Author: YBB Capital Researcher Zeke

Preface

According to CoinGecko data, the total market value of stablecoins has exceeded the $200 billion mark. Compared with last year when we mentioned this track, the overall market value has nearly doubled and exceeded the previous historical high. I once compared stablecoins to the crypto world. As a key link in the chain, it serves as a key entry point in various on-chain activities as a stable means of value storage. Now that stablecoins are beginning to move into the real world, they are reflected in retail payments, business-to-business transactions (B2B), and international transfers. In emerging markets such as Asia, Africa and Latin America, the application value of stablecoins has gradually been reflected. Strong financial inclusion enables residents of third world countries to effectively cope with the monetary instability caused by government instability. High inflation, through stablecoins, one can also participate in some global financial activities and subscribe to the world's most cutting-edge virtual services (such as online education, entertainment, cloud computing, and AI products).

Entering emerging markets and challenging traditional payments is the next step for stablecoins. In the foreseeable future, the compliance and accelerated adoption of stablecoins will become inevitable, and the rapid development of AI will also further strengthen the demand for stablecoins (computing power Compared with the development in the past two years, the only thing that remains unchanged is that Tether and Circle still have a high degree of dominance in this field, and more start-up projects are beginning to turn their attention to stablecoins. Upstream and downstream. But what we are going to talk about today is still the issuers of stablecoins. Who can take the next piece of the pie in this extremely involuted trillion-dollar track?

1. Evolution of trends

In the past, when we mentioned the classification of stablecoins, we generally divided them into three categories:

Fiat-collateralized stablecoins: These stablecoins are backed by fiat currencies (such as the U.S. dollar or the euro) and are usually issued at a 1:1 ratio. For example, each USDT or USDC corresponds to one coin stored in the issuer’s bank account. The U.S. dollar. This type of stablecoin is relatively simple and straightforward, and in theory can provide a high degree of price stability;

Overcollateralized stablecoins: These stablecoins are created by overcollateralizing other high-quality crypto assets with high volatility and good liquidity (such as ETH, BTC). In order to cope with the potential risk of price fluctuations, these stablecoins often require higher The collateral ratio means that the value of the collateral must significantly exceed the value of the minted stablecoin. Typical representatives include Dai, Frax, etc.

Algorithmic stablecoins: The supply and circulation of stablecoins are completely regulated by algorithms. This algorithm controls the supply and demand of the currency and aims to keep the price of the stablecoin pegged to a reference currency (usually the US dollar). Generally speaking, when the price rises, the algorithm More coins will be issued, and when the price drops, more coins will be bought back from the market. Representatives include UST (Luna's stablecoin).

In the years since the collapse of UST, the development of stablecoins has mainly been micro-innovation around Ethereum LST, building some over-collateralized stablecoins through different risk balances. However, with the emergence of Ethena at the beginning of this year, stablecoins have gradually determined a new development direction, that is, combining high-quality assets with low-risk financial management, thereby attracting a large number of users through higher returns, in the relatively solidified stablecoin market. The situation creates an opportunity to snatch food from the tiger's mouth, and the three projects I mention below all fall into this direction.

2. Ethena

Ethena is the fastest growing non-currency-collateralized stablecoin project since the collapse of Terra Luna. Its native stablecoin USDe has surpassed Dai with a volume of 5.5 billion US dollars and ranks third. The overall idea of the project is based on Ethereum and Bitcoin collateral. Delta Hedging, the stability of USDe is achieved by shorting Ethereum and Bitcoin on Cex with the same value as the collateral. This is a risk hedging strategy designed to offset the impact of price fluctuations on the value of USDe. If the prices of both increase, the short position will lose money, but the value of the collateral will also increase, thus offsetting the loss; vice versa. The entire operation process relies on over-the-counter settlement service providers to implement, that is, the protocol assets are managed by multiple external entities. The project's income comes from three main sources:

Ethereum staking income: The LST pledged by the user will generate Ethereum staking rewards;

Hedging transaction income: Ethena Labs' hedging transactions may generate funding rates or basis spreads.

Liquid Stables’ fixed rewards: deposit in the form of USDC on Coinbase or in other stablecoins on other exchanges to earn deposit interest.

In other words, the essence of USDe is a packaged Cex low-risk quantitative hedging strategy financial product. Combining the above three points, Ethena can provide a floating annualized rate of return of up to dozens of points when the market is good and liquidity is excellent (currently 27%), which is higher than the 20% APY of Anchor Protocol (the decentralized bank in Terra). Although it is not a fixed annualized rate of return, it is still extremely exaggerated for a stablecoin project. In this case, does Ethena have the same extremely high risk as Luna?

Theoretically, the biggest risk of Ethena comes from the collapse of Cex and custody, but this black swan situation is unpredictable. Another risk needs to be considered is the run. The large-scale redemption of USDe requires the existence of a sufficient number of counterparties. Given the rapid growth of Ethena, this situation is not impossible. Users quickly sell off USDe, causing the secondary market price to decouple. In order to restore the price, the protocol needs to close its positions and sell spot collateral to buy back USDe. The process may convert floating losses into actual losses, and eventually aggravate the entire vicious cycle. "1" Of course, this probability is much smaller than the probability of UST single-layer barrier rupture, and the consequences are not so serious, but the risk still exists.

Ethena also experienced a long period of lows in the middle of the year. Although its revenue dropped sharply and its design logic was questioned, it did not pose any systemic risks. As a key innovation of this round of stablecoins, Ethena provides a The design logic of the integration of on-chain and Cex introduces a large amount of LST assets brought by the mainnet merger into the exchange, becoming the scarce short liquidity in the bull market, and also providing a large amount of handling fees and fresh blood for the exchange. This is a compromise but very interesting design idea, which can achieve high returns while maintaining good security. In the future, with the rise of order book Dex and matching more mature chain abstraction, I wonder if there will be a chance to implement it according to this idea. A fully decentralized stablecoin?

3. Usual

Usual is a RWA stablecoin project created by former French MP Pierre PERSON, who was also an advisor to French President Emmanuel Macron. The project has been greatly influenced by the news of Binance Launchpool’s launch, and its TVL has also increased from The project's native stablecoin USD0 uses a 1:1 reserve system. Unlike USDT and USDC, users no longer exchange fiat currency for equivalent virtual currency, but The core selling point of this project is to exchange fiat currency for equivalent U.S. Treasury bonds and share the profits obtained by Tether.

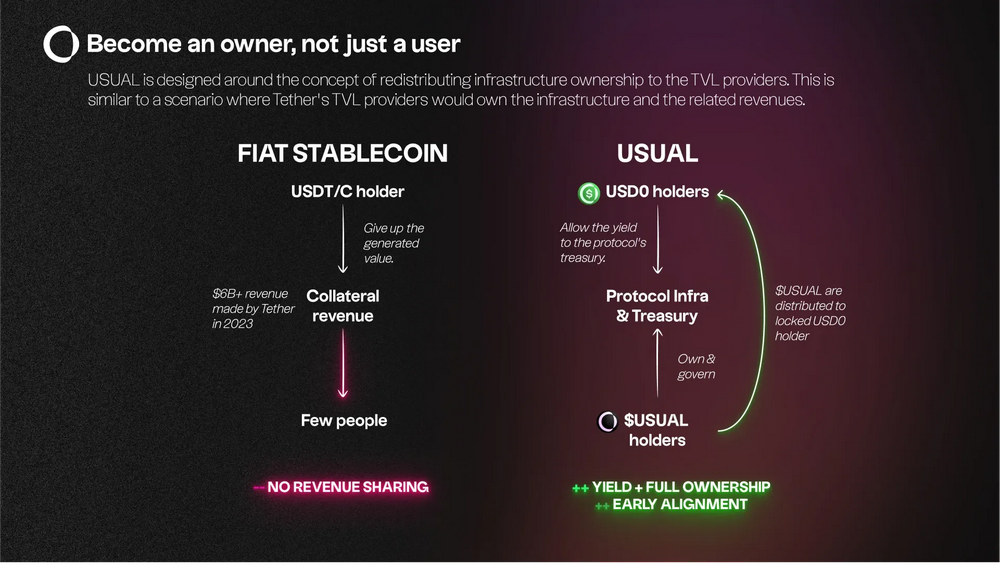

As shown in the figure above, the left side shows the operation logic of traditional fiat currency collateralized stablecoins. Taking Tether as an example, users will not receive any interest in the process of casting fiat currency into USDT. To some extent, Tether’s fiat currency can also be used as collateral for stablecoins. The company used a large amount of fiat currency to purchase low-risk financial products (mainly U.S. Treasury bonds), earning as much as $6.2 billion last year alone, and then transferred these profits to high-risk Invest in the field and make money without doing anything.

On the right is the operating logic of Usual, whose core concept is Become An Owner, Not Just A User. The project is designed around this concept, reshaping infrastructure ownership. The fiat currency allocated to the total locked value (TVL) providers, that is, the user's currency will be converted into RWA of ultra-short-term US Treasury bonds. The entire implementation process is carried out through USYC (USYC is operated by Hashnote, which is currently a leading on-chain Institutional asset managers, backed by DRW’s partners), ultimately the proceeds go into the protocol’s treasury and are owned and governed by the protocol’s token holders.

Its protocol token USUAL token will be distributed to locked USD0 holders (locked USD0 will be converted to USD0++) to achieve revenue sharing and early alignment. It is worth noting that this lock-up period is as long as four years, which is similar to some mid-term US The redemption period of government bonds is consistent (US medium- and long-term government bonds are generally 2 to 10 years).

The advantage of Usual is that it maintains capital efficiency while breaking the control of a number of centralized entities such as Tether and Circle over stablecoins and dividing the profits equally. However, the longer lock-up period and the lower interest rate compared to the cryptocurrency circle In the short term, it may be difficult to achieve the large-scale growth of Ethena in a short period of time. For retail investors, the attraction may be more focused on the value of Usual tokens. In the long term, USD0 has more advantages. It makes it easier for citizens of other countries who do not have US bank accounts to invest in US Treasury bonds. Second, it has better underlying assets as support, and the overall scale can be much larger than Ethena. Third, the decentralized governance method also means that the Stablecoins will no longer be so easily frozen and will be more preferred for non-transactional users.

4. f(x)Protocol V2

f(x)Protocol is Aladdindao's current core product. We introduced the project in detail in last year's article. Compared with the above two star projects, f(x)Protocol is less famous. The design also brings it quite a lot of flaws, such as easy to be attacked, low capital efficiency, high transaction costs, complex user access, etc. But I still think this project is the most worthwhile one born in the 23-year bear market. I will briefly introduce the stablecoin project mentioned here. (For details, please refer to the white paper of f(x)Protocol v1)

In the V1 version, f(x)Protocol created a concept called "floating stablecoin", which is to split the underlying asset stETH into fETH plus xETH. fETH is a "floating stablecoin" whose value is not fixed. xETH is a leveraged ETH long position that absorbs most of the ETH price fluctuations. This means that xETH holders will bear more The market risk and return of fETH have been reduced, but at the same time, it has also helped stabilize the value of fETH, making fETH relatively more stable. At the beginning of this year, following this idea, the rebalancing pool was designed. In this framework, there is only one kind of liquidity The stablecoin pegged to the US dollar is fxUSD. All other stable derivative tokens in stable leverage pairs no longer have independent liquidity, but can only exist in the rebalancing pool or as the backing part of fxUSD.

A basket of LSDs: fxUSD is backed by multiple Liquid Staking Derivatives (LSDs) such as stETH, sfrxETH, etc. Each LSD has its own stable/leverage pair mechanism;

Minting and redemption: When users want to mint fxUSD, they can provide LSD or withdraw stable currency from the corresponding rebalancing pool. In this process, LSD is used to mint stable derivatives of that LSD, and then these stable derivatives are stored in Similarly, users can also redeem fxUSD back to LSD.

So in simple terms, this project can be seen as a super-complex version of Ethena and early hedging stablecoins, but in the on-chain scenario, the balancing and hedging process is very complicated. First, the volatility is split, and then various balancing mechanisms and leverages are used. The negative impact of the margin on user access has outweighed the positive attraction. In the V2 version, the entire design focus shifted to eliminating the complexity brought by leverage and better support for fxUSD. In this version, xPOSITION was introduced , which is essentially a high-leverage trading tool, i.e. a non-homogeneous, high-beta (i.e., highly sensitive to market price changes) leveraged long position product. This feature allows users to trade without worrying about individual The benefits of conducting high-leverage transactions on-chain without clearing or paying funding fees are obvious.

Fixed leverage ratio: xPOSITION provides a fixed leverage ratio. The user's initial margin will not be required to increase due to market fluctuations, nor will it lead to unexpected liquidation due to changes in leverage ratio;

No liquidation risk: Traditional leveraged trading platforms may cause users’ positions to be forced to close due to drastic market fluctuations, but the design of f(x) Protocol V2 avoids this from happening;

No funding fees: Typically, using leverage involves additional funding costs, such as interest on borrowed assets. However, xPOSITION does not require users to pay these fees, reducing overall transaction costs.

In the new stable pool, users can deposit USDC or fxUSD with one click to provide liquidity support for the stability of the protocol. Unlike the V1 stable pool, the V2 stable pool acts as an anchor between USDC and fxUSD. Investors can conduct price arbitrage in the fxUSD-USDC AMM pool and help fxUSD achieve stability. The revenue source of the entire protocol is based on the opening, closing, liquidation, rebalancing, funding fees and collateral income of positions.

This project is one of the few non-overcollateralized and fully decentralized stablecoin projects. For stablecoins, it is still a bit too complicated and does not meet the minimalist design premise of stablecoins. Users must also have a certain Only with a basic understanding can you get started with peace of mind. In extreme market conditions, when a run occurs, the framework design of various defense barriers may also harm the interests of users in turn. However, the goal of this project does meet the ultimate vision of every crypto person for stablecoins, a native A decentralized stablecoin backed by top crypto assets.

Conclusion

Stablecoins are always a battleground and a high-threshold track in Crypto. In last year’s article “It’s on the verge of death, but it’s stable and hasn’t stopped innovating”, we briefly introduced the past and present of stablecoins and I hope to see some more interesting decentralized non-overweight stablecoins emerge. Now a year and a half has passed, and we have not seen any startups other than f(x)Protocol working in this direction, but fortunately Ethena and Usual provide some compromise ideas, at least we can choose some more ideal and Web3 stablecoins.

References

1. Mario's View on Web3: In-depth Analysis of Ethena's Success and Death Spiral Risks