This article still uses the AI track as the opening explanation. To be honest: I don’t understand AI itself, but I think AI+Web3 can explain a lot of tracks.

1. What does AI mean to Web3?

To put it in an official way, AI is sweeping various fields, from here to there. Anyway, starting from Open AI, it provides each industry with a story that can be wrapped in another layer of shell.

But in Web3, this story is real and can be sold to the market quickly.

I have seen quite a few "AI+" applications circulating on the market. It is still unknown whether there is such a demand in the market itself, but attracting market attention may be the main value of this type of shell.

Web3 games, metaverse, and NFT tracks are among the hardest hit areas. The same things are in this cycle, but with an AI shell, they become a whole new plate.

However, these are just superficial manifestations. Regarding AI to Web3, I have expressed my opinion in a meme I wrote a few days ago : https://x.com/sjbtc9/status/1853750864080773370?t=rmE6Kef_-LRajl62x1hPPA&s=19…

(1) “Most people question whether the combination of AI and Web3 is a pseudo-concept, and most of these doubts are based on actual use cases.”

(2) “But I think the core of Web3+AI is somewhat similar to Meme. It gives market participants the opportunity to participate in the AI track with a sufficiently low threshold.”

It’s not that Web3 itself has brought about great changes or even subversion to the original AI market, but that the market itself has such a demand. What’s more, even in the eyes of many technical parties, Web3’s AI is just a rubbish shell, but I have actually seen some GPT+ applications perform well.

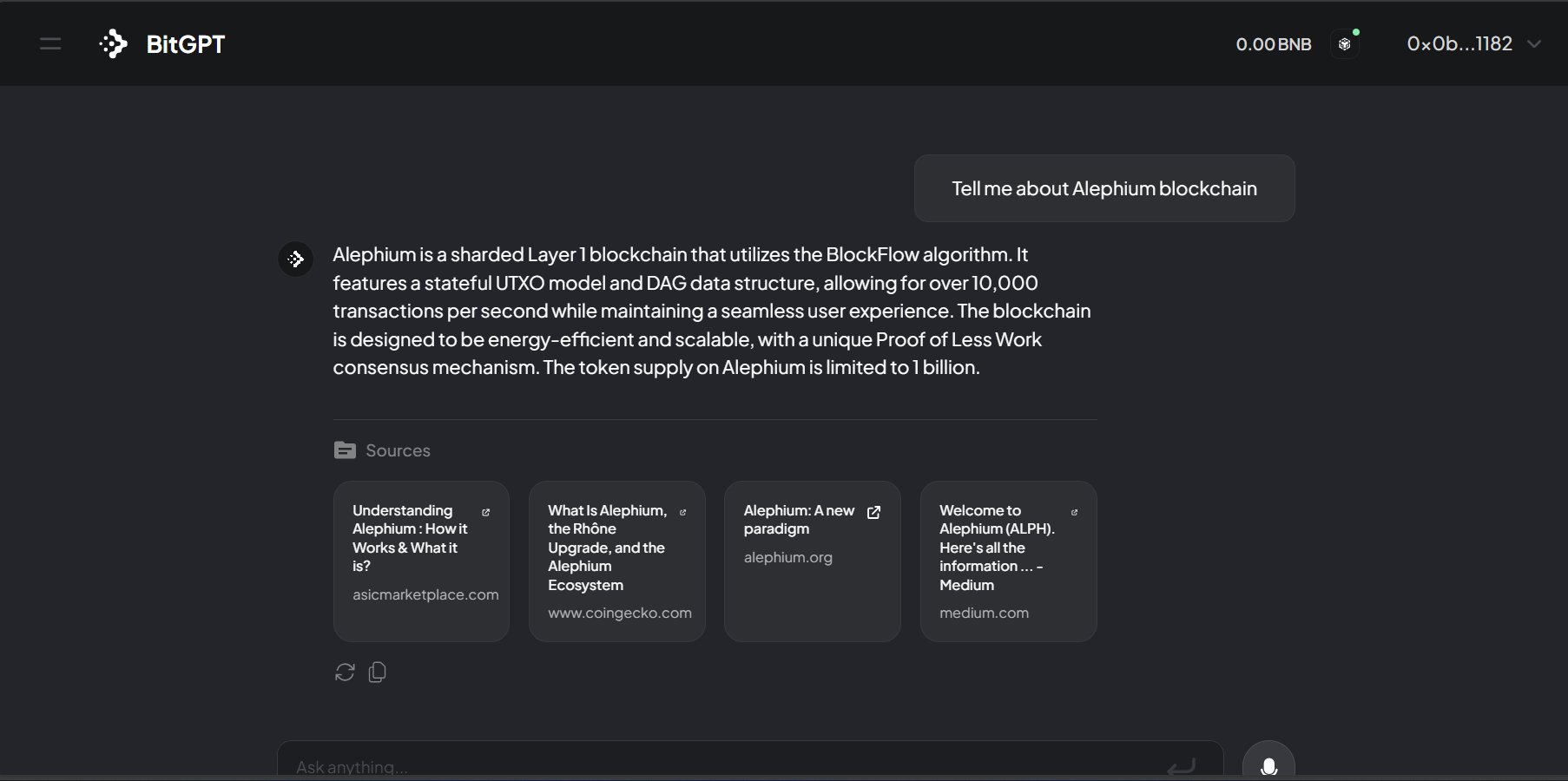

It is the kind that is attractive to me, at least from the perspective of product strength. At the Binance Blockchain Week exhibition last week, I saw a project using GPT to quickly retrieve the required records on the chain. I was watching from the audience at the time and thought it was a really good application with a very quick response (even if it traced to the bottom layer of the model, it was not something independently developed).

2. What is DePin for AI?

With the basic model application, distributed infrastructure and computing power provision, this is a very Web3 thing.

This is what DePin means to AI. If AI will eventually make waves in Web3 in this cycle, then after the waves, there will definitely be a wave called Depin.

The distributed solution provided by DePin can theoretically serve as a supply source for training. This is why I said at the beginning that the market demand for this round of DePin is clearer than that of previous storage tracks.

As individuals, I think we only need to understand this logic.

As for DePin that is separated from AI, this is not the scope of this chapter. The DePin track itself is a relatively large concept. The storage in the previous round is only a subset of this round of DePin. In addition to storage and the GPU market discussed in this article, there are also DePin sub-concepts such as wireless network data and positioning data . We will expand on this when we talk about specific cases below.

3. DePin Solution | Aethir

This is the theme of this chapter, which will expand on the Aethir @AethirCloud solution and extend some views on token economics (in terms of token economics, I think it is a common problem with the current DePin tokens)

-GPU Service Market

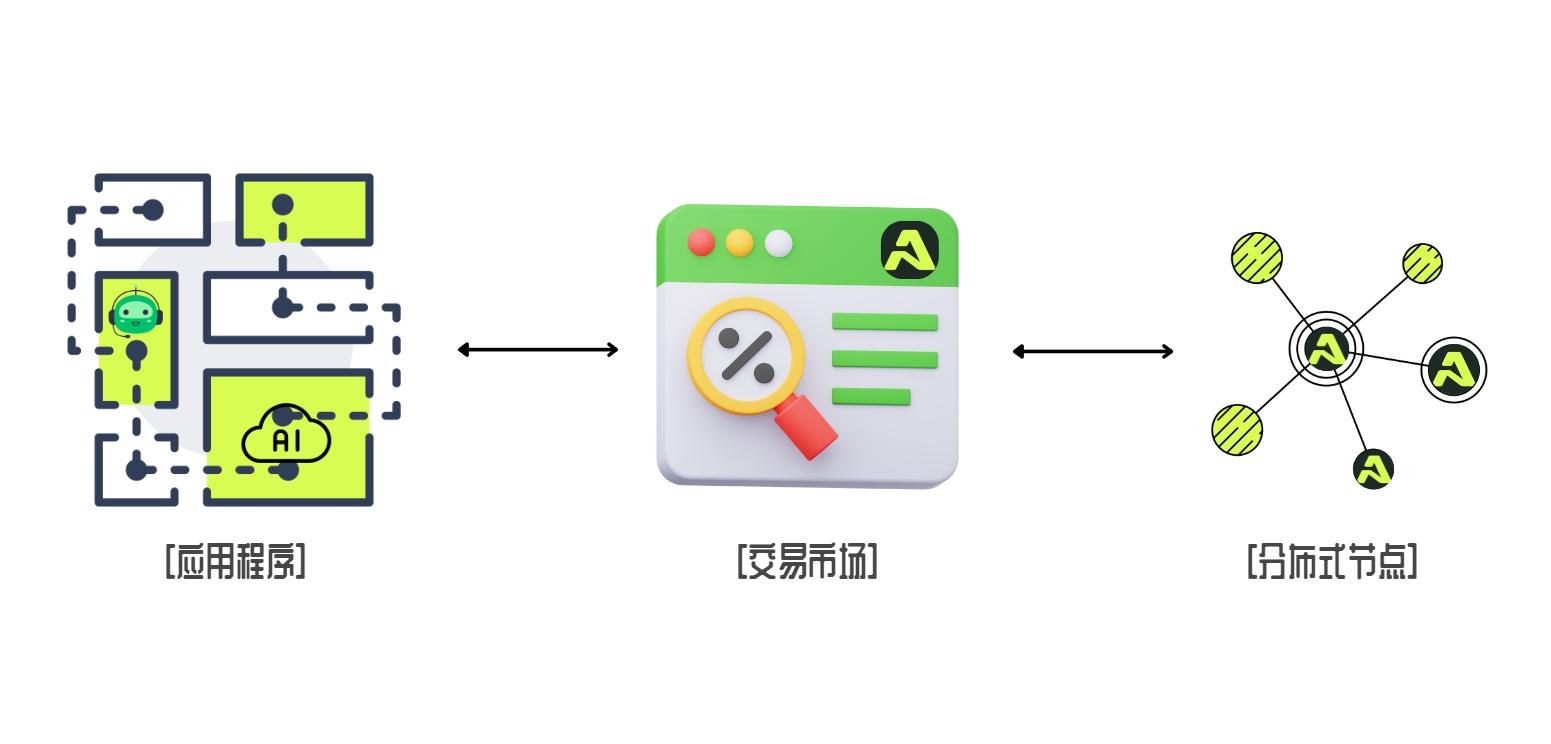

The core of what Aethir provides is to provide a computing power market and a computing power supply source for some applications that need computing power.

The entire supply and demand chain is as follows:

(1) Upstream: Various applications that require computing power, generally AI, but Aethir also includes other fields such as games.

(2) Midstream: The buying and selling market between applications and computing power

(3) Downstream: Also under the Aethir framework, the computing power supply source is provided based on distributed GPUs

This is a supply and demand closed loop that we can understand more intuitively without all the technical details. If you have ever participated in FIL, I think you will understand this very well. It is also based on idle GPU resources to form a distributed computing node group to obtain network incentives.

[Idle resources] is the original intention of these distributed infrastructure networks, but the reality is often that everyone uses more professional equipment to engage in "mining" activities.

In the past, I have called this type of mining a disguised form of "proof of work", and this is also true for Aethir. In a public report in July this year, I saw that Aethir self-reported that its revenue in the past year was $36 million, and its costs were 60% lower than its competitor Amazon in the Web2 market.

The authenticity of these two data cannot be verified, but if they are true, then in terms of cost and narrative alone, they have a natural advantage in upstream applications.

At the same time, there is another problem here: there must be real applications upstream

And: The application is really useful

Conclusion: The infrastructure is real, the potential demand is real, but the application market and the demand for the application itself still need to be questioned.

This leads to uncertainty in the supply and demand scenario itself (the same applies to L1). Even so, reflected in the secondary market, it will not affect DePin as the infrastructure of AI. It will follow the wave of AI and create waves. Depin itself can take on part of the premium as the downstream infrastructure of the AI track.

-Token Economy

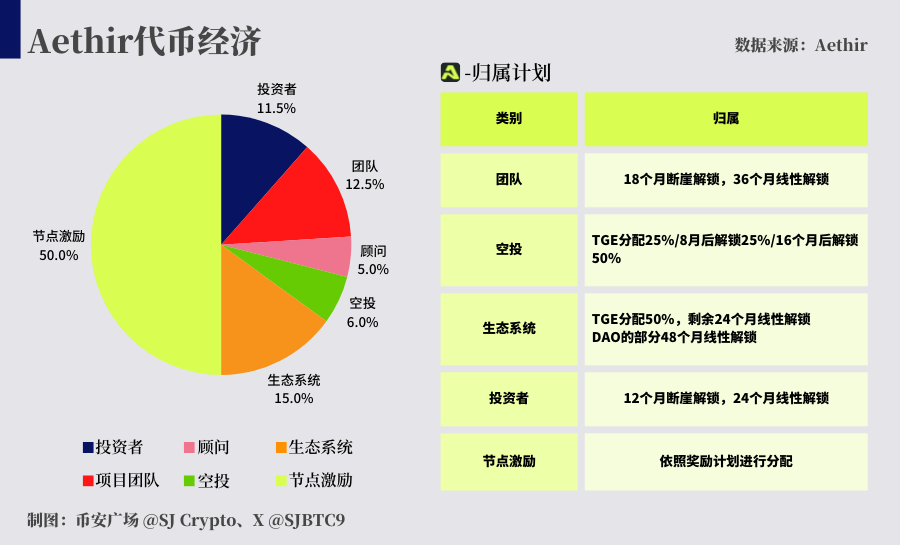

$ATH is the native token of Aethir. From the distribution point of view, 50% of it is produced by nodes, and the distribution of the rest is relatively balanced, and there are lock-up plans.

This section is not about talking about these trivial things, but about some issues about the token economy and the project itself. I have mentioned before that the current Depin projects generally have the problem of imbalance between supply and demand in token economic design.

To put it simply: in the planning of the project itself, the demand for tokens is insufficient.

In other words, you only need to provide some real resources required by the protocol to get token incentives. They can be computing power, electricity, network data and even location information.

Simply by providing these resources, you can get token incentives, which brings up a problem: for holders in the secondary market, it weakens the purchasing power.

There are some things you can actually not have, but you cannot not even have a plan. A typical example is $LINK . Its token economy 1.0 is a unilateral release market model. The only way for nodes to obtain actual profits is to sell them in the secondary market.

This design has sufficient liquidity to support the market during its upward cycle, but once it enters a downward cycle, the death spiral effect will be further reflected in prices.

Therefore, there was an upgrade to the 2.0 plan. In terms of the utility of tokens, in addition to node staking, part of the secondary selling pressure was transferred to other ecological partners, so that the node’s profit is no longer achieved only by selling native tokens (it can sell other coins hhh)

As a current example, I think it is appropriate to mention Worldcoin. I don’t know whether this will be done in the future, at least not at the moment.

I suddenly give these examples to tell you that $ATH also has a similar economic design plan, that's all.

“By staking, users will also earn additional tokens from Aethir ecosystem partners”

This design cannot be said to be really very good or perfect, but it is at least better than the simple [staking + governance] design. This design is also lacking in many projects, because often only the top protocols can do such a thing, and they also have to make ecological partners willing to take on the selling pressure. Some even at the top, have not planned for such a thing.

Finally, a final word: $ATH is in a downward trend after it went online. The market has recovered in the past few days, but it is still within the trend. To reverse the trend, it must at least break through the resistance of 0.058. This is the conclusion I just drew from the market.