Author: Stella L ( stella@footprint.network )

Data source: Footprint Analytics public chain research page

Exactly 16 years after Satoshi Nakamoto published the Bitcoin white paper on October 31, 2008, Bitcoin has once again demonstrated its revolutionary impact on the financial world. In October 2024, Bitcoin approached its all-time high, driven by strong institutional investors, while the entire blockchain ecosystem continued to develop rapidly. This month has highlighted a clear market split, with Bitcoin leading the market with a 15.9% increase, Ethereum's gains were more modest, and the Layer 2 solutions of the two major networks continued to improve and expand. At the same time, emerging public chains such as Sui are developing rapidly and are about to enter the top ten public chains.

The data for this report comes from Footprint Analytics’ public chain research page , which provides an easy-to-use dashboard that contains the most critical statistics and indicators for understanding the public chain field and is updated in real time.

Market Overview

October 2024 saw a significant market divergence, with Bitcoin leading the gains while other cryptocurrencies saw relatively modest gains. Bitcoin performed exceptionally well, rising 15.9% from $60,764 to $70,398, and hitting a recent high of $72,751 on October 29, close to its all-time high in March. In contrast, Ethereum was more subdued, with a monthly gain of 2.7% to close at $2,519.

Data source: Bitcoin and Ethereum price trends

Multiple macroeconomic factors have influenced market trends this month. Changes in global currency markets, especially the strengthening of the U.S. dollar against major currencies including the Chinese yuan, have affected the flow of funds in the cryptocurrency market. This change occurred against the backdrop of rising bond yields and rising gold prices, reflecting a change in risk appetite in global markets.

Political factors have a growing influence on market sentiment, and the upcoming US election has become an important market driver. Investors are planning ahead for possible policy changes, which has accelerated the rise of Bitcoin, and the market is closely watching the impact of different election results on digital asset regulation and broader financial policies.

Institutional participation remains an important driver of the market, as evidenced by the large inflows into Bitcoin exchange-traded products (ETPs). This trend highlights the growing recognition of digital assets as a strategic investment tool by institutional investors, although they are more cautious in their investment positioning.

Regulatory dynamics continue to influence the market landscape. The FBI’s investigation into NexFundAI tokens through “fishing enforcement” was a major milestone, leading to market manipulation charges against three cryptocurrency companies and 15 individuals. Meanwhile, Crypto.com’s legal action against the SEC highlights the ongoing tensions between industry participants and regulators.

Layer 1

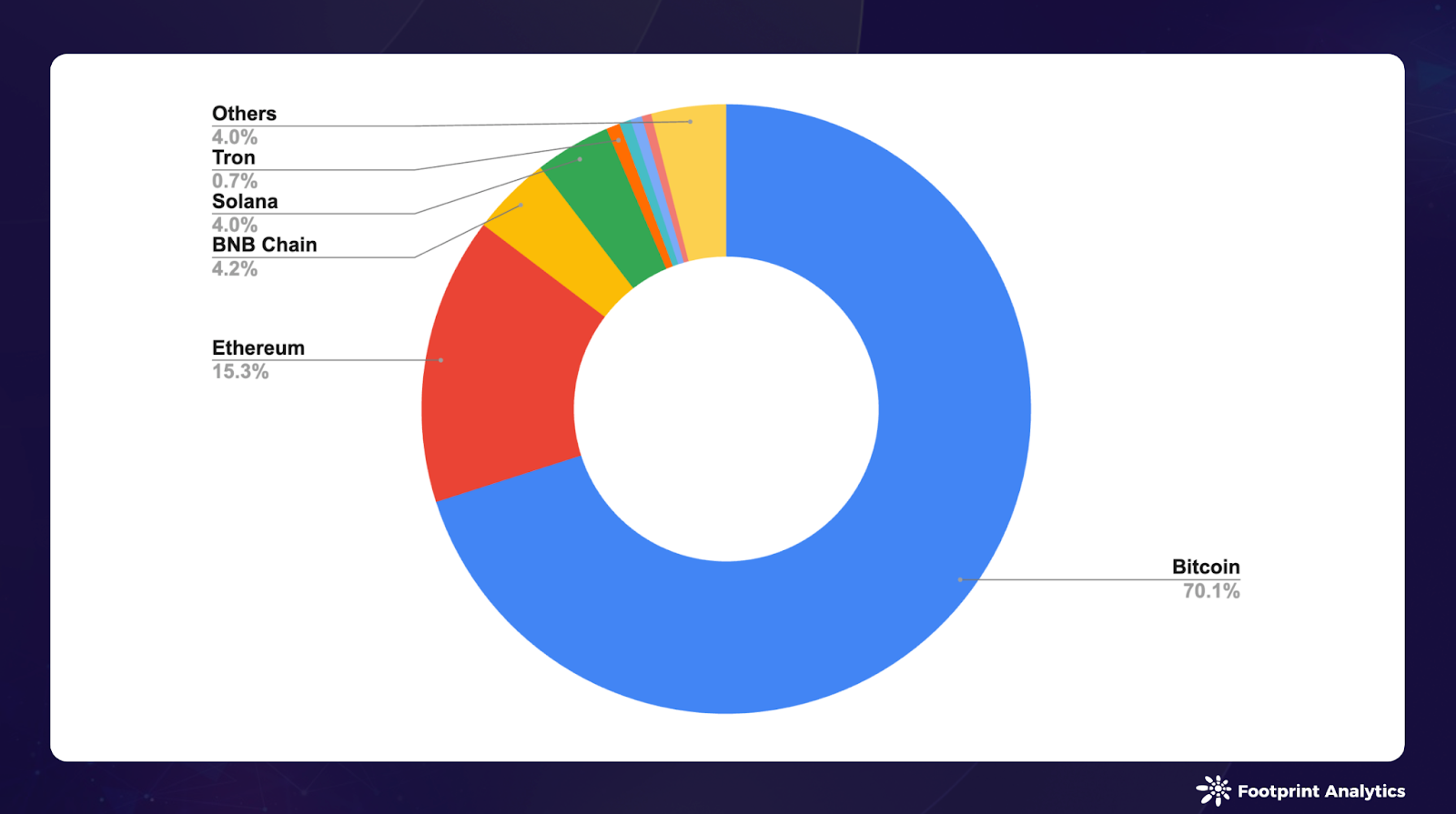

In October 2024, the total market value of blockchain cryptocurrencies increased by 6.7% to $2.0 trillion, and Bitcoin's market dominance increased from 67.3% in September to 70.1%. At the same time, Ethereum's share continued to decline, from 16.8% to 15.3%, while BNB Chain and Solana 's shares remained relatively stable, maintaining at 4.2% and 4.0%, respectively.

Data source: Public chain token market value

Market growth was mainly driven by strong performance of mature tokens, led by Bitcoin, with Bitcoin Cash (12.9%) and Litecoin (9.5%) also seeing significant gains. Solana maintained its position as one of the best performing altcoins, up 17.6%, while emerging blockchain Sui continued its upward momentum, up 11.5%.

Data source: Public chain token price and market value

Sui's market cap ranking rose to 11th place. By capitalizing on the meme coin trend and Telegram-based gaming opportunities, Sui has also significantly expanded its DeFi ecosystem. Circle's launch of native USDC on Sui in October marked another milestone in its development. However, this growth has not been without controversy - in October, allegations of a "$400 million token sell-off by Sui insiders" were denied by the Sui Foundation, but sparked community discussion.

The DeFi space faced headwinds in October, with total TVL falling 6.8% to $63.5 billion. While the Bitcoin ecosystem performed strongly, the Ethereum ecosystem’s DeFi sector underperformed. Notably, Polygon was an exception, with a 30.3% increase in TVL, driven by Polymarket’s record-breaking performance as activity intensified in the run-up to the U.S. presidential election.

Data source: Public chain TVL

Stablecoins continue to demonstrate their key role in the crypto ecosystem. Bitwise Research's Q3 2024 crypto market review shows that global stablecoin trading volume exceeded $5.1 trillion in the first half of 2024, close to Visa's $6.5 trillion trading volume. Tether's profitability exceeding BlackRock highlights the financial influence of the field and intensifies the competition among public chains to launch stablecoins.

Bitcoin Layer 2 & Sidechains

In October 2024, Bitcoin Layer 2 and sidechains continued to maintain strong growth, with total TVL reaching US$1.8 billion, an increase of 22.2% from September.

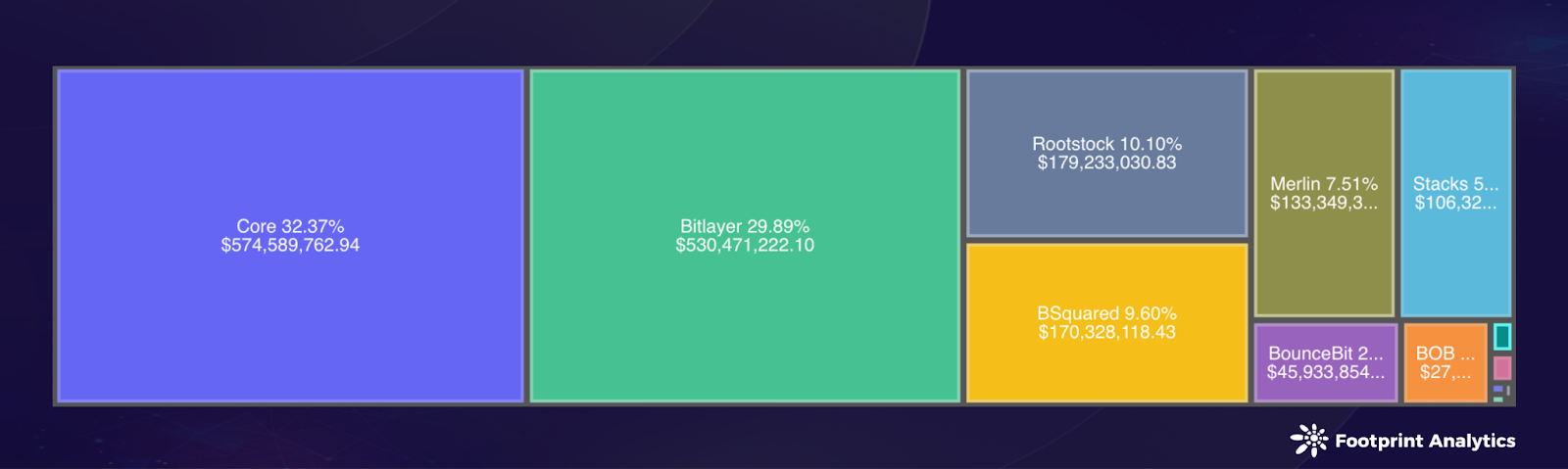

Core maintained its leading position in the industry, with TVL increasing by 29.8% to $570 million and a market share of 32.4%. Bitlayer consolidated its position, with TVL increasing by 36.1% to $530 million and a market share of 29.9%. Rootstock ranked third with a TVL of $180 million and a market share of 10.1%, while BSquared emerged as a dark horse, with a TVL of $170 million, a monthly increase of 54.4%, surpassing Merlin and jumping to fourth place.

Data source: Bitcoin Ecosystem Public Chain TVL

October saw a major technological breakthrough for the Bitcoin Layer 2 ecosystem. BEVM launched the innovative "Super Bitcoin" framework, proposing a comprehensive solution to expand Bitcoin's functionality while maintaining its underlying security.

The framework proposes a five-layer architecture based on the Bitcoin network, using its proven PoW consensus to ensure security. Building upward, it integrates Lightning Network technology for efficient communication, Taproot consensus for standardization, and a multi-chain fusion layer that supports various virtual machines. This architecture ultimately forms an application layer that enables developers to build DApps while leveraging Bitcoin security.

In a major move to connect the Bitcoin and Ethereum ecosystems, BOB Network announced its integration with Optimism’s “Hyperchain.” As a self-proclaimed “hybrid layer-2” solution, BOB aims to create a seamless connection between Bitcoin and Ethereum, placing Bitcoin at the center of the DeFi space.

Cross-chain capabilities have taken a step further with Cardano’s integration with BitcoinOS (BOS). This collaboration aims to provide users of the established public chain Cardano with direct, trustless access to Bitcoin liquidity.

Additionally, BTCFi continued its impressive growth, especially Babylon’s Bitcoin staking program Cap-2. The program demonstrated remarkable efficiency, attracting 23,000 Bitcoins while incurring a minimal fee of only 1.56 BTC. This successful deployment demonstrates the strong market demand for Bitcoin-based financial products.

Ethereum Layer 2

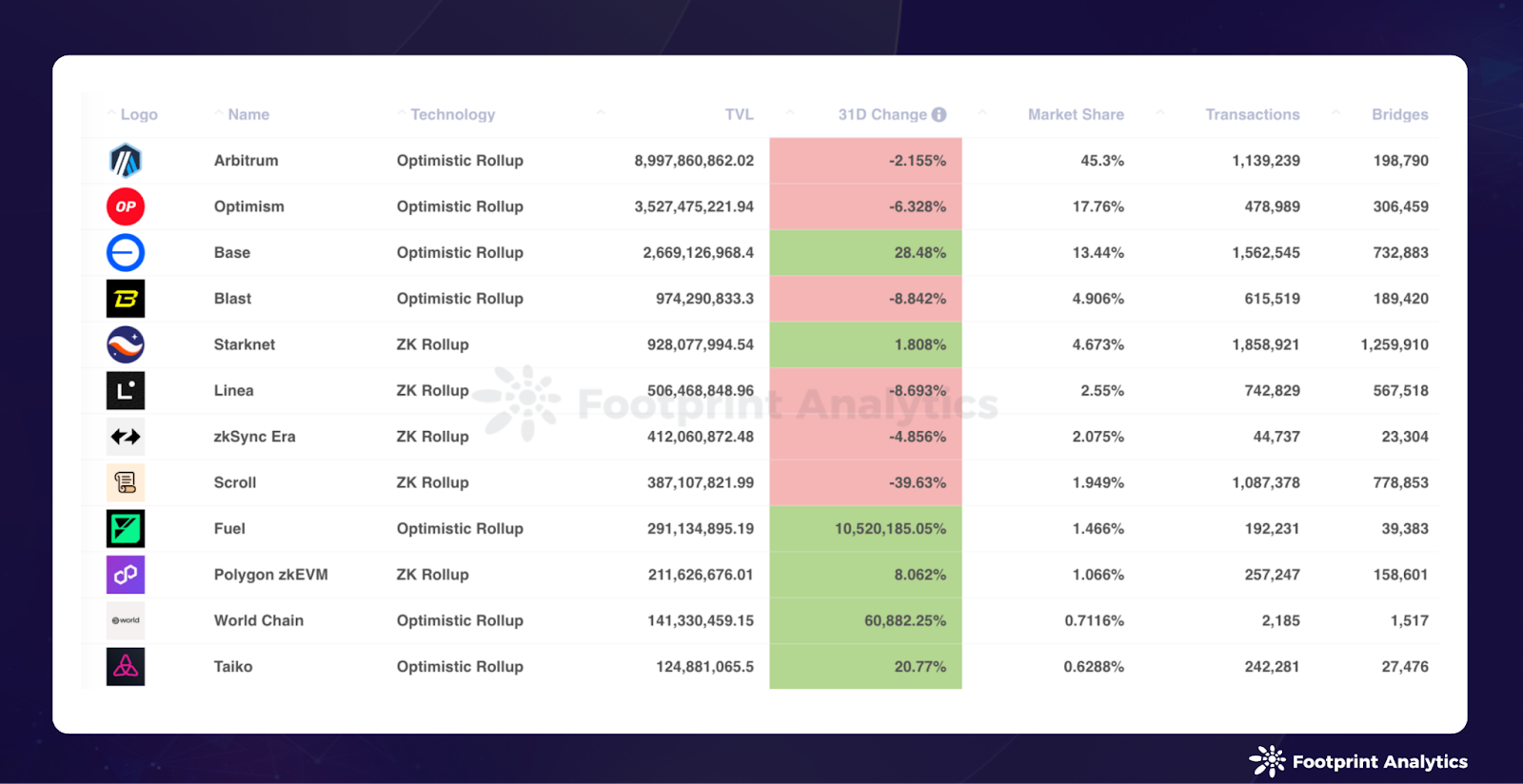

In October 2024, Ethereum Layer 2 solutions achieved moderate growth, with the total TVL of canonical bridges reaching $19.8 billion, up 1.2% from September, significantly lagging behind the growth rate of Bitcoin scaling solutions. The competitive landscape continues to evolve, with established leaders maintaining their dominance but declining share, and new entrants making good progress.

Market leaders Arbitrum One and Optimism maintained their positions with 45.3% and 17.8% market share respectively, although both saw small declines. Base grew significantly, expanding its market share from 8.1% to 13.4% and TVL by 28.5%. This growth was mainly attributed to Coinbase’s Smart Wallet, which simplified dApp interactions and attracted a large inflow of funds in lending, derivatives, and DEX protocols. Base’s native DEX Aerodrome performed well in this expansion.

Data source: Ethereum Layer 2 Overview in September 2024 - Rollups (Bridge-related Indicators)

Several new entrants made a notable impact. Fuel Ignition and World Chain saw significant growth in TVL after their mainnet launches, while Taiko’s TVL grew 20.8% driven by the success of Panko Finance and Avalon Finance.

However, Scroll’s TVL dropped by 39.6% after the airdrop. Its airdrop campaign faced community controversy over its distribution plan, and like the previous zkSync and Starknet cases, the activity dropped significantly after the airdrop, and its token price fell by more than 50% from the launch price.

In addition to market indicators, the industry has intensified its focus on fundamental challenges in the ecosystem, particularly in terms of user experience and interoperability.

Vitalik Buterin actively participated in addressing community concerns and published a series of comprehensive articles exploring the future direction of Ethereum. He published several articles on social media, especially emphasizing cross-Layer 2 interoperability as a key development priority. The roadmap he submitted outlines improvements aimed at unifying the Ethereum ecosystem by standardizing chain-specific addresses, unifying the payment request system, and integrating key storage wallets across Layer 2. These enhancements are designed to simplify cross-chain asset transfers while reducing gas fees for cross-Layer 2 transactions.

Despite ongoing challenges, Ethereum’s Layer 2 ecosystem continues to attract important projects and developments. October saw several notable mainnet launches. World Network (formerly Worldcoin) went live, bringing its privacy-focused identity solution to mainnet. Yuga Labs’ ApeChain launched, leveraging Ethereum’s security to develop NFT applications, while Eclipse and Fuel Ignition completed mainnet deployments, adding new scaling solutions to the ecosystem.

Another important development came from Uniswap Labs, which unveiled plans for Unichain, a new Layer 2 network built on Optimism's OP Stack. Given Uniswap's dominance in the DeFi space, the announcement sparked a lot of industry discussion. Following major players such as Coinbase's Base and Sony's Soniem, Unichain's testnet launch heralds a potential shift in Layer 2 competition dynamics, with competition for liquidity and gas fees set to intensify in the future.

Unichain

Blockchain Game Public Chain

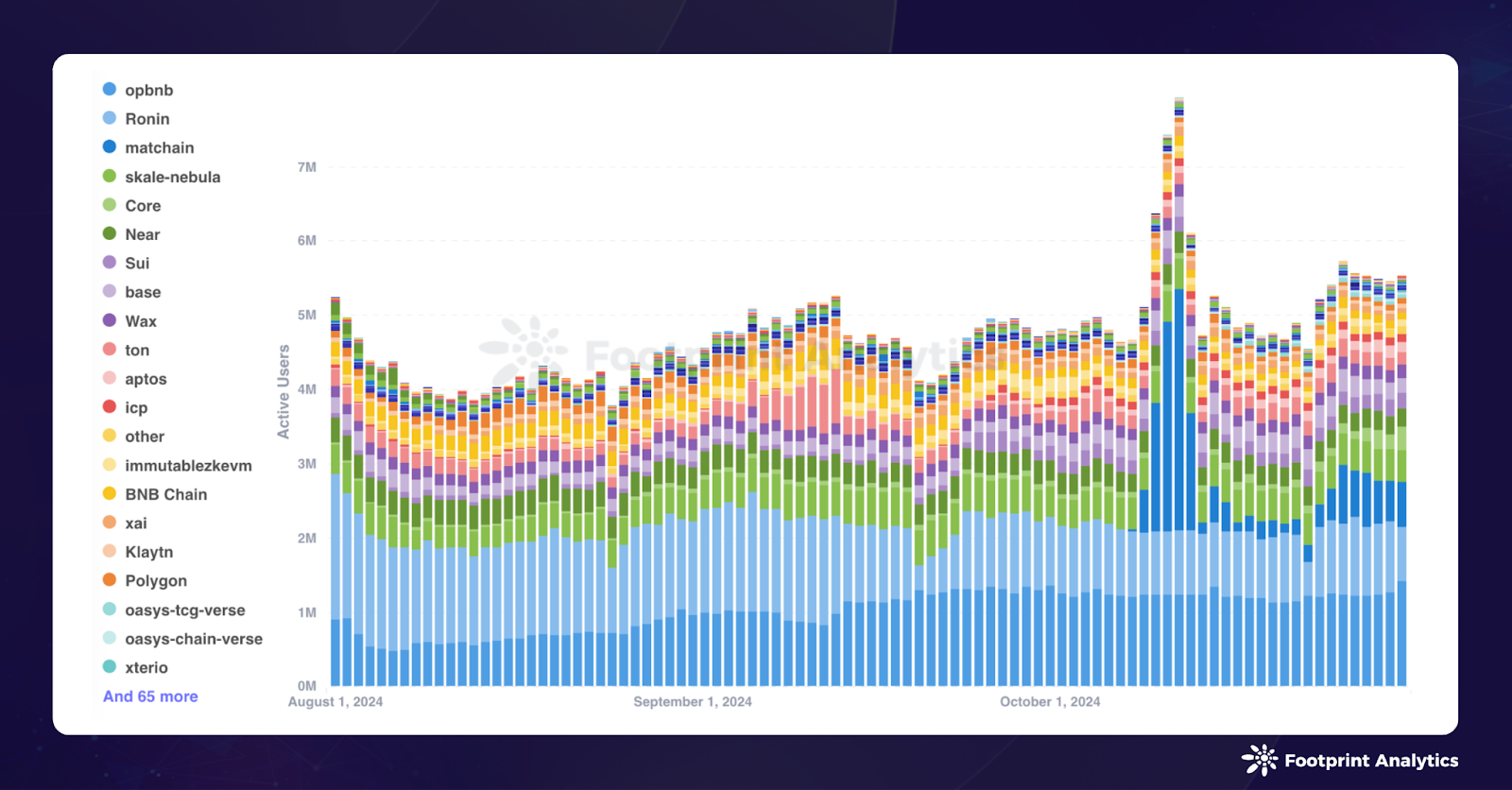

There are 1,606 active games in the blockchain gaming space in October 2024, with BNB Chain , Polygon , and Ethereum dominating the game distribution. OpBNB leads in user engagement with 1.2 million average daily active users (DAU), followed by Ronin (886,000 DAU) and Matchain (548,000 DAU).

Data source: Proportion of active blockchain games on each public chain

Matchain achieved a major breakthrough in October, surging from 78 daily average DAU in September to 548,000 DAU through Telegram-based games. The chain peaked at 3.3 million users on October 12, and then stabilized at around 615,000 users at the end of the month, demonstrating the potential and volatility of Telegram-based user acquisition strategies.

Sui and Core showed strong growth, with DAUs increasing by 105.1% to 190,000 and 75.7% to 109,000 respectively, both leveraging Telegram-based initiatives. Meanwhile, TON’s DAUs fell by 27.7% to 195,000, and while its pioneering Telegram-based strategy has inspired adoption by multiple public chains including Sei, Ancient8, and Viction, user retention is a common challenge facing the entire industry.

For more data insights, please refer to " October 2024 Blockchain Game Research Report: Interpretation of the Latest Trends in Active Users and On-Chain Game Ecosystem ".

Financing

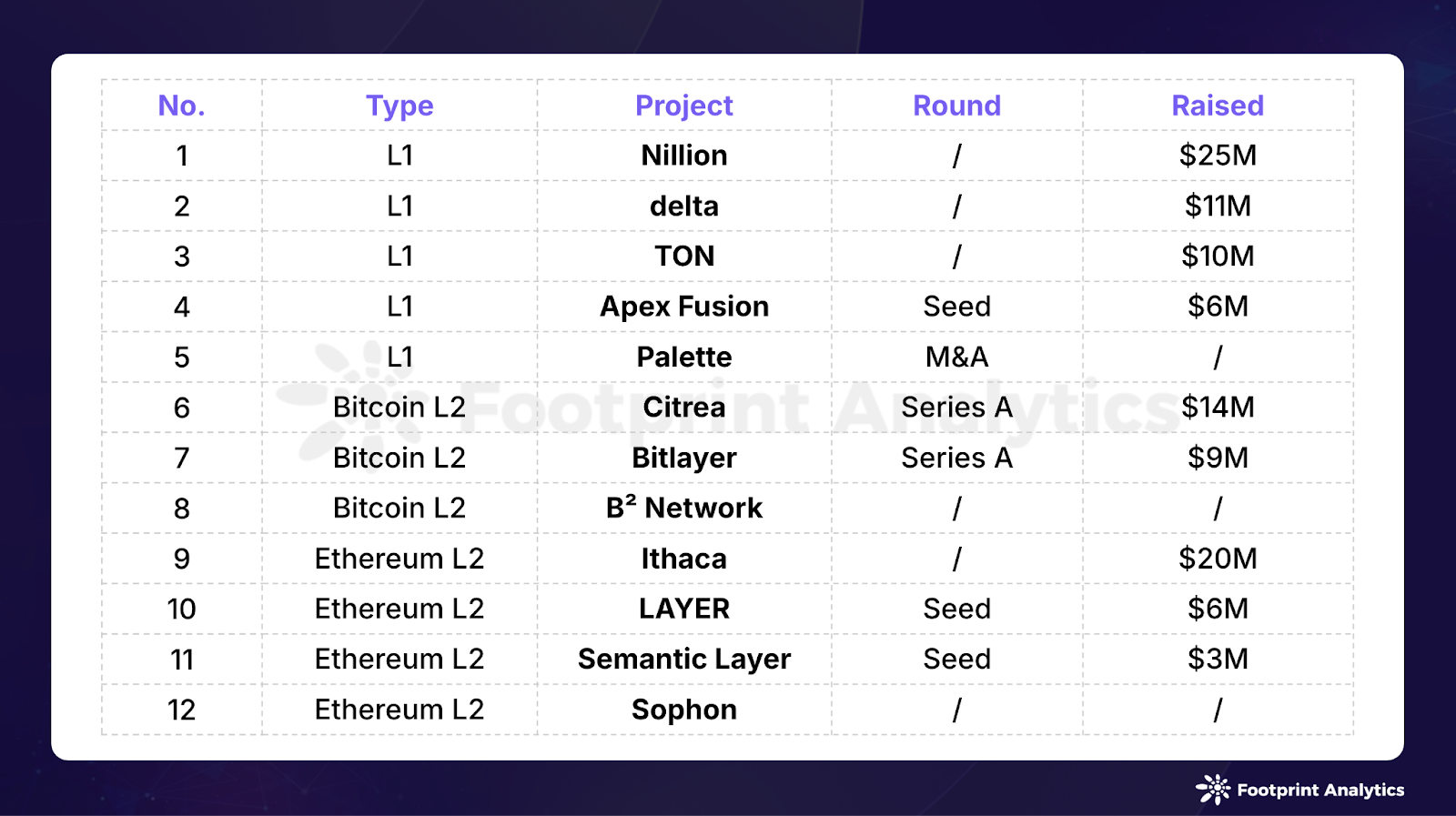

In October 2024, 12 blockchain financing events were recorded, with a total amount of US$104 million, down 40.1% from US$174 million in September. Three of the events did not disclose the specific financing amount.

Public chain financing events in October 2024 (data source: crypto-fundraising.info )

Privacy-focused blockchain project Nillion became the largest recipient of funding in October, raising $25 million in a round led by Hack VC. The project's innovative "blind computing" approach allows data to be processed without exposing its contents, enabling applications to collaborate while maintaining data privacy. This breakthrough technology positions Nillion at the intersection of privacy protection and decentralized computing, meeting the growing need for secure data processing in Web3 applications.

TON continued its fundraising momentum after receiving a $30 million investment from Bitget and Foresight Ventures in September. In October, TON received funding support from Gate.io.

Layer 2 solutions continue to attract investor attention across the Bitcoin and Ethereum ecosystems. Bitcoin Layer 2 platforms Bitlayer and B² Network successfully completed new rounds of funding, while the Ethereum Layer 2 space saw funding flow to innovative projects including Ithaca, Semantic Layer, Sophon, and LAYER.