Original | Odaily Planet Daily (@OdailyChina)

Author: Golem (@web3_golem)

On November 6, the much-anticipated US election finally came to an end, with Republican presidential candidate Trump declaring victory in the 2024 presidential election. Trump is known as the "crypto president" because he has repeatedly promised in public that he will support the development of the crypto industry after taking office. With the positive news of Trump's victory, Bitcoin hit a new all-time high on the day of the vote, breaking through $75,000 in a short period of time. In the early hours of this morning, Bitcoin rose to $76,848, setting a new record.

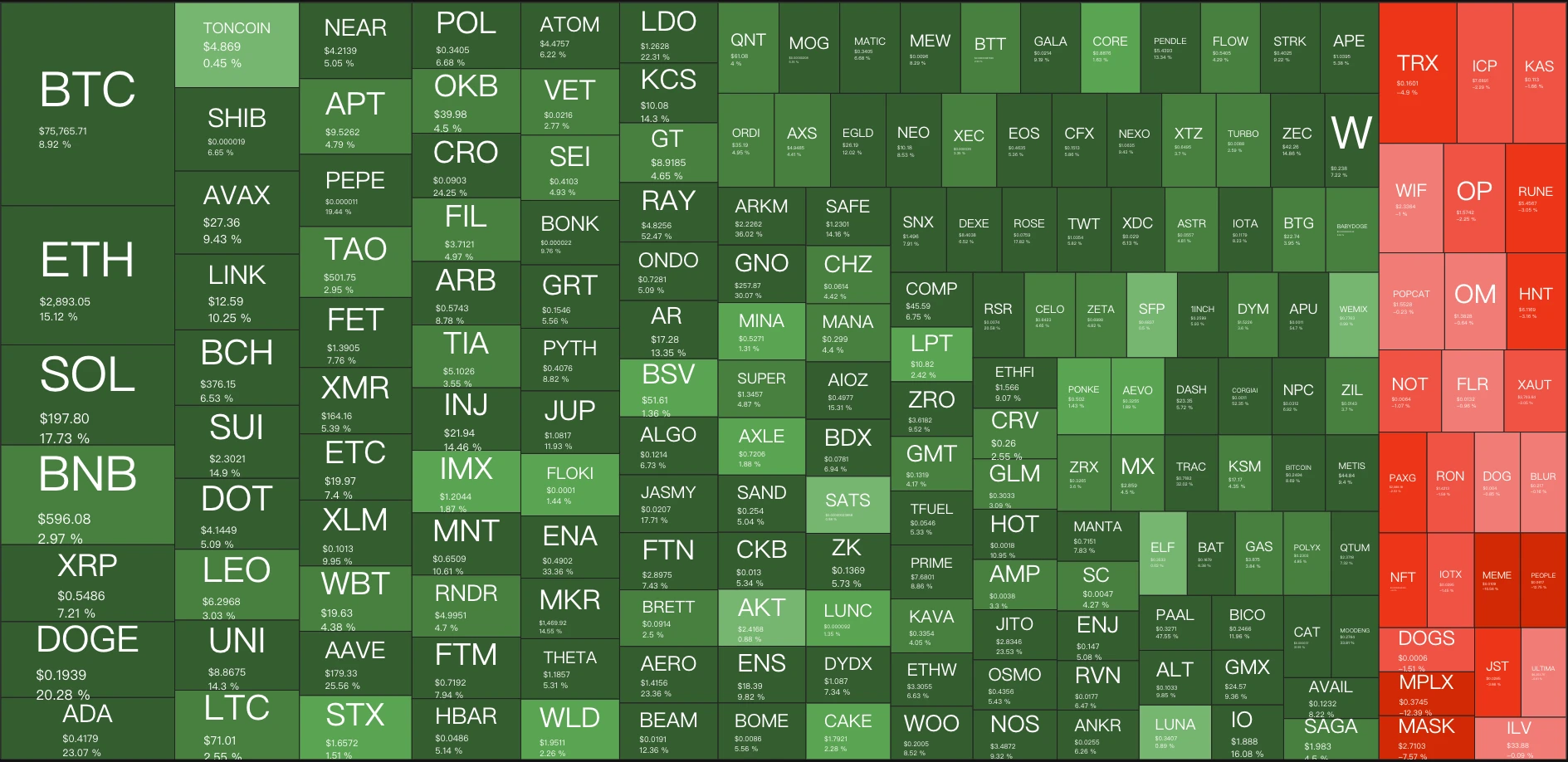

As of writing, according to Coingecko and TradingView data, the total market value of cryptocurrencies is $2.672 trillion, with Bitcoin accounting for 59.86% of the market. Although Bitcoin still has a high market share, the altcoin market is also recovering this month. According to Quantify Crypto data, in the past week, among the top 200 cryptocurrencies by market value, in addition to BTC, 173 tokens have risen, including SOL up more than 17%, DOGE up more than 20%, UNI up more than 14%, LDO up more than 22%, etc.

So, can the subsequent rise of the altcoin market continue in November? Which altcoins are worth paying attention to? In this article, Odaily Planet Daily will try to analyze the factors that are currently favorable to the altcoin market, and at the same time collect the views of various institutions on the subsequent altcoin market, and finally consider which altcoins are worth paying attention to from a trading perspective.

So, can the subsequent rise of the altcoin market continue in November? Which altcoins are worth paying attention to? In this article, Odaily Planet Daily will try to analyze the factors that are currently favorable to the altcoin market, and at the same time collect the views of various institutions on the subsequent altcoin market, and finally consider which altcoins are worth paying attention to from a trading perspective.

With the Trump administration taking office, the altcoin market may usher in a regulatory spring

Trump was elected as the next US president, and both the traditional financial market and the crypto market began to digest Trump's election victory.

In traditional financial markets, the U.S. dollar and U.S. bonds surged due to the election results, but gold and oil prices fell after the election results because Trump's previous plans to reduce immigration, impose widespread tariffs and cut taxes could push up inflation.

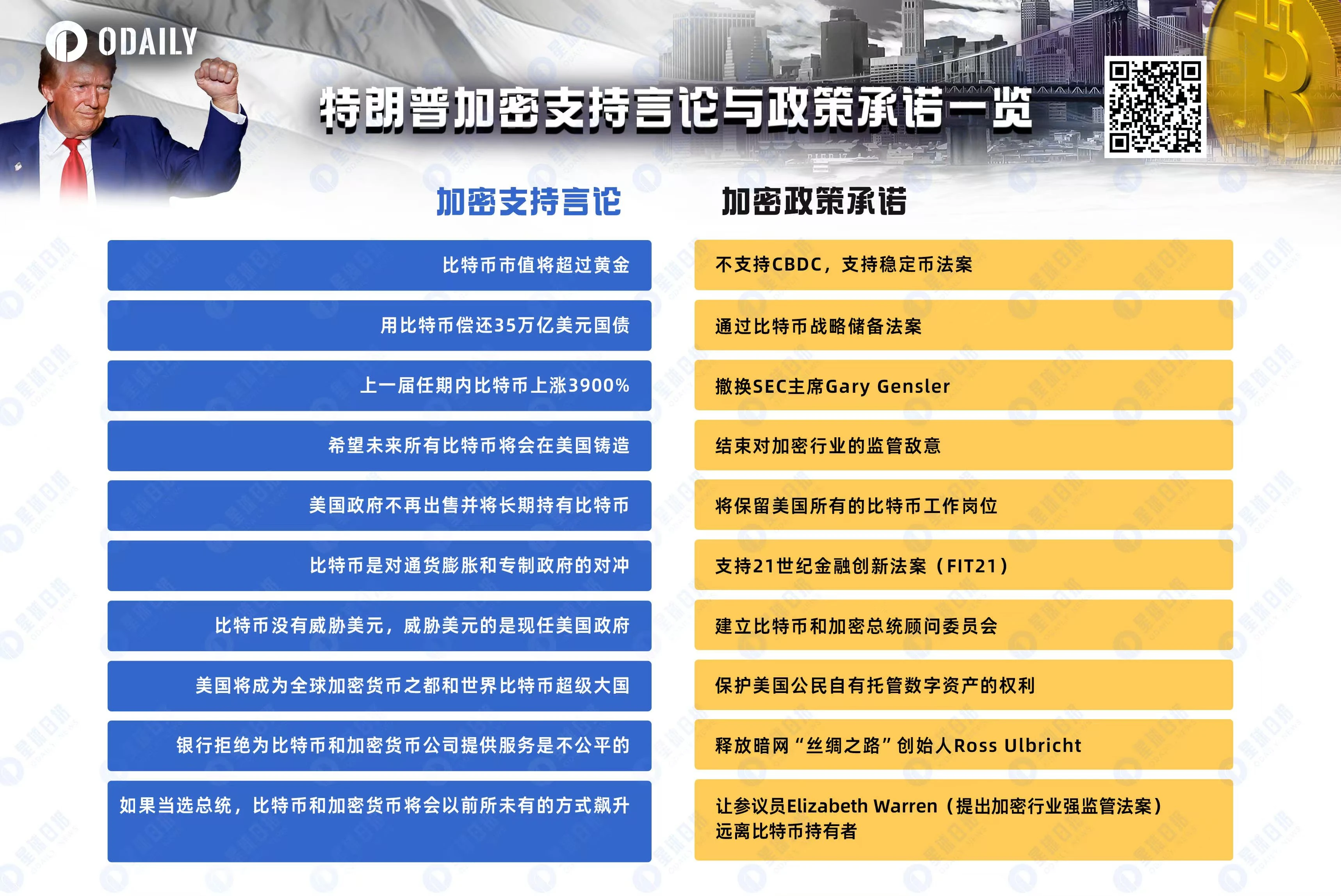

In the crypto market, Bitcoin prices were the first to directly respond to Trump's victory, continuing to hit new highs. Trump made many promises to the crypto industry during his campaign, including not supporting CBDC and establishing a national Bitcoin reserve (see the figure below for details). For the more strictly regulated altcoin market, if these crypto-friendly regulatory policies can continue to be implemented, it will truly promote the recovery of the altcoin market.

In 2024, the U.S. SEC, the "number one enemy" of the crypto industry, has imposed fines of up to $4.68 billion on the crypto sector. Many crypto companies have been accused by the SEC, including Binance, Coinbase, ConsenSys, and Uniswap. After Trump took office, there is a high probability that the U.S. SEC will relax its vigilance against the crypto industry.

In 2024, the U.S. SEC, the "number one enemy" of the crypto industry, has imposed fines of up to $4.68 billion on the crypto sector. Many crypto companies have been accused by the SEC, including Binance, Coinbase, ConsenSys, and Uniswap. After Trump took office, there is a high probability that the U.S. SEC will relax its vigilance against the crypto industry.

On November 6, Republican Bernie Moreno, who supports cryptocurrency, defeated Ohio Democratic Senator Sherrod Brown and successfully won the Ohio Senate seat. The Republican Party has already controlled the Senate. In order for Bernie Moreno to win the seat, the cryptocurrency-supporting super political action committee "Defend American Jobs" spent $40.1 million to support Bernie Moreno.

The reason why this seat has attracted much attention in crypto is that Brown is currently the chairman of the Senate Banking Committee, which is one of the most influential committees in the Senate and has jurisdiction over the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Therefore, the crypto-friendly Bernie Moreno is expected to pass a large number of cryptocurrency-related bills.

At the same time, the current US SEC Chairman Gary Gensler will also be replaced, and Trump will likely appoint a "crypto-friendly chairman"...

The above regulatory trends all indicate that after the Trump administration comes to power, the regulatory pressure faced by the altcoin market will be improved, ushering in a regulatory spring.

Bitcoin hits new high, altcoin rotation is likely

As Bitcoin breaks new highs and its market share remains at around 60%, based on past bull market experience, when Bitcoin's market share remains at a high of 60%, the altcoin season will arrive soon. Compared with the past, the general view in this cycle is that Bitcoin spot ETFs have brought a large amount of capital inflows and institutional purchases, which is one of the main factors affecting the rise in Bitcoin prices.

According to Grayscale's October crypto report, the total net inflow of U.S. spot Bitcoin exchange-traded products (ETPs) in October was US$5.3 billion, the highest level since February. The total net inflow has exceeded US$24.2 billion. U.S. ETPs currently hold about 5% of the total supply of Bitcoin.

However, it also pointed out that due to the existence of Bitcoin "basis trading", that is, buying Bitcoin (through ETP) and selling Bitcoin (through futures), the impact of spot Bitcoin ETP inflows on Bitcoin price increases is not as great as imagined. Grayscale estimates that of the $24.2 billion in net inflows into U.S. ETPs, about $5 billion (about 20%) may be used to match spot/futures positions.

Therefore, in addition to traditional financial market funds such as Bitcoin spot ETFs and institutional purchases, there are still many active crypto funds or retail funds in the market that are boosting the price of Bitcoin. When Bitcoin reaches a new high and Trump takes office and crypto regulation may shift, these funds are more likely to rotate to the altcoin market, ushering in the altcoin season.

How do various institutions view the future trend of copycat stocks?

Previously, many institutions were still pessimistic about the future trend of the altcoin market and believed that Bitcoin would absorb a large amount of crypto funds.

Top trader Eugene wrote on the X platform at the end of October that the price trend in October really shows the PvP level of the current cryptocurrency environment, which shows that although traditional financial funds are flowing into buying Bitcoin, no one is buying altcoins yet. Users can make money in some aspects (such as GOAT and early AI Meme), but it is also easy to return all profits to the market due to subsequent panic buying.

Matrixport said on November 5 that driven by multiple positive factors, Bitcoin's market share rose from 50% to 60%, but altcoins were limited by declining user activity and pressure to unlock tokens, which was in sharp contrast to the explosive growth during the DeFi boom in 2020-2021. Investors are now gradually transferring their crypto assets to Bitcoin.

Bitfinex analysts also said that there has been a lukewarm situation in the altcoin market, and the speculative interest that once supported altcoins seems to have disappeared, which is reflected in the stable funding rate and the overall low market sentiment. With Bitcoin absorbing most of the funds flowing into the crypto asset field, the prospects for altcoins to recover in the short term appear slim without new catalysts.

However, there are also views that the funds will move to the altcoin market.

Jeffrey Ding, chief analyst at HashKey Group, analyzed that Trump's election has been regarded as the "starting gun" of the cryptocurrency market, and it is expected that the digital currency market will continue to digest this good news until Trump enters the White House. A series of policies that Trump promised during the campaign to support cryptocurrencies, including the inclusion of Bitcoin in the national reserve and the removal of the current SEC Chairman Gary Gensler, are all seen as major positives for the market. Given that Trump is known for "keeping his campaign promises", we have reason to expect these policies to be gradually implemented after he takes office. The expected implementation of these policies, coupled with the high probability of Trump's election, provide strong support for the price increase of Bitcoin and other cryptocurrencies.

Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom, said on the Unchained podcast on November 1 that although liquidity will flow to Bitcoin after the election, if Bitcoin rises, then other currencies will rise more in percentage terms. Because people usually have a "nominal price misconception", such as Bitcoin is $72,000, they think it is cheaper to buy a $1 coin and think it has more room to rise. This mentality will cause investors to buy those coins that look cheap, which forms the so-called "rotation effect."

GSR analysts said that the election will not affect Bitcoin too much, but from the perspective of altcoins, many project parties have been waiting for the opportunity to observe the issuance of other tokens and the results of the election. When project parties do not know whether the tokens they want to deploy will be sued by the U.S. Securities and Exchange Commission within two months, not many project parties are willing to issue coins now. If the election results are conducive to improving crypto regulation, this situation will improve.

Matt Hougan, chief investment officer of Bitwise, pointed out before the election that whether Trump or Harris wins, the regulatory environment for Bitcoin is improving, and if Trump wins, it will have a greater impact on Ethereum and other altcoins. Benjamin Cowen, founder of Into The Cryptoverse, also said on November 4 that altcoin liquidation should end in December 2024 (the second week of January 2025 at the latest).

Inventory of oversold altcoins

Judging from the performance of altcoins in the past two days, the market tends to be positive. However, although some altcoins have experienced a rebound, combined with the long-term market trend of altcoins and the current market trend of Bitcoin, many altcoins are still in the "ankle-cutting" stage. Among the new projects launched by Binance in 2024, many altcoins have experienced a correction of more than 80% from their highs. From a trading perspective, if the altcoin market comes, these oversold altcoins will have a better chance of rebounding.

Below is a brief list of some altcoins that were newly listed on Binance in 2024 but had large pullbacks from their highs: (data as of November 7)

Starknet (STRK)

Plate: L2

Launch date: 2024-2-20

High point correction: -85%

Sleepless AI (AI)

Section: GAMEFI, AI

Launch date: 2024-1-8

High retracement: -84%

AltLayer (ALT)

Section: Modular blockchain

Launch date: 2024-1-25

High point correction: -85%

Pyth Network (PYTH)

Section: Oracle, SOL Ecosystem

Launch date: 2024-2-2

High pullback: -67%

IO.NET (IO)

Sector: AI

Launch date: 2024-6-11

High retracement: -72%

Dogwifhat (WIF)

Section: SOL MEME

Launch date: 2024-3-5

High pullback: -52%

AEVO (AEVO)

Sector: DEX

Launch date: 2024-3-13

High retracement: -91%

Ethena (ENA)

Sector: Synthetic Stablecoins

Launch date: 2024-4-2

High retracement: -65%

Dogs(DOGS)

Sectors: TON, MEME

Launch date: 2024-8-30

High point correction: -65%

Hamster Kombat (HMSTR)

Sectors: TON, GameFi

Launch date: 2024-9-26

High retracement: -63%

The above are just some oversold altcoins as examples. The altcoin market has experienced a long-term decline, and Bitcoin has been rising. In the short term, there are many opportunities in the altcoin market. However, not all players have the time to carefully analyze the altcoin market and find money-making opportunities in it when the altcoin season comes.