Author: 0x Lao Dong

2024 Airdrop List

- The top of the FDV list on the day of launch: StarkNet, $19.2 billion.

- The highest airdrop value: Hyperliquid, 2.613 billion US dollars, with an average of 28,000 U per address.

- 0. The top of the list: Movement, $734.8 million airdrop.

- The number of airdrop addresses ranked first: HMSTR, 129 million TG accounts, an average of 3U.

- First on the list of gains: UXLINK, ATH is 15 times the closing price of the day.

- First on the decline list: HLG, 30-day price drop of 90.66%

Key insights

Emerging narrative tracks are rising, and traditional hot tracks are cooling down. The 30-day average increase of old hot tracks (infrastructure, Layer2, GameFi) is -1.34%, and the 30-day average increase of new narrative tracks such as DEPIN, RWA, AI, etc. is 41.98%, suggesting that investors should pay attention to emerging tracks

The valuation of 2024 projects is high, and the market is optimistic. The average FDV/financing of 79 projects on the day of launch is 103.9 times, indicating that the overall valuation of projects in 24 years is high, and the market is optimistic, but there may be some bubbles.

Speculative operations were frequent in the early stage, and prices fluctuated violently. 40% of the projects reached ATH on the first day, and 1% of the projects reached ATL on the first day. This shows that most projects had great selling pressure in the early stage, and a large number of investors tended to speculate in the early stage of listing. The subsequent highs may cause prices to fall rapidly.

Most projects have a clear price decline trend in the short term. 62% of projects have a downward trend within 7 days, and 65% of projects have a downward trend within 30 days. Most projects face a price decline trend in the short term after TGE, and the decline ratio and magnitude have increased over time.

Projects with large distribution ratios and few lock-up mechanisms perform better Projects with large distribution ratios are generally more stable and perform well, with an average increase of 16.66% in 30 days. Tokens with lock-up mechanisms perform poorly, with an average decrease of -43.73% in 30 days.

More platforms bring higher recognition. With the increase in the number of listed exchanges, the average financing amount and FDV of projects have increased significantly, indicating that market recognition and liquidity have increased, and risk tolerance has also been improved.

Preface

2024 is a year of alternating bull and bear markets, and also a year of extremely volatile crypto market. BTC has broken through its historical highs from its lowest point of $38,500 at the beginning of the year to over $100,000. At the same time, as the market heats up, the activities of the project parties are becoming more frequent.

Compared with only 270 TGE projects in 2023, this number surged to 731 in 2024, an increase of 170%. Among these numerous projects, only a few are "big hair" and "medium hair", and most are still "small hair" and "diamond hair". How do these projects perform after they go online?

To answer this question, Lao Dong selected 100 hot and representative projects in 24 years, combined with key data such as financing scale, price performance, distribution rules, etc. to conduct a systematic analysis to reveal the trends and rules of current airdrop projects. This article will use data to help readers see the situation of airdrop projects in 2024.

Data table: Click to view detailed data

This article does not provide any investment advice, only objective data statistics and analysis

Data analysis

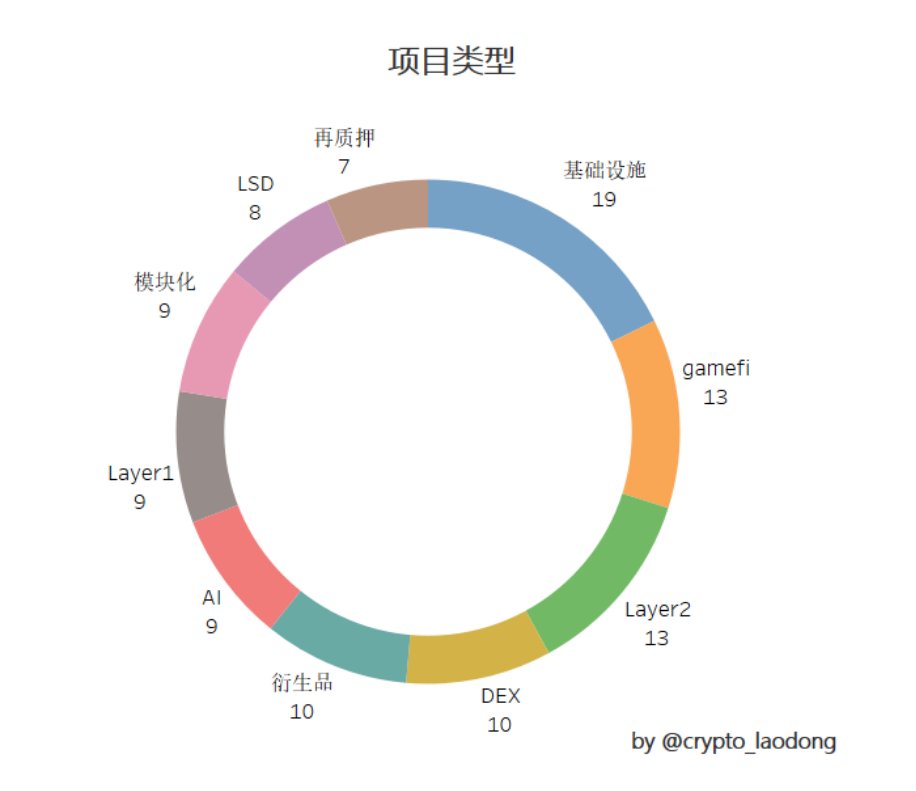

1. Analysis of the 24-year TGE track

The chart shows the distribution of project types in 2024. It can be seen that the VC coin TGE in 2024 is mainly concentrated in traditional popular tracks such as infrastructure, GameFi, and Layer2. Projects in these tracks usually require a long construction cycle, and many of them have actually been developed in the past few years and will not be launched until 2024.

- Infrastructure projects: 19 projects, with an average increase of 12.18% in 30 days

- Layer2 projects: 12, 30-day average increase -0.2%

- Gamefi’s projects: 12, with an average increase of 2.3% in 30 days

This year, the main emerging popular narratives revolve around DEPIN, RWA, AI and other directions. There are not many TGE projects overall, but this type of project is very eye-catching. It may continue to explode in the future.

- AI projects: 3, with an average increase of 24.56% in 30 days

- DEPIN projects: 3, with an average increase of 53.56% in 30 days

- RWA projects: 3, with an average increase of 42.17% in 30 days

Traditional hot tracks are gradually cooling down, and emerging narratives are rising rapidly. Focusing on new narrative tracks may be a better investment direction.

2. Financing situation and FDV analysis

Among the 100 projects, 79 projects announced financing, with an average financing amount of US$38.91 million.

- There are 8 projects with financing exceeding US$100 million.

- Projects in the range of US$10 million to US$100 million account for the largest proportion, with 44 projects.

- There are 26 projects with a value of US$2 million to US$10 million.

VC institutions usually conduct strict due diligence on projects, which reflects the market's recognition of the projects. The larger the amount, the stronger the confidence investors have in their future development. The frequency of financing can also be used to determine the popularity of the track and the direction of capital attention. However, the amount of financing cannot completely determine the quality of the project. We need to analyze it from multiple dimensions.

FDV (fully diluted market value) is an indicator used to assess the future potential value of a project. FDV is affected by multiple factors before the project goes online, including financing amount, initial circulation, market sentiment, narrative direction, track popularity, liquidity and trading depth.

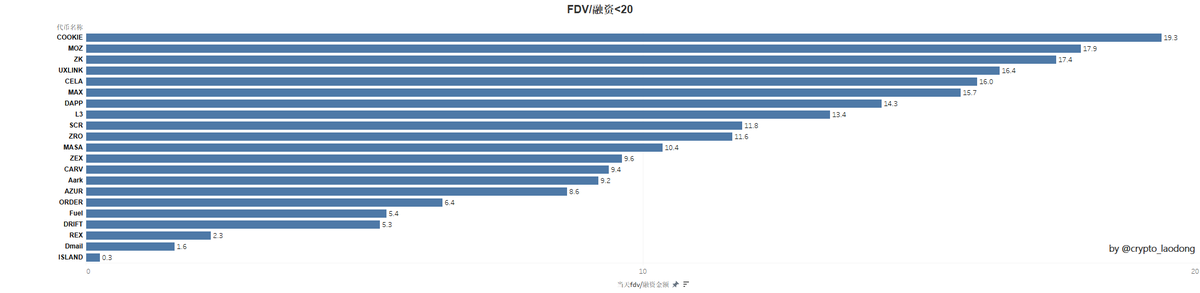

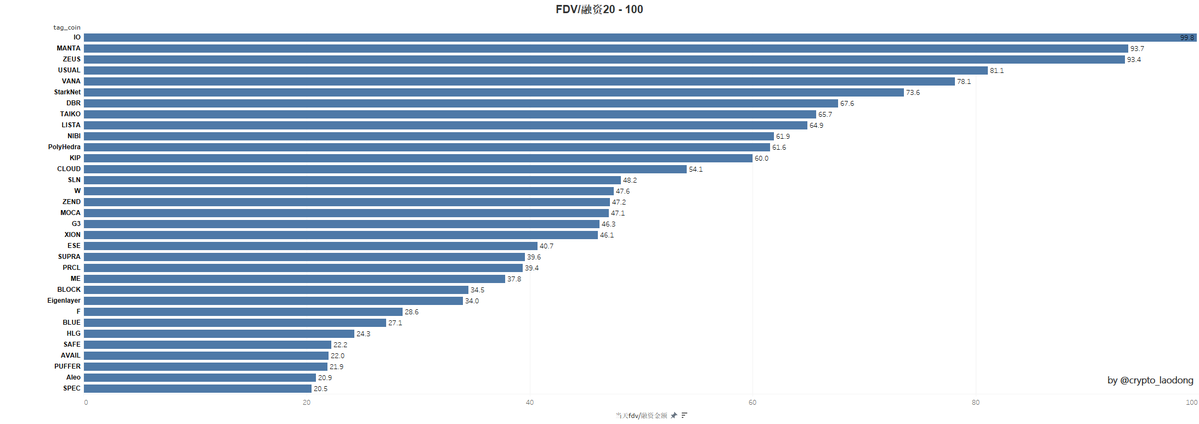

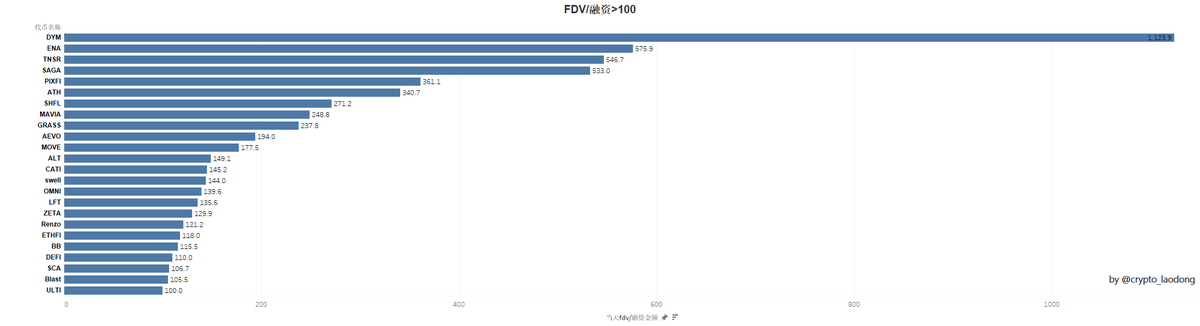

In order to more objectively evaluate the relationship between the initial valuation of a project and its actual financing, we use the FDV/financing ratio of the closing price of the day to divide the intervals and analyze the market performance of projects in different intervals:

FDV/financing 0-20 range: reasonable or conservative

There are 21 projects in this range, with an average financing amount of US$48.83 million. Data shows that 57% of the projects did not exceed the closing price of the day within 7 days and 30 days. Compared with other ranges, the market expectations of these projects are relatively stable, the valuations are relatively reasonable, and the investment risks are relatively low.

FDV/financing 20-100 range: expected to be high

There are 33 projects in this range, with an average financing amount of 51.64 million US dollars. Statistics show that 63.6% of the projects weakened in price within 7 days, and this proportion increased to 75.8% after 30 days, indicating that investors have high expectations for these projects in the early stage, but the prices have fallen sharply in the short term, which has certain volatility risks.

FDV/Financing 100 and above: High-risk speculation

This range includes 24 projects, with an average financing amount of US$12.72 million. Most of these projects are small projects with relatively small financing scales, and there are no projects with financing of over 100 million. Data shows that 70.8% of the projects have weakened in price after 7 days, and this proportion has dropped to 54.2% after 30 days. These projects are mostly concentrated in hot tracks such as infrastructure, GameFi, and LSD.

Among the 79 statistical projects, the average FDV/financing ratio is 103.9 times, indicating that the overall valuation of projects in 2024 is relatively high and market expectations are relatively optimistic.

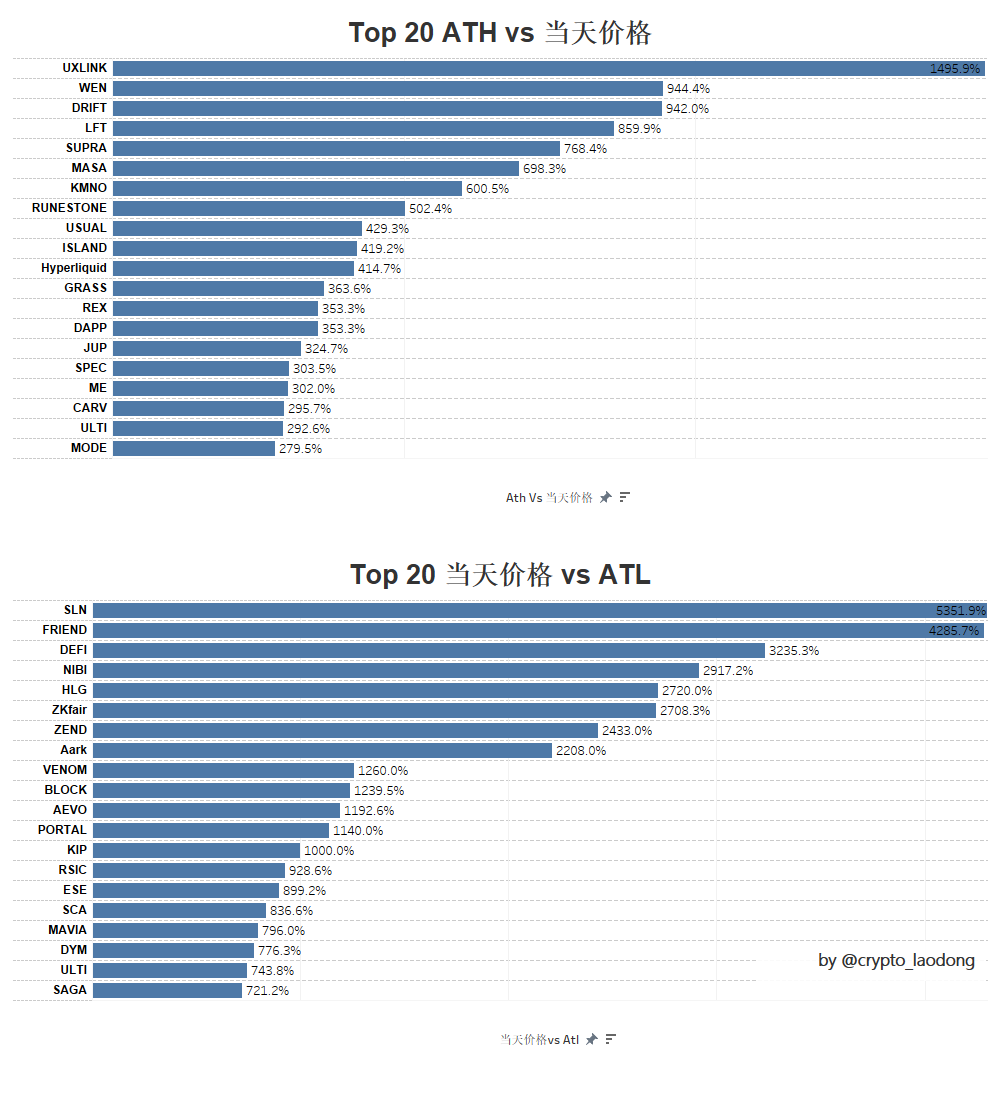

3. ATH vs ATL Analysis

Analyzing ATH (historical high) and ATL (historical low) can help us fully understand the overall performance of the project in the market and the degree of investor recognition. Analyzing ATH/current price and current price/ATL can assess the project's profit potential and selling pressure risk, and provide data support for judging the initial stability of the project, reasonable valuation, and investment timing.

Statistics on the price trends of 100 projects show that as of today, 40% of the projects reached ATH on the first day, and 1% of the projects reached ATL on the same day.

Price trend statistics of 100 projects: 40% of the projects reached ATH on the first day. 1% of the projects reached ATL on the first day.

The average price of the day is 245.22% compared to the ATH, indicating that the price of the day has a potential increase of 2.45 times from the historical high. The best performing projects include UXLINK, WEN, and DRIFT

The price on that day vs. ATL averaged 633.52%, indicating that it would take 6.34 times of increase to recover from the historical lowest point to the closing price on that day. The worst performing projects were SLN, FRIEND, and DEFI.

The market is full of speculative sentiment, with 40% of projects reaching ATH on the first day, indicating that a large number of investors tend to speculate in the early stages of launch, which may lead to a rapid price decline later.

The ATH increase of 245.22% and the ATL decrease of 633.52% indicate that the market selling pressure risk is far greater than the project's profit margin. This data reflects that in the initial price fluctuations of the project, in most cases, investors are more likely to push prices up rapidly due to high market sentiment, but then the price may fall rapidly due to selling pressure or token unlocking.

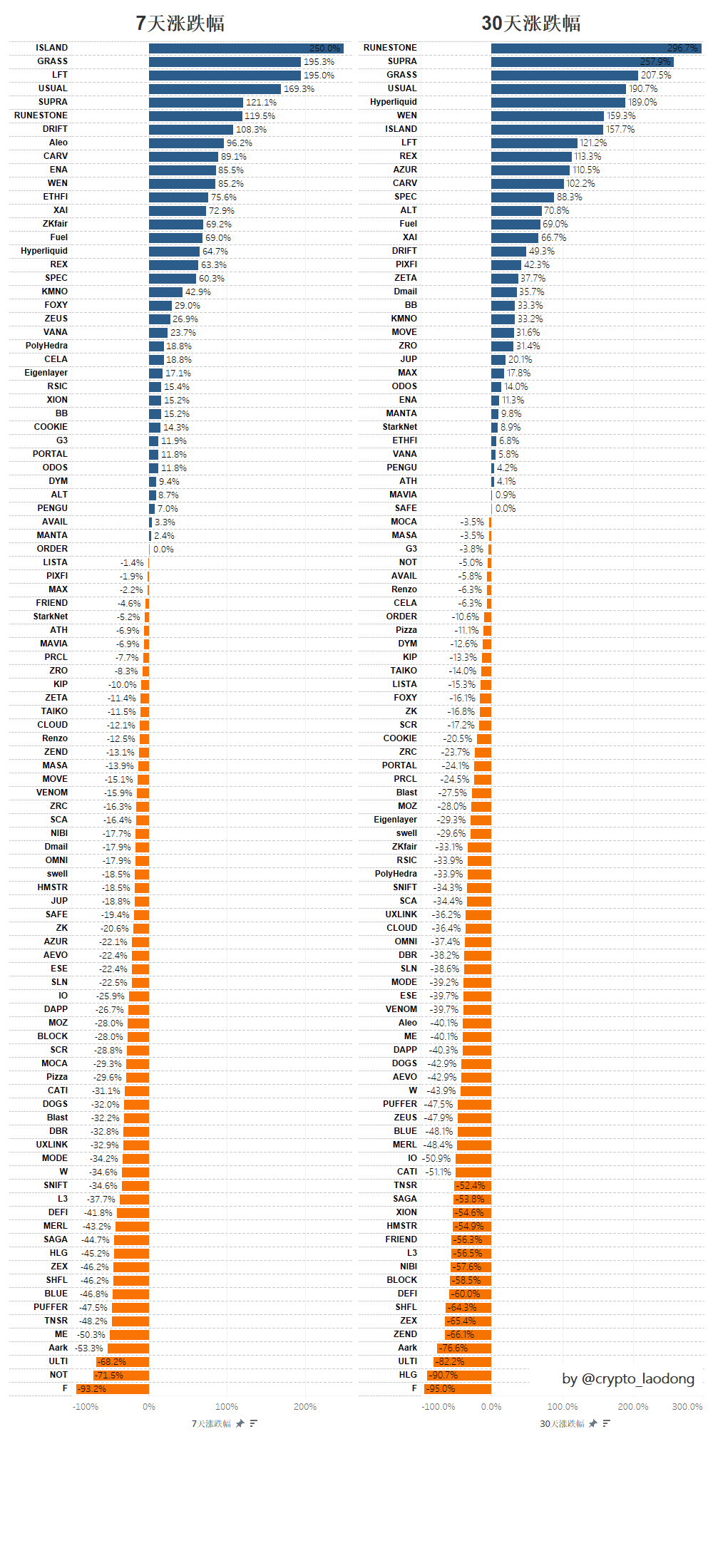

IV. Comparison of short-term project trends

The main purpose is to analyze the short-term trend of the project. By comparing the closing price of the day with the changes in the 7-day and 30-day prices, you can have a clearer understanding of the project's performance and trends in the short term.

From the chart we can see that:

Day 7:

- 62% of the projects were priced lower than the closing price of TGE on the day, with an average drop of 27.03%.

- 38% of the projects were priced higher than the closing price of TGE on the day, with an average increase of 60.34%.

Day 30:

- 65% of the projects were priced lower than the closing price of TGE on the day, with an average drop of 37.42%.

- 35% of the projects were priced higher than the closing price of TGE on the day, with an average increase of 74.26%.

Most projects face a downward trend in prices in the short term after TGE, and the proportion and magnitude of the decline have increased over time.

Although the prices of most projects have fallen, a small number of projects have performed well after TGE and have seen a high increase. Some high-quality projects will be able to gain higher market recognition in the short term and achieve significant price growth.

Among them, ISLAND GRASS RUNESTONE performed well, while F AARK HLG performed the worst.

Possible reasons for short-term gains:

- Excellent project fundamentals: Projects with strong technical support, clear application scenarios or innovative business models are usually able to attract the attention of long-term investors, thereby driving up prices.

- Narrative-driven: Projects that seize current market hot spots (such as GameFi, meme, DEPIN, RWA, etc.) are likely to attract market capital inflows, thereby driving up prices.

- Strong community consensus: Community consensus can increase the project's attention and demand in the market, thereby driving up prices. At the same time, continued community support can reduce selling pressure and enhance the long-term stability of the project.

- Good liquidity: Good liquidity helps stabilize project prices and enhance investor confidence.

Possible reasons for short-term decline:

- Cooling of market sentiment: The price on the day of TGE is often driven by FOMO (fear of missing out) and may be higher than the reasonable price. As the enthusiasm subsides, the price will return to rationality.

- Increased selling pressure: After the TGE, investors, especially airdrop participants or short-term investors, may choose to cash in their profits, leading to increased selling pressure in the market and falling prices.

- Token unlocking mechanism: Many VC coins adopt a long-term release mechanism. As the tokens are unlocked, early investors (such as private equity parties and teams) may choose to cash in their profits, thereby increasing market selling pressure.

- Insufficient liquidity: After TGE, some projects may have insufficient liquidity and limited trading depth. Once a large sell order appears, the price will fall rapidly and the volatility will increase.

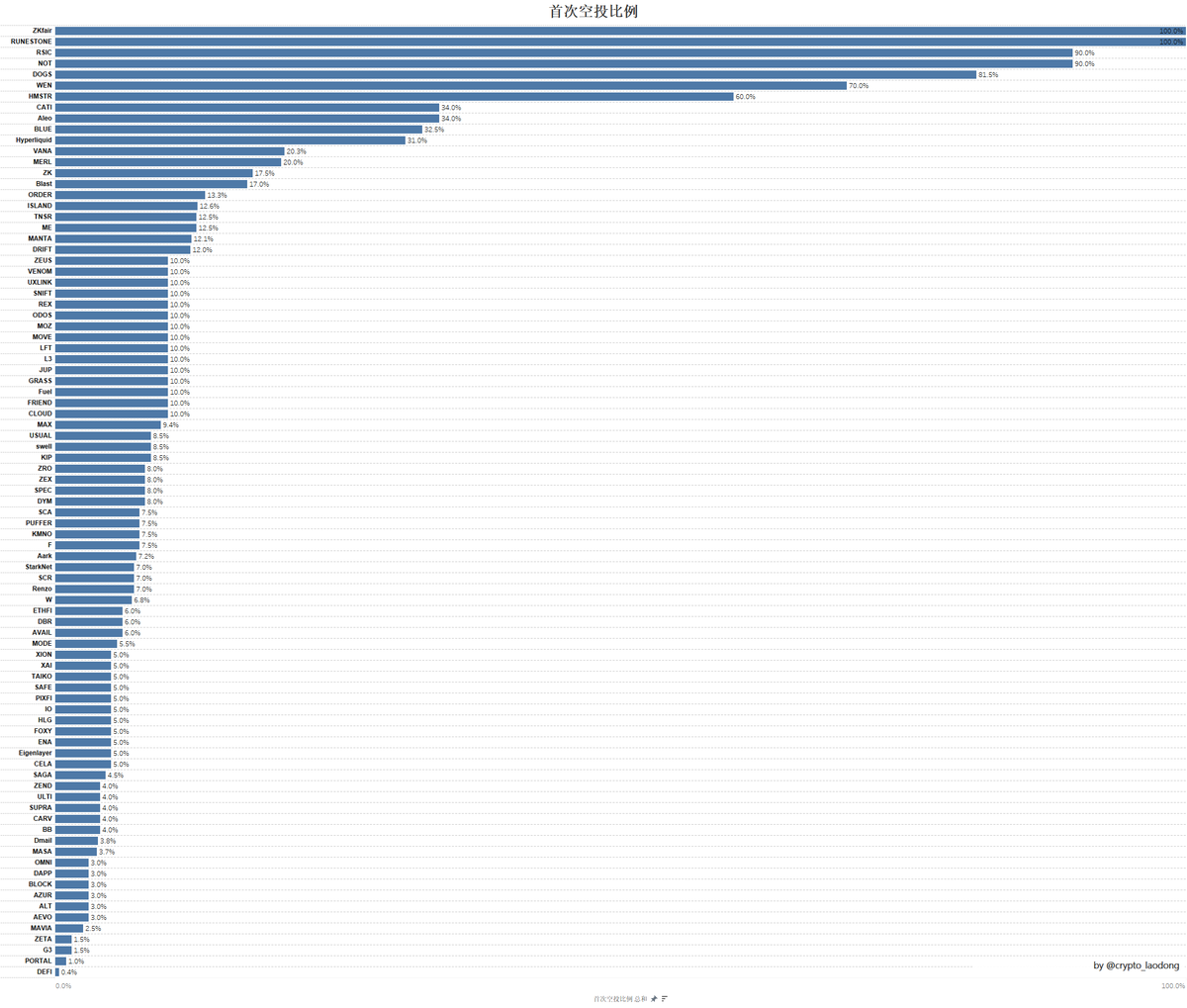

5. The impact of distribution ratio on price

**There are 15 projects with an airdrop ratio greater than 15%**, with an average 7-day increase of 11.87% and an average 30-day increase of 16.66%.

**There are 76 projects with an airdrop ratio of less than 15%**, with an average increase of 8.31% in 7 days and 3.36% in 30 days.

There are 10 projects with lock-up mechanism, with an average decline of -16.68% in 7 days and -43.73% in 30 days.

The data shows that projects with a larger airdrop ratio perform more stably in the short term, while projects with a stronger lock-up mechanism perform worse than expected and experience greater price fluctuations.

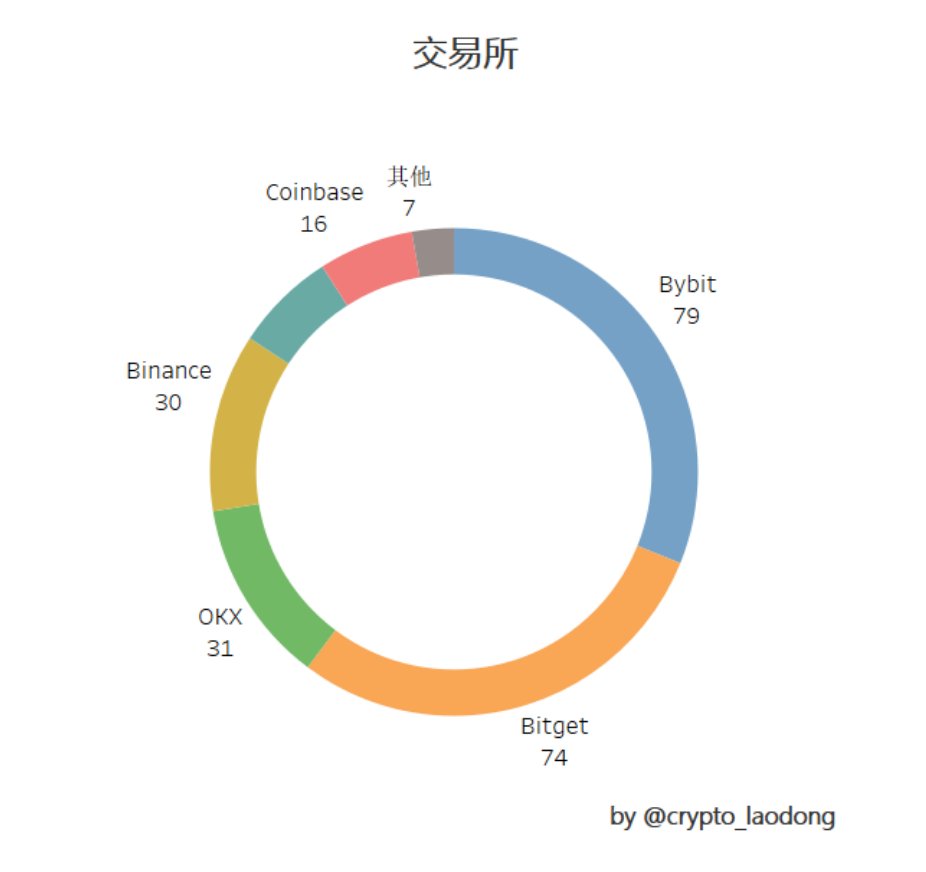

6. Exchange Selection and Project Performance

Listing on different exchanges and multiple exchanges usually have different impacts on the market. In order to better understand the overall performance of projects listed on major exchanges, Lao Dong compiled data from several major exchanges, including the number of listings, price fluctuations, and the impact of FDV liquidity. This allows us to understand the performance of projects on different exchanges and make more informed investment decisions.

Binance: 30 projects launched, 7-day change -0.02%, 12 projects rising (40%), 30-day change -4.57%, 12 projects rising (40%)

OKX: 31 projects launched, 7-day increase/decrease rate -13.06%, 7 projects increased (22.58%), 30-day increase/decrease rate -18.75%, 10 projects increased (32.26%)

Bybit: 79 projects launched, 7-day increase or decrease +2.27%, 29 projects rising (36.7%), 30-day increase or decrease -4.65%, 28 projects rising (35.44%)

Bitget: 74 projects launched, 7-day increase or decrease +6.57%, 26 projects increased (35.14%), 30-day increase or decrease +3.3%, 28 projects increased (37.84%)

Coinbase: 16 projects launched, 7-day change -3.68%, 3 projects rising (18.75%), 30-day change +26.64%, 6 projects rising (37.5%)

Upbit: 17 projects launched, 7-day change -5.05%, 3 projects rising (17.65%), 30-day change +2.94%, 9 projects rising (52.94%)

Judging from the number of listed coins, Coinbase and Upbit have fewer listed coins. They tend to carefully screen projects and pay more attention to the long-term stability and compliance of projects, avoiding listing projects that are still in the experimental stage or high-risk. Bybit and Bitget have more listed coins and are more aggressive. These exchanges focus on attracting users and expanding market share by frequently launching new projects. This strategy can help them expand rapidly in the market and attract a large amount of trading volume and liquidity.

From the short-term price of the project:

Bitget and Bybit performed well in 7 days and 30 days, especially Bitget, which had positive growth in both 7 days and 30 days, and the proportion of rising projects was relatively high.

Coinbase performed well, especially in terms of 30-day growth, reaching +26.64%, and many projects increased (37.5%).

Both OKX and Binance have shown some decline in the past 30 days, especially OKX, which has seen a larger decline of about -18.75% in 30 days.

Upbit’s performance has rebounded in the past 30 days, with an increase of +2.94%, and 52.94% of the projects have increased, which is a good performance.

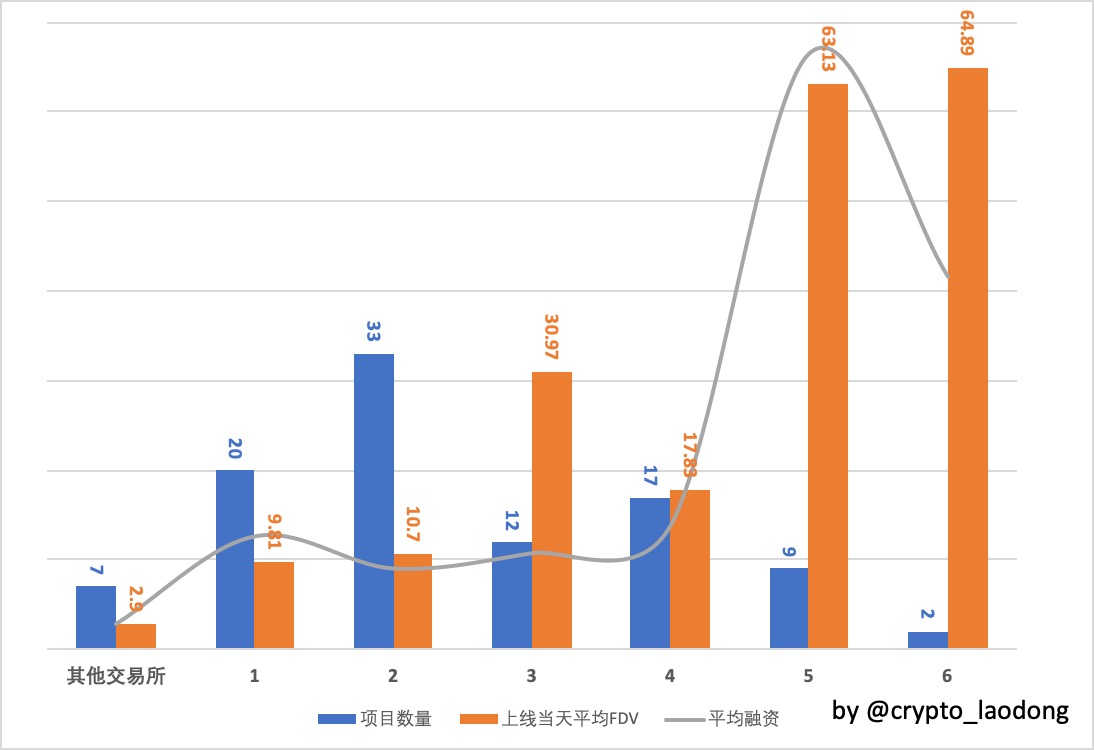

Other exchanges: 7 projects, with an average financing of 6.5 million and an average FDV of 290 million on the day

1 exchange listed: 20 projects, average financing of 28.86 million, average FDV of 981 million on the day

2 exchanges were launched: 33 projects, with an average financing of 20.68 million and an average FDV of 1.07 billion on the day

3 exchanges were launched: 12 projects, with an average financing of 24.57 million and an average FDV of 3.097 billion on the day

4 exchanges were launched: 17 projects, with an average financing of 31.67 million and an average FDV of 1.783 billion on the day

5 exchanges were listed: 9 projects, with an average financing of 152.15 million and an average FDV of 6.313 billion on the day

6 exchanges were listed: 2 projects, with an average financing of 95.2 million and an average FDV of 6.489 billion on the day

As more projects are listed on exchanges, the average financing amount of the projects and the FDV on the day of listing have increased significantly, which means that the market recognition is high, the liquidity is better, and the ability to resist risks is enhanced, which can attract more investors.