Written by: Bao Yilong

Source: Wall Street Journal

The volatility of U.S. stocks rarely surpasses emerging markets and Bitcoin. At the same time, U.S. bonds, which have always been regarded as safe assets, have fluctuated sharply, which has caused investors to question the wisdom of holding U.S. assets. UBS believes that once the global risk-free interest rate fluctuates, it means that all markets will be subverted. Analyst Ed Al-Hussainy pointed out: "I am not worried about a recession. I am worried about a financial crisis."

U.S. stocks resumed their upward trend on Friday, and it seemed that the market's risk appetite had recovered, but in fact, investors had begun to question the safety of U.S. assets, especially the sharp fluctuations in U.S. bonds, which once again cast the fear of a financial crisis over Wall Street.

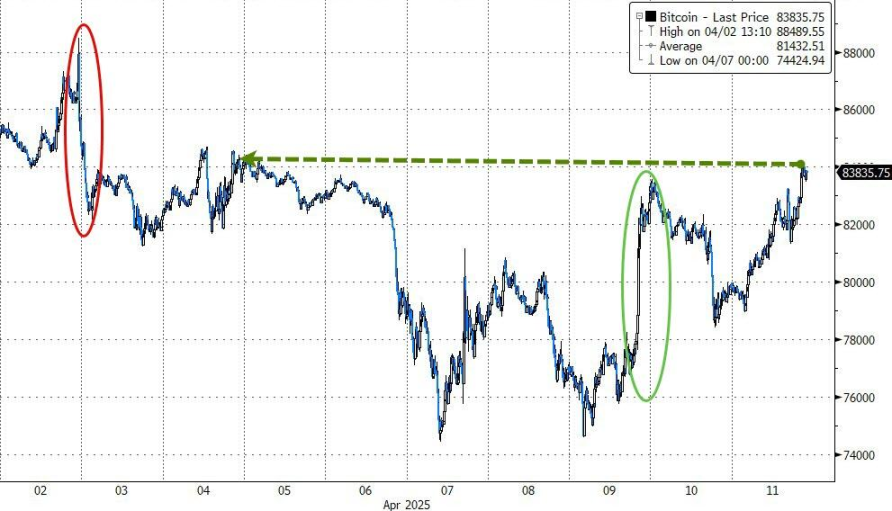

In the past week, the yield on the 10-year U.S. Treasury bond hit its biggest weekly jump in more than 20 years, while U.S. stocks plunged and then soared. On the surface, the S&P 500 index rose more than 5% this week, the U.S. Treasury yield returned to the level in February, and Bitcoin closed higher, and everything seemed normal.

However, what is disturbing is that the phenomenon of the simultaneous decline of US stocks, US bonds and the US dollar this week is a typical emerging market feature, not the performance of the world's safest assets. In particular, the volatility of US long-term bonds this week is so great that a liquidity crisis seems to be imminent, which makes investors begin to question the wisdom of holding US assets. UBS Group Chief Strategist Banu Baweja even said: This is terrible. We are redefining the global risk-free rate. If the global risk-free rate fluctuates, it will subvert all markets.

Historically rare, US asset volatility surpasses emerging markets and Bitcoin

Trump's recent tariff policy has not only damaged confidence in the US economy, but also shaken investors' trust in the direction of US policy and US dollar assets. Even by Wall Street's long historical standards, this week has been a brutal trading week, with US stocks like a roller coaster ride, and the trend of US bonds and the US dollar suggests that the US's safe-haven status seems to be lost:

On Monday, due to the so-called false tariff news, the U.S. stock market staged a 15-minute pulse-like shock. The Nasdaq once surged 10% from a low, and U.S. bonds plunged.

On Tuesday, news that there would be no tariff exemptions shattered hopes for a rebound in U.S. stocks. The Dow Jones Industrial Average plunged more than 2,000 points from its intraday high, the S&P 500 erased a gain of more than 4% and turned to decline, while the U.S. Treasury market experienced a deleveraging-style plunge.

On Wednesday, the United States suspended some tariffs, and the three major U.S. stock indexes closed up by at least 8%, with the S&P recording its largest gain since 2008, and U.S. stock trading volume hitting a record high of 30 billion shares. The 10-year U.S. Treasury yield rose and then fell.

On Thursday, global investors fled U.S. assets, with U.S. stocks, bonds and currencies falling. The Nasdaq fell more than 4%, the dollar suffered its biggest daily drop in two years, and gold hit a new high.

On Friday, the Federal Reserve hinted that it might take action, and U.S. stocks rebounded and closed higher, but the decline in U.S. Treasuries and the dollar warned that the United States' status as a safe haven seemed to be no longer secure.

“Is the U.S. market starting to behave like emerging markets? Absolutely, yes, and that’s exactly what we’re seeing,” said Andrea DiCenso, portfolio manager at Loomis, Sayles & Company.

According to data, the volatility of US stock ETFs even exceeds that of funds tracking emerging markets, and was once higher than Bitcoin. This situation has almost never occurred except during the epidemic, the crisis in August last year, and the period of aggressive interest rate hikes by the Federal Reserve.

Neil Dutta of Renaissance Capital put it bluntly in an email to clients: “The S&P 500 is trading like cryptocurrencies, which is probably not a good thing.”

The sharp fluctuations in risk-free interest rates indicate a recurrence of the financial crisis

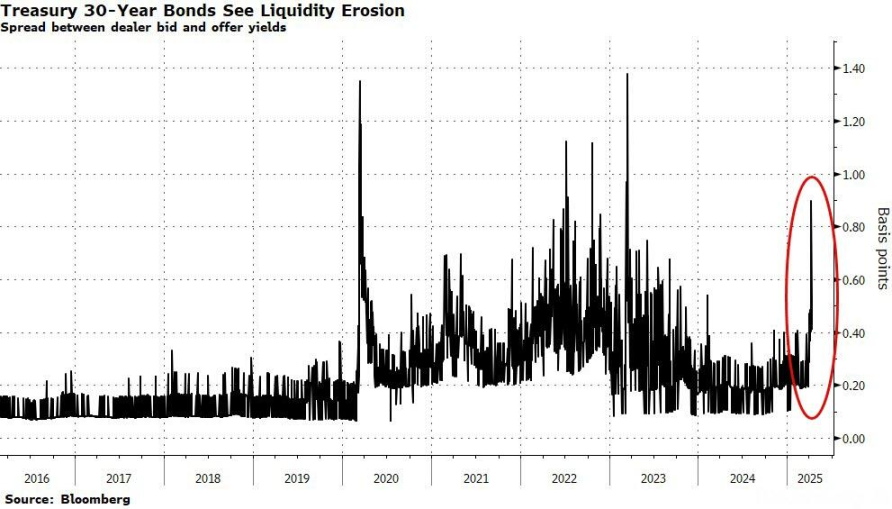

When the long-term bond market fluctuates violently, the interest rate spread is huge and the liquidity is low, it will affect all other capital markets, especially putting upward pressure on interest rates and US government debt, which may even develop into a financial crisis in the long run.

The volatility of U.S. Treasuries jumped this week, with the 20-year Treasury bond volatility quickly catching up with the VIX U.S. stock volatility.

While this week’s losses didn’t extend to last week’s broad-based declines, some cracks appeared in the bid-ask spread of the benchmark 30-year bond — a sign of declining long-term liquidity in the Treasury yield curve. The spread reached almost a full basis point this week, a level not seen since early 2023.

Confidence in the quality of U.S. equities, fixed income and currency assets outside the U.S. has been damaged. Fund manager Nathan Thooft said, "The question is, is this a temporary shock or a long-term shift? We still believe in the former. But this does not deny that some large asset owners are looking for alternatives and diversification of safe-haven assets."

Analyst Ed Al-Hussainy put it bluntly: I am not worried about a recession, I am worried about a financial crisis.

Funds flock to safe-haven assets, Wall Street calls for Fed intervention

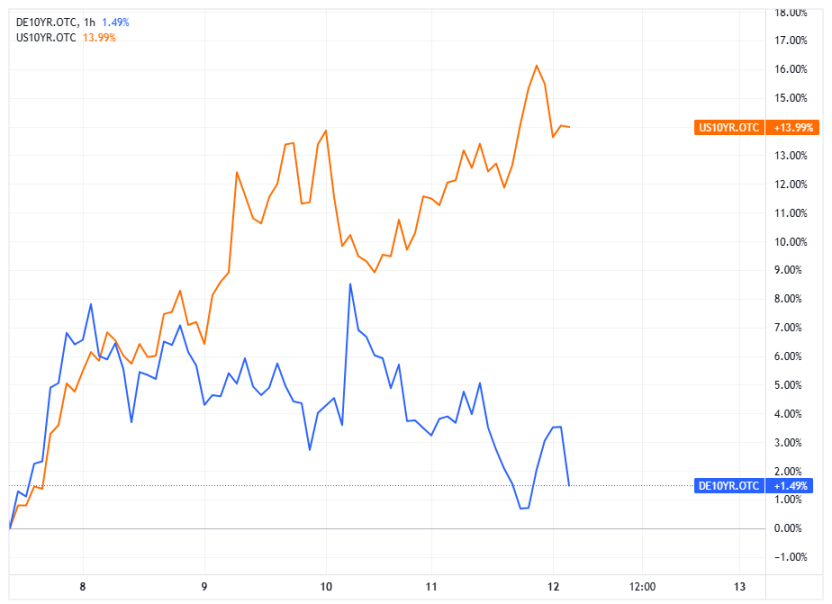

The shadow of the financial crisis caused global investors to withdraw from the United States and flock to safe-haven assets such as the European bond market, gold, Japanese yen and Swiss franc to avoid wider turmoil.

German bond yields were largely unchanged this week, while U.S. 10-year bond yields surged by more than 50 basis points, the largest gap between U.S. Treasury yields and German yields since 1989. In contrast, the U.S. dollar index fell below the psychological 100 mark, posting its worst two-week decline since November 2022, while the euro appreciated sharply against the dollar, appreciating more than the yen this week.

The extreme volatility has brought unprecedented psychological pressure to investors and traders, and there have been calls on Wall Street for the Federal Reserve to intervene. On Friday, JPMorgan Chase CEO Jamie Dimon said he expected "chaos" in the U.S. Treasury market.

“When you have a lot of volatile markets, when Treasuries are trading at very wide spreads, when liquidity is low, it impacts all other capital markets,” Dimon said on the earnings call. “That’s the reason the Fed should intervene, not to help the banks.”

Fortunately, Fed voting member Susan Collins said on Friday that if market conditions become chaotic, the Fed is "absolutely ready" to help stabilize financial markets. But she also emphasized: The market continues to operate well and we do not see overall liquidity concerns.