Author: Foxi (DeFi / AI)

Compiled by: TechFlow

“Intelligent agents aren’t just here for your Twitter feed — they’re reshaping the entire digital economy.”

This article will dive into how to discover the next leading AI agent (Alpha) by understanding the methodology. Remember: once everyone sees it, it has lost its lead. The key is to be two steps ahead, and by applying this methodology, you can seize the opportunity and succeed.

Special thanks to Delphi_Digital for their AI report and other groundbreaking researchers for their contributions.

The Golden Rule: Consensus

In the market, everyone tries to sell their assets to others at a higher price. Your goal is to exit at the right time, rather than being too attached to a certain asset. In order to exit successfully, you need to find a project with "consensus". This means that most people in the market agree on the value of the project and provide you with liquidity support. Building consensus is a complex topic, and we will not discuss it in depth today.

How to make money?

- Predict an emerging trend (consensus) and build conviction (need knowledge to support your judgment).

- Invest in potential projects that are innovative and legitimate.

- When the market reaches a consensus, sell your assets.

This article will focus on the most challenging step: prediction. If you don’t have a clear understanding or belief in the trend, it will be difficult to independently judge the value of potential projects. In this way, you will either rely entirely on luck or wait for others to give you tips, and you may end up being the object of others’ profit. Let’s get started.

Part I: Three Waves of Intelligent Agent Evolution

The AI field in 2024 is marked by OpenAI's o1 system and multi-billion dollar valuations, and 2025 is considered a key year for the financialization of artificial intelligence. However, to find the real value in this rapidly developing field, it is necessary to jump out of the concept hype of "AI intelligent agents" and deeply understand the fundamental changes behind them.

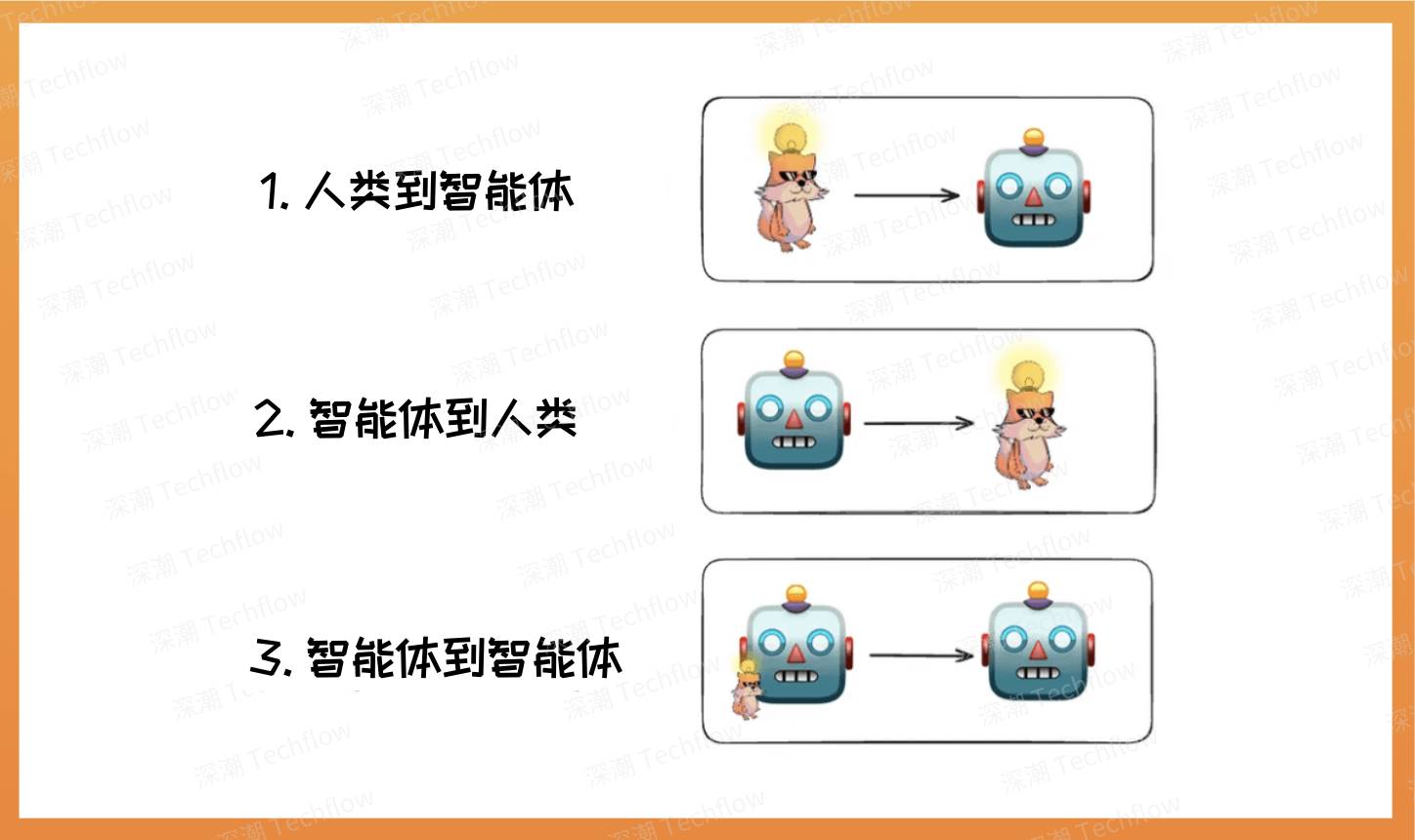

Understanding where we are in the technology adoption cycle is critical to seizing opportunities. The development of the agent economy can be divided into three stages:

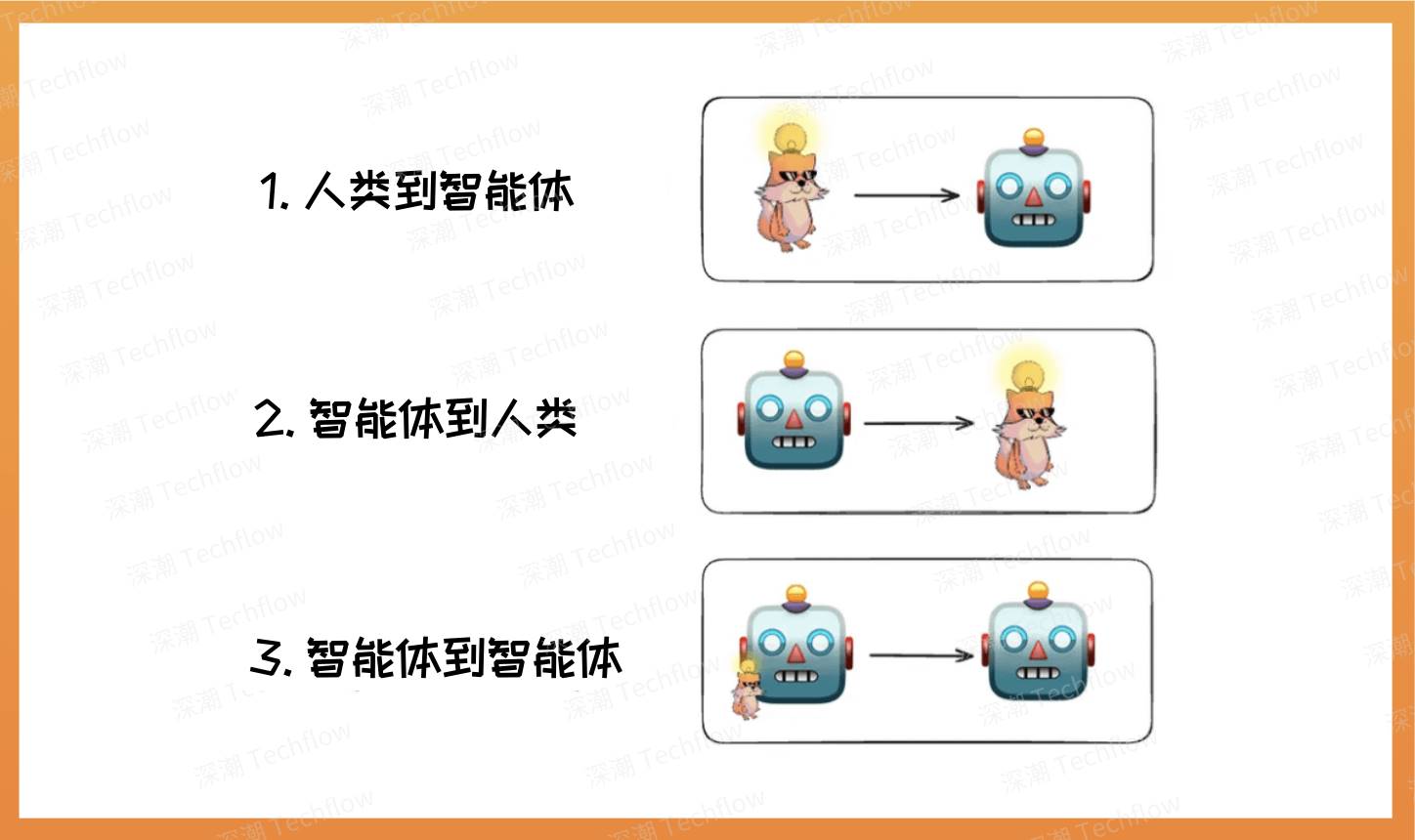

Figure: From Foxi (DeFi / AI), compiled by TechFlow

Wave 1: Human to Intelligent Agent (Current Stage)

We are currently at this stage, with a typical example being a simple chatbot on X (@aixbt_agent). These agents mainly serve as research assistants or execution tools for humans to help complete simple tasks. Although they have certain value, they do not require disruptive infrastructure reforms. Most current agents are similar to a customized ChatGPT, helping users complete simple research work, but with weak autonomy. They cannot independently manage resources, take risks, or pay for services.

Wave 2: Agent to Human (emerging)

Agents at this stage begin to truly demonstrate their potential. They can independently complete daily tasks, such as running trading strategies, optimizing home energy usage, and even negotiating and paying bills. These tasks no longer require frequent user intervention. Tools such as Stripe's Agent SDK can already cover some scenarios, and also reveal a trend: the traditional fixed monthly or annual fee model will gradually be replaced by an on-demand pricing model.

As agents take on more responsibilities, they need to pay for computing resources, API query fees, model inference costs, etc. - these expenses may be real-time and on-demand. However, the limitations of existing payment systems are exposed in these scenarios because they are not designed for real-time micropayments. Cryptocurrencies have shown advantages in this area, providing faster settlement speeds, lower transaction costs, and more flexible payment methods to better meet these new needs.

Some real-world examples on the chain include:

- Automated Trading System

- Optimizing revenue tools

- Portfolio rebalancing mechanism

Wave 3: Agent to Agent/Collaboration (Future)

This is the most promising phase of the agent economy. We have already seen some early experiments in inter-agent commerce, such as projects like Terminal of Truth and Zerebro. However, the true potential of these explorations goes far beyond the application of social media tokens:

- Resource Market: Computing agents can negotiate with storage agents for the best data storage location, thereby optimizing resource allocation.

- Service optimization: Database agents can negotiate query optimization services with computing agents to improve efficiency.

- Financial services: Risk assessment agents can transact with insurance coverage agents to provide users with smarter protection solutions.

This stage requires infrastructure designed specifically for machine-to-machine interaction. The traditional monetary system is human-centric and emphasizes manual verification and control, but it is not flexible enough in an economy dominated by autonomous intelligent entities. Stablecoins, with their programmability, cross-border payment capabilities, fast transaction settlement, and support for micropayments, have become a key tool in this field (yes, I am also very optimistic about the stablecoin field).

Part 2: Unpacking the AI stack for Web3

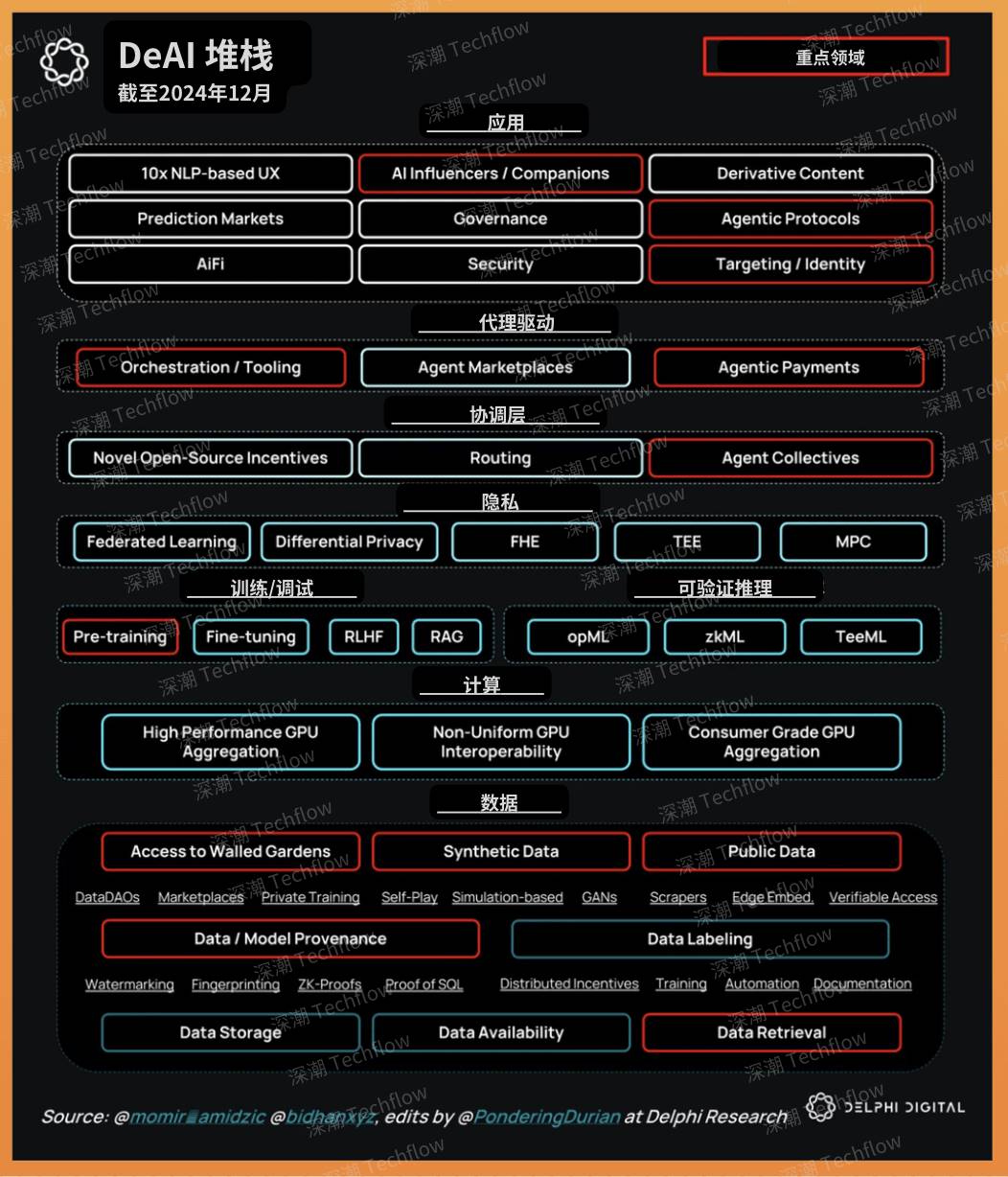

Delphi Digital has come up with a clear “decentralized AI” stack classification framework. The framework contains 6 key directions (which I think are very promising), each of which contains several sub-fields that can be seen as narratives or innovation directions. I believe that in the next few months, each sub-field will have a leading project with a market value of at least $500 million.

6 key directions and their well-known examples

- Application - aixbt

- Agent Enablement/Coordination - Virtuals Protocol

- Privacy Protection- Phala Network

- AI Training/Inference- Ritual

- Compute Services - io.net

- Data Storage - Arweave

Figure: From Foxi (DeFi / AI), compiled by TechFlow

Whether you bookmark this article or save this image, it can become an important reference guide as you explore new narratives.

There are many sub-areas within each direction, so I won’t go into them all in this article. However, I expect that the flow of funds into these directions will follow a certain “sequence”, depending on the maturity and development stage of the market. Here is a brief visual explanation:

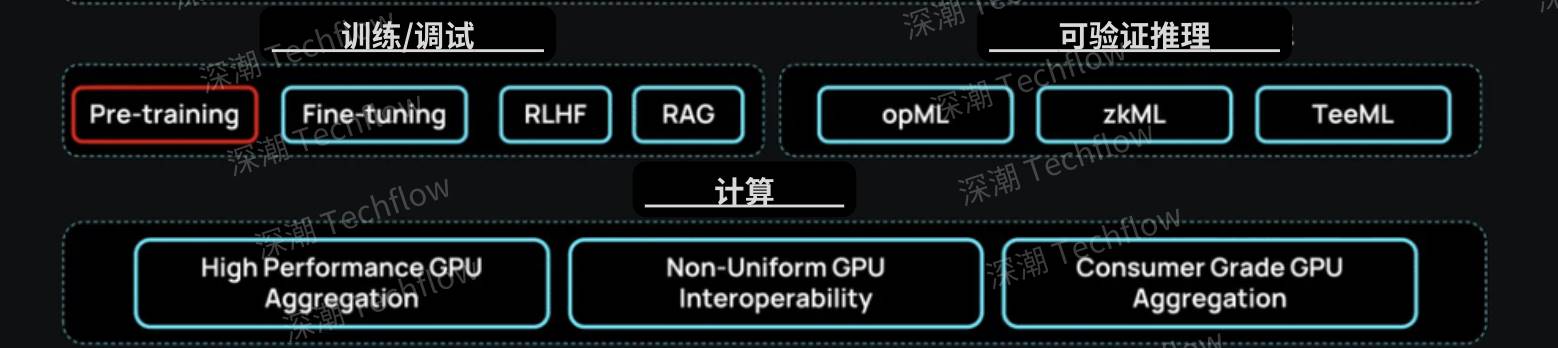

Figure: From Foxi (DeFi / AI), compiled by TechFlow

Why choose aixbt? Just because it is interesting does not mean it will become the ultimate king of the AI industry.

Phase 1:

We can see that a large number of agents are launched every day, most of which are just simple wrappers of chatbots or ChatGPTs with limited practical uses, but their meme attributes make them interesting. As we know, whether a product is practical has no direct relationship with its market valuation. Therefore, those interesting agents with enough imagination space tend to be sought after by the market.

At this stage, agent enabling platforms (such as Launchpad) become the underlying support layer for agents.

Example: Agents generate revenue by interacting with users, which is used to buy back and burn tokens paired with $Virtual. This mechanism directly ties the success of the agent to the value of the platform, thereby achieving incentive alignment across the entire ecosystem.

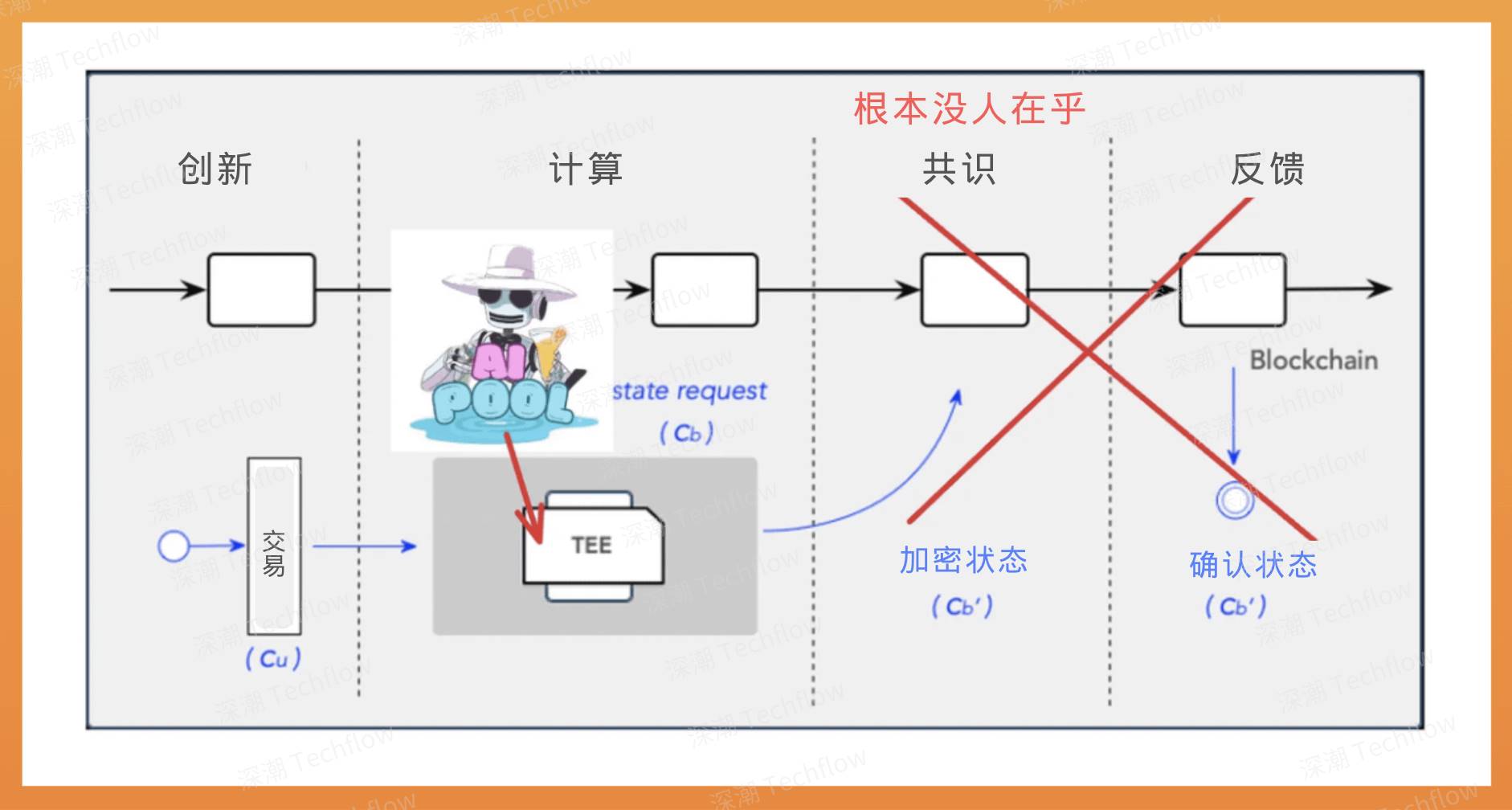

Figure: The current market focus has been marked with a red frame

Phase 2:

This narrative has gradually lost its appeal when Twitter is filled with "meaningless content" posted by chatbots. Therefore, we see more and more people starting to incorporate the concept of "privacy" into intelligent applications (such as @aipool_tee and @sporedotfun). Interestingly, most people don't understand complex technical terms such as TEE (Trusted Execution Environment), FHE (Fully Homomorphic Encryption), ZKP (Zero Knowledge Proof). This makes intelligent applications look more innovative, even though they may not actually implement these technologies. In any case, the addition of these concepts does make intelligent applications more "practical".

The next development direction of intelligent agents is to enter the field of DeFi and wallets. In the future, we will see intelligent agents helping users complete tasks such as token exchange, cross-chain bridge operations, optimizing transaction paths, and reducing transaction fees. These functions will be directly integrated into the user interface of the wallet. However, unlike the first stage, these intelligent agents need to compete on "technical capabilities" in this stage instead of relying on "faith fever". Therefore, some tokens (such as $BUZZ and $ACOLYT) are sought after by the market because they have strong AI teams or developers behind them, although the technical level of these teams may still be a certain distance away from the AI experts of Web2.

As the agent economy continues to develop, the “wealth effect of AI agents” will attract a large number of top Web2 AI developers to the Web3 field to seek new opportunities. This will give rise to many powerful AI projects. If you want to seize these opportunities, I suggest you pay more attention to LinkedIn instead of just staring at Dexscreener.

Phase 3:

Intelligent agents will eventually mature, and their core value will come from AI reasoning, data processing, and distributed computing. We will see the emergence of the following key infrastructures:

- TEE-based secure key management system

- A dedicated Data Availability (DA) layer for storing and retrieving context for Large Language Models (LLMs)

- On-chain Oracles to provide trusted data sources

- zkVM framework for verifiable computation execution

- Chain abstraction solutions to simplify cross-chain interactions

These infrastructures will support large-scale, trustless computing resources while ensuring the security and verifiability of interactions, data flows, and outputs. By then, advanced infrastructures like Ritual, io.net, and Story Protocol will transform from mere speculative objects to core tools for driving the next generation of AI innovation.

Part 3: So what should I invest in now?

Based on current market conditions, we are transitioning from Phase 1 to Phase 2.

Agents will be more attractive if they can “actively” provide value to users, rather than just tweeting or analyzing token prices (which GPT can do). I hope that agents can autonomously manage resources and make decisions on behalf of users, and even complete transaction settlements independently. Here are some more complex application directions that I would personally consider investing in:

- Automated Trading System

- Portfolio Rebalancing Tools

- Virtual Reality

- AI-driven smart contracts (e.g., prediction market arbitration)

- Other innovative applications

Of course, the above directions may still be too broad for most people (including me). According to the "Golden Rule of Consensus", I observe that the current market consensus is mainly concentrated in the following aspects:

I. Shaw

He is the most influential convener of faith in the current AI supercycle, just like Murad was in the memecoin supercycle. Don’t ignore projects that ai16z and Shaw or other core ai16z members follow. Any project they promote could be a buying opportunity.

Note: Please be careful of those who call themselves "ai16z partners", they are sometimes not the real core members. In fact, I can also call myself a "partner" casually.

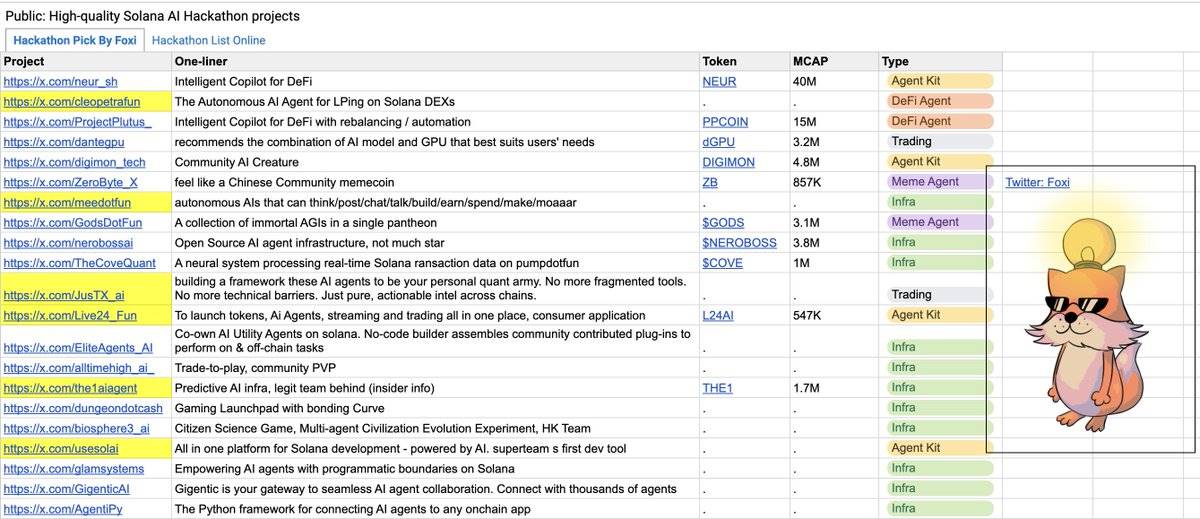

II. Solana Hackathon Winning Projects

The Solana ecosystem is vigorously promoting the development of some innovative projects. In order to seize the market opportunity, you need to select high-quality projects in advance. I have screened some projects for you, you can refer to my post. Although I am not an insider, I have evaluated these projects based on my personal experience. Of course, you should also do in-depth research on your own.

Link: Google Sheets link

To really profit from these narratives, you need to use some tools, otherwise you may miss the best investment opportunities. For example: @AgentiPy is one of my high-quality projects, and it did not issue tokens at first. Once it launched its tokens, its market value quickly soared to $40 million, but I personally failed to participate quickly due to the lack of timely tool support. Therefore, it is recommended to use tools to monitor the dynamics of the project, such as tracking its Twitter, and when the tool detects the release of the contract address (CA), it can intervene as soon as possible. More tutorials on these tools are coming soon.

III. AI Framework

You may have noticed that there are more and more infrastructure projects in the blockchain industry, and even many dApps are beginning to transform into Appchains. The reason behind this is simple - infrastructure projects usually get higher valuations. However, not all frameworks are equally valuable. You can choose the largest leader in the market, or delve into technical documentation and GitHub to find infrastructure projects with strong technical capabilities.

If you think these research works are too complicated, then a simple strategy is to focus on high-quality tokens like $ai16z or $Virtual and find a suitable entry point. Never invest your SOL or ETH in AI scam projects that have no technical support.

IV. DeFi x AI

As mentioned above, I am very optimistic about the prospects of the narrative of DeFi and AI integration (DEFAI). This trend is in line with my prediction of Phase 2, that is, the interaction mode between intelligent agents and humans gradually matures. A good starting point for research is to deeply analyze some DeFi x AI projects and their sub-sectors to understand their specific application scenarios and technical implementations.

Ultimately, understanding these market dynamics is critical to capturing the real opportunities in the agent economy. While the market is still dominated by simple social media agents, the real value lies in the infrastructure and frameworks that will power the next generation of autonomous economic activity. I will continue to hold $ai16z and $Virtual as I believe they have great potential in the future.