Political black swans come without warning.

Affected by the martial law in South Korea, the Korean won and Korean stocks plummeted, and the price of BTC on Upbit, South Korea's largest crypto exchange, once plunged to $61,600. Upbit data shows that as soon as the martial law news came out, the exchange rate of Bitcoin to the Korean won (KRW) plummeted from 130 million won to 93.6 million won, a drop of nearly 33%. Mainstream altcoins also saw double-digit declines on the platform, including the recently soaring XRP, as well as tokens such as Shiba Inu and Dogecoin.

Whales pick up chips at low prices

This event created arbitrage opportunities for smart traders.

Unlike in past years, when smart money could buy Bitcoin at lower prices on exchanges in Hong Kong and North America and then sell it at a “Kimchi premium” in South Korea, this time the opposite is true.

According to Lookonchain, as the Korean market fell, many whales moved large amounts of USDT to the Upbit exchange to snap up tokens at a discount.

Data shows that within an hour after the South Korean president declared martial law, large traders transferred more than $163 million in USDT to Upbit. Lookonchain said on X: "Many whales transferred a large amount of USDT to Upbit, probably in search of bargain hunting opportunities." Due to the influx of panic sellers and bargain hunters, Upbit announced that its application and open API services were suspended and delayed due to increased traffic.

In the early morning of the 4th local time, Yoon Seok-yeol announced the lifting of martial law, just over 6 hours after he announced the implementation of martial law the night before. The price of Bitcoin on Upbit has recovered slightly, and is around $88,600 as of press time.

Juan Leon, senior investment strategist at Bitwise, said in a statement that bitcoin’s discount on South Korean exchanges reflects the “stuckness” of liquidity within centralized venues. He said that while bitcoin is a decentralized asset that trades 24/7, disruptions can still occur when “special circumstances somewhere” cause sudden restrictions.

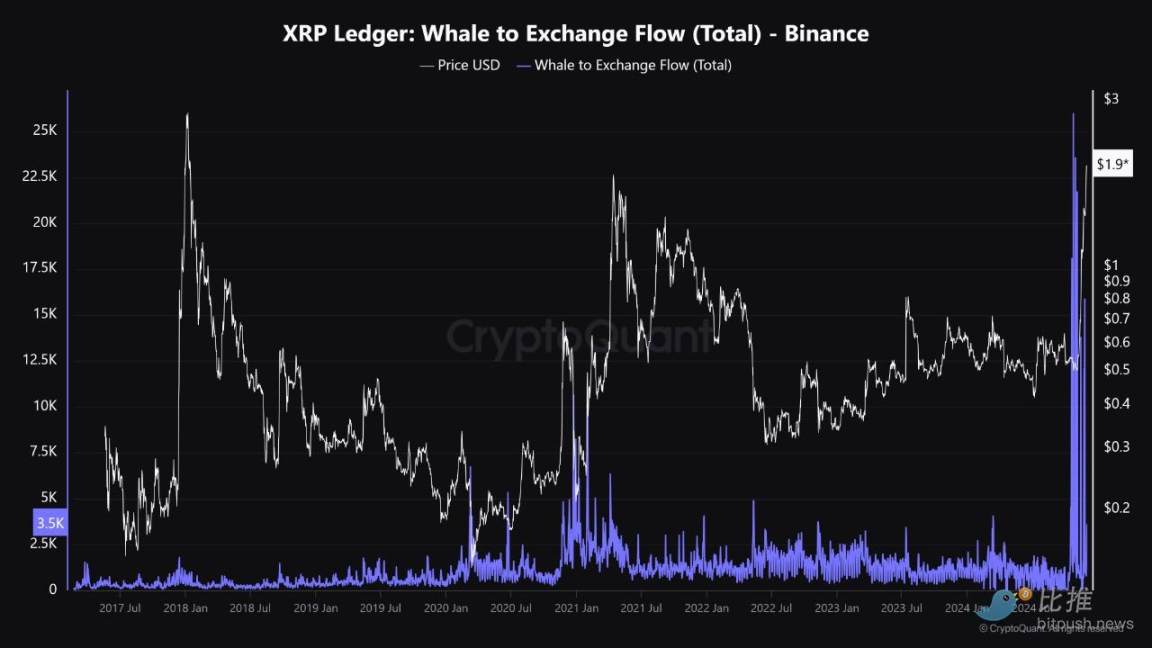

XRP whale activity surges to all-time high

According to Bitpush data, the price of XRP tokens has skyrocketed 4 times in the past month, becoming the third largest crypto asset by market value.

CryptoQuant data shows that XRP whale activity has hit a record high. CryptoQuant analyst Woominkyu pointed out that historically, a sharp surge in whale XRP trading activity "is closely related to XRP price peaks." These transactions have recently surged, pushing the coin price to a peak of around $2.6, indicating that whales may be "preparing for potential profit-taking or increased market activity."

Analysts believe that XRP's price momentum is driven by the launch of Ripple's stablecoin, potential pro-crypto SEC leadership changes, and the expected approval of spot XRP ETFs. At least five companies have applied to list spot XRP exchange-traded funds (ETFs) in the United States recently, including Grayscale, WisdomTree, Bitwise, 21Shares, and Canary Capital.