Author: Bai Ding&Shew, GodRealmX

Since the Mentougou incident in 2014, the corruption and market manipulation of centralized trading platforms have always troubled all Crypto participants. After the FTX bankruptcy incident in 2022 sounded the alarm for people, people's attention to decentralized order book platforms has significantly deepened. Well-known on-chain order book platforms such as dydx and Degate are all representatives of this type. While they have achieved remarkable results, they have not become phenomenal large platforms due to policy and technical reasons.

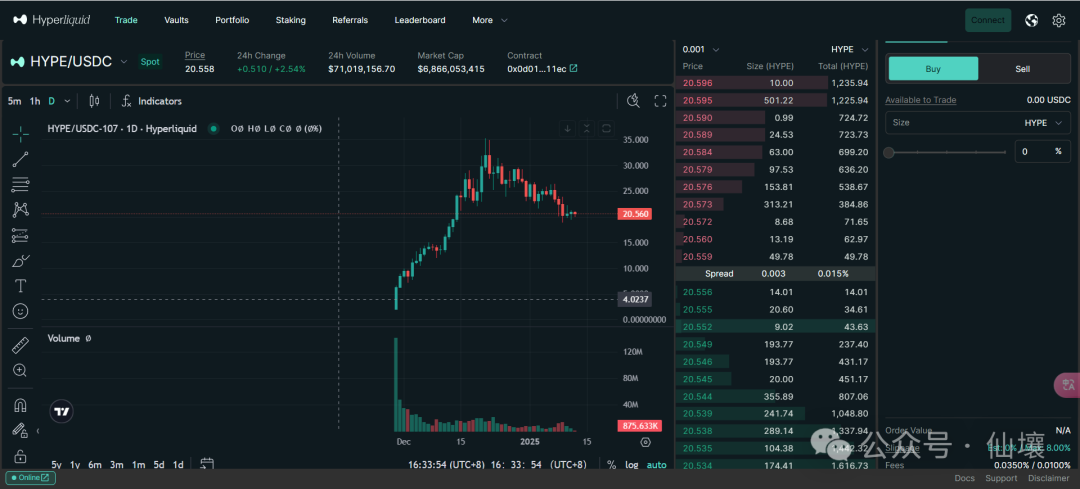

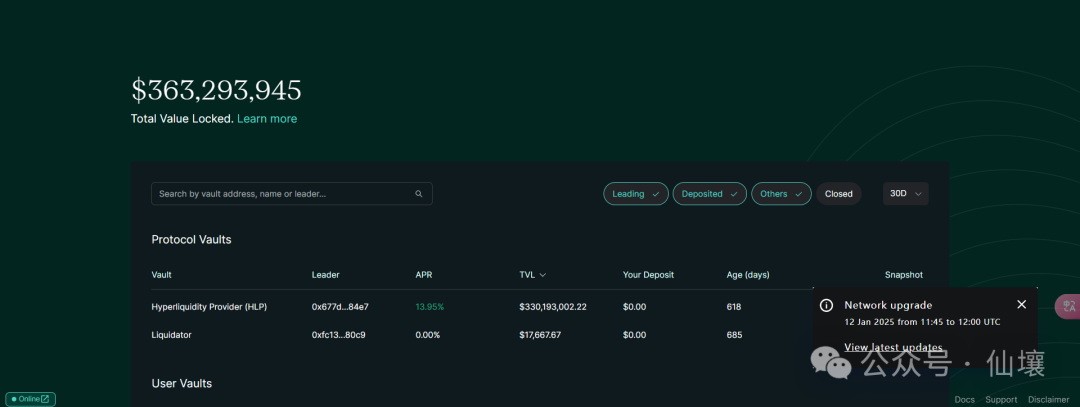

At the end of 2024, Hyperliquid, launched by Jeff Yan's team specializing in quantitative trading , quickly became popular in the entire Web3 with its efforts in products and marketing, attracting widespread attention. With a TVL of billions of dollars, Hyperliquid is expected to completely open a new chapter in decentralized trading platforms and become a phenomenal application.

In the previous article "Hyperliquid Technology Interpretation: Bridge Contracts, HyperEVM and Potential Problems", we mentioned that Hyperliquid designed an application chain dedicated to high-performance order book systems and built a bridge for this application chain on Arbitrum, so it was identified as "pseudo Layer3" by L2BEAT. Currently, Hyperliquid has only 4 validator nodes. The risk of bridge contracts is extremely high, which greatly sacrifices decentralization and security, but it also improves transaction matching efficiency and achieves CEX-level user experience. Although controversial, this reflects the Hyperliquid team's style of doing things:

At the beginning, the core goal is to focus on UX and rapid user acquisition, even if this will bring security risks. As the product reaches a certain level, it will gradually clear the minefields and solve the decentralization and security issues. This project operation idea is common in high-performance infrastructure such as Solana and Optimism, and it often achieves good results in commercialization.

Similarly, Hyperliquid and other trading platforms face the same difficulty: the cold start problem. The trading platform itself has a very strong network effect, "the more people use it, the better it is", which makes this track very easy for oligarchs to control. Nowadays, the cold start of a new trading platform is extremely difficult. Looking at Hyperliquid's previous large-scale airdrops and KOL matrix, it is not difficult to see that they have put a lot of effort in market operations.

However, marketing alone cannot make a new trading platform rise quickly. There must be strong products behind it. From the perspective of Hyperliquid's product design ideas, it is also centered around the core purpose of "cold start". The author of this article will give an overview of Hyperliquid from the perspective of HIP, Vaults and Token model to help everyone deeply understand the design ideas behind this hot project.

HIP-1 and HIP-2

Analogous to Ethereum's EIP proposal, Hyperliquid named its proposal HIP and took the lead in introducing the two most important core HIPs: HIP-1 and HIP-2, to solve the listing and circulation problems of tokens. Among them, HIP-1 mainly solves the token issuance and management solution on the Hyperliquid chain, similar to Ethereum's ERC-20.

Here we can compare the way Ethereum DEX lists tokens. Most DEXs adopt the AMM product model, and there are two steps to list new tokens:

1. First, the Token developer needs to call the Mint function in the token contract that complies with the ERC-20 standard to define basic data such as the token name, symbol, and total supply.

2. After that, the newly minted token is paired with another asset (such as ETH or USDT) and added to the liquidity pool of the DEX to provide initial liquidity. After that, people in the market will naturally price the token through arbitrage, SWAP, etc.

In Hyperliquid's system, the process of List tokens is much simpler. First of all, the Hyperliquid application chain is dedicated to the order book system. If you issue a new token on Hyperliquid through the HIP-1 standard, the system will directly help you create a trading pair between the new token and USDC. When you deploy the Token contract, you can set a hyperliquidityInit parameter to determine how many tokens will be automatically injected into the order book market as initial liquidity. In this way, you don't have to manually inject initial liquidity like in Ethereum AMM.

In this regard, the main function of HIP-2 is to use the above initial liquidity for automated market making to solve the initial circulation problem of Tokens.

So what are the details of the HIP-2 automated market making solution? In short, the solution proposed by HIP-2 is to perform "linear market making" within a preset price range. The token deployer must first preset a price range, and then the Hyperliquid system automatically issues buy and sell orders based on this range to ensure that there is always liquidity in the market.

The details of this part mainly include three parts:

Set the price range and order frequency: The token issuer must specify the upper and lower limits of the market-making price, as well as the demarcation points for buy and sell orders. Each price point increases by 0.3% relative to the previous price point. This process will be updated every 3 seconds or so (or longer) to ensure that the system's orders always keep up with market fluctuations and avoid lags.

Order generation: When the price range is updated, HIP-2 will calculate how many orders should be placed at different price levels based on the spot quantity provided by the token issuer.

Automatic reverse market making: Whenever a "full sell order" is executed, the system will automatically use the funds (such as USDC) to place a reverse limit buy order. In this way, there will always be new orders in the market to ensure that liquidity is always active.

At present, there are two main charging methods for general market makers on the market: the first is to charge a fixed monthly fee, and the second is not to charge a monthly fee directly, but to borrow a certain proportion of tokens from the project party for market making, usually 0.5%-1.5%. Of course, in order to prevent the token price from soaring and causing a sharp increase in repayment costs, market makers can change the charging method at any time, or repay the tokens at a pre-agreed price. This involves a game between the project party and the market maker, which is not described in detail due to space limitations.

Hyperliquid officially uses the HIP-2 solution to reduce the cost of market making, and accepts user deposits in a decentralized manner for market making. This involves its module called Vaults, which we will introduce later.

HIP-1 and HIP-2 are designed to significantly reduce the listing and circulation costs of projects. HIP-1 ensures the decentralization and transparency of listing, while HIP-2 specifically provides "automatic market making" services for the order book system, allowing projects that lack market maker resources to make markets on the spot order book platform with confidence. This has brought a good reputation to Hyperliquid, but because Hyperliquid's listing fee is too expensive, general project parties are still blocked from the threshold.

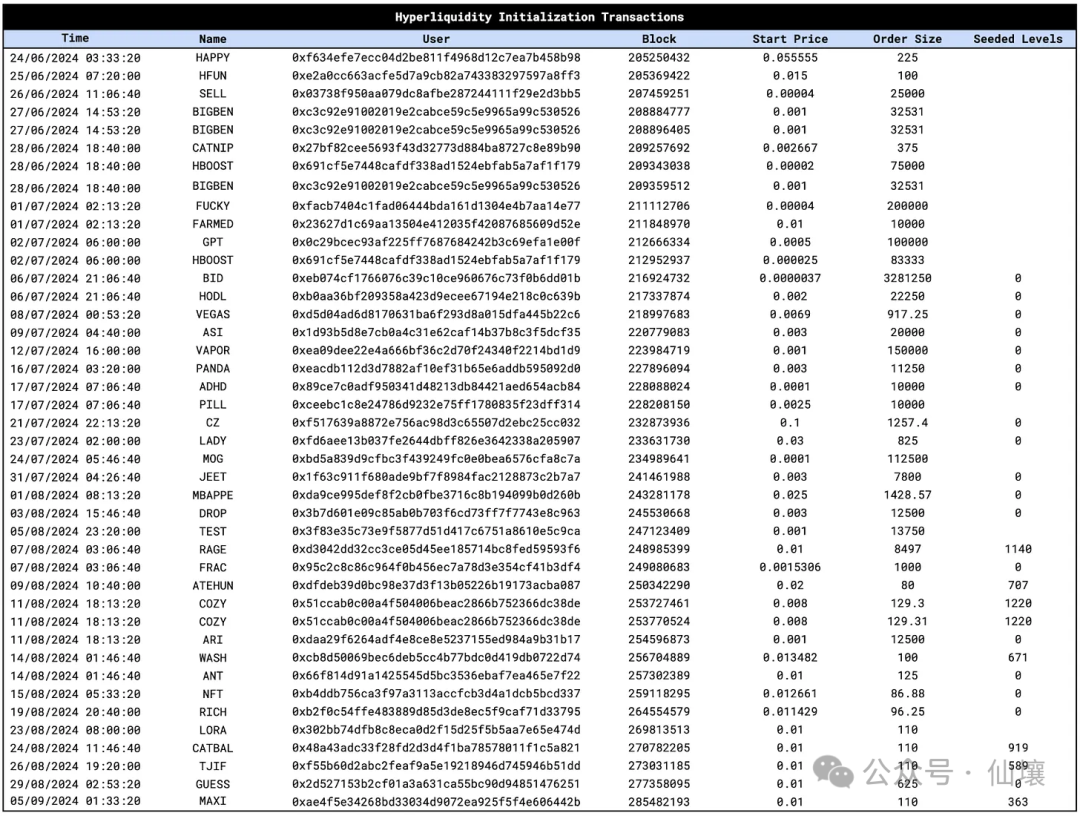

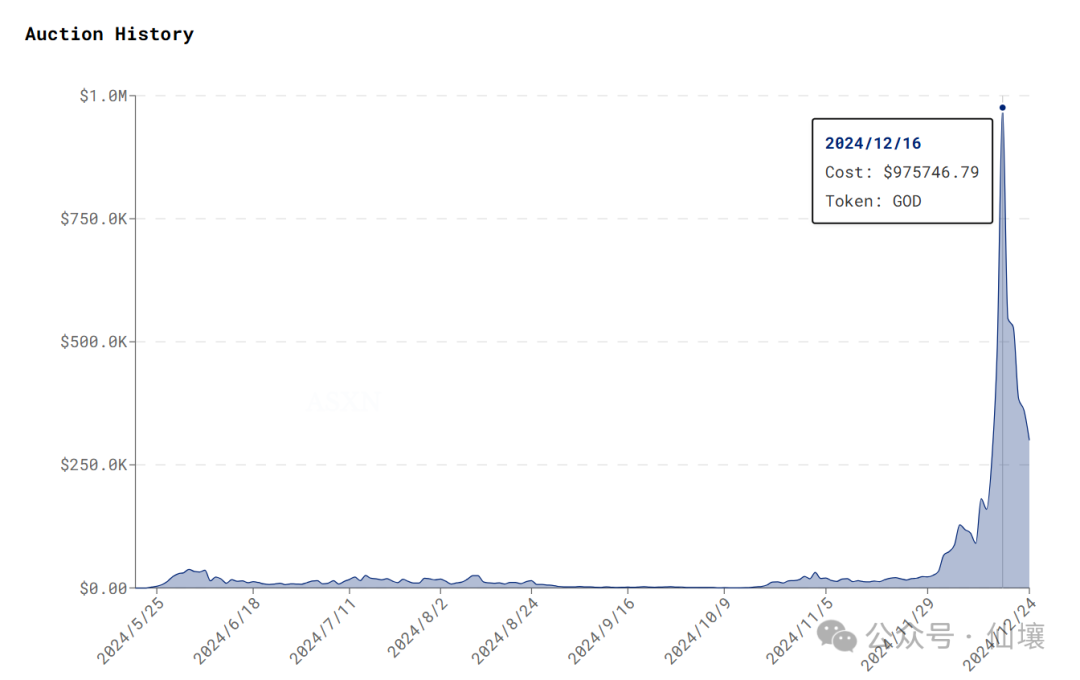

When it comes to the topic of listing fees, we must explain the Dutch auction mechanism adopted by Hyperliquid. In the past six months, CEX has charged sky-high listing fees, listed controversial tokens, and the tokens plummeted as soon as they were listed. All these criticisms directly point to the centralization of its listing process. In this context, the HIP-1 proposal stipulates that the listing of tokens on the Hyperliquid platform adopts an open and transparent Dutch auction mechanism, rather than being decided by the platform itself, which has gained widespread favor.

In Hyperliquid's solution, every 31 hours is considered an "auction cycle", and one listing quota is publicly auctioned in each cycle, and the number of listing quotas per year is limited to 280. At the beginning of each auction cycle, a new round of auctions will start at twice the transaction price in the previous cycle. If the auction in the previous cycle is unsuccessful, the current cycle will start again at 10,000 US dollars. Due to the Dutch auction, the auction price will gradually decrease from the initial price until a bidder who accepts the selling price appears and obtains the right to list the coin.

Compared with traditional CEX, Hyperliquid's listing mechanism is quite innovative. First, it ensures the openness and transparency of the listing process, avoiding human intervention and price manipulation. Secondly, this approach completely gives the decision-making power to the market, avoiding CEX insiders from collecting insider fees. In December last year, Hyperliquid's listing auction price was close to 1 million US dollars, which also made it impossible for low-quality project parties to have the financial resources to list coins, directly avoiding the phenomenon of memecoin flooding.

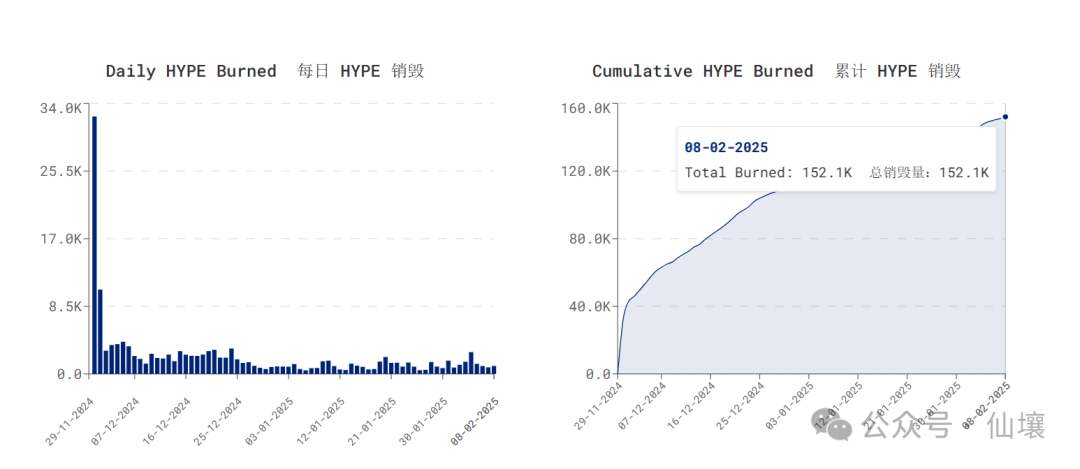

Image source: ASXN Data

From the above, we can see that the significance of HIP-2 is more to help weak projects to quickly cold start and provide them with initial liquidity support, which is also helpful for the cold start of Hyperliquid as a trading platform. The Dutch auction method leaves the right to list coins to the market for pricing, which is open and transparent throughout the process, and is a fair and just approach. It can be said that Hyperliquid has indeed opened up a new model for order book trading platforms. After it solves the security risks existing in the underlying application chain in the future, it is expected to become a phenomenal platform that can compete with Binance for the right to speak.

Vaults

Similar to traditional CEX platforms, Hyperliquid also has basic scenarios such as leverage and contract trading. When it comes to contracts and leverage, there must be corresponding clearing components. In this regard, Hyperliquid provides a more decentralized and open form that everyone can participate in.

The Hyperliquid platform has a core primitive called Vaults, which is written at the bottom layer of the L1 chain. The market making and liquidation activities on the Hyperliquid platform are all operated by Vaults, and users can provide funds to Vaults and share the profits/losses of market making or liquidation according to their share ratio.

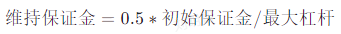

Here is a brief explanation. The maximum leverage multiples supported by each asset in Hyperliquid are different, ranging from 3 to 50 times. The specific calculation formula is as follows:

For example, if the maximum leverage supported by an asset is 50 times, then according to the formula, the liquidation line is 1% of the initial margin. If the maximum leverage is 3 times, the liquidation line is 16.7%. When the account net value is lower than the liquidation line, liquidation is triggered. There are two types of liquidation methods: order book liquidation and backup liquidation.

Order book liquidation means that if the net value of a trader's account falls below the liquidation line for the first time, the trader's position will automatically attempt to issue a market order to the order book platform to close all or part of the position, and the remaining collateral can still belong to the trader. Backup liquidation means that if the net value of the account falls below 2/3 of the liquidation line and the position is not processed in time through order book liquidation, Vaults will intervene for backup liquidation. At this time, the trader's position and margin will be transferred to the liquidator and will not be returned to the user. It can be said that Vaults is mainly responsible for backup liquidation in such scenarios, providing a bottom line for the Hyperliquid platform to prevent bad debts.

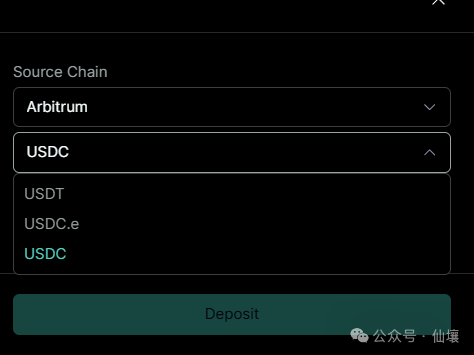

Currently, Vaults only supports the deposit of three stablecoin assets: USDC, USDT and USDC.e (cross-chain USDC).

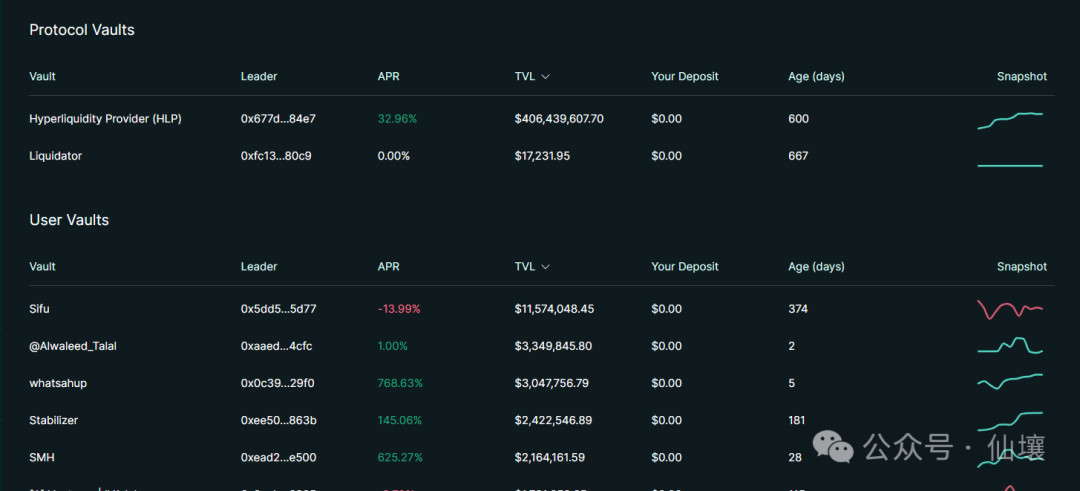

Image source: Hyperliquid.xyz/vaults

From the perspective of income sources, there are three potential income sources for Vaults participants. The first is market-making income, including short-term price fluctuations and the funding rate obtained by holding unilateral positions. The second is order-making income. In Hyperliquid, order takers have to pay a transaction fee of 0.025, and order makers will receive a 0.002% reward for providing liquidity. The third is liquidation income. When the position is lower than 2/3 of the liquidation line, the HLP liquidation vault can take over the position and make a profit from it.

Depositing assets to Vaults is not a sure win. On the one hand, market price fluctuations may lead to losses in market making strategies. On the other hand, after Vaults takes over the positions to be liquidated, if the liquidation is not timely due to various reasons, or the assets to be liquidated plummet, it will also lead to losses.

Currently, there are two original vaults created by the Hyperliquid official team, namely the HLP vault responsible for market making and the Liquidator vault responsible for liquidation. In addition, anyone can create their own customized "User vault" on the Hyperquid chain, formulate their own quantitative strategies, and become a "creator" responsible for their own profits and losses.

Of course, users can also join the official or other Vaults created and become "followers", which is a bit like the copy trading model. Since the Vault creator is responsible for managing the funds, he will receive 10% of the profit share of the followers. However, the proportion of assets injected by the creator in his own vault must always be greater than or equal to 5%, otherwise withdrawals will be restricted.

Vaults with different yields

It is still important to emphasize that as an emerging exchange, Hyperliquid's series of designs are all aimed at solving the cold start problem. The existence of Vaults means that the potential benefits of market making and liquidation are shared with the community. According to Hyperliquid's official documents, the purpose of doing so is to "de-platform" and open up the power of CEX monopoly to achieve democratization, but this is essentially a means to solve the cold start problem of the trading platform, just like using a blank check to attract users and liquidity, which not only solves the cold start problem, but also gains a lot of praise, killing two birds with one stone.

Although the market has cooled down, the TVL of Hyperliquid Vaults still maintains at hundreds of millions of dollars, and the cold start has been completed. The APR of some Vaults even reaches nearly 9000%, which is quite a wealth-creating effect. However, there is one problem that needs attention. As for how to ensure the security of the funds deposited in the vault, the official does not seem to disclose relevant information at present, which poses certain risks.

Token Empowerment

Previously, Hyperliquid airdropped 70% of $HYPE to the community, but $Hype did not see a large sell-off. Instead, it rose from $2 at the time of TGE to about $30, which is inseparable from the strong empowerment of $HYPE tokens. Currently, there are two main ideas for common token empowerment: one is to give holders income incentives, and the other is to form deflation and reduce circulation.

Hyperliquid shares a large amount of business revenue with $HYPE holders to form an incentive. The platform's revenue is mainly divided into two parts: transaction fees and listing fees. Part of the transaction fees is used to repurchase $HYPE. According to statistics, about 50% of the daily transaction fee income of the Hyperliquid platform is used to repurchase $HYPE, and these $HYPE are usually destroyed to reduce the circulation; and part of the listing fee (about 50%, the official has not disclosed the specific documents) is also used to repurchase and destroy $HYPE.

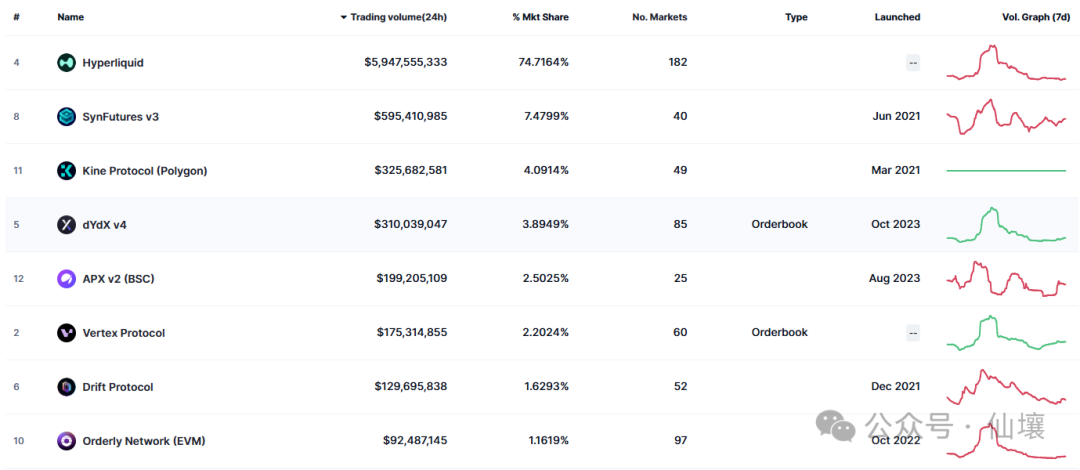

As of early February, Hyperliquild has a market share of nearly 75% among all on-chain derivatives trading platforms, which has become a monopoly. Therefore, the effect of its business revenue in empowering the official token of the platform is quite significant. Currently, Hyperliquid still maintains a strong growth trend.

As of February 8, 2025, the destruction of $HYPE has reached 152,000 pieces, worth approximately US$3.426 million.

In addition to business revenue, Hyperliquid's infrastructure also empowers $HYPE. First of all, Hyperliquid L1 uses $HYPE as the gas fee. Although it claims to provide gas-free transactions, this means that users do not need to perceive the existence of Gas when trading. The system has included the Gas fee in the transaction fee, but this does not mean that the Gas design has been cancelled at the bottom of the chain. In addition, as the DeFi infrastructure in the ecosystem is built and improved after the landing of HyperEVM, $HYPE may have specific scenarios such as lending and staking.

Hyperliquid Controversy

The controversy surrounding Hyperliquid is mainly concentrated in two aspects. The first is the issue of fund security. Hyperliquid runs on an independent public chain that is not open source, and transactions on Hyperliquid are equivalent to deposits into the Hyperliquid L1 bridge. Although the Hyperliquid bridge contract is audited by the well-known company Zellic, the node code that matches the bridge contract is not open source, and there may be problems with this part of the code. In addition, Hyperliquid uses a multi-signature bridge, and its multi-signature nodes are most likely controlled by the project party itself.

Some of the projects that Zellic has provided audit services for

In addition, Hyperliquid has been criticized for its trading volume, and its open interest data is also very exaggerated for a DEX.

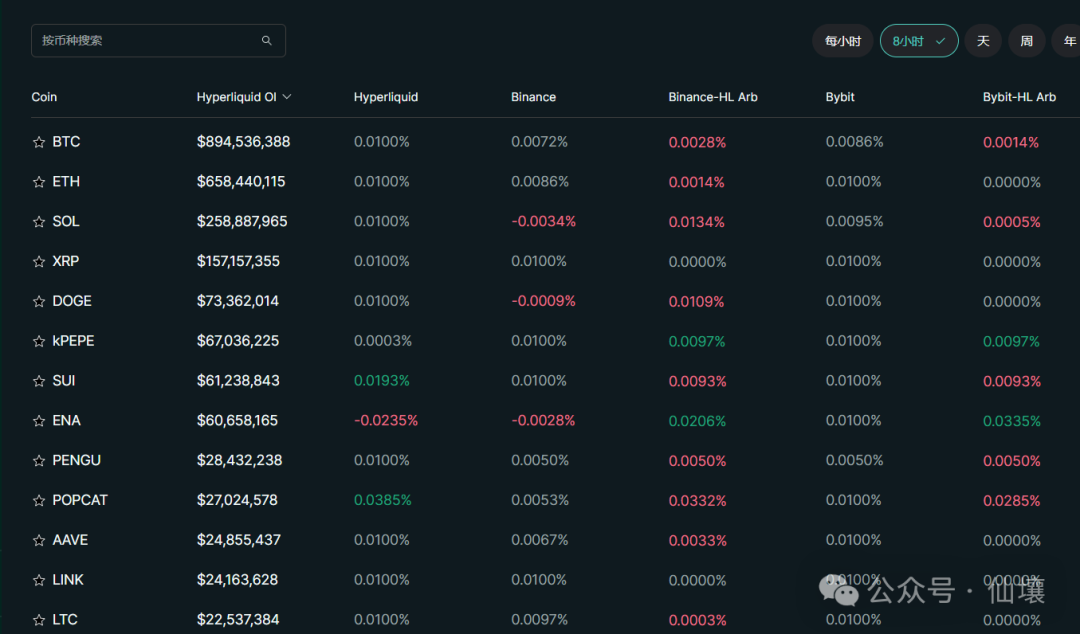

Hyperliquid Funding Rate Panel

This is the funding rate panel provided by Hyperliquid. Its original intention is to provide users with an intuitive funding rate comparison to facilitate cross-market arbitrage, but it exposes some intriguing problems of Hyperliquid. We can see that the funding rates of most tokens are similar, remaining at the default 0.01%. Many people suspect that there is not much actual trading volume on Hyperliquid.

Because in a truly active market, supply and demand cannot be completely balanced, and funding rate fluctuations will occur. When there are more buy orders than sell orders, the borrower's funding rate will be lower, and when there are more sell orders, the funding rate will rise. The appearance of so many identical 0.01% means that Hyperliquid may be brushing orders, that is, increasing trading volume through frequent clearing transactions and repeated pending orders to create the illusion of an active market.

Some traders in the market also reported that they tried to do quantitative trading on Hyperliquid but failed because the actual trading depth was not enough. However, apart from user experience and inference, the problem of brushing orders cannot be verified because Hyperliquid is not open source and we cannot obtain complete original transaction data by building nodes. In fact, there is no need to verify this issue. We might as well think about another question: if brushing orders really exist, why does Hyperliquid do this? In fact, it is still a cold start problem.

Brushing orders is an effective way to solve the cold start of trading platforms. Referring to various Web2 products with significant network effects, various forms of brushing orders are far more common than Web3. To date, about 30-40% of the transactions on e-commerce platforms such as Taobao and Tmall are completed through brushing orders every year; YouTube video websites often have automatic likes, comments, and follows that simulate user behavior; in popular games such as Peace Elite, you may be the only real person among 50 people in a game, and the rest are all AI.

As for the larger order book CEXs in Web3, no one dares to say that they have never brushed orders, so the problem of brushing orders is widespread and not as bad as everyone imagines. As we said before, Hyperliquid's style is that all actions are firmly aimed at solving core problems, even if there are some negative impacts on reputation, so brushing orders is in line with its consistent style. There are actually only two core problems: cold start and user experience. In order to solve these two problems, it can even build a centralized, non-open source public chain, let alone brushing orders?

In general, Hyperliquid's product design is basically based on one principle: all product links and operational actions fully cooperate to get through the cold start period and give users the CEX experience, even if it is controversial or even if some things are given up. Judging from the results, its strategy is very successful and worth reviewing and studying.