By Doug O'Laughlin

Compiled by: TechFlow

Sorry for being gone for a while. I just finished moving to New York City and am dealing with some health issues. A quick update for you all: I will be taking a week off starting March 27th to recover from outpatient surgery. But let's get down to business.

The market is rapidly pricing in an impending recession, due in part to the Trump administration's policies and significant pressure on the U.S. dollar. I'm going to do a casual summary from a macroeconomic perspective and discuss the semiconductor industry and areas I'm interested in. Let's start with the macro perspective and then go in-depth.

The “manufactured” recession and the 10-year Treasury yield

Recent comments suggest the current administration is placing more emphasis on the 10-year Treasury yield than on stock market levels — a departure from past strategies such as the so-called “Trump protection.” Multiple references to the “adjustment period” in a Fox News interview suggest a shift in focus from stock market performance to bond market signals.

The main measure of this is the 10-year Treasury yield. The 10-year Treasury yield is the rate the U.S. government pays to borrow money, and by lowering this key rate, it can improve housing affordability or consumers' ability to buy cars. However, "manipulating" the 10-year Treasury yield is not as direct as adjusting interest rates. Interest rate adjustments are mainly overnight bank lending rates determined by the Federal Reserve, while the price of the 10-year Treasury is a market-driven price determined through auctions to investors willing to buy government bonds.

Here's the thing: The 10-year Treasury yield isn't an exact science. No one really knows how the 10-year bond, whose price is set by trading and is thought to reflect inflation and real GDP growth in the country that issued the bond, moves.

That presents challenges. Tariffs could spark inflationary pressures in the short term, while if the 10-year Treasury yield falls to 3% (as some, like Bessent, predict), that could reflect a downward revision in expectations for real growth. In that case, the market could view a recession as a necessary adjustment.

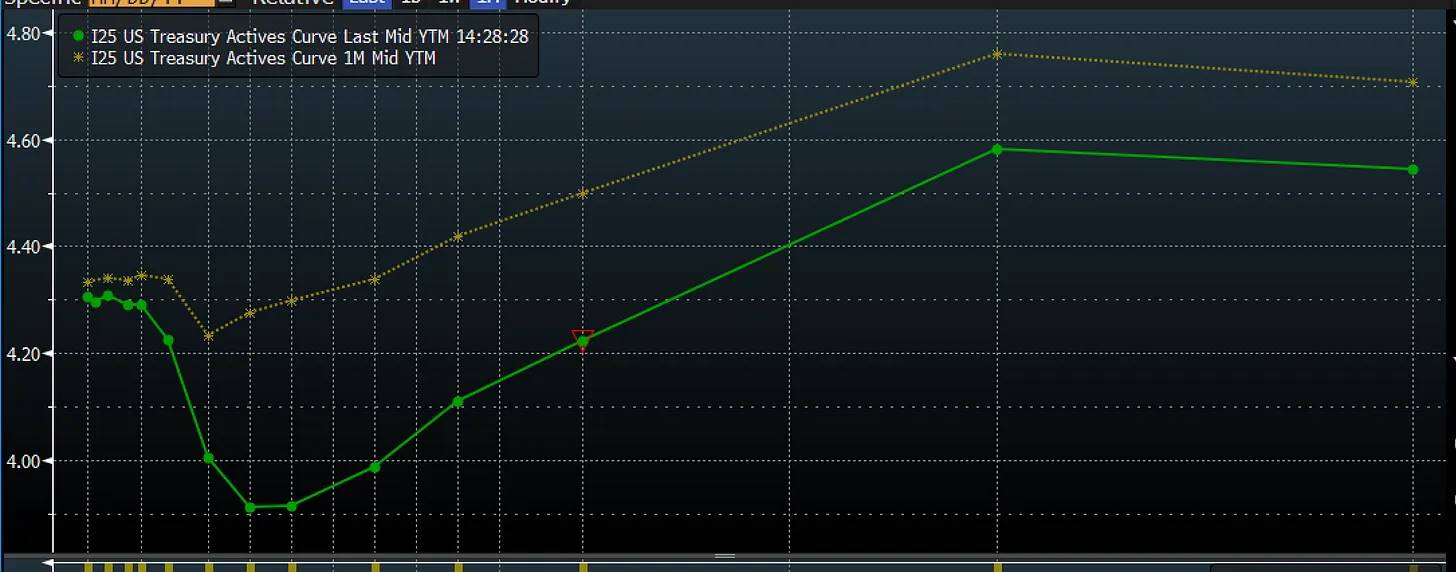

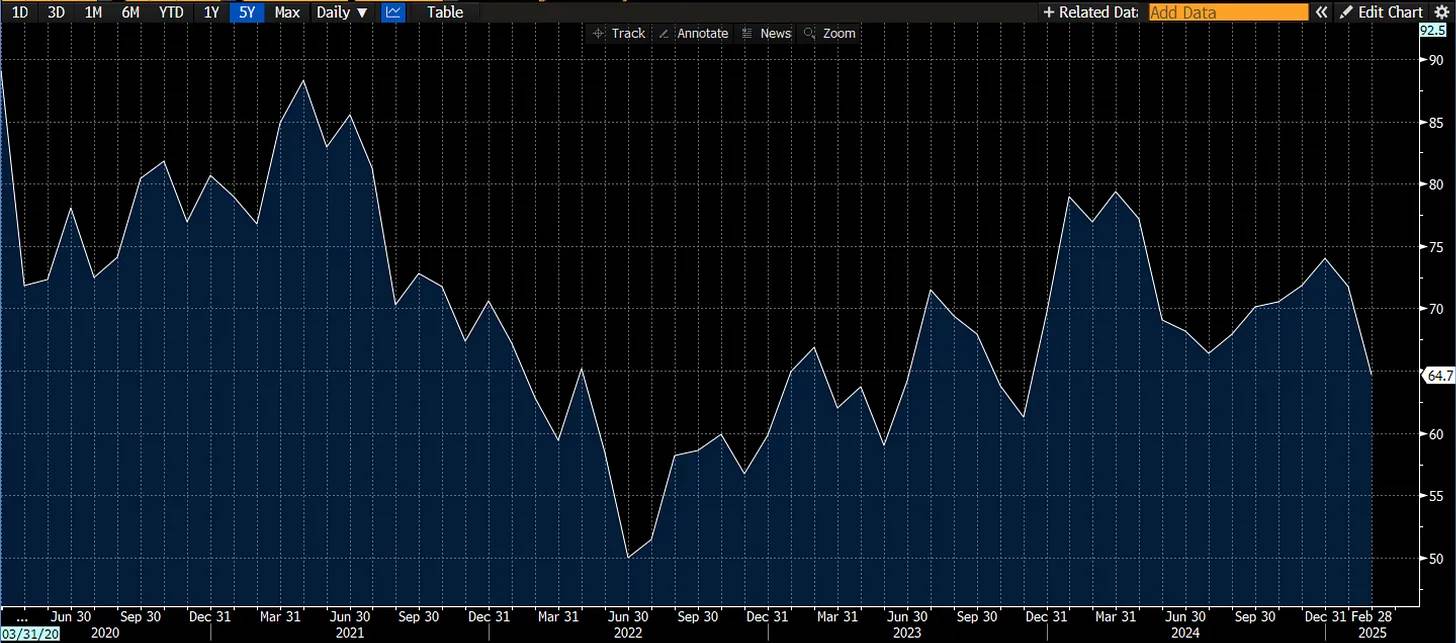

This is exactly what the market is expecting right now. Here is the yield curve from a month ago and now. Specifically, the short end of the curve is starting to fall. This means that the market is rapidly pricing in lower short-term rates and a lower federal funds rate. In this case, this may not be a reflection of lower inflation, but rather a reflection of a weak economy and the market's belief that the Fed is not cutting rates fast enough.

Source: Bloomberg

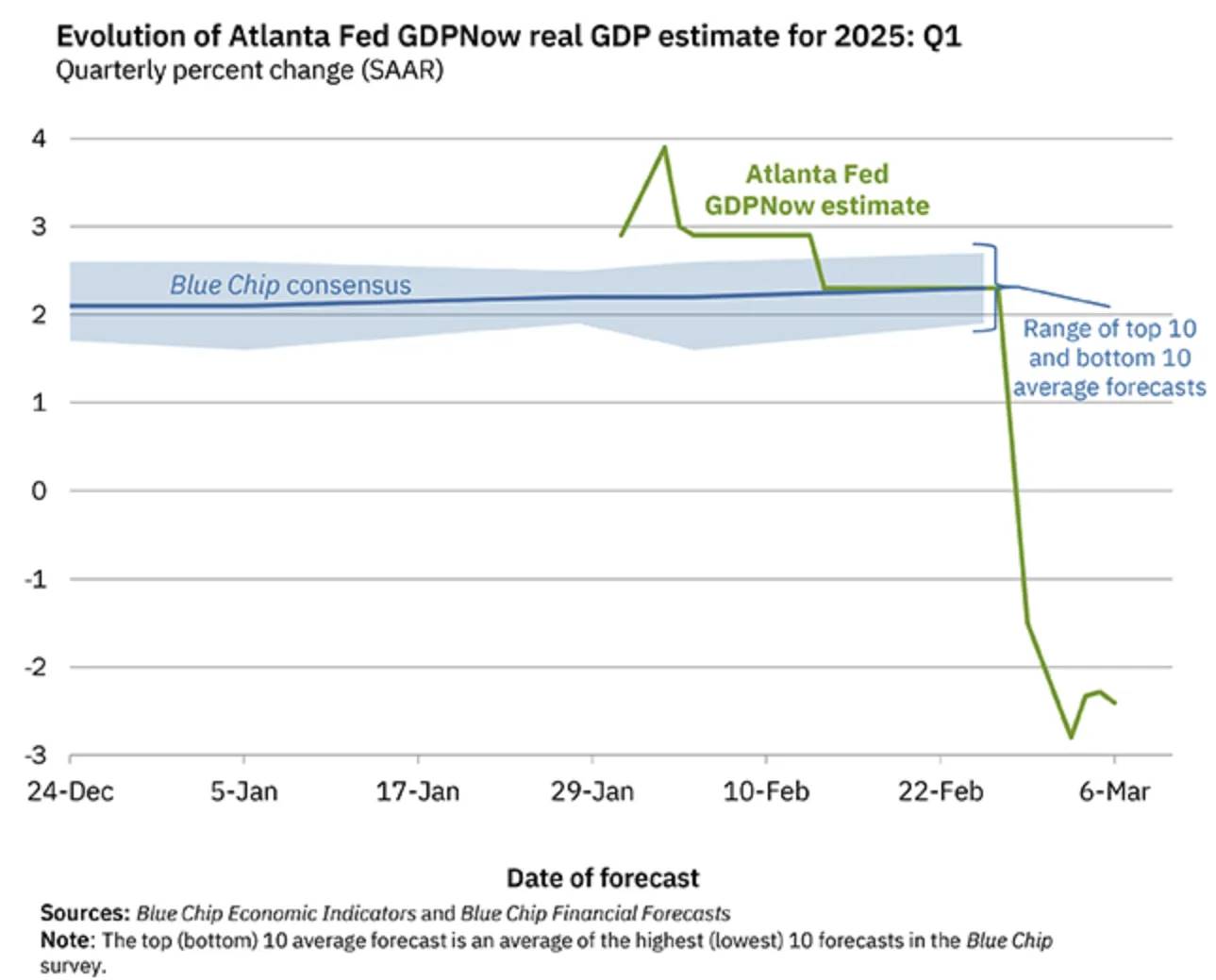

We are experiencing this in real time. GDPNow (a real-time economic forecasting tool) now predicts a significant contraction in the first quarter. There are technical reasons for this, but the overall trend is still weakening.

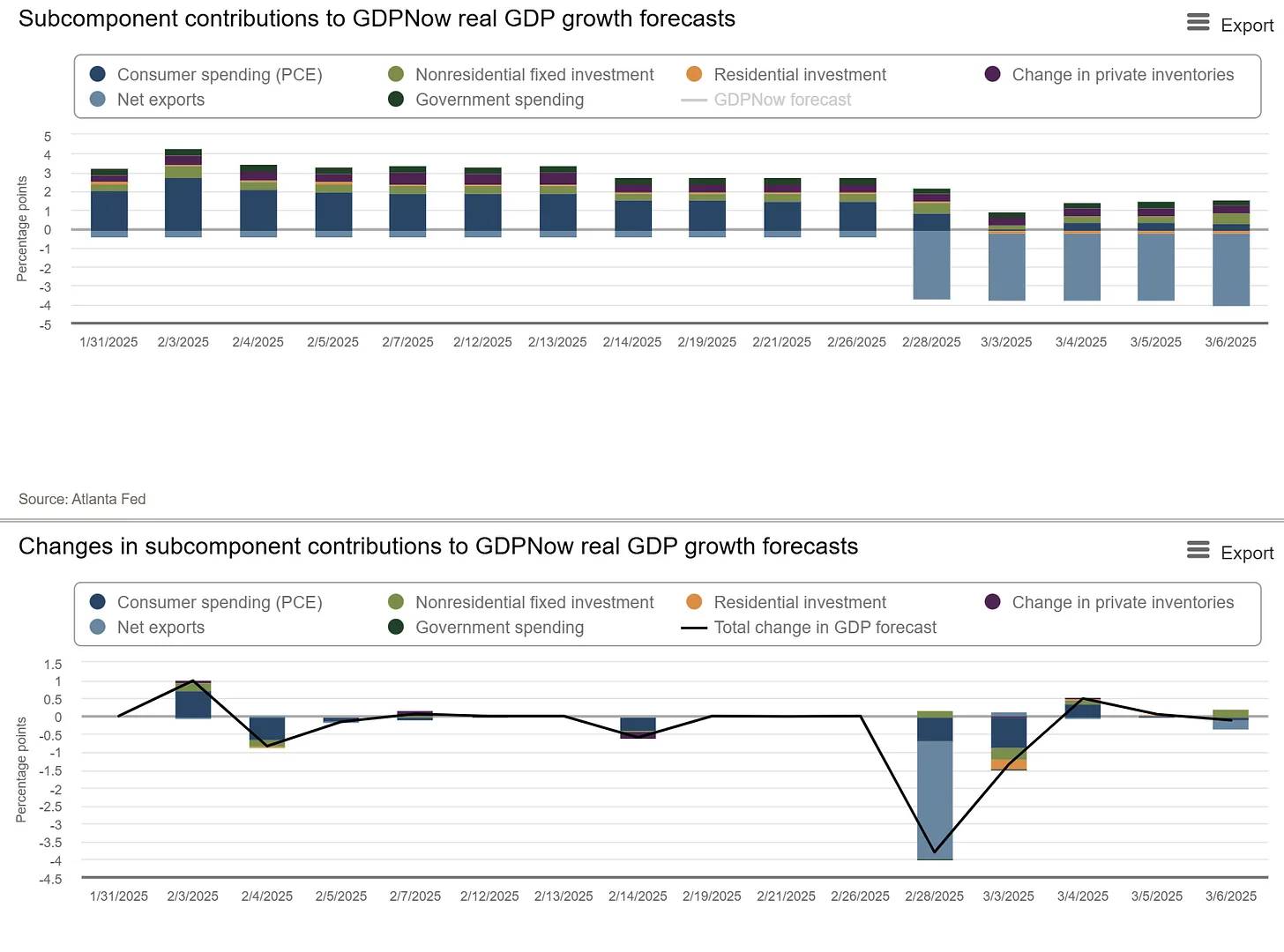

One important factor is the impact of net imports on GDP calculations. Net imports are deducted in GDP calculations, partly as an early response to tariffs. But underneath the surface, the economy is weakening across the board. The chart above shows the trend of growth contributions and their estimates. Imports are a big drag, but more importantly, the rates of change in most other categories are also deteriorating.

Source: GDPNow

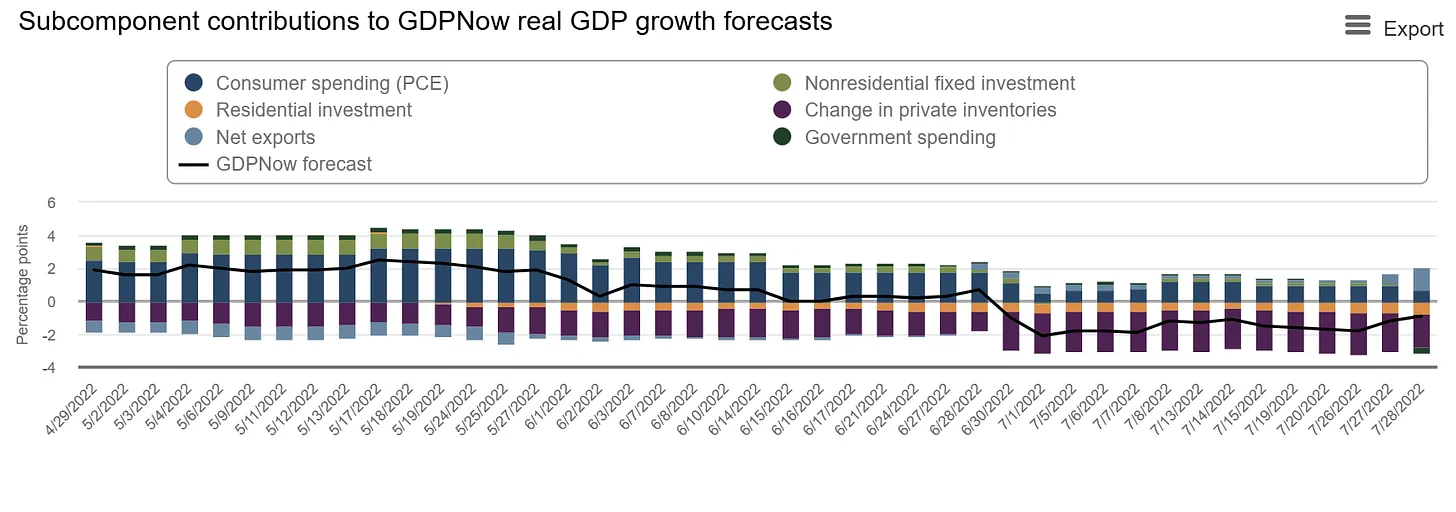

The second chart further shows the weakness in imports, while residential investment, government spending (as expected), and consumer spending are also weakening. The rate of change is deteriorating sharply, similar to the period of economic contraction in the second quarter of 2022. Below is a chart of the growth contribution in 2022, when the economy is hit by a large inventory drawdown.

This situation was quickly reversed as inventories normalized. So, will the front-loaded effect of tariffs this time recover as quickly as the post-pandemic inventory adjustment (one-off), or will it lead to a downward spiral in consumer and business confidence?

The problem is that consumer confidence is starting to decline and some leading indicators, such as the Consumer Confidence Index and the Leading Economic Index, are also starting to decline. The worrying thing is that this decline is accelerating. Most economic indicators and consumer data seem to be pointing to further weakness and uncertainty.

The yield curve is showing signs of a weak economy amid a surge in imports, falling consumer confidence and the possibility of a technical recession. Expectations of a weak economy have a reflexive effect because seeing a weak economy encourages people to save more. Trump now uses the term "transition period," but such language is generally not a good sign in the market.

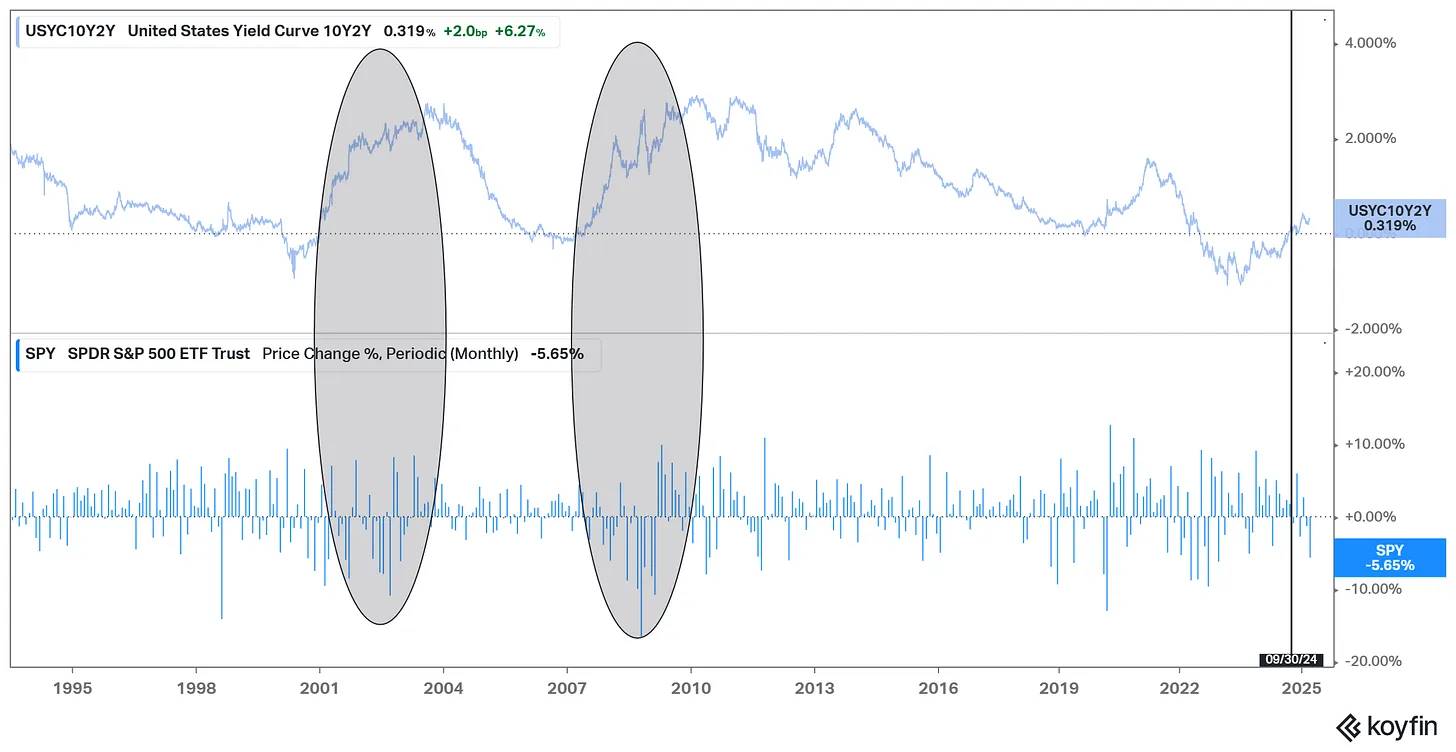

The timing is very delicate. The yield curve has just normalized, which is almost always the beginning of pain. When the curve steepens, a correction or recession begins. In other words, an inverted yield curve usually foreshadows a recession; and when the yield curve normalizes, a recession and its impact on the stock market begins. What we are seeing now is that the yield curve inverted in late September last year.

Source: Koyfin

We are experiencing pain right now. Another key factor is tariffs and uncertainty, because in economics, uncertainty is almost synonymous with volatility. When we can't be sure whether the tariff rate is 10%, 20% or 25%, decision-making becomes more difficult. However, the one overwhelming theme is trade.

Trade Deficit and Asset Flows

The United States has a chronically large trade deficit, meaning it imports more than it exports. However, these dollars do not disappear into thin air; they are transferred to foreign entities as payment for goods and services. These foreign exchange funds typically flow back into U.S. financial markets through investment. In this way, trade deficits accompany capital inflows that finance purchases of U.S. assets.

This creates a natural impetus to use the dollars accumulated from the trade deficit to purchase U.S. assets. This can be viewed as a natural inflow of dollars brought about by trade.

However, Trump's policy is explicitly focused on trade through tariffs. Tariffs naturally push up consumer prices, reduce trade, and, if they are high enough, reduce the trade deficit. This reduces the flow of dollars back to the United States, which in turn has a more adverse effect on asset prices - capital outflows.

Higher tariffs could mean fewer dollars accumulated by foreign entities that are already the largest buyers of U.S. assets. For example, a large Japanese conglomerate that runs a trade surplus with the U.S. would reduce its purchases of assets, including U.S. Treasuries, due to reduced business. Given that the main auction portion of U.S. Treasuries is now facing outflows and 24% of Treasuries are held by foreign investors, this would reduce demand for purchases by foreign investors, pushing up the 10-year Treasury yield. This is a very tricky situation.

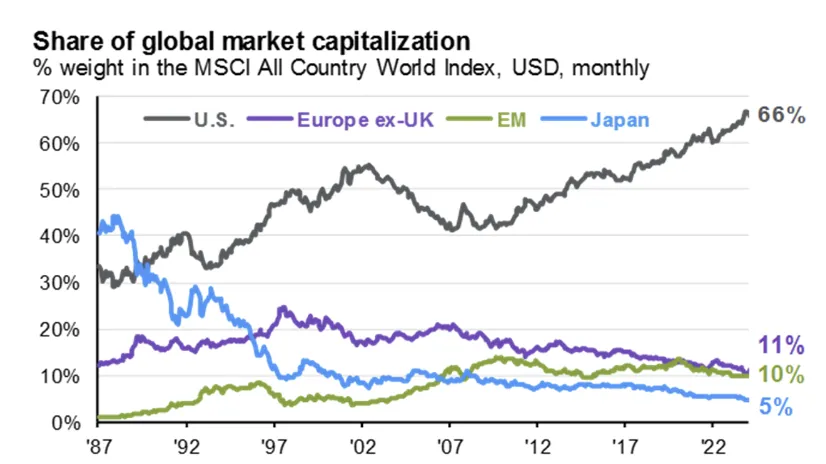

The US's increasing tariffs and negative attitude towards global trade will lead to a natural outflow of assets and prompt some foreign entities to flee US assets. After decades of trade deficits, this mechanism may become automatic and seriously out of control. Trade deficits have long existed as a natural source of capital inflows. The following chart of the US's share of global market capitalization has been discussed repeatedly - now it seems that there is a way to stop the inflow of funds, that is tariffs.

Source: JPMorgan Chase Market Guide

Another uncertainty is that the “West” is no longer so united. The Financial Times is questioning the transatlantic partnership. It is one thing to park assets in the financial markets of an ally, but it is something else entirely if it is no longer a strong ally. With the US pulling away and implementing reciprocal tariffs similar to Smoot-Hawley (essentially unilateral tariffs that eventually turned into a bilateral tariff war with Canada), it is hard to say whether their alliance is still strong.

A split in trade is a split in alliances. And as this continues, assets will flee. A retaliatory US administration could push European trade toward China, the world’s largest manufacturing base. The old world order is at risk, and betting all your chips on the US basket no longer seems a wise strategy. So where will the assets go? So far, Europe seems to be the biggest beneficiary.

Reversal of European and American roles

In an ironic pattern, the United States and the European Union are strangely reversing roles. Driven by a slew of AI investment announcements and new potential defense spending plans, Europe is doing something long neglected: deficit spending.

At the same time, it can be said that raising revenues through higher tariffs while slashing costs is the very definition of austerity. This is exactly the strategy Europe adopted after the financial crisis, and now the roles are being reversed. Austerity has an abysmal record, while deficit spending created the economic dominance and differentiation of the United States after the financial crisis.

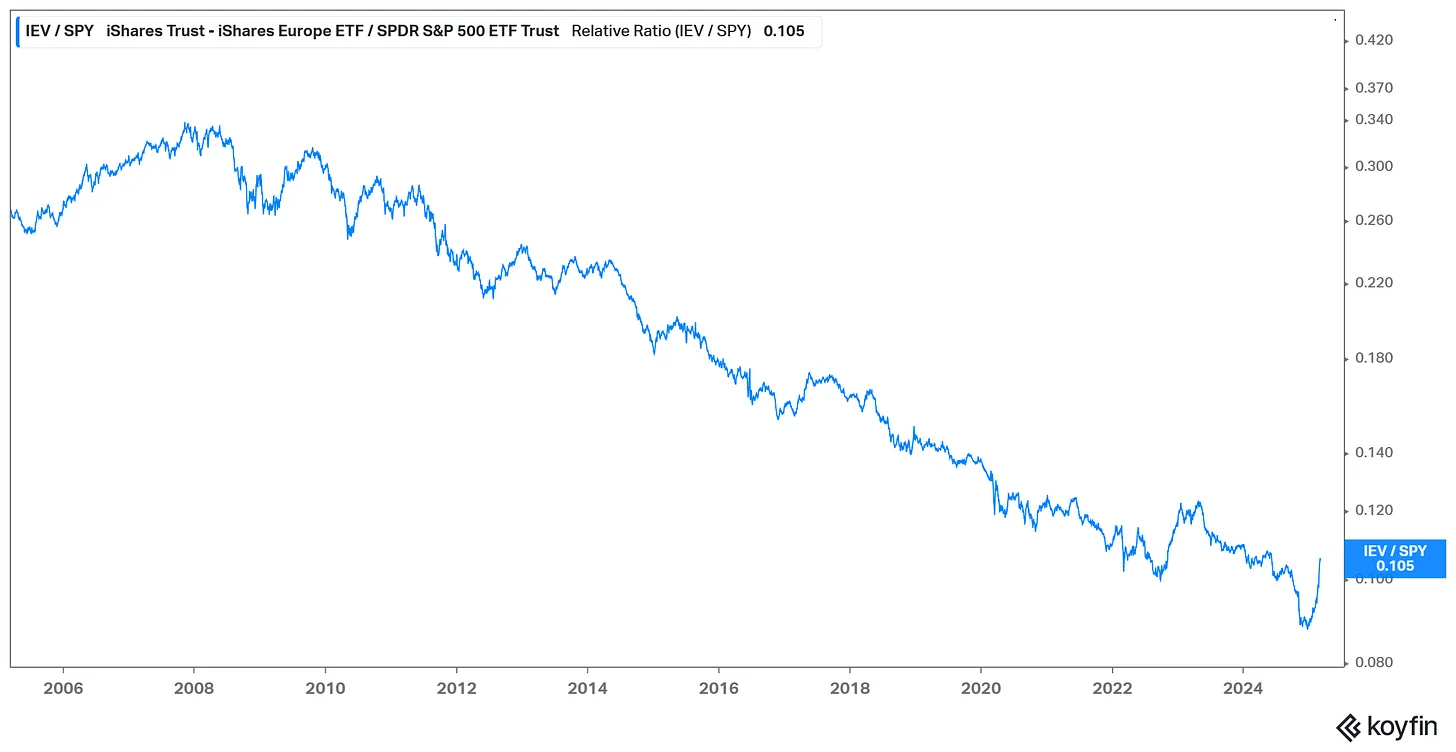

This can partially explain why assets are beginning to flow out, and the biggest divergence in developed country assets is flowing to Europe. The huge funds that used to flow to the United States are now reversing, and in the short term they will first flow to large liquid assets in Europe or markets with similar languages. One way to express this trend is the ratio of IEV (European ETF) to S&P 500 ETF. In 2025, the trend of relative outperformance of the United States is broken, and the trend of funds flowing to Europe becomes significant.

This is going to be a long-term trend because a lot of the American exceptionalism trade is unravelling. Another thing that is accelerating this trend is the rapid decline in US asset prices while the rest of the world is doing relatively well.

But let's be honest - this is a newsletter about semiconductors, not macroeconomics. Most of the developments mentioned here are basically relatively consistent macroeconomic views and are being quickly priced in by the market. The reality is that significant changes in the market take time and are rapidly approaching the final result. This can be a dramatic process.

Market Dynamics and Semiconductors

Finally, let's return to my beloved semiconductor industry. I want to make a few observations. First, the market top is very reminiscent of most market declines. There is an old saying that the semiconductor industry leads the market, and in my experience, this statement is indeed true.

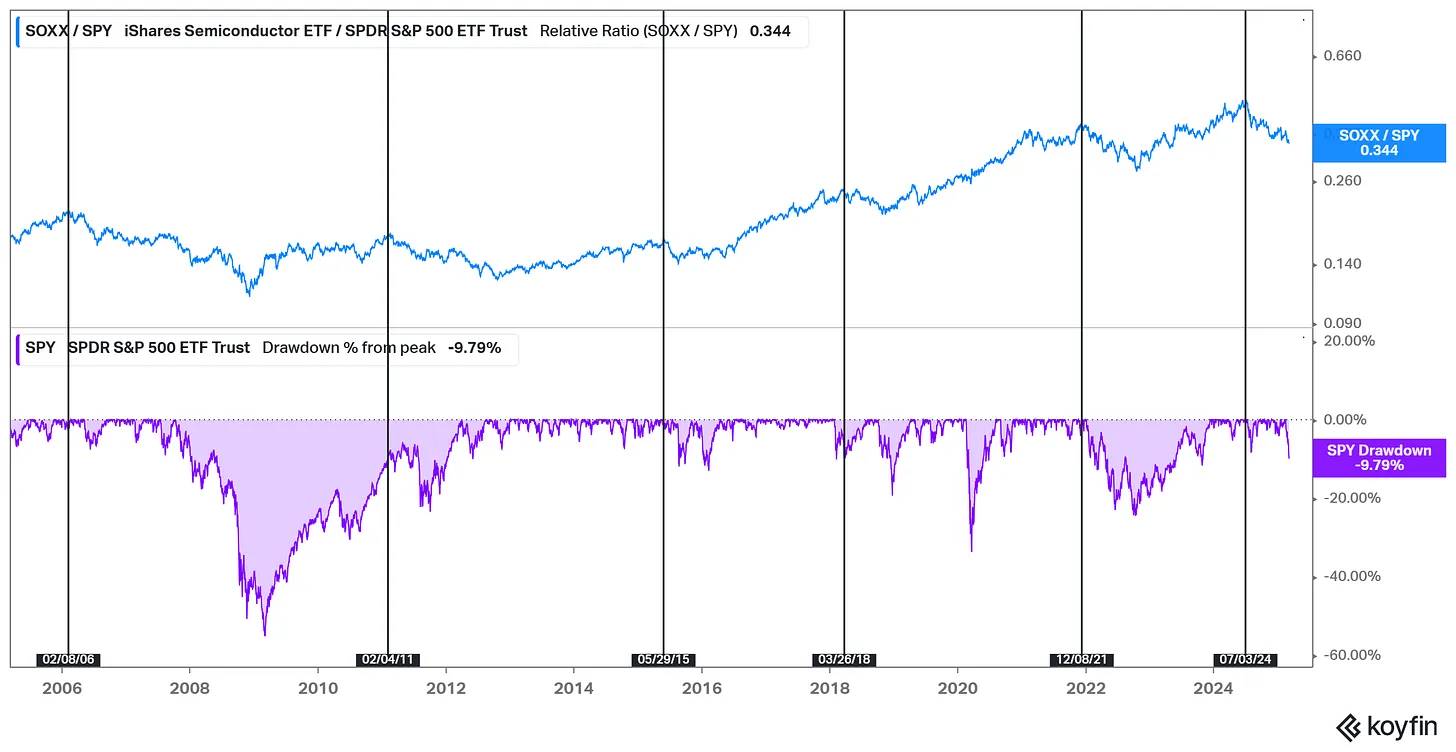

The chart below illustrates that when the semiconductor sector stops its relative strength, the market tends to experience a significant correction in the following months.

But the semiconductor industry is cyclical. We have experienced declines, and if the S&P 500 declines 10%, then the semiconductor industry will typically decline 20%, and even a 40% decline is possible. The market is telling us that the economic health is not good, which is a forward-looking indicator that reflects changes in orders and future revenue growth for semiconductor companies.

The question now is, how big will this decline be? We just saw a 10% decline number, which is consistent with history. Declines usually take more time and are usually more severe than this. Considering that the growth scare in 2022 was enough to cause the market to fall by 20%, I think this decline may end up in this range as well, not to mention that this growth scare is far more severe than the 2022 one.

Will this lead to a recession? That's a question beyond my ability to predict. But clearly there are some economic uncertainties right now, such as trade headwinds and potential flows of capital outside the U.S. At the very least, it's certain that we are in the midst of a regime or environment shift. This adjustment period could be just a market correction and economic contraction.