Author: BitpushNews

At the start of this week, trading enthusiasm in the U.S. stock and crypto markets was high.

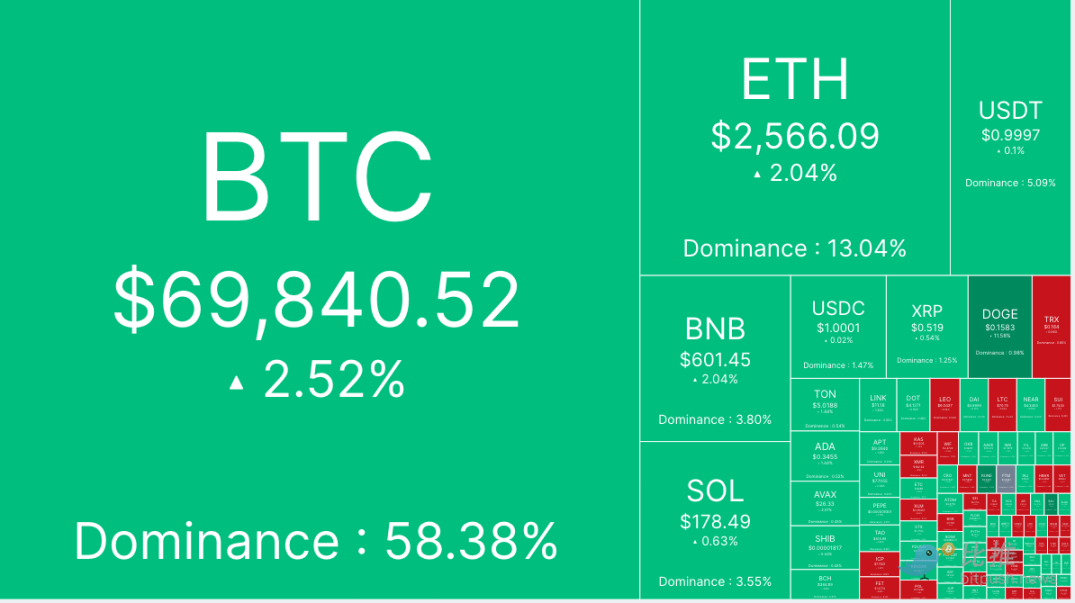

According to Bitpush data, Bitcoin rebounded from the support level of $67,600 that day and broke through $70,000 at around 6:00PM EST. Short-selling forces then fought back. As of press time, the BTC trading price fell slightly to $69,680, a 24-hour increase of 2.52%.

The altcoin market saw mixed gains and losses. Among the top 200 tokens by market cap, Dogecoin (DOGE) led the gains with an increase of 11.1%; Bitcoin SV (BSV) increased by 10%; THORChain (RUNE) increased by 8.3%; Safe (SAFE) fell the most, by 9.2%; followed by ApeCoin (APE) and ZetaChain (ZETA), which fell by 7.2% and 6.5%, respectively.

The current overall market value of cryptocurrencies is $2.34 trillion, with Bitcoin accounting for 58.3% of the market share.

This week's economic calendar is unusually dense, with a series of heavy data to be released, including the JOLTS job vacancies report on Tuesday, the Bank of Japan's interest rate decision on Wednesday, the core PCE price index on Thursday, and the key non-farm payrolls data on Friday. At the same time, the earnings season of technology giants has entered its climax, and the performance of giants such as Alphabet, Microsoft, Meta, Amazon and Apple will directly affect market sentiment.

As for U.S. stocks, as of the close of Monday, the S&P 500, Dow Jones and Nasdaq all rose, up 0.35%, 0.72% and 0.37% respectively.

The Road to $100,000

Although the market may still fluctuate in the short term, most analysts are optimistic about the long-term prospects of Bitcoin. They generally believe that once the market environment improves, it is not far-fetched for the price of Bitcoin to break through $100,000 or even higher.

Ed Hindi, chief investment officer at Tyr Capital, said in a report: "BTC looks and feels like it may go supernova in the coming months. It dominates the total value of crypto assets, recently reaching 58% of the market capitalization."

The report believes that as BTC continues to attract attention and attention, it is absorbing more and more industry liquidity, which may weaken the upside of altcoins in the coming months. Institutional leaders like MicroStrategy are opening the floodgates of corporate balance sheets, and investment giants like Paul Tudor Jones are making BTC's position in financial portfolios mainstream.

Hindi said: "We firmly believe that BTC could reach $100,000 by the end of this year and $200,000 by 2025, and we expect BTC's upside to strengthen in the run-up to the US election as long as a Trump win remains the base case."

But Hindi also warned that Bitcoin prices will not only rise but not fall, because "profit-taking may weigh on Bitcoin prices in the days following the election results, but bargain hunters should maintain strong support below $60,000. Regardless of the election results, Bitcoin should regain its footing in the medium term and hit new highs in 2024."

“All indicators point to a stunning 12-month rally,” said TradingShot, a technical chart analyst at TradingView.

He pointed out: "Bitcoin broke out of its 7-month bearish megaphone pattern last week, which actually absorbed the correction after the sharp rise in the market caused by ETF expectations and launches since October 2023. This means that Bitcoin has successfully escaped the downward trend during this period and is expected to restart a new upward cycle."

TradingShot said: “This pattern is part of a 7-year large channel rise that covers BTC’s two previous cycles. Midway through the 2018-2021 cycle, the market also saw a bearish trumpet pattern that was slightly larger and lasted for 12 months before the price broke out.”

Analysts point out that Bitcoin's recent rise is due to its re-standing on the important support level of the 50-week moving average. Moreover, historical data shows that Bitcoin's price is often affected by the 50-week moving average. In the past period of time, the 50-week moving average has repeatedly become a support level for Bitcoin's price, which shows that it is a very reliable support.

Secondly, a MACD golden cross appeared on Bitcoin's weekly chart, the first time since October 2023. A MACD golden cross is generally seen as a bullish signal, indicating that there may be a significant increase in prices in the future.

Historical data shows that when these technical indicators appear at the same time, they often trigger a strong rise in Bitcoin. A similar situation occurred in Bitcoin in mid-2020, and then a strong rise began.

Even without a major catalyst like the launch of a Bitcoin ETF at the beginning of the year, if Bitcoin can repeat the bull run from November 2022 to March 2024, reaching the $200,000 target is not a fantasy. TradingShot believes: "Historical data shows that as long as the weekly candlestick chart does not close below the 50-week moving average, we can remain optimistic whether the price of Bitcoin climbs to $100,000, $150,000 or $200,000."