Written by: adam

Compiled by: TechFlow

Before we get into the details, it is important to remember that trading is a complex and high-risk activity.

There is no method that will allow you to quickly grow your account in a short period of time without experiencing any losses.

In fact, those who are able to grow their accounts quickly often do so by taking great risks, even close to going all out.

The point of this article is not to tell you to be patient and wait for ideal market conditions, nor is it to teach you how to analyze the market in depth.

Instead, I will share some methods to help you achieve rapid account growth while reasonably controlling risk.

If you are not familiar with basic concepts such as "risk management", I strongly recommend you to read this article on risk management first.

If you found this post helpful, check out the rest of the blog or join the Tradingriot Bootcamp for access to the full video course, a private Discord group, and regularly updated trading strategies.

Why choose to trade unpopular markets?

If you mainly trade big markets like BTC, ES (S&P 500 futures), major forex pairs or gold,

You will be directly facing off against retail traders like yourself, while also competing with large institutional players, quant firms, etc.

This is mainly because these markets are extremely liquid, allowing players with large funds to easily compete.

While it is not impossible to trade these markets, if you do not have sufficient capital, there are actually more advantages in the less liquid markets.

For example, many altcoin derivatives, NFTs, or on-chain coins are not very attractive to large players because these markets do not have sufficient liquidity to meet their trading scale needs.

When I started to delve deeper into the altcoin markets, I often found the clearest trading signals in the less liquid markets.

Initially, I was confident in these “low barrier to entry” markets, but when I tried to execute large positions, I found that my orders were extremely conspicuous in the order book, which made me realize the disadvantages of insufficient liquidity.

However, for small account traders, this problem is not something to worry about too much, because this liquidity problem will not really affect you until your order size reaches the high five or six figures.

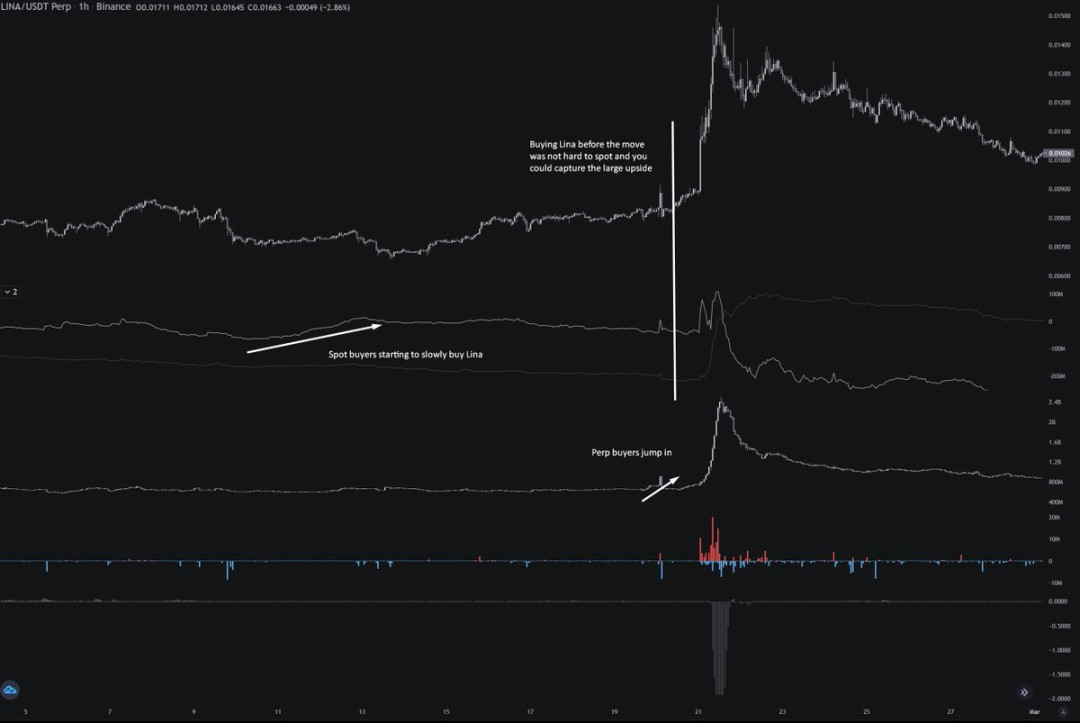

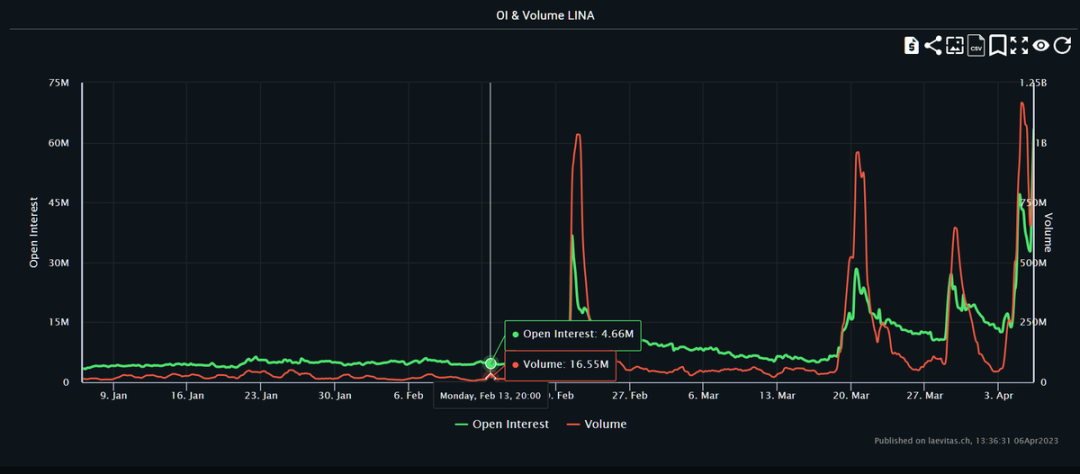

Taking Lina on Velo as an example, we can see from the chart that potential breakout signals for Lina could be observed a few days before the breakout occurred.

Such opportunities could bring significant gains, but we also need to consider potential risks.

Looking at Lina’s volume and open interest data on the Laevitas platform, we can see that before the breakout, Lina’s daily volume was 16 million, while open interest was 4.5 million.

If this trade fails and you have a large position, your stop loss may slip and cause you to lose more than you expected, but for traders with smaller accounts, their position sizes are smaller and their stops can often be triggered closer to the invalidation point, so they don't face this problem.

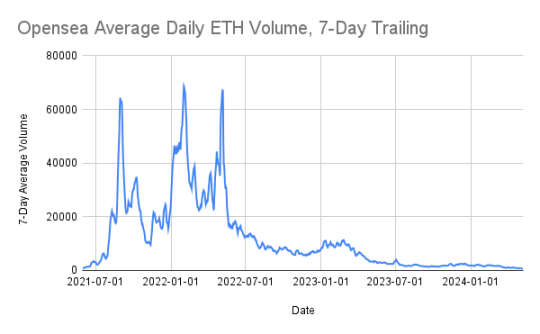

Low market cap alternative derivatives aren’t the only things you can get involved in. The same goes for on-chain tokens or NFTs.

When placing a trade, the most important thing is to be aware of where the "meta" currently is.

For example, NFTs were very popular a few years ago, but are now dead.

You need to understand how quickly information travels in this space so you don't take unnecessary risk but also so you don't miss out on big gains by selling too early.

On-chain transactions are very challenging. Although you may see many success stories on the X platform, in reality, the possibility of increasing the value of "1 SOL" to "1000" is very low.

There are some unique strategies that can be used in on-chain transactions, such as tracking different wallets, analyzing the distribution of holdings, or simply relying on common sense and trying to avoid tokens that are hyped by KOLs.

Beyond that, you’ll find that using simple support and resistance levels or trading indicators is often sufficient to navigate the trade, especially for tokens with larger market caps and lower risk of runaway activity.

Day Trading

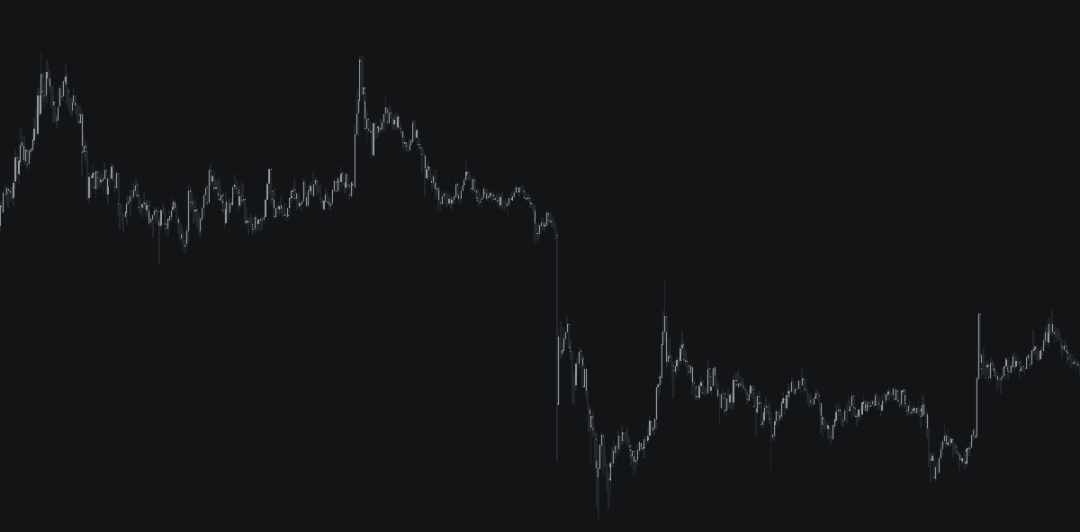

Prices have fractal properties. This means that if I show you a chart, it might be hard to tell if it's a daily chart, a monthly chart, or a 5-minute chart.

In addition, for markets with higher liquidity, it is difficult to tell which specific market it is if you are not familiar with it.

For example, shown above is a 5-minute chart of XRP.

If you choose swing trading, the trading frequency will be relatively low. Even if you make a profit, most of the time you are just patiently waiting for opportunities, which usually only appear 1-2 times per market per week.

I will discuss swing trading in more detail later, but day trading is different in that it provides instant feedback and there are plenty of small moves to take advantage of each day.

Therefore, if you day trade and execute a small number of trades per trading session, in theory, your account funds will grow faster.

However, day trading is one of the most challenging areas of trading. One distraction or tiny mistake can wipe out all your gains in just a few minutes just as quickly as you made them.

I recommend every new trader to try day trading as it gives you quick market feedback and speeds up the learning process.

One of the main advantages of day trading is that you can focus on markets with large liquidity, which makes trading scalable. If you focus on BTC, ETH, ES, NQ, Gold or major Forex pairs, you will not encounter position size limitations.

Nevertheless, day trading is very difficult and not for everyone. It requires a lot of skills such as high concentration, quick decision-making, and decisive stop-loss.

Therefore, it is very important to have a detailed trading plan and strategy for each step. Once you enter a trade, emotions may cloud your judgment, and this is when a plan prepared in advance will come in handy.

There are many ways to day trade, such as operating through price trends, order flow, news, technical indicators, etc. Each method has its applicable scenarios, and there is no absolute distinction between good and bad.

If you are interested in my day trading and swing trading methods, you can check out Tradingriot Bootcamp, a training course designed specifically for traders.

Trading with other people’s assets

In recent years, the field of online funding companies (prop firms) has developed rapidly.

If this is your first time dealing with such a company, you will need to pay an evaluation fee and abide by the trading rules in a demo account before you can gain access to a funding account.

This model allows you to trade with a larger bankroll, with the only cost being to pay for the appraisal.

However, if you are not familiar with the transaction, you may waste money by paying frequent assessment fees without getting a funded account.

Although funding companies are often controversial, I believe that they are a great opportunity for those who have the ability to trade but lack the funds.

As this field expands rapidly, it is even more important to choose a reputable and stable company. In recent years, we have seen companies refuse to pay profits, set rules that are almost impossible to pass, or even go out of business.

I may be biased here because I am directly involved with the Breakout funding company. But if you are focused on cryptocurrency trading, Breakout is a very good choice. It provides daily payouts, has no record of refused payouts, and has very reasonable evaluation rules.

High Time Frame Analysis vs Low Time Frame Execution

If you find that day trading is not for you, don’t be discouraged. This method can also help you grow your account quickly and make it easier.

In fact, this approach is not limited to small accounts; I have personally switched completely to this trading style because I no longer want to spend hours staring at charts.

Despite this, I still want to emphasize that the experience of day trading, studying different futures markets, and understanding market microstructure over the past few years has been very important to me, and I am very glad that I have experienced this.

Although we mentioned that prices have fractal properties, key points on higher timeframes such as the daily, weekly or monthly charts often cause greater market reactions than points on the 1-minute chart. This is because more traders and algorithms will pay attention to these higher timeframe key points and act accordingly.

For example, at the end of February 2023, Solana rose to the daily resistance level and then fell back to the next daily support level. If a short position is established at the daily close and a stop loss based on the 1-day ATR is set, a 2.5x risk-reward (R) can be achieved within 18 days.

Sure, a 2.5x return in 18 days is pretty good, but if you have a smaller account, like $100 risked per trade, then a $250 return might not be that exciting, whereas a $25,000 return with a $10,000 risked per trade would be pretty impressive.

If you want to grow your account quickly, you can switch to a lower timeframe while following the high timeframe (HTF) trading ideas. This means that your target remains the same, but by executing trades on a low timeframe (LTF), you can narrow your stop loss and thus increase your position size.

You don't need to switch to a 1-minute or 5-minute chart, an H1 or H4 time frame is enough. Focusing too much on a low time frame may increase risk-reward, but it also greatly increases the risk of being washed out before the market starts.

If you choose H1/H4 timeframe, you may still not get the ideal entry point, or be stopped out before the market starts. But in my experience, giving high timeframe trading ideas 1-3 attempts on low timeframe execution usually brings better results than relying solely on daily chart trading.

in conclusion

Trading is not easy and requires time and patience. However, as long as you control the risk, a small amount of money has the opportunity to gradually grow into a large amount of money.

In trading, always try to think outside the box, be patient in execution, and have a sound trading plan.