Original|Odaily Planet Daily (@OdailyChina)

Author: Wenser (@wenser 2010)

In the crypto world, there is no "myth of eternal profit", but there is a "legend of making money".

In October, which just ended, according to Dune data , pump.fun's cumulative revenue exceeded 160 million US dollars, the total number of addresses exceeded 2.4 million, and the total number of deployed tokens exceeded 2.8 million; currently, its cumulative revenue has reached 167.3 million US dollars . In other words, in just about 4 days, pump.fun, as the "strongest money-making machine" in this cycle, has increased its revenue by about 7.3 million US dollars again, which is terrifying.

Combining the revenue data of various agreements in the past year, Odaily Planet Daily will classify and inventory the top 10 "most profitable agreements" in this article. In the process of looking through the changes in the industry cycle, it will reveal the trend of the wind direction for readers' reference.

A comprehensive review of money-making machines: 42 major projects have generated revenues of more than 30 million US dollars in the past year, mainly in four categories

According to the data from the DefiLlama website , if the time is narrowed down to less than one year, the current 42 major projects have agreement revenues exceeding US$30 million, which can be mainly divided into the following categories:

Blockchain Ecosystem: L1 Network is Still the “Mainstream Money-Making Giant”

Looking closely at the list of “players with protocol revenue exceeding 30 million US dollars”, we can clearly see that in the past ten years of blockchain ecosystem development, the L1 public chain network is still the most mainstream “money-making behemoth”, among which:

Ethereum took the lead with a revenue of $2.57 billion in the past year;

Bitcoin ranked second with revenue of $1.323 billion in the past year;

TRON, positioned as a “stablecoin network”, earned $515 million in revenue;

Solana has benefited from the Meme coin craze that has been in full swing this year, earning $407 million;

BSC (i.e. BNB Chain) benefits from the revenue of up to $180 million from Binance Exchange;

Avalanche experienced a wave of explosive growth at the end of 2023, with monthly contract revenue increasing from US$2.5 million to US$52.25 million.

Overall, although the L1 ecosystem has a very bumpy road to development, it is still the main "pillar" supporting the crypto world, and Ethereum's protocol revenue of $19.367 billion (as of November 3, 2024) is indeed daunting. This also shows from the side that as the largest ecosystem in the crypto world, Ethereum is indeed far from the desperate situation of "running out of ammunition and food" as many people say.

Some representative ecosystems

Infrastructure projects: Stablecoins and DEX become "money-making experts"

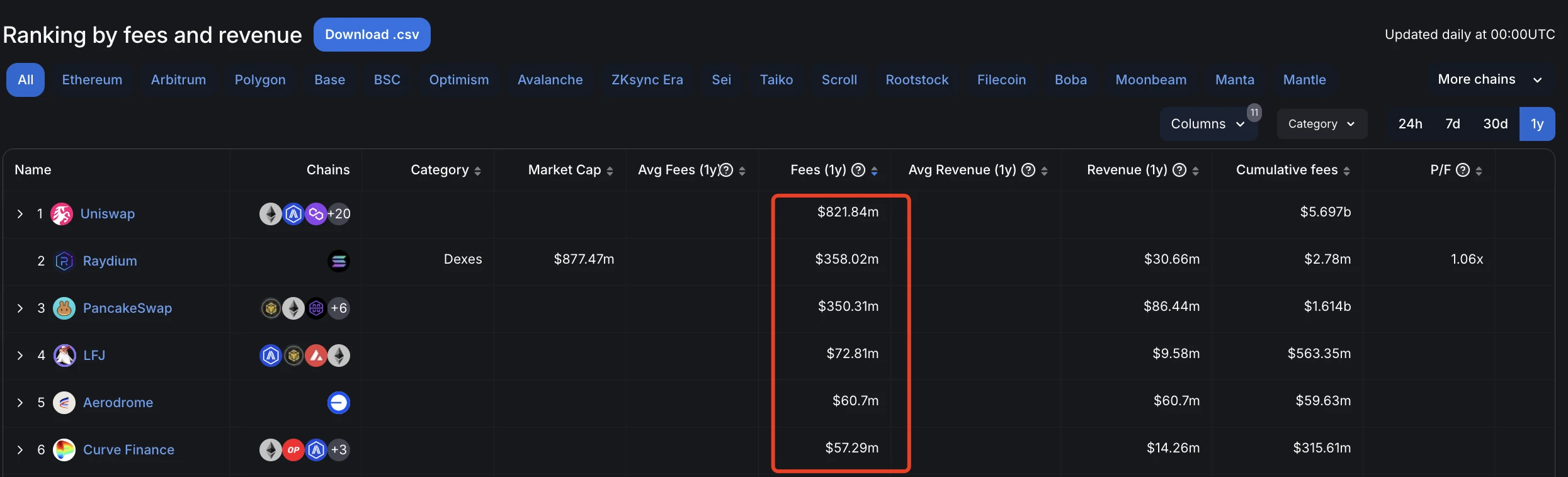

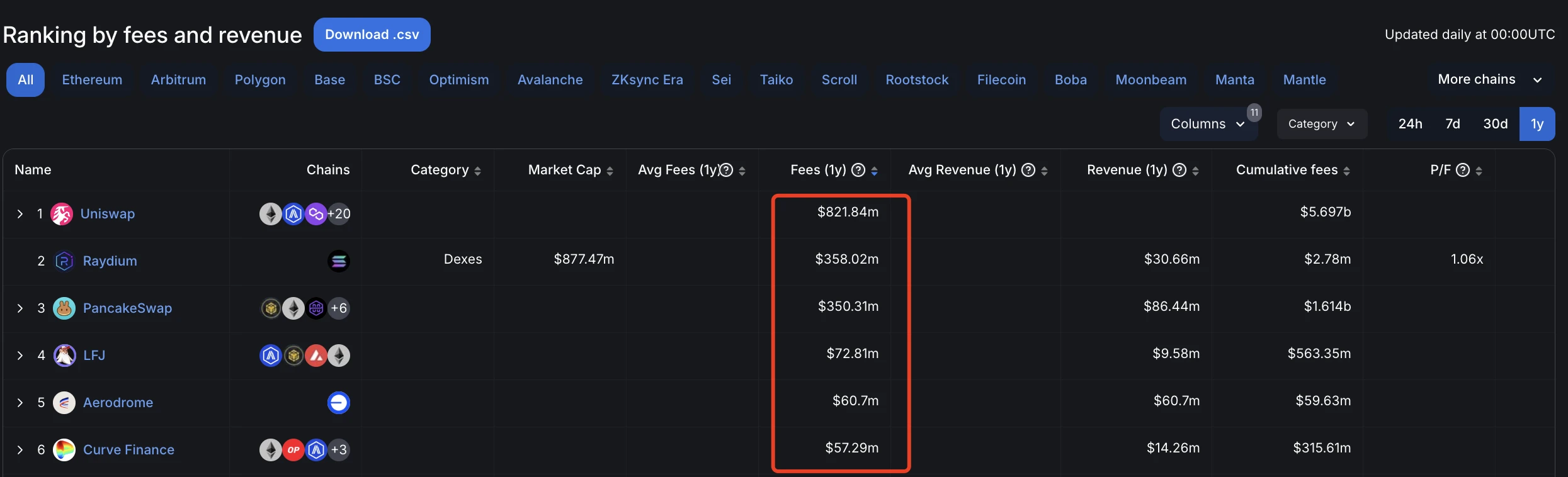

Another category of projects that rank at the top of the “money-making rankings” are many infrastructure projects including stablecoins, staking protocols, and DEX, among which:

Tether, the issuer behind USDT, and Circle, the issuer behind USDC, ranked first with $16.17 billion and $516 million in agreement revenue in the past year respectively;

DEXs such as Uniswap, Raydium, and PancakeSwap are in the second tier of such projects, with protocol revenues ranging from US$350 million to US$820 million within a year;

In addition, Ethereum ecosystem staking and re-staking protocols such as Lido and Ethena also ranked among them with annual agreement revenues of US$986 million and US$136 million, becoming part of the "new infrastructure" and gaining high recognition from the market.

Some representative projects

Application projects: Wallets and Meme coin platforms are "money-making machines"

As for specific application projects, the previous "industry hot spots" - wallet applications and the theme track of this cycle "Meme coin platform" have become the "money-making machines" with the largest proportion. Among them -

pump.fun (Pump as platform note) ranked 16th with $146 million in contract revenue in the past year;

pump.fun ranked 16th

MetaMask (commonly known as the Little Fox Wallet) ranked 28th with $70.49 million in contract revenue in the past year.

MetaMask ranked 28th

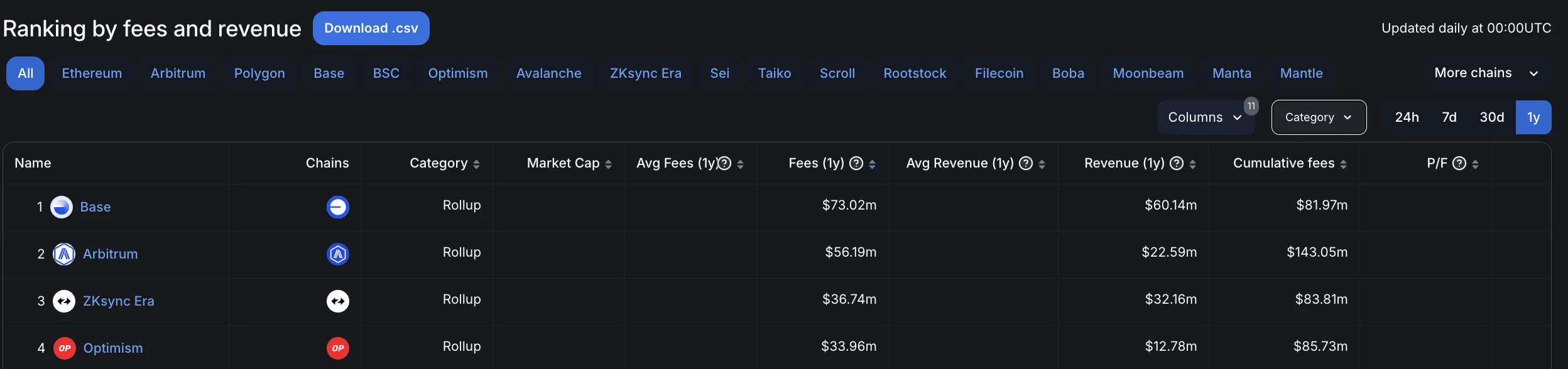

Expansion projects: L2 and service platforms are "new money-making platforms"

In addition to the above main categories, there are also many "expansion projects" that have ranked at the top of the protocol revenue in the past year, such as Ethereum L2 networks including Base, Arbitrum, ZKsync Era, and Optimism. Among them,

- Base ranks 26th with $73.02 million in nearly one-year agreements;

- Arbitrum ranked 32nd with $56.19 million in contract revenue in the past year;

- ZKsync Era ranked 38th with $36.74 million in contract revenue in the past year;

- Optimism ranked 41st with $33.96 million in contract revenue in the past year.

Some representative ecosystems

Service platforms are more diverse, including the former "NFT market king" OpenSea, as well as aggregated trading platforms such as DEX Screener, and a number of Telegram ecosystem trading bots such as Photon, BONKbot, Trojan, Banana Gun, and Maestro. Of course, as we can see from the figure below, the Solana ecosystem is still the main focus of these projects.

Some representative projects

A review of the top 10 "most profitable" protocols, a look at the most profitable tracks in crypto

Based on the above information and the data from the DefiLlama website, we can filter out the following representative "money-making projects" based on the total revenue of the protocol:

- Ethereum, with total protocol revenue reaching $19.369 billion;

- Uniswap, with total protocol revenue reaching $5.697 billion;

- BTC, with total protocol revenue reaching $4.144 billion;

- BSC (BNB Chain), with total protocol revenue reaching $2.857 billion;

- OpenSea, with total agreement revenue of $2.783 billion;

- Lido, with total agreement revenue of $1.939 billion;

- Tether, with total protocol revenue of $1.684 billion;

- PancakeSwap, with total protocol revenue of $1.614 billion;

- TRON, with total protocol revenue reaching $1.17 billion;

- AAVE, with total agreement revenue reaching $961 million.

Project Ranking Summary

Summary: Compared with the "version answer", the long-term solution is the best

To be fair, in my opinion, the coming and going of "money-sucking agreements" also reflects the changes in the crypto industry from the side:

- Before 2020, the most profitable protocols were undoubtedly the public chains that started with various IC0s. Ethereum also stood out since then, laying the foundation for today's market value of 300 billion US dollars;

- In the period of 2020-2022, the Ethereum ecosystem has become the "center of the cryptocurrency industry". Driven by waves of industry trends such as DeFi Summer, GameFi Summer, and NFT Summer, platforms and projects in corresponding tracks such as Uniswap, Axie Infinity, STEPN, and OpenSea have emerged one after another, taking up the banner of attracting money in the industry;

- In the 2023-2024 period, that is, this cycle, the "SocialFi Golden Product" represented by friend.tech first appeared, and then the "MeméFi MVP" represented by pump.fun emerged. The "gold-sucking black hole" in the crypto industry has become an "asset issuance platform" that controls both liquidity and attention.

But if we look closely at the ranking of agreement revenue in the past year or even in a longer period of time, the version answer is at best a new player in the "money-making track". As for whether they can survive the early and middle stages of the product life cycle and still ensure that they "do not leave the table" and "stay on the field" in the later stages, it is still an unknown at present.

Compared with the countless "one-wave" "protocols and applications", perhaps a long-lasting ecosystem is still the best "money-making tool".