Author/Source: Nina Bambysheva Forbes

Compiled by: Liam

MicroStrategy is not only a huge bet on Bitcoin, it's a revolution in corporate finance.

Most people view billionaire Michael Saylor’s publicly traded company MicroStrategy as a big, risky bet on Bitcoin. But a closer look reveals a masterpiece, a blueprint for manipulating traditional finance to tap into the magic dust that’s fueling the cryptocurrency frenzy.

New Year’s Eve at Villa Vecchia was a riot of orange and gold, a scene straight out of Fitzgerald’s most florid fantasy. More than 500 people packed the manicured lawns of the century-old house, whose Versailles-style ballroom has hosted the likes of Margaret Thatcher, Henry Kissinger and Mikhail Gorbachev.

Bitcoin’s recent break above $100,000, rather than its arrival in 2025, was the real raison d’être for the feast. Waiters circulated champagne on silver trays, appetizers were emblazoned with the ubiquitous B, and dancers in gold tights waved glittering orange orbs in a nod to Bitcoin’s signature hue. A giant playing card loomed in the center of the garden, with the king’s face replaced by a cheeky B.

The party on the water continued aboard the Usher. The 154-foot superyacht, featured in the 2015 film Entourage, gleamed against the Miami skyline. Shuttle buses streamed by, carrying Bitcoin executives, influencers, and most importantly, institutional investors, all dressed in “Bitcoin chic” (orange suits, B logo accessories). Two giant projectors played clips predicting Bitcoin’s rise to millions, while a DJ wearing a space helmet conducted bass-heavy tracks among swaying palm trees.

“I’m a little tired of winning,” quipped one reveler wearing a black Satoshi hat.The partygoers all had crypto cred: The man in the Satoshi hat was David Bailey, the 34-year-old CEO of BTC Inc. and publisher of Bitcoin Magazine, who hosted the Bitcoin conference in July, where Donald Trump vowed to make the U.S. “the crypto capital of the planet” and establish a national Bitcoin reserve.

Villa Vecchia owner and host Michael Saylor, 59, moved among the revelers in his signature black blazer, blue jeans and a T-shirt with a B. on the front. He graciously accepted requests for handshakes and selfies. Here, Bitcoin is God and Saylor is its prophet.

Cryptocurrency is like a second life for Saylor, as he made and lost more than $10 billion during the original dot-com bubble. Back then, he co-founded MicroStrategy, a software company based in Tysons Corner, Virginia, after graduating from MIT in 1989. The company started out in the data mining and business intelligence software business before running afoul of the Securities and Exchange Commission over accounting practices. In 2000, the company paid a fine, settled with the federal government, and restated its results for previous years.

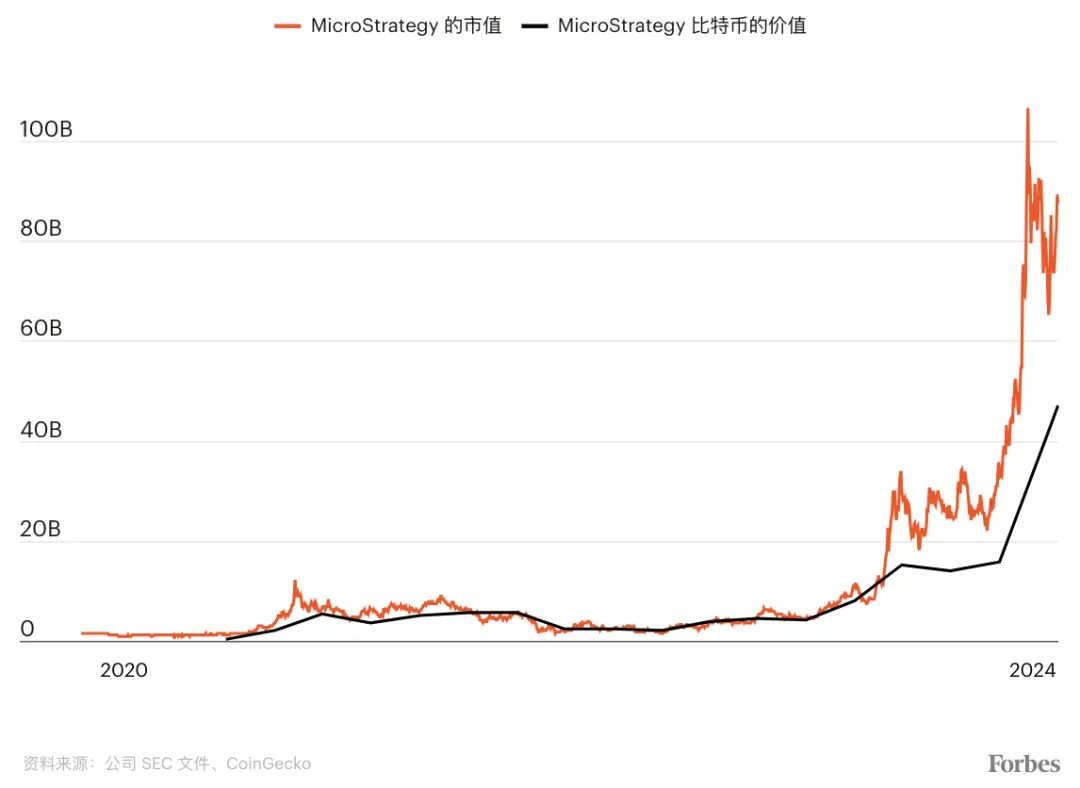

Over the next two decades, MicroStrategy's sales were mediocre and its market value hovered around $1 billion. That all changed in 2020, when Saylor decided to make Bitcoin a core strategy for MicroStrategy.

Last year, after the SEC approved Bitcoin ETFs from giants like BlackRock and Fidelity, the price of the cryptocurrency soared, more than doubling in 12 months and topping $100,000 in early December. Just before Christmas, MicroStrategy joined the Nasdaq 100 index, spurring more demand for its shares, which rose more than 700% last year as it issued bonds and accumulated more Bitcoin (it now owns 471,107). Saylor's company is now the largest holder of the digital asset, second only to the elusive Satoshi Nakamoto, who is said to hold 1 million Bitcoins. During 2024, Saylor's net worth jumped from $1.9 billion to $7.6 billion. A month into the new year, he's worth $9.4 billion.

MicroStrategy's stunning gains have sparked a chorus of critics and short sellers who can't understand how a small software company with just $48 billion in Bitcoin can be worth $84 billion. But what Saylor's critics don't understand is that MicroStrategy deftly straddles two worlds: one governed by the rules of traditional finance, where companies issue debt and equity that are bought and sold by hedge funds, traders and other institutions; and another ruled by faithful, staunch believers who believe Bitcoin will bring you a better world.

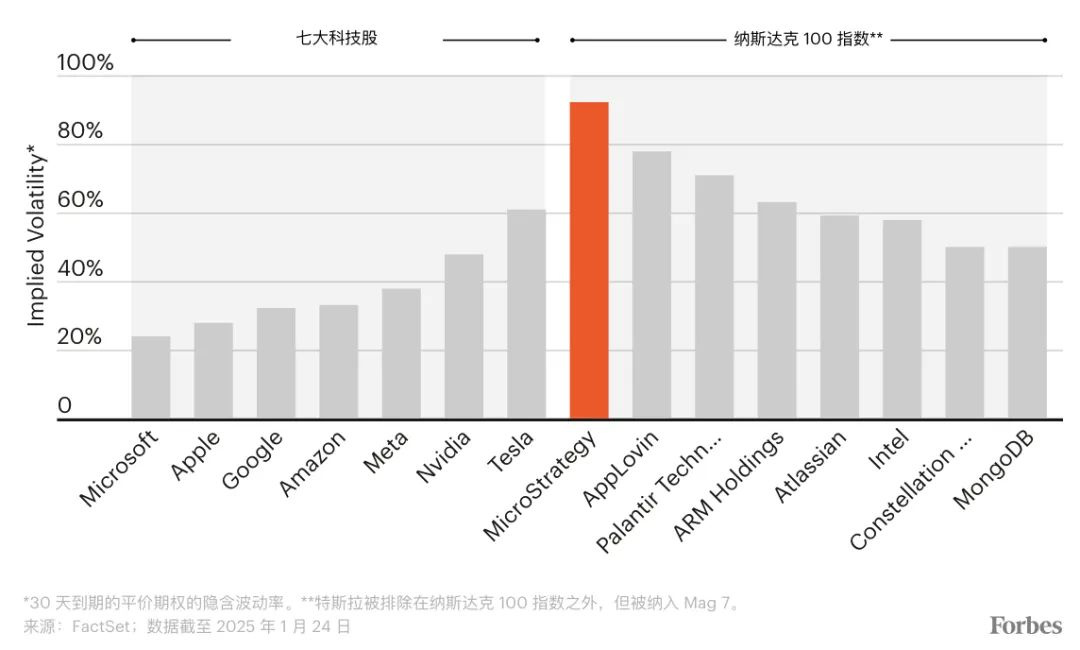

The driving force behind MicroStrategy's success is embracing and cultivating volatility, a distinguishing feature of its core assets. Volatility is the enemy of traditional investors, but the best friend of options traders, hedge funds and retail speculators, making MicroStrategy one of the most active stocks on the market. Although its annual revenue is relatively small, only $496 million, its daily trading volume is comparable to that of the seven major technology giants (Meta, Apple, Alphabet, Microsoft, Amazon, Tesla and Nvidia).

“People think this is crazy,” Saylor said. “How can such a small company have such high liquidity? It’s because we put a crypto reactor in the middle of the company, attracting capital and then spinning it. This increases stock volatility and makes our options and convertible bonds the most interesting and best-performing products in the market.”

Michael Saylor was 100 percent correct about the popularity of the $7.3 billion in convertible bonds the company has issued since 2021. Every minute of the trading day, MicroStrategy’s stock price is amplified in real time by the constant fluctuations of Bitcoin, which increases the implied volatility of the call options inherent in its convertible bonds. That’s because, unlike regular bonds, convertible bonds offer debt holders the security of having the option to exchange their bonds for MicroStrategy stock at a predetermined price before maturity. Every trader trained in the Black-Scholes option pricing formula knows that high implied volatility increases the value of options. As a result, Saylor was able to issue convertible bonds with virtually no interest costs.

The six convertible bonds MicroStrategy has issued so far have maturities between 2027 and 2032, with interest rates ranging from 0% to 2.25%. In the public bond market, where liquidity has been shrinking due to the boom in private credit, institutional investors are hungry for excess returns. Not only are MicroStrategy's bonds one of the only ways for large investors such as German insurer Allianz and U.S. bank State Street to invest in digital assets, they are also among the best performing bonds on the market, with returns of more than 250% since issuance. Even MicroStrategy's $3 billion, five-year bond issued in November with a 0% coupon and a strike price of $672 (80% higher than MicroStrategy's current stock price) is up 89% in just a few months.

Volatility is vitality

Those were the three words MicroStrategy co-founder Michael Saylor tweeted last March that revealed the magic formula driving the outperformance of his stocks and bonds: the implied volatility of the company’s options, which was driven by his accumulation of Bitcoin. Many traders crave volatility, and they expect MicroStrategy’s stock price to swing more than 90% over the next month, compared with 60% for Tesla and 30% for Amazon.

Saylor understood that institutional investors, who measure performance on a quarterly basis, would continue to buy his risky stocks in order to boost their portfolio returns. Issuing large amounts of convertible bonds like MicroStrategy's would normally dilute a company's stock, but in this case, the convertible bonds had a bullish effect because they represented future demand for increasingly higher-priced shares. Through secondary offerings and convertible bond offerings, MicroStrategy's outstanding shares have grown from 97 million to 246 million since 2020. Its stock price has risen 2,666% over the same period. In late January, its shareholders voted to significantly increase the company's authorized shares to 10.3 billion shares. The cycle feeds on itself: issuing billions of low-cost or no-cost debt and equity, driving up the price of Bitcoin through large purchases, and driving big moves in MicroStrategy's stock. Over and over again.

“They found a monetary loophole in the financial markets and they exploited it,” marveled Richard Byworth, a former convertible bond trader at Nomura Securities and now managing partner at Syz Capital, an alternative investment firm in Zurich, Switzerland.

Saylor makes no secret of his admiration for Bitcoin, which is understandable. Last August, he invented a brand new financial indicator called Bitcoin Yield, or BTC Yield. This "yield" has nothing to do with any revenue generated, but simply measures the percentage of Bitcoin held by a company compared to the company's fully diluted shares over time. His original goal was to grow 4% to 8% per year, but data released by MicroStrategy in January showed that Bitcoin's yield in the fourth quarter was 48% and 74.3% for the whole of 2024 - these numbers, although large, are meaningless, and he offers these numbers like bait to his followers who adore him.

Ben Werkman, a former merchant banker, consultant and early investor in the firm’s Bitcoin strategy, said trying to value MicroStrategy the old-fashioned way would just drive you crazy. Saylor “turned off the P&L thinking and said, ‘We’re going to start with the net asset side of the company and focus on leveraging our strengths on the balance sheet,’ which in this case meant acquiring more Bitcoin.”

This is exactly what MicroStrategy is doing. In October, Saylor announced a plan called "21/21" to raise up to $42 billion in the next three years (half through equity financing and half through debt financing) to buy more Bitcoin. In November and December alone, the company acquired nearly 200,000 Bitcoins worth about $18 billion.

This is all well and good as long as the price of Bitcoin keeps rising, but what if Bitcoin crashes like it has so many times before?

“Scale is everything because liquidity is everything. MicroStrategy is the single largest source of liquidity for trading Bitcoin-related risk, both in the spot market and, more importantly, in the options market.”

Unless the world does end, MicroStrategy should be fine. Bitcoin would need to fall more than 80% from its current level of over $100,000 and last for at least two years for MicroStrategy to be unable to repay its current debt. Saylor once again demonstrates his talent for exploiting the capital markets and the behavior of bond investors.

All of MicroStrategy’s $7 billion in debt is unsecured, and technically, none of the Bitcoin in its coffers can serve as collateral. Moreover, at the company’s current share price of $373, more than $4 billion of its debt is “worth money,” or effectively equity.

"In reality, MicroStrategy has very little debt on its balance sheet," said Jeff Park, head of alpha strategy at Bitwise, a San Francisco-based crypto asset management firm, adding that MicroStrategy's Bitcoin holdings are unlikely to be forcibly liquidated because institutional bondholders have a high tolerance for refinancing, even in the worst-case scenario of bankruptcy.

What’s stopping other companies from replicating Seller’s bitcoin financial engineering? Nothing. Many are already following suit. According to Park, Bitwise counts about 90 public companies, including big names like Tesla and Block, that have added bitcoin to their balance sheets. In March, his company will launch the Bitwise Bitcoin Standard Corporate ETF, which will be a bitcoin-weighted index of 35 public companies that hold at least 1,000 bitcoins (about $100 million). MicroStrategy will lead the index.

Copycats are providing ammunition for MicroStrategy's opponents. Kerrisdale Capital, a Miami-based investment firm, issued a short report on the stock in March, saying: MicroStrategy stock represents a rare and unique way to get bitcoin, but this situation is no longer there. But Park believes that, like Netflix in the streaming field, MicroStrategy's first-mover advantage and scale make it different.

"Scale is everything because liquidity is everything. Whether it is the spot market or the options market, they are the most liquid sources for trading Bitcoin-related risks," Park said. "MicroStrategy's options market is by far the deepest single-name options market in the world." MicroStrategy's crazy options even spawned a fund called YieldMax MSTR Option Income Strategy ETF, which generates income by selling call options. The fund, which was established one year ago, has an annual return of 106% and has accumulated $1.9 billion in assets.

Sitting by the pool at Villa Vigia, his three parrots, Hodl, Satoshi and Max, chattering behind him, Saylor shrugs off critics. “The conventional business wisdom of the last 40 years says that capital is a liability and volatility is bad. The Bitcoin standard says that capital is an asset and volatility is good — that’s its nature,” he insists. “They live in a flat world, a pre-Copernican world. We’re on a train going 60 miles an hour, spinning a gyroscope with 30 tons on it, while the rest of the world stands by the track, motionless.”

This is not the first time Michael Saylor has flown close to the sun.

Born in 1965 on an Air Force base in Lincoln, Nebraska, he was immersed in military discipline early in life. His father was a chief master sergeant, and the family moved between Air Force bases around the world before settling near Wright-Patterson, Ohio, home of the Wright Brothers Aviation School.

He attended MIT on a full scholarship from the Air Force ROTC to study aeronautics and astronautics and write a paper on computer simulations of Italian Renaissance city-states. In his spare time, he enjoyed playing guitar in a rock band and flying gliders. He graduated with highest honors in 1987 and was commissioned as a second lieutenant in the Air Force, but his dream of becoming a fighter pilot was put on hold by a heart murmur that turned out to be a misdiagnosis.

When 1+1=3, by doubling down on Bitcoin, MicroStrategy’s market value has grown 60 times in 4 years, even with Bitcoin prices in the doldrums.

At 24, he co-founded MicroStrategy with fellow MIT fraternity member Sanju Bansal. The company was a pioneer in data analytics at a time when few understood its potential. Riding the dot-com boom, it went public in 1998, and by 2000 its market value soared to more than $24 billion. Saylor’s net worth peaked at nearly $14 billion, and he became a technology evangelist, predicting a world in which data would flow like water. “We’re going to wipe out entire supply chains with our technology,” Saylor told Forbes in late 1998. “We’re going to do everything in our power to win permanent victory over entire industries around the world.”

Then the company collapsed. On March 10, 2000, MicroStrategy's stock price peaked at $313 per share, more than 60 times higher than its IPO price. Two weeks later, the company announced it needed to restate its financial results, and its stock price plummeted to $72. The SEC charged Saylor and others with accounting fraud, and MicroStrategy later settled the charges for $11 million. Within two years, the company's stock price fell below $1. Saylor's $13 billion fortune evaporated.

"It was the darkest moment of my life," he said. "It sucks when people lose money because they trusted you."

In 2020, after years of quantitative easing and trillions of dollars in government stimulus related to the COVID-19 pandemic, Saylor was convinced that the $530 million in cash and short-term investments remaining on MicroStrategy's balance sheet would be better invested in Bitcoin. The U.S. government can print dollars at will - and it is working to do so - but Bitcoin is designed with a hard cap: There will never be more than 21 million Bitcoins.

If the price of Bitcoin plummets, MicroStrategy’s stock price will fall harder and faster than Bitcoin itself. But don’t dismiss Saylor as too smart. Many other companies have followed MicroStrategy’s lead — the company now calls itself “the world’s first and largest Bitcoin Treasury.”

Some public companies, like Metaplanet, are even relying on Bitcoin to stay afloat. The Tokyo-based hotel chain faced an existential crisis during the pandemic, when Japan closed its borders to tourists. The small hotelier sold nine of its 10 hotels and issued shares and bonds to buy the hotels for $70 million in Bitcoin. Metaplanet's shares, which trade on the Tokyo Stock Exchange and over-the-counter, are up 2,600% by 2024, and its market value is now $1 billion, despite holding just $183 million worth of Bitcoin. The company's homepage now reads "Securing the Future with Bitcoin" and barely mentions the hotels. "We are very grateful to Michael Saylor for giving us a business plan for the world to follow," said Metaplanet CEO Simon Gerovich, a guest at Saylor's New Year's party.

“I invented 20 things and worked hard to make them successful, but none of them changed the world. Satoshi created one thing, gave it to the world, and then disappeared. It made me more successful than any of my ideas.”

While many companies are unlikely to go as extreme as Metaplanet, there will certainly be more and more Bitcoin holders. In January, the Financial Accounting Standards Board amended a rule that previously only allowed companies to record a decline in the value of cryptocurrencies as a loss in quarterly reports. Now holding cryptocurrencies will be valued at market value, allowing for simultaneous hedging of gains and losses. For MicroStrategy, which lobbied for the rule change, this could mean multiple quarters of profitability in the future and the possibility of being included in the S&P 500 index.

According to YCharts data, hundreds of large public companies around the world now hold more than twice the cash they need for current operations and liabilities. The most famous of these is Berkshire Hathaway, which currently holds $320 billion in cash.

Given the $35 trillion (and growing) national debt, Saylor’s mantra has been “cash is trash.” “Financial repression is a perpetual phenomenon,” insists Bitwise’s Park, an inevitable consequence of the government’s lowering of interest rates. We live in a highly financially advanced world where the real economy has become largely disconnected from the financial economy. You can’t actually pay off your debts without printing more money. If you think you have to keep printing more money, then you better believe the yield curve will be suppressed.

To Saylor, Villa Vecchia itself is the perfect example. The 18,000-square-foot mansion on Miami’s “Millionaire’s Row” was built in 1928 for the president of F.W. Woolworth’s department store. Saylor bought the house in 2012 for $13 million. “This house was worth $100,000 in 1930. It was valued at $46 million a few years ago,” Saylor said in a 2023 podcast interview. “Do the math — it’s on its way to being worth $100 million, which means the dollar is going to be worth 99.9% less in 100 years. The bottom line is: money in the bank is not money.”

Trump's next few years in office could be good for MicroStrategy and Bitcoin. Despite his big talk about "government efficiency," Trump was a big spender during his first term as president: the national debt increased by $8.4 trillion during Trump 1.0's four years in office, according to the Committee for a Responsible Federal Budget. Although he once publicly called Bitcoin a "scam" that would compete with the dollar in 2021, Trump is now all-in on cryptocurrency. In fact, his son Eric recently posted a photo with Saylor at Mar-a-Lago with the caption "Two friends, one passion: Bitcoin."

Not only is the value of the dollar likely to depreciate further over the next four years, Saylor’s relentless advocacy fits neatly into the dystopian MAGA worldview. “The human condition has always been plagued by dirt: toxic food, toxic liquids, and the human economic condition has always been plagued by toxic capital. My mission is to educate the world about non-toxic capital,” he preached.

But even Michael Saylor occasionally steps down from his podium to reflect on his entrepreneurial journey. "We adopted Bitcoin out of frustration and desperation, and then it became an opportunity, then a strategy, then an identity, and finally a mission," he said. "The irony of my career is that I invented 20 things and tried to make them successful, but I really didn't change the world with any of them. Smart people create something, give it to the world, and then disappear, and now we are just passing on the spirit. Ironically, this has made me more successful than people who try to commercialize every idea they have. It's a lesson in humility."

It’s also a reminder that lightning can indeed strike the same place twice, especially when there’s a savvy and opportunistic manager at the helm.