTC, unifying the BTC liquidity of different ecosystems, and holders can redeem the principal after the pledge ends; YAT has its own re-pledge plan, start and end time, and can be traded and transferred before expiration. Holders can receive POS chain rewards, and YAT of the same pledge plan can also be interchangeable. Its value comes from accumulated income and speculation on future income.

The project supports multiple staking methods, such as circular and leveraged staking. Circular staking leverages external DEX partnerships to allow users to stake BTC, borrow more BTC, and increase staking rewards; leveraged staking simplifies the process by providing internal liquidity, allowing users to apply maximum leverage with a single click, improving capital efficiency and optimizing staking returns.

Current problems with BTCFi

There are quite a few projects in this track at present, and its total TVL has also seen explosive growth in 2024, but the BTCFi track itself has not yet really caused a trend in the industry.

At present, there are still many problems in the development of this track. First of all, the most core problem is that it is often difficult to reach a consensus within the Bitcoin community on some technical upgrades and innovative solutions, which makes it difficult to promote projects related to the Bitcoin ecosystem.

On the technical level, there are also great difficulties. First, the block scalability of Bitcoin itself is insufficient, and it cannot realize automated financial transactions and complex business logic like Ethereum. In addition, the interoperability between Bitcoin and other blockchains is limited, and most solutions rely on centralized institutions to achieve cross-chain interaction.

Moreover, the transaction fees of the BTCFi project are also high, which greatly increases the cost of participants. For example, Babylon exposed the problem of high transaction fees during the staking process, including the surge in miner fees caused by the FOMO effect, and the high fees for unlocking and withdrawing operations after staking.

Insufficient liquidity is also a common problem in this field. On the one hand, the liquidity risk of the Wrapped version of BTC still exists. For example, in the Babylon protocol, the Wrapped BTC provided by the nodes participating in the pledge is not completely matched with the liquidity of the aggregated native BTC, and needs to be maintained by the reputation guarantee of each aggregation platform. On the other hand, the liquidity provision method of financial activities such as Bitcoin pledge lending is relatively single, mainly relying on capital lending, and has not yet formed a diversified and efficient liquidity provision mechanism like that in the traditional financial market.

It is in this situation that the total locked value of the BTCFi project is still relatively small compared to mainstream public chains such as Ethereum, the market acceptance and participation in it is not high, and the development and promotion of the project face great challenges.

Looking ahead

Currently, exchanges such as Binance and OKX have cooperated with Babylon, Chakra, Bedrock, B², Solv Protocol, etc. to carry out a series of pre-staking, farming and other activities. Users can obtain very high returns by participating. This is also a very convenient way for ordinary users to participate in BTCFi.

Looking at the projects mentioned above, we can find that in addition to BTC itself, the current BTCFi ecosystem already has a wide variety of asset types to participate in BTCFI. For example, inscriptions, runes and other BTC-based first-layer assets; rgb++, taproot asset and other second-layer assets based on the BTC network; WBTC on the ETH chain, various LST or LRT certificates representing pledged BTC and other wrap/stake assets; the liquidity of these assets expands the scope of BTCFi and makes BTCFi's scenarios more and more diverse.

Looking into the future, with the development of technology, Layer2 technology will continue to develop and improve, and solutions such as Rollups will become more mature, bringing significant improvements to Bitcoin's transaction processing capabilities.

With the emergence of reliable cross-chain bridges, asset transfers and interactions between Bitcoin and other blockchain networks will be safer and more efficient. Bitcoin will be able to participate more widely in DeFi applications on different chains.

With the help of solutions such as RSK, AVM, and BITVM, Bitcoin's smart contract functionality will be enhanced to support more complex financial business logic and applications.

The advancement of the above technologies will provide stronger technical support for decentralized financial services in the Bitcoin ecosystem, enabling more flexible financial products such as staking, lending, and derivatives trading.

With the revival of DeFi, we may see BTCFi's connection with real finance become closer. For example, the application of stablecoins in the BTCFi ecosystem will continue to expand, which will provide more efficient and low-cost solutions for cross-border payments and international trade. For example, the USDI stablecoin supported by RGB++, with its 1:1 anchoring design to the US dollar and AML/KYC compliance requirements, has become an important tool in the field of international payments. In the future, it is expected to be implemented on a large scale in global cross-border e-commerce, international settlement and other scenarios, which will promote the widespread use of Bitcoin in the global financial system.