Author: Three Sigma

Compiled by: Felix, PANews

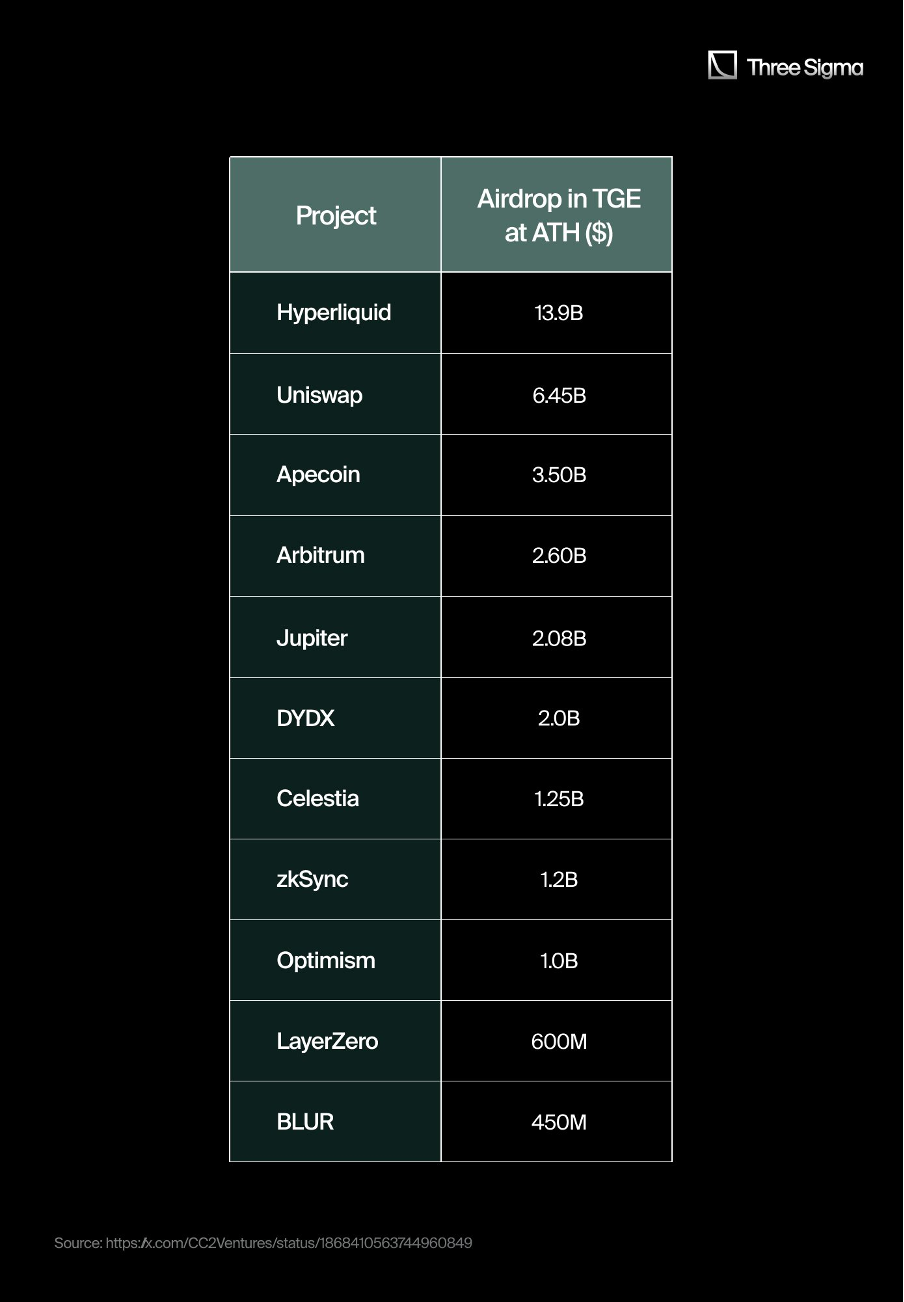

Hyperliquid broke the airdrop mold and it’s the talk of the crypto community. This article aims to explain Hyperliquid’s points system and why it became one of the most successful airdrops in history.

1. Brief introduction to integration and psychology

Points are a structured way to measure and reward user engagement and loyalty within an ecosystem. They provide a framework for tracking activity and incentivizing behaviors that align with a project's growth goals, such as engaging with the project platform or contributing to the community. In the context of airdrops, points often determine airdrop eligibility and allocation, turning an otherwise random reward into an interactive process that fosters competition and a sense of achievement. Beyond that, point systems are used to guide users and launch final products.

Most importantly, the real goal of launching a points system is to strengthen the project’s user base, improve its liquidity, and ultimately boost all growth-related metrics. Some projects even use these metrics to raise funds at higher valuations, proving the project’s engagement and traction.

Psychologically, points are a powerful behavioral driver that enhances user engagement. Concepts such as reward anticipation motivate users by promising future benefits, while the principle of reciprocity encourages users to remain loyal to a system that rewards their efforts. The visibility of points also promotes social comparison, motivating users to engage more deeply in competition.

2. Hyperliquid Points Program

Hyperliquid is a decentralized derivatives trading platform with its own L1 that aims to combine the speed and efficiency of CEX with the security and transparency of blockchain. Hyperliquid stands out in 2024 as the only notable project with no external funding.

Additionally, Hyperliquid created the best token airdrop in the crypto space using a points system, which became one of the most successful airdrops in history in terms of both size and execution.

To understand how Hyperliquid achieved this feat, one needs to examine the various factors that propelled the platform to the top and into the center of conversation.

Hyperliquid Points Season Event

The points program is a cornerstone of Hyperliquid's success, designed to reward users and promote real engagement with the platform. Three major seasons were launched during this period: closed alpha, public season 1, and season 2. Hyperliquid also implemented unannounced seasons 1.5 and 2.5, offering additional points for real usage rather than pure point mining.

Hyperliquid distributed 446 million credits among 11,500 active users during the closed alpha phase, which ended on October 31, 2023. This phase rewarded early adopters who participated in testing the platform, laying the foundation for Hyperliquid's community-driven ethos.

The points program and Season 1 officially launch on November 1, 2023, distributing 1 million points per week over six months to reward users who contribute to the growth of the protocol. This initial phase ends on May 1, 2024. In addition, users can earn fees and points through referrals. To further incentivize participation and distribution, an interim Season 1.5 (May 1 - May 28, 2024) uses 2x point rewards and distributes a total of 8 million points over four weeks.

Season 2 begins on May 29, 2024, with 700,000 credits distributed each week until September 29, 2024. Following these 4 months is the undisclosed Season 2.5, which runs from September 30, 2024 to November, with a total of 8.4 million credits distributed.

Earn Rewards: What We Know and What We Don't Know

Hyperliquid’s reward system encourages users to participate in compliant activities, such as generating trading volume and depositing funds. However, manipulative behaviors such as wash trading, withdrawals, and using linked wallets for mining are penalized and labeled as Sybil activities.

While the distribution rate and season duration are transparent, key details remain uncertain or not disclosed until some time later, including the total number of points in the season, the existence of tokens, how points are converted into tokens, the exact criteria for earning points, and actions that may result in penalties.

This mix of clarity and ambiguity allowed participants to focus on meaningful contributions while speculating on the broader potential of the campaign system.

Perps trade and first season

While the total points distribution for each season is known, the exact calculation of token distribution remains unclear to this day. In Season 1, since the perpetual contract market was not considered until the last few weeks, it is assumed that the points distribution was based on typical metrics in the perpetual contract space, such as trading volume, number of trades, funding fees paid, liquidation volume, and user profit or loss.

Compared to Season 2, the points distribution in Season 1 was more linear, with users who moved more capital through perpetual contracts receiving significantly more points. There may be a cap on the points distribution, or it may become increasingly expensive to earn additional points after reaching certain thresholds. However, there was a clear distinction between users with more capital and those who could only trade with a few thousand dollars at the time.

Spot Trading, Retail and Participation

The spot market was launched with the PURR airdrop before the end of Season 1. Initially, there was no indication that there would be incentives attached to spot market trading, or trading in general. However, after May, the Season 2 points campaign was launched, marking a shift in the rewards mechanism.

During Season 1, the only way to earn points was to trade perpetual contracts, a system that naturally favored whales, high-frequency traders, and market makers because they had access to larger capital and advanced trading strategies. Season 2 introduced a more inclusive system that allowed users to earn points not only by trading in the spot market, but also by holding assets. This change leveled the playing field, putting retail traders and whales on an equal footing as the spot market lacked deep liquidity, and made it easier for participants with less capital to compete for points.

Unlike most airdrop mechanisms, where whales dominate by leveraging their capital through staking or high trading volume, the Hyperliquid team implemented a mechanism to ensure a more equitable distribution of rewards. This design significantly increased the community's positive sentiment towards the platform. By the start of Season 2, point distribution had been spread across users of both perpetual and spot markets. While the exact breakdown of weekly point distribution remains undisclosed, metrics unique to spot markets, such as token holdings or liquidity contribution, may affect reward calculations.

The decision to keep these reward mechanisms opaque requires users to experiment and discover the best strategies themselves, preventing whales from cheating and monopolizing point distribution. This approach produces a fairer reward structure and promotes inclusion and participation among users of different capital levels.

3. Indicators

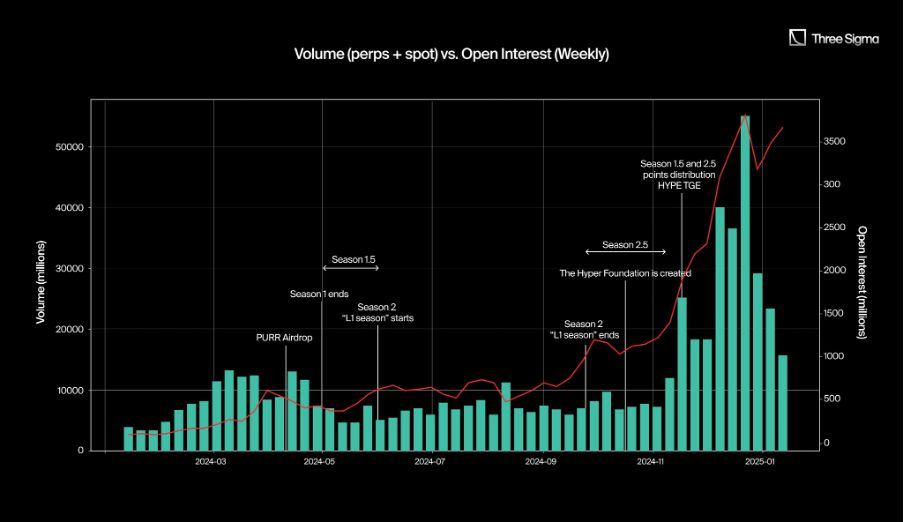

Over the time period analyzed in the chart above, open interest (OI) showed a consistent upward trend, closely tracking volume patterns, with no signs of wash trading throughout the year. Most activity appears to be natural, capturing the market's attention during active periods and tapering off during the quieter summer months when the broader market trended sideways and slightly to the downside.

A key moment was the PURR airdrop, which drove a significant increase in platform activity. After the first season, activity naturally declined, leaving only users who were truly engaging with the dApp. Later, during the launch of Season 1.5, these users were rewarded with additional points, further incentivizing their participation.

The initial launch of the first season attracted less attention, but in the following months, activity gradually increased even in the depressed crypto market. By the end of the second season, when the broader market was still recovering, Hyperliquid had become a hot topic. Despite the lack of public rewards and the general market belief that the hype about the platform had faded, its metrics saw a significant increase. As the market rebounded after the US election, Hyperliquid became the preferred platform for on-chain traders and has been outperforming its competitors.

The launch of the Hyperliquid Foundation, coupled with the confirmation of the upcoming launch of the network token, has solidified the platform’s position in the market. This surge in exposure has stimulated exponential growth in related metrics, attracting new users who have maintained a certain level of recognition for the platform, attracted by its strong performance and innovative features.

4. What did other projects do?

To summarize and understand why Hyperliquid’s points system succeeded while other projects’ points did not, the following table compares the main features of the main airdrops and points systems in this cycle:

5. Secrets to Success

The success of Hyperliquid’s points system lies in its ability to balance user stickiness mechanisms with the quality of its underlying product. By analyzing its uniqueness and common features with other airdrop campaigns, we can draw key lessons on improving user loyalty, token retention, and project growth.

What makes Hyperliquid's points system unique

Hyperliquid has introduced innovative elements that set its campaign apart. The system’s limited points create a fair and competitive environment, avoiding the user dissatisfaction often caused by unlimited point mining. In addition to this, users can also receive additional airdrops, increasing the perceived value of participation. Most importantly, point mining requires skill and effort, ensuring that the most dedicated and capable users are rewarded, while filtering out those who seek easy gains.

Common features of airdrops

Despite its uniqueness, Hyperliquid’s campaign shares certain features with other airdrops. The total points were not disclosed ahead of time, thus maintaining market interest and speculation. Like many other campaigns, it lasted for about 10 months and featured one or more points seasons leading up to the Token Generation Event. However, the lack of clear rules was a common drawback, leaving users to mine for rewards on their own. Points mining also required a capital investment, which is standard practice in similar campaigns, but sometimes exclusive.

Lessons Learned for Future Airdrops

If the goal is to distribute tokens to skilled, loyal holders who understand the ecosystem, then users who receive airdrops require effort and expertise. This approach aligns participants with the vision of the project and reduces the likelihood of tokens being sold off after the TGE. Limiting total points can further increase user satisfaction, thereby cultivating trust and mitigating excessive point mining. In addition, miners should feel that their rewards are earned through a combination of time, money, and skills, rather than for free, which increases the perceived value of the token.

The ideal point mining period seems to be around ten months. As demonstrated by Hyperliquid and other leading campaigns, this period balances sustained engagement with user fatigue. Simple programs like Grass that require minimal effort can afford a shorter period, but those with demanding commitments will take longer to succeed.

The bigger picture: Products over points

Hyperliquid’s success goes far beyond its points system. It avoids excessive marketing costs, refuses to charge fees during events, and provides a user-centric platform. It is not bound by external funding and investor-driven roadmaps, allowing for a consistent, community-driven narrative. By focusing on perpetual contract trading, Hyperliquid has built a product that remains essential even during market downturns, ensuring continued trading activity.

The project’s step-by-step approach has fostered a loyal community that truly believes in its mission. The emphasis on effort and skill in the points campaign not only filters out opportunistic miners, but also builds a strong connection between top contributors and the project.

Related reading: Is Hyperliquid's valuation reasonable? A quick look at its product status and economic model