By Lars, Head of Research at The Block

Compiled by: Jordan, PANews

For the crypto industry, most indicators finally began to rebound in October. This article will use 11 charts to review the crypto market conditions over the past month.

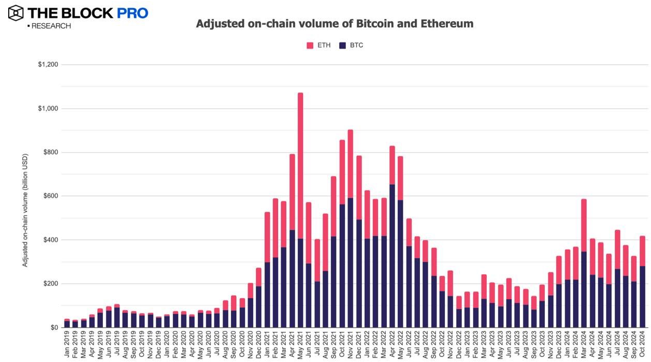

1. In October, the total transaction volume of Bitcoin and Ethereum after adjustment increased by 28.1% as a whole to US$420 billion, of which Bitcoin’s adjusted transaction volume increased by 32.1% and Ethereum’s increased by 20.9%.

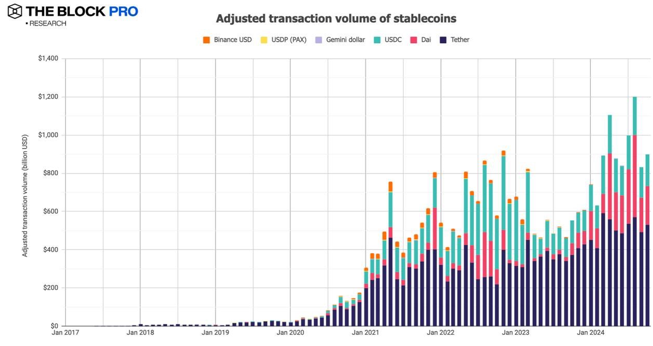

2. The adjusted on-chain transaction volume of stablecoins in October increased by 8% to US$899 billion, and the supply of stablecoins issued fell by 0.7% to US$149.3 billion, of which USDT and USDC had market shares of 79.5% and 16.9% respectively.

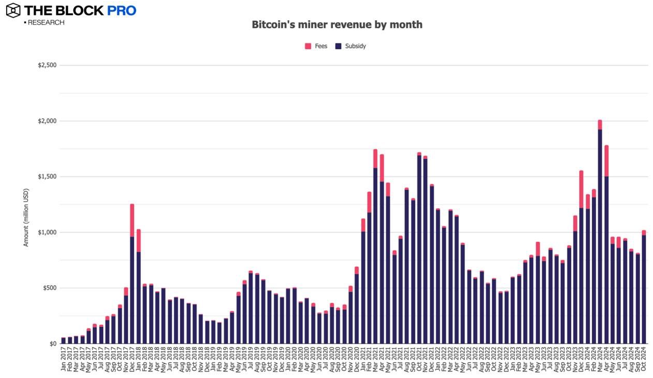

3. Bitcoin miners’ income increased by 25.4% in October to $1.02 billion. In addition, Ethereum staking income also rebounded to $221.5 million, an increase of 5.8%.

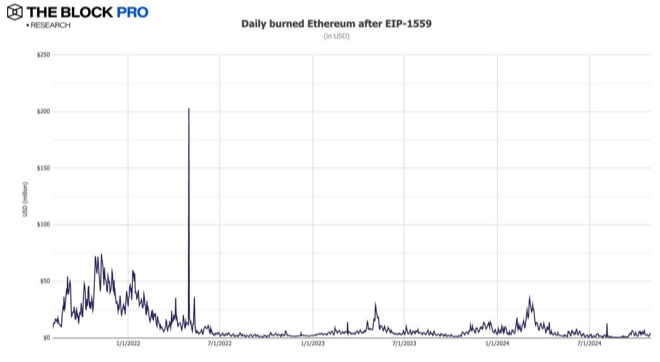

4. In October, the Ethereum network destroyed a total of 41,648 ETH, equivalent to $105 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has destroyed a total of about 4.43 million ETH, worth about $12.5 billion.

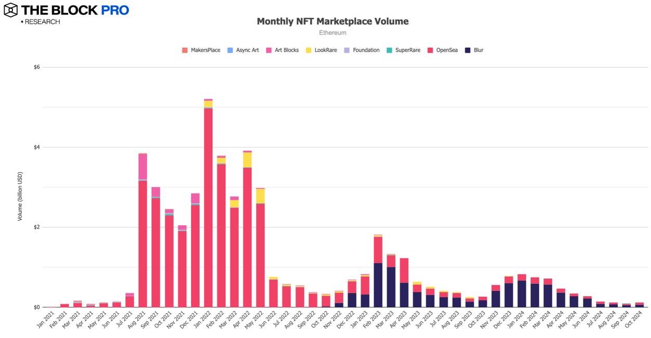

5. In October, the transaction volume of the NFT market on the Ethereum chain rebounded and increased by 26.5% to approximately US$121.6 million.

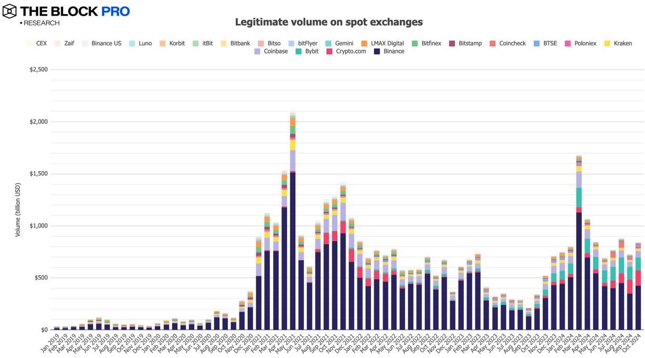

6. The spot trading volume of compliant centralized exchanges (CEX) increased by 16.3% in October to US$843 billion;

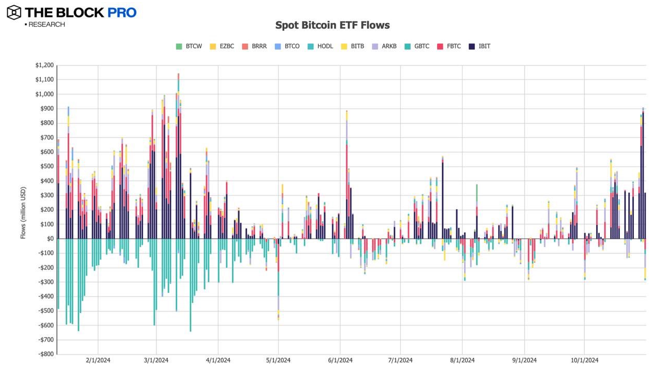

7. In October, the net inflow of spot Bitcoin ETFs showed positive growth, with an inflow of approximately US$5.3 billion. On October 30, the inflow of BlackRock IBIT reached US$872 million, setting a new record.

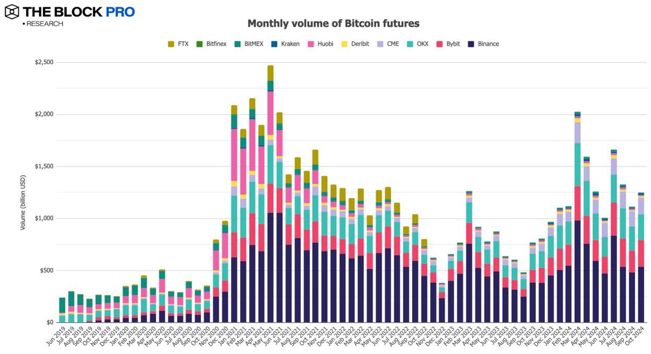

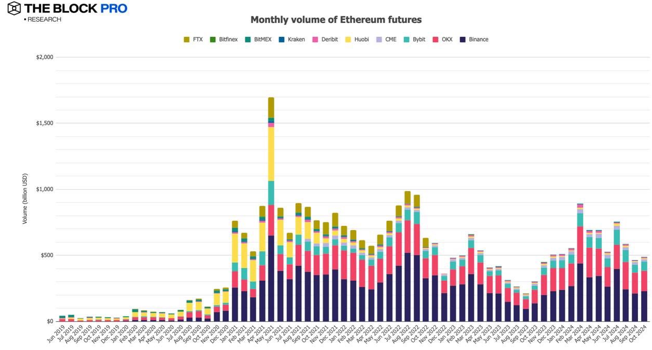

8. In terms of crypto futures, the open interest of Bitcoin futures increased by 22.9% in October; the open interest of Ethereum futures increased by 14.6%; in terms of futures trading volume, the trading volume of Bitcoin futures increased by 12.1% in October to US$1.25 trillion, and the trading volume of Ethereum futures increased by 4.8%.

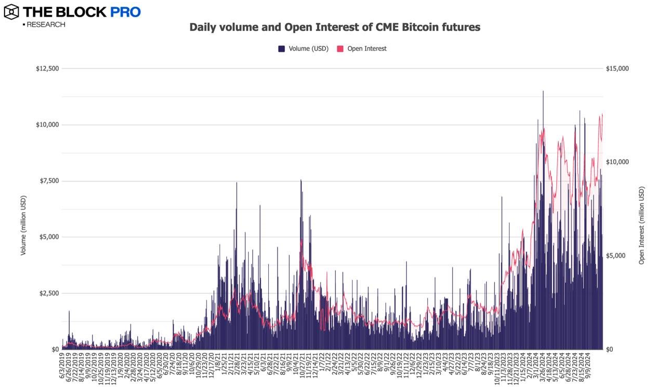

9. In October, CME Bitcoin futures open interest increased by 21.5% to $12.5 billion (a record high), and the average daily trading volume (daily avg volume) increased by 9.6% to approximately $5.3 billion.

10. In October, the average monthly trading volume of Ethereum futures increased to US$488.8 billion, an increase of 4.8%.

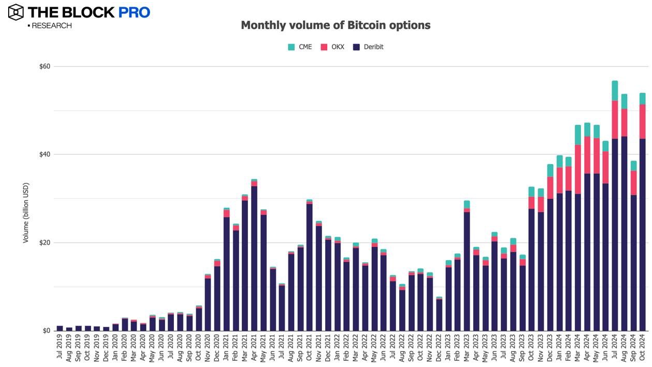

11. In terms of cryptocurrency options, the open interest of Bitcoin options increased by 35.76% in October, while the open interest of Ethereum options remained unchanged. In addition, in terms of Bitcoin and Ethereum option trading volume, the monthly Bitcoin option trading volume reached US$54 billion, up 39.8%; the Ethereum option trading volume was US$10.2 billion, up 4.7%.