Prospectus link: https://www.sec.gov/Archives/edgar/data/1876042/000119312525070481/d737521ds1.html

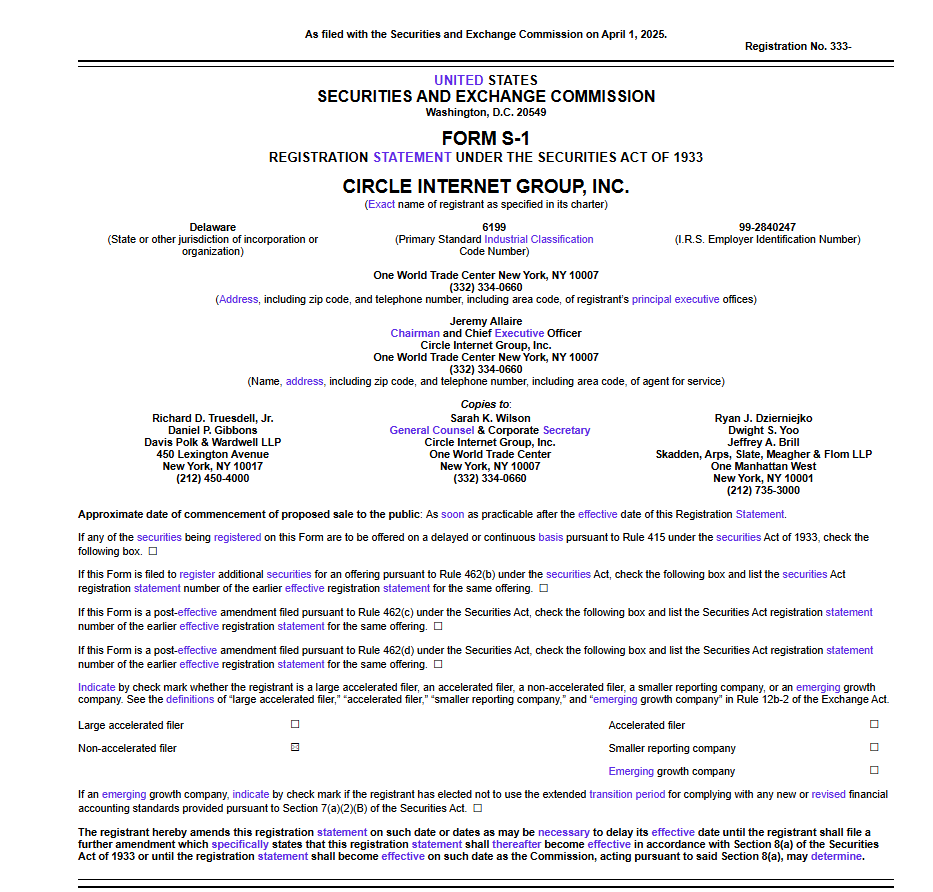

On April 1, 2025, Circle Internet Financial submitted an S-1 prospectus to the U.S. Securities and Exchange Commission (SEC), planning to list on the New York Stock Exchange with the stock code "CRCL". This company, which focuses on the USDC stablecoin, tried to go public through a SPAC in 2022 but failed. Now it has returned to the public eye with clearer financial data and strategic goals. What is Circle's intention to go public? Can its financial situation support this step? What is unique about its business model? What does it mean for the crypto industry? By analyzing this prospectus, this article will answer these questions one by one, exploring the internal logic of this stablecoin giant and its potential impact.

Part 1: Circle’s Financial Profile

1.1 The contradiction between revenue growth and profit decline

Circle's financial data shows a dual face of growth and pressure. In 2024, total revenue and reserve income reached $1.676 billion, a year-on-year increase of 16%, and a steady increase from $1.450 billion in 2023. However, net income fell from $268 million to $156 million, a drop of 42%. Revenue increased, but profits decreased. What is behind this?

Data shows that revenue growth is mainly driven by reserve income, which is $1.661 billion in 2024, accounting for 99% of total revenue. This is due to the significant increase in USDC circulation-as of March 2025, the circulation reached $32 billion, a year-on-year increase of 36%. But the pressure on the cost side cannot be ignored. Distribution and transaction costs increased from $720 million to $1.011 billion, an increase of 40%, and operating expenses also increased from $453 million to $492 million, of which general administrative expenses increased from $100 million to $137 million. The reason for this is that the revenue sharing agreement with Coinbase is an important factor, which will be discussed in detail later. I think this shows that although Circle's financial growth is impressive, the profit pressure is not small.

1.2 The Secret of Reserve Income

Reserve income is a core pillar of Circle, reaching $1.661 billion in 2024, accounting for 99% of total revenue. This part of the income comes from the interest income from managing USDC reserve assets. USDC is a stablecoin pegged 1:1 to the US dollar, and every 1 USDC issued is backed by 1 US dollar. As of March 2025, the circulation of $32 billion means an equal amount of reserve assets, which are invested in low-risk instruments, including US Treasuries (85% managed by BlackRock's Circle Reserve Fund) and cash (10-20% deposited in global systemically important banks).

Taking 2024 as an example, assuming the average reserve size is $31 billion and the Treasury yield is 5.35% (U.S. Treasury data), the annualized interest is about $1.659 billion, which is almost the same as the actual $1.661 billion. But an unexpected detail is that Circle needs to split this income with Coinbase. According to Decrypt, Coinbase took 50%, or $830.5 million, and Circle actually kept half. When I saw this split ratio, I understood why the net income was low. The stability of this part of the income also depends on the circulation and interest rates. If the Federal Reserve cuts interest rates in the future or the demand for USDC fluctuates, it may bring risks.

1.3 Overview of assets and liquidity

Circle's asset structure focuses on liquidity and transparency. 85% of USDC reserves are invested in government bonds, 10-20% are in cash, deposited in top banks, and monthly public reports enhance trust. However, the company's own cash and short-term investment interest income is negative, at -34.712 million US dollars in 2024, which may be affected by management fees. The specific total assets and liabilities data are not fully disclosed in the existing information, but the robustness of reserve management is obvious. Circle has a solid financial foundation, but the impact of the external environment cannot be ignored.

Part 2: Deconstructing Circle’s business model

2.1 The core position of USDC

Circle's business is centered around USDC, which ranks second in the world in terms of stablecoin. According to Coingecko data, USDC has a circulation of $60.1 billion (which may be different from the $32 billion in S-1 due to time differences), with a market share of about 26%, second only to USDT. It is widely used in payments, cross-border transfers (market size of $150 trillion) and decentralized finance (DeFi), using blockchain technology to achieve fast and low-cost transactions, which is superior to the traditional SWIFT system.

USDC's advantage lies in compliance and transparency. It complies with EU MiCA regulations (Introduction to AIY (Europe) Business), obtained the French EMI license in July 2024, and its monthly reserve report is verified by an auditing agency, in contrast to the unregulated USDT. Among the sources of income, 99% comes from reserve interest ($1.661 billion), and transaction fees and other income are only $15.169 million, which is a small proportion. This makes me feel that Circle is more like "saving money to earn interest" rather than relying mainly on service fees.

2.2 Diversified attempts

In addition to USDC, Circle is also developing digital wallets, cross-chain bridges (connecting different blockchains) and self-developed Layer 2 public chains to enhance the use cases and scalability of USDC. These businesses currently contribute limited revenue and are included in other income of $15.169 million. Nevertheless, they represent future growth potential, but the high investment in technology development may increase the cost burden in the short term.

2.3 The delicate relationship with Coinbase

The relationship between Circle and Coinbase is quite dramatic. The two co-founded CentreConsortium to manage USDC. In 2023, Circle acquired Coinbase's shares for $210 million in stock and took sole control of Centre, but the revenue sharing agreement continues to this day. Coinbase took 50% of the reserve income, resulting in a distribution cost of up to $1.011 billion in 2024. This is both a legacy of cooperation and a drag on profits. Whether the share will be adjusted in the future is worth paying attention to.

Part III: Strategic Intentions of Listing

3.1 Funding and Expansion

Circle's IPO aims to raise funds, with a net amount of US$X million (depending on the issue price), part of which will be used to pay RSU taxes and the rest will be invested in working capital, product development and potential acquisitions. USDC's market share is only 26%, far lower than Tether's 67%. Circle obviously hopes to accelerate expansion through funds, such as promoting Layer 2 public chains and global market penetration.

3.2 Dealing with regulation and improving credibility

As the United States' regulation of stablecoins becomes increasingly strict, Circle moved its headquarters to the United States and chose to go public, actively accepting the disclosure requirements of the SEC. Disclosing financial and reserve data not only meets regulatory expectations, but also enhances institutional trust. I think this transparency strategy is quite smart in the crypto industry and may win Circle more traditional financial partners.

3.3 Shareholders and Liquidity

Circle's equity structure is divided into Class A (1 vote/share), Class B (5 votes/share, capped at 30%) and Class C (no voting rights), with founders retaining control. The listing will also provide liquidity for early investors and employees, and secondary market transactions (valued at $4-5 billion) have shown demand. IPO is a balancing act between financing and shareholder returns.

Part 4: Implications for the Crypto Industry

4.1 Setting an industry benchmark

Circle's IPO has opened up a traditional exit path for crypto companies. In the past, ICOs and private placements were mainstream, but they were high-risk and had poor liquidity. Circle has proven the viability of the public market through its IPO, which may enhance the confidence of venture capital (VC), attract more funds to crypto startups, and promote the development of the industry.

4.2 Possibility of Innovative Gameplay

If Circle succeeds, other companies may follow suit, such as through SPAC or direct listing to quickly enter the market. Stock tokenization, trading on the blockchain, or combining with DeFi (such as for lending or staking) are all potential new ways to play. I imagine that these models may blur the boundaries between traditional and crypto finance and bring new opportunities to investors.

4.3 Risks and Challenges

However, going public is not an easy journey. The recent downturn in the technology stock market (Nasdaq’s worst quarter since 2022) may depress pricing, and regulatory uncertainty (such as tightening stablecoin legislation) also poses a threat. Circle’s success or failure will test the adaptability of crypto companies in traditional markets.

in conclusion

Circle's IPO demonstrated its financial strength (1.676 billion in revenue), business ambitions (USDC + diversification), and industry aspirations. Reserve income is its lifeblood, but the sharing and interest rate dependence with Coinbase are hidden dangers. I think that if the listing is successful, Circle will not only consolidate its position in the stablecoin market, but may also open the door to traditional finance for the crypto industry, bringing capital and technological innovation. From compliance to exit paths, Circle's story is both a display of opportunities and a reminder of risks. At the intersection of crypto and traditional finance, its next step is worth looking forward to.