Author: Cryptowrit3r

Translation: Blockchain in Vernacular

The most discussed topic in the cryptocurrency space has always been “Altseason.” This is because of the crazy gains that usually occur during this short period. Altseason is considered a major source of attraction for crypto tourists as it helps introduce newcomers to the crypto space. Today, we will take a look at the top four indicators that predict Altseason in 2025.

1. What is the alt season in cryptocurrency?

Alt season is a phenomenon in the crypto space that is famous for creating crazy profits. This phenomenon happens to all cryptocurrencies other than Bitcoin, that is, altcoins. So think of your Solana, your BNB, your SUI, and so on. When the alt season arrives, all these tokens start to surpass Bitcoin in various indicators, and their prices soar. Some tokens double in price in a few hours, and some increase by 1000% in less than a week.

But all good things must come to an end. That’s why an alt season is usually followed by a severe sell-off, marking the apex of a bull cycle. We see an interruption in the uptrend, with prices crashing due to massive whale selling pressure. When an alt season occurs during a bear market, it is often called a relief rally and is short-lived. The sell-off begins when a token hits a resistance level on its High Time Frame (HTF). In a high time frame, each candle represents a day, week, or month. This is often called a trapped bull, a favorite term of Capo in the crypto space.

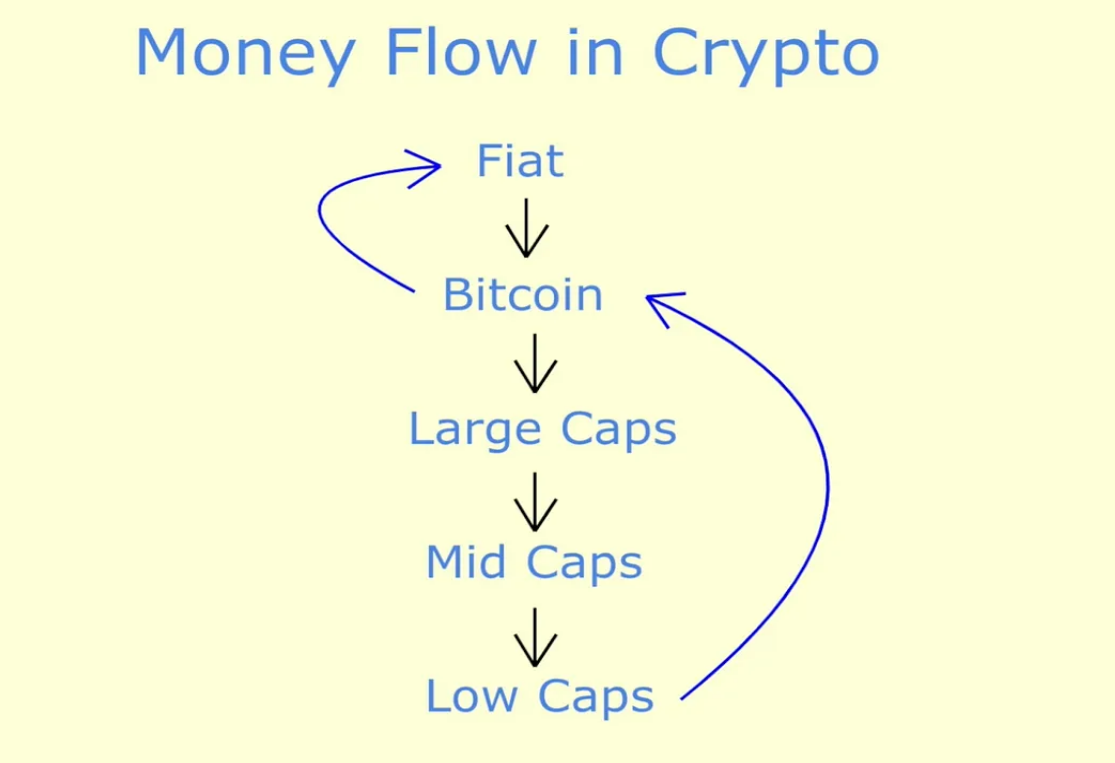

The cryptocurrency market has changed a lot recently. This is because there are now millions of crypto projects in operation, which means that when funds flow into the market, there will be a large number of projects to choose from. This may lead to the dilution of returns in the upcoming alt season in 2025, and many token holders will be disappointed. The flow of funds is usually shown in the figure below.

Let’s discuss the top indicators, the four major indicators of the 2025 copycat season. We believe that there are four indicators that will play a key role in the 2025 copycat season:

Bitcoin Dominance (BTC.D)

ETH/BTC

USDT Dominance

Other trading pairs/BTC

Let’s dissect each metric one by one.

2. Why is BTC.D important?

BTC.D stands for Bitcoin Dominance. This metric is crucial in predicting where we are in the market cycle. This is because it measures Bitcoin's share of the entire crypto market. If BTC.D is 61%, then Bitcoin controls 61% of the cryptocurrency market. Therefore, 61% of the liquidity is dedicated to Bitcoin. Naturally, this means that it is Bitcoin season and we should expect alts to weaken relative to Bitcoin. When BTC.D starts to fall, it is a good sign for alts. This is when things get interesting as liquidity flows more to other crypto assets like Ethereum, blue chips, and alts.

Note that Bitcoin Dominance (BTC.D) has reached an important resistance level on the weekly chart. This means we can expect it to top out between 62-63%. If it does not top out, then it will continue to rise until it approaches 70% before potentially topping out again. A drop below 58% on the daily chart followed by another test of 60% and a failure to close above 60% could indicate that this "big brother" (chad) has topped out.

The blue circle on the chart represents the 2021 alt season, when many notable crypto millionaires were created.

3. ETH/BTC Oracle

If you ask any crypto expert, they will tell you that ETH/BTC is one of the most important charts to keep a close eye on. When ETH moves lower relative to BTC, altcoins tend to weaken and experience distribution (which is a fancy way of saying massive selling). However, when ETH gains momentum relative to BTC, you can expect the 2025 alt season to arrive.

As we all know, ETH is the largest ecosystem in the crypto space and has the most TVL (Total Value Locked). TVL is as important to blockchain as deposits are to banks. That's why when it goes up, everything goes up quickly and we see green candles everywhere. Observing the high timeframe chart, you can see that ETH/BTC has been trending lower for a long time. It is now facing a strong support level of about 0.031 and can start to reverse upwards. This means that the alt season may be triggered. ETH/BTC may also reverse if it fails to break below 0.033 and closes above 0.04.

Pro Tip: When plotting indicators like these, always use HTF candlesticks, such as monthly and weekly, or at least daily.

4. USDT.D and liquidity flows

USDT.D is the share of USDT, the US dollar stablecoin, in the crypto market. Tether issues USDT, and we know it is the largest stablecoin in the crypto space. This means that whenever there is buying pressure, people will buy it by exchanging USDT for various crypto assets.

Generally speaking, when USDT.D drops, people will sell USDT to buy cryptocurrencies, whether Bitcoin or altcoins. In difficult times, people will flock to Bitcoin, but will buy in Bitcoin season (remember BTC.D) because the price of Bitcoin will rise. But if you see USDT.D falling and altcoin prices rising, then liquidity will flow more to altcoins than Bitcoin.

There is also a chart called OTHERS which you can find on Tradingview. This chart represents all alts except blue chips and top 10 projects. If this chart goes up and USDT.D goes down, it means alt season 2025 in simple terms.

USDT.D falling could also mean that investors are cashing in profits or panicking. If you see TOTAL1, the total market cap of the crypto market, falling when this metric falls, it means something serious is happening.

You want to see this indicator drop below 4% and close below this weekly to confirm that liquidity is flowing into crypto assets. If this coincides with BTC.D falling, it's time to act!

5. OTHERS/BTC secrets

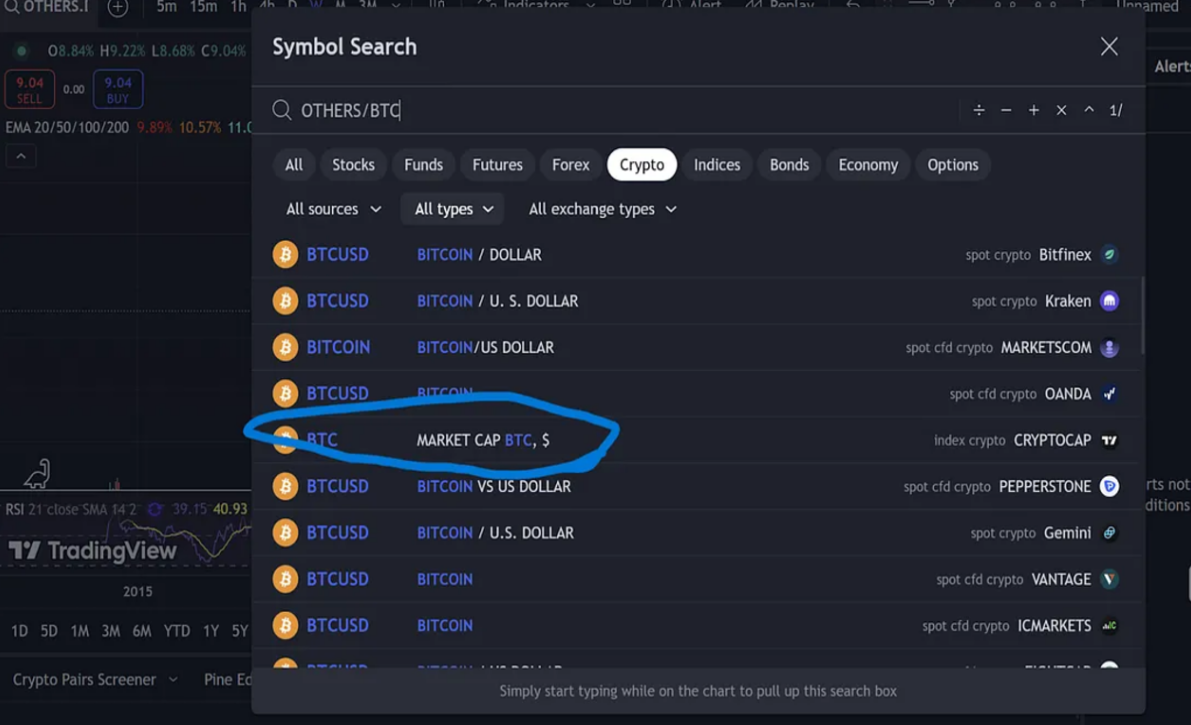

We talked about OTHERS, which are all the alts except the blue chips. A better chart would be to look at how these alts (OTHERS) perform relative to Bitcoin. To get this chart on Tradingview, just open the search bar and type in OTHERS/BTC as shown in the picture. Then look for the indicator labeled and click on it.

You will be able to chart the performance of alts relative to Bitcoin. In simple terms, whenever these alts gain momentum relative to Bitcoin, it is an alt season. Whenever Bitcoin gains momentum, it is a Bitcoin season. The best time to buy alts is when they form long-term lows relative to Bitcoin, as they are doing now.

Instead, the best time to sell altcoins is when they peak, which is what will happen in early 2022.

6. Summary

Remember, no one can predict market tops/bottoms. The best we can do is make rational guesses. The indicators help us make those guesses, but we can never get the long-term lows everyone is waiting for. The cryptocurrency market is extremely volatile and unpredictable. Never forget that. Remember, this is educational content and should not be considered financial advice.