Author: flowie, ChainCatcher

Recently, U.S. regulators appear to be racing to meet performance targets for the upcoming 2024 fiscal year, and have stepped up regulatory enforcement in the crypto sector.

Last week, the Wall Street Journal reported that the federal government is investigating cryptocurrency company Tether for possible violations of sanctions and anti-money laundering regulations. Although Tether denied the report, it still caused some panic in the market.

Throughout October, the SEC charged at least 20 crypto projects and individuals, including Cumberland, Gotbit, CLS, ZM Quant, Saitama, and Robo Inu, and seized more than $25 million in cryptocurrencies. Many of these charges were jointly enforced by the FBI and DOJ, and crypto market makers and crypto trading institutions that are closer to the money have also become the focus of the crackdown.

As U.S. regulators do not slow down their crypto review, crypto litigation settlement records may hit a new high in 2024.

2024 Cryptocurrency Settlements Reach a New High of Nearly $20 Billion, with Leaders Becoming the Focus of Crackdowns

2024 is a year of surging crypto regulatory enforcement in the United States. According to Coingecko data, as of October 9, the crypto enforcement settlements of U.S. regulators in 2024 reached nearly $20 billion, an increase of 78.9% over 2023, accounting for two-thirds of the total settlement amount in the past five years. Given that 2024 has not yet ended and the actions of regulators have not slowed down, it is expected that this year's crypto litigation settlement record will surpass 2023.

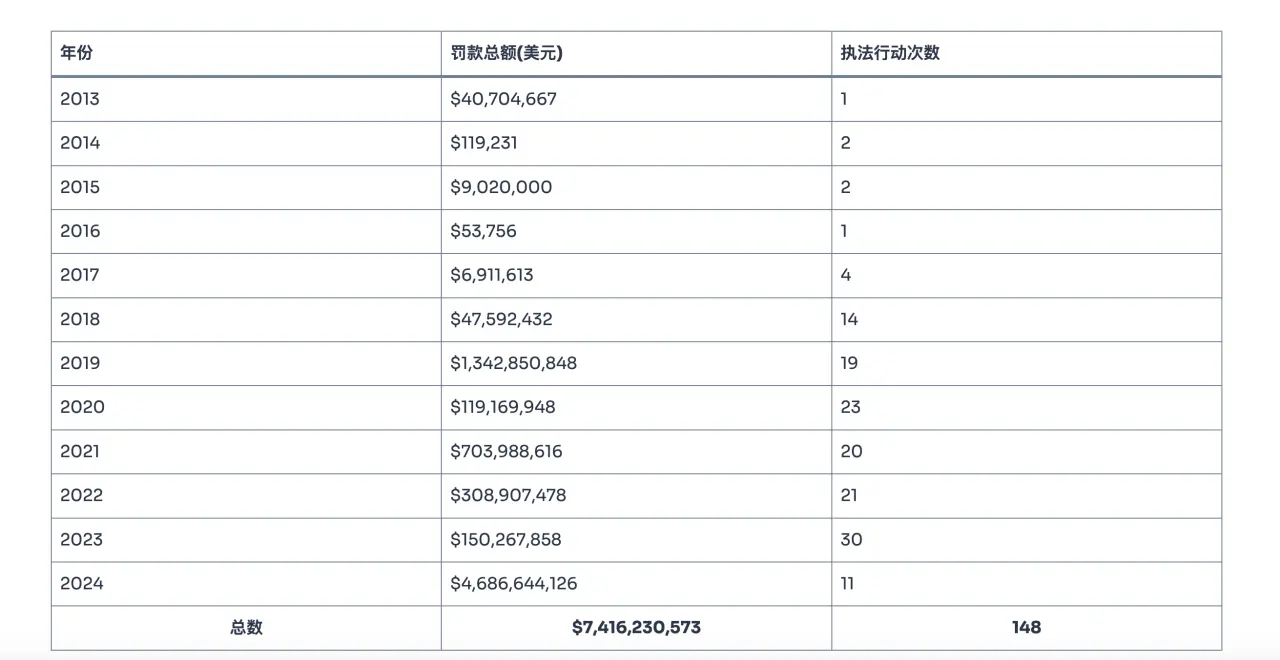

From the perspective of the SEC alone, according to a report updated on October 19 by Social Capital Markets, the SEC's fines for the crypto sector in 2024 will be as high as $4.68 billion. Since 2013, the SEC has imposed a total of $7.42 billion in fines on cryptocurrency companies and individuals, which means that 63% of the fines will be concentrated in 2024.

The amount of fines in 2024 increased by 3018% compared to 150.26 million yuan in 2023.

Although the amount of fines has increased, the number of incidents has decreased. In 2024, the number of SEC crypto enforcement cases will be only 11, far lower than the 30 in 2023.

The SEC's crypto enforcement strategy has clearly been adjusted, and it has begun to take more influential enforcement actions (such as higher fines, more vigorous publicity, etc.) against representative cases to establish industry cases.

The SEC's huge fine this year was mainly contributed by Terra and its co-founder Do Kwon, which also set a precedent for crypto law enforcement for SEC enforcement.

This year, except for Terra, the leaders in various crypto sectors have been unable to escape the clutches of the SEC's regulatory lawsuits.

In April, DeFi leaders Uniswap Labs and ConsenSys both received pre-litigation Wells Notices from the SEC, alleging that their products violated securities laws, were not registered as brokers, and were involved in the issuance and sale of certain unregistered securities. Among them, ConsenSys was formally sued by the SEC on June 28.

On August 28, NFT market leader OpenSea and top crypto exchange Crypto.com also received notices from Wells that they were accused of NFTs or tokens traded on their markets that may be considered unregistered securities.

In October, the SEC also joined forces with the FBI and DOJ to crack down on Gotbit, the largest meme market maker, and accused the top market maker Cumberland of violating securities laws.

While the market is guessing who will be the next regulator in the United States, Fox Business reporter Eleanor Terrett recently said on the X platform that no major cryptocurrency players registered with the SEC in 2024, but the commission still included cryptocurrency in its 2025 review focus list.

Terrett speculated, “The only two crypto assets that the SEC has interacted with in a regulatory role (not an enforcement role) are the Bitcoin and Ethereum ETFs. Is the scrutiny focused on those ETFs and the companies that work with them?”

According to the Wall Street Journal, the U.S. Treasury Department has set its sights on Tether, the largest stablecoin issuer.

Repressive regulation is a catalyst for memes. Is Trump's coming to power bad for memes?

Nic Carter, co-founder of Castle Island Ventures, said on his social platform that the hype of Meme coins is largely a response to the SEC's oppressive regulation. If the SEC regulates rationally, the market demand for trading Meme coins will decrease.

Crypto KOL @WutalkWu also believes that one of the regulatory reasons for the popularity of Meme is that the SEC does not allow issuers to assign value to tokens, otherwise they will become securities that need to be registered.

He said that under such supervision, many VC tokens have become meme coins. VCs that should have made equity investments, shared income and followed the project for a long time have turned out to be hyping the project as a meme.

But if Trump is elected, the situation may change. Overseas crypto KOL @malekanoms analyzed that Trump's victory would have a negative effect on Meme.

@malekanoms believes that a Republican victory will overturn all of this, restore initial coin offerings (ICOs), realize universal airdrops, and other forms of token rationalization. In addition, they may also make fee conversion and token dividends possible. The rationalized regulation in the United States will refocus the focus of cryptocurrencies on dApps and other really important things, but it may also lead to a long-term bear market.

Supervision increases business operating costs, hiring officials becomes a trend

In order to minimize the operating costs brought by huge fines, it has become a trend for crypto companies to hire government officials.

FOX reporters said that the SEC's "revolving door" phenomenon was particularly evident this year, with many well-known officials leaving the company and joining private companies.

- Carolyn Welshhans, former acting head of the Crypto Assets and Cyber Unit, joins Morgan Lewis to focus on securities enforcement matters.

- Former Enforcement Director Gurbir Grewal has joined Milbank Law as a partner, and the firm is currently representing clients such as Binance in a lawsuit filed by the SEC, which was initiated while Grewal was in office.

- David Hirsch, former head of the crypto assets and cyber unit, has joined McGuireWoods LLP to advise clients on crypto-related matters and cybersecurity regulations.

- Ladan Stewart, who previously prosecuted cases against Coinbase and Ripple for the SEC, has also joined White & Case to help clients deal with SEC enforcement actions related to areas such as encryption.

In addition to hiring officials, Uniswap's launch of Unichain is, to some extent, a means of dealing with regulation. Crypto KOL @_FORAB believes that subsequent DeFi projects with local currency staking income should follow Uniswap's example and launch their own application chains to avoid securities-related regulatory issues. "After all, the cost of running a stand-alone chain is much less than paying a fine to the SEC."

Gary Gensler's term ends, will crypto regulation usher in a new era?

In a few days, the 2024 US election will come to an end. Whether Trump or Harris wins, SEC Chairman Gary Gensler may step down early, as his term was originally due to expire on January 5, 2026.

But Trump made it clear at the Bitcoin conference in July this year that he would fire Gensler, and Harris' team has met with people in the encryption industry and privately stated that it will reset industry relations.

U.S. Rep. French Hill (R-AR) said in an interview with the Thinking Crypto podcast that the SEC should have new leadership next year, regardless of which party controls the White House.

Ripple Labs CEO Brad Garlinghouse also predicted that Gensler will leave his position after the upcoming presidential election, regardless of the outcome.

According to CNBC, Gensler’s list of potential successors includes J. Christopher Giancarlo and Heath Tarbert, two chairmen of the Commodity Futures Trading Commission (CFTC) during Trump’s first term, Dan Gallagher, the current chief legal officer of Robinhood and a two-term SEC commissioner, and Paul Atkins, who served as an SEC commissioner in the Bush administration.

Judging from their past remarks or regulatory attitudes during their tenure, almost all of them hold a more friendly attitude towards cryptocurrencies than Gensler.

In addition to expecting a more relaxed attitude from US regulators, crypto companies need clear regulatory rules. Instead of spending a lot of manpower and resources thinking about how to avoid being sued, crypto companies may be more willing to focus on building clearer rules.

Consensys sent an open letter to the future US president last week, calling for clear and supportive regulations for cryptocurrencies and Web3.

SEC Commissioner Mark T. Uyeda also recently pointed out that Indo-Pacific countries such as Japan, Singapore and Hong Kong have developed clear frameworks that support innovation and protect investors. In contrast, the United States lacks clear guidelines, which makes market participants face uncertainty. He will urge the United States to take a more proactive attitude in crypto regulation.