introduction

Solv Protocol is a project founded in 2020 that aims to lower the threshold for creating and using on-chain financial instruments and bring diverse asset classes and income opportunities to the crypto space. Solv Protocol focuses on minting and trading NFTs related to financial ownership certificates. In 2024, with the continuous development of the BTCFi track, Solv Protocol focused on BTCFi and created the full-chain income Bitcoin asset SolvBTC, aiming to provide new opportunities and possibilities for Bitcoin holders while creating an efficient BTCFi ecosystem. Recently, Solv Protocol launched the Staking Abstraction Layer (SAL), which aims to simplify and standardize the cross-chain Bitcoin staking process, thereby abstracting the complexity of Bitcoin staking scenarios and allowing users and developers to quickly adopt it.

Basic information of the project

Basic Information

Website: https://solv.finance/

Twitter: https://twitter.com/SolvProtocol, 272,000 followers

TG: https://t.me/Solv_Protocol

DC: https://discord.com/invite/solvprotocol

Github: https://github.com/solv-finance

Whitepaper: https://docs.solv.finance/

Launch time: The mainnet will be launched in June 2021. Solv Protocol has not issued any tokens.

Project Team

Core Team

Ryan Chow: Co-founder. Graduated from Beijing Foreign Studies University, he served as co-founder of Beijing Youzan Technology, committed to applying blockchain technology to automotive industry databases. In addition, he worked as a financial analyst at Singularity Financial, researching blockchain technology integration and financial regulation.

Will Wang: Co-founder. He created the "ERC-3525: semi-homogeneous token standard". He has been engaged in the financial IT field for 20 years and has presided over the design and development of the world's largest bank account system based on open platforms and distributed technologies. He is the winner of the "Zhongguancun 20th Anniversary Outstanding Contribution Award".

Meng Yan: Co-founder. Former vice president of CSDN. In addition, he is also an active KOL in the Crypto industry.

Financing:

Solv Protocol has raised approximately $29 million through three rounds of financing.

Angel round

- On November 10, 2020, it announced the completion of a US$6 million angel round of financing, led by Laser Digital, UOB Venture, Mirana Ventures, ApolloCrypto, Hash CIB, GeekCartel, ByteTrade, Matrix Partners, BincVentures, and Emirates Consortium;

Seed round

- On May 8, 2021, it announced the completion of a $2 million seed round of financing, invested by Binance Labs;

- On August 30, 2021, it announced the completion of a $4 million seed round of financing, led by Blockchain Capital, Sfermion and Gumi Cryptos Capital, with participation from DeFi Alliance, Axia 8 Ventures, TheLao, CMSholdings, Apollo Capital, Shima Capital, SNZ Holding, Spartan Group and others;

- On August 1, 2023, it announced the completion of a US$6 million seed round of financing, with investments from Laser Digital, UOB Venture Management, Mirana Ventures, Emirates Consortium, Matrix Partners China, Bing ventures, Apollo Capital, HashCIB, Geek Cartel, Bytetrade labs and other institutions under Japanese banking giant Nomura Securities.

Strategy Wheel

- On October 14, 2024, it announced the completion of a US$11 million strategic financing round, with participation from companies such as Laser Digital, Blockchain Capital and OKX Ventures.

During the three rounds of financing, Solv Protocol raised 29 million US dollars, and well-known investment institutions such as Binance Labs, Blockchain Capital, Laser Digital, Matrix Partners China, and OKX Ventures made large investments in it. It can be seen that the capital field is still very optimistic about the future development of Solv Protocol.

Development Strength

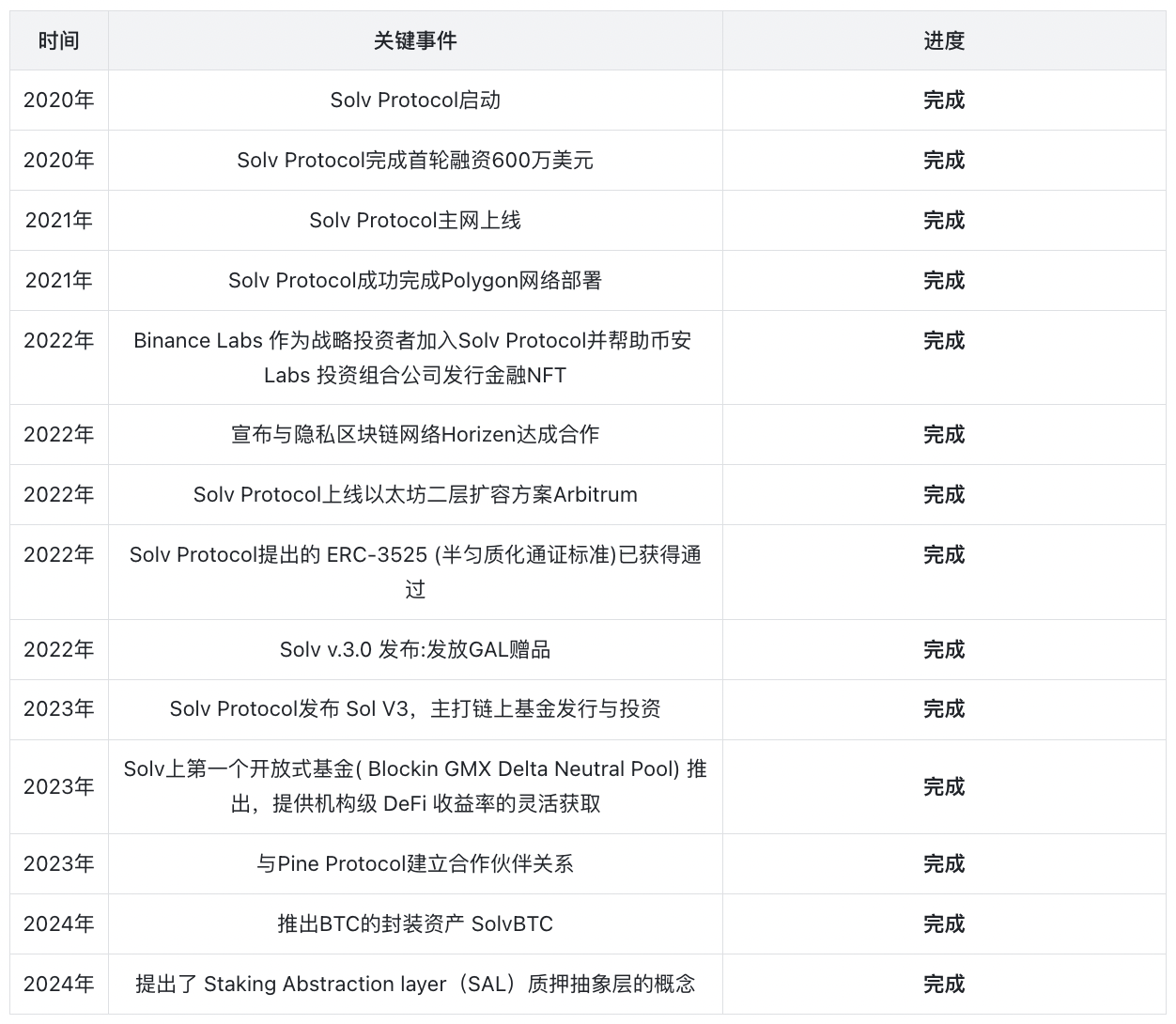

Solv Protocol was launched in 2020. The key events in the development of the project are shown in the table:

Judging from the key events in the development of Solv Protocol's project, Solv Protocol has been working hard to lower the threshold for creating and using on-chain financial instruments, which enabled Solv Protocol to quickly issue BTC's packaged asset SolvBTC after the rise of the BTCFi track, and quickly occupy the BTC-based LST market. In terms of the time it takes for Solv Protocol to achieve various key technical nodes, Solv Protocol has completed the development of project technology as scheduled, which shows the strength of the Solv Protocol technical team.

Operation Mode

As the largest asset in the Crypto industry, BTC has a market value of over $1.3 trillion. However, for a long time, BTC holders have simply held BTC and have not released its potential value like ETH, so Solv Protocol advocates unlocking the $1.3 trillion BTC asset potential through BTC staking. In 2024, Solv Protocol shifted the focus of the project to BTCFi and launched the full-chain BTC asset SolvBTC, which can release BTC's staking liquidity. Recently, it has launched the concept of the Staking Abstraction layer (SAL), marking the beginning of Solv Protocol's aggregation of BTC's liquidity.

Integrated staking platform

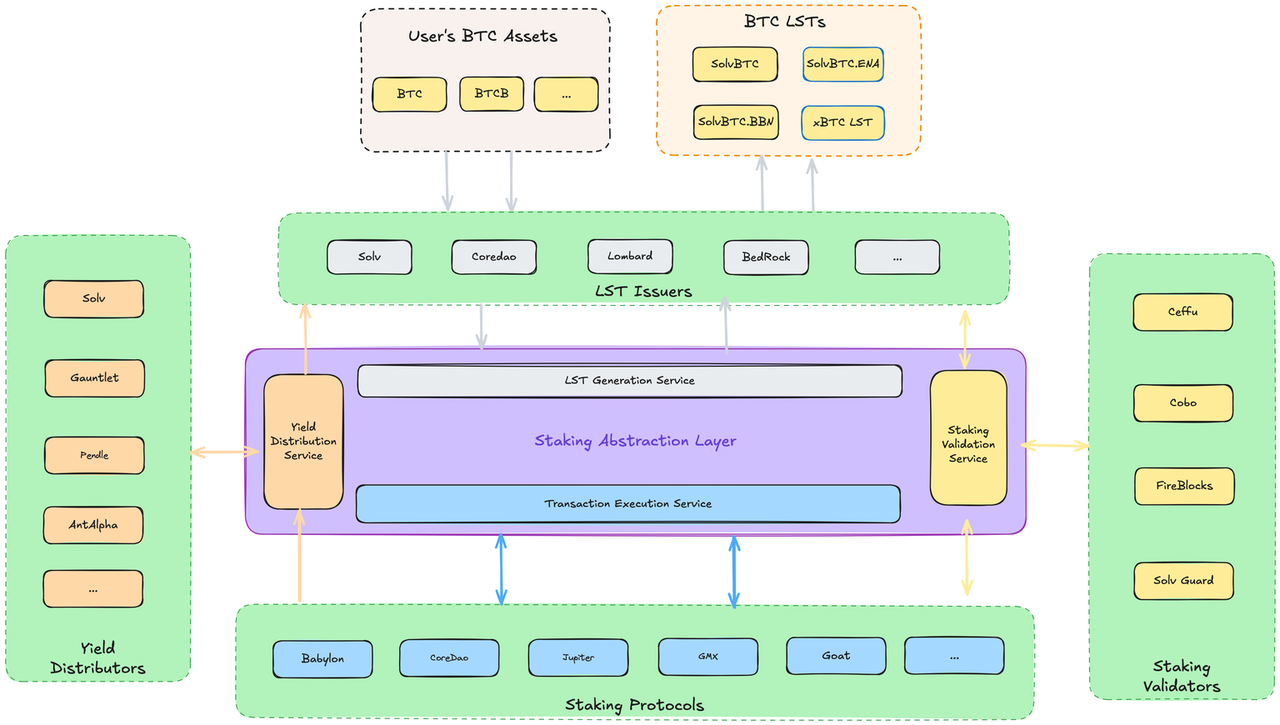

Solv Protocol Architecture (Image source: https://docs.solv.finance/staking-abstraction-layer-sal/the-ecological-view)

In the Solv Protocol architecture, the staking process is broken down into four key roles, and they are closely linked together through an integrated platform architecture:

- LST Issuers: Create liquidity income tokens (LST) linked to staked Bitcoin. Solv is currently the largest Bitcoin LST Issuer on the market. It allows users to maintain asset liquidity when staking staked tokens (LST) and Bitcoin, and participate in DeFi and other income activities.

- Staking Protocols: Manage the Bitcoin deposited by users and provide safe returns. Integrated staking protocols such as Babylon, CoreDao, Botanix, Ethena, GMX and other protocols provide a source of Bitcoin staking income. By staking Bitcoin in the POS network, users can obtain rewards from the POS chain.

- Staking Validators: such as Ceffu, Cobo, Fireblocks, Solv Guard, etc. are responsible for verifying transactions, ensuring the legitimacy and security of staking transactions, verifying that the staked Bitcoin corresponds to the LST Token, and updating the verification status in a timely manner.

- Yield Distributors: Ensure that the staking income is distributed to LST holders transparently and fairly, and ensure that users can obtain staking returns in a timely manner. For example, Babylon, Pendle, Gauntlet, Antalpha, etc.

Solv Protocol integrates these four key roles to build a complete Bitcoin staking ecosystem. By integrating the staking protocol, LST issuer, validator, and revenue distributor, it realizes seamless interaction between the Bitcoin mainnet and the EVM-compatible chain, and simplifies the staking implementation at the user and developer levels. The staking protocol provides a source of income for staking Bitcoin. The LST issuer issues liquid staking tokens to allow users to maintain asset liquidity during the staking period. The validator is responsible for verifying the legality and security of the staking transaction, and the revenue distributor is responsible for distributing the revenue generated by the staking to LST holders in a transparent manner. Provide users with a more convenient, safer, and more attractive staking experience.

Staking Abstraction Layer (SAL)

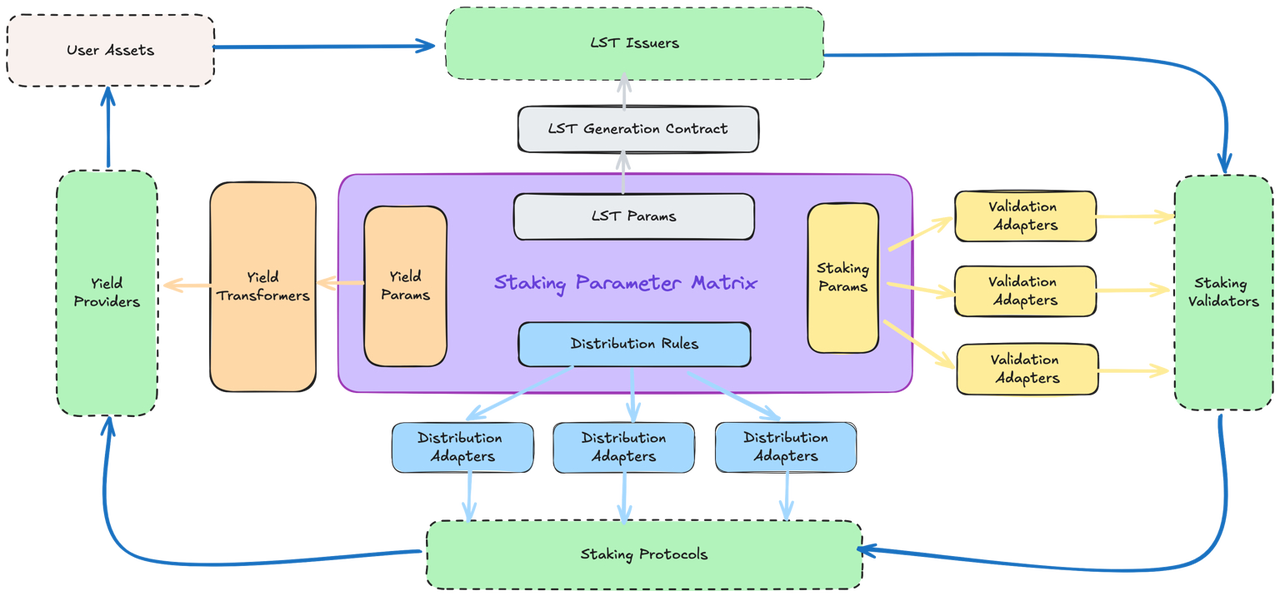

Staking Abstraction Layer (SAL) is a modular architecture designed to facilitate secure and efficient BTC accounting through key components that interact with the Staking Parameter Matrix (SPM). SAL's key modules include the LST Generation Module, Transaction Generation Module, Verification Node, and Revenue Distribution Module, all of which rely on SPM to define transaction rules, verification criteria, and revenue calculations. Together, these components form a framework that ensures the security, transparency, and efficiency of BTC accounting and LST issuance, enabling users to maximize their earnings while minimizing the risks associated with accounting processes and cross-chain interactions.

Staking Parameter Matrix (SPM): The purpose of the SPM module is to standardize the various settings and parameters of BTC staking. SPM provides developers with a simple and standard set of rules, making it easier for them to integrate BTC staking scenarios into their own applications without having to design a complex system from scratch.

LST Generation Module: The purpose of the LST Generation Module is to simplify the issuance of cross-chain liquidity pledge tokens (LST). The cross-chain pledge token issuance process is standardized and automated, and users do not need to manually participate in complex cross-chain operations. This module enables LST issuers to quickly and easily issue liquidity pledge tokens and distribute these tokens to users.

Transaction generation module: The function of the transaction generation module is to automatically generate and broadcast BTC pledge transactions. In simple terms, the job of this module is to automatically create and send pledge transactions to the BTC mainnet. Previously, users had to manually perform many steps, but now this module will automatically help users complete most of the work, making the pledge process much simpler.

Verification nodes: Verify the legality and security of pledge transactions in real time. The role of verification nodes is to ensure that all pledge transactions are legal and secure. When users make a pledge, these nodes will check and verify the correctness of the transaction and confirm the transaction only after ensuring that there are no problems.

Revenue Distribution Module: Responsible for correctly mapping staking rewards to LST holders. When users earn income through staking, the revenue distribution module will be responsible for correctly distributing these income to the user's LST Token. Users can obtain corresponding staking income based on the proportion of LST Tokens they hold.

In summary, SAL, as a staking abstraction layer, is characterized by the integration of multiple staking participants (including Bitcoin staking providers, yield acquisition, and DeFi scenario unlocking), abstracting and encapsulating these complex processes into standardized modules. This enables developers to quickly integrate Bitcoin staking functions into their own applications and allows users to start staking in a comprehensive way. SAL is simplifying the implementation of staking to promote the adoption of more dApps. For example, a DeFi application or wallet application only needs to integrate SAL to provide a range of staking options to its user base. However, since Bitcoin itself does not support staking, all third-party staking may bring certain security risks, and SAL is no exception. Since SAL integrates Staking-related solutions, the technical complexity and compatibility behind the integration may also bring new security risks. Therefore, SAL needs to continuously address challenges related to operational robustness and security.

Advantages compared to other BTCFi projects

As an LST project in the BTCFi track, Solv Protocol has many projects with a high degree of homogeneity in the market, such as Bedrock, Lombard, Lorenzo, Pell Network, PumpBTC and Stakestone, each of which has a high degree of similarity with Solv Protocol. After Solv Protocol launched SAL and began to focus on integrating BTC liquidity, Solv Protocol has great advantages over other projects.

Safety and security

Solv Protocol ensures the security of staking transactions by integrating the Active Verification Service (AVS). The AVS system fully monitors all aspects of staking transactions, including target addresses, script hashes, staking deadlines, etc., to ensure the validity and security of transactions, thereby avoiding errors or malicious behavior. This comprehensive monitoring and verification mechanism provides reliable protection for users' staking transactions.

Process Optimization

While integrating BTC liquidity, Solv Protocol also optimizes the project's pledge process, allowing users to perform pledge operations more conveniently. Users only need to deposit Bitcoin into the platform without having to perform other on-chain operations. This ensures user security while improving user pledge efficiency and generating revenue.

Full-chain revenue aggregation platform

Solv Protocol is a full-chain revenue aggregation platform that adopts the CeDeFi model, combines CeFi and DeFi, and provides transparent contract management services. Through Gnosis Safe's multi-signature contract address and Solv Vault Guardian, refined permissions and conditional execution are achieved to ensure asset security and efficient system operation.

Industry Standardization

After launching SAL, Solv Protocol not only integrates BTC liquidity, but also promotes the industry standardization of LST based on BTC. As a standardized staking process that regulates the BTC staking process and parameter system, by formulating industry standards, it can promote cooperation and communication among all parties in the industry, promote the healthy development of the industry, and provide users with more stable and reliable staking services.

Unified liquidity

As a unified liquidity portal within the BTCFi industry, Solv Protocol integrates various liquidity resources and investment opportunities onto one platform by launching SAL. Users can find and manage their investments on Solv Protocol without having to visit multiple different platforms or protocols, simplifying the operational process.

In summary, after launching SAL, Solv Protocol wants to further aggregate the decentralized BTC liquidity of the entire chain and provide a scalable and transparent unified solution. SAL can simplify the interaction between users and the Bitcoin staking protocol and facilitate a convenient staking experience. At the same time, the abstract layer will define a set of general functions including LST asset issuance, distributed node staking verification, revenue distribution and Slash rules. At the same time, it can not only integrate the packaged tokens of other LST projects into its own liquidity, but also greatly simplify the operations of users on the chain.

Project Model

Business Model

The Solv Protocol economic model consists of two roles: BTC and LST stakers, and projects that collaborate with Solv.

BTC and LST stakers: Solv Protocol can support users on the BTC mainnet (currently only accepting stakers with more than 100 BTC), Merlin, Mantle, Avalanche, BOB and other chains to deposit their BTC or packaged BTC into Solv Protocol. After launching SAL, it can absorb BTC liquidity in many scenarios such as Ethereum EVM, BNBChain, CeDeFi, etc. Users can deposit their BTC or packaged BTC into Solv Protocol on the above chains to mint SolvBTC at a 1:1 ratio, and users are allowed to mint SolvBTC into other forms of LST. Users can use Solv Protocol to obtain other benefits while holding BTC.

Projects cooperating with Solv: Solv Protocol can deposit the BTC and wrapped BTC pledged by users into various DeFi protocols according to the different needs of the projects it cooperates with and the yields provided. For example, it can be deposited in Merlin Chain, Stacks, Bsquare and other BTC-L2 to obtain Staking income; it can also be deposited in projects such as Babylon to obtain Restaking income; it can also be deposited in Defi projects in L2 such as Arbitrum and BNB Chain to obtain liquidity providing income. This not only increases the income of Solv Protocol users, but also enhances the liquidity and security of projects cooperating with Solv.

From the above analysis, we can see that Solv Protocol’s revenue is:

- Solv Protocol charges a certain percentage of user profits.

Token Model

Solv Protocol has not yet released any tokens or plans to issue tokens.

On-chain data

TVL

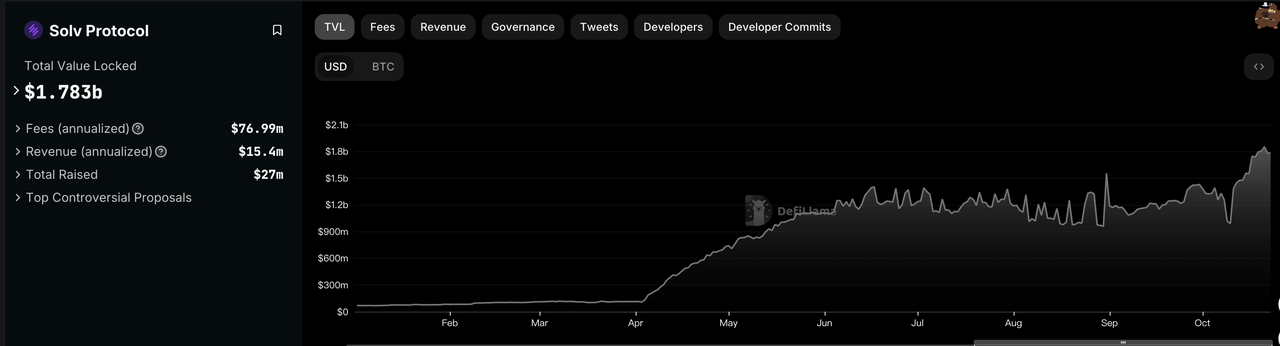

Solv Protocol TVL (Image source: https://defillama.com/protocol/solv-protocol?denomination=USD)

As can be seen from the figure, Solv Protocol's TVL has increased significantly since January 2024, and has grown very rapidly in the past month, from US$1.153 billion to US$1.783 billion, an increase of 54.64%. It can be seen that users are optimistic about its future development.

Number of users

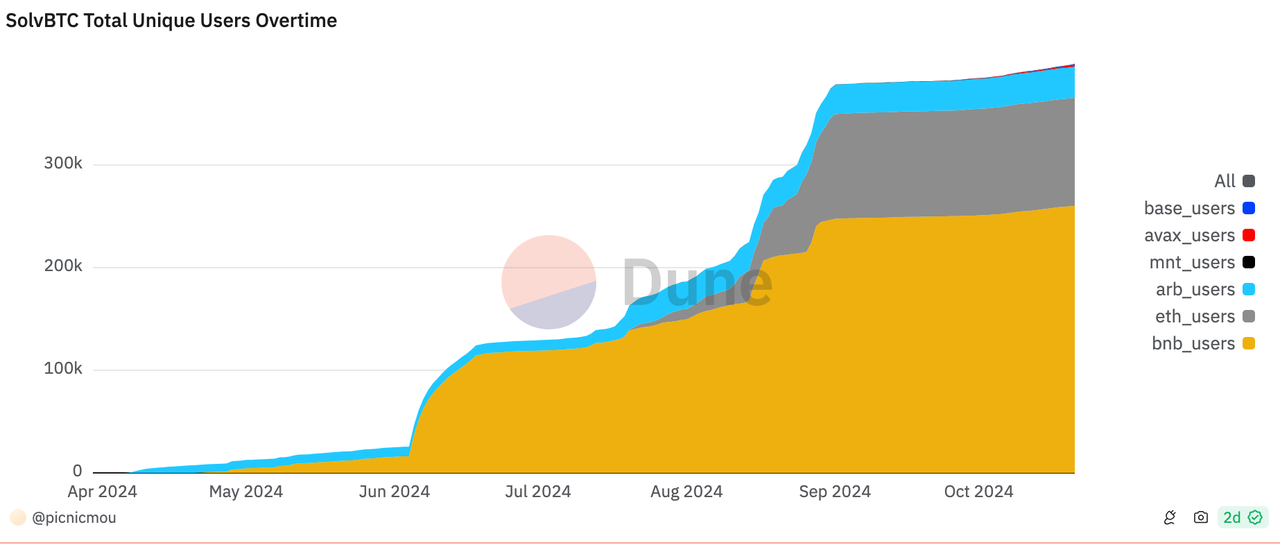

Number of SolvBTC users (Image source: https://dune.com/picnicmou/solv-protocol)

From the chart, we can see that the number of SolvBTC users has grown rapidly, and the growth rate from August to now has been even faster, from 185,799 in August to 397,324 now, an increase of 113.85%. It can be seen that more and more users choose SolvBTC and are very optimistic about Solv Protocol.

Support Projects

As a project in the BTCFi track that mainly uses LST, whether more projects adopt its LST — SolvBTC determines its success. From the financing process of Solv Protocol, we can see that Solv Protocol has a very deep background in the Crypto industry, which enables it to contact more projects and gain support from other projects. After Solv Protocol achieved initial success, more projects and public chains supported it, forming a positive cycle.

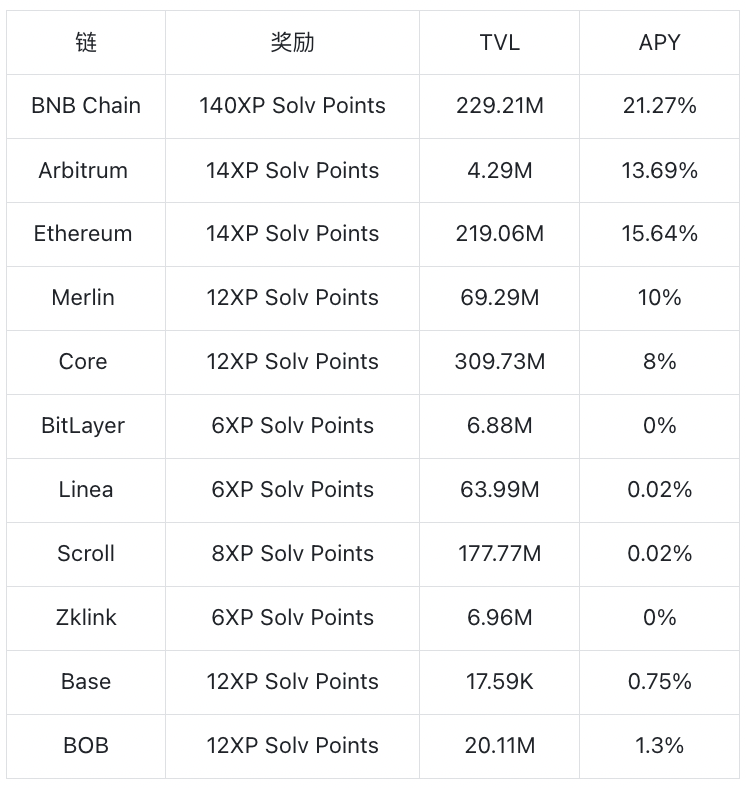

Chains supporting Solv Protocol:

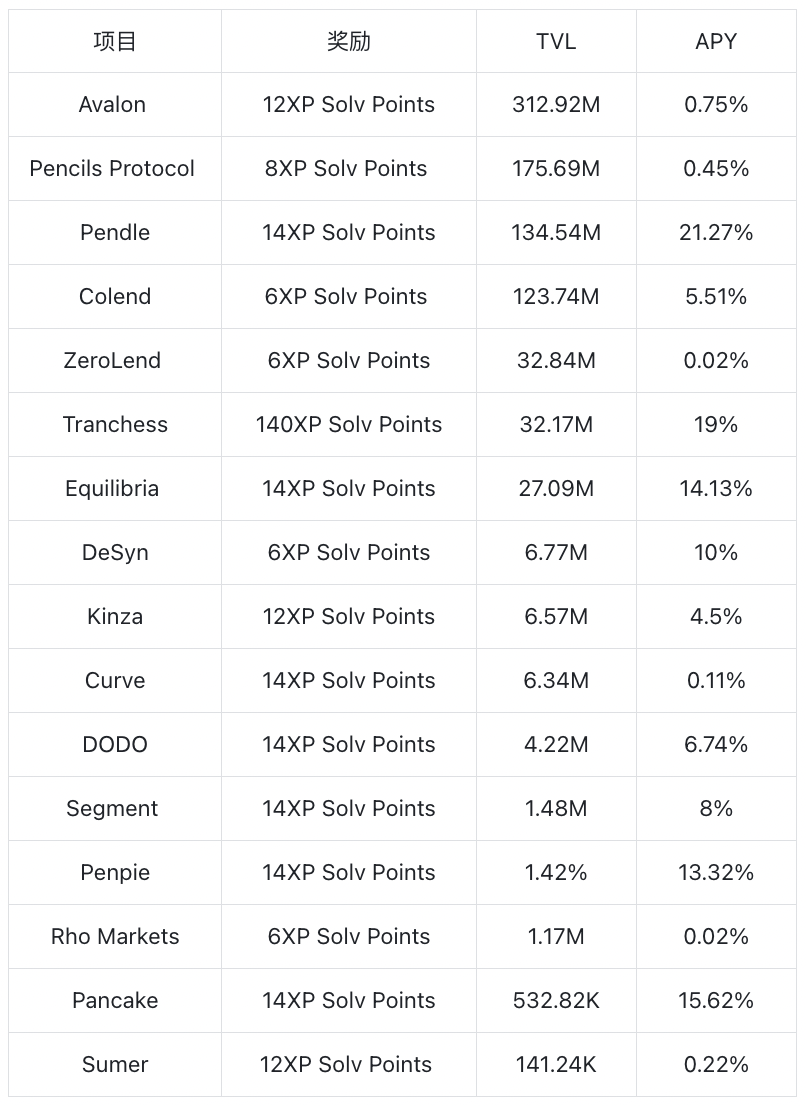

Defi projects that support Solv Protocol (those with an APY of 0 are not included in the table below):

From the above table, we can see that there are now many chains and projects that strongly support Solv Protocol, making Solv Protocol's encapsulated assets:

SolvBTC, SolvBTC.BBN, SolvBTC.ENA, and SolvBTC.CORE have all received a lot of support, allowing them to be adopted in more chains and Defi projects, making it easier for users to arbitrage their packaged assets, and also increasing user benefits.

Comparison with Babylon

Solv Protocol and Babylon have a close partnership in the field of BTC staking, but they each have unique features and positioning. Babylon is a protocol focused on BTC staking that aims to extend the security of Bitcoin to other networks through shared economic security. It allows BTC holders to earn returns through staking, and Solv Protocol will be one of the first participants after the mainnet goes live. Babylon extends the security of BTC to PoS chains, AVS, roll-ups, etc. through its native BTC staking protocol.

Solv Protocol is a full-chain yield and liquidity protocol that uses SAL to simplify the process of Bitcoin staking, allowing users to use SolvBTC for staking on different blockchains. Solv Protocol not only provides Babylon with more than 20% of BTC staking assets, but also becomes the main provider of liquidity for the Babylon ecosystem. In addition, Solv Protocol launched the SolvBTC.BBN liquidity staking token, allowing users to obtain native token rewards of the PoS chain through Babylon while maintaining liquidity access to their BTC.

So by comparing the two, we can see that Babylon is more similar to Eigenlayer in BTCFi, and Solv Protocol is more like Lido, so the relationship between Solv Protocol and Babylon should be parallel. Solv Protocol has a lot of liquidity and is not limited to providing support for Babylon. In addition, Solv Protocol has also launched BTC staking tokens on other chains, such as the BTC staking token launched on Solana.

For the BTCFi project, TVL is an important indicator of its project development. Let’s compare the TVL of Solv Protocol and Babylon: Solv Protocol’s TVL is $1.783 billion, while Babylon’s TVL is $1.605 billion. By comparison, we can see that Solv Protocol’s TVL has surpassed Babylon.

In summary, Babylon focuses on enabling secure scaling of Bitcoin staking through its native protocol, while Solv Protocol simplifies and enhances the BTC staking experience across multiple DeFi ecosystems through its staking abstraction layer and liquid staking tokens.

Project Risks

- Smart contract vulnerability risk : Although Solv uses multiple signatures and other security mechanisms to protect assets, the smart contract itself may still have vulnerabilities or risks of being attacked. This risk may cause the user's assets to be lost or stolen. The risk of smart contract vulnerability has always been one of the important challenges faced by crypto asset management services.

- Lack of a clear token economic model: Solv Protocol has always used a point reward mechanism to incentivize users to participate in Solv Protocol's BTC staking activities, but has not launched a token economic model or coin issuance plan, which will reduce user participation enthusiasm to a certain extent.

- Challenges of decentralized management : Solv Protocol attempts to solve the opacity problem in traditional crypto asset management services through a decentralized approach. Although decentralized management can solve the opacity problem in traditional crypto asset management services, it also brings trust issues. Decentralized management may complicate the decision-making process and make it difficult to respond quickly to market changes in some cases, so it is necessary to find a suitable solution to balance the relationship between decentralization and efficiency.

- Liquidity risk : As a liquidity layer, Solv Protocol relies on the participation and capital investment of a large number of users. If the market fluctuates drastically or user confidence declines, it may lead to liquidity depletion, which in turn affects the stability and security of the platform.

- Risks of high-risk DeFi protocols : Solv Protocol manages the risks of high-risk DeFi protocols by designing features such as Convertible Voucher, but these mechanisms cannot completely eliminate potential financial risks. In a highly volatile market, these risks may be magnified.

- Market acceptance and user trust : Although Solv Protocol has received support from well-known institutions such as Binance and OKX, it still takes time to build market acceptance and user trust. If users’ trust in the platform cannot be effectively improved, it may affect its long-term development.

Summarize

As an innovative project in the BTCFi track, Solv Protocol has successfully integrated the key roles of the Bitcoin staking ecosystem through its full-chain yield Bitcoin asset SolvBTC and Staking Abstraction Layer (SAL) technology, significantly lowering the threshold for user participation. Its advantages are reflected in its strong security mechanism, optimized staking process, full-chain yield aggregation capabilities, and efforts to promote industry standardization. The project has received support from several well-known investment companies in the Crypto industry, helping Solv Protocol to gain support from some well-known public chains and DeFi projects in the industry. It has also shown a rapidly growing TVL and number of users, reflecting the market's recognition of it. Solv Protocol creates more value for BTC holders by providing a unified liquidity entry and diverse staking options, while promoting the development of the BTCFi ecosystem.

However, Solv Protocol faces a series of challenges and potential risks. First, its complex cross-chain operations and smart contract interactions increase the risk of potential security vulnerabilities, especially when dealing with large amounts of user assets. Second, the project has not yet issued tokens and lacks a clear token economic model, which may affect the effectiveness of the long-term incentive mechanism. In addition, as a third-party staking solution, Solv Protocol may face challenges in user trust. The project's degree of decentralization and governance mechanism also need to be further improved to ensure long-term sustainable development. Finally, although TVL is growing rapidly, the user base is relatively small, and market education and user adoption still need time.

In summary, although Solv Protocol has certain project risks, the risks it faces are all the risks faced by BTCFi track projects at this stage, and there are no risks unique to the Solv Protocol project. After Solv Protocol launched the Staking Abstraction Layer (SAL) technology, we can clearly see that Solv Protocol has undergone tremendous changes in its future development direction compared with other LST projects that simply provide BTC-based projects, and the development ceiling of aggregating the decentralized liquidity of the entire chain BTC is larger. Therefore, we believe that Solv Protocol is a project that is very worthy of investment and attention.