Gary Gensler曾說過目前的加密世界就是“狂野西部”,但是我們也沒必要因為西部眾多的不法之徒,而忽視了“西進運動”給那個時代帶來的拓荒精神,和牛仔們剛踏上這片熱土的自主、冒險和創新。恰如2008年出現的比特幣,正在給這個社會,這個世界帶來種種變革。

以下編譯一篇來自The Economist 2015年關於比特幣的文章——The Trust Machine,以此來對照兩個7年時間跨度,比特幣/區塊鏈行業的狀況。這會讓我們認識到,儘管如今處於加密寒冬,但是當初的信仰,自由與熱愛依舊。

以下,enjoy:

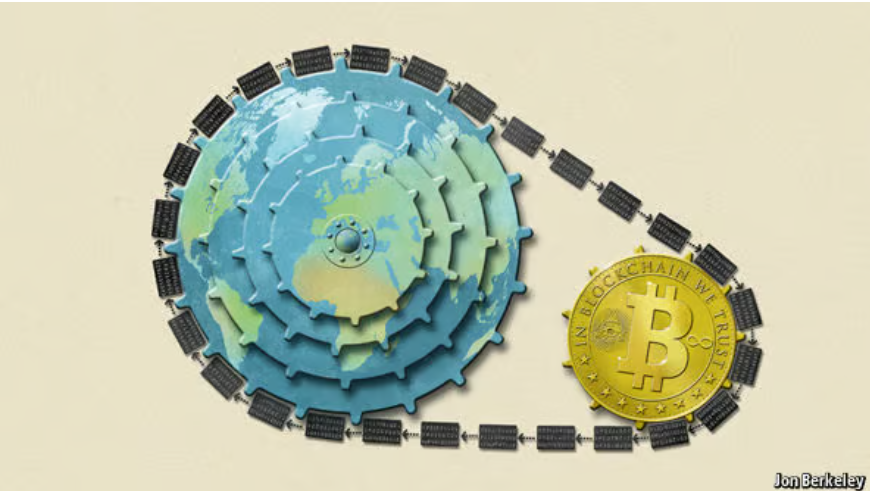

比特幣背後的技術將會改變經濟運行方式。

The technology behind bitcoin could transform how the economy works.

Oct 31st 2015

BITCOIN has a bad reputation. The decentralised digital cryptocurrency, powered by a vast computer network, is notorious for the wild fluctuations in its value, the zeal of its supporters and its degenerate uses, such as extortion, buying drugs and hiring hitmen in the online bazaars of the “dark net”.

比特幣對外界來說一直臭名昭著,這種去中心化的數字加密貨幣,由大型計算機的算力網絡驅動,以其價值的劇烈波動、信仰者的狂熱,以及其墮落的非法用途而聞名,例如在“暗網”在線市場上購買毒品、僱傭殺手等。

This is unfair. The value of a bitcoin has been pretty stable, at around $250, for most of this year. Among regulators and financial institutions, scepticism has given way to enthusiasm (the European Union recently recognised it as a currency). But most unfair of all is that bitcoin's shady image causes people to overlook the extraordinary potential of the “blockchain”, the technology that underpins it. This innovation carries a significance stretching far beyond cryptocurrency. The blockchain lets people who have no particular confidence in each other collaborate without having to go through a neutral central authority. Simply put, it is a machine for creating trust.

這是不公平的。比特幣的價值在2015 年的大部分時間內一直保持在250 美元左右,相當穩定。對於監管系統和金融機構,曾經的懷疑已經被逐步認可所取代(歐盟已經承認它為貨幣)。但最不公平的是,比特幣的陰暗形象導致人們忽視了“區塊鏈”的非凡潛力,而這項技術正是比特幣的基礎。這項創新的意義遠遠超出了加密貨幣本身。區塊鏈可以讓沒有信任基礎的人們,在不必經過中立的中央信任背書的情況下進行合作。簡而言之,它是一種創造信任的機器。

區塊鏈的由來(The blockchain food chain)

To understand the power of blockchain systems, and the things they can do, it is important to distinguish between three things that are commonly muddled up, namely the bitcoin currency, the specific blockchain that underpins it and the idea of blockchains in general. A helpful analogy is with Napster, the pioneering but illegal “peer-to-peer” file-sharing service that went on line in 1999, providing free access to millions of music tracks. Napster itself was swiftly shut down, but it inspired a host of other peer-to-peer services. Many of these were also used for pirating music and films. Yet despite its dubious origins, peer-to-peer technology found legitimate uses, powering internet startups such as Skype (for telephony) and Spotify (for music streaming)—and also, as it happens, bitcoin.

為了理解區塊鏈的功能,以及理解區塊鏈能夠實現的能力,有必要區分三個時常混淆的概念,即比特幣貨幣本身、支撐比特幣網絡的區塊鏈技術,以及區塊鏈的總體概念。一個有用的類比是1999 年上線的Napster,這是一個開創性但又不合法的“點對點”文件共享服務網絡,為數百萬音樂曲目提供免費訪問。 Napster 本身很快被關閉,但它啟發了許多其他的點對點服務網絡,許多同樣被用於盜版音樂和電影。

儘管上述點對點服務網絡的初衷有待商榷,但是該技術後來確實找到了合法用途,為互聯網初創企業(如用於電話的Skype 和用於音樂流媒體的Spotify)提供動力與方向,同樣也適用於比特幣。

The blockchain is an even more potent technology. In essence it is a shared, trusted, public ledger that everyone can inspect, but which no single user controls. The participants in a blockchain system collectively keep the ledger up to date: it can be amended only according to strict rules and by general agreement. Bitcoin's blockchain ledger prevents double-spending and keeps track of transactions continuously. It is what makes possible a currency without a central bank.

區塊鍊是一種強大的技術,本質上,它是一個共享的、受信任的、公共的賬本,任何人都可以檢查賬本,但沒有任何單個用戶可以控制它。區塊鏈系統的參與者共同維護賬本的更新:它只能根據嚴格的規則進行修改。比特幣的區塊鍊網絡可以防止交易的雙重支付,並對賬本持續保持跟踪。這就是實現一個沒有中央銀行控制的貨幣的關鍵所在。

Blockchains are also the latest example of the unexpected fruits of cryptography. Mathematical scrambling is used to boil down an original piece of information into a code, known as a hash. Any attempt to tamper with any part of the blockchain is apparent immediately—because the new hash will not match the old ones. In this way a science that keeps information secret (vital for encrypting messages and online shopping and banking) is, paradoxically, also a tool for open dealing.

區塊鏈也是密碼學領域意想不到成果的最新範例,數學混淆用於將原始信息壓縮成一個稱為哈希的代碼。任何試圖篡改區塊鏈的嘗試都會立即顯露出來,因為新的哈希不會與舊的哈希相匹配。自相矛盾的是,一個使信息保密的科學(加密消息和在線購物和銀行業務的重要組成部分)同樣也是一個公開交易的工具。

Bitcoin itself may never be more than a curiosity. However blockchains have a host of other uses because they meet the need for a trustworthy record, something vital for transactions of every sort. Dozens of startups now hope to capitalise on the blockchain technology, either by doing clever things with the bitcoin blockchain or by creating new blockchains of their own.

比特幣本身可能僅僅基於人們的好奇。然而,區塊鏈有許多其他用途,因為它滿足了對可信記錄的需求,這對於各種交易至關重要。現在有數十家創業公司希望利用區塊鏈技術,要么通過在比特幣區塊鏈上做創新,要么創建自己的新區塊鏈。

One idea, for example, is to make cheap, tamper-proof public databases—land registries, say, (Honduras and Greece are interested); or registers of the ownership of luxury goods or works of art. Documents can be notarised by embedding information about them into a public blockchain—and you will no longer need a notary to vouch for them. Financial-services firms are contemplating using blockchains as a record of who owns what instead of having a series of internal ledgers. A trusted private ledger removes the need for reconciling each transaction with a counterparty, it is fast and it minimises errors. Santander reckons that it could save banks up to $20 billion a year by 2022. Twenty-five banks have just joined a blockchain startup, called R3 CEV, to develop common standards, and NASDAQ is about to start using the technology to record trading in securities of private companies.

例如,一個想法是製作低成本、防篡改的公共數據庫,比如土地登記(洪都拉斯和希臘感興趣),或對奢侈品、藝術品的所有權進行登記。上述的想法可以通過將有關標的的信息嵌入公共區塊鏈來作為公證的文件,這樣就不再需要公證人為它們提供見證。金融服務公司正在考慮使用區塊鏈作為誰擁有什麼的記錄,而不是擁有一系列內部分類賬簿。

可信的私有分佈式正本消除了與交易對手的每筆交易進行對賬的必要性,它高效並且無誤。 Santander 銀行認為,到2022年,它可以為銀行節省高達200億美元的成本。 25家銀行剛剛加入了一個名為R3 CEV的區塊鏈初創公司,以製定共同標準,納斯達克即將開始使用這項技術記錄私人公司證券的交易。

These new blockchains need not work in exactly the way that bitcoin's does. Many of them could tweak its model by, for example, finding alternatives to its energy-intensive “mining” process, which pays participants newly minted bitcoins in return for providing the computing power needed to maintain the ledger. A group of vetted participants within an industry might instead agree to join a private blockchain, say, that needs less security. Blockchains can also implement business rules, such as transactions that take place only if two or more parties endorse them, or if another transaction has been completed first. As with Napster and peer-to-peer technology, a clever idea is being modified and improved. In the process, it is fast throwing off its reputation for shadiness.

這些新的區塊鏈不需要基於比特幣一樣的機制進行工作,它們中的許多可以通過尋找替代其消耗巨大算力能耗的“挖礦”過程來調整其模型,以及替代比特幣網絡以鑄造新的比特幣作為對參與者提供維護賬本所需的報酬。

行業內一組經過許可的參與者也可以相互商定加入一個私有區塊鏈。新的區塊鏈還制定實施業務規則,例如僅當兩個或更多方認可它們時,交易才會發生。與Napster和點對點技術一樣,基於此的創新正在/已經誕生。在此過程中,區塊鏈正在快速擺脫其不良信譽的影響。

區塊鏈的創新(New chains on the block)

The spread of blockchains is bad for anyone in the “trust business”—the centralised institutions and bureaucracies, such as banks, clearing houses and government authorities that are deemed sufficiently trustworthy to handle transactions. Even as some banks and governments explore the use of this new technology, others will surely fight it. But given the decline in trust in governments and banks in recent years, a way to create more scrutiny and transparency could be no bad thing.

區塊鏈的普及對於任何“信任中介業務”來說都是不利的——那些被認為足夠可靠以處理交易的集中機構和官僚機構,如銀行、清算機構和政府當局。儘管一些銀行和政府正在探索使用這項新技術,但其他人肯定會反對它。但考慮到近年來對政府和銀行信任的下降,創造更多的監督和透明度可能並不是壞事。

Drawing up regulations for blockchains at this early stage would be a mistake: the history of peer-to-peer technology suggests that it is likely to be several years before the technology's full potential becomes clear. In the meantime regulators should stay their hands, or find ways to accommodate new approaches within existing frameworks, rather than risk stifling a fast-evolving idea with overly prescriptive rules.

在這個早期階段製定針對區塊鏈的規則將是一個錯誤:點對點技術的歷史表明,在技術的潛力被完全釋放之前,可能還需要更多時間。在此期間,監管機構應該保持克制,或找到在現有框架內能夠適應創新的方式,而不是通過過度監管而扼殺一個創新的湧現。

The notion of shared public ledgers may not sound revolutionary or sexy. Neither did double-entry book-keeping or joint-stock companies. Yet, like them, the blockchain is an apparently mundane process that has the potential to transform how people and businesses co -operate. Bitcoin fanatics are enthralled by the libertarian ideal of a pure, digital currency beyond the reach of any central bank. The real innovation is not the digital coins themselves, but the trust machine that mints them—and which promises much more besides.

分佈式賬本的概念可能聽起來不具有革命性或吸引力,但是雙重會計記賬法和股份制公司也同樣如此。然而,與這些偉大的創新相同的是,區塊鏈這個看似平凡的技術或改進過程,有潛力改變人們和企業的合作方式。比特幣信仰者們著迷於這種自由主義理想——一種超越任何央行的純粹數字貨幣。但真正的創新不是數字貨幣本身,而是創造它們的信任機器,以及它能夠帶來的更多變革。

-END-

本文僅供學習、參考,希望對您有所幫助,不構成任何法律、投資意見,not your lawyer,DYOR。