Author: Techub News

Compiled by: J1N, Techub News

The cryptocurrency market in 2024 is full of twists and turns and challenges. At the beginning of the year, the US Bitcoin spot ETF was officially launched; at the end of the year, Bitcoin broke through $100,000. In the meantime, DCG's bankruptcy crisis was resolved, Mt.Gox repaid $7 billion in Bitcoin debt; the global cryptocurrency field entered a new stage of compliance. Hong Kong, China launched Bitcoin and Ethereum spot ETFs, Russian President Putin officially signed the digital currency taxation law, and Trump was elected as the US president as a supporter of the crypto field. Various events have affected the entire cryptocurrency market. Today, we will review the monthly major events in the cryptocurrency market in 2024.

January:

US Bitcoin Spot ETF is officially launched: the decade-long extreme struggle comes to an end

On January 11, the U.S. Securities and Exchange Commission (SEC) officially approved 11 Bitcoin spot ETFs, including VanEck, Bitwise, Fidelity, Franklin, Valkyrie, Hashdex, Ark Invest, Grayscale, BlackRock, WisdomTree, and Invesco Galaxy. After the news was released, the price of Bitcoin fluctuated sharply, briefly breaking through 47,000 USDT and then falling below 45,000 USDT. Previously, there was also an oolong incident in which the SEC official account was stolen, causing the maximum intraday drop of Bitcoin to exceed 7%.

DCG announced that it has repaid all short-term loans to Genesis and has repaid more than $1 billion in debt

On January 8, Digital Currency Group (DCG) announced that it had repaid all short-term loans from Genesis. Over the past year or so, DCG has repaid more than $1 billion in debt to creditors, including nearly $700 million in Genesis debt, fulfilling the repayment requirements for all currently due debts.

Memecoin platform Pump.fun is officially launched

Pump.fun is a one-stop Memecoin trading platform on Solana, where users can create tokens and trade them immediately. The platform was officially launched on January 19, 2024. As of January 2, 2025, a total of 1.5 million SOL (worth approximately $300 million) has been deposited into Kraken addresses through it.

February:

Genesis settles Gemini Earn lawsuit with SEC, agrees to pay $21 million fine

On February 2, Bloomberg reported that Genesis has reached a settlement with the SEC regarding the Gemini Earn project, agreeing to pay the SEC a $21 million civil penalty to end the lawsuit. Gemini Earn is jointly operated by Genesis and Gemini. The SEC accused it of violating securities laws. Genesis and Gemini denied any wrongdoing. Genesis stated in court documents that the settlement agreement will avoid further litigation with the SEC, thereby saving cash flow.

March:

On March 8, Bitcoin exceeded 70,000 USDT, setting a new record since November 2021

Market value exceeded 100 million in 30 minutes: Slerf "Oh Fxxk"

On March 18, @Slerfsol, the founder of the Slerf project, tweeted that he destroyed LP and airdrop reserved tokens due to an error, and the minting rights have been revoked. He was powerless and even cried in Space. It was thought that the meme project SLERF, which raised more than 50,000 SOLs, was aborted, but it was unexpected that this move made SLERF break the previous record of BOME taking 9 hours to break the market value of 100 million. In just 30 minutes, SLERF's market value exceeded 100 million, becoming a meme.

BlackRock launches first tokenized fund BUIDL on Ethereum

On March 20, BlackRock launched its first tokenized fund issued on Ethereum, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). BUIDL will subscribe to the fund through Securitize Markets, LLC, providing qualified investors with the opportunity to earn US dollar returns. BUIDL strives to provide a stable value of $1 per token and pays daily accrued dividends directly to investors' wallets as new tokens every month. The fund invests 100% of its total assets in cash, U.S. Treasuries and repurchase agreements. BUIDL's initial ecosystem participants include Anchorage Digital Bank NA, BitGo, Coinbase and Fireblocks, as well as other market participants and infrastructure providers in the crypto industry.

April:

Uniswap and other projects received Wells notices from the SEC

On April 10, Uniswap Labs received a Wells Notice from the U.S. Securities and Exchange Commission (SEC). The founder of Uniswap Labs said, "I am not surprised, but annoyed, disappointed, and ready to fight back. We will not stop operating. I believe that the products we provide are legal and our work is correct from a historical perspective. But it is clear that the SEC has not worked hard to formulate clear and sensible rules for so long, but has decided to focus on attacking long-term builders such as Uniswap and Coinbase. At the same time, bad actors such as FTX are at large.

The SEC’s Wells Notice is a formal notification that tells the recipient that the regulator plans to take enforcement action against it.

Bitcoin block reward halving

On April 20, 2024, Bitcoin ushered in its quadrennial block reward halving event. This halving reduced the mining reward for each block from 6.25 bitcoins to 3.125 bitcoins, further reducing the supply of bitcoins.

Hong Kong virtual asset spot ETF approved for listing

The first batch of Hong Kong Bitcoin and Ethereum spot ETF products applied for by the Hong Kong subsidiaries of China Asset Management, Bosera and Harvest Asset Management were officially approved by the Hong Kong Securities Regulatory Commission. Subsequently, they were officially listed on the Hong Kong Stock Exchange on April 30.

According to Futu NiuNiu data, as of the close of the first day, the total trading volume of the first six virtual asset spot ETFs issued in Hong Kong was approximately HK$87.58 million, of which Hua Xia Bitcoin ETF ( 3042.HK ) had a trading volume of HK$37.16 million, Hua Xia Ethereum ETF ( 3046.HK ) had a trading volume of HK$12.66 million, Bose HashKey Bitcoin ETF ( 3008.HK ) had a trading volume of HK$12.44 million, Bose HashKey Ethereum ETF ( 3009.HK ) had a trading volume of HK$2.48 million, Harvest Bitcoin Spot ETF ( 3439.HK ) had a trading volume of HK$17.89 million, and Harvest Ethereum Spot ETF ( 3179.HK ) had a trading volume of HK$4.95 million.

May:

Changpeng Zhao Sentenced to 4 Months in Prison

On May 1, Zhao Changpeng, the former CEO of the cryptocurrency exchange Binance, attended a sentencing hearing after pleading guilty to violating U.S. money laundering laws because he failed to implement an effective anti-money laundering framework within the deadline, causing Binance to become a financial platform that condoned cybercrime and terrorist activities.

The judge rejected the 36-month sentence recommended by the Department of Justice, and Zhao Changpeng was eventually sentenced to four months in prison by the Seattle Federal Court. U.S. District Judge Richard told Zhao Changpeng, "You had the ability, financial resources, and manpower to ensure compliance with every regulation, but you missed this opportunity."

In November 2023, officials from the U.S. Department of Justice stated that Binance admitted to participating in suspected money laundering, unlicensed remittances, and sanctions violations, and agreed to pay a fine of approximately US$4.3 billion; at the same time, Zhao Changpeng admitted that he had failed to maintain an effective anti-money laundering program and had resigned as CEO of Binance.

As part of the plea agreement, Binance agreed to forfeit $2.51 billion and pay a criminal fine of $1.81 billion, for a total of $4.32 billion. Binance also agreed to retain an independent compliance monitor for three years to correct and strengthen its anti-money laundering and sanctions compliance programs.

After accepting the punishment from the U.S. Department of Justice, the U.S. Commodity Futures Trading Commission (CFTC) announced in December 2023 that it would impose a penalty of $2.85 billion on Binance and Zhao Changpeng. Together with the $4.32 billion settlement amount from the U.S. Department of Justice, Binance and Zhao Changpeng have paid a total of $7.17 billion in fines.

Mt. Gox transfers over $7 billion worth of Bitcoin to prepare for debt repayment

On May 28, the Mt. Gox wallet address transferred more than 107,000 bitcoins, worth about $7 billion, to a new address. Mt. Gox said this was in preparation for repaying creditors before October 31, 2024.

June:

FTX settles $24 billion tax claim with IRS

FTX has reached a settlement with the IRS for $24 billion in tax claims, a fraction of what the IRS said it owed, which will help FTX pay off a large number of customer compensation. The IRS will receive $200 million in priority claims in the FTX bankruptcy case and will pay it within 60 days of the company's proposed reorganization plan taking effect.

Hong Kong SFC requires all licenced exchanges not to have mainland Chinese users and to sign a letter of commitment

On June 1, the Hong Kong Securities and Futures Commission (SFC) required all applicants for virtual asset trading platform licenses to sign a letter of commitment, promising that none of their entities could have mainland Chinese users in any region. This requirement made it impossible for traditional offshore exchanges to meet. Binance, OKX, HTX, Bybit Gate and others withdrew their applications for Hong Kong licenses. OKX tried to form an industry alliance to oppose this requirement but ultimately failed. However, industry insiders said that the withdrawn entities can apply again in the future after updating the legal entity or framework, but they should not be able to apply using brands similar to offshore exchanges.

WikiLeaks founder Julian Paul Assange reaches agreement with US Justice Department, pleads guilty and will be freed and return to Australia

On June 25, documents from the U.S. District Court for the Northern Mariana Islands showed that 52-year-old Julian Paul Assange agreed to plead guilty to conspiracy to obtain and leak U.S. defense secrets and reached an agreement with the U.S. Department of Justice. After pleading guilty, he would be free and return to Australia.

South Korea's Cabinet passed the "Virtual Asset User Protection Act" executive order, which will take effect on July 19

On June 25, the South Korean State Council passed the "Virtual Asset User Protection Act" executive order, which will take effect on July 19. The decree aims to protect virtual asset users and regulate the order of the virtual asset market. According to the new law, virtual asset service providers (VASPs) must protect user deposits through banks and isolate users' virtual assets from the Internet to prevent risks such as hacker attacks.

VanEck, ARK 21Shares Submit Solana Spot ETF S-1 Filing to SEC

On June 28, VanEck and 21Shares submitted S-1 documents for Solana spot ETF in the United States. Matthew Sigel, head of digital asset research at VanEck, said in an interview that whether VanEck's application for spot Solana ETF can be approved depends largely on the results of the 2024 US presidential election and whether Gary Gensler continues to serve as chairman of the US Securities and Exchange Commission (SEC). VanEck submitted an application for spot Solana ETF last week, followed by 21Shares. Matthew Sigel pointed out that as the regulatory environment in Washington changes, several Democratic lawmakers have begun to support crypto legislation, and crypto voters may play a key role in this election. He also mentioned that if Ethereum-related products are approved for trading, their commodity status will be confirmed, and he believes that Solana should do the same.

July:

SEC drops PAXOS investigation, determines BUSD is not a security

On July 11, the SEC decided to end its investigation into New York-based stablecoin issuer Paxos, determining that BUSD is not a security. On July 9, Jorge Tenreiro, acting director of the crypto assets and networks division, said in a letter to Fortune that he had no intention of recommending enforcement action. More than a year ago, the Securities and Exchange Commission issued a Wells Notice, or notice of impending enforcement action, to Paxos for the dollar-backed BUSD stablecoin issued by Paxos in partnership with Binance.

“The official closure of this investigation is a huge relief for us,” Walter Hessert, Paxos’ head of strategy, said in an interview. “This is what we had been expecting, and it really should create more certainty in the market, and we’re seeing more and more large enterprises coming on board.”

German government address sells 50,000 Bitcoins in one month, worth about $3.3 billion

On July 13, the 24-day sell-off at the German government address ended, with a total of 50,179 bitcoins sold, worth about $3.3 billion. Lennart Ante, co-founder and CEO of the German Blockchain Research Lab, pointed out that the German law enforcement agency's sale of bitcoins is not an investment strategy, but a standard procedure for confiscating assets in criminal investigations. In addition, the analysis found that it was not the German government itself that sold bitcoins, but a small state in eastern Germany called Saxony. The Saxony State Attorney General's Office is responsible for liquidating confiscated assets, so the asset sell-off is not surprising, as the seized assets need to be liquidated within a certain period of time, which is a regular business process, although the scale is larger than normal this time.

In most cases, seized assets can only be transferred or sold if a judge rules that the state is allowed to do so, with the proceeds going into the state budget, but that was not the case in this case. States can, however, request an emergency sale to be initiated, for example if the assets could depreciate rapidly in value or are difficult to store.

US Ethereum Spot ETF officially launched

On July 23, according to official information from the U.S. SEC, it has officially approved the S-1 applications of 9 ETF issuers, and the Ethereum spot ETF has been officially approved for listing and trading, including the Grayscale and Bitwise Ethereum spot ETFs listed on the New York Stock Exchange Arca, the BlackRock iShares Ethereum spot ETF listed on the Nasdaq, and the VanEck, ARK 21Shares, Invesco Galaxy, Fidelity and Franklin Ethereum spot ETFs listed on the Chicago Board Options Trading Platform BZX.

After years of fighting and bargaining with regulators, Ethereum finally entered the US ETF trading market after Bitcoin. The approval of the Ethereum spot ETF will be another important milestone in the history of the cryptocurrency field, and it also indicates that the regulation of the crypto industry has officially broken the ice and entered a mature regulatory pattern dominated by market demand and centered on innovation.

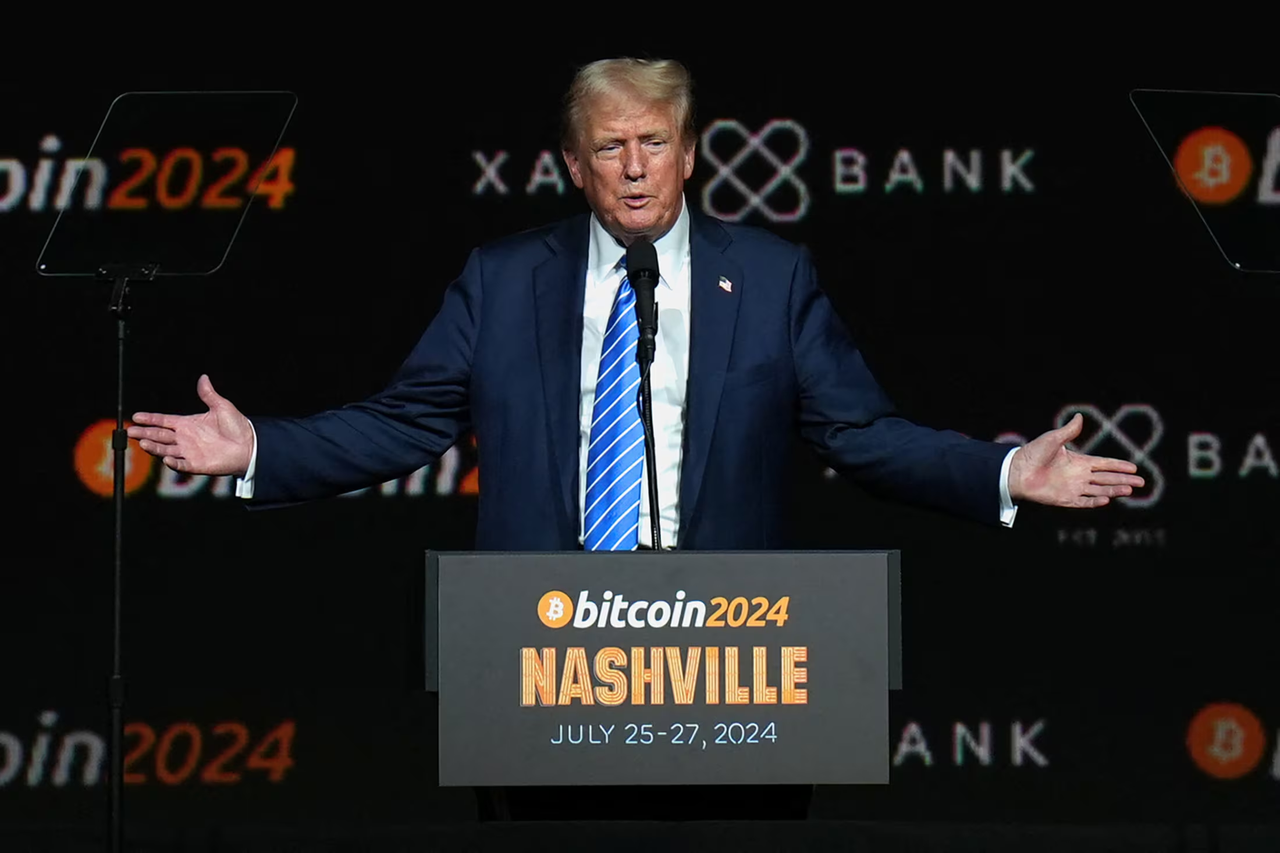

Trump: Will establish a national Bitcoin reserve in the United States

On July 27, Trump, then the Republican presidential candidate of the United States, said at the Bitcoin Conference (bitcoin2024) held in Nashville, Tennessee, USA, "If we don't accept cryptocurrencies and Bitcoin technology, China will accept it, and other countries will accept it. They will dominate, and we can't let China dominate. They have made too much progress."

Trump talked about establishing a presidential advisory committee on cryptocurrency and building a national Bitcoin reserve using cryptocurrency currently held by the U.S. government, mostly seized in law enforcement actions.

August:

Telegram co-founder and CEO arrested in France

On August 25, Telegram co-founder and CEO Pavel Durov was arrested in France. Durov was arrested by the French National Anti-Fraud Office after arriving in France from Azerbaijan on a private plane. The reason for the arrest is allegedly related to illegal activities on the Telegram platform, including assisting terrorism, drug and stolen goods sales, fraud, etc.

Hong Kong Monetary Authority launches Ensemble project sandbox to promote tokenization applications

On August 28, the Hong Kong Monetary Authority’s official website issued an announcement stating that the Ensemble project sandbox launch ceremony was held today, announcing that the first phase of the trial will cover four major tokenized asset use case themes, marking an important step forward in the financial industry’s practical application of tokenization technology.

September:

The pygmy hippopotamus Moo Deng swept the world, and the memecoin of the same name exceeded the market value of 300 million US dollars

Moo Deng (Bouncing Pig), a two-month-old pygmy hippopotamus at the Chonburi Zoo in Thailand, quickly became popular due to its funny interactions with the keeper, becoming a famous online meme and being made into various memes. Hippopotamus fever also swept the crypto circle. On September 10, the memecoin of the same name was born on Solana, and its market value exceeded US$300 million at the end of the month.

Zhao Changpeng released from prison

Binance founder Zhao Changpeng will be released from prison on September 29 and is currently undergoing preparation and assessment for reentry at the Residential Reentry Management (RRM) in Long Beach, central California. The "Reentry Management", also known as the "halfway house", mainly serves as a local liaison between the Federal Bureau of Prisons and the federal courts, the U.S. Marshals Service, and state and local correctional institutions. It signs contracts with federal prisons to provide the necessary help and support to prisoners who are about to be released to ensure that they can smoothly transition into social life.

October:

El Salvador's president proposes to "rent 170 volcanoes to Bitcoin miners" and plans to promote the introduction of a geothermal energy bill

On October 4, Salvadoran President Nayib Bukele wrote that miners can use geothermal energy generated by volcanoes to reduce mining costs. El Salvador has successfully used geothermal energy to mine 474 bitcoins, worth about $46 million. Bukele pointed out that El Salvador has 170 volcanoes, which is a rich energy treasure trove that attracts miners from all over the world. He wrote: "With 170 volcanoes, it actually makes sense to launch a 'rent volcanoes to mine bitcoins' program." In response, Daniel Alvarez, director of the General Directorate of Energy, Hydrocarbons and Mines of El Salvador, said that the team will start drafting a new geothermal energy bill to support the implementation of the plan.

US judge approves FTX bankruptcy plan to fully repay cryptocurrency customers in cash plus interest

On November 8, John Dorsey, a judge of the Delaware Bankruptcy Court, decided to approve FTX's bankruptcy plan at a hearing, and will fully repay cryptocurrency customers in cash plus interest. According to the plan, 98% of creditors will receive at least 118% of the value of their claims in cash. FTX lawyers said they are still considering distributing stablecoins to creditors as an option and confirmed that they are in discussions with at least four companies that can handle such distribution if necessary.

AI Agent exploded, GOAT surpassed $1 billion within one month of listing

On October 10, Marc Andreeson, founder of a16z, provided Andy and AI @truth_terminal with a $50,000 research grant. Subsequently, @truth_terminal launched GOAT, which triggered a new craze on the AI Agent topic. Its market value exceeded $1 billion within a month of its listing.

November:

Monetary Authority of Singapore promotes commercialization of asset tokenization

On November 5, the Monetary Authority of Singapore (MAS) announced a number of measures to advance the commercialization of asset tokenization. MAS draws lessons from multiple projects and develops new frameworks to provide guidance. At the first MAS Layer One Summit, Vice President Liang Xingqiang reviewed the success of large financial institutions participating in Project Guardian in foreign exchange and fund tokenization testing. The Project Guardian industry group released two tokenization implementation frameworks: the Guardian Fixed Income Framework and the Guardian Fund Framework. SGD Testnet will provide wholesale central bank digital currency (CBDC) in Singapore dollars for payments and securities settlement. Project Orchid develops use cases for retail CBDC and introduces the concept of purpose-bound currencies.

On November 12, Bitcoin exceeded 90,000 USDT

Bitcoin's market value has risen to $1.758 trillion, surpassing silver's $1.732 trillion, becoming the world's eighth largest asset by market value.

Polish presidential candidate: If elected, will use Bitcoin as a strategic reserve

On November 18, Polish presidential candidate Sławomir Mentzen promised to adopt a strategic reserve of Bitcoin if elected.

Russian President Vladimir Putin officially signed the digital currency tax law, and digital currency is recognized as property

On November 29, Russian President Vladimir Putin signed a law regulating the taxation of digital currencies. According to the law, digital currencies are recognized as property. This also applies to currencies used for foreign trade payments "within the framework of the Experimental Legal Regime (EPR) in the field of digital innovations." The mining and sale of digital currencies are not subject to VAT.

Operators of mining infrastructure must report to the tax authorities the issuance of cryptocurrencies using their services. Failure to transmit such information on time is subject to a fine of 40,000 rubles. For the purpose of personal income tax payment, the digital currency obtained through mining will be classified as income in kind (a term usually used when payment is made with goods or services instead of currency). The value of the currency obtained will be determined based on market quotations.

Such income will be taxed at the usual progressive rates, taking into account tax deductions for the amount of mining expenses. At the same time, the gains from the acquisition, sale or other circulation of digital currencies will be taxed at a two-stage personal income tax rate (13% for income up to 2.4 million rubles and 15% for income exceeding this amount). They will be included in the same tax base as income from trading in securities, bank deposits and other sources. In terms of corporate income tax, digital currency mining will be taxed at the standard rate (25% from 2025).

Japanese Prime Minister Shigeru Ishiba Reorganizes Web3 and Crypto Policy Department

On November 29, Prime Minister Shigeru Ishiba reorganized the Web3 and cryptocurrency policy-making departments. Digital Minister Masaaki Taira recently stated that the Liberal Democratic Party will disband the existing Web3 Project Team (PT) and instead set up a special agency in the party's digital society promotion department, led by former Web3 PT Secretary-General Akihisa Shiozaki. Previously, Shigeru Ishiba's campaign manifesto showed that the government plans to use blockchain technology and NFT to promote local development projects and raise the value of local products such as food and tourism experiences to global levels.

December:

The South Korean president issued a martial law order, and the Upbit platform Bitcoin had a negative premium and fell below 72,000 USDT

On December 3, the South Korean president issued a martial law order. Members of the South Korean opposition party said that the entrance to the National Assembly was blocked and they were trying to overturn the martial law order issued by South Korean President Yoon Seok-yeol. Opposition leader Lee Jae-myung said that Yoon Seok-yeol's declaration of martial law was illegal and unconstitutional.

Perhaps affected by this incident, South Korea's cryptocurrency exchange Upbit showed a serious negative premium for Bitcoin. Bitcoin on Upbit showed a negative premium and fell below 72,000 USDT. XRP fell 60% in a short period of time, and the USDC/USDT exchange rate rose to 1.2.

Microsoft Shareholders Vote Against Bitcoin Investment Proposal

On December 11, Microsoft's major shareholders voted against the company's Bitcoin investment proposal on Tuesday. Previously, Microsoft's board of directors urged shareholders to reject a proposal from the National Center for Public Policy Research that Microsoft invest 1% of its total assets in Bitcoin to hedge against inflation. At the annual shareholders' meeting, MicroStrategy founder Michael Saylor gave a three-minute speech trying to convince Microsoft shareholders to support the proposal. But the final voting results showed that shareholders failed to accept the proposal. Currently, Microsoft's largest shareholders are major institutional investors such as Vanguard and BlackRock.