KAIA has attracted attention due to the merger of Klaytn and Finschia. It actively builds the Web3 ecosystem with the user base of over 250 million in East Asia by Kakao and LINE. At present, the development of Web3 ecology has become a trend, and KAIA's layout here has the potential to bring opportunities to participants. Recently, its Portal v1.2 was released to encourage the core defi pool to improve the ecology. TON has also performed well in the Web3 field relying on Telegram. Although both are based on social platforms, their business, technology, and market positioning are different. Comparing the KAIA and TON ecosystems can enable us to have a deep understanding of the project characteristics, insight into the potential of blockchain application scenarios, provide a strategic perspective for investment and innovative applications, and grasp the development trend of the digital economy.

Klaytn (KAIA) Focus after Rebranding

- Why the name change and update?

- What is the development roadmap for the post-update phase?

- Analogous to TON’s dependence on TG, do Klaytn and Line have a similar development relationship?

- What are the similarities, differences, advantages and disadvantages between Klaytn and TON?

- What is the current development status of Klaytn? Does it have any unique development prospects?

1. Review of KAIA’s brand remodeling

On April 30, 2024, Klaytn and Finschia officially merged into a unified Layer-1 platform through deep integration and were renamed Kaia.

Kaia has the joint support of two giants, Kakao and LINE, which undoubtedly injects strong impetus into its development. Kakao has a usage rate of 96% in South Korea, and LINE is also popular among users in Japan, Taiwan, Thailand and other regions. Together, Kaia's potential user base exceeds 250 million. With such a large user base, Kaia is expected to greatly enhance the popularity and acceptance of blockchain technology in the East Asian market, lay a solid foundation for the large-scale application of blockchain technology, and create a large-scale and vibrant Asian largest Web3 ecosystem;

- Kaia successfully launched the test network in June 24

- On August 29, 2024, Kaia’s mainnet was officially launched, demonstrating its strong technical strength and development potential to the world (during which it received upgrade support from exchanges such as Binance)

2. Roadmap: KAIA Phase Planning

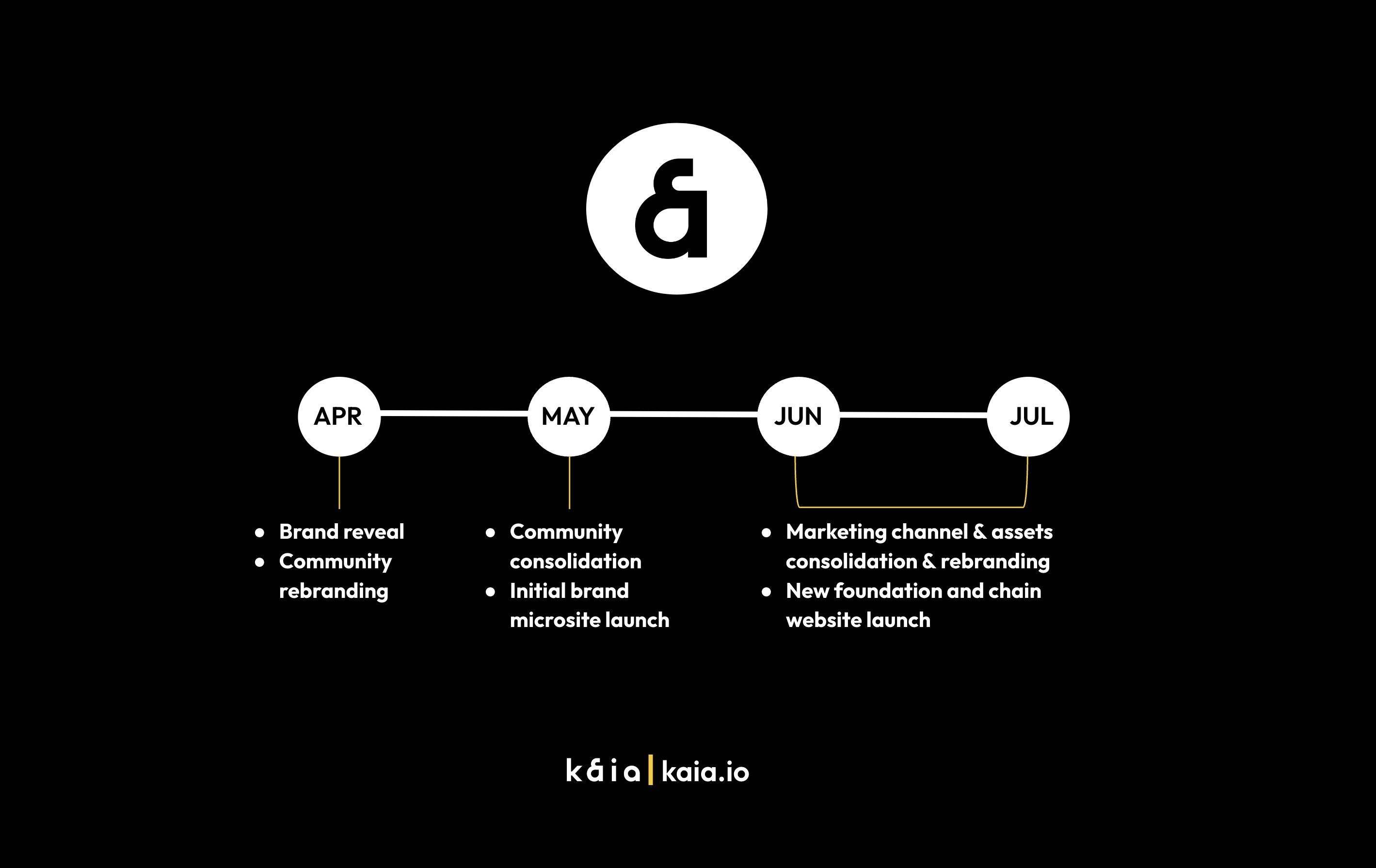

Next, let’s interpret the project’s development plan after the brand reorganization in combination with the official roadmap. The overall rhythm is divided into a two-step strategy. In the short term, the L1 public chain will be built to improve infrastructure and basic services. In the long term, various channels will be used to expand institutions, official-level partners, and customers, aiming to create the largest Web3 ecosystem in Asia.

Short-term route:

- 2024 Q1: Integration, construction and operation of Klaytn & Finschia. (Integrate the technical advantages and resources of both parties to lay a solid foundation for subsequent brand transformation and business expansion)

- 2024 Q2: Establish a new brand Kaia, establish a joint marketing system and community integration, etc. (Strengthen communication and collaboration with partners, promote community integration, build consensus, and build a community ecosystem)

- 2024 Q3: Issue new integrated tokens and provide Swap services, etc. (Enrich the financial product system of Kaia ecosystem)

- 2024 Q4: Foundation reorganization and joint business promotion, establishment of a second integrated network. (Optimize organizational structure and business layout, build long-term sustainable development)

Long-term roadmap:

- Establish infrastructure that meets institutional needs. (Integrate tokens and convenient access to deposits and withdrawals to lower institutional entry barriers)

- Strengthen large-scale DeFi infrastructure. (Build DeFi ecosystem and expand RWA-related services)

- Launch a native stablecoin. (This is the foundation)

- Accelerate the Asian community. (Cultivate developer and user communities in different countries, expand governance and ecological partners)

- AI Dapp Discovery. (This wave cannot be missed at the moment)

- Large-scale on-chain tokenization of Web2. (web2 to web3 pathway)

- Global intellectual property cooperation.

Its roadmap does not emphasize the ecological relevance with Line, which is the comparison between Kaia and TON mentioned below. The latter is strongly related to Telegram. This may lead to completely different development results.

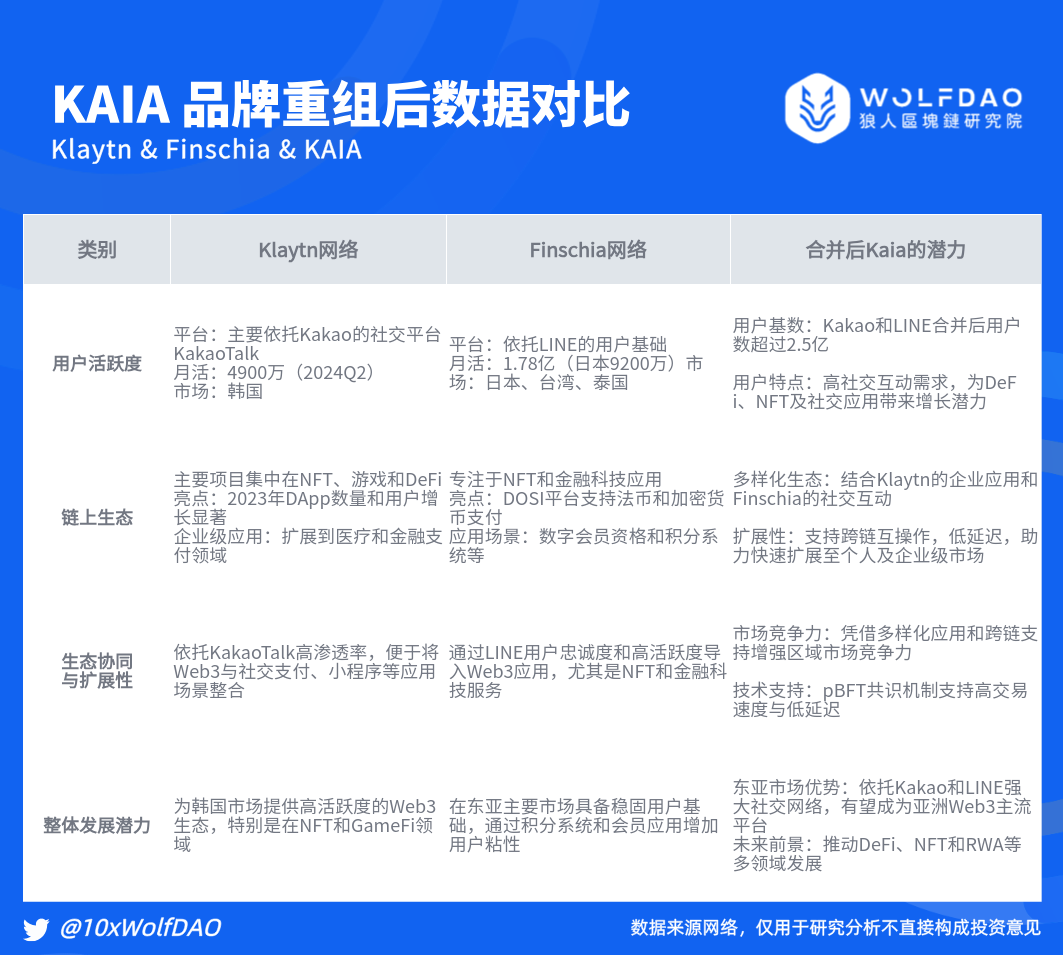

KAIA Ecosystem Users and Project Activity

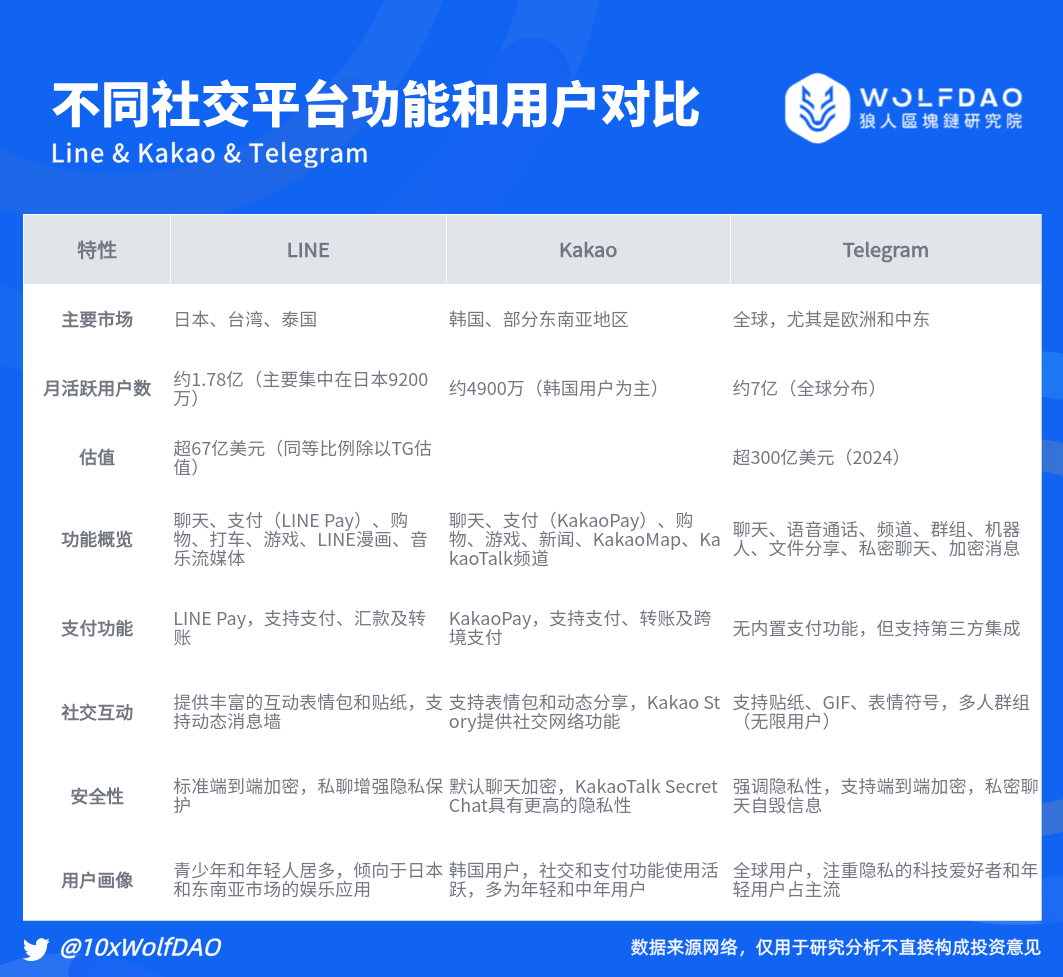

Before the merger, Klaytn and Finschia each formed different on-chain ecosystems, which laid a certain foundation for the merged Kaia in terms of user base and on-chain projects. Before Kaia’s data is clear, we can get a glimpse of the ecosystems and project activities of Klaytn and Finschia.

Figure: Data comparison after KAIA brand reorganization Source: @10xWolfDAO

4. Multi-dimensional comparison between KAIA and TON ecosystem

1. Comparison of core business logic

TON: Its unique business formula is TON = Telegram user base + Web3 applet + PoS node group. The core is to adopt the Web2 + Web3 approach . By making full use of Telegram's huge user base, Web3 applet is deeply embedded into users' daily social scenarios. At the same time, PoS node groups are used to ensure the efficient operation and security of the network, providing users with a new decentralized application experience.

Kaia: Different from this, Kaia's business formula is Kaia = weak Line user base + stablecoin + institutional services (INFRR + RWA), the core is to weaken Line and strengthen RWA . Although Kaia is weaker than Telegram in terms of user base, it still has certain user traffic advantages through cooperation with LINE. In addition, Kaia pays more attention to the issuance and application of stablecoins, as well as providing institutions with a series of professional services including infrastructure as a service (INFRR) and real-world asset tokenization (RWA), so as to build a more robust and sustainable business ecosystem.

2. User base and market positioning

KAIA: Deeply rooted in the East Asian market, with LINE's approximately 178 million monthly active users in Japan, Taiwan, Thailand and other places, and KakaoTalk's 49 million monthly active users in South Korea with a penetration rate of up to 96%, KAIA accurately targets the social and financial needs of Asian users. Most of its users are groups that are accustomed to Asian social culture, have high demands for local financial services and have frequent social interactions. KAIA is committed to cleverly integrating blockchain services into their familiar social and payment scenarios, creating a Web3 ecological experience with Asian characteristics, just like a life service platform tailored for local residents.

Company Number of Active Users Valuation Major User Regions Telegram About 900 million (2024) Over 30 billion USD (2024) Global (mainly Russia, India, Pakistan, Ukraine, and the United States) Line About 200 million (2022) Over 6.7 billion USD (divided by TG valuation in the same proportion) Asia

TON: With about 700 million monthly active users worldwide, Telegram has a global expansion in the market, especially in Europe and the Middle East. TON's user base is broader and more diverse, including global technology enthusiasts and young users who value privacy protection and pursue decentralization. It is more like a comprehensive digital plaza facing the world, providing a decentralized space for users from different regions and cultural backgrounds to freely communicate, trade and innovate.

Protocol Market ValueFDVTVL24h Vol. Number of ValidatorsActive WalletsTON12.9 billionUS$25.9 billionUS$390 millionUS$300 millionUS$383.114 billion32.47 millionKaia (replacement just completed, data inaccurate)US$730 millionUS$730 millionUS$55 millionUS$100,000

3. Technical architecture and performance

KAIA: It adopts the pBFT consensus mechanism, which is like an efficient traffic control system, and can support the rapid processing of 4,000 transactions per second, ensuring efficient and smooth transactions. In addition, it is compatible with the Ethereum Virtual Machine (EVM), which is like a bridge, greatly facilitating developers to easily migrate their original projects to the KAIA ecosystem, providing strong technical support for the rapid enrichment and development of the ecosystem, and enabling various RWA, DeFi and NFT applications to take root quickly.

TON: Using multi-chain parallel mechanism combined with PBFT consensus algorithm, a lightning-fast transaction network is built. Its second-layer network, instant payment channel, creates an exclusive high-speed transaction channel for high-frequency traders, just like providing a top track for racers. Although TON is not directly compatible with EVM, it excels in cross-chain interoperability. Through convenient cross-chain bridging technology, it can realize the free flow of assets between different chains, just like building a huge interstellar trade network that can easily connect the resources and values of various planets (different blockchains).

4. Ecological projects and application scenarios

KAIA: Ecosystem projects present a diversified layout, ranging from decentralized exchanges (such as DragonSwap) to liquid pledge platforms (such as Stake.ly), from lending services (such as KlayBank) to yield aggregators, etc. Its application scenarios focus on the integration and innovation of social and financial, such as leveraging the user habits of KakaoPay and LINE Pay to promote the popularity of blockchain payments in social scenarios, while using social interactivity to attract traffic to DeFi and NFT projects and promote the promotion and development of projects, just like integrating financial services into social gatherings, so that every interaction may become an opportunity for value creation.

TON: The ecosystem has seen the emergence of popular projects such as Notcoin and Catizen, and has made remarkable achievements in the field of stablecoins. The supply of USDT on the chain has shown explosive growth in a short period of time, injecting strong financial vitality into the ecosystem. Its application scenarios are involved in decentralized social networking, payment, DApps development, etc., and it focuses on the construction of a cross-chain ecosystem. Through cross-chain protocols, it realizes interconnection with other blockchain projects, just like building a huge cosmic alliance, sharing resources and developing collaboratively between various planets (projects).

5. Regulatory Compliance

KAIA: Mainly focusing on the East Asian market, it benefits from the relatively stable and clear regulatory environment in countries such as Japan and South Korea. Under such a regulatory framework, KAIA can conduct business in an orderly manner and has more room to cooperate with local financial institutions and government departments, just like playing in a competition field with clear rules. It can safely display its strategic and technological advantages, reduce the uncertainty risks caused by policy changes, and provide users and investors with more reliable protection.

TON: As a global decentralized project, it faces a complex and ever-changing regulatory environment around the world. Different countries and regions have different regulatory policies on blockchain and cryptocurrency. TON needs to constantly adapt to and coordinate various regulatory requirements on a global scale. This is like walking on a thorny road. It needs to carefully balance the relationship between compliance and innovation. If you are not careful, you may face regulatory challenges and affect the advancement and development of the project.

Figure: Comparison of functions and user portraits of different social platforms Source: @10xWolfDAO

Kaia has more advantages than TON in terms of the East Asian market and localized needs, but TON is still attractive in terms of global decentralization and privacy protection. The two have formed a complementary ecological layout in terms of market positioning and user needs. The arrest of TON's founder has weakened TON's market trust and stability to a certain extent, providing Kakao and LINE with opportunities to enter the market.

However, TON still has unique appeal in terms of decentralization and technological innovation, especially among the international developer community and decentralization enthusiasts. Therefore, Kakao and LINE are more likely to focus on replacing TON's social + blockchain application status in the East Asian market, rather than completely replacing TON's global influence (even as shown in the figure above, the slogan on Kaia's official website has already indicated that the target user market is positioned in Asia).

V. Analysis of KAIA Ecological Development Issues

Currently, the Kaia ecosystem shows a relatively diverse project layout, but it also faces some key development challenges. From the on-chain data disclosed by DeFiLlama, the ecological development of Kaia can be deeply analyzed from the following dimensions.

Figure: KAIA - TVL data change trend Source: Deflama x: @10xWolfDAO

Figure: Data comparison of projects in the same track Source: Deflama X: @10xWolfDAO

1. The ecological structure and project distribution are unbalanced, and the top projects are highly dependent on each other.

Kaia's ecosystem covers multiple categories such as decentralized exchanges (DEX), liquid staking, lending, yield aggregation, cross chain, etc. This diversified structure helps to attract user groups with different preferences and promote the widespread application of the ecosystem. However, the concentration of ecological projects is high, especially DEX and liquid staking projects (such as NEOPIN, Lair Finance, DragonSwap, and Capybara Exchange) have attracted most of the users and trading volume, indicating that Kaia's users prefer investment tools with high liquidity, while the demand for other categories has yet to be explored.

The transaction volume and user activity of the top projects are significantly higher than other protocols. This phenomenon of top concentration shows that Kaia's ecosystem is not yet fully mature. In the future, Kaia can balance the ecological layout by supporting more innovative projects and encourage users to diversify their investments and interactions to achieve more stable ecological growth.

2. User transaction preferences and conversions

The cumulative trading volumes of projects such as NEOPIN, Lair Finance, and DragonSwap are close to $600M, $182M, and $715K, respectively. These high-volume projects are concentrated in the DEX and liquid staking fields, indicating that users have a high demand for these projects. In particular, DEX platforms provide convenient token trading channels, attracting users who trade frequently. User activity is mainly concentrated in projects that provide high liquidity and stable returns, showing that Kaia users prefer products with higher liquidity. However, the relatively single application scenarios make it difficult to meet the diverse needs of users.

In addition, user base conversion is also a difficult problem. How to effectively convert the massive users of social platforms into active users of the blockchain ecosystem is an important problem that Kaia needs to solve. If the application scenarios are not expanded in time and the user conversion efficiency is not improved, it may lead to user loss and affect the long-term development of the ecosystem.

3. Total locked value (TVL) and liquidity analysis

Although the top projects within Kaia have high transaction volumes, the overall TVL of its ecosystem is relatively low.

Lending platforms (such as KlayBank) and liquid staking projects (such as Stake.ly) have the potential to increase TVL, attracting more funds into the ecosystem through staking income and lock-up rewards. If Kaia can further enrich DeFi tools and add high-yield products such as leveraged trading and options, it may attract more users and increase capital retention, thereby significantly increasing TVL.

4. Insufficient technology and ecological infrastructure

Although Klaytn has strong network performance and low transaction costs, it still has certain limitations in actual DeFi and cross-chain compatibility, especially when compared with the Ethereum ecosystem. Klaytn and Finschia have not formed a unified resource integration and marketing strategy in ecological development. It is difficult for independent development projects to form a joint force, and they have not provided sufficient developer support and capital investment when promoting NFT or social applications. In contrast, projects on mainstream chains receive more development resources and community attention.

5. Cultural characteristics and policy environment of the cryptocurrency ecosystem in Japan and South Korea

The cryptocurrency ecosystem in Japan and South Korea has unique cultural characteristics and policy environments. Japanese and Korean users, especially Korean users, have a strong acceptance of high-risk financial instruments. This is reflected in their enthusiasm for cryptocurrency trading and their preference for short-term investments. On the one hand, users tend to pursue high-yield financial instruments, which may lead to problems such as excessive speculation and market volatility within the ecosystem, increasing the operational risks of the project. On the other hand, although the policies in Japan and South Korea are relatively loose, there are still deficiencies in market supervision, which may trigger some potential risks and uncertainties, such as market manipulation, money laundering and other illegal and irregular behaviors, posing a threat to the healthy development of the ecosystem.

6. Limitations of operations and marketing strategies

Despite Kakao and LINE’s high brand recognition in social applications, the two companies are relatively cautious in promoting blockchain projects. This is in contrast to the high-profile marketing and incentive mechanisms of many mainstream blockchain projects. Klaytn and Finschia lack a clear user incentive strategy and educational promotion activities, resulting in a lack of driving force for their ecological development. There is less cross-chain cooperation and liquidity sharing with other chains, which makes it difficult for their ecosystems to attract users and developers on other chains. This also limits the scale expansion of the project and the liquidity of cross-chain assets, indirectly leading to the lack of growth of its ecology.

6. KAIA’s future restart path

Kaia's competitiveness lies in its regional advantages and the stability of the regulatory environment. In the Japanese and Korean markets, which have high compliance requirements, Kaia can provide financial and NFT services with a legal identity, increasing its trust and usage in the Asian market. Compared with TON's global decentralized positioning, Kaia is expected to quickly occupy the East Asian market through localized services and regulatory support.

Kaia's rise in the East Asian market is not only the result of the merger of Klaytn and Finschia, but also represents the possibility of blockchain in mainstream social and payment applications. Its success will depend on whether it can continue to invest in diversified products, user education and marketing to achieve wide coverage of the Web3 ecosystem. Judging from the current project activity and protocol development status, Kaia's ecological boom is still a long way to go. At present, Kaia has released the Portal task (announced on October 30 that it will carry out Portal v1.2 to increase the incentives and launch to attract more participants. Exchanges in different regions have expressed support for Kaia's conversion, as summarized in the following table, but the ecological operation status needs long-term attention.

Looking ahead, Kaia, as an emerging blockchain project formed by the merger of Klaytn and Finschia, has unique competitiveness and development potential. Its regional advantages and stable regulatory environment provide a strong guarantee for its rise in the East Asian market. It is expected to build an Asian Web3 ecosystem with a wide range of influence by leveraging the strong user base of LINE and Kakao.

After the rebranding, KAIA is writing its own unique story in the comparison and competition with the TON ecosystem. Its future is full of variables, but also contains infinite possibilities, which deserves our continued attention and expectations.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Cage / Mat / Darl / WolfDAO

Proofread by: Punko

Special thanks: Thanks to the above partners for their outstanding contributions to this issue.